Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

QS05 - Class Exercises Solution

Caricato da

lyk0texCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

QS05 - Class Exercises Solution

Caricato da

lyk0texCopyright:

Formati disponibili

Accounting 225 Quiz Section #5

Chapter 3-2 Class Exercises Solution

1. Babb Company is a manufacturing firm that uses job-order costing. The company's inventory

balances were as follows at the beginning and end of the year:

The company applies overhead to jobs using a predetermined overhead rate based on machinehours. At the beginning of the year, the company estimated that it would work 17,000 machinehours and incur $272,000 in manufacturing overhead cost. The following transactions were

recorded for the year:

Raw materials were purchased, $416,000.

Raw materials were requisitioned for use in production, $412,000 $(376,000 direct and

$36,000 indirect).

The following employee costs were incurred: direct labor, $330,000; indirect labor, $69,000;

and administrative salaries, $157,000.

Selling costs, $113,000.

Factory utility costs, $29,000.

Depreciation for the year was $121,000 of which $114,000 is related to factory operations and

$7,000 is related to selling, general, and administrative activities.

Manufacturing overhead was applied to jobs. The actual level of activity for the year was

15,000 machine-hours.

Sales for the year totaled $1,282,000.

Assume all SG&A expenses are fixed.

Required:

a) Complete a set of T-accounts and record all applicable transactions.

b) Correct for any over/under-applied MOH using the direct write-off method.

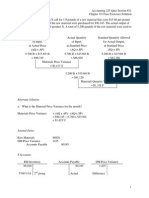

Predetermined Rate = 272000/17000 = 16

Raw Materials

BB

11,000

Used in

Purchases 416,000 412,000 Production

EB

BB

COGM

15,000

Finished Goods

108,000

964,000

123,000

949,000

BB

DM

DL

MOH

EB

Plug

Plug Adjustment

WIP

32,000

376,000

330,000

240,000

14,000

964,000

COGM

COGS

949,000

8,000

957,000

Accounting 225 Quiz Section #5

Chapter 3-2 Class Exercises Solution

Admin Salary

Selling Cost

S&A

157,000

113,000

Depreciation

7,000

IM

IL

Fac

Utility

Dep

277,000

MOH

36,000

240,000 (15000*16)

69,000

29,000

114,000

248,000

Under

240,000 Applied

8000 Adjustment

c) Prepare an income statement using the traditional Gross Margin format.

Income Statement

Sales

COGS

Gross Margin

SG&A

Net Operating Income

1282000

-957000

325000

-277000

48000

Alternative Solution for part c:

The other solution to this problem assumes that all COGS are variable. I believe this is an

incorrect portrayal, and that the factory depreciation should be treated as a fixed expense. Using

this assumption your contribution margin format income statement is shown below. Also of

note, you could consolidate the selling, admin, and SG&A depreciation into one line item titled

SG&A expense of $277,000.

Income Statement (CM Format)

Sales

$

1,282,000

VC: Var. Product Costs

$

(843,000)

Contribution Margin

$

439,000

FMOH/Factory

FC: Depreciation

$

(114,000)

Selling exp.

$

(113,000)

Admin exp.

$

(157,000)

SG&A Depreciation

$

(7,000)

Net Operating Income $

48,000

Accounting 225 Quiz Section #5

Chapter 3-2 Class Exercises Solution

2. Alvardo Inc. has provided the following data for the month of November. There were no

beginning inventories; consequently, the direct materials, direct labor, and manufacturing

overhead applied listed below are all for the current month.

Manufacturing overhead for the month was underapplied by $6,000.

The company allocates any underapplied or overapplied manufacturing overhead among work in

process, finished goods, and cost of goods sold at the end of the month on the basis of the

overhead applied during the month in those accounts.

Calculate MOH Applied as %

MOH Applied

WIP

=3840/48000 = 8%

Finished Goods

=7680/48000 = 16%

COGS

=36480/48000 = 76%

a) Provide the journal entry that would record the allocation of underapplied or overapplied

among work in process, finished goods, and cost of goods sold.

WIP

Finished Goods

COGS

MOH

480 (6000 x .08)

960 (6000 x .16)

4560 (6000 x .76)

6000

b) Determine the cost of work in process, finished goods, and cost of goods sold AFTER

allocation of the underapplied or overapplied manufacturing overhead for the period.

