Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

16 - Plant Valuation & Construction Cost

Caricato da

mkpasha55mp0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

14 visualizzazioni5 pagine16_Plant Valuation & Construction Cost

Titolo originale

16_Plant Valuation & Construction Cost

Copyright

© © All Rights Reserved

Formati disponibili

PDF o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documento16_Plant Valuation & Construction Cost

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

14 visualizzazioni5 pagine16 - Plant Valuation & Construction Cost

Caricato da

mkpasha55mp16_Plant Valuation & Construction Cost

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

Sei sulla pagina 1di 5

16 PLANT VALUATION &

CONSTRUCTION COST

16.1 Plant Valuation

Plant Valuation can be determined using a variety of methods. The

appropriate method will be determined by the need. For example, for

insurance purposes, valuation would be based on fair market value or

replacement value. Financial value is based on historical cost. For acqui-

sition purposes, an operating plant would be valued as a going concern

while a shut down plant would be assessed at the break-up value of the

assets.

Financial Value is the historical cost of the assets less depreciation and

depletion and is the easiest valuation to obtain. As a going concern,

asset value can be derived from the standard financial equation:

or:

CA+FA+OA = CLHLD+E

where CA = current assets (cash equivalents & accounts

receivable)

FA = fixed assets (original cost less depreciation and

depletion)

OA = other assets (non producing assets & intangible

assets)

CL. = current liabilities (payables and current portion

of LD)

LD = long term debt (maturity greater than one year)

E = equity

or:

Valuation = FA+ OA +(CA-CL) = LD+E

where (CA-CL) = net working capital

For most purposes, excluding financial reporting and return-on-invest-

ment calculations, the financial value of an asset is of little use. This is

especially true during periods of rising prices when historical cost

misrepresents the current cost of the assets being valued.

Fair market value of a plant can be determined using several methods

Briefly, the fair market value of an asset represents the amount a

Cement Plant Operations Handbook * 201

a”)

4

P=

=

a

i

Pd

<<

i

=

fo}

r=

willing buyer would pay to a willing seller, neither under compulsion

to participate in the transaction, and where both have full knowledge of

the facts and circumstances regarding the transaction. In practice, of

course, this situation rarely exists.

Discounted Cash Flow values an asset based upon the net present

value (NPV) of all the after tax cash flows the asset produces over a

period of time, ideally twenty years or more, including the residual

value (RV).

Valuation = NPV [R (CFyr1, CFya... CFyrx + RV)]

where R = discount (interest) rate

The calculation of the cash flow resulting from the asset requires

subjective assumptions. This is especially true with the cash flows (rev-

enues) due to the uncertainty of projecting volumes and prices into the

future. The effect of this uncertainty can be minimized by preparing

values based on ‘most likely’ and ‘worst case’ projections. In valuing an

asset for investment purposes, the discount rate will equal the investor's

after-tax cost of capital.

Current Cash Equivalent values an asset at the present realisable price

that would be received from the sale of the asset under orderly (non-

distress) conditions. The realisable price would be based on recent sales

of comparable assets adjusted for known differences such as capacity,

technology and location. This value represents a floor price without

allowance for goodwill (going concern value).

Replacement Value is the current cost to replace the asset adjusted for

depreciation to recognise wear-and-tear and obsolescence. Depreciation

is based on replacement cost less salvage value divided by useful life.

In practice it is desirable to employ all or several of the above valuation

methods and apply a sanity test upon completion. Several projects and

acquisitions in recent years doubtless resulted from sophisticated eco-

nomic analysis but clearly failed the sanity test.

Asa going concern, plant valuation can be based upon:

@ Replacement value applying depreciation for wear-and-tear and

obsolescence to current new replacement cost. For financial reporting

202 » Cement Plant Operations Handbook

purposes (as opposed to tax write-off which may be accelerated),

depreciation schedules are typically straight-line over:

Mobile equipment 3-10 years

Machinery & equipment 10-20 years

Buildings 20-40 years

& Net earnings (after interest, amortisation, depreciation, and tax)

adjusted for the average market P/E ratio of comparable companies

and the average acquisition premium of comparable deals.

