Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

QA Before Week 8 Tute PDF

Caricato da

Shek Kwun HeiDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

QA Before Week 8 Tute PDF

Caricato da

Shek Kwun HeiCopyright:

Formati disponibili

Tutorial Week 8 Moodle Questions and Solutions

Chapter 18: CFS: Non-controlling interest

REVIEW QUESTIONS

1.

What is meant by the term non-controlling interest (NCI)?

NCI is the term used for the ownership interest in a subsidiary other than the parent.

It is defined in AASB 127 as:

The equity in a subsidiary not attributable, directly or indirectly, to a parent.

3. Explain whether the NCI is entitled to a share of subsidiary equity or some other

amount.

If the NCI is classified as equity, it is entitled to a share of consolidated equity. Note

that consolidated equity is basically subsidiary equity adjusted for the effects of

intragroup transactions that is, realised subsidiary equity.

If it were classified as a liability of the subsidiary then the calculation of the NCI would

be based on the obligation held by the subsidiary.

6. Why is it necessary to change the format of the worksheet where a NCI exists in the

group?

The AASB require the disclosure of the equity of the group, as well as the relative

proportions of the parent and the subsidiary. For a wholly owned subsidiary situation,

the final column in the worksheet represents the group position which is also the

parents position, as there is no NCI. Where an NCI exists, having determined the

group position, the equity must be divided into parent share and the NCI share. Hence,

the worksheet must have additional columns to divide the group equity into the relative

shares of the parent and the NCI. This is done by calculating the NCI share and

subtracting it from the group equity so that the final column is then the parent entitys

share.

Tutorial Week 8 Moodle Questions and Solutions

7.

Explain how the adjustment for intragroup transactions affects the calculation of

the NCI share of equity.

The NCI does not affect the adjustment itself, as the full effects of the intragroup

transaction are adjusted for on consolidation. However, where the subsidiary records

profit which is unrealised to the group, this affects the calculation of the NCI. The NCI

is entitled only to a share of consolidated equity rather than subsidiary equity. Hence,

where the subsidiary has recorded unrealised profit, the NCI share of the recorded profit

of the group must be adjusted for any of that profit which is unrealised. In the Step 2 &

Step 3 calculations of the NCI share of equity, this is a share of recorded equity. As

adjustments are made for intragroup transactions, where these transactions reflect

adjustments for unrealised subsidiary profit, an adjustment is also made to the NCI

share of profit. The net result is then that the NCI gets a share of realised subsidiary

equity.

8.

Explain whether an NCI adjustment needs to be made for all intragroup

transactions.

An NCI adjustment does NOT need to be made for all intragroup transactions.

An NCI adjustment only needs to be made where the adjustment is for unrealised profit

recorded by the subsidiary. Hence the transaction must be an upstream subsidiary to

parent transaction in order for an NCI adjustment to be made. Further the upstream

transaction must relate to unrealised subsidiary profit.

Tutorial Week 8 Moodle Questions and Solutions

PRACTICE QUESTIONS

QUESTION 18.2

NORILSK LTD RUDNY LTD

90%

Norilsk Ltd

Rudny Ltd

Norilsk Ltd 90%

NCI

10%

At 1 July 2012:

Net fair value of identifiable assets

and liabilities of Rudny Ltd

=

(a) Consideration transferred

(b) Non-controlling interest

Aggregate of (a) and (b)

Goodwill of the parent

=

=

=

=

=

=

=

$200 000 + $80 000 (equity)

+ $10 000 (1 30%) (land)

+ $2 000 (1 30%) (inventory)

+ $20 000 (1 30%) (machinery)

$302 400

$290 160

10% x $302 400

$30 240

$320 400

$320 400 - $302 400

$18 000

A. Worksheet entries at 1 July 2012

1. Business combination valuation entries

Land

2.

Dr

Cr

Cr

10 000

Deferred tax liability

Business combination valuation reserve

Machinery

Deferred tax liability

Business combination valuation reserve

Dr

Cr

Cr

20 000

Inventory

Deferred Tax Liability

Business combination valuation reserve

Dr

Cr

Cr

2 000

Dr

Dr

Dr

Dr

Cr

180 000

72 000

20 160

18 000

Dr

Dr

Dr

Cr

20 000

8 000

2 240

3 000

7 000

6 000

14 000

600

1 400

Pre-acquisition entries

Share capital

Retained earnings (1/7/12)

Business combination valuation reserve

Goodwill

Shares in Rudny Ltd

290 160

3. NCI share of equity at 1 July 2012

Share capital

Retained earnings (1/7/09)

Business combination valuation reserve

NCI

30 240

Tutorial Week 8 Moodle Questions and Solutions

B.

Worksheet entries at 30 June 2013

1. Business combination valuation entries

Land

Dr

Cr

Cr

10 000

Deferred tax liability

Business combination valuation reserve

Machinery

Deferred tax liability

Business combination valuation reserve

Dr

Cr

Cr

20 000

Depreciation expense

Accumulated depreciation

(1/10 x $20 000)

Dr

Cr

2 000

Deferred tax liability

Income tax expense

Dr

Cr

600

Cost of sales

Income tax expense

Transfer from business combination

valuation reserve

Dr

Cr

2 000

3 000

7 000

6 000

14 000

2 000

600

600

Cr

1 400

2. Pre-acquisition entries

Retained earnings (1/7/12)

Share capital

Business combination valuation reserve

Goodwill

Shares in Rudny Ltd

Dr

Dr

Dr

Dr

Cr

72 000

180 000

20 160

18 000

Transfer from business combination

valuation reserve

Business combination valuation reserve

Dr

Cr

1 260

Dr

Dr

Dr

Cr

20 000

2 240

8 000

290 160

1 260

3. NCI share of equity at 1 July 2012

Share capital

Business combination valuation reserve

Retained earnings (1/7/12)