WIP

Unadjusted

EB

Allocation of

underapplied

MOH

Finished Goods

COGS

10,600

480

33,280

960

154,880

4,560

11,080

34,240

159,440

Potrebbero piacerti anche

- QS14 - Class Exercises SolutionDocumento4 pagineQS14 - Class Exercises Solutionlyk0tex100% (1)

- QS04 - Class Exercises SolutionDocumento3 pagineQS04 - Class Exercises Solutionlyk0texNessuna valutazione finora

- Kraft Foods Inc Case AnalysisDocumento24 pagineKraft Foods Inc Case Analysismylenevisperas50% (2)

- Assignment CH 2Documento30 pagineAssignment CH 2Svetlana50% (2)

- 3. If the critical path is longer than 60 days, what is the least amount that Dr. Watage can spend and still achieve the schedule objective? How can he prove to the Pathminder Fund that this is the minimum cost alternative?Documento2 pagine3. If the critical path is longer than 60 days, what is the least amount that Dr. Watage can spend and still achieve the schedule objective? How can he prove to the Pathminder Fund that this is the minimum cost alternative?Jonathan Altamirano Burgos0% (1)

- Zkhokhar - 1336 - 3711 - 1 - CHAPTER 04 - JOB-ORDER COSTING - PROBLEMSDocumento34 pagineZkhokhar - 1336 - 3711 - 1 - CHAPTER 04 - JOB-ORDER COSTING - PROBLEMSnabeel nabiNessuna valutazione finora

- 2b. Manufacturing Overhead CR PDFDocumento15 pagine2b. Manufacturing Overhead CR PDFpoNessuna valutazione finora

- QS16 - Class Exercises SolutionDocumento5 pagineQS16 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS08 - Class Exercises SolutionDocumento5 pagineQS08 - Class Exercises Solutionlyk0texNessuna valutazione finora

- Bumi Resources Minerals Reported Progress On Cooperation With Chinas NFC To Develop Dairis Zinc Lead ProjectDocumento1 paginaBumi Resources Minerals Reported Progress On Cooperation With Chinas NFC To Develop Dairis Zinc Lead ProjectIshen SimamoraNessuna valutazione finora

- BFS1001 - Session 2 - Resume Templates To Help You For Your Assignment - Uploaded Onto IVLEDocumento3 pagineBFS1001 - Session 2 - Resume Templates To Help You For Your Assignment - Uploaded Onto IVLEJavier ThooNessuna valutazione finora

- Day 06Documento8 pagineDay 06Cy PenalosaNessuna valutazione finora

- Attempt-1: The Company's Accountant Used A Denominator of Budgeted Machine Hours For The Current Accounting PeriodDocumento18 pagineAttempt-1: The Company's Accountant Used A Denominator of Budgeted Machine Hours For The Current Accounting Periodpragadeeshwaran100% (2)

- 6e Brewer Ch02 B EocDocumento10 pagine6e Brewer Ch02 B EocHa Minh0% (1)

- BA 7000 Study Guide 1Documento11 pagineBA 7000 Study Guide 1ekachristinerebecaNessuna valutazione finora

- 6e Brewer CH02 B EOCDocumento12 pagine6e Brewer CH02 B EOCLiyanCenNessuna valutazione finora

- HW Assignment 2 4Documento2 pagineHW Assignment 2 4phi_maniacsNessuna valutazione finora

- 203 Practice WTR 2013 PDFDocumento22 pagine203 Practice WTR 2013 PDFKarim IsmailNessuna valutazione finora

- Dorji GyeltshenDocumento7 pagineDorji Gyeltshenyeshey460Nessuna valutazione finora

- Managerial Accounting Practice Problems2 PDFDocumento9 pagineManagerial Accounting Practice Problems2 PDFFrank Lovett100% (1)

- Assignment 1-Winter2024-Ch-Cost and Job Order QuestionDocumento6 pagineAssignment 1-Winter2024-Ch-Cost and Job Order Questionstudent.devyankgosainNessuna valutazione finora

- ACT202 Midterm ExamDocumento2 pagineACT202 Midterm ExamSalahuddin BadhonNessuna valutazione finora

- Act Exam 1Documento14 pagineAct Exam 1aman_nsu100% (1)

- Finals SolutionsDocumento9 pagineFinals Solutionsi_dreambig100% (3)

- Managerial Acctg Problems & Exercises in CVP AnalysisDocumento4 pagineManagerial Acctg Problems & Exercises in CVP AnalysisJanelleNessuna valutazione finora

- Pendants Plus Company CaseDocumento4 paginePendants Plus Company CaseShuo LuNessuna valutazione finora

