Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Sucession Laws

Caricato da

Vidya Adsule0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

144 visualizzazioni17 paginegood read

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentogood read

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

144 visualizzazioni17 pagineSucession Laws

Caricato da

Vidya Adsulegood read

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 17

SUCCESSION LAWS

CA. Rajkumar S. Adukia

B.Com (Hons.), FCA, ACS, ACWA, LL.B,

DIPR, DLL & LP, MBA, IFRS(UK)

098200 61049/09323061049

email id: rajkumarradukia@caaa.in

Website: www.caaa.in

To download information on various subjects visit www.caaa.in

To receive regular updates kindly send test email to

rajkumarfca-subscribe@yahoogroups.com

rajkumarfca+subscribe@googlegroups.com

INTRODUCTION

Sucession is the transmission of property belonging to a person at his death to

some other person or persons.

Succession and Inheritance can be of two kinds Testamentary or testate

inheritance which means inheritance as per the Will of the deceased and Non

Testamentary or intestate succession, where the deceased dies without making a

Will.

The law on intestate succession for different communities in India is governed by

different succession laws applicable for that particular community. For e.g. the

Hindu Succession Act, Indian Succession Act, Shariat laws etc.

The law on testate succession is governed by the Indian Succession Act, 1925 for

all communities except Muslims. The law in relation to making of wills by

Muslims is governed by the relevant Muslim Shariat Law as applicable to the

Shias and the Sunnis.

With the exception of Muslims, the Indian Succession Act, 1925 governs and has

a common set of rules for persons of all religions. However, the Muslims shall be

bound by the Indian Succession Act, 1925 for the purpose of testamentary

succession, if the will relates to immovable property situated within the State of

West Bengal and within the jurisdiction of the Madras and Bombay High Courts.

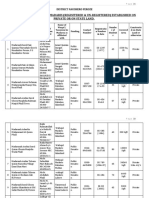

Applicability of the Succession law to a person belonging to a particular

community is explained in the following diagram:

When a person dies

Without making a valid Will After making a valid Will

Hindu,

Jain, Sikh,

Buddhist

Christian,

Parsi, Jew

Muslim

Hindu

Succession

Act

Indian

Succession

Act

Muslim

Law

(Shurriyat)

Indian

Succession

Act

Hindu, Jain, Sikh,

Buddhist, Christian,

Parsi, Jew

Muslim

Muslim

Law

(Shurriyat)

INDIAN SUCCESSION ACT, 1925

The Indian Succession Act came into operation on 30th September 1925 and it

seeks to consolidate all Indian Laws relating to succession. The Act consists of 11

parts, 391 sections and 7 schedules. This Act is applicable to intestate and

testamentary succession.

"Succession" means capable of comprehending every kind of passing of property.

When the British settled down to govern India, they were faced with the task of

ascertaining the nature and incidents of the laws to be administered. With

reference to the two main communities inhabiting the country, namely, the

Hindus and Mohammadans, each of these communities had its own personal

laws embodied in its sacred texts, but there were other smaller sections of the

population which belonged to neither of these communities and in those cases it

was not proper to administer the laws of a religion to which they did not owe

any adherence or commitment. Amongst such minor communities were the

Christians and Parsis. It was then the thought of enactment of law of sucession

for the other communities was felt. Thus came the Indian Succession Law.

Consanguinity

Part IV of the Indian Succession Act deals with Consanguinity. This part does not

apply to intestate or testamentary succession to the property of any Hindu,

Muhammadan, Buddhist, Sikh, Jain or Parsi. Consanguinity is the connection or

relation of persons descended from the same stock or common ancestor.

Lineal consanguinity is that which subsists between two persons, one of whom is

descended in a direct line from the other, as between a man and his father,

grandfather and great-grandfather, and so upwards in the direct ascending line;

or between a man and his son, grandson, great-grandson and so downwards in

the descending line.

Collateral consanguinity is that which subsists between two persons who are

descended from the same stock or ancestor, but neither of whom is descended in

a direct line from the other.

For the purpose of succession, there is no distinction

(a) between those who are related to a person deceased through his father, and

those who are related to him through his mother; or

(b) between those who are related to a person deceased by the full blood, and

those who are related to him by the half blood; or

(c) between those who were actually born in the lifetime of a person deceased,

and those who at the date of his death were only conceived in the womb, but

who have been subsequently born alive.

Intestate Succession

Part V of the Indian Succession Act deals with Intestate Succession. This part will

not apply to the property of any Hindu, Muhammadan, Buddhist, Sikh or Jain.

Under the Indian Succession Act, a mans widow and children, male and female,

inherit equally. However, a man may, by Will can bequeath his or her property

to anyone, totally disinheriting his own children and widow.

