Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

10-14 MB Jaffa

Caricato da

api-241999402Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

10-14 MB Jaffa

Caricato da

api-241999402Copyright:

Formati disponibili

C

SERVICING

INVESTING IN THE FORCES OF

CHANGE

b y A L A N J A F FA

TOO MANY COOKS IN THE KITCHEN, too many hands in the potwhatever

the saying, it describes the mortgage servicing industry and the multitude of

external regulatory and compliance forces that continue to mold the industry.

But these forces are not limited to those coming from clients, the federal government

or local municipalities. They are coming from within the industry as well.

In response to the overwhelming and

constantly changing compliance landscape, field services companies are proactively developing industry best practices

and quality-control procedures to ensure

compliance with existing regulations,

and to plan for those yet to come.

Evolution of the industry

The volume of vacant and foreclosed

properties will remain high for some

time. Yet the frenetic pace has slowed,

which offers field services companies

like Safeguard Properties breathing room

to enhance their focus on technology

research and development.

Smart devices, coupled with business

intelligence, are changing the industry

paradigm and shaping the way technology is used to ensure that vendors in

the field operate effectively and efficiently through every facet of the default

management process.

At Safeguard Properties annual Vendor Conference this past June, attendees

were asked how many had integrated

mobile technology into their business

practices94 percent responded positively. The increased reach of mobile

networks and lower costs have helped

with rapid adoption of mobile devices

among vendors.

ing a prior visit cannot be

reused, thus further minimizing

the risk for fraud.

More than 98 percent of all

inspections Safeguards inspector network performs are completed through this application,

with close to 70 percent of the

inspections Safeguard performs

in a given month reported in

under two hours of completiona process that was previously counted in days.

Another new proprietary application weve begun to roll

out to our vendors is PhotoDirect. Vendors can take pictures of property damage, upload them while still at the property and transmit the photos in real

time. These photos can then be made

available for client viewing.

More than 1 billion photos flow

through Safeguard annually, along with

many millions of data points. We have

invested in end-to-end processes and

the supporting technology that can help

our clients make informed decisions,

many times in real time, while we have

someone at a property. In addition, our

clients can in turn use this information

to document their own compliance with

industry and regulatory requirements.

Safeguards investment

in the development of

mobile technology is

by far our largest dollar

spend.

Safeguards investment in the development of mobile technology is by far

our largest dollar spend. We recognize

that it is not going to be the only driver

for us as a company, but it is going to be

a significant part of what we are doing

and where we are headed.

For example, INSPI Mobile, our proprietary mobile inspections platform,

was designed to ensure the accuracy,

quality and timeliness of inspections.

The platform uses smart script technology to guide the inspector through the

entire inspection reporting process, including the tracking, labeling and timestamping of all photos. Because all photos are time-stamped, photos taken dur-

M O R T G A G E B A N KI N G |

149

| O C TO B E R 2 0 1 4

SERVICING

Forward-looking approaches

New and tighter regulations are squeezing an already highly regulated mortgage industry, putting players at greater

risk than before. This scrutiny not only

affects mortgage companies, but cascades down to field services companies

and their vendors and employees. But

it doesnt stop there. It cascades even

further down to subcontractors who

also must comply with all regulatory

requirements.

Safeguard has always conducted audits of our vendors, but over the past

year we have instituted additional audit

procedures to align with the new laws

and regulations and the increased level

of third-party oversight.

Safeguards business process and

compliance audits are a proactive way

to provide vendor network support to

ensure effective operational controls,

adequate screening, training and quality

assurance. We firmly believe that just

as our client audits have helped Safeguard improve our own business

processes, vendors will experience similar benefits.

Background checks of employees and

vendors are a key component of Consumer Financial Protection Bureau (CFPB)

regulations. Safeguard performs background checks on the principals of all

of its vendor companies as part of the

initial onboarding and credentialing

process.

