Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Hughes 2014 PFS

Caricato da

jmrussell870 valutazioniIl 0% ha trovato utile questo documento (0 voti)

32 visualizzazioni14 pagineHughes 2014 PFS

Copyright

© © All Rights Reserved

Formati disponibili

PDF o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoHughes 2014 PFS

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

32 visualizzazioni14 pagineHughes 2014 PFS

Caricato da

jmrussell87Hughes 2014 PFS

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

Sei sulla pagina 1di 14

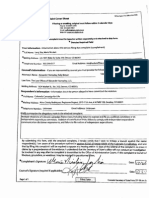

Texas Ethics Commission P.O. Box 12070 ___ Austin, Texas 78711-2070 (512)465-5800___ 1.900.326.8506

PERSONAL FINANCIAL STATEMENT FORM PFS.

COVER SHEET

Filed in accordance with chapter 572 of the Government Code. PACEY page 1 of 13,

For flings required in 2014, covering calendar year ending December 31,2013. Lasaay

Use FORM PFS - INSTRUCTION GUIDE when competing this frm, s/o 3G

1 NAME TEAST OFFICE USE ONLY

D. Bryan Has

a RECEIVED

JAN 24 204

2 ADDRESS

PO Box 450

Mineola, TX 78773

(check ir FRer's Home ADORESS)

3 TELEPHONE [AREACODE MONDE EXTENSION

NUMBER (903) 569-8880

@ REASON

FOR FILING

STATEMENT OI canoioare (noveare orcs)

BW evecten oricer State Representative, District Five tnocareoFrce)

11 appownTeD OFFICER (neveare Aceh)

C1 executive HEAD tnoveareaceney)

Cl FORMER OR RETIRED JUDGE SITTING BY ASSIGNMENT

Oi state party chai tmvicatz any

O otHer {INDICATE POSITION)

5. Family members whose financial activity you are reporting filer must roport information about the financial activity of the fers

‘spouse or dependent children ifthe filer had actual control over that activity):

In parts 1 through 18, you will disclose your financial activity during the calendar year. ln parts 1 through 14, you are

required to disclose not only your own financial activity, but also that of your spouse or a dependent child if you had actual control

‘over that person's financial activity

ie { COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY R WOi4\9,

“Texas Ethics Commission P.0.80x 12070 ___Austo, Tex

rar-2070, r2Me3.ss00 1-800-325-8508,

SOURCES OF OCCUPATIONAL INCOME Part 1A

C1 Nor APPLICABLE

‘When reporting information about a dependent chila’s activity, indicate the child about whom you are reporting by

providing the number under which the child is isted on the Cover Sheet,

7

INFORMATION RELATES TO

@ Fier O spouse (0 DEPENDENT CHILD —__

2 NAME AND ADDRESS OF EMPLOYER / POSITION HELD

EMPLOYMENT

i (heck iFters Home Adcress)

1 EMPLOYED BY ANOTHER | Law Office of D. Bryan Hughes

701 North Pacific Ave

Mineola, TX'75773

Principal

By seurcuptoven NATURE OF OCCUPATION

Law Practice

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Texas Ethies Commission P.0, 80112070 __Austn, Texas 78711-2070

(12)463-5800___1-900-325-8506

PERSONAL NOTES AND LEASE AGREEMENTS

1 Nor APPLICABLE

PART 6

tion, see FORM PFS--INSTRUCTION GUIDE

providing the number under which the child is listed on the Cover Sheet

Identify each guarantor ofa loan and each person or financial institution to whom you, your spouse, or

dependent child had a total financial liability of more than $1,000 in the form of a personal note or notes or lease

‘agreement at any time during the calendar year and indicate the category of the amount of the liability. For more informa-

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

1 PERSON OR INSTITUTION General Motors Acceptance Corporation

HOLDING NOTE OR

LEASE AGREEMENT

2 UIABILITY OF

LABILITY © Bruce CO srouse

Ci bePenoent cH.o

3 GUARANTOR

on Bi)s1000-s4008 2] s5,000-s9,000

D1 st0000- $24,098] $25,000.08 MoRE

PERSON OR INSTITUTION | Southside Bank

HOLDING NOTE OR.

