Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

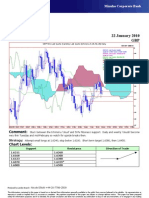

Technical Analysis 19 January 2010 EUR: Comment: Strategy: Chart Levels

Caricato da

Miir ViirDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Technical Analysis 19 January 2010 EUR: Comment: Strategy: Chart Levels

Caricato da

Miir ViirCopyright:

Formati disponibili

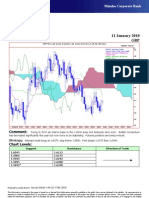

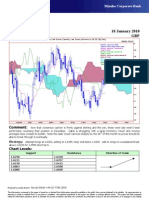

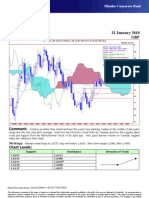

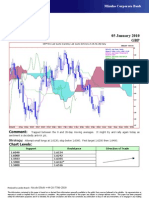

Mizuho Corporate Bank

Technical Analysis 19 January 2010

EUR

EUR=EBS, Last Quote [Candle] EUR=, Bid [Ichimoku 9, 26, 52, 26] Daily

19Sep09 - 24Feb10

Pr

EUR=EBS , Last Quote, Candle 1.515

19Jan10 1.4384 1.4415 1.4381 1.4398

EUR= , Bid, Tenkan Sen 9 1.51

19Jan10 1.4422

EUR= , Bid, Kijun Sen 26

1.505

19Jan10 1.4440

EUR= , Bid, Senkou Span(a) 52

23Feb10 1.4431 1.5

EUR= , Bid, Senkou Span(b) 52

23Feb10 1.4680 1.495

EUR= , Bid, Chikou Span 26

15Dec09 1.4396 1.49

1.485

1.48

1.475

1.47

1.465

1.46

1.455

1.45

1.445

1.44

1.435

1.43

1.425

25Sep09 02Oct 09Oct 16Oct 23Oct 30Oct 06Nov 13Nov 20Nov 27Nov 04Dec 11Dec 18Dec 25Dec 01Jan 08Jan 15Jan 22Jan 29Jan 05Feb 12Feb 19Feb

Comment: Rather messy as the Euro loses ground (slowly) against a series of other European currencies.

Futures positions are being re-built and volume has been fairly good so far this year, despite relatively narrow

ranges, suggesting much speculation.

Strategy: Stand aside if possibly. If not, attempt small longs at 1.4400; stop below 1.4335. Short term target

1.4460, then 1.4550.

Chart Levels:

Support Resistance Direction of Trade

1.4381 1.4415

1.4335 1.4460

1.4300 1.4555

1.4255 1.4580*

1.4218/1.4200* 1.4600

Produced by London Branch - Nicole Elliott +44-20-7786-2509

The information contained in this paper is based on or derived from information generally available to the public from sources believed to be reliable. No representation or

warranty is made or implied that it is accurate or complete. Any opinions expressed in this paper are subject to change without notice. This paper has been prepared

solely for information purposes and if so decided, for private circulation and does not constitute any solicitation to buy or sell any instrument, or to engage in any trading

strategy.

Charts provided by Reuters.

Potrebbero piacerti anche

- Case Analysis (ELITE PERSONAL TRAINING)Documento16 pagineCase Analysis (ELITE PERSONAL TRAINING)Dhruvesh Shekhar75% (4)

- Business Plan Green Oasis KutaDocumento19 pagineBusiness Plan Green Oasis KutaNyoman Supatra100% (1)

- 2019 Fusion For Energy Financial RegulationDocumento60 pagine2019 Fusion For Energy Financial Regulationale tof4eNessuna valutazione finora

- Coverage of NGNBN by JP MorganDocumento142 pagineCoverage of NGNBN by JP Morganalbert_linhNessuna valutazione finora

- Vietnam Application For GSPDocumento121 pagineVietnam Application For GSPdoitaisanNessuna valutazione finora

