Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Chap 11

Caricato da

Jamie Catherine GoTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Chap 11

Caricato da

Jamie Catherine GoCopyright:

Formati disponibili

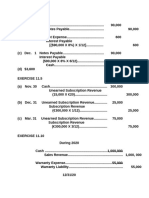

CCC11

(a)

CONTINUING COOKIE CHRONICLE

Estimated liability, 2010

30 mixers sold X 10% = 3 mixers X $60 = $180

(b) 2010

Dec. 31 Warranty Expense .........................................

Warranty Liability .....................................

(c)

180

180

2011

Warranty Liability2010 .............................

Cash..............................................................

210

Warranty Liability2011 .............................

Cash..............................................................

55

210

55

(d) Estimated liability, Dec. 31, 2011

40 mixers sold X 10% = 4 mixers; 4 X $60................

Less: Two already returned X $60 .............................

Estimated liability Dec. 31, 2011 ..................................

Current balance in account (debit balance).............

Required adjustment .......................................................

$240

(120)

120

85

$205

Note that there is no longer any liability outstanding for the mixers

sold in 2010. The one-year warranty period has expired.

Copyright 2009 John Wiley & Sons, Inc.

Weygandt, Accounting Principles, 9/e, Continuing Cookie Chronicles

(For Instructor Use Only)

11-1

CCC11 (Continued)

(d) (Continued)

Date

2010

Dec. 31

2011

Warranty Liability

Ref.

Debit

Explanation

Adjusting entry

180

4 returned mixers (2010)

2 returned mixers (2011)

(e)

Credit

210

55

Balance

180

(30)

(85)

2011

Dec. 31

Date

2010

Dec. 31

2011

Dec. 31

Warranty Expense ...........................

Warranty Liability .......................

Warranty Liability

Ref.

Debit

Explanation

Adjusting entry

4 returned mixers (2010)

2 returned mixers (2011)

Adjusting entry

Copyright 2009 John Wiley & Sons, Inc.

205

205

Credit

Balance

180

180

205

(30)

(85)

120

210

55

Weygandt, Accounting Principles, 9/e, Continuing Cookie Chronicles

(For Instructor Use Only)

11-2

Potrebbero piacerti anche

- Cookie Ch3Documento7 pagineCookie Ch3Charmaine Bernados Brucal67% (3)

- Solve 6Documento2 pagineSolve 6lalalalaNessuna valutazione finora

- 1621 Acct6174 Tabe TK1-W3-S4-R1 Team1Documento11 pagine1621 Acct6174 Tabe TK1-W3-S4-R1 Team1Raisul Ma'arif100% (1)

- CH 18Documento2 pagineCH 18Jamie Catherine GoNessuna valutazione finora

- Chapter 4Documento4 pagineChapter 4Jamie Catherine Go100% (1)

- Chapter 3Documento8 pagineChapter 3Jamie Catherine Go100% (1)

- WCPDocumento6 pagineWCPkhanhleduy0% (1)

- Cookie Ch2Documento5 pagineCookie Ch2Charmaine Bernados Brucal100% (3)

- ch03 Part10Documento6 paginech03 Part10Sergio HoffmanNessuna valutazione finora

- CH 06Documento1 paginaCH 06kidNessuna valutazione finora

- Chap 3 Cookie Creations BBA 2201 Unit III - ACCT Principles IDocumento9 pagineChap 3 Cookie Creations BBA 2201 Unit III - ACCT Principles IChristy SnowNessuna valutazione finora

- Tugas Kelompok Ke-3 Week 8: Flexible BudgetDocumento4 pagineTugas Kelompok Ke-3 Week 8: Flexible BudgetNadilla NurNessuna valutazione finora

- MIKROEKON.docx Pengantar Akuntansi II (Part 1Documento38 pagineMIKROEKON.docx Pengantar Akuntansi II (Part 1Cok Angga PutraNessuna valutazione finora

- Illustration On Special Revenue FundDocumento2 pagineIllustration On Special Revenue FundJichang Hik0% (1)

- Chapter 5Documento11 pagineChapter 5Jamie Catherine Go67% (9)

- Exercises Chapter1Documento4 pagineExercises Chapter1Huyen Siu NhưnNessuna valutazione finora

- Chapter 6 Solutions 2241Documento22 pagineChapter 6 Solutions 2241JamesNessuna valutazione finora

- Solution Chapter 20 Waterways Continuing Problem: WCP20 (A)Documento6 pagineSolution Chapter 20 Waterways Continuing Problem: WCP20 (A)Elapse Dreammaker Kibria100% (2)