NCI

30 240

Tutorial Week 8 Moodle Questions and Solutions

4. NCI share of equity: 1/7/12 - 30/6/13

NCI share of profit

Dr

NCI

Cr

(10% ($20 000 ($2 000 - $600) ($2 000 $600)))

Transfer from business combination

valuation reserve

Business combination valuation reserve

(10% x $1 400)

Dr

Cr

1 720

1 720

140

140

C. FULL GOODWILL METHOD

NCI has fair value of $31 800

At 1 July 2012:

Net fair value of identifiable assets

and liabilities of Rudny Ltd

=

(a) Consideration transferred

(b) Non-controlling interest

Aggregate of (a) and (b)

Goodwill

=

=

=

=

=

=

Goodwill of Subsidiary

Fair value of Rudny Ltd

$200 000 + $80 000 (equity)

+ $10 000 (1 30%) (land)

+ $2 000 (1 30%) (inventory)

+ $20 000 (1 30%) (machinery)

$302 400

$290 160

$31 800

$321 960

$321 960 - $302 400

$19 560

=

=

$31 800/10%

$318 000

Net fair value of identifiable assets

and liabilities

Goodwill of subsidiary

=

=

$302 400

$15 600

Goodwill of parent

Goodwill acquired

Goodwill of subsidiary

Goodwill of parent (control premium)

=

=

=

$19 560

$15 600

$3 960

There will need to be an additional BCVR entry:

Goodwill

Business combination valuation entry

Dr

Cr

15 600

Dr

Dr

Dr

Dr

Cr

180 000

72 000

34 200

3 960

15 600

The pre-acquisition entry at 1 July 2012 would change to:

Share capital

Retained earnings (1/7/12)

Business combination valuation reserve *

Goodwill

Shares in Rudny Ltd

* 90% [$22 400 + $15 600]

290 160

Tutorial Week 8 Moodle Questions and Solutions

The Step 1 NCI would change to:

Share capital

Retained earnings (1/7/12)

Business combination valuation reserve *

NCI

Dr

Dr

Dr

Cr

20 000

8 000

3 800

31 800

* 10% [$22 400 + $15 600]

Tutorial Week 8 Moodle Questions and Solutions

QUESTION 18.4

DINGO LTD DUGONG LTD

75%

Dingo Ltd

Dugong Ltd

Dingo Ltd 75%

NCI

25%

Acquisition analysis

1 July 2009

Net fair value of identifiable assets

and liabilities of Dugong Ltd

=

(a) Consideration transferred

(b) Non-controlling interest

Aggregate of (a) and (b)

Goodwill parent only

=

=

=

=

=

=

($80 000 + $20 000 + $40 000) (equity)

+ $20 000 (1 30%) (land)

+ $6 000 (1 30%) (plant)

+ $4 000 (1 30%) (inventory)

$161 000

$125 750

25% x $161 000

$40 250

$166 000

$5 000

A. Consolidation Worksheet Entries - 1 July 2009

1. Business combination valuation entries

Accumulated depreciation - plant

Plant

Deferred tax liability

Business combination valuation reserve

Dr

Cr

Cr

Cr

15 000

Inventory

Deferred tax liability

Business combination valuation reserve

Dr

Cr

Cr

4 000

Dr

Dr

Dr

Dr

Dr

Dr

Cr

30 000

60 000

15 000

10 500

5 250

5 000

9 000

1 800

4 200

1 200

2 800

2. Pre-acquisition entries

Retained earnings (1/7/09)

Share capital

General reserve

Asset revaluation surplus

Business combination valuation reserve

Goodwill

Shares in Dugong Ltd

125 750

Tutorial Week 8 Moodle Questions and Solutions

3. NCI share of equity at 1 July 2009

Share capital

Retained earnings (1/7/09)

General reserve

Asset revaluation surplus

Business combination valuation reserve

NCI

B.

Dr

Dr

Dr

Dr

Dr

Cr

20 000

10 000

5 000

3 500

1 750

Accumulated depreciation - plant

Plant

Deferred tax liability

Business combination valuation reserve

Dr

Cr

Cr

Cr

15 000

Depreciation expense

Accumulated depreciation - plant

(1/3 x $6 000 p.a.)

Dr

Cr

2 000

Deferred tax liability

Income tax expense

Dr

Cr

600

Cost of sales

Income tax expense

Transfer from business combination

valuation reserve

Dr

Cr

4 000

40 250

Consolidation Worksheet Entries - 30 June 2010

1. Business combination valuation entries

9 000

1 800

4 200

2 000

600

1 200

Cr

2 800

2. Pre-acquisition entry

Retained earnings (1/7/09)

Share capital

General reserve

Asset revaluation surplus

Business combination valuation reserve

Goodwill

Shares in Dugong Ltd

Dr

Dr

Dr

Dr

Dr

Dr

Cr

30 000

60 000

15 000

10 500

5 250

5 000

Transfer from business combination

valuation reserve

Business combination valuation reserve

(75% x 70% x $4 000)

Dr

Cr

2 100

125 750

2 100

Tutorial Week 8 Moodle Questions and Solutions

3. NCI share of equity at 1 July 2009

Share capital

Retained earnings (1/7/09)

General reserve

Asset revaluation surplus

Business combination valuation reserve

NCI

Dr

Dr

Dr

Dr

Dr

Cr

20 000

10 000

5 000

3 500

1 750

NCI share of profit

Dr

NCI

Cr

(25% [$10 000 ($2 000 - $600) ($4 000 - $1 200)])

1 450

40 250

4. NCI share of equity: 1 July 2009 - 30 June 2010

Transfer from business combination

valuation reserve

Business combination valuation reserve

(25% x 70% x $4 000)

Dr

Cr

700

Dr

Cr

500

Accumulated depreciation - plant

Plant

Deferred tax liability

Business combination valuation reserve

Dr

Cr

Cr

Cr

15 000

Depreciation expense

Retained earnings (1/7/10)

Accumulated depreciation - plant

Dr

Dr

Cr

2 000

2 000

Deferred tax liability

Income tax expense

Retained earnings (1/7/10)

Dr

Cr

Cr

1 200

Asset revaluation surplus

NCI

(25% x $2 000)

C.

