Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Wasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions Manual

Caricato da

api-137921271Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Wasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions Manual

Caricato da

api-137921271Copyright:

Formati disponibili

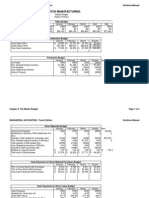

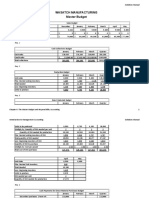

MANAGERIAL ACCOUNTING - Fourth Edition

Solutions Manual

WASATCH MANUFACTURING

Master Budget

Unit Sales

Sales Price per unit

Sales Revenue

Cash Sales

Credit Sales

Total Cash Collections

Unit Sales

Plus: Desired ending Inventory

Total needed

Less: Beginning Inventory

Units to produce

Chapter 9: The Master Budget

Sales Budget

January

February

8900

9900

$9

$9

$80,100

$89,100

March

9200

$9

$82,800

Cash Collections Budget

January

February

$20,025

$22,275

$57,000

$60,075

$77,025

$82,350

March

$20,700

$66,825

$87,525

Quarter

$63,000

$183,900

$246,900

Production Budget

January

February

8900

9900

1485

1380

10385

11280

1335

1485

9050

9795

March

9200

1425

10625

1380

9245

Quarter

28000

1425

29425

1335

28090

December

8444

$9

$76,000

April

9500

$9

$85,500

May

8600

$9

$77,400

Page 1 of 6

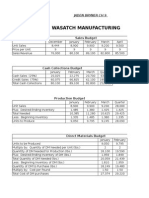

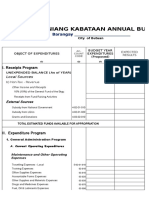

MANAGERIAL ACCOUNTING - Fourth Edition

Solutions Manual

Direct Materials Budget

January

February

Units to be produced

9050

9795

2

2

Multiply by: Quantity of DM needed per unit

(lbs.)

March

9245

2

Quarter

28090

2

18490

1873

20363

1849

18514

$1.50

$27,771

56180

1873

58053

1810

56243

$1.50

$84,365

Cash Payments for Direct Material Purchases Budget

January

February

March

30% of Current Month DM Purchases

$8,212

$8,766

$8,331

70% of Prior Month DM Purchases

$22,000

$19,161

$20,454

Total Cash Payments DM Purchases

$30,212

$27,927

$28,785

Quarter

$25,309

$61,615

$86,925

Cash Payments for Direct Labor Budget

January

February

Units Produced

9050

9795

Multiply by: Hours per unit

0.03

0.03

Direct Labor Hours

272

294

Multiply by: Direct Labor Rate per Hour

$13

$13

Direct Labor Cost

$3,530

$3,820

Quarter

28090

0.03

843

$13

$10,955

Quantity of DM needed for production (lbs.)

Plus: Desired ending inventory of DM (lbs.)

Total quantity of DM needed (lbs.)

Less: Beginning inventory of DM (lbs.)

Quantity of DM to purchase (lbs.)

Multiply by: Cost per pound

Total cost of DM purchases

Chapter 9: The Master Budget

18100

1959

20059

1810

18249

$1.50

$27,374

19590

1849

21439

1959

19480

$1.50

$29,220

March

9245

0.03

277

$13

$3,606

Page 2 of 6

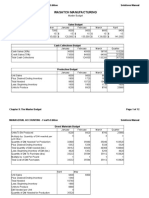

MANAGERIAL ACCOUNTING - Fourth Edition

Chapter 9: The Master Budget

Solutions Manual

Page 3 of 6

MANAGERIAL ACCOUNTING - Fourth Edition

Solutions Manual

Cash Payments for Manufacturing Overhead Budget

January

February

March

Variable Manufacturing Overhead Costs

$12,670

$13,713

$12,943

Rent (fixed)

$6,500

$6,500

$6,500

Other Manufacturing Overhead (fixed)