- ACT 202 AssignmentDocumento3 pagineACT 202 AssignmentFahim AnjumNessuna valutazione finora

- Management Accounting Midterm TestDocumento5 pagineManagement Accounting Midterm TestSơn HoàngNessuna valutazione finora

- Garrison 17e GEs PPT Chapter 6Documento19 pagineGarrison 17e GEs PPT Chapter 6Jawad ahmadNessuna valutazione finora

- Brewer Chapter 2 Alt ProbDocumento6 pagineBrewer Chapter 2 Alt ProbAtif RehmanNessuna valutazione finora

- GNB13 e CH 03 ExamDocumento6 pagineGNB13 e CH 03 ExamAnne Dorcas S. DomingoNessuna valutazione finora

- Homework AssignmentDocumento11 pagineHomework AssignmentHenny DeWillisNessuna valutazione finora

- Job Costing and Overhead ER PDFDocumento16 pagineJob Costing and Overhead ER PDFShaira VillaflorNessuna valutazione finora

- Homework Chapter 2: BE 3-4 Larned Corporation Recorded The Following Transactions For The Past MonthDocumento3 pagineHomework Chapter 2: BE 3-4 Larned Corporation Recorded The Following Transactions For The Past MonthLee Xing100% (1)

- Job Order QuestionsDocumento6 pagineJob Order Questionsإبراهيم الشيخيNessuna valutazione finora

- Practice Test 1 New For Summer 2010Documento16 paginePractice Test 1 New For Summer 2010samcarfNessuna valutazione finora

- Job CostingDocumento19 pagineJob CostingSteven HouNessuna valutazione finora

- QS07 - Class Exercises SolutionDocumento8 pagineQS07 - Class Exercises Solutionlyk0texNessuna valutazione finora

- Discussion - Job CostingDocumento3 pagineDiscussion - Job CostingHannah Jane ToribioNessuna valutazione finora

- 8508 QuestionsDocumento3 pagine8508 QuestionsHassan MalikNessuna valutazione finora

- Joc ProbDocumento10 pagineJoc ProbSoothing BlendNessuna valutazione finora

- Problem 4-47 Application of Overhead Rate Service IndustryDocumento26 pagineProblem 4-47 Application of Overhead Rate Service IndustryIkram100% (1)

- Bài Tập Tự LuậnDocumento5 pagineBài Tập Tự Luậnhn0743644Nessuna valutazione finora

- Advanced Managerial Accounting Final Exam Questions Gaza Company Project NPV IRRDocumento7 pagineAdvanced Managerial Accounting Final Exam Questions Gaza Company Project NPV IRRRabah ElmasriNessuna valutazione finora

- "You Will Only Be Remembered For Two Things: The Problems You Solve or The Ones You Create." - Mike MurdockDocumento4 pagine"You Will Only Be Remembered For Two Things: The Problems You Solve or The Ones You Create." - Mike MurdockMaya BarcoNessuna valutazione finora

- Cost Accounting Quiz Chapter 4 SolutionsDocumento4 pagineCost Accounting Quiz Chapter 4 SolutionsMaya BarcoNessuna valutazione finora

- Practice Problem Job CostingDocumento4 paginePractice Problem Job CostingDonna Zandueta-TumalaNessuna valutazione finora

- A. Calculate The Break-Even Dollar Sales For The MonthDocumento25 pagineA. Calculate The Break-Even Dollar Sales For The MonthMohitNessuna valutazione finora

- G4 ZAKARIA - Job Order Costing SystemDocumento6 pagineG4 ZAKARIA - Job Order Costing SystemZakaria HasaneenNessuna valutazione finora

- Managerial Accouting TestDocumento16 pagineManagerial Accouting TestBùi Yến NhiNessuna valutazione finora

- Cga-Canada Management Accounting Fundamentals (Ma1) Examination March 2014 Marks Time: 3 HoursDocumento18 pagineCga-Canada Management Accounting Fundamentals (Ma1) Examination March 2014 Marks Time: 3 HoursasNessuna valutazione finora

- ch23 PDFDocumento8 paginech23 PDFnidal charaf eddineNessuna valutazione finora

- Managerial Accounting 16th Edition Garrison Test Bank 1Documento25 pagineManagerial Accounting 16th Edition Garrison Test Bank 1margaret100% (49)

- A. Calculate The Break-Even Dollar Sales For The MonthDocumento25 pagineA. Calculate The Break-Even Dollar Sales For The MonthPriyankaNessuna valutazione finora