1 450

700

500

Consolidation Worksheet Entries - 30 June 2011

1. Business combination valuation entries

9 000

1 800

4 200

4 000

600

600

Tutorial Week 8 Moodle Questions and Solutions

2. Pre-acquisition entries

Retained earnings (1/7/10) *

Share capital

General reserve

Asset revaluation surplus (1/7/10)

Business combination valuation reserve

Goodwill

Shares in Dugong Ltd

Dr

Dr

Dr

Dr

Dr

Dr

Cr

32 100

60 000

15 000

10 500

3 150

5 000

Dr

Cr

10 500

Dr

Dr

Dr

Dr

Dr

Cr

20 000

10 000

5 000

3 500

1 750

Dr

Dr

Cr

Cr

2 150

500

NCI share of profit

NCI

(25% ($23 000 [$2 000 - $600])

Dr

Cr

5 400

Transfer from asset revaluation surplus

Asset revaluation surplus

(25% x 70% x $20 000)

Dr

Cr

3 500

Asset revaluation surplus

NCI

(25% x $5 000)

Dr

Cr

1 250

125 750

*RE: [$30 000 + $2 100 BCVR - inventory]

Transfer from asset revaluation surplus

Asset revaluation surplus

(75% x 70% x $20 000)

10 500

3. NCI share of equity at 1 July 2009

Share capital

Retained earnings (1/7/10)

General reserve

Asset revaluation surplus

Business combination valuation reserve

NCI

40 250

4. NCI share of equity: 1 July 2009 - 30 June 2010

Retained earnings (1/7/10)

Asset revaluation surplus

Business combination valuation reserve

NCI

(RE: 25% ($10 000 [$2 000 - $600])

ARS: 25% x $2 000

BCVR: 25% x 70% x $4 000)

700

1 950

5. NCI share of equity: 1 July 2010 - 30 June 2011

5 400

3 500

1 250

10

Tutorial Week 8 Moodle Questions and Solutions

D.

Consolidation Journal entries - 30 June 2012

1. Business combination valuation entries

Depreciation expense - plant

Income tax expense

Retained earnings (1/7/11)

Transfer from business combination

valuation reserve

Dr

Cr

Dr

2 000

600

2 800

Cr

4 200

2. Pre-acquisition entries

Retained earnings (1/7/11) *

Share capital

General reserve

Business combination valuation reserve

Goodwill

Shares in Dugong Ltd

Dr

Dr

Dr

Dr

Dr

Cr

42 600

60 000

15 000

3 150

5 000

Dr

Cr

3 150

Dr

Dr

Dr

Dr

Dr

Cr

20 000

10 000

5 000

3 500

1 750

Dr

Cr

Cr

Cr

7 550

125 750

* $30 000 + 70% x 75% ($20 000 + $4 000)

Transfer from business combination

valuation reserve

Business combination valuation reserve

(75% x 70% x $6 000)

3 150

3. NCI share of equity at 1 July 2009

Share capital

Retained earnings (1/7/11)

General reserve

Asset revaluation surplus

Business combination valuation reserve

NCI

40 250

4. NCI share of equity: 1 July 2009 - 30 June 2011

Retained earnings (1/7/11)

Asset revaluation surplus

Business combination valuation reserve

NCI

RE: 25% ($10 000 + $23 000 $2 800)

BCVR: 25% (70% x $4 000)

ARS: 25% ($2 000 + $5 000 - $14 000)

11

1 750

700

5 100

Tutorial Week 8 Moodle Questions and Solutions

5. NCI share of equity: 1 July 2011 - 30 June 2012

NCI

NCI share of profit/loss

(25% [(6 000) ($2 000 - $600)])

Transfer from business combination

valuation reserve

Business combination valuation reserve

(25% x 70% x $6 000)

Asset revaluation surplus

NCI

(25% x $7 000)

E.

Dr

Cr

1 850

Dr

Cr

1 050

Dr

Cr

1 750

Dr

Dr

Dr

Dr

Cr

45 750

60 000

15 000

5 000

1 850

1 050

1 750

Consolidation Journal Entries - 30 June 2013

1. Pre-acquisition entry

Retained earnings (1/7/12) *

Share capital

General reserve

Goodwill

Shares in Dugong Ltd

125 750

* [$30 000 + 75% x 70%($20 000 + $6 000 + $4 000)]

2. NCI share of equity at 1 July 2009

Share capital

Retained earnings (1/7/12)

General reserve

Asset revaluation surplus

Business combination valuation reserve

NCI

Dr

Dr

Dr

Dr

Dr

Cr

20 000

10 000

5 000

3 500

1 750

Dr

Cr

Cr

6 750

Dr

Cr

5 500

40 250

3. NCI share of equity: 1 July 2009 - 30 June 2012

Retained earnings (1/7/12)