Additionally, as part of our guidelines,

we require our contractors to perform

background checks on their employees

and subcontractors who perform services

on our behalf. As an additional compliance

measure, and part of the annual business

process and compliance audit, Safeguard

audits our vendors employee/subcontractor files to ensure that background

check information is available for anyone

who steps on a property where Safeguard

is performing services.

We are in an environment where we

have to minimize the risks to our clients

and to properties. By being proactive,

and in a sense by self-regulating, we

will help our industry comply with the

new requirements.

Creative thinking

Safeguard has long been the standard

bearer for introducing best practices

into the field services industry. By utilizing the vast amount of metadata col-

lected daily at properties across the

country, valuable business intelligence

is helping to improve the accuracy and

efficiency of the work completed by the

vendors who are at properties every

day. This information also is being used

by clients to make more effective business decisions about the properties in

their portfolios.

By looking at industry problems or

situations from a fresh perspective, Safeguard has been able to optimize mobile

location and tracking to help ensure the

right people are at the right property at

the right time.

By utilizing mobiles GPS functionality

and the millions of data points in our

system, each property is geocoded, feed-

By being proactive, and

in a sense by self-regulating, we will help our

industry comply with

the new requirements.

ing real-time location information to

our mobile technology platforms. This

satellite information is used to triangulate where the vendor is, and because it

is fully integrated into the companys

secured internal system, it can provide

additional guidance through property

verification information.

Embedded metadata also is being

used as a control when photos are

submitted from the field. Technology

has advanced to the point where date,

time and GPS coordinates associated

with a photo can be locked. By deploying an automated process that

looks at embedded metadata, Safeguard is able to identify if work orders

are submitted with reused, cropped,

altered, fraudulent and other ineligible

photos tagged as suspect and block

their submission.

To house the massive amount of

data being collected and stored, data

centers are an integral part of a field

services companys infrastructure and

data security strategy. This exponential

data growth led to a strategic decision

M O R T G A G E B A N KI N G |

150

| O C TO B E R 2 0 1 4

by Safeguard to shift its technological

paradigm.

Traditional disaster-recovery models

and regional Internet service providers

had to be replaced with global Internet

active/active data centers as well as be

geographically dispersed. This data-center model gives Safeguard the necessary

agility and scalability, and protects the

companys technology from environmental threats and regional disasters

through its physical construction and

service offerings, in line with Safeguards

geographic-dispersion strategy.

In addition, Safeguards investment

in technology ensures that the data centers can support the companys current

and future needs by providing real-time

disaster-recovery capabilities

and scalability options to provide excess capacity as needed.

The next technological evolution that will enhance quality

will be the use of real-time video

from the property. For example,

the field services industrys No.

1 risk is determining if a property is occupied or vacant. With

video, if there is a question

about a propertys status, the

inspector can share the live

video stream right from the

property and another set of eyes

can help with the property status

determination.

Or, when a vendor is submitting a

damages bid, it can use video to provide

a detailed view of the issue and get approval while still on site, potentially

eliminating additional trips to the property to repair damages.

Moving forward

As the industry continues to evolve to

meet new requirements, the field services industry, whose job it is to protect

and preserve vacant properties on behalf

of the mortgage servicing industry, has

made the business decision to embrace

this new world head-on. Were proving

we can adapt quickly to market changes

by looking ahead and using creative

thinking to advance industry standards

and quality control procedures.

Alan Jaffa is chief executive officer of Valley

View, Ohiobased Safeguard Properties, the

largest mortgage field service company in the

United States. He can be reached at

alan.jaffa@safeguardproperties.com.

