Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

QS06 - Class Exercises Solution

Caricato da

lyk0texDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

QS06 - Class Exercises Solution

Caricato da

lyk0texCopyright:

Formati disponibili

Accounting 225 Quiz Section #6

Chapter 5 Class Exercises Solution

1. Churchill Corporation produces and sells a single product. Data concerning that product

appear below:

Fixed Expenses:

$603,000

Sales Price:

$200

Variable Mfg Cost: $95

Var. Selling Cost:

$15

a) What is the breakeven point in units?

$603,000 / $90 CMU = 6,700 units.

b) What is the breakeven in sales dollars?

$603,000 / 45% = $1,340,000

c) Assume the company's monthly target profit is $500,000. Determine the unit sales to

attain that target profit.

(603,000+500,000) / 90

CMU = 12,255.55 round up to 12,256 units

d) Assume current monthly sales is 10,000 units. What is the Margin of Safety in:

i.

Units? 3,300 units

ii.

Sales dollars? $660,000

iii. Percentage? 33%

Units

Sales

10,000

Less:

Breakeven Sales

6,700

Equals: Margin of Safety

3,300

Sales $'s

$ 2,000,000

$ 1,340,000

$ 660,000

%

100%

67%

33%

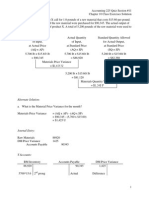

2. Parkins Company produces and sells a single product. The company's income statement for

the most recent month is given below:

There are no beginning or ending inventories.

Accounting 225 Quiz Section #6

Chapter 5 Class Exercises Solution

a. Compute the company's monthly break-even point in units of product.

The company's income statement in contribution format would be:

The break-even point in units would be: $72,000 $16 per unit = 4,500 units

b. What would the company's monthly net operating income be if sales increased by 25% and

there is no change in total fixed expenses?

6,000 units 125% = 7,500 units

c. What dollar sales must the company achieve in order to earn a net operating income of

$50,000 per month?

($72,000 + $50,000) 0.40 = $305,000

d. The company has decided to automate a portion of its operations. The change will reduce

direct labor costs per unit by 40 percent, but it will double the costs for fixed factory overhead.

Compute the new break-even point in units.

Direct labor costs are presently $10 per unit ($60,000 6,000 units) and will decrease by $4 per

unit ($10 40%). Therefore, the company's new cost structure will be:

((2 $30,000) + $42,000) $20 per unit = 5,100 units

2

Potrebbero piacerti anche

- Chapter 7Documento10 pagineChapter 7Eki OmallaoNessuna valutazione finora

- Section 6Documento6 pagineSection 6AmrNessuna valutazione finora

- Marginal CostingDocumento13 pagineMarginal CostingKUNAL GOSAVINessuna valutazione finora

- Acct 2302 Quiz 3 KeyDocumento11 pagineAcct 2302 Quiz 3 KeyRachel YangNessuna valutazione finora

- Case Study Break EvenDocumento20 pagineCase Study Break EvenSan Lee ChyNessuna valutazione finora

- Revise Mid TermDocumento43 pagineRevise Mid TermThe FacesNessuna valutazione finora

- Slo 02 Acc230 08 TestDocumento5 pagineSlo 02 Acc230 08 TestSammy Ben MenahemNessuna valutazione finora

- Key Accob3 Exercises On CVP and BeDocumento16 pagineKey Accob3 Exercises On CVP and BeJanine Sabrina LimquecoNessuna valutazione finora

- CVP AnalysisDocumento7 pagineCVP AnalysisKat Lontok0% (1)

- CVP Analysis Chapter-10: Were $140,000, AL's Margin of Safety, in Units, WasDocumento7 pagineCVP Analysis Chapter-10: Were $140,000, AL's Margin of Safety, in Units, Wasali hansiNessuna valutazione finora

- CH8 Practice-ProblemsDocumento11 pagineCH8 Practice-ProblemsLuigi Enderez BalucanNessuna valutazione finora

- 6-3B - High-Low Method, Scattergraph, Least-Squares RegressionDocumento8 pagine6-3B - High-Low Method, Scattergraph, Least-Squares RegressionDias AdhyaksaNessuna valutazione finora

- Cost Volume Profit Analysis - With KEYDocumento8 pagineCost Volume Profit Analysis - With KEYPatricia AtienzaNessuna valutazione finora

- Kelompok E-Akuntansi Manajemen-Module 7Documento11 pagineKelompok E-Akuntansi Manajemen-Module 7vidiamyNessuna valutazione finora