Business combination valuation reserve

NCI

(RE: [25% ($10 000 + $23 000 - $6 000)]

ARS: 25% ($2 000 + $5 000 + $7 000 - $14 000)

BCVR: 25% x 70% x ($6 000 + $4 000)

1 750

5 000

5. NCI share of equity: 1 July 2012 - 30 June 2013

NCI share of profit

NCI

(25% x $22 000])

5 500

12

Tutorial Week 8 Moodle Questions and Solutions

QUESTION 18.5

ECHIDNA LTD - EMU LTD

75%

Echidna Ltd

Emu Ltd

Echidna Ltd 75%

NCI

25%

Acquisition analysis

At 1 July 2012:

Net fair value of identifiable assets

and liabilities of Emu Ltd

(a) Consideration transferred

(b) Non-controlling interest

Aggregate of (a) and (b)

Goodwill

Goodwill of subsidiary:

Fair value of Emu Ltd

Net fair value of identifiable assets

and liabilities of Emu Ltd

Goodwill of Emu Ltd

Goodwill of Echidna Ltd:

Goodwill acquired

Goodwill of Emu Ltd

Goodwill of Echidna Ltd

- control premium

=

=

=

=

=

=

=

=

$400 000 + $50 000 + $40 000

+ $30 000 + $40 000(equity)

$560 000

(75% x 400 000 shares) x $1.50 per share

$450 000

$147 000

$597 000

$597 000 - $560 000

$37 000

=

=

$147 000/0.25

$588 000

=

=

=

$560 000

$588 000 - $560 000

$28 000

=

=

$37 000

$28 000

$9 000

1. Business combination valuation entries

Goodwill

Business combination valuation reserve

Dr

Cr

28 000

Dr

Dr

Dr

Dr

Dr

Dr

Dr

Cr

30 000

300 000

37 500

30 000

22 500

21 000

9 000

28 000

2. Pre-acquisition entries

At 1 July 2012

Retained earnings (1/7/12)

Share capital

General reserve

Asset revaluation surplus (1/7/12)

Other components of equity (1/7/12)

Business combination valuation reserve

Goodwill

Shares in Emu Ltd

13

450 000

Tutorial Week 8 Moodle Questions and Solutions

At 30 June 2013:

Retained earnings (1/7/12)

Share capital

General reserve

Asset revaluation surplus (1/7/12)

Other components of equity (1/7/12)

Business combination valuation reserve

Goodwill

Shares in Emu Ltd

Dr

Dr

Dr

Dr

Dr

Dr

Dr

Cr

30 000

300 000

37 500

30 000

22 500

21 000

9 000

Dr

Dr

Dr

Dr

Dr

Dr

Cr

10 000

100 000

12 500

10 000

7 500

7 000

NCI share of profit

NCI

(25% x $223 200)

Dr

Cr

55 800

Gains/Losses - asset revaluation surplus

NCI

(25% [$60 000 - $40 000])

Dr

Cr

5 000

Gains/Losses - other components of equity

NCI

(25%[$40 000 - $30 000])

Dr

Cr

2 500

NCI

Dr

Cr

7 500

Dr

Cr

2 500

Dr

Cr

22 500

450 000

3. NCI share of equity of at 1/7/12

Retained earnings (1/7/12)

Share capital

General reserve

Asset revaluation surplus (1/7/12)

Other components of equity (1/7/12)

Business combination valuation reserve

NCI

4.

147 000

NCI share of equity: 1/7/12 - 30/6/13

Dividend paid

(25% x $30 000)

NCI

Dividend declared

(25% x $10 000)

55 800

5 000

2 500

7 500

2 500

5. Dividend paid

Dividend revenue

Dividend paid

(75% x $30 000)

22 500

14

Tutorial Week 8 Moodle Questions and Solutions

6. Dividend declared

Dividend payable

Dividend declared

(75% x $10 000)

Dr

Cr

7 500

Dividend revenue

Dividend receivable

Dr

Cr

7 500

Dr

Cr

80 000

7 500

7 500

7. Advance

Advance from Echidna Ltd

Advance to Emu Ltd

80 000

8. Sale of inventory: Echidna Ltd to Emu Ltd

Sales revenue

Cost of sales

Inventory

Dr

Cr

Cr

55 000

Deferred tax asset

Income tax expense

Dr

Cr

1 500

Dr

60 000

50 000

5 000

1 500

9. Sale of equipment: Emu Ltd to Echidna Ltd

Proceeds on sale of equipment other income

Carrying amount of equipment sold

other expenses

Equipment

Cr

Cr

Deferred tax asset

Income tax expense

Dr

Cr

2 400

Dr

Cr

1 400

52 000

8 000

2 400

10. NCI adjustment

NCI

NCI share of profit

(25% ($8 000 - $2 400))

15

1 400

Tutorial Week 8 Moodle Questions and Solutions

11. Depreciation

Accumulated depreciation

Depreciation expense

(10% x $8 000)

Dr

Cr

800

Income tax expense

Deferred tax asset

Dr

Cr

240

Dr

Cr

140

800

240

12. NCI adjustment

NCI share of profit

NCI

(25% ($800 - $240))

140

16

Tutorial Week 8 Moodle Questions and Solutions

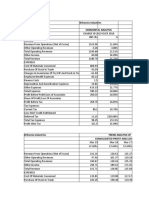

Financial

Statements

Sales revenue

Cost of sales

Other income

Echidna

Ltd

878 900

374 400

504 500

302 100

Emu

Ltd

388 900

112 400

276 500

112 500

Other expenses

806 600 389 000

216 200 115 800

Profit before

tax

Tax expense

590 400 273 200

Profit

478 000 223 200

Ret. earnings

(1/7/12)