LEASE AGREEMENT

LIABILITY OF

FILER Di srouse

D1 DEPENDENT CHILD

GUARANTOR

a C1 s1.000-s4,099 1] $5,000- $9,999

Di si0.000- $24,099 [i] $25,000-0R MORE

PERSON OR INSTITUTION — | Biuegreen Corporation

HOLDING NOTE OR

LEASE AGREEMENT

LIABILITY OF

spouse

(1 DePENDENT CHILD

GUARANTOR

AMOUNT (s1.000-s4.999 [3 $5,000 - $9,900

i st0;000- $24,999 1] $25,000-0R MORE

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Tones Ethics Commission P.O. Box 12070

Austin, Texas 78711-2070

(s12)463-5800 1-900-325-8506

1 NoT APPLICABLE

PERSONAL NOTES AND LEASE AGREEMENTS

PART 6

Identify each guarantor of a loan and each person or financial insttution to whom you, your spouse, or

2 dependent child had a total financial liability of more than $1,000 in the form of & personal note or notes or lease

‘agreement at any time during the calendar year and indicate the category of the amount of the liability. For more informa-

tion, see FORM PFS--INSTRUCTION GUIDE

\When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

Providing the number under which the child is listed on the Cover Sheet

Hl $1,000 $4,090

1 PERSON OR INSTITUTION | Bank of America

HOLDING NOTE OR

LEASE AGREEMENT

2 LIABILITY OF

rue Lisrouse Ci vepenoent cHito

3 GUARANTOR

a

ee Cs1.c00-s4.993 1) $5,000-$9,999 [] st0,000-$24,909 [ $25,000-0F MORE

PERSON ORINSTITUTION — ] citibank USA

HOLDING NOTE OR

LEASE AGREEMENT

LIABILITY OF

FILER Dseouse CloePenoent cxito

GUARANTOR

‘AMOUNT,

11 $5,000 - $9,999

Li si0.00-$24,999 1] $25,000-0R MORE

PERSON OR INSTITUTION.

HOLDING NOTE OR

LEASE AGREEMENT

‘Amecican Express

LIABILITY OF

Bi ruer Osrouse Cloerenoenr cH

GUARANTOR,

ee Lisi000-$8.000 C1] s5,000-88.900 [R]$10,000-$24.900 [1] $25,000-OR MORE

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Toxascthies Commission P.O. Box 12070 __ Austin, Texas 76711-2070 (512)469-5800

4-900-326-8506

PERSONAL NOTES AND LEASE AGREEMENTS

D1 Nor APPLICABLE

PART 6

Identity each guarantor of a loan and each person or financial institution to whom you, your spouse, oF

tion, see FORM PFS--INSTRUCTION GUIDE

providing the number under which the child is listed on the Cover Sheet.

‘a dependent child had a total financial liability of more than $1,000 in the form of a personal note or notes or lease

agreement at any time during the calendar year and indicate the category of the amount of the liability. For more informa-

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

1 PERSON ORINSTITUTION — | Wells Fargo

HOLDING NOTE OR

LEASE AGREEMENT

2 LIABILITY OF

Bl ruer D spouse Di verenoent cHiLD

3 GUARANTOR

4 AMOUNT

1s1.000- $4,999 J $5.000-s2.999 [] $10,000- $24,999] $25,000-OR MORE

PERSON ORINSTITUTION | Discover Bank

HOLDING NOTE OR

LEASE AGREEMENT

LIABILITY OF

Bruce Di spouse (1 bePeNDENT CHILD

GUARANTOR:

‘AMOUNT

Ls1,000-s4.999 5} $5,000-s9,902 L] s109000-$24,908 1] $25,000-0R MORE:

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Toxas Ethics Commission P.0.0x12070___Avatn, Texas 78711-2070 (512)463-5800

1.900.375.0506

1 Nor APPLICABLE

INTERESTS IN REAL PROPERTY

PART 7A

INSTRUCTION GUIDE,

Describe all beneficial interests in real property he'd or acquired by you, your spouse, or a dependent child during the

calendar year. If the interest was sold, also indicate the category of the amount of the net gain or oss realized from the sale.

For an explanation of ‘beneficial interest’ and other specific directions for completing this section, see FORM PFS~

When reporting information about a dependent chila's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

1 HELD OR ACQUIRED BY

Bruer Di spouse Doerenoent cHi.o

2 STREET ADDRESS

Dor avanaace

Ci cHeck ir FILER'S HOME ADDRESS

621 South Atlantic Avenue

‘Ormond Beach, FL 32176

3 DESCRIPTION

Qhors

Dacres.

