Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

DCF Model

Caricato da

Kyron Jacques0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

90 visualizzazioni2 pagineDCF MODEL

Titolo originale

DCF MODEL

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoDCF MODEL

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

90 visualizzazioni2 pagineDCF Model

Caricato da

Kyron JacquesDCF MODEL

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

STREETOFWALLS

Update: STREET OF WALLS JOBS HAVE MOVED TO VETTERY

DISCOUNTED CASH FLOW MODEL

Interviewer: Walk me through a Discounted Cash Flow Model

This is one of the most asked technical questions during investment banking interviews. A DCF

model is something you need to know inside-and-out! Missing one question like this can be the

difference of getting the offer or not.

So how does a discounted cash flow model work? There are three essential parts to a

DCF:

1. Companys Free Cash Flow

2. Terminal Value of the Company

3. The Weighted Average Cost of Capital (WACC)

Now lets break these down:

1. Free Cash Flow = Operating Cash Flow Capital Expenditures Change in Net Working Capital

2. Terminal Value of the Company two methods: EBITDA Multiple or Perpetuity Growth

3. WACC two components: Cost of Equity (CAPM) and the after tax cost of debt

Final Step: Discount all back to find your Enterprise Value (EV) of the Company

Now, this is just a quick-and-dirty version. Street of Walls goes into pages of detail in the Investment

Banking Technical Guide.

For those of you looking to really get an edge during interview, go through our Discounted Cash

Flow Model that is posted online. This is a fully working investment banking DCF model. A DCF

model snapshot taken from the model is shown below:

ARTICLES TRAINING

Other interesting

articles:

How Investment

Bankers Read Your

Resume

Investment Banking

Deadlines & Dates

Investment Banking

Interview Prep

Investment Banking

Salaries and Bonus

Investment Banking

Technical Questions

Home News & Insights About Terms Privacy Contact

Copyright 2013 Street of Walls. All Rights Reserved. All prices USD.

Potrebbero piacerti anche

- DCF Model Training - 4Documento10 pagineDCF Model Training - 4mohd shariqNessuna valutazione finora

- Cash CDO Modelling in Excel: A Step by Step ApproachDa EverandCash CDO Modelling in Excel: A Step by Step ApproachNessuna valutazione finora

- Net Profit (Review and Analysis of Cohan's Book)Da EverandNet Profit (Review and Analysis of Cohan's Book)Nessuna valutazione finora

- CMDB Systems: Making Change Work in the Age of Cloud and AgileDa EverandCMDB Systems: Making Change Work in the Age of Cloud and AgileNessuna valutazione finora

- CUSTOMER CENTRICITY & GLOBALISATION: PROJECT MANAGEMENT: MANUFACTURING & IT SERVICESDa EverandCUSTOMER CENTRICITY & GLOBALISATION: PROJECT MANAGEMENT: MANUFACTURING & IT SERVICESNessuna valutazione finora

- IBanking Interview - DCF-GuideDocumento61 pagineIBanking Interview - DCF-GuideElianaBakerNessuna valutazione finora

- RE - DCF ValuationDocumento123 pagineRE - DCF ValuationJiayu HeNessuna valutazione finora

- Problem Solving: The 5-Why’s: Unlocking the Power of Quality Assurance for Success in BusinessDa EverandProblem Solving: The 5-Why’s: Unlocking the Power of Quality Assurance for Success in BusinessNessuna valutazione finora

- ValuFocus Investing: A Cash-Loving Contrarian Way to Invest in StocksDa EverandValuFocus Investing: A Cash-Loving Contrarian Way to Invest in StocksNessuna valutazione finora

- Discounted Cash Flow Budgeting: Simplified Your Path to Financial ExcellenceDa EverandDiscounted Cash Flow Budgeting: Simplified Your Path to Financial ExcellenceNessuna valutazione finora

- ABC Inc.: A Vision For The Future Investor PresentationDocumento17 pagineABC Inc.: A Vision For The Future Investor PresentationJason MeiNessuna valutazione finora

- The MSP’s Guide to the Ultimate Client Experience: Optimizing service efficiency, account management productivity, and client engagement with a modern digital-first approach.Da EverandThe MSP’s Guide to the Ultimate Client Experience: Optimizing service efficiency, account management productivity, and client engagement with a modern digital-first approach.Nessuna valutazione finora

- IBIG 04 05 Valuation DCF AnalysisDocumento118 pagineIBIG 04 05 Valuation DCF AnalysisCarloNessuna valutazione finora

- Evolve Business Model Modern Core Platform WPDocumento23 pagineEvolve Business Model Modern Core Platform WPMutaz BakriNessuna valutazione finora

- Project Management and Quality Control: Dr. Mwaffaq Otoom Mof - Otoom@yu - Edu.joDocumento48 pagineProject Management and Quality Control: Dr. Mwaffaq Otoom Mof - Otoom@yu - Edu.joAhmad ElhajNessuna valutazione finora

