Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Absorption Costing Reconciliation Statement

Caricato da

ali_sattar150 valutazioniIl 0% ha trovato utile questo documento (0 voti)

247 visualizzazioni4 pagineAbsorption Costing Reconciliation Statement

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoAbsorption Costing Reconciliation Statement

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

247 visualizzazioni4 pagineAbsorption Costing Reconciliation Statement

Caricato da

ali_sattar15Absorption Costing Reconciliation Statement

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 4

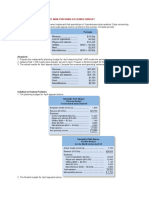

Absorption Costing: Profit Reconciliation Statement

Budgeted profit (Budgeted units x budgeted profit)

Sales variance

Sales price variance

x F or (A)

Sales profit volume variance

x F or (A)

X F or (A)

Actual sales minus the standard full cost of sales

Cost variance

Direct material price

Direct material usage

Direct labour rate

Direct labour usage/efficiency

Variable O/H expenditure

Variable O/H efficiency

Fixed O/H expenditure

Fixed O/H capacity

Fixed O/H efficiency

_____________

Total cost variance

A__

x F x (A)

__________

Actual Profit

__________

Marginal Costing: Profit Reconciliation Statement

Budgeted profit

Add: Budgeted fixed costs

X

___

Budgeted contribution

Sales variances

Sales price variance

x F or (A)

Sales profit volume variance

x F or (A)

X F or (A)

Actual sales minus the marginal full cost of sales

Cost variance

Direct material price

Direct material usage

Direct labour rate

Direct labour usage/efficiency

Variable O/H expenditure

Variable O/H efficiency

Actual contribution

x F/ x (A)

X

Budgeted fixed O/H

Fixed overhead expenditure variance x (F)/ x A

X

Actual Profit

Absorption Costing: Cost Reconciliation Statement

Standard cost of production

Cost Variances

X

F

Direct material price

Direct material usage

Direct labour rate

Direct labour usage/efficiency

Variable O/H expenditure

Variable O/H efficiency

Fixed O/H expenditure

Fixed O/H capacity

Fixed O/H efficiency

_____________

Total cost variance

A__

x (F) x A

__________

Actual cost

__________

Favourable variances are subtracted from standard

costs to reach actual

cost and adverse variances are added.

Marginal Costing: Cost reconciliation Statement

Standard marginal cost of production

Cost Variances

X

F

Direct material price

Direct material usage

Direct labour rate

Direct labour usage/efficiency

Variable O/H expenditure

Variable O/H efficiency

_____________

Total cost variance

A__

x (F) x A

__________

Actual cost

__________

Potrebbero piacerti anche

- Absorption Costing Vs Variable CostingDocumento20 pagineAbsorption Costing Vs Variable CostingMa. Alene MagdaraogNessuna valutazione finora

- Cost Accounting Chapter 11Documento6 pagineCost Accounting Chapter 11Random100% (1)

- Job Order Costing System ExplainedDocumento47 pagineJob Order Costing System Explainedslow dancerNessuna valutazione finora

- CVP Relationships and Break-Even AnalysisDocumento3 pagineCVP Relationships and Break-Even AnalysisExequiel AdradaNessuna valutazione finora

- 7166materials Problems-Standard CostingDocumento14 pagine7166materials Problems-Standard CostingLumina JulieNessuna valutazione finora

- Income statement comparison of variable costing and absorption costingDocumento14 pagineIncome statement comparison of variable costing and absorption costingapiNessuna valutazione finora

- Variable and Absorption CostingDocumento38 pagineVariable and Absorption CostingstarlightNessuna valutazione finora

- Name: - Section: - Schedule: - Class Number: - DateDocumento13 pagineName: - Section: - Schedule: - Class Number: - Datechristine_pineda_2Nessuna valutazione finora

- 4Documento3 pagine4Carlo ParasNessuna valutazione finora

- Calculate breakeven point, target sales, and safety margin for contribution margin analysisDocumento5 pagineCalculate breakeven point, target sales, and safety margin for contribution margin analysisAbhijit AshNessuna valutazione finora

- VALLEJOS-ACCTG 301-Retail Inventoy Method-Hand OutDocumento5 pagineVALLEJOS-ACCTG 301-Retail Inventoy Method-Hand OutEllah RahNessuna valutazione finora