- Break Even AnalysisDocumento4 pagineBreak Even AnalysisOwen Hudson0% (1)

- Chap 6Documento4 pagineChap 6anam_khan0% (1)

- Multiple Choice Answer On The Scantron Provided ONLYDocumento10 pagineMultiple Choice Answer On The Scantron Provided ONLYGiovana Marie Balasquide100% (1)

- Short Term Decision Making 2Documento8 pagineShort Term Decision Making 2Pui YanNessuna valutazione finora

- MASDocumento13 pagineMASchloe maeNessuna valutazione finora

- (Done) Activity-Chapter 2Documento8 pagine(Done) Activity-Chapter 2bbrightvc 一ไบร์ทNessuna valutazione finora

- Chapter-05 CVP RelationshipDocumento29 pagineChapter-05 CVP RelationshipShahinul Kabir100% (4)

- Chapter 7 Facility LayoutDocumento6 pagineChapter 7 Facility LayoutAndrew Miranda100% (1)

- Aminta Leon-Patnett (Hermain Tzib (200116452) ACTG 3015 - Managerial Accounting Lecturer: Ms. Aurelia Cal Assignment #1Documento6 pagineAminta Leon-Patnett (Hermain Tzib (200116452) ACTG 3015 - Managerial Accounting Lecturer: Ms. Aurelia Cal Assignment #1Sheila ArjonaNessuna valutazione finora

- 20211016231949-A4362 - 201093M 2Documento4 pagine20211016231949-A4362 - 201093M 2bucin yaNessuna valutazione finora

- Exercises and Problems CVPDocumento8 pagineExercises and Problems CVPMalak KinaanNessuna valutazione finora

- Solutions To ProblemsDocumento5 pagineSolutions To ProblemsFajar KhanNessuna valutazione finora

- Multiple Choices: Assignment 1Documento4 pagineMultiple Choices: Assignment 1Rogger SeptryaNessuna valutazione finora

- Sol Q3Documento4 pagineSol Q3hanaNessuna valutazione finora

- 2-Contribution Margin:: - WithDocumento6 pagine2-Contribution Margin:: - WithAlyn AlconeraNessuna valutazione finora

- Contribution Contributio N Margin Per Unit Margin Ratio: AMIS 4310 Cost-Volume-Profit AnalysisDocumento5 pagineContribution Contributio N Margin Per Unit Margin Ratio: AMIS 4310 Cost-Volume-Profit Analysissev gsdNessuna valutazione finora

- The Following Is Last Month's Contribution Format Income StatementDocumento22 pagineThe Following Is Last Month's Contribution Format Income StatementWilliam DC RiveraNessuna valutazione finora

- Test 2 Sample Questions With Correct AnswersDocumento8 pagineTest 2 Sample Questions With Correct AnswersBayoumy ElyanNessuna valutazione finora

- Bill French Google Docs Group 5Documento7 pagineBill French Google Docs Group 5Jay Florence DalucanogNessuna valutazione finora

- Cost Volume Profit AnalysisDocumento15 pagineCost Volume Profit AnalysisxxpinkywitchxxNessuna valutazione finora

- ACCT 3001 Chapter 5 Assigned Homework SolutionsDocumento18 pagineACCT 3001 Chapter 5 Assigned Homework SolutionsPeter ParkNessuna valutazione finora

- AS5Documento13 pagineAS5Andrea RobinsonNessuna valutazione finora

- Managerial Accounting2Documento2 pagineManagerial Accounting2gmurali_179568100% (1)

- Garrison 14e Practice Exam - Chapter 5Documento4 pagineGarrison 14e Practice Exam - Chapter 5Đàm Quang Thanh TúNessuna valutazione finora

- Addtional Exercises - 6Documento18 pagineAddtional Exercises - 6Gega XachidENessuna valutazione finora

- 04 Review Problem - CVP AnalysisDocumento3 pagine04 Review Problem - CVP AnalysisIzzahIkramIllahi100% (1)

- 04 Review Problem - CVP AnalysisDocumento3 pagine04 Review Problem - CVP AnalysisIzzahIkramIllahiNessuna valutazione finora

- Tugas Cost-Volume-Profit Analysis (Irga Ayudias Tantri - 120301214100011)Documento5 pagineTugas Cost-Volume-Profit Analysis (Irga Ayudias Tantri - 120301214100011)irga ayudiasNessuna valutazione finora

- Revision CVPDocumento18 pagineRevision CVPMostafa MahmoudNessuna valutazione finora