- Question 1 - Adjusting EntriesDocumento10 pagineQuestion 1 - Adjusting EntriesVyish VyishuNessuna valutazione finora

- ch03 Part9Documento6 paginech03 Part9Sergio HoffmanNessuna valutazione finora

- Optimize sales tax adjusting entriesDocumento6 pagineOptimize sales tax adjusting entriesHuỳnh Thị Thu BaNessuna valutazione finora

- Prob 3-30 - Advanced Accounting HoyleDocumento2 pagineProb 3-30 - Advanced Accounting Hoylessmith0128Nessuna valutazione finora

- ITFA Solution June 2018 ExamDocumento7 pagineITFA Solution June 2018 ExamF A Saffat RahmanNessuna valutazione finora

- CH 10 - End of Chapter Exercises SolutionsDocumento57 pagineCH 10 - End of Chapter Exercises SolutionssaraNessuna valutazione finora

- ACCT 100 - Principles of Financial Accounting Fall 2020, Section 6 Week 10 Chapter 10 - LiabilitiesDocumento2 pagineACCT 100 - Principles of Financial Accounting Fall 2020, Section 6 Week 10 Chapter 10 - LiabilitiesAli Zain ParharNessuna valutazione finora

- Key Chapter 11Documento3 pagineKey Chapter 11JinAe NaNessuna valutazione finora

- Igcse Yr 10 Paper 2 Nov 2020 AssessmentDocumento9 pagineIgcse Yr 10 Paper 2 Nov 2020 AssessmentVoon Chen WeiNessuna valutazione finora

- Ch10 ExercisesDocumento15 pagineCh10 Exercisesjamiahamdard001Nessuna valutazione finora

- IGCSE Accounting Year 10 AssessmentDocumento9 pagineIGCSE Accounting Year 10 AssessmentVoon Chen WeiNessuna valutazione finora

- Current Liabilities Tutorial SolutionsDocumento5 pagineCurrent Liabilities Tutorial SolutionsKenNessuna valutazione finora

- Tata Steel 09 Balance SheetDocumento1 paginaTata Steel 09 Balance SheetGoNessuna valutazione finora

- Exercise 4-10 1Documento3 pagineExercise 4-10 1hoàng anh lêNessuna valutazione finora

- Corrections to Mitsubishi's 2010 Annual Report Financial SectionDocumento3 pagineCorrections to Mitsubishi's 2010 Annual Report Financial SectionbuddyNessuna valutazione finora

- Adjusted Trial Balance for Thayer Motel IncDocumento18 pagineAdjusted Trial Balance for Thayer Motel IncDan M SummersNessuna valutazione finora

- Chapter 18Documento10 pagineChapter 18Ali Abu Al Saud100% (2)

- Solutions to Bond ExercisesDocumento31 pagineSolutions to Bond ExercisesMaha M. Al-MasriNessuna valutazione finora

- Principles of Taxation Law 2021 Full ChapterDocumento41 paginePrinciples of Taxation Law 2021 Full Chapteralyssa.lalley545100% (26)

- Chapter 15 - Alternate SolutionsDocumento15 pagineChapter 15 - Alternate SolutionsAlex MadarangNessuna valutazione finora

- Key Chapter 8Documento6 pagineKey Chapter 8JinAe NaNessuna valutazione finora

- Igcse Accounting Ratios Questionnaire PDFDocumento18 pagineIgcse Accounting Ratios Questionnaire PDFAdenosineNessuna valutazione finora

- Yoto Tire Company Master Budgets for Sales, Production, Materials, Labor & OverheadDocumento3 pagineYoto Tire Company Master Budgets for Sales, Production, Materials, Labor & Overheadnega guluma100% (1)

- ACCT5001 S1 2010 Week 8 Self-Study SolutionsDocumento5 pagineACCT5001 S1 2010 Week 8 Self-Study Solutionszhangsaen110Nessuna valutazione finora

- E7 25Documento2 pagineE7 25Muhammad Syafiq RamadhanNessuna valutazione finora

- Assignment CHPT 10 (Liability)Documento2 pagineAssignment CHPT 10 (Liability)Sultan LimitNessuna valutazione finora

- Bryant Ritchie Trisnodjojo - 041911333021 - AKM 3 Week 10Documento4 pagineBryant Ritchie Trisnodjojo - 041911333021 - AKM 3 Week 10Goji iiiNessuna valutazione finora