- The Cloud Adoption Playbook: Proven Strategies for Transforming Your Organization with the CloudDa EverandThe Cloud Adoption Playbook: Proven Strategies for Transforming Your Organization with the CloudNessuna valutazione finora

- Lesson 5 EntreprenerushipDocumento6 pagineLesson 5 Entreprenerushipkaye.o.ambrosioNessuna valutazione finora

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelDa Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNessuna valutazione finora

- Economicmodel of Roic Eva WaccDocumento29 pagineEconomicmodel of Roic Eva Waccbernhardf100% (1)

- Project MGTDocumento41 pagineProject MGTAnonymous 65IaejKmNessuna valutazione finora

- Master Thesis Payment SystemsDocumento8 pagineMaster Thesis Payment SystemsAngel Evans100% (2)

- Cash Conversion Cycle ThesisDocumento5 pagineCash Conversion Cycle ThesisMartha Brown100% (2)

- Modeling Structured Finance Cash Flows with Microsoft Excel: A Step-by-Step GuideDa EverandModeling Structured Finance Cash Flows with Microsoft Excel: A Step-by-Step GuideValutazione: 4 su 5 stelle4/5 (1)

- Cashflow Waterfall TutorialDocumento2 pagineCashflow Waterfall TutorialRichard Neo67% (3)

- Stream Theory: An Employee-Centered Hybrid Management System for Achieving a Cultural Shift through Prioritizing Problems, Illustrating Solutions, and Enabling EngagementDa EverandStream Theory: An Employee-Centered Hybrid Management System for Achieving a Cultural Shift through Prioritizing Problems, Illustrating Solutions, and Enabling EngagementNessuna valutazione finora

- ModelSheet CashFlow011Documento64 pagineModelSheet CashFlow011kralik62Nessuna valutazione finora

- Payment System HubsDocumento27 paginePayment System HubsgautamojhaNessuna valutazione finora

- 07 Valuation DCF Analysis Guide PDFDocumento123 pagine07 Valuation DCF Analysis Guide PDFParas BholaNessuna valutazione finora

- IP 4 Financial PlanningDocumento14 pagineIP 4 Financial PlanningFELICIALILIAN JNessuna valutazione finora

- Dissertation Topics On Working CapitalDocumento6 pagineDissertation Topics On Working CapitalBestWriteMyPaperWebsiteHighPoint100% (1)

- VCE Summer Internship Program 2021Documento5 pagineVCE Summer Internship Program 2021Niharika MathurNessuna valutazione finora

- Cac & LTV GeneralDocumento6 pagineCac & LTV Generalspps140899Nessuna valutazione finora

- A Fast Track to Structured Finance Modeling, Monitoring, and Valuation: Jump Start VBADa EverandA Fast Track to Structured Finance Modeling, Monitoring, and Valuation: Jump Start VBAValutazione: 3 su 5 stelle3/5 (1)

- Startup Killer The Cost of Customer Acquisition - For EntrepreneursDocumento1 paginaStartup Killer The Cost of Customer Acquisition - For Entrepreneursreza darmawanNessuna valutazione finora

- Discounted Cash Flow AnalysisDocumento13 pagineDiscounted Cash Flow AnalysisJack Jacinto67% (3)

- Why Startups FailDocumento20 pagineWhy Startups FailDinesh RuhelaNessuna valutazione finora

- Siebel Incentive Compensation Management ( ICM ) GuideDa EverandSiebel Incentive Compensation Management ( ICM ) GuideNessuna valutazione finora

- NYU Stern CasebookDocumento64 pagineNYU Stern Casebookdiego_munoz_a100% (4)

- L2 Business ModalDocumento29 pagineL2 Business ModalyadNessuna valutazione finora

- Term Loan Appraisal: A New Manufacturing Unit Wants A Term Loan - Will The Bank Appraise It ?Documento39 pagineTerm Loan Appraisal: A New Manufacturing Unit Wants A Term Loan - Will The Bank Appraise It ?Omkar VedpathakNessuna valutazione finora

- The Customer Catalyst: How to Drive Sustainable Business Growth in the Customer EconomyDa EverandThe Customer Catalyst: How to Drive Sustainable Business Growth in the Customer EconomyNessuna valutazione finora

- VCE Summer Internship Program 2020: Smart Task Submission FormatDocumento4 pagineVCE Summer Internship Program 2020: Smart Task Submission FormatRevanth GupthaNessuna valutazione finora

- Modeling CH 2Documento58 pagineModeling CH 2rsh765Nessuna valutazione finora

- Super Day Secrets - Your Technical Interview GuideDocumento24 pagineSuper Day Secrets - Your Technical Interview GuideJithin RajanNessuna valutazione finora

- Subject Code & NameDocumento10 pagineSubject Code & NameIkramNessuna valutazione finora

- SDLC:: Traditional Model of SDLCDocumento7 pagineSDLC:: Traditional Model of SDLChadoop certification training onlineNessuna valutazione finora