Valuation = Net earnings x P/E + premium

P/E ratios and acquisition premiums vary considerably with time

and market area. The premium might be 33% and average P/E

ratios are:

Europe 11.9

United States and Mexico 86

Japan and Taiwan 19.0

(ICR; 5/2001, pg 17).

Simple share-price / earning-per-share ratios are considered crude para-

meters due to distortions of earnings by items such as depreciation. An

alternative measure has been proposed which takes the ratio of enter-

prise value (debt + market value of equity — estimated market value of

non-relevant assets) to cash flow (annual cash flow from core business

before interest, taxes and depreciation). This EV /CF ratio, though more

complex to determine, does give a more realistic measure than P/E.

If the subject plant is part of a multi-plant company, determination or

confirmation of appropriate profit centre figures is necessary as cost

allocation or transfer pricing practices may cause distortion.

A particular problem is encountered when attempting to value opera-

tions or perform cost/benefit analyses in countries subject to subsidies

and price controls. ‘Shadow pricing’ is an attempt to impute free mar-

ket costs and prices.

Foreign exchange risk is nearly always significant in developing coun-

tries as local currency finance, if available, is prohibitively expensive.

Devaluation will, almost inevitably, be followed by direct or indirect

control of product prices while debt service, spare parts, imported sup-

plies, and, usually, fuel is payable in hard currency. Hedging is, of

course, possible but expensive and a number of companies in South East

Cement Plant Operations Handbook * 203

7

P=

P=

a

S

a.

5

om

oO

Pad

Asia have suffered from this exposure to an extreme degree since 1997.

Inherent in the calculation of future earnings is a market projection over

the life of the investment. Such long term projections are never easy but

are particularly fraught when considering developing markets. A review

of long term forecasting methods is given by Joos (ICR; 8/1992, pg 29).

16.2 New Plant Construction

New green-field cement plants cost $200-300 per tonne of annual pro-

duction, while kiln expansions cost $80-150 depending upon the usable

excess capacity of existing ancillary equipment and storage. Permitting

of heavy industrial facilities becomes ever more difficult and expensive,

so that considerable intangible value may attach to an existing opera-

tion and its market, even if the equipment is antiquated and inefficient.

Obviously, profitable markets suck in imports from low cost producers

and, unless protected geographically, by tariffs or by other regulation,

high margins tend to be ephemeral. Also, the lead time for new capac-

ity and the cyclical nature of most cement markets enhance both risk

and reward for building new cement plants.

A typical project cost for adding a new 1.5 million tonne/year line to an

existing plant is:

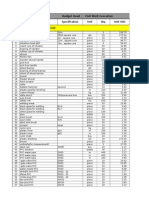

Equipment Quarry equipment Us$3,000,000

Raw milling & blending 13,000,000

Kiln, preheater & cooler 18,000,000

Coal system & storage 5,000,000

Clinker storage 3,000,000

Cement milling 9,000,000

Cement storage and packing 3,000,000

Electrical & control 9,000,000

Sub-total $63,000,000

Civil, structural & erection $38,000,000

Engineering, construction management, freight, $19,000,000

commissioning

Owner's capitalised cost $5,000,000

Construction interest $14,000,000

Spares $4,000,000

Contingency (5%) 7,000,000

Total project cost $150,000,000

204 * Cement Plant Operations Handbook

There is a considerable variation due to specification, location, degree

of local fabrication, labour and materials costs, and cost of capital.

There is also considerable variation in schedule for construction.

Conventionally, process and preliminary engineering design, and

permitting are completed before procurement and contract bidding

begin. However, where expedition is essential the risks of overlapping

engineering with construction are sometimes accepted though the cost

penalty is unpredictable and usually severe. Site preparation is also

frequently performed by plant forces or separately contracted. Then,

assuming permitting does not impact the critical path, a typical sched-

ule would be:

"~

ie

Pd

=

=r

—

Pad

me

5

om

(2)

=

Cumulative

Start detailed engineering 0 months

Issue tender documents 2

Contracts for equipment and construction 5

Ground breaking 7

Complete civil work 12

Major equipment delivered 12

Complete mechanical erection 18

Complete electrical and instrumentation 20

Begin commissioning 21

Commercial operations 24

Cement Plant Operations Handbook * 205

Potrebbero piacerti anche

- Construction Hand BookDocumento237 pagineConstruction Hand BookNson Lee100% (1)