- Technical Analysis 15 January 2010 EUR: Comment: Strategy: Chart LevelsDocumento1 paginaTechnical Analysis 15 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNessuna valutazione finora

- Mizuho Corporate BankDocumento1 paginaMizuho Corporate BankMiir ViirNessuna valutazione finora

- Mizuho Corporate BankDocumento1 paginaMizuho Corporate BankMiir ViirNessuna valutazione finora

- Technical Analysis 14 January 2010 EUR: Comment: Strategy: Chart LevelsDocumento1 paginaTechnical Analysis 14 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNessuna valutazione finora

- Mizuho Corporate BankDocumento1 paginaMizuho Corporate BankMiir ViirNessuna valutazione finora

- Technical Analysis 11 January 2010 EUR: Comment: Strategy: Chart LevelsDocumento1 paginaTechnical Analysis 11 January 2010 EUR: Comment: Strategy: Chart LevelsMiir Viir100% (1)

- Technical Analysis 05 January 2010 EUR: Comment: Strategy: Chart LevelsDocumento1 paginaTechnical Analysis 05 January 2010 EUR: Comment: Strategy: Chart LevelsMiir Viir100% (1)

- Technical Analysis 08 January 2010 EUR: Comment: Strategy: Chart LevelsDocumento1 paginaTechnical Analysis 08 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNessuna valutazione finora

- Technical Analysis 27 January 2010 EUR: Comment: Strategy: Chart LevelsDocumento1 paginaTechnical Analysis 27 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNessuna valutazione finora

- Mizuho Corporate BankDocumento1 paginaMizuho Corporate BankMiir ViirNessuna valutazione finora

- Mizuho Corporate BankDocumento1 paginaMizuho Corporate BankMiir ViirNessuna valutazione finora

- Mizuho Corporate BankDocumento1 paginaMizuho Corporate BankMiir ViirNessuna valutazione finora

- Mizuho Corporate BankDocumento1 paginaMizuho Corporate BankMiir ViirNessuna valutazione finora

- Technical Analysis 18 January 2010 EUR: Comment: Strategy: Chart LevelsDocumento1 paginaTechnical Analysis 18 January 2010 EUR: Comment: Strategy: Chart LevelsMiir ViirNessuna valutazione finora

- Eur-Usd-04 January 2010 DailyDocumento1 paginaEur-Usd-04 January 2010 DailyMiir ViirNessuna valutazione finora

- GBP Usd 01 19 2010Documento1 paginaGBP Usd 01 19 2010Miir ViirNessuna valutazione finora

- AUG-10 Mizuho Technical Analysis GBP USDDocumento1 paginaAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNessuna valutazione finora

- AUG-05 Mizuho Technical Analysis EUR USDDocumento1 paginaAUG-05 Mizuho Technical Analysis EUR USDMiir ViirNessuna valutazione finora

- Mizuho Corporate BankDocumento1 paginaMizuho Corporate BankMiir ViirNessuna valutazione finora

- Mizuho Corporate BankDocumento1 paginaMizuho Corporate BankMiir ViirNessuna valutazione finora

- Mizuho Corporate BankDocumento1 paginaMizuho Corporate BankMiir ViirNessuna valutazione finora

- Mizuho Corporate BankDocumento1 paginaMizuho Corporate BankMiir ViirNessuna valutazione finora

- Mizuho Corporate BankDocumento1 paginaMizuho Corporate BankMiir ViirNessuna valutazione finora

- MyFXForecastsforTHURSDAY July29thDocumento2 pagineMyFXForecastsforTHURSDAY July29thapi-26441337Nessuna valutazione finora

- Mizuho Corporate BankDocumento1 paginaMizuho Corporate BankMiir ViirNessuna valutazione finora

- Gbp-Usd-05 January 2010 DailyDocumento1 paginaGbp-Usd-05 January 2010 DailyMiir ViirNessuna valutazione finora

- Mizuho Corporate BankDocumento1 paginaMizuho Corporate BankMiir ViirNessuna valutazione finora