- Vee Jay AccountingDocumento221 pagineVee Jay AccountingWesley KisiNessuna valutazione finora

- Problem 3-2b SolutionDocumento7 pagineProblem 3-2b SolutionAbdul Rasyid RomadhoniNessuna valutazione finora

- Akm 2Documento10 pagineAkm 2Putu DenyNessuna valutazione finora

- Wa0040.Documento12 pagineWa0040.ibbbi shkhNessuna valutazione finora

- Exercise E9-3Documento7 pagineExercise E9-3Kara Mhisyella AssadNessuna valutazione finora

- Jawaban Laporan Arus Kas Dan Laba Rugi KomprehensifDocumento4 pagineJawaban Laporan Arus Kas Dan Laba Rugi KomprehensifAksit RistiyaningsihNessuna valutazione finora

- New York City Capital Commitment Plan FY 2010 Vol 3Documento723 pagineNew York City Capital Commitment Plan FY 2010 Vol 3Aaron MonkNessuna valutazione finora

- 11&27 Fin 201Documento3 pagine11&27 Fin 201Bopha vongNessuna valutazione finora

- Computation of Taxable Income and Tax After General Reductions For CorporationsDocumento20 pagineComputation of Taxable Income and Tax After General Reductions For CorporationsKiều Thảo Anh100% (1)

- eThekwini Municipality Annual Report 2017/2018Documento874 pagineeThekwini Municipality Annual Report 2017/2018Joel Christian Mascariña100% (1)

- Solutions To Problems: 13/e, Solutions Manual (For Instructor Use Only)Documento5 pagineSolutions To Problems: 13/e, Solutions Manual (For Instructor Use Only)Adam IngberNessuna valutazione finora

- Saham Di BeiDocumento34 pagineSaham Di BeiAyu RithaNessuna valutazione finora

- Week 11 CH 11 SolutionsDocumento5 pagineWeek 11 CH 11 SolutionslizaNessuna valutazione finora

- Problems and Answers On ch.3, ACT 101Documento19 pagineProblems and Answers On ch.3, ACT 101clara2300181Nessuna valutazione finora

- Nisha Nur Aini - 43219110183 - TM 02 - AKM IIDocumento11 pagineNisha Nur Aini - 43219110183 - TM 02 - AKM IInisha nuraini100% (1)

- Oblicon Memory Aid 2002Documento28 pagineOblicon Memory Aid 2002soarpsy100% (1)

- Acctng 240 Activity 4 - Finance Lease Accounting For LesseesDocumento2 pagineAcctng 240 Activity 4 - Finance Lease Accounting For LesseesJamie Catherine GoNessuna valutazione finora

- Chapter 8Documento3 pagineChapter 8Jamie Catherine Go100% (3)

- 2014 Volume 2 CH 1 Solution ManualDocumento10 pagine2014 Volume 2 CH 1 Solution ManualGabriel Dave AlamoNessuna valutazione finora

- Chapter 1Documento2 pagineChapter 1Jamie Catherine Go100% (1)

- Chapter 5Documento11 pagineChapter 5Jamie Catherine Go67% (9)

- Chapter 3Documento8 pagineChapter 3Jamie Catherine Go100% (1)

- Corporation Code (BP 68)Documento73 pagineCorporation Code (BP 68)Myron GutierrezNessuna valutazione finora

- Chapter 2Documento4 pagineChapter 2Jamie Catherine GoNessuna valutazione finora

- CH 9 AnswersDocumento3 pagineCH 9 AnswersRaymundo VyNessuna valutazione finora

- ACC101 Chapter9newDocumento19 pagineACC101 Chapter9newXiao HoNessuna valutazione finora

- Chapter 1-Introduction To Cost Management: Learning ObjectivesDocumento15 pagineChapter 1-Introduction To Cost Management: Learning Objectivesshineshoujo100% (1)

- CH 1 Vol 1 Answers 2014Documento1 paginaCH 1 Vol 1 Answers 2014Jamie Catherine GoNessuna valutazione finora

- CH 7 Vol 1 Answers 2014Documento18 pagineCH 7 Vol 1 Answers 2014Jamie Catherine GoNessuna valutazione finora

- CH 1 Vol 1 Answers 2014Documento1 paginaCH 1 Vol 1 Answers 2014Jamie Catherine GoNessuna valutazione finora

- CH 6 Vol 1 Answers 2014Documento6 pagineCH 6 Vol 1 Answers 2014Jamie Catherine GoNessuna valutazione finora