112 000

Dividend paid

Div. declared

Ret. earnings

(30/6/13)

Share capital

BCVR

General reserve

ARS (1/7/12)

Gains/losses

ARS (30/6/13)

Other comp (op)

Gains/losses

Other comp. (cl)

Total equity:

parent

Total equity:

NCI

Total equity

Current

liabilities

Total liabilities

Total equity

and liabilities

112 400

50 000

40 000

5

6

9

Adjustments

Dr

Cr

55 000

50 000

800

52 000

24 000 50 000

1 724 000 673 200

40 000 40 000

30 000 20 000

70 000 60 000

25 000 30 000

5 000 10 000

30 000 40 000

11

9

Parent

Cr

1 212 800

436 800

776 000

324 600

1 100 600

279 200

821 400

11

240

1 500

2 400

8

9

158 740

662 660 4

12

122 000 3

30 000

22 500

7 500

5

6

2

2

2

300 000

21 000 28 000

37 500

30 000

22 500

1 824 000 773 200

177 000 124 400

NCI

Dr

22 500

7 500

60 000

590 000 263 200

40 000 30 000

50 000 10 000

90 000 40 000

500 000 223 200

1 200 000 400 000

Group

784 660

47 500

52 500

100 000

684 660

1300 000

7 000

36 500

2 028 160

50 000

50 000

100 000

32 500

15 000

47 500

2 175 660

6

7

7 500

80 000

213 900

177 000 124 400

2001000 897 600

213 900

2 389 560

17

55 800

140

10 000

1 400

10

112 000

7 500

2 500

4

4

3 100 000

7 000

3

3 12 500

-3 10 000

5 000

4

3

4

7 500

2 500

4

4

10

7 500

2 500

1 400

608 120

147 000

55 800

5 000

2 500

140

221 840 221 840

720 120

40 000

50 000

90 000

630 120

1 200 000

0

24 000

1 854 120

40 000

45 000

85 000

25 000

12 500

37 500

1 976 620

3

4

4

4

12

199 040

2 175 660

Tutorial Week 8 Moodle Questions and Solutions

Receivables

320 000 175 000

Inventory

Financial assets

Shares in Emu

Other

investments

Equipment

Accum

depreciation

Deferred tax

asset

Land

Goodwill

287 500 210 600

280 000 204 000

450 000

-47 000

-650 000 360 000

(250 000) (160000) 11

--

--

216 500 108 000

--2 001 000 897 600

8

9

1

2

7 500

80 000

5 000

6

7

8

450 000

8 000

1 002 000

(409 200)

240

11

3 660

800

1 500

2 400

28 000

9 000

715 440 715 440

407 500

493 100

484 000

-47 000

324 500

37 000

2 389 560

18

Tutorial Week 8 Moodle Questions and Solutions

ECHIDNA LTD

Consolidated Statement of Profit or Loss and Other Comprehensive Income

for the financial year ended 30 June 2013

Income:

Sales revenue

Other income

Total income

Expenses:

Cost of sales

Other

Total expenses

Profit before income tax

Income tax expense

Profit for the period

Other comprehensive income:

Asset revaluation surplus: gains

Other components of equity: gains

Comprehensive income for the period

Profit for the period attributable to:

Parent interest

Non-controlling interest

$1 212 800

324 600

1 537 400

436 800

279 200

716 000

821 400

158 740

$662 660

50 000

15 000

$727 660

$608 120

$ 54 540

$662 660

Comprehensive income for the period attributable to:

Parent interest

Non-controlling interest

19

665 620

62 040

$727 660

Tutorial Week 8 Moodle Questions and Solutions

ECHIDNA LTD

Consolidated Statement of Changes in Equity

for the financial year ended 30 June 2013

Comprehensive income for the period

Group

$727 660

Parent

$665 620

Retained earnings:

Balance at 1 July 2012

Profit for the period

Dividend paid

Dividend declared

Balance at 30 June 2013

$122 000

662 660

(47 500)

(52 500)

$684 660

$112 000

608 120

(40 000)

(50 000)

$630 120

General reserve:

Balance at 1 July 2012

Balance at 30 June 2013

$36 500

$36 500

$24 000

$24 000

Share capital

Balance at 1 July 2012

Balance at 30 June 2013

$1 300 000

$1 300 000

$1 200 000

$1 200 000

Asset revaluation reserve:

Balance at 1 July 2012

Gains/Losses

Balance at 30 June 2013

$50 000

50 000

$100 000

$40 000

45 000

$85 000

$32 500

15 000

$47 500

$25 000

12 500

$37 500

$7 000

$7 000

Other components of equity:

Balance at 1 July 2012

Gains/Losses

Balance at 30 June 2013

Business combination valuation reserve:

Balance at 1 July 2013

Balance at 30 June 2013

20

Tutorial Week 8 Moodle Questions and Solutions

ECHIDNA LTD

Consolidated Statement of Financial Position

as at 30 June 2013

ASSETS

Current Assets

Receivables

Inventory

Financial assets

Non-current Assets

Property, plant and equipment

Land

Equipment

Accumulated depreciation

Goodwill

Deferred tax assets

Other investments

Total Non-current Assets

Total Assets

$407 500

493 100

484 000

$324 500

1 002 000

(409 200)