Cash Payments for Manufacturing Overhead

$2,100

$21,270

$2,100

$22,313

Cash Payments for Operating Expenses Budget

January

February

Variable Operating Expenses

$10,680

$11,880

Fixed Operating Expenses

$1,400

$1,400

Cash Payments for Operating Expenses

$12,080

$13,280

Cash Balance, Beginning

Plus: Cash Collections

Total Cash Available

Less Cash Payments:

DM Purchases

Direct Labor

MOH costs

Operating Expenses

Tax payment

Equipment Purchases

Total Cash Payments

Ending Cash before financing

Financing:

Chapter 9: The Master Budget

Combined Cash Budget

January

February

$6,000

$4,933

$77,025

$82,350

$83,025

$87,283

$30,212

$3,530

$21,270

$12,080

$15,000

$82,092

$933

$27,927

$3,820

$22,313

$13,280

$10,800

$6,000

$84,141

$3,143

Quarter

$39,326

$19,500

$2,100

$21,543

$6,300

$65,126

March

$11,040

$1,400

$12,440

Quarter

$33,600

$4,200

$37,800

March

$5,143

$87,525

$92,668

Quarter

$6,000

$246,900

$252,900

$28,785

$3,606

$21,543

$12,440

$86,925

$10,955

$65,126

$37,800

$10,800

$25,000

$236,606

$16,294

$4,000

$70,374

$22,294

Page 4 of 6

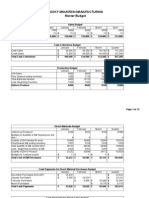

MANAGERIAL ACCOUNTING - Fourth Edition

Borrowings

Repayments

Interest payments

Cash Balance, Ending

Chapter 9: The Master Budget

Solutions Manual

$4,000

$4,933

$2,000

$5,143

$6,000

$240

$16,054

$6,000

$6,000

$240

$16,054

Page 5 of 6

MANAGERIAL ACCOUNTING - Fourth Edition

Solutions Manual

Budgeted Manufacturing Cost per Unit

Direct materials cost per unit

$3.00

Direct labor cost per unit

$0.39

Variable manufacturing costs per unit

$1.40

Fixed manufacturing overhead per unit

$0.60

Cost of manufacturing each unit

$5.39

Budgeted Income Statement

Sales Revenue

$252,000

Less: Cost of Goods Sold

$150,920

Gross Profit

$101,080

Less: Operating Expenses

$37,800

Less: Depreciation Expense

$5,200

Operating Income

$58,080

Less: Interest Expense

($240)

Less: Income Tax Expense

($16,195)

Net Income

$41,645

Chapter 9: The Master Budget

Page 6 of 6

Potrebbero piacerti anche

- P5-3a Pa1Documento10 pagineP5-3a Pa1Agnes Eviyany50% (6)

- Case 08-29 Cravat Sales CompanyDocumento5 pagineCase 08-29 Cravat Sales Companysubash1111@gmail.comNessuna valutazione finora

- Advanced Accounting Baker Test Bank - Chap010Documento67 pagineAdvanced Accounting Baker Test Bank - Chap010donkazotey50% (2)

- Capital IQ Interview Questions Answers, Capital IQ Placement All PapersDocumento38 pagineCapital IQ Interview Questions Answers, Capital IQ Placement All PapersSri Royal100% (1)

- Financial PolicyDocumento4 pagineFinancial PolicyJill Allison WarrenNessuna valutazione finora

- Acct 2020 Excel Budget ProblemDocumento4 pagineAcct 2020 Excel Budget Problemapi-241815288Nessuna valutazione finora

- Master BudgetDocumento4 pagineMaster Budgetapi-233205686Nessuna valutazione finora

- Wasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions ManualDocumento12 pagineWasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions Manualapi-239130031Nessuna valutazione finora

- Accounting Chapter 9 Eportfolio ExcelDocumento12 pagineAccounting Chapter 9 Eportfolio Excelapi-273030710Nessuna valutazione finora

- Wasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions ManualDocumento12 pagineWasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions Manualapi-269073570Nessuna valutazione finora

- Wasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions ManualDocumento5 pagineWasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions Manualapi-284934265Nessuna valutazione finora