Potrebbero piacerti anche

- Background Check Consent FormDocumento1 paginaBackground Check Consent FormFatin Maisarah100% (1)

- Driver Sues Uber Over Background ChecksDocumento22 pagineDriver Sues Uber Over Background ChecksChristopher ZaraNessuna valutazione finora

- Backgroud Check Form With LOADocumento6 pagineBackgroud Check Form With LOASho VictoriaNessuna valutazione finora

- Human Resource Management: Testing and Selecting EmployeesDocumento8 pagineHuman Resource Management: Testing and Selecting EmployeesSupia ChaoNessuna valutazione finora

- Surveillance Camera ReportDocumento51 pagineSurveillance Camera Reportlmccarty2656100% (2)

- Offer LetterDocumento13 pagineOffer LetterVikas KarandeNessuna valutazione finora

- Wearable Technology: Automotive's Next Digital FrontierDocumento12 pagineWearable Technology: Automotive's Next Digital FrontierCognizantNessuna valutazione finora

- Brochure Guidewire PolicyCenter PDFDocumento4 pagineBrochure Guidewire PolicyCenter PDFSaiKiran Tanikanti0% (1)

- Brochure Guidewire ClaimCenterDocumento4 pagineBrochure Guidewire ClaimCenterSaiKiran TanikantiNessuna valutazione finora

- Recruitment and Selection SoPDocumento7 pagineRecruitment and Selection SoPAhmadshah NejatiNessuna valutazione finora

- Investigative Services ProposalDocumento6 pagineInvestigative Services ProposalBheki TshimedziNessuna valutazione finora

- MARUTI AutomobileCompany DMSDocumento4 pagineMARUTI AutomobileCompany DMSbuccas1367% (3)

- Digital Network Solutions (Company Profile) UpdatedDocumento9 pagineDigital Network Solutions (Company Profile) Updatedsaleem khanNessuna valutazione finora

- Ey Digital Transformation in InsuranceDocumento18 pagineEy Digital Transformation in InsuranceSandeepPattathil100% (6)

- Pinnergy Overview Q3 2016Documento55 paginePinnergy Overview Q3 2016obryjefaNessuna valutazione finora

- Website ReferenceDocumento10 pagineWebsite Referencesalmar2622Nessuna valutazione finora

- Report On VSaaS ProductDocumento31 pagineReport On VSaaS ProductHarsh Biyani100% (1)

- Unleash The Benefits of Ibm Mobile Smarter Process With Ibm Business Process Manager and Ibm Mobilefirst PlatformDocumento12 pagineUnleash The Benefits of Ibm Mobile Smarter Process With Ibm Business Process Manager and Ibm Mobilefirst PlatformpruebaorgaNessuna valutazione finora

- Impacts of SmartDocumento9 pagineImpacts of SmartPeterNessuna valutazione finora

- Related Links: ProductsDocumento7 pagineRelated Links: ProductsnikithasreekanthaNessuna valutazione finora

- O Human Resource Management o Firm Infrastructure o Procurement o Marketing Sales and Service o Technology DevelopmentDocumento4 pagineO Human Resource Management o Firm Infrastructure o Procurement o Marketing Sales and Service o Technology Developmentakhil pillaiNessuna valutazione finora

- Business Application ServicesDocumento7 pagineBusiness Application ServicesBảo VyNessuna valutazione finora

- Project Work 2.0Documento18 pagineProject Work 2.0PurviNessuna valutazione finora

- The Pillars of A Next Generation Enterprise Mobility Solution by Heavy ReadingDocumento15 pagineThe Pillars of A Next Generation Enterprise Mobility Solution by Heavy ReadingAvraam PapadopoulosNessuna valutazione finora

- Shop Scan Go Grocery App Streamlines ShoppingDocumento12 pagineShop Scan Go Grocery App Streamlines ShoppingLilian May MalfartaNessuna valutazione finora

- Task3 - Martin Wildbaum, Gillermo Fiorina and Federico CapoDocumento6 pagineTask3 - Martin Wildbaum, Gillermo Fiorina and Federico CapoMartin WildbaumNessuna valutazione finora

- Group6 InstantTransportSolutionPvtLtdDocumento10 pagineGroup6 InstantTransportSolutionPvtLtdAshay ParasharNessuna valutazione finora

- J&T Delivery ServicesDocumento11 pagineJ&T Delivery ServicesRenzo CalongcagongNessuna valutazione finora