EQUITY AND LIABILITIES

Equity attributable to equity holders of the parent

Share capital

Reserves: General reserve

Asset revaluation surplus

Other components of equity

Retained earnings

Parent Interest

Non-controlling Interest

Total Equity

Total Liabilities: Current Liabilities

Total Equity and Liabilities

21

$1 384 600

917 300

37 000

3 660

47 000

1 004 960

$2 389 560

$1 200 000

24 000

85 000

37 500

630 120

1 976 620

199 040

2 175 660

213 900

$2 389 560

Potrebbero piacerti anche

- Suggested Solution: For Corrections and Clarifications, Just Private Message Me, Okay?Documento12 pagineSuggested Solution: For Corrections and Clarifications, Just Private Message Me, Okay?lixvanter0% (1)

- Chapter 12: Consolidation: Non-Controlling Interest Review QuestionsDocumento35 pagineChapter 12: Consolidation: Non-Controlling Interest Review QuestionsLevi LilluNessuna valutazione finora

- Solution Manual For Fundamental Financial Accounting Concepts 7th Edition by EdmondsDocumento9 pagineSolution Manual For Fundamental Financial Accounting Concepts 7th Edition by EdmondsDiane Jones100% (26)

- 13 Week Cash Flow ModelDocumento16 pagine13 Week Cash Flow ModelASChipLeadNessuna valutazione finora

- Questions and SolutionsDocumento12 pagineQuestions and SolutionsCris Joy Balandra BiabasNessuna valutazione finora

- Seminar 12.2 Outline - Auditing of Group Financial Statements IIDocumento6 pagineSeminar 12.2 Outline - Auditing of Group Financial Statements IIJasmine TayNessuna valutazione finora

- Activity 3 CAMINGAWAN BSMA 2B PDFDocumento7 pagineActivity 3 CAMINGAWAN BSMA 2B PDFMiconNessuna valutazione finora

- IFRS Chapter 9 The Consolidated Statement of Financial PositonDocumento44 pagineIFRS Chapter 9 The Consolidated Statement of Financial PositonMahvish Memon0% (1)

- 3.1 Multiple Choice Questions: Chapter 3 An Introduction To Consolidated Financial StatementsDocumento32 pagine3.1 Multiple Choice Questions: Chapter 3 An Introduction To Consolidated Financial StatementsGaith1 AldaajahNessuna valutazione finora

- Fixed Asset Register SampleDocumento55 pagineFixed Asset Register SampleClarisse30Nessuna valutazione finora

- MC 789Documento59 pagineMC 789Minh Nguyễn83% (6)

- Project in Fin Acc Chester Gutierrez Project in Fin Acc Chester GutierrezDocumento17 pagineProject in Fin Acc Chester Gutierrez Project in Fin Acc Chester GutierrezJoseph Asis50% (2)

- 1 Read Me First PDFDocumento3 pagine1 Read Me First PDFEhsanulNessuna valutazione finora

- Chapter 17 - Consolidated Financial Statements: Intragroup TransactionsDocumento14 pagineChapter 17 - Consolidated Financial Statements: Intragroup TransactionsShek Kwun HeiNessuna valutazione finora

- Direct Non ControllingDocumento24 pagineDirect Non ControllingJamie ZhangNessuna valutazione finora

- Chapter 15 - Consolidation: Controlled Entities: Review QuestionsDocumento13 pagineChapter 15 - Consolidation: Controlled Entities: Review QuestionsShek Kwun Hei100% (1)

- FR-342.AFR (AL-I) Solution CMA January-2023 Exam.Documento7 pagineFR-342.AFR (AL-I) Solution CMA January-2023 Exam.practice78222Nessuna valutazione finora

- Additional Topics - Business CombinationDocumento39 pagineAdditional Topics - Business CombinationIan Pol FiestaNessuna valutazione finora

- AcFN 3151 CH, 5 CONSOLIDATED FINANCIAL STATEMENTS IFRS 10Documento41 pagineAcFN 3151 CH, 5 CONSOLIDATED FINANCIAL STATEMENTS IFRS 10BethelhemNessuna valutazione finora

- Chapter 19: Consolidation: Other Issues: Review QuestionsDocumento20 pagineChapter 19: Consolidation: Other Issues: Review QuestionsShek Kwun HeiNessuna valutazione finora

- CA Question 21 7 Revised VersionDocumento7 pagineCA Question 21 7 Revised VersionDeepak Simon100% (1)

- Conso F.SDocumento16 pagineConso F.SshinefrdrknsNessuna valutazione finora

- Reading 21 Financial Analysis TechniquesDocumento74 pagineReading 21 Financial Analysis TechniquesNeerajNessuna valutazione finora

- Consolidation of Financial Statement - Miscellaneous TopicsDocumento42 pagineConsolidation of Financial Statement - Miscellaneous TopicsJen KerlyNessuna valutazione finora

- HI6025 Final Assessment T1 2021Documento11 pagineHI6025 Final Assessment T1 2021Muhammad AshrafNessuna valutazione finora

- Sem 7Documento84 pagineSem 7Bình QuốcNessuna valutazione finora

- SasgerDocumento48 pagineSasgerbillyNessuna valutazione finora

- ACCADocumento12 pagineACCAAbdulHameedAdamNessuna valutazione finora

- Chapter 9 - Annand, D. (2018) :: Concept Self-Check: 1 To 6Documento6 pagineChapter 9 - Annand, D. (2018) :: Concept Self-Check: 1 To 6Minh HuyyNessuna valutazione finora

- Faculty of Business Studies: Submitted ToDocumento10 pagineFaculty of Business Studies: Submitted Tomd fahadNessuna valutazione finora

- Management AccountingDocumento7 pagineManagement AccountingNageshwar singhNessuna valutazione finora

- Solution Practice 6 Consolidations 3Documento8 pagineSolution Practice 6 Consolidations 3Mya Hmuu KhinNessuna valutazione finora