- Wasatch ManufacturingDocumento12 pagineWasatch Manufacturingapi-301899907Nessuna valutazione finora

- Carolyn Trowbridge Acct 2020 Excel Budget Problem Student Template 1Documento8 pagineCarolyn Trowbridge Acct 2020 Excel Budget Problem Student Template 1api-284502690Nessuna valutazione finora

- Hailey Fernelius ch9 Excel ProjectDocumento4 pagineHailey Fernelius ch9 Excel Projectapi-242652884Nessuna valutazione finora

- Managerial Accounting - Fourth Edition Solutions Manual: Wasatch Manufacturing Master BudgetDocumento12 pagineManagerial Accounting - Fourth Edition Solutions Manual: Wasatch Manufacturing Master Budgetapi-283953708Nessuna valutazione finora

- Wasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions ManualDocumento12 pagineWasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions Manualapi-242429455Nessuna valutazione finora

- Wasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions ManualDocumento10 pagineWasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions Manualapi-231890132100% (1)

- p9-60 PsimasinghDocumento8 paginep9-60 Psimasinghapi-241811190Nessuna valutazione finora

- Acct 2020 Excel Budget Problem Student TemplateDocumento12 pagineAcct 2020 Excel Budget Problem Student Templateapi-249190933Nessuna valutazione finora

- Wasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions ManualDocumento4 pagineWasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions Manualapi-240678692Nessuna valutazione finora

- Presidio Manufacturing: Managerial Accounting - Fourth Edition Solutions ManualDocumento12 paginePresidio Manufacturing: Managerial Accounting - Fourth Edition Solutions Manualapi-260629653Nessuna valutazione finora

- Wasatch Manufacturing Master BudgetDocumento6 pagineWasatch Manufacturing Master Budgetapi-255137286Nessuna valutazione finora

- EportfolioDocumento8 pagineEportfolioapi-220792970Nessuna valutazione finora

- Acct 2020 Emily RufenerDocumento4 pagineAcct 2020 Emily Rufenerapi-284746082Nessuna valutazione finora

- Master Budget Assignment CH 9Documento4 pagineMaster Budget Assignment CH 9api-240741436Nessuna valutazione finora

- p9-60b TemplateDocumento5 paginep9-60b Templateapi-253078310Nessuna valutazione finora

- ch9 Final EditionDocumento6 paginech9 Final Editionapi-291516969Nessuna valutazione finora

- Acct 2020 Excel Budget Problem Student TemplateDocumento12 pagineAcct 2020 Excel Budget Problem Student Templateapi-242720692Nessuna valutazione finora

- Tori Kallerud Chapter 9 HWDocumento12 pagineTori Kallerud Chapter 9 HWapi-325347697Nessuna valutazione finora

- Wasatch Manufacturing Master Budget Q1 2015: Managerial Accounting - Fourth Edition Solutions ManualDocumento12 pagineWasatch Manufacturing Master Budget Q1 2015: Managerial Accounting - Fourth Edition Solutions Manualapi-247933607Nessuna valutazione finora

- Acct 2020 Excel Budget Problem FinalDocumento12 pagineAcct 2020 Excel Budget Problem Finalapi-301816205Nessuna valutazione finora

- Chapter 9 Excel Budget AssignmentDocumento4 pagineChapter 9 Excel Budget Assignmentapi-261038165Nessuna valutazione finora

- Accounting Excel Budget ProjectDocumento8 pagineAccounting Excel Budget Projectapi-242531880Nessuna valutazione finora

- Acct 2020 Excel Budget Problem Student Template 1 AutosavedDocumento10 pagineAcct 2020 Excel Budget Problem Student Template 1 Autosavedapi-273073964Nessuna valutazione finora

- Chapter 16Documento8 pagineChapter 16Rahila RafiqNessuna valutazione finora

- Excell Budget Assignment-Master BudgetDocumento6 pagineExcell Budget Assignment-Master Budgetapi-213470756Nessuna valutazione finora