- Esquema Prueba Viga Vpt-1aDocumento1 paginaEsquema Prueba Viga Vpt-1aVictor HerreraNessuna valutazione finora

- MyFXForecastsforMONDAY August2ndDocumento2 pagineMyFXForecastsforMONDAY August2ndapi-26441337Nessuna valutazione finora

- MyFXForecastsforWEDNESDAY August18thDocumento2 pagineMyFXForecastsforWEDNESDAY August18thapi-26441337Nessuna valutazione finora

- My Latest FXForecastsfor JULY5Documento2 pagineMy Latest FXForecastsfor JULY5api-26441337Nessuna valutazione finora

- Mizuho Corporate BankDocumento1 paginaMizuho Corporate BankMiir ViirNessuna valutazione finora

- Mizuho Corporate BankDocumento1 paginaMizuho Corporate BankMiir ViirNessuna valutazione finora

- My FX Forecasts For MAY 14th: Euro/Us Dollar - Medium Term ViewDocumento3 pagineMy FX Forecasts For MAY 14th: Euro/Us Dollar - Medium Term Viewapi-26441337Nessuna valutazione finora

- My LATESTFXForecastsfor MAY13Documento2 pagineMy LATESTFXForecastsfor MAY13api-26441337Nessuna valutazione finora

- AUDITORIO CASA DE LA CULTURA HUANCAYO-ModelDocumento1 paginaAUDITORIO CASA DE LA CULTURA HUANCAYO-ModelBrandon RiveraNessuna valutazione finora

- BM 09 - Jalan Revolusi Kiri - Long & Cross (Iik)Documento7 pagineBM 09 - Jalan Revolusi Kiri - Long & Cross (Iik)Rizky Wahyu SyaputraNessuna valutazione finora

- MyFXForecastsforMONDAY August23rdDocumento2 pagineMyFXForecastsforMONDAY August23rdapi-26441337Nessuna valutazione finora

- EUR USDUPDATEApril23Documento2 pagineEUR USDUPDATEApril23api-26441337Nessuna valutazione finora

- Gbp-Usd-04 January 2010 DailyDocumento1 paginaGbp-Usd-04 January 2010 DailyMiir ViirNessuna valutazione finora

- MyFXForecastsforTHURSDAY August12thDocumento2 pagineMyFXForecastsforTHURSDAY August12thapi-26441337Nessuna valutazione finora

- Comuna Calui: Clasa de Calitate A Lemnului: I Clasa de Exploatare: 2 Modul de Tratare A Lemnului: IgnifugatDocumento1 paginaComuna Calui: Clasa de Calitate A Lemnului: I Clasa de Exploatare: 2 Modul de Tratare A Lemnului: Ignifugatdarhim2017Nessuna valutazione finora

- Bucatarie Living+ Loc de Luat Masa Dormitor: P P P PDocumento1 paginaBucatarie Living+ Loc de Luat Masa Dormitor: P P P PRoxana CiobanuNessuna valutazione finora

- TV Glorietta DysonDocumento1 paginaTV Glorietta DysonJean Lindley JosonNessuna valutazione finora

- Arkananta: Denah Kolom Lt. 1 Denah Kolom Lt. 2Documento1 paginaArkananta: Denah Kolom Lt. 1 Denah Kolom Lt. 2Wahyu UNessuna valutazione finora

- Details Coffrage C1-C3Documento4 pagineDetails Coffrage C1-C3Beta-Pi ExpertsNessuna valutazione finora

- NSPT Cross LT 15 BH 2 +desainDocumento1 paginaNSPT Cross LT 15 BH 2 +desainSyarifudin BahriNessuna valutazione finora

- Stair 1Documento2 pagineStair 1Edan John HernandezNessuna valutazione finora

- Instalatii EtajDocumento1 paginaInstalatii EtajOana RusuNessuna valutazione finora

- My LATESTFXForecastsfor APRIL23Documento2 pagineMy LATESTFXForecastsfor APRIL23api-26441337Nessuna valutazione finora

- EF Emergency Part 2 - 083919Documento1 paginaEF Emergency Part 2 - 083919adelnagehxiiiNessuna valutazione finora