- Name Netid Group Number: Website Link: Tutorial Details Time Spent On AssignmentDocumento12 pagineName Netid Group Number: Website Link: Tutorial Details Time Spent On Assignmenthuman360Nessuna valutazione finora

- Case Study - HealthCareDocumento2 pagineCase Study - HealthCareNikhil SatavNessuna valutazione finora

- Module 6 Reading - 7 Technology Trends That Will Impact Equipment Dealers by The Year 2020Documento22 pagineModule 6 Reading - 7 Technology Trends That Will Impact Equipment Dealers by The Year 2020Sergio VelardeNessuna valutazione finora

- Multitenant Cloud Infrastructure Delivers Scale, Security and ReliabilityDocumento13 pagineMultitenant Cloud Infrastructure Delivers Scale, Security and ReliabilityEswarNessuna valutazione finora

- 1 2022 Trends in Video SurveillanceDocumento12 pagine1 2022 Trends in Video SurveillancehoainamcomitNessuna valutazione finora

- Evolution and Future Trends in Flexible and Contract ManufacturingDocumento2 pagineEvolution and Future Trends in Flexible and Contract ManufacturingSudarshan MandalNessuna valutazione finora

- Brochure Guidewire CorporateOverviewDocumento12 pagineBrochure Guidewire CorporateOverviewSaiKiran TanikantiNessuna valutazione finora

- Name Netid Group Number: Website Link: Tutorial Details Time Spent On AssignmentDocumento11 pagineName Netid Group Number: Website Link: Tutorial Details Time Spent On Assignmentskoo437Nessuna valutazione finora

- Name Netid Group Number: Website Link: Tutorial Details Time Spent On AssignmentDocumento11 pagineName Netid Group Number: Website Link: Tutorial Details Time Spent On AssignmentMaggieZhouNessuna valutazione finora

- Clinton Bank M Case Study AnswersDocumento9 pagineClinton Bank M Case Study AnswersClinton OnyenemezuNessuna valutazione finora

- Application Development and Blockchain TechnologyDocumento3 pagineApplication Development and Blockchain TechnologyHariSharanPanjwaniNessuna valutazione finora

- $RF28QJDDocumento12 pagine$RF28QJDshivani kumariNessuna valutazione finora

- Kumpulan 5 E-Commerce System: I. Speed of DeliveryDocumento4 pagineKumpulan 5 E-Commerce System: I. Speed of DeliveryMuhd Firdzaus Mat RosNessuna valutazione finora

- National Institute of Fashion Technology: Submitted By: Submitted To: Saurav Mahato Mr. Kamaljeet SinghDocumento11 pagineNational Institute of Fashion Technology: Submitted By: Submitted To: Saurav Mahato Mr. Kamaljeet SinghToxic SkyNessuna valutazione finora

- Concept PaperDocumento7 pagineConcept PaperPius VirtNessuna valutazione finora

- Updated ROI Guide 2 1Documento11 pagineUpdated ROI Guide 2 1SaltojitoNessuna valutazione finora

- PROPOSAL For Planning Software System (1) 23Documento21 paginePROPOSAL For Planning Software System (1) 23sishirNessuna valutazione finora

- Unit 2 IotDocumento8 pagineUnit 2 Iotlakshmi prasannaNessuna valutazione finora

- Name Netid Group Number: Website Link: Tutorial Details Time Spent On AssignmentDocumento9 pagineName Netid Group Number: Website Link: Tutorial Details Time Spent On Assignmentaiva245Nessuna valutazione finora

- SecuritasDocumento4 pagineSecuritasVikas SainiNessuna valutazione finora

- Sepfinal1 OdtDocumento136 pagineSepfinal1 OdtshrutiNessuna valutazione finora

- Emerging TechnologirsDocumento8 pagineEmerging TechnologirsAkshatNessuna valutazione finora