- CHAO-ANGAN, JAPHRELLE W - Linear Regression Analysis of Store Size and ProfitDocumento1 paginaCHAO-ANGAN, JAPHRELLE W - Linear Regression Analysis of Store Size and ProfitUchayyaNessuna valutazione finora

- Both Statements Are FalseDocumento26 pagineBoth Statements Are FalseBanana QNessuna valutazione finora

- MAS 9204 Product Costing Activity-Based Costing (ABC)Documento19 pagineMAS 9204 Product Costing Activity-Based Costing (ABC)Mila Casandra CastañedaNessuna valutazione finora

- Break-Even Analysis and Sales Mix CalculationsDocumento5 pagineBreak-Even Analysis and Sales Mix CalculationsFlorabelle May LibawanNessuna valutazione finora

- Our Lady of The Pillar College - CauayanDocumento5 pagineOur Lady of The Pillar College - CauayanLu CioNessuna valutazione finora

- Absorption and Variable CostingDocumento2 pagineAbsorption and Variable CostingJenni LoricoNessuna valutazione finora

- Quiz 1 Just in Time SystemDocumento5 pagineQuiz 1 Just in Time SystemMicah CarpioNessuna valutazione finora

- 01 - Cost-Volume-Profit AnalysisDocumento56 pagine01 - Cost-Volume-Profit AnalysisSuzanne SenadreNessuna valutazione finora

- Absorption and Variable CostingDocumento13 pagineAbsorption and Variable CostingdarylNessuna valutazione finora

- Answers - Chapter 1 Vol 2 2009Documento10 pagineAnswers - Chapter 1 Vol 2 2009Shiela PilarNessuna valutazione finora

- ACCCOB3 CVP Analysis Case Problems Instructions:: Ryan - Roque@dlsu - Edu.phDocumento2 pagineACCCOB3 CVP Analysis Case Problems Instructions:: Ryan - Roque@dlsu - Edu.phdanii yaahNessuna valutazione finora

- D. Depends On The Significance of The Amount.: Cost Accounting Comprehensive Examination 1Documento14 pagineD. Depends On The Significance of The Amount.: Cost Accounting Comprehensive Examination 1Ferb CruzadaNessuna valutazione finora

- Job Costing: 1. Whether Actual or Estimated Costs Are UsedDocumento16 pagineJob Costing: 1. Whether Actual or Estimated Costs Are UsedalemayehuNessuna valutazione finora

- Pom Exam Part 2 PDFDocumento11 paginePom Exam Part 2 PDFREIGN EBONY ANNE AGUSTINNessuna valutazione finora

- Standard Costing - Answer KeyDocumento6 pagineStandard Costing - Answer KeyRoselyn LumbaoNessuna valutazione finora

- QUIZ3Documento6 pagineQUIZ3Jillian Mae Sobrino BelegorioNessuna valutazione finora

- Finished Goods Inventory: Exercise 1-1 (True or False)Documento16 pagineFinished Goods Inventory: Exercise 1-1 (True or False)Isaiah BatucanNessuna valutazione finora

- Cost Final Exam ReviewerDocumento8 pagineCost Final Exam ReviewerAlliana CunananNessuna valutazione finora

- 1-3-Ulo D ExerciseDocumento5 pagine1-3-Ulo D ExerciseJames Darwin TehNessuna valutazione finora

- COST ACCOUNTING 1 8 Final Allocation of Joint CostsDocumento15 pagineCOST ACCOUNTING 1 8 Final Allocation of Joint CostsZoe MendozaNessuna valutazione finora

- Review Problem 1: Variance Analysis Using A Flexible Budget: RequiredDocumento12 pagineReview Problem 1: Variance Analysis Using A Flexible Budget: RequiredGraieszian LyraNessuna valutazione finora

- Assignment PPE PArt 2Documento7 pagineAssignment PPE PArt 2JP MirafuentesNessuna valutazione finora

- Dissolution of Partnership Firm Accounting ProblemsDocumento5 pagineDissolution of Partnership Firm Accounting ProblemsPrageeth Roshan WeerathungaNessuna valutazione finora

- Module 1 ExamDocumento4 pagineModule 1 ExamTabatha Cyphers100% (2)