- HOUSE Model - pdf1Documento1 paginaHOUSE Model - pdf1Sham ParitNessuna valutazione finora

- ANEXA NR. 1.37 La Regulament Plan Etaj Releveu Imobil: RecapitulatieDocumento1 paginaANEXA NR. 1.37 La Regulament Plan Etaj Releveu Imobil: RecapitulatieSandu Denis-SorinNessuna valutazione finora

- Mizuho Corporate BankDocumento1 paginaMizuho Corporate BankMiir ViirNessuna valutazione finora

- Puma Pib 2021Documento454 paginePuma Pib 2021Emperor OverwatchNessuna valutazione finora

- ScienceDocumento9 pagineScience심린Nessuna valutazione finora

- Arki Barangay Hall A3Documento1 paginaArki Barangay Hall A3Prycian TaerNessuna valutazione finora

- Plan ParterDocumento1 paginaPlan ParterAdrian StanciuNessuna valutazione finora

- BotellaDocumento1 paginaBotellaJES JNessuna valutazione finora

- Westpack AUG 11 Mornng ReportDocumento1 paginaWestpack AUG 11 Mornng ReportMiir ViirNessuna valutazione finora

- AUG-10 Mizuho Technical Analysis EUR JPYDocumento1 paginaAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNessuna valutazione finora

- AUG 11 UOB Global MarketsDocumento3 pagineAUG 11 UOB Global MarketsMiir ViirNessuna valutazione finora

- AUG 11 DBS Daily Breakfast SpreadDocumento6 pagineAUG 11 DBS Daily Breakfast SpreadMiir ViirNessuna valutazione finora

- AUG-10 Mizuho Technical Analysis GBP USDDocumento1 paginaAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNessuna valutazione finora

- AUG 10 UOB Global MarketsDocumento3 pagineAUG 10 UOB Global MarketsMiir ViirNessuna valutazione finora

- AUG 10 UOB Asian MarketsDocumento2 pagineAUG 10 UOB Asian MarketsMiir ViirNessuna valutazione finora

- Danske Daily: Key NewsDocumento4 pagineDanske Daily: Key NewsMiir ViirNessuna valutazione finora

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocumento5 pagineMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNessuna valutazione finora

- AUG 10 DBS Daily Breakfast SpreadDocumento8 pagineAUG 10 DBS Daily Breakfast SpreadMiir ViirNessuna valutazione finora

- JYSKE Bank AUG 10 Corp Orates DailyDocumento2 pagineJYSKE Bank AUG 10 Corp Orates DailyMiir ViirNessuna valutazione finora

- AUG 10 Danske FlashCommentFOMC PreviewDocumento7 pagineAUG 10 Danske FlashCommentFOMC PreviewMiir ViirNessuna valutazione finora

- AUG 10 Danske EMEADailyDocumento3 pagineAUG 10 Danske EMEADailyMiir ViirNessuna valutazione finora

- AUG-09 Mizuho Technical Analysis EUR JPYDocumento1 paginaAUG-09 Mizuho Technical Analysis EUR JPYMiir ViirNessuna valutazione finora

- JYSKE Bank AUG 09 Market Drivers CurrenciesDocumento5 pagineJYSKE Bank AUG 09 Market Drivers CurrenciesMiir ViirNessuna valutazione finora

- Westpack AUG 10 Mornng ReportDocumento1 paginaWestpack AUG 10 Mornng ReportMiir ViirNessuna valutazione finora

- AUG-09-DJ European Forex TechnicalsDocumento3 pagineAUG-09-DJ European Forex TechnicalsMiir ViirNessuna valutazione finora

- Jyske Bank Aug 09 em DailyDocumento5 pagineJyske Bank Aug 09 em DailyMiir ViirNessuna valutazione finora

- ScotiaBank AUG 09 Daily FX UpdateDocumento3 pagineScotiaBank AUG 09 Daily FX UpdateMiir ViirNessuna valutazione finora

