Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

QS05 - Class Exercises

Caricato da

lyk0texDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

QS05 - Class Exercises

Caricato da

lyk0texCopyright:

Formati disponibili

Accounting 225 Quiz Section #5

Chapter 3-2 Class Exercises

1. Babb Company is a manufacturing firm that uses job-order costing. The company's inventory

balances were as follows at the beginning and end of the year:

The company applies overhead to jobs using a predetermined overhead rate based on machinehours. At the beginning of the year, the company estimated that it would work 17,000 machinehours and incur $272,000 in manufacturing overhead cost. The following transactions were

recorded for the year:

Raw materials were purchased, $416,000.

Raw materials were requisitioned for use in production, $412,000 $(376,000 direct and

$36,000 indirect).

The following employee costs were incurred: direct labor, $330,000; indirect labor, $69,000;

and administrative salaries, $157,000.

Selling costs, $113,000.

Factory utility costs, $29,000.

Depreciation for the year was $121,000 of which $114,000 is related to factory operations and

$7,000 is related to selling, general, and administrative activities.

Manufacturing overhead was applied to jobs. The actual level of activity for the year was

15,000 machine-hours.

Sales for the year totaled $1,282,000.

Assume all SG&A expenses are fixed.

Required:

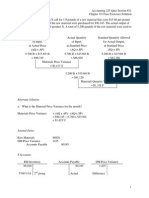

a) Complete a set of T-accounts and record all applicable transactions.

b) Correct for any over/under-applied MOH using the direct write-off method.

c) Prepare an income statement using the traditional Gross Margin format.

Accounting 225 Quiz Section #5

Chapter 3-2 Class Exercises

2. Alvardo Inc. has provided the following data for the month of November. There were no

beginning inventories; consequently, the direct materials, direct labor, and manufacturing

overhead applied listed below are all for the current month.

Manufacturing overhead for the month was underapplied by $6,000.

The company allocates any underapplied or overapplied manufacturing overhead among work in

process, finished goods, and cost of goods sold at the end of the month on the basis of the

overhead applied during the month in those accounts.

a) Provide the journal entry that would record the allocation of underapplied or overapplied

among work in process, finished goods, and cost of goods sold.

b) Determine the cost of work in process, finished goods, and cost of goods sold AFTER

allocation of the underapplied or overapplied manufacturing overhead for the period.

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- QS17 - Class ExercisesDocumento4 pagineQS17 - Class Exerciseslyk0texNessuna valutazione finora

- QS14 - Class ExercisesDocumento4 pagineQS14 - Class Exerciseslyk0texNessuna valutazione finora

- QS17 - Class Exercises SolutionDocumento4 pagineQS17 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS16 - Class ExercisesDocumento5 pagineQS16 - Class Exerciseslyk0texNessuna valutazione finora

- QS15 - Class Exercises SolutionDocumento5 pagineQS15 - Class Exercises Solutionlyk0tex100% (1)

- QS15 - Class ExercisesDocumento4 pagineQS15 - Class Exerciseslyk0texNessuna valutazione finora

- QS16 - Class Exercises SolutionDocumento5 pagineQS16 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS14 - Class Exercises SolutionDocumento4 pagineQS14 - Class Exercises Solutionlyk0tex100% (1)

- QS12 - Midterm 2 ReviewDocumento5 pagineQS12 - Midterm 2 Reviewlyk0texNessuna valutazione finora

- QS12 - Midterm 2 Review SolutionDocumento7 pagineQS12 - Midterm 2 Review Solutionlyk0tex0% (1)

- QS13 - Class ExercisesDocumento2 pagineQS13 - Class Exerciseslyk0texNessuna valutazione finora

- QS13 - Class Exercises SolutionDocumento2 pagineQS13 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS12 - Class ExercisesDocumento2 pagineQS12 - Class Exerciseslyk0texNessuna valutazione finora

- QS11 - Class ExercisesDocumento5 pagineQS11 - Class Exerciseslyk0texNessuna valutazione finora

- QS09 - Class ExercisesDocumento4 pagineQS09 - Class Exerciseslyk0texNessuna valutazione finora

- QS08 - Class ExercisesDocumento4 pagineQS08 - Class Exerciseslyk0texNessuna valutazione finora

- QS11 - Class Exercises SolutionDocumento8 pagineQS11 - Class Exercises Solutionlyk0tex100% (2)

- QS12 - Class Exercises SolutionDocumento2 pagineQS12 - Class Exercises Solutionlyk0tex100% (1)

- QS10 - Class ExercisesDocumento1 paginaQS10 - Class Exerciseslyk0texNessuna valutazione finora

- QS10 - Class Exercises SolutionDocumento2 pagineQS10 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS07 - Class ExercisesDocumento8 pagineQS07 - Class Exerciseslyk0texNessuna valutazione finora

- QS09 - Class Exercises SolutionDocumento4 pagineQS09 - Class Exercises Solutionlyk0tex100% (1)

- QS08 - Class Exercises SolutionDocumento5 pagineQS08 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS06 - Class ExercisesDocumento3 pagineQS06 - Class Exerciseslyk0texNessuna valutazione finora

- QS05 - Class Exercises SolutionDocumento3 pagineQS05 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS07 - Class Exercises SolutionDocumento8 pagineQS07 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS06 - Class Exercises SolutionDocumento2 pagineQS06 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS04 - Class ExercisesDocumento3 pagineQS04 - Class Exerciseslyk0texNessuna valutazione finora

- QS04 - Class Exercises SolutionDocumento3 pagineQS04 - Class Exercises Solutionlyk0texNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)