Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Managing Credit Cards

Caricato da

api-285965297Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Managing Credit Cards

Caricato da

api-285965297Copyright:

Formati disponibili

Two basic distinctions between cards:

Where the card is accepted

When the charges must be paid

Managing Credit Cards

Katelin Collins, Meg Nolan, Kisiah

Waterhouse

Private Label Cards:

Ex:

Can be used only at a single retailer

General Purpose Cards:

ex:

Used at different businesses around the country/world. (Bank care,

major credit card)

General purpose cards can be used to make purchases and to obtain cash

advances

Revolving Credit:

Payment options the cardholder has upon reviewing the bill:

Pay for charges in full

Make a minimum payment

Obtain any inbetween amount

Also referred to as a charge card

Co-branded Cards:

Carries the name of a card network, a bank, and possibly another

company

Status Cards:

Offers increased credit and other benefits

Highly promoted to customers with established credit

Charge of an annual fee

Also known as a prestige, gold, or platinum cards.

Affinity Card:

Ex:

ex:

Carries the name of a nonprofit or charitable organization

Organization receives money for every dollar charged on the card or

a portion of the annual fee.

Smart Card:

Has a computer chip to make web order forms easier to fill out

Cost and features of credit cards

Annual Fees:

Teaser Rate:

Ex:

APR:

Annual rate of interest that is charged for using credit

Makes a difference on the cost of using credit

Can go up or down depending on economic factors.

Computation Method:

Few private label cards charge a fee, some general purpose cards do.

Agreement that specifies how finance charges are

computed

Makes a difference on how much you will pay

Low introductory rate that effect us for a limited time

Minimum Payment:

Must make a minimum payment by the due date listed in the credit

agreement

Creditor may require the full outstanding balance of your account if

not payed on time

Truth in Lending Act:

Requires creditors to inform consumers about terms and costs

Lender must disclose specific information such as;

APR

How variable rates are calculated

When payments are due

All fees

Before applying: read disclosures and understand basic terms

Time during the balance may be paid in full to avoid finance charges

Might not apply if previous bill is unpaid

Allowed by most credit cards

Common time is 20-25 days

Once applications are accepted a cardholder agreement spells out the

terms in detail

Minimum Finance Charge:

Grace Period:

Some specify that in months when you owe a finance charge, it will at

least specify a certain amount

Ex: Carry over balance of $1.00 and $.50 minimum charge may apply

Different cardholder agreements may specify fees for:

Late Payments

Cash Advances

Exceeding credit limit

Returned checks

Colleges have banned on campus credit pitches

Students run up debt and end up in a credit card trap

Credit Limit:

Maximum credit that the creditor will extend to the borrower

Special Features:

Rebates/Discounts

Flyer miles

Insurance coverage

Benefits way against annual fee/interest rate

If you carry over a balance, search for a low interest rate

Pay bill in full you get a card and no annual fee

Using Credit Cards:

Your credit limit is a maximum, not a goal

Save your receipts and check them with your monthly bill

Set a personal limit on how much to spend each month

If possible pay the balance in full so you dont get finance charges, if not

pay the largest payment you can

Fair Credit Billing Act

Outlines procedures for settling credit card billing disputes.

To preserve your rights:

Write a letter to the creditor

The letter must be received by the creditor within 60 days

after you received the bill containing the error

Include: name, account number, description of the

problem, receipt copies and document copies

Send the letter by mail and keep a copy of it.

Pay bills on time to protect your credit history and avoid late fees

Fair Credit Billing Act

The creditor is required to respond in writing to your letter within 30 days,

and resolve the problem within 90 days.

During this time period:

The creditor will investigate the situation

You are obligated to pay the bill as usual, but may withhold payment

from the disputed amount

If the investigation says that the amount is correct, you must pay

that amount and finance charges that have accumulated

If the error on your bill is confirmed, the creditor must credit your

account for the errors amount and remove any related finance

charges.

Safeguarding your card: Credit Card fraud

Unauthorized use of credit cards or account numbers that have fallen

into the wrong hands.

To protect yourself Keep cards with you or in a safe place

Make sure you have your card is returned to you after making a

purchase

Know the site is secure before online purchasing

Keep your card in site when paying for a purchase

Keep record of your card numbers

Notify the card company ASAP if its lost or stolen

Consumer Credit Protection Act:

Maximum amount for which you may be held liable if someone uses the

card illegally. ($50)

If the company is notified of the lost card, you have no liability.