Timeshare

4 NAMES OF PERSONS

RETAINING AN INTEREST

Dror appucane

(SEVERED MINERAL INTEREST)

5 IF SOLD

ner oan

Cnertoss:

Ditess tHaN $5000 1) $5,000-s9.209 E] st0000-$24,999 [1] $25,000-0R MORE

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Texas Ethos Commission P.O. Box 12070___Austn, Texas 78711:2070, (612)469-5600___ 1-900-325-0506

INTERESTS IN BUSINESS ENTITIES PART 7B

Cl NOT APPLICABLE

Describe all beneficial interests in business entities held or acquired by you, your spouse, or a dependent child during the

calendar year. Ifthe interest was sold, also indicate the category ofthe amount of the net gain or loss realized from the sale.

For an explanation of ‘beneficial interest’ and other specific directions for completing this section, see FORM PFS--

INSTRUCTION GUIDE

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

Providing the number under which the child is listed on the Cover Sheat,

* HELD OR ACQUIRED BY Bruce Ci srouse C1 bePenoenr chit

Fiectaules Dioner ane sae)

Pacific Good Properties, LP- Partner

701 Noah Pacie Ave

Mineola, "759773

3 IF SOLD

Oner gain C1Less Tuan $5,000 [1] $5,000-s9,999 [] $10,000-$24,999 [1] $25,000-OF MORE

Dinerioss

pe On AoauneD ay Fier Clsrouse ——_ bePenoenr cuit

DESCRIPTION Deserts Home tes)

Paciic Good Management, LLC - Pariner

701 North Paste Ave

Mineola, "TX'75773

IF SOLD

Ci ner can Ctess Tuan s5.000 [1] $5.000-99.999 1) s10,000-$24.999 [1] $25,000.08 MORE

Cnet Loss

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Texas Ethics Commission P.0.8o« 12070 ___Austin, Texas 70711-2070, (612)465-5800___ 1.800.395.8508,

ASSETS OF BUSINESS ASSOCIATIONS. PART 11A

C7 Nor APPLICABLE

Describe all assets of each coporation, fim, partnership, limited parinership, imited lability partnership, professional

corporation, professional association, joint venture, of other business association in which you, your spouse, or 2 depen-

dent child held, acquired, or sold 50 percent or more of the outstanding ownership and indicate the category of the amount

of the assets. For more information, seo FORM PFS--INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

7 BUSINESS Nave AND ABERESS (Oat Flars Hove Aor)

ASSOCIATION | Pecc Good Properties, LP

701 North Pacife Ave

Mineola, TX 75773

2 BUSINESS TYPE | Partnership

3 HELD, ACQUIRED, FILER SPOUSE DEPENDENT CHILD

OR SOLD BY a f =

+ ASSETS DESCRIPTON CATEGORY

Real Property and improvements at 701 North Pacific

‘Avo, Minoola Texas 78773, Bess THan $5,000] $5,000 - $9,909

T

I

|

| C1 s10,000- 824,009 $25,000-0R MORE

|

|

Checking Account at Bank Texas

C1 Less tHan $5,000 [XJ $5,000 - $9,999

| Clste00-s24909 O)s2s000-0n wore

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Toxas Ethics Commission

P.O. 80% 12070 __Austin, Texas 78711-2070,

«sr2y63.ss00___1-800-325-8506

1 NOT APPLICABLE

LIABILITIES OF BUSINESS ASSOCIATIONS

PART 11B

Describe all iabilties of each coporation, firm, partnership, limited partnership, limited liability partnership, professional

Corporation, professional association, joint venture, or other business association in which you, your spouse, or a depen-

dent child held, acquired, or sold 50 percent or more of the outstanding ownership and indicate the category of the amount

ofthe labilties. For more information, see FORM PFS~INSTRUCTION GUIDE,

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child Is listed on the Cover Sheet

1 BUSINESS NAME AND ADDRESS: D1 (check i Fier's Home Address)

BUSINESS, | acta od Pmpaes, LP

701 Norn Paci Ave

fincas 1 75779

2 BUSINESS TYPE _| Partnership

Peers Borner Lisrouse —— CJoerenoenrcno

4 LIABILITIES DESCRIPTION T ‘CATEGORY

Mortgage on real property and improvements at 701

North Pacific Ave, Mingola Texas 75773

Less THAN 5.000 [] $8.000- 3,008

|

| Clsto00-s2402 Bl s2s000-on wore

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Toxas Ethics Commission P.O. 80x 12070 __Auelin, Texas 78711-2070 (512)465-5800__ 1.900.525.0506

BOARDS AND EXECUTIVE POSITIONS PART 12

C1 Not APPLICABLE

List all boards of directors of which you, your spouse, or a dependent child are a member and all executive positions you,

your spouse, or a dependent child hold in corporations, firms, partnerships, limited partnerships, limited liablity partner-

hips, professional corporations, professional associations, joint ventures, other business associations, or proprietorship,

stating the name ofthe organization and the position held, For more information, see FORM PFS~INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

Providing the number under which the child is listed on the Cover Sheet.