- UGBA 102B Section02 - Handout - SolutionsDocumento11 pagineUGBA 102B Section02 - Handout - SolutionsGwendolyn Chloe PurnamaNessuna valutazione finora

- MBA Job Order CostingDocumento2 pagineMBA Job Order Costingumangsharma0494Nessuna valutazione finora

- COST VOLUME PROFIT ANALYSIS - ExercisesDocumento4 pagineCOST VOLUME PROFIT ANALYSIS - ExercisesLloyd Vincent O. TingsonNessuna valutazione finora

- Contabilidad M2Documento6 pagineContabilidad M2Azin RostamiNessuna valutazione finora

- CVP Analysis of Billings CompanyDocumento3 pagineCVP Analysis of Billings CompanyAhmed El Khateeb100% (1)

- Adms2510f FL95Documento9 pagineAdms2510f FL95rabeya26Nessuna valutazione finora

- Wahyudi 29123005 Case6 Syndicate1 YP69BDocumento5 pagineWahyudi 29123005 Case6 Syndicate1 YP69Bwahyudimba69Nessuna valutazione finora

- Garrison 14e Chapter 3 Practice ExamDocumento4 pagineGarrison 14e Chapter 3 Practice ExamBlackBunny103Nessuna valutazione finora

- Remodelers' Cost of Doing Business Study, 2020 EditionDa EverandRemodelers' Cost of Doing Business Study, 2020 EditionNessuna valutazione finora

- Cost & Managerial Accounting II EssentialsDa EverandCost & Managerial Accounting II EssentialsValutazione: 4 su 5 stelle4/5 (1)

- QS17 - Class ExercisesDocumento4 pagineQS17 - Class Exerciseslyk0texNessuna valutazione finora

- QS17 - Class Exercises SolutionDocumento4 pagineQS17 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS12 - Midterm 2 Review SolutionDocumento7 pagineQS12 - Midterm 2 Review Solutionlyk0tex0% (1)

- QS12 - Midterm 2 ReviewDocumento5 pagineQS12 - Midterm 2 Reviewlyk0texNessuna valutazione finora

- QS15 - Class Exercises SolutionDocumento5 pagineQS15 - Class Exercises Solutionlyk0tex100% (1)

- QS16 - Class ExercisesDocumento5 pagineQS16 - Class Exerciseslyk0texNessuna valutazione finora

- QS15 - Class ExercisesDocumento4 pagineQS15 - Class Exerciseslyk0texNessuna valutazione finora

- QS14 - Class ExercisesDocumento4 pagineQS14 - Class Exerciseslyk0texNessuna valutazione finora

- QS13 - Class ExercisesDocumento2 pagineQS13 - Class Exerciseslyk0texNessuna valutazione finora

- QS13 - Class Exercises SolutionDocumento2 pagineQS13 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS12 - Class ExercisesDocumento2 pagineQS12 - Class Exerciseslyk0texNessuna valutazione finora

- QS11 - Class ExercisesDocumento5 pagineQS11 - Class Exerciseslyk0texNessuna valutazione finora

- QS11 - Class Exercises SolutionDocumento8 pagineQS11 - Class Exercises Solutionlyk0tex100% (2)

- QS10 - Class ExercisesDocumento1 paginaQS10 - Class Exerciseslyk0texNessuna valutazione finora

- QS09 - Class ExercisesDocumento4 pagineQS09 - Class Exerciseslyk0texNessuna valutazione finora

- QS12 - Class Exercises SolutionDocumento2 pagineQS12 - Class Exercises Solutionlyk0tex100% (1)

- QS10 - Class Exercises SolutionDocumento2 pagineQS10 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS09 - Class Exercises SolutionDocumento4 pagineQS09 - Class Exercises Solutionlyk0tex100% (1)

- QS07 - Class Exercises SolutionDocumento8 pagineQS07 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS08 - Class ExercisesDocumento4 pagineQS08 - Class Exerciseslyk0texNessuna valutazione finora

- QS06 - Class Exercises SolutionDocumento2 pagineQS06 - Class Exercises Solutionlyk0texNessuna valutazione finora

- QS06 - Class ExercisesDocumento3 pagineQS06 - Class Exerciseslyk0texNessuna valutazione finora

- QS07 - Class ExercisesDocumento8 pagineQS07 - Class Exerciseslyk0texNessuna valutazione finora

- QS05 - Class ExercisesDocumento2 pagineQS05 - Class Exerciseslyk0texNessuna valutazione finora