- Excel Project P9-59aDocumento3 pagineExcel Project P9-59aapi-272100463Nessuna valutazione finora

- Acct 2020 Excel Budget Problem Student TemplateDocumento12 pagineAcct 2020 Excel Budget Problem Student Templateapi-278341046Nessuna valutazione finora

- Acct 2020 Excel Budget ProblemDocumento10 pagineAcct 2020 Excel Budget Problemapi-325362908Nessuna valutazione finora

- Acct 2020 Excel Budget Problem - Patricia HallDocumento4 pagineAcct 2020 Excel Budget Problem - Patricia Hallapi-237087046Nessuna valutazione finora

- Managerial Accounting ProjectDocumento11 pagineManagerial Accounting Projectapi-271746126Nessuna valutazione finora

- Excel HomeworkDocumento9 pagineExcel Homeworkapi-248528639Nessuna valutazione finora

- MASTER BUDGET CHAPTERDocumento28 pagineMASTER BUDGET CHAPTERMarc Jim Gregorio100% (1)

- Project A Cash Budget and Financial StatementsDocumento3 pagineProject A Cash Budget and Financial Statementskhedberg126Nessuna valutazione finora

- Excel Budget ProblemDocumento5 pagineExcel Budget Problemapi-313254091Nessuna valutazione finora

- Acct 2020 EportfolioDocumento5 pagineAcct 2020 Eportfolioapi-311375616Nessuna valutazione finora

- CH 3Documento4 pagineCH 3api-289783245Nessuna valutazione finora

- Project A Sales BudgetDocumento3 pagineProject A Sales BudgetShay Kay SamNessuna valutazione finora

- PROJECT A - Case 9-30: Student NameDocumento3 paginePROJECT A - Case 9-30: Student NameMihnea GrecuNessuna valutazione finora

- Budget Project LLDocumento10 pagineBudget Project LLapi-220037346Nessuna valutazione finora

- Earrings Unlimited Cash BudgetDocumento3 pagineEarrings Unlimited Cash BudgetPhuong DangNessuna valutazione finora

- Tanner McqueenDocumento4 pagineTanner Mcqueenapi-242859321Nessuna valutazione finora

- Book 1Documento2 pagineBook 1tuanNessuna valutazione finora

- Group Members: 1) FENG Shile (54052978) 2) 3) : Semester B 2015-2016 Department of Accounting Group Project CB2101/T01Documento5 pagineGroup Members: 1) FENG Shile (54052978) 2) 3) : Semester B 2015-2016 Department of Accounting Group Project CB2101/T01Ong Ming KaiNessuna valutazione finora

- Prepare The Contribution Margin Income StatementDocumento4 paginePrepare The Contribution Margin Income StatementCorvitz SamaritaNessuna valutazione finora

- Project 1 ExcelDocumento2 pagineProject 1 ExcelA AntonicelloNessuna valutazione finora

- Master Budget ProjectDocumento10 pagineMaster Budget Projectapi-268950886Nessuna valutazione finora

- Brewer8e GEs PPT Chapter 8 UpdDocumento22 pagineBrewer8e GEs PPT Chapter 8 UpdNguyễn Ngọc Quỳnh TiênNessuna valutazione finora

- Masterbudget Acct2020Documento4 pagineMasterbudget Acct2020api-249190933Nessuna valutazione finora

- Account-Based Marketing: How to Target and Engage the Companies That Will Grow Your RevenueDa EverandAccount-Based Marketing: How to Target and Engage the Companies That Will Grow Your RevenueValutazione: 1 su 5 stelle1/5 (1)

- Data Smart: Using Data Science to Transform Information into InsightDa EverandData Smart: Using Data Science to Transform Information into InsightValutazione: 4.5 su 5 stelle4.5/5 (17)

- Irctc: Accounting Report On Comparative and Ratio Analysis OFDocumento14 pagineIrctc: Accounting Report On Comparative and Ratio Analysis OFSoumya Sumana SendNessuna valutazione finora

- Iexpenses GuideDocumento89 pagineIexpenses GuideVijay VinnakotaNessuna valutazione finora