MUSLIM LAW OF SUCCESSION

The Muslim law of succession is a codification of the four sources of Islamic law,

which are (1) The Holy Koran, (2) The Sunna that is, the practice of the

Prophet, (3) The Ijma that is, the consensus of the learned men of the

community on what should be the decision on a particular point, and (4) The

Qiya that is, an analogical deduction of what is right and just in accordance

with the good principles laid down by God.

Muslim law recognizes two types of heirs, the first being Sharers, and the second

being Residuaries. A relative who is a Sharer will take a specified portion of the

deceased's estate irrespective of anything else excepting for one important

exception being the Rule of Awl and Radd. A relative who is a Residuary will

take whatever is left over, once the Sharers have taken their specified shares.

The Sharers are 12 in number and are as follows:

(1) Husband, (2) Wife, (3) Daughter, (4) Daughter of a son (or son's son or son's

son's son and so on), (5) Father, (6) Paternal Grandfather, (7) Mother, (8)

Grandmother on the male line, (9) Full sister (10) Consanguine sister (11) Uterine

sister, and (12) Uterine brother.

The share taken by each sharer will fluctuate in certain circumstances.

For instance, a wife takes a one-fourth share in a case where the couple are

without lineal descendants, and a one-eighth share otherwise. A husband (in the

case of succession to the wife's estate) takes a half share in a case where the

couple are without lineal descendants, and a one-fourth share otherwise.

A sole daughter takes a half share. Where the deceased has left behind more than

one daughter, all daughters jointly take two-thirds. However, these two rules

apply only in cases where the deceased has left behind no sons.

If the deceased had left behind son(s) and daughter(s), then, the daughters cease

to be sharers and become residuaries instead, with the residue being so

distributed as to ensure that each son gets double of what each daughter gets.

Lineal descendants (such as sons) exclude brothers and sisters, and therefore, the

share of brothers and sisters (whether full, consanguine or uterine) will become

nil in the presence of such descendants.

Next is the Rule of Awl and Radd. There may be, and indeed there are, cases

where the arithmetical sum of the fractional shares to which each Sharer is

entitled, becomes more than One. This is not an absurdity. Muslim Law clearly

provides for such contingencies as well. In such cases, the ratio of the shares held

by each sharer is preserved, crystallized, and reworked out so as to ensure that

they succeed to the available estate in that ratio.

There is no concept of ancestral property or rights by birth in the case of Muslim

succession. The rights that a Muslim's heirs acquire upon his death are fixed and

determined with certainty on that date and do not fluctuate.

Widows right to succession

Under Muslim law, no widow is excluded from succession. A childless Muslim

widow is entitled to one-fourth of the property of the deceased husband, after

meeting his funeral and legal expenses and debts. However, a widow who has

children or grandchildren is entitled to one-eighth of the deceased husband's

property. If a Muslim man marries during an illness and subsequently dies of

that medical condition without brief recovery or consummating the marriage, his

widow has no right of inheritance. But if her ailing husband divorces her and

afterwards, he dies from that illness, the widow's right to a share of inheritance

continues until she remarries.

Legitimacy under Muslim Law

Parentage is only established in the real father and mother of a child, and only if

they beget the child in lawful matrimony. In Hanafi Law maternity is established

in the case of every child but in Shiite Law, maternity is established only if the

child is begotten in lawful wedlock. They (Sunnis or the Hanafis) adopt a view

that an illegitimate child, for certain purposes, such as for feeding and

nourishment, is related to the mother. For these purposes the Hanafi Law confers

some rights on its mother.

In Muslim Law, a son to be legitimate must be the offspring of a man and his

wife or that of a man and his slave; any other offspring is the offspring of Zina,

which is illicit connection, and hence is not legitimate. The term 'wife' essentially

implies marriage but marriage may be entered into without any ceremony, the

existence of marriage therefore in any particular case may be an open question.

Direct proof may be available, but if there be no such proof, indirect proof may

suffice. Now one of the ways of indirect proof is by an acknowledgement of

legitimacy in favour of a son. This acknowledgement must be made in such a

way that it shows that the acknowledger meant to accept the other not only as his

son, but also as his legitimate son.

Thus under Muslim Law acknowledgement as a son prima facie means

acknowledgement as a legitimate son. Therefore, under the Muslim Law there is

no rule or process, which confers a status of legitimacy upon children proved to

be illegitimate. The Privy Council in Sadiq Hussain v. Hashim Ali pithily laid

down this rule:

"No statement made by one man that another (proved to be illegitimate) as his

son can make other legitimate, but where no proof of that kind has been given,

such a statement or acknowledgement is substantive evidence that the person so

acknowledged is the legitimate son of the person who makes the statement,

provided his legitimacy is possible."