- Service and Production Department Cost AllocationDocumento58 pagineService and Production Department Cost AllocationLorena TudorascuNessuna valutazione finora

- 18 x12 ABC ADocumento12 pagine18 x12 ABC AKM MacatangayNessuna valutazione finora

- Factory Overhead PDFDocumento18 pagineFactory Overhead PDFANDI TE'A MARI SIMBALANessuna valutazione finora

- Garfield Company bonus calculation and Kaila Corporation debt restructuring journal entriesDocumento2 pagineGarfield Company bonus calculation and Kaila Corporation debt restructuring journal entriesvenice cambryNessuna valutazione finora

- Problems: 2-58. Cost ConceptsDocumento16 pagineProblems: 2-58. Cost ConceptsChristy HabelNessuna valutazione finora

- Intermediate Accounting SolmanDocumento14 pagineIntermediate Accounting SolmanAlarich CatayocNessuna valutazione finora

- Accounting For Joint Products and by ProductsDocumento13 pagineAccounting For Joint Products and by ProductsSteffi CabalunaNessuna valutazione finora

- Labor Variance: By: Group 2Documento24 pagineLabor Variance: By: Group 2Kris BayronNessuna valutazione finora

- Fifo Costing Problems - Even and UnevenDocumento3 pagineFifo Costing Problems - Even and UnevenDarra MatienzoNessuna valutazione finora

- P1-1 P1-2 Jaja Bearings Company PPG CompanyDocumento4 pagineP1-1 P1-2 Jaja Bearings Company PPG CompanyPrincesipieNessuna valutazione finora

- Eoq PDFDocumento23 pagineEoq PDFMica Ella Gutierrez0% (1)

- Cost Concept Exercises PDFDocumento2 pagineCost Concept Exercises PDFAina OracionNessuna valutazione finora

- Week17 2010 CorDocumento20 pagineWeek17 2010 CormdafeshNessuna valutazione finora

- CVP AnalysisDocumento24 pagineCVP AnalysisKim Cherry BulanNessuna valutazione finora

- Solved ProblemsDocumento8 pagineSolved Problemsantony1993Nessuna valutazione finora

- A Company's Statement of Financial PositionDocumento22 pagineA Company's Statement of Financial PositionThe Brain Dump PHNessuna valutazione finora

- Quiz 5 Problems Second Semester AY2223 With AnswersDocumento4 pagineQuiz 5 Problems Second Semester AY2223 With AnswersManzano, Carl Clinton Neil D.Nessuna valutazione finora

- CVP Analysis Guide for Cost Planning and Decision MakingDocumento4 pagineCVP Analysis Guide for Cost Planning and Decision MakingEmma Mariz GarciaNessuna valutazione finora

- 3MA 03 Absortion and Variable CostingDocumento3 pagine3MA 03 Absortion and Variable CostingAbigail Regondola BonitaNessuna valutazione finora

- Multiple Predetermined Overhead RatesDocumento4 pagineMultiple Predetermined Overhead RatesWag NasabiNessuna valutazione finora

- Cost Accounting - Marginal CostingDocumento2 pagineCost Accounting - Marginal CostingS Usama SNessuna valutazione finora

- Absorption Marginal CostingDocumento36 pagineAbsorption Marginal CostingsamiNessuna valutazione finora

- CVP NotesDocumento7 pagineCVP NotesKerrice RobinsonNessuna valutazione finora

- 1 Absorotion-Direct Costing Final-1Documento30 pagine1 Absorotion-Direct Costing Final-1moss roffattNessuna valutazione finora

- Break Even PointDocumento29 pagineBreak Even PointDanbryanNessuna valutazione finora

- Mid Term ExamDocumento7 pagineMid Term Examali_sattar15Nessuna valutazione finora

- Career Commitment - Sir Ali 2Documento10 pagineCareer Commitment - Sir Ali 2ali_sattar15Nessuna valutazione finora

- Double Entry BookkeepingDocumento1 paginaDouble Entry Bookkeepingali_sattar15100% (1)

- EXAMPLE Basic AccountingDocumento1 paginaEXAMPLE Basic Accountingali_sattar15100% (1)

- Capital Structure TheoriesDocumento1 paginaCapital Structure Theoriesali_sattar15Nessuna valutazione finora