- JYSKE Bank AUG 09 Corp Orates DailyDocumento2 pagineJYSKE Bank AUG 09 Corp Orates DailyMiir ViirNessuna valutazione finora

- Regional Economic IntegrationDocumento50 pagineRegional Economic IntegrationIskandar Zulkarnain KamalluddinNessuna valutazione finora

- 08-18-16 EdiitonDocumento31 pagine08-18-16 EdiitonSan Mateo Daily JournalNessuna valutazione finora

- Annual Report TTFDocumento19 pagineAnnual Report TTFThùyy VyNessuna valutazione finora

- Stellar - Lumens - 26-Nov-2017XDocumento22 pagineStellar - Lumens - 26-Nov-2017XAbhishek PriyadarshiNessuna valutazione finora

- International Economics Final Exam ReviewDocumento28 pagineInternational Economics Final Exam ReviewYash JainNessuna valutazione finora

- AFME Guide To Infrastructure FinancingDocumento99 pagineAFME Guide To Infrastructure Financingfunction_analysisNessuna valutazione finora

- Forecasting Usd - Euro Ex Rates Using ARMA ModelDocumento13 pagineForecasting Usd - Euro Ex Rates Using ARMA ModelNavin Poddar100% (1)

- KrakowDocumento75 pagineKrakowAndras KondratNessuna valutazione finora

- 2019 EU VAT Engleza PDFDocumento164 pagine2019 EU VAT Engleza PDFcris_ileana_39763320Nessuna valutazione finora

- Sony Music MRP Phase II Review (2014)Documento84 pagineSony Music MRP Phase II Review (2014)Stephanie SchneiderNessuna valutazione finora

- EstruturalismoDocumento372 pagineEstruturalismorocco cocoNessuna valutazione finora

- Wise Transaction Invoice Transfer 686874213 1116305162 enDocumento3 pagineWise Transaction Invoice Transfer 686874213 1116305162 enSlyvia RamirezNessuna valutazione finora

- Environmental Analysis Example PESTDocumento7 pagineEnvironmental Analysis Example PESTThomas DemeyNessuna valutazione finora

- Intermarket Analysis Cheat SheetDocumento1 paginaIntermarket Analysis Cheat SheetrexNessuna valutazione finora

- Shodhganga - Inflibnet.ac - in Bitstream 10603 3830-9-09 Chapter 1Documento4 pagineShodhganga - Inflibnet.ac - in Bitstream 10603 3830-9-09 Chapter 1Ganesh KaleNessuna valutazione finora

- Intl Monetary SystemDocumento18 pagineIntl Monetary SystemRadhika VermaNessuna valutazione finora

- World Steel Prices PDFDocumento16 pagineWorld Steel Prices PDFIAmaeyNessuna valutazione finora

- European UnionDocumento21 pagineEuropean UnionrathanlalNessuna valutazione finora

- Fims Unit - 1Documento17 pagineFims Unit - 1arjunmba119624Nessuna valutazione finora

- Assignment 1: Case Study: Lecturer: Wil MartensDocumento3 pagineAssignment 1: Case Study: Lecturer: Wil MartensLinh ChiNessuna valutazione finora

- Econ 406 Assignment 1 International FinanceDocumento5 pagineEcon 406 Assignment 1 International FinanceCharlotteNessuna valutazione finora

- Court of Appeal of LyonDocumento44 pagineCourt of Appeal of LyonWalktheWalkNessuna valutazione finora

- Negative Interest Rates in Switzerland-What Have We LearnedDocumento14 pagineNegative Interest Rates in Switzerland-What Have We LearnedADBI EventsNessuna valutazione finora

- Economics Department Working Papers: 593 by Jean-Yves Gnabo, and Diego MocceroDocumento40 pagineEconomics Department Working Papers: 593 by Jean-Yves Gnabo, and Diego MocceroBernard SalongaNessuna valutazione finora

- FIN301 Outline FinalDocumento13 pagineFIN301 Outline FinalArsalan AqeeqNessuna valutazione finora