1 ORGANIZATION Mineola Foundation

2 POSTITION HELD Trustee

3 POSITION HELD BY

Bru Di srouse Di berenoenr cH

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Texas Ethics Commission P.O. Box 12070_Austin, Texas 78711-2070, (12)469-5000__ 1-900-225-0506,

LEGISLATIVE CONTINUANCES PART 18

CO NoT APPLICABLE

Identify any legislative continuance that you have applied for or obtained under section 30.003 of the Civil Practice

and Remedies Code, or under another law or rule that requires or permils a court to grant continuances on the

grounds that an attorney for a party is a member or member-olect ofthe legislature.

1 NAME OF PARTY Proneer Royalty, Inc;Exploration Forest Hil, etal

REPRESENTED

2 DATE RETAINED:

1110672012

3 STYLE, CAUSE NUMBER, Pioneer Royalty, Inc., Exploration Forest Hills, Inc. v Gaither Petroleum Corporation, Gaither

COURT & JURISDICTION | Asset Management, and Depoconter Forest Hil, LUC; No 2012-256, In the District Court of

Wood County, 402nd Judicial District.

4 DATE OF CONTINUANCE

APPLICATION o9/06i2013

5 WAS CONTINUANCE

GRANTED? yes Chxo

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

“Texas Ethles Commission 2.0. Box 12070 __ Austin, Toxas 78711-2070 (512)663.5800__ 1.000.225.9506

PERSONAL FINANCIAL STATEMENT

PARTS MARKED 'NOT APPLICABLE’ BY FILER

Rather than printing a page for each Part the filer checked 'Not Applicable, this page summarizes whether the

'Not Applicable’ checkbox was checked for each Part. Ifthe checkbox is checked next to a Part below, then no

‘pages for that Part should be present in the report. Ifa checkbox is not checked, then pages for that Part

should be present in the report.

C1 NIA Part 1A - Sources of Occupational Income

Bi NIA Part 18- Retainers

BI NA Part2-- Stock

NIA. Part 3- Bonds, Notes & Other Commercial Paper

NA Part 4- Mutual Funds

NA Part - Income from Interest, Dividends, Royalties & Rents

NA Part 6 - Personal Notes and Lease Agreements.

NIA. Part 7A- Interests in Real Property

NIA Part 7B. Interests in Business Entities

NIA Pan cits

NIA Part 9 - Trust income

NIA Part 108 - Blind Trusts

NIA Part 108 - Trustee Statement

NIA Part 11A- Assets of Business Associations

NIA Part 118 -Liailties of Business Associations

NIA Part 12- Boards and Executive Positions

NIA Part 13- Expenses Accepted Under Honorarium Exception

NIA Part 14- Interest in Business in Common with Lobbyist

NIA Patt 15 Fees Received for Services Rendered to a Lobbyist or Lobbyist's Employer

a

a

a

g@

a

@

a

a

a

a

q

@

a

g

N/A Part 16 - Representation by Legislator Before State Agency

8

NIA. Part 17 - Benefits Derived from Functions Honoring Public Servant

o

NIA Part 18 Legislative Continuances

“Texas Ethics Commission P.0. 80x 12070__ Austin, Tras 78711:2070 (512)468-5800___1.600-325.8806

PERSONAL FINANCIAL STATEMENT AFFIDAVIT

The law requires the personal financial statement to be vertied. The verfication page must have the signature of the

individual required to file the personal financial statement, as well as the signature and stamp or seal of office of a notary

public or other person authorized by law to administer oaths and affirmations. Without proper verification, the statement

isnot considered fled.

| swear, or afirm, under penaity of perjury, that this financial statement

‘covers calendar year ending December 31, 2013. and is true and correct

‘and includes all information required to be “gforted by me under chapter

572 of the Government Code,

AFFIX NOTARY STAMP / SEAL ABOVE

@& i, ISABEL W. MoGUFFIN |

Nola Psi, Sate toms. f

‘Swom to and subscribed botore me by L2- Bi Aes insine Baliny ot DANA AY. 20/4

tocerty wich: nose my hand and Seal oF oft

bel JANE Jf Lx. Toppan WM Cufind NERY

‘Sera ctw oh mel

0402-11282 Sexa, unsnY

ee 0L0ZT X0d Od

Hs HONE UOISSTWIWIOD SITUIY SEX],

G3Ai2038

€LLSL SVXAL VIOANIN

OS XOd Od

SAHONH NVAUE C

Potrebbero piacerti anche

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Obergefell Vs HodgesDocumento103 pagineObergefell Vs HodgesCNBCDigitalNessuna valutazione finora