- Plagiarism Presentation Muhammad SajideenDocumento15 paginePlagiarism Presentation Muhammad Sajideenali_sattar15Nessuna valutazione finora

- Islamic BankingDocumento41 pagineIslamic Bankingali_sattar15Nessuna valutazione finora

- Chapter 07, 08, 09 Non Current AssetsDocumento8 pagineChapter 07, 08, 09 Non Current Assetsali_sattar15Nessuna valutazione finora

- Chapter 5 Sales TaxDocumento5 pagineChapter 5 Sales Taxali_sattar15Nessuna valutazione finora

- PartnershipsDocumento7 paginePartnershipsali_sattar15Nessuna valutazione finora

- 2013 Exam SyllabusDocumento12 pagine2013 Exam SyllabusIoana PopescuNessuna valutazione finora

- Capital Structure TheoriesDocumento1 paginaCapital Structure Theoriesali_sattar15Nessuna valutazione finora

- Tesco Financial AnalysisDocumento34 pagineTesco Financial AnalysisAli Sattar100% (1)

- ACCAReloaded ACCA Syllabus Changes PDFDocumento14 pagineACCAReloaded ACCA Syllabus Changes PDFpiyalhassan0% (1)

- Finance Act 2013Documento27 pagineFinance Act 2013ali_sattar15Nessuna valutazione finora

- Ruling System Islam Vs DemocracyDocumento27 pagineRuling System Islam Vs Democracyali_sattar15Nessuna valutazione finora

- ICAEW Approved EmployerDocumento5 pagineICAEW Approved Employerali_sattar15100% (1)

- Financial Accounting: ACCA Paper F3Documento2 pagineFinancial Accounting: ACCA Paper F3ali_sattar15Nessuna valutazione finora

- Mudarabah by Muhammad Zubair UsmaniDocumento22 pagineMudarabah by Muhammad Zubair Usmaniali_sattar15Nessuna valutazione finora

- Operating Costs and Profits for a 350-Student SchoolDocumento2 pagineOperating Costs and Profits for a 350-Student Schoolali_sattar15Nessuna valutazione finora

- PEST ANALYSIS OF PAKISTAN TOBACCODocumento5 paginePEST ANALYSIS OF PAKISTAN TOBACCOali_sattar150% (1)

- Scholar Educational Society Aims and ObjectiveDocumento1 paginaScholar Educational Society Aims and Objectiveali_sattar15Nessuna valutazione finora

- Check Your Vocabulary For IELTS Examination - WyattDocumento125 pagineCheck Your Vocabulary For IELTS Examination - Wyattminhvanyeudoi100% (7)

- Learn Financial Accounting in 10 monthsDocumento18 pagineLearn Financial Accounting in 10 monthsali_sattar15Nessuna valutazione finora

- Interviewing Skills ManualDocumento26 pagineInterviewing Skills ManualTanim Misbahul MNessuna valutazione finora

- Economic System in IslamDocumento11 pagineEconomic System in Islamali_sattar15Nessuna valutazione finora

- Learn Financial Accounting in 10 monthsDocumento18 pagineLearn Financial Accounting in 10 monthsali_sattar15Nessuna valutazione finora

- Private Candidates MA/MSc Subjects ListDocumento8 paginePrivate Candidates MA/MSc Subjects Listali_sattar15Nessuna valutazione finora

- Economics Test 12Documento1 paginaEconomics Test 12ali_sattar15Nessuna valutazione finora

- LTC Advance and Final Claims FormsDocumento27 pagineLTC Advance and Final Claims Formsseeyem2000100% (3)

- CAPE Economics 2016 U1 P2Documento20 pagineCAPE Economics 2016 U1 P2roxanne taylorNessuna valutazione finora

- JioMart Invoice 16513858180161817ADocumento2 pagineJioMart Invoice 16513858180161817APrem Chand GuptaNessuna valutazione finora

- Fedex Fabric Detailsheet en CNDocumento1 paginaFedex Fabric Detailsheet en CNJeiran MoNessuna valutazione finora

- MultimediaDocumento2 pagineMultimediaMihai-Sergiu MateiNessuna valutazione finora

- BBA & MBA Marketing Curriculum at BSSTUDocumento59 pagineBBA & MBA Marketing Curriculum at BSSTUami habib0% (1)