- Restructuring Investment Banking - How To Get in and What You DoDocumento18 pagineRestructuring Investment Banking - How To Get in and What You DoAditya Goel100% (1)

- Sub-Broker Servicing AND Competitive Analysis: Summer Training ReportDocumento21 pagineSub-Broker Servicing AND Competitive Analysis: Summer Training ReportchaitalimehtaNessuna valutazione finora

- Venture Capital Valuation, + Website: Case Studies and MethodologyDa EverandVenture Capital Valuation, + Website: Case Studies and MethodologyNessuna valutazione finora

- Banking SimulationDocumento14 pagineBanking SimulationSzabó BenceNessuna valutazione finora

- 1.retail Banking IntroductionDocumento23 pagine1.retail Banking IntroductionKamila sharminNessuna valutazione finora

- Businessmodel 160702132003Documento12 pagineBusinessmodel 160702132003manojNessuna valutazione finora

- Businessmodel 160702132003Documento12 pagineBusinessmodel 160702132003manojNessuna valutazione finora

- Businessmodel 160702132003Documento12 pagineBusinessmodel 160702132003manojNessuna valutazione finora

- Financial Modeling 2020Documento16 pagineFinancial Modeling 2020aftababbasNessuna valutazione finora

- FinalDocumento19 pagineFinalKyron Jacques100% (2)

- Assignment 3Documento7 pagineAssignment 3Kyron JacquesNessuna valutazione finora

- Assignment 5Documento9 pagineAssignment 5Kyron JacquesNessuna valutazione finora

- Form I-9 Section 1 InstructionsDocumento1 paginaForm I-9 Section 1 InstructionsKyron JacquesNessuna valutazione finora

- Solution 3Documento3 pagineSolution 3Kyron JacquesNessuna valutazione finora

- Driving PDFDocumento116 pagineDriving PDFChad WhiteNessuna valutazione finora

- Solution 2Documento5 pagineSolution 2Kyron JacquesNessuna valutazione finora

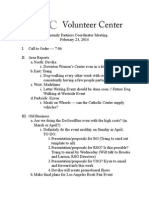

- Meeting Minutes 02:23Documento2 pagineMeeting Minutes 02:23Kyron JacquesNessuna valutazione finora

- SyllabusDocumento11 pagineSyllabusKyron JacquesNessuna valutazione finora

- Solution 1Documento7 pagineSolution 1Kyron JacquesNessuna valutazione finora

- Greek: Rationality, Honor, and Social Stratification in Ancient GreeceDocumento4 pagineGreek: Rationality, Honor, and Social Stratification in Ancient GreeceKyron JacquesNessuna valutazione finora

- Danielle History FinalDocumento6 pagineDanielle History FinalKyron JacquesNessuna valutazione finora

- Global History To 1500 Syllabus - Spring 2015-2Documento5 pagineGlobal History To 1500 Syllabus - Spring 2015-2Kyron JacquesNessuna valutazione finora

- SyllabusDocumento3 pagineSyllabusKyron JacquesNessuna valutazione finora

- Region 1 $295,290.21 Region 4 $399,599.04Documento2 pagineRegion 1 $295,290.21 Region 4 $399,599.04Kyron JacquesNessuna valutazione finora

- Thursday, February 7, 2013Documento5 pagineThursday, February 7, 2013Kyron JacquesNessuna valutazione finora

- International Relations Research PaperDocumento2 pagineInternational Relations Research PaperKyron JacquesNessuna valutazione finora

- Tuberculosis CaseDocumento22 pagineTuberculosis CaseKyron JacquesNessuna valutazione finora

- SSF2Documento89 pagineSSF2Kyron JacquesNessuna valutazione finora

- Moneythink Reflection Slip NameDocumento1 paginaMoneythink Reflection Slip NameKyron JacquesNessuna valutazione finora

- SyllabusDocumento11 pagineSyllabusKyron JacquesNessuna valutazione finora

- Theme ParksDocumento1 paginaTheme ParksKyron JacquesNessuna valutazione finora

- Summer ProgramsDocumento1 paginaSummer ProgramsKyron JacquesNessuna valutazione finora

- Just Desserts (Partial Final)Documento15 pagineJust Desserts (Partial Final)Kyron JacquesNessuna valutazione finora

- SyllabusDocumento7 pagineSyllabusKyron JacquesNessuna valutazione finora

- Unilever Case StudyDocumento4 pagineUnilever Case StudyKyron JacquesNessuna valutazione finora

- Pepsico - Buco 252Documento26 paginePepsico - Buco 252Kyron JacquesNessuna valutazione finora

- Nike JOUR 351A Sample AdvosryDocumento1 paginaNike JOUR 351A Sample AdvosryKyron JacquesNessuna valutazione finora

- OMGOMGOMGDocumento6 pagineOMGOMGOMGKyron JacquesNessuna valutazione finora