- Imported Items Shipment Details: PO PO# Date SupplierDocumento4 pagineImported Items Shipment Details: PO PO# Date Suppliermkpasha55mpNessuna valutazione finora

- Loeffler Engineering Group 20511 Highland Lake Drive, Lago Vista, Texas 78645 512-267-8700Documento5 pagineLoeffler Engineering Group 20511 Highland Lake Drive, Lago Vista, Texas 78645 512-267-8700mkpasha55mpNessuna valutazione finora

- MS Welding ElectrodesDocumento7 pagineMS Welding Electrodesmkpasha55mpNessuna valutazione finora

- VRM Kiln CoolerDocumento130 pagineVRM Kiln Coolermkpasha55mpNessuna valutazione finora

- Budget Heads With Detail 1ADocumento44 pagineBudget Heads With Detail 1Amkpasha55mpNessuna valutazione finora

- Astagavarga CALCDocumento14 pagineAstagavarga CALCmkpasha55mpNessuna valutazione finora

- BOQ Suryadev ChennaiDocumento2 pagineBOQ Suryadev Chennaimkpasha55mpNessuna valutazione finora

- Introduction To Numerical Methods and Matlab Programming For EngineersDocumento180 pagineIntroduction To Numerical Methods and Matlab Programming For EngineersNeneNessuna valutazione finora

- Beam3 PortalDocumento33 pagineBeam3 Portalmkpasha55mpNessuna valutazione finora

- Beam Design FunctionsDocumento86 pagineBeam Design Functionsmkpasha55mpNessuna valutazione finora

- 12 Plant ReportingDocumento10 pagine12 Plant Reportingmkpasha55mpNessuna valutazione finora

- Circular Water Tank (Rigid Joint)Documento28 pagineCircular Water Tank (Rigid Joint)Lachu M. SharmaNessuna valutazione finora

- Beam Analysis: Analysis of A Single Beam Subject To Transvers and Distributed LoadDocumento17 pagineBeam Analysis: Analysis of A Single Beam Subject To Transvers and Distributed Loadmkpasha55mpNessuna valutazione finora

- B4 - Milling (Ball Mills)Documento8 pagineB4 - Milling (Ball Mills)shani5573Nessuna valutazione finora

- LIST of MaterialDocumento8 pagineLIST of Materialmkpasha55mpNessuna valutazione finora

- D1e 002Documento20 pagineD1e 002mkpasha55mpNessuna valutazione finora

- 17 StatisticsDocumento7 pagine17 Statisticsmkpasha55mpNessuna valutazione finora

- B4 - Milling (Ball Mills)Documento8 pagineB4 - Milling (Ball Mills)shani5573Nessuna valutazione finora

- B 1 - PowerDocumento3 pagineB 1 - Powermkpasha55mpNessuna valutazione finora

- 6 Quality ControlDocumento25 pagine6 Quality Controlmkpasha55mpNessuna valutazione finora

- 11 - Other Kiln TypesDocumento7 pagine11 - Other Kiln Typesmkpasha55mpNessuna valutazione finora

- 9 - Combustion & Heat Transfer ProcessesDocumento32 pagine9 - Combustion & Heat Transfer Processesmkpasha55mpNessuna valutazione finora

- B3 ConveyingDocumento4 pagineB3 Conveyingmkpasha55mpNessuna valutazione finora

- 13 AccountingDocumento5 pagine13 Accountingmkpasha55mpNessuna valutazione finora

- 9 - Combustion & Heat Transfer ProcessesDocumento32 pagine9 - Combustion & Heat Transfer Processesmkpasha55mpNessuna valutazione finora

- 10 - Hydration of Portland CementDocumento3 pagine10 - Hydration of Portland Cementmkpasha55mpNessuna valutazione finora

- 14 - Technical & Process AuditsDocumento8 pagine14 - Technical & Process Auditsmkpasha55mpNessuna valutazione finora

- B8 Miscellaneous DataDocumento5 pagineB8 Miscellaneous Datamkpasha55mpNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (120)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)