- QS04 - Class ExercisesDocumento3 pagineQS04 - Class Exerciseslyk0texNessuna valutazione finora

- Aditya Birla Internship AmanDocumento51 pagineAditya Birla Internship AmanManas MaheshwariNessuna valutazione finora

- Fa MCQDocumento4 pagineFa MCQShivarajkumar JayaprakashNessuna valutazione finora

- Axis Childrens Gift Fund Leaflet PDFDocumento2 pagineAxis Childrens Gift Fund Leaflet PDFSrinivasan RajaramanNessuna valutazione finora

- Making Decisions in the Oil and Gas Industry Using Decision Tree AnalysisDocumento8 pagineMaking Decisions in the Oil and Gas Industry Using Decision Tree AnalysisSuta Vijaya100% (1)

- Solman SOAL 1 Asis CHP 15 Options MarketDocumento4 pagineSolman SOAL 1 Asis CHP 15 Options MarketfauziyahNessuna valutazione finora

- Chapter 8 Study GuideDocumento5 pagineChapter 8 Study GuideHieu NguyenNessuna valutazione finora

- Mergers and Acquisitions: Turmoil in Top Management TeamsDocumento20 pagineMergers and Acquisitions: Turmoil in Top Management TeamsBusiness Expert Press100% (1)

- SEIU LM-2 2011 Labor Organization Annual ReportDocumento422 pagineSEIU LM-2 2011 Labor Organization Annual ReportUnion MonitorNessuna valutazione finora

- A Comparative Financial Analysis of Soft Drink IndustryDocumento41 pagineA Comparative Financial Analysis of Soft Drink Industryvs1513100% (1)

- Bse and NseDocumento15 pagineBse and NseChinmay P Kalelkar50% (2)

- Imradc Format ExampleDocumento88 pagineImradc Format ExampleCarms YasayNessuna valutazione finora

- AML and KYCDocumento36 pagineAML and KYCSamaksh Kumar100% (1)

- Analysis of Home Loan in Bassein Catholic Co-Operative Bank Ltd. (Scheduled Bank)Documento58 pagineAnalysis of Home Loan in Bassein Catholic Co-Operative Bank Ltd. (Scheduled Bank)Nikhil BhaleraoNessuna valutazione finora

- Anatomy of Corporate LawDocumento4 pagineAnatomy of Corporate Lawnupur chaurasiaNessuna valutazione finora

- HARPTA FAQsDocumento8 pagineHARPTA FAQskauaiskyNessuna valutazione finora

- Machine Investment Cash Flow Analysis and NPV CalculationDocumento22 pagineMachine Investment Cash Flow Analysis and NPV CalculationNadya RizkitaNessuna valutazione finora

- Navy Hill Development Advisory Commission Final ReportDocumento70 pagineNavy Hill Development Advisory Commission Final ReportLowell FeldNessuna valutazione finora

- China Industrial Primer - Deutsche Bank (2010) PDFDocumento176 pagineChina Industrial Primer - Deutsche Bank (2010) PDFnssj1234Nessuna valutazione finora

- Level I Ethics Quiz 1Documento16 pagineLevel I Ethics Quiz 1Shreshth Babbar100% (1)

- Adjudication Order in Respect of Mr. Bikramjit Ahluwalia and Others in The Matter of Ahlcon Parenterals India) LTDDocumento9 pagineAdjudication Order in Respect of Mr. Bikramjit Ahluwalia and Others in The Matter of Ahlcon Parenterals India) LTDShyam SunderNessuna valutazione finora

- Theories of DividendDocumento2 pagineTheories of DividendBALRAM SHAHNessuna valutazione finora

- Arcus Team Profiles - Senior Infrastructure Investment ProfessionalsDocumento7 pagineArcus Team Profiles - Senior Infrastructure Investment ProfessionalsEhud No-bloombergNessuna valutazione finora

- Deloitte Doing Business Guide KSA 2017Documento32 pagineDeloitte Doing Business Guide KSA 2017HunterNessuna valutazione finora

- Welcome to Pass4Sure Mock TestDocumento28 pagineWelcome to Pass4Sure Mock TestManan SharmaNessuna valutazione finora

- Arbitrage in India: Past, Present and FutureDocumento22 pagineArbitrage in India: Past, Present and FuturetushartutuNessuna valutazione finora

- Capm DerivationDocumento12 pagineCapm DerivationAbdulAzeemNessuna valutazione finora

- Credit Analysis of Cipla LTDDocumento3 pagineCredit Analysis of Cipla LTDnishthaNessuna valutazione finora