- Name Netid Group Number: Website Link: Tutorial Details Time Spent On AssignmentDocumento10 pagineName Netid Group Number: Website Link: Tutorial Details Time Spent On AssignmentKenneth CaiNessuna valutazione finora

- Agile 1 PDFDocumento5 pagineAgile 1 PDFGARLAPATI VIVEK SAINessuna valutazione finora

- Idc Marketscape: Worldwide Saas and Cloud-Enabled Sourcing Applications 2021 Vendor AssessmentDocumento22 pagineIdc Marketscape: Worldwide Saas and Cloud-Enabled Sourcing Applications 2021 Vendor AssessmentYounous EL MriniNessuna valutazione finora

- Real Estate TechnologyDocumento34 pagineReal Estate Technologylyka.pajarillo.cbaaNessuna valutazione finora

- Tugas SIM Regina Salsalina BR Ginting (180502033)Documento3 pagineTugas SIM Regina Salsalina BR Ginting (180502033)REGINANessuna valutazione finora

- Case StudyDocumento4 pagineCase StudyGee-ann BadilloNessuna valutazione finora

- The Role of IT in The Digital Industrial RevolutionDocumento3 pagineThe Role of IT in The Digital Industrial RevolutionAdhytra Cipta RahmadhanaNessuna valutazione finora

- Smart Sensors Enable Enterprise Opportunities: EnterprisesDocumento9 pagineSmart Sensors Enable Enterprise Opportunities: EnterpriseskumsureshNessuna valutazione finora

- Insurers Missing The Boat With Claims Technology: Property Casualty 360Documento4 pagineInsurers Missing The Boat With Claims Technology: Property Casualty 360Covenant22Nessuna valutazione finora

- The Future of AuditDocumento9 pagineThe Future of AuditeogollaNessuna valutazione finora

- Mobile QA Tester ResumeDocumento4 pagineMobile QA Tester ResumeJitendra kumarNessuna valutazione finora

- SmartServe: Field Service Management Software ComparisonDocumento5 pagineSmartServe: Field Service Management Software ComparisonMilind Teli100% (1)

- A New Distribution Model: Finance On-Request InsuranceDocumento8 pagineA New Distribution Model: Finance On-Request Insurancenagarajbu031Nessuna valutazione finora

- Sunrise Software Fortek Case StudyDocumento4 pagineSunrise Software Fortek Case Studycsteer5026Nessuna valutazione finora

- Name Netid Group Number: Website Link: Tutorial Details Time Spent On AssignmentDocumento9 pagineName Netid Group Number: Website Link: Tutorial Details Time Spent On AssignmentXianXiaoNessuna valutazione finora

- What Is Predictive Maintenance Services - Software AGDocumento5 pagineWhat Is Predictive Maintenance Services - Software AGkhaledhassangamal9516Nessuna valutazione finora

- Analysis and Design of Next-Generation Software Architectures: 5G, IoT, Blockchain, and Quantum ComputingDa EverandAnalysis and Design of Next-Generation Software Architectures: 5G, IoT, Blockchain, and Quantum ComputingNessuna valutazione finora

- Gretchen e Fri Apr Communications Professional Resume Weebly 2015Documento2 pagineGretchen e Fri Apr Communications Professional Resume Weebly 2015api-241999402Nessuna valutazione finora

- Ds News Measuring Security by Darren Kruk 4-15Documento4 pagineDs News Measuring Security by Darren Kruk 4-15api-241999402Nessuna valutazione finora

- DSN May15 SafeguardDocumento13 pagineDSN May15 Safeguardapi-241999402Nessuna valutazione finora

- Customer Jun2013 Es-Infocision With Gretchens FixDocumento2 pagineCustomer Jun2013 Es-Infocision With Gretchens Fixapi-241999402Nessuna valutazione finora

- Right Call - Issue 9Documento4 pagineRight Call - Issue 9api-241999402Nessuna valutazione finora

- Carl Albright Fortune ArticleDocumento2 pagineCarl Albright Fortune Articleapi-241999402Nessuna valutazione finora