- Revision NotesDocumento51 pagineRevision NotesMelody RoseNessuna valutazione finora

- Combined FS Eliminating Intercompany MarkupDocumento13 pagineCombined FS Eliminating Intercompany MarkupRujean Salar AltejarNessuna valutazione finora

- SK Forms - Budget PrepDocumento45 pagineSK Forms - Budget Prepsteven orillaneda50% (2)

- CBLM TemplateDocumento78 pagineCBLM TemplateRam-tech Jackolito Fernandez75% (4)

- EOT MaterialDocumento21 pagineEOT Materialpavan bNessuna valutazione finora

- Arwana Citramulia TBK - 30 - 06 - 2021 - ReleasedDocumento85 pagineArwana Citramulia TBK - 30 - 06 - 2021 - ReleasedM Fany AFNessuna valutazione finora

- Journal entries for Lopez TradingDocumento12 pagineJournal entries for Lopez TradingŁei Silvestre100% (1)

- CASH TO ACCRUAL SINGLE ENTRY With ANSWERSDocumento8 pagineCASH TO ACCRUAL SINGLE ENTRY With ANSWERSRaven SiaNessuna valutazione finora

- Accounting 0452 Revision NotesDocumento48 pagineAccounting 0452 Revision NotesMasood Ahmad AadamNessuna valutazione finora

- Shoaib StatementDocumento88 pagineShoaib StatementshaikhNessuna valutazione finora

- Term Question HUM279Documento49 pagineTerm Question HUM279sanathNessuna valutazione finora

- Consolidated Financial StatementsDocumento66 pagineConsolidated Financial StatementsGlenn Taduran100% (1)

- AccointingDocumento20 pagineAccointingGhalib HussainNessuna valutazione finora

- Mountain Home Public Schools Certified Staff Recommendations April 21, 2022Documento6 pagineMountain Home Public Schools Certified Staff Recommendations April 21, 2022KTLO NewsNessuna valutazione finora

- Chapter Two: Cost Terms, Concepts and ClassificationsDocumento72 pagineChapter Two: Cost Terms, Concepts and ClassificationsYuvaraj SubramaniamNessuna valutazione finora

- Accounts Gce Jan 2010 - MARKING SCHEMEDocumento14 pagineAccounts Gce Jan 2010 - MARKING SCHEMEaqua05Nessuna valutazione finora

- S Y J C Accounts Model Question Paper For Board Exam No 4 2009 - 2010Documento6 pagineS Y J C Accounts Model Question Paper For Board Exam No 4 2009 - 2010AMIN BUHARI ABDUL KHADER100% (1)

- 7.0 Financial Analysis & Projections: 7.1 Sources & Uses of CapitalDocumento5 pagine7.0 Financial Analysis & Projections: 7.1 Sources & Uses of CapitalRey OñateNessuna valutazione finora

- SEBI Grade A 2020: Commerce & Accountancy: Cash Flow Statement, Fund Flow Statement, Financial Statement Analysis & Ratio AnalysisDocumento20 pagineSEBI Grade A 2020: Commerce & Accountancy: Cash Flow Statement, Fund Flow Statement, Financial Statement Analysis & Ratio Analysismrinal kumarNessuna valutazione finora

- Valuation Report of Relaxo Footwear LTDDocumento11 pagineValuation Report of Relaxo Footwear LTDPRAJAYSCRIBDNessuna valutazione finora

- Salary Slip-Format 547Documento2 pagineSalary Slip-Format 547dinescNessuna valutazione finora

- PFRS For Small Entities 1 PDFDocumento43 paginePFRS For Small Entities 1 PDFRojohn ValenzuelaNessuna valutazione finora

- Financial Accounting For ICWADocumento944 pagineFinancial Accounting For ICWAAmit Kumar100% (2)

- Departmental Accounting PresentationDocumento15 pagineDepartmental Accounting PresentationSurabhi AgrawalNessuna valutazione finora

- 05 JUNE AnswersDocumento13 pagine05 JUNE AnswerskhengmaiNessuna valutazione finora