- Institute of Certified General Accountants of Bangladesh (ICGAB) Performance Management (P13) LC-3: CVP AnalysisDocumento5 pagineInstitute of Certified General Accountants of Bangladesh (ICGAB) Performance Management (P13) LC-3: CVP AnalysisMozid RahmanNessuna valutazione finora

- Adam Bataineh Ch5Documento10 pagineAdam Bataineh Ch5Omar AssafNessuna valutazione finora

- Accounting QuestionsDocumento18 pagineAccounting QuestionsashmitaNessuna valutazione finora

- Problem Solving FinmanDocumento4 pagineProblem Solving FinmanJenina Rose SalvadorNessuna valutazione finora

- AFDM Evening Winter 2020 Quiz 2Documento5 pagineAFDM Evening Winter 2020 Quiz 2AUNessuna valutazione finora

- Answers Chapter 4 - ACCT5204Documento16 pagineAnswers Chapter 4 - ACCT5204abdulraheem.eesNessuna valutazione finora

- Post Test 3Documento5 paginePost Test 3trixie manitoNessuna valutazione finora

- FMA Assg 1Documento8 pagineFMA Assg 1Dagmawit NegussieNessuna valutazione finora

- Cost, Volume, Profit Analysis - Ex. SoluDocumento19 pagineCost, Volume, Profit Analysis - Ex. SoluHimadri DeyNessuna valutazione finora

- Cost-Volume-Profit Relationships: Solutions To QuestionsDocumento79 pagineCost-Volume-Profit Relationships: Solutions To QuestionsMursalin HossainNessuna valutazione finora

- ACCY 2002 Fall 2013 Quiz # 5 - Chapter 7 DUE October 20thDocumento4 pagineACCY 2002 Fall 2013 Quiz # 5 - Chapter 7 DUE October 20thRad WimpsNessuna valutazione finora

- Chapter 3 Multiple Choice Questions: Answer: BDocumento9 pagineChapter 3 Multiple Choice Questions: Answer: BPALETI HYNDAVINessuna valutazione finora

- Assignment Acct.Documento9 pagineAssignment Acct.Dagmawit NegussieNessuna valutazione finora

- Aactg 15 Relevant CostingDocumento7 pagineAactg 15 Relevant CostingRosevelCunananCabrera100% (1)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsDa EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNessuna valutazione finora

- Account-Based Marketing: How to Target and Engage the Companies That Will Grow Your RevenueDa EverandAccount-Based Marketing: How to Target and Engage the Companies That Will Grow Your RevenueValutazione: 1 su 5 stelle1/5 (1)

- QS15 - Class Exercises SolutionDocumento5 pagineQS15 - Class Exercises Solutionlyk0tex100% (1)

- QS13 - Class Exercises SolutionDocumento2 pagineQS13 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS16 - Class Exercises SolutionDocumento5 pagineQS16 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS16 - Class ExercisesDocumento5 pagineQS16 - Class Exerciseslyk0texNessuna valutazione finora

- QS14 - Class Exercises SolutionDocumento4 pagineQS14 - Class Exercises Solutionlyk0tex100% (1)

- QS12 - Midterm 2 Review SolutionDocumento7 pagineQS12 - Midterm 2 Review Solutionlyk0tex0% (1)

- QS11 - Class Exercises SolutionDocumento8 pagineQS11 - Class Exercises Solutionlyk0tex100% (2)

- QS12 - Midterm 2 ReviewDocumento5 pagineQS12 - Midterm 2 Reviewlyk0texNessuna valutazione finora

- QS09 - Class Exercises SolutionDocumento4 pagineQS09 - Class Exercises Solutionlyk0tex100% (1)

- QS09 - Class ExercisesDocumento4 pagineQS09 - Class Exerciseslyk0texNessuna valutazione finora

- QS07 - Class Exercises SolutionDocumento8 pagineQS07 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS04 - Class ExercisesDocumento3 pagineQS04 - Class Exerciseslyk0texNessuna valutazione finora

- QS08 - Class Exercises SolutionDocumento5 pagineQS08 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS05 - Class Exercises SolutionDocumento3 pagineQS05 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS04 - Class Exercises SolutionDocumento3 pagineQS04 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS06 - Class ExercisesDocumento3 pagineQS06 - Class Exerciseslyk0texNessuna valutazione finora

- QS02 - Class ExercisesDocumento3 pagineQS02 - Class Exerciseslyk0texNessuna valutazione finora