- Advanced Financial Accounting and Reporting ExamDocumento10 pagineAdvanced Financial Accounting and Reporting ExamMuhammad HassaanNessuna valutazione finora

- ACC501 Practice Exam IIDocumento32 pagineACC501 Practice Exam IIgilli1trNessuna valutazione finora

- HI6025 Final Assessment T1 2021Documento12 pagineHI6025 Final Assessment T1 2021Purnima Sidhant BabbarNessuna valutazione finora

- Online Ass Advance Acc NEWDocumento6 pagineOnline Ass Advance Acc NEWRara Rarara30Nessuna valutazione finora

- FMA Assgnments - EX 2022Documento12 pagineFMA Assgnments - EX 2022Natnael BelayNessuna valutazione finora

- Midterm Revision AnswersDocumento10 pagineMidterm Revision AnswersAhmed IsmaelNessuna valutazione finora

- Self Study Solutions Chapter 13Documento11 pagineSelf Study Solutions Chapter 13ggjjyy0% (1)

- Business Combinations: Answers To Questions 1Documento13 pagineBusiness Combinations: Answers To Questions 1BriandLukeNessuna valutazione finora

- MA 习题强化 Chapter 14-18Documento15 pagineMA 习题强化 Chapter 14-18roseliu.521.jackNessuna valutazione finora

- Inancing Ecisions: Unit - I: Cost of Capital Answer Weighted Average Cost of CapitalDocumento15 pagineInancing Ecisions: Unit - I: Cost of Capital Answer Weighted Average Cost of Capitalanon_672065362Nessuna valutazione finora

- SOLUTIONS - Practice Final ExamDocumento12 pagineSOLUTIONS - Practice Final ExamsebmccabeeNessuna valutazione finora

- Accounting SamplesDocumento10 pagineAccounting Samplesleviadain100% (2)

- Accounting 561Documento10 pagineAccounting 561enesworldNessuna valutazione finora

- Answers March2012 f2Documento10 pagineAnswers March2012 f2Dimuthu JayawardanaNessuna valutazione finora

- F7.2 - Mock Test 1Documento5 pagineF7.2 - Mock Test 1huusinh2402Nessuna valutazione finora

- Chapter 4 Sample BankDocumento18 pagineChapter 4 Sample BankWillyNoBrainsNessuna valutazione finora

- SX Dec 2007 ADocumento12 pagineSX Dec 2007 AGrand OverallNessuna valutazione finora

- Acct 2251 Enlarged Review Qs Final ExamW07Documento9 pagineAcct 2251 Enlarged Review Qs Final ExamW07hatanolove100% (1)

- Financial Mgt. Capital Structure M.Com. Sem-II - Sukumar PalDocumento19 pagineFinancial Mgt. Capital Structure M.Com. Sem-II - Sukumar PalalokNessuna valutazione finora

- F2 May 2011 AnswersDocumento11 pagineF2 May 2011 AnswersMyat Zar GyiNessuna valutazione finora

- FINC - 341 - Problem - Set - TPC - 6 - SolutionsDocumento5 pagineFINC - 341 - Problem - Set - TPC - 6 - SolutionsShamma AlshamsiNessuna valutazione finora

- Third Examination Review (ACP 312/8B)Documento20 pagineThird Examination Review (ACP 312/8B)Jerah TorrejosNessuna valutazione finora

- SLC ACCT5 2019S3 101 Assignment04Documento8 pagineSLC ACCT5 2019S3 101 Assignment04kasad jdnfrnasNessuna valutazione finora

- Professional Nov 2018Documento163 pagineProfessional Nov 2018multenplanintegratedltdNessuna valutazione finora

- Trial Day 3Documento7 pagineTrial Day 3seemaNessuna valutazione finora

- Do Not Turn Over This Question Paper Until You Are Told To Do SoDocumento17 pagineDo Not Turn Over This Question Paper Until You Are Told To Do SoMin HeoNessuna valutazione finora

- Week 2 Tutorial Solutions - Financial AccountingDocumento5 pagineWeek 2 Tutorial Solutions - Financial AccountingMi ThaiNessuna valutazione finora

- DocxDocumento15 pagineDocxmaria evangelistaNessuna valutazione finora

- CFS Company Has The Following Details For Two-Year Period, 2019 and 2018Documento7 pagineCFS Company Has The Following Details For Two-Year Period, 2019 and 2018MiconNessuna valutazione finora

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsDa EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNessuna valutazione finora

- Internal Control of Fixed Assets: A Controller and Auditor's GuideDa EverandInternal Control of Fixed Assets: A Controller and Auditor's GuideValutazione: 4 su 5 stelle4/5 (1)

- Implementing Results-Based Budget Management Frameworks: An Assessment of Progress in Selected CountriesDa EverandImplementing Results-Based Budget Management Frameworks: An Assessment of Progress in Selected CountriesNessuna valutazione finora

- QA Before Week 11 Tute PDFDocumento17 pagineQA Before Week 11 Tute PDFShek Kwun HeiNessuna valutazione finora

- Chapter 4 - Fundamental Concepts of Corporate Governance: Review QuestionsDocumento3 pagineChapter 4 - Fundamental Concepts of Corporate Governance: Review QuestionsShek Kwun HeiNessuna valutazione finora

- Chapter 1 - Nature and Regulation of Companies: Review QuestionsDocumento19 pagineChapter 1 - Nature and Regulation of Companies: Review QuestionsShek Kwun HeiNessuna valutazione finora

- Chapter 19: Consolidation: Other Issues: Review QuestionsDocumento20 pagineChapter 19: Consolidation: Other Issues: Review QuestionsShek Kwun HeiNessuna valutazione finora