A monthly statement, or bill, lists:

All transactions

Finance charges

Account balance

Minimum payment due

Due Date

Check:

Transactions against receipts

Check interest rate on your statement and verify that its the same

on the C.C.A (Credit card agreement)

Potrebbero piacerti anche

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

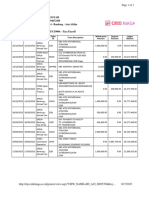

- Account Number Customer Id Account Currency Opening Balance Closing BalanceDocumento4 pagineAccount Number Customer Id Account Currency Opening Balance Closing Balancesamaa adelNessuna valutazione finora

- CEO President Risk Management in Atlanta GA Resume Charles "Bill" FordDocumento3 pagineCEO President Risk Management in Atlanta GA Resume Charles "Bill" FordCharlesBillFordNessuna valutazione finora

- Practice Questions 308Documento9 paginePractice Questions 308Nidale ChehadeNessuna valutazione finora

- Subsequent To Acquisition DateDocumento1 paginaSubsequent To Acquisition DateJean De GuzmanNessuna valutazione finora

- Postal Submission ListDocumento1 paginaPostal Submission ListBibekananda RoyNessuna valutazione finora

- Credit Appraisal ReportDocumento125 pagineCredit Appraisal ReportSadaf IqbalNessuna valutazione finora

- DXB - Your Medical Insurance SummaryDocumento5 pagineDXB - Your Medical Insurance SummaryKarthikeyanNessuna valutazione finora

- Rhode Island Participating Lenders of PPP (SBA Rhode Island District Office)Documento2 pagineRhode Island Participating Lenders of PPP (SBA Rhode Island District Office)Frank MaradiagaNessuna valutazione finora

- Mutual Savings Banks: Are Very Similar To Saving and Loan AssociationsDocumento3 pagineMutual Savings Banks: Are Very Similar To Saving and Loan Associationssamuel debebeNessuna valutazione finora

- Chapter I - Overview of AuditDocumento16 pagineChapter I - Overview of AuditMarj Manlagnit100% (1)

- Problem 17-3 Dan 17-5Documento3 pagineProblem 17-3 Dan 17-5Bagus SeptiawanNessuna valutazione finora

- MUTASI NIAGA-5 - MergedDocumento5 pagineMUTASI NIAGA-5 - Mergedoky daniNessuna valutazione finora

- Joint Arrangements: Use The Following Information For Questions 1 and 2Documento1 paginaJoint Arrangements: Use The Following Information For Questions 1 and 2Mary Jescho Vidal AmpilNessuna valutazione finora

- Port Folio Management of Banking SectorDocumento45 paginePort Folio Management of Banking SectorNitinAgnihotriNessuna valutazione finora

- Role of Commercial BanksDocumento16 pagineRole of Commercial BanksJayant MishraNessuna valutazione finora

- Questions For ESP2Documento35 pagineQuestions For ESP2Wabi SabiNessuna valutazione finora

- ACCT451 Assignment 1: QUESTION 1A) Cost MethodDocumento7 pagineACCT451 Assignment 1: QUESTION 1A) Cost MethodsmaNessuna valutazione finora

- Tiga Pilar Sejahtera Food GA 30 Juni 2020Documento128 pagineTiga Pilar Sejahtera Food GA 30 Juni 2020Fadel Khalif MuhammadNessuna valutazione finora

- Profit MaximizationDocumento42 pagineProfit MaximizationSwarnima SinghNessuna valutazione finora

- IFSCode All BanksDocumento470 pagineIFSCode All BanksPatil NarendraNessuna valutazione finora

- Audit of Liabs 1Documento2 pagineAudit of Liabs 1Raz MahariNessuna valutazione finora

- FABM 2 QuizDocumento2 pagineFABM 2 QuizShann 2Nessuna valutazione finora

- MCQs Chapter 9 Financial CrisesDocumento12 pagineMCQs Chapter 9 Financial Crisesphamhongphat2014Nessuna valutazione finora

- Format For Course Curriculum: Course Title: Advanced Financial Accounting Course Code: ACCT 603 Credit Units: 3 Level: PGDocumento4 pagineFormat For Course Curriculum: Course Title: Advanced Financial Accounting Course Code: ACCT 603 Credit Units: 3 Level: PGUbaid DarNessuna valutazione finora

- Chapter 12 Exercise E12-7 SOLUTION Fall 2018Documento2 pagineChapter 12 Exercise E12-7 SOLUTION Fall 2018Areeba QureshiNessuna valutazione finora

- Unit 1 - Ffa Study Material-DrjDocumento19 pagineUnit 1 - Ffa Study Material-DrjTushar Singh SanuNessuna valutazione finora

- Submitted By, Sruthy Sadassivan 2028053 Christ University Bangalore Mentor-Rahul RajDocumento8 pagineSubmitted By, Sruthy Sadassivan 2028053 Christ University Bangalore Mentor-Rahul RajHT SøurâvNessuna valutazione finora

- 1 Crore: Age 40 S/A (Term - 25/16) Minimum 6 YearDocumento4 pagine1 Crore: Age 40 S/A (Term - 25/16) Minimum 6 YearramNessuna valutazione finora

- BUSINESS COMBINATION - PTDocumento13 pagineBUSINESS COMBINATION - PTSchool FilesNessuna valutazione finora

- Corporate Bond FundDocumento2 pagineCorporate Bond FundAmit SharmaNessuna valutazione finora