- Paxton IndictmentDocumento2 paginePaxton IndictmentRyan E. PoppeNessuna valutazione finora

- Hughes 2010 PFSDocumento14 pagineHughes 2010 PFSjmrussell87Nessuna valutazione finora

- PlaintDocumento2 paginePlaintjmrussell87Nessuna valutazione finora

- Molly White July 2015Documento55 pagineMolly White July 2015jmrussell87Nessuna valutazione finora

- Hughes 2011 PFSDocumento12 pagineHughes 2011 PFSjmrussell87Nessuna valutazione finora

- Hughes 2012 PFSDocumento13 pagineHughes 2012 PFSjmrussell87Nessuna valutazione finora

- Hughes 2013 PFSDocumento14 pagineHughes 2013 PFSjmrussell87Nessuna valutazione finora

- Texas State Rep. Bryan Hughes 2010 Personal Financial StatementDocumento18 pagineTexas State Rep. Bryan Hughes 2010 Personal Financial StatementTexas WatchdogNessuna valutazione finora

- Lincoln Wilberforce Recent FilingDocumento2 pagineLincoln Wilberforce Recent Filingjmrussell87Nessuna valutazione finora

- Amended 08 NameDocumento2 pagineAmended 08 Namejmrussell87Nessuna valutazione finora

- LW 2008 FilingDocumento2 pagineLW 2008 Filingjmrussell87Nessuna valutazione finora

- Hughes 2008 PFSDocumento29 pagineHughes 2008 PFSjmrussell87Nessuna valutazione finora

- Dan Patrick To Ken PaxtonDocumento2 pagineDan Patrick To Ken Paxtonjmrussell87Nessuna valutazione finora

- CSHB 4105Documento3 pagineCSHB 4105jmrussell87Nessuna valutazione finora

- EC Complaint - Exhibit 3 - Colorado For Family Values SD22 MailerDocumento2 pagineEC Complaint - Exhibit 3 - Colorado For Family Values SD22 Mailerjmrussell87Nessuna valutazione finora

- CSHB 4105Documento3 pagineCSHB 4105jmrussell87Nessuna valutazione finora

- Social Conservatives Letter To AbbottDocumento3 pagineSocial Conservatives Letter To Abbottjmrussell87Nessuna valutazione finora

- Texas Tea Party Leaders Issue Letter To Abbott, PatrickDocumento2 pagineTexas Tea Party Leaders Issue Letter To Abbott, Patrickjmrussell87Nessuna valutazione finora

- EC Complaint - Exhibit 4 - Colorado Citizens For Right To Work SD22 MailerDocumento7 pagineEC Complaint - Exhibit 4 - Colorado Citizens For Right To Work SD22 Mailerjmrussell87Nessuna valutazione finora

- CCL Cover SheetDocumento2 pagineCCL Cover Sheetjmrussell87Nessuna valutazione finora

- EC Complaint - Exhibit 2 - National Family Coalition SD19 MailerDocumento2 pagineEC Complaint - Exhibit 2 - National Family Coalition SD19 Mailerjmrussell87Nessuna valutazione finora

- EC Complaint - Exhibit 1 - Christian Coalition of Colorado SD19 MailerDocumento2 pagineEC Complaint - Exhibit 1 - Christian Coalition of Colorado SD19 Mailerjmrussell87Nessuna valutazione finora

- CCL Complaint - Exhibit 3 - 2014 State Frequent Filing CalendarDocumento1 paginaCCL Complaint - Exhibit 3 - 2014 State Frequent Filing Calendarjmrussell87Nessuna valutazione finora

- CCL Complaint - Exhibit 1 - SD19 MailerDocumento2 pagineCCL Complaint - Exhibit 1 - SD19 Mailerjmrussell87Nessuna valutazione finora

- CCL Complaint ExecutedDocumento6 pagineCCL Complaint Executedjmrussell87Nessuna valutazione finora

- CCL Complaint - Exhibit 2 - SD22 MailerDocumento2 pagineCCL Complaint - Exhibit 2 - SD22 Mailerjmrussell87Nessuna valutazione finora

- CCC Et Al Complaint ExecutedDocumento5 pagineCCC Et Al Complaint Executedjmrussell87Nessuna valutazione finora