- Tony The TriceratopsDocumento6 pagineTony The TriceratopsAxle KendallNessuna valutazione finora

- SOP for Laundry Collection and Delivery TrainingDocumento14 pagineSOP for Laundry Collection and Delivery Trainingsabeerssr75% (4)

- ISE211 Chapter4SSand5FallDocumento37 pagineISE211 Chapter4SSand5FallV GozeNessuna valutazione finora

- The Limited City - Building Height Regulations in The City of Melbourne, 1890-1955 by Peter Mills 1997Documento75 pagineThe Limited City - Building Height Regulations in The City of Melbourne, 1890-1955 by Peter Mills 1997tismdblNessuna valutazione finora

- ا رارــ ا رــ دــ ـ رـ رـ ـ Final Damage Assessment ReportDocumento2 pagineا رارــ ا رــ دــ ـ رـ رـ ـ Final Damage Assessment Reportراكان العزبNessuna valutazione finora

- An Introduction To Financial ManagementDocumento17 pagineAn Introduction To Financial Managementariel mahardikaNessuna valutazione finora

- Graduate Thesis Topics in EconomicsDocumento6 pagineGraduate Thesis Topics in Economicslizbundrenwestminster100% (2)

- This Study Resource Was: Economic Problems: Possible Initiatives To Protect Small BusinessesDocumento7 pagineThis Study Resource Was: Economic Problems: Possible Initiatives To Protect Small BusinessesMalik AsadNessuna valutazione finora

- From Infection To Inflation:: Global Crises Hit Hard Poor and Vulnerable Households in Latin America and The CaribbeanDocumento102 pagineFrom Infection To Inflation:: Global Crises Hit Hard Poor and Vulnerable Households in Latin America and The CaribbeanrafardzvNessuna valutazione finora

- Door HandlingDocumento316 pagineDoor HandlingdipinnediyaparambathNessuna valutazione finora

- Comparative Economic SystemsDocumento67 pagineComparative Economic SystemsMay FlowerNessuna valutazione finora

- Inlias ManualDocumento57 pagineInlias Manualrai duttaNessuna valutazione finora

- Management Accounting: Formation 2 Examination - August 2007Documento19 pagineManagement Accounting: Formation 2 Examination - August 2007Chansa KapambweNessuna valutazione finora

- 1997-Article Text-5665-1-10-20220212Documento6 pagine1997-Article Text-5665-1-10-20220212widian rienandaNessuna valutazione finora

- An Introduction To Consolidated Financial StatementDocumento27 pagineAn Introduction To Consolidated Financial StatementKelvin Febriansyah PratamaNessuna valutazione finora

- Techno-Funda BasicsDocumento39 pagineTechno-Funda BasicsAnuranjan VermaNessuna valutazione finora

- Dr. Heriberto Priego Colorado: Armenian Women For Health & Healthy Environment (Awhhe)Documento13 pagineDr. Heriberto Priego Colorado: Armenian Women For Health & Healthy Environment (Awhhe)Kavita SharmaNessuna valutazione finora

- Official Receipt: - 0000 Agent Code: Tin: Business Style: AmountDocumento1 paginaOfficial Receipt: - 0000 Agent Code: Tin: Business Style: AmountFamela Mae CagampangNessuna valutazione finora

- FDNACCT Unit 3 - Financial Statements - Rules of DR & CR - Study GuideDocumento2 pagineFDNACCT Unit 3 - Financial Statements - Rules of DR & CR - Study GuideAshley SheyNessuna valutazione finora

- Accounting Cycle and Book of AccountsDocumento23 pagineAccounting Cycle and Book of AccountsChaaaNessuna valutazione finora

- Practice Problems Cost Accounting VariancesDocumento2 paginePractice Problems Cost Accounting VariancesLuke Robert Hemmings0% (1)

- Chapter 5 Present Worth AnalysisDocumento82 pagineChapter 5 Present Worth Analysisيوسف محمدNessuna valutazione finora

- 2023-24 SSR Rates SimplifiedDocumento93 pagine2023-24 SSR Rates SimplifiedpardhivNessuna valutazione finora

- SWOT OF Azerbaijan EconomyDocumento30 pagineSWOT OF Azerbaijan EconomyIsmayil ƏsədovNessuna valutazione finora