- Edu Outbound 060713Documento1 paginaEdu Outbound 060713api-241999402Nessuna valutazione finora

- HR Recruitment PROCESS FLOW PDFDocumento162 pagineHR Recruitment PROCESS FLOW PDFEdward BullecerNessuna valutazione finora

- Orientation For The Hiring Guidelines For The Master Teacher-I ApplicantsDocumento42 pagineOrientation For The Hiring Guidelines For The Master Teacher-I ApplicantsMelvin BetonioNessuna valutazione finora

- TruTeam Careers PDFDocumento6 pagineTruTeam Careers PDFLupita RamirezNessuna valutazione finora

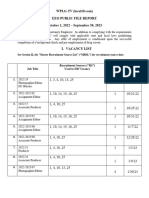

- WPLG 2022 2023 EEO Annual ReportDocumento10 pagineWPLG 2022 2023 EEO Annual ReportAmanda RojasNessuna valutazione finora

- MNGT24 (Recruiment and Selection) Chapter 2Documento55 pagineMNGT24 (Recruiment and Selection) Chapter 2Maroden Sanchez GarciaNessuna valutazione finora

- Tips On Choosing An Immigration LawyerDocumento6 pagineTips On Choosing An Immigration LawyerZefu ANessuna valutazione finora

- Confidential offer letter for Agent positionDocumento7 pagineConfidential offer letter for Agent positionBobby GenitaNessuna valutazione finora

- Background Verification GuidelinesDocumento2 pagineBackground Verification GuidelinesYerrarapu SureshNessuna valutazione finora

- Confirmation Letter Electronics Engineer TraineeDocumento3 pagineConfirmation Letter Electronics Engineer TraineendhmittalNessuna valutazione finora

- Prior Criminal Indictments Against Corey GaynorDocumento26 paginePrior Criminal Indictments Against Corey GaynorPenn Buff NetworkNessuna valutazione finora

- Covid 19 Per Diem Offer Letter TemplateDocumento7 pagineCovid 19 Per Diem Offer Letter TemplateAtchim NaiduNessuna valutazione finora

- Acknowledgment and Authorization For Background CheckDocumento1 paginaAcknowledgment and Authorization For Background CheckEvan JosephNessuna valutazione finora

- Complete Fingerprint Forms GuideDocumento4 pagineComplete Fingerprint Forms GuidejacobNessuna valutazione finora

- Background Screening ConsentDocumento1 paginaBackground Screening ConsentsammyNessuna valutazione finora

- SRI LANKA POLICE RECRUITMENT EXAMDocumento5 pagineSRI LANKA POLICE RECRUITMENT EXAMsupunNessuna valutazione finora

- LTIMindtree Data Privacy Notice For Job Applicants V1 FinalDocumento26 pagineLTIMindtree Data Privacy Notice For Job Applicants V1 FinalMD NASEERUDDINNessuna valutazione finora

- DPD Video Surveillance System SpecsDocumento102 pagineDPD Video Surveillance System SpecsDallasObserverNessuna valutazione finora

- Application Form TcsDocumento5 pagineApplication Form TcsMallineni MeghanaNessuna valutazione finora

- MTA Background Check ReleaseDocumento2 pagineMTA Background Check ReleaseAdriano GuedesNessuna valutazione finora

- c39def6f-c4ed-4b6a-98c7-2e625e10ebe2Documento3 paginec39def6f-c4ed-4b6a-98c7-2e625e10ebe2eugene orbitaNessuna valutazione finora

- BITS Pilani: Chapter 7: Selecting Human ResourcesDocumento49 pagineBITS Pilani: Chapter 7: Selecting Human ResourcesSita RamachandranNessuna valutazione finora

- UnofficialresultsDocumento2 pagineUnofficialresultsapi-334151244Nessuna valutazione finora

- KI Amendments 2013Documento28 pagineKI Amendments 2013Sarah8605Nessuna valutazione finora