- Chapter 7: Property, Plant and Equipment: Practice QuestionsDocumento7 pagineChapter 7: Property, Plant and Equipment: Practice QuestionsShek Kwun HeiNessuna valutazione finora

- Chapter 5 - Fair Value Measurement: Review QuestionsDocumento5 pagineChapter 5 - Fair Value Measurement: Review QuestionsShek Kwun HeiNessuna valutazione finora

- Chapter 20: Accounting For Investments in Associates: Review QuestionsDocumento6 pagineChapter 20: Accounting For Investments in Associates: Review QuestionsShek Kwun HeiNessuna valutazione finora

- Chapter 6: Accounting For Income Tax: Review QuestionsDocumento10 pagineChapter 6: Accounting For Income Tax: Review QuestionsShek Kwun HeiNessuna valutazione finora

- Chapter 10 - Business Combinations: Review QuestionsDocumento8 pagineChapter 10 - Business Combinations: Review QuestionsShek Kwun HeiNessuna valutazione finora

- Week 2 Homework SolutionsDocumento4 pagineWeek 2 Homework SolutionsShek Kwun HeiNessuna valutazione finora

- Chapter 7: Property, Plant and Equipment: Practice QuestionsDocumento4 pagineChapter 7: Property, Plant and Equipment: Practice QuestionsShek Kwun HeiNessuna valutazione finora

- Chapter 6: Accounting For Income Tax: Review QuestionsDocumento5 pagineChapter 6: Accounting For Income Tax: Review QuestionsShek Kwun HeiNessuna valutazione finora

- COMPARISON OF IFRS AND GAAP REPORTONG STANDARDS Case Study On Abay BankDocumento29 pagineCOMPARISON OF IFRS AND GAAP REPORTONG STANDARDS Case Study On Abay BanknigusNessuna valutazione finora

- Mary Joy L. Amigos Rice Store Notes To The Financial StatementsDocumento5 pagineMary Joy L. Amigos Rice Store Notes To The Financial StatementsLizanne GauranaNessuna valutazione finora

- Certificate Program in Marketing & HRM: Dr. Abhijit P. PhadnisDocumento19 pagineCertificate Program in Marketing & HRM: Dr. Abhijit P. PhadnisGurvinder SinghNessuna valutazione finora

- Reliance Universal Traders Private LimitedDocumento28 pagineReliance Universal Traders Private LimitedNaureen ShabnamNessuna valutazione finora

- Reading 22 Slides - Understanding Balance SheetsDocumento41 pagineReading 22 Slides - Understanding Balance SheetstamannaakterNessuna valutazione finora

- 2 PDocumento238 pagine2 Pbillyryan1100% (3)

- Local Water UtilitiesDocumento75 pagineLocal Water UtilitiesadsleeNessuna valutazione finora

- Compliancewith Accounting StandardsDocumento109 pagineCompliancewith Accounting Standardsfalope femiNessuna valutazione finora

- Intermediate Accounting 2Documento27 pagineIntermediate Accounting 2cpacpacpaNessuna valutazione finora

- ACC705 Corporate Accounting AssignmentDocumento9 pagineACC705 Corporate Accounting AssignmentMuhammad AhsanNessuna valutazione finora

- MMS 1-Fcfe, Amortization, Roc, RoeDocumento10 pagineMMS 1-Fcfe, Amortization, Roc, RoeASHISH RASALNessuna valutazione finora

- Suggested CAP III Group I June 2023Documento66 pagineSuggested CAP III Group I June 2023ranjanNessuna valutazione finora

- Britannia Industries Horizontal AnalysisDocumento4 pagineBritannia Industries Horizontal AnalysisSneha BhartiNessuna valutazione finora

- Solutions IAS 1 For SEPT ATTEMPT FinalDocumento25 pagineSolutions IAS 1 For SEPT ATTEMPT FinalShehrozSTNessuna valutazione finora

- Deferred Tax CalculatorDocumento2 pagineDeferred Tax Calculatoramitanshu chaturvediNessuna valutazione finora

- FINAL Conceptual Framework and Accounting Standards PDFDocumento24 pagineFINAL Conceptual Framework and Accounting Standards PDFJotaro KujoNessuna valutazione finora

- 9825061Documento54 pagine9825061Gabriela TunareanuNessuna valutazione finora

- 2 Days Marathon Notes - Accounting Paper 1 - CA Inter & IPCC PDFDocumento88 pagine2 Days Marathon Notes - Accounting Paper 1 - CA Inter & IPCC PDFAditya AundhekarNessuna valutazione finora

- Acc005 PPT IA3 C01 SMEsLiabilitiesDocumento38 pagineAcc005 PPT IA3 C01 SMEsLiabilitiesMonique VillaNessuna valutazione finora

- Comprehensive Example of Interperiod TAX ALLOCATIONDocumento9 pagineComprehensive Example of Interperiod TAX ALLOCATIONarsykeiwayNessuna valutazione finora

- Avenue Dmart PDFDocumento74 pagineAvenue Dmart PDFdarshanmadeNessuna valutazione finora

- Compustat Users Guide-2003Documento735 pagineCompustat Users Guide-2003Gain GainNessuna valutazione finora

- CH 02Documento56 pagineCH 02AL SeneedaNessuna valutazione finora

- Al Habib BankDocumento13 pagineAl Habib BankMohammad UsmanNessuna valutazione finora

- Daimler Ir Annual Financialstatements Entity 2017 PDFDocumento55 pagineDaimler Ir Annual Financialstatements Entity 2017 PDFGate Bennet4Nessuna valutazione finora