In Muslim law, the illegitimate child has no right to inherit property through the

father and in the classical law, as well as in some modern Islamic jurisdictions,

the mother of an illegitimate child may well find herself subject to harsh

punishments imposed or inflicted on those found guilty of zina. Thus, the

difficult status of legitimacy in Islamic law has very important consequences for

children and their parents, especially mothers. Under no school of Muslim law

an illegitimate child has any right of inheritance in the property of his putative

father.

INHERITANCE UNDER THE HINDU SUCCESSION ACT, 1956

Background

Patrilineal Hindu law is divided into two schools, the Dayabhaga and

Mitakshara. Dayabhaga prevails in West Bengal, Assam, Tripura and in most

parts of Orissa whereas Mitakshara is followed in the rest of India. Mitakshara

law is again divided into Benaras , Mithila, Mayukha (Bombay) and Dravidia

(Southern) sub-schools.

One of the important differences between the two schools is that under the

Dayabhaga, the father is regarded as the absolute owner of his property whether

it is self-acquired or inherited from his ancestors. Mitakshara law draws a

distinction between ancestral property (referred to as joint family property or

coparcenary property) and separate (e.g. property inherited from mother) and

self-acquired properties. In case of ancestral properties, a son has a right to that

property equal to that of his father by the very fact of his birth. The term son

includes paternal grandsons and paternal great-grandsons who are referred to as

coparceners. An important category of ancestral property is property inherited

from one's father, paternal grandfather and paternal great-grand father. The

other categories are: i) Share obtained from partition (ii) accretions to joint

properties and self-acquisitions thrown into common stock. In case of separate or

self-acquired property, the father is an absolute owner under the Mitakshara law.

Under the Mitakshara School, the joint family property devolves by

survivorship. When a male Hindu dies after the commencement of this Act

having at the time of his death an interest in a Mitakshara coparcenary property,

his interest in the property will devolve by survivorship upon the surviving

members of the coparcenary and not in accordance with this Act. However if the

Mitakshara dies leaving behind a female relative or male relative claiming

through Class I, this undivided interest will not devolve by survivorship but by

succession as provided under the Act.

Applicability of the Act

The Hindu Succession Act applies to:

(a) to any person, who is a Hindu by religion in any of its forms or developments

including a Virashaiva, a Lingayat or a follower of the Brahmo, Parathana or

Arya Samaj.

(b) to any person who is Buddhist, Jain or Sikh by religion, and

(c) to any other person who is not a Muslim, Christian, Parsi or Jew by religion

unless it is proved that any such person would not have been governed by the

Hindu law or by custom or usage as part of that law in respect of any of the

matters dealt with herein if this Act had not been passed.

The following persons are considered as Hindus, Buddhists, Jains or Sikhs by

religion:

(a) any child, legitimate or illegitimate, both of whose parents are Hindus,

Buddhists, Jains or Sikhs by religion.

(b) any child, legitimate or illegitimate one of whose parent is a Hindu, Buddhist,

Jain or Sikh by religion and who is brought up as a member of the tribe,

community, group or family to which such parent belongs or belonged.

(c) any person who has converted or re-converted to the Hindu, Buddhist, Jain or

Sikh religion.

General Rules of Succession - Male Hindu

The property of the male Hindu dying intestate will devolve in the following

manner

Firstly upon all the heirs, being the relatives specified in Class I;

Secondly, if there is no heir of Class I, then upon heirs being the relatives

specified in Class II;

Thirdly if there is no heir of any of the classes, then upon the agnates of

the deceased; (one person is said to be agnate of another if the two are

related by blood or adoption wholly through males) and;

Lastly, if there is no agnate, then upon the cognates of the deceased. (One

person is said to be a cognate of another if the two are related by blood or

adoption but not wholly through male).

CLASS 1 HEIRS

1. Son

2. Daughter

3. Widow

4. Mother

5. Son of a predeceased son

6. Daughter of predeceased son

7. Widow of predeceased son

8. Son of predeceased daughter

9. Daughter of predeceased daughter

10. Son of predeceased so of predeceased son

11. Daughter of predeceased so of predeceased son

12. Widow of predeceased son of a predeceased son

General Rules of Succession FEMALE HINDU

The property of a female Hindu dying intestate shall devolve:

firstly, upon the sons and daughters (including the children of any

predeceased son or daughter) and the husband;

secondly upon the heirs of the husband;

thirdly, upon the mother and father;

fourthly, upon the heirs of the father; and;

lastly, upon the heirs of the mother

However, if any property is inherited by a female Hindu from her father or

mother it will devolve in the absence of any son or daughter of the deceased

(including the children of any predeceased son or daughter) not upon the heirs

referred to above but upon the heirs of the father; and any property inherited by

a female Hindu from her husband or from her father in law will devolve, in the

absence of any son or daughter of the deceased (including the children of any

predeceased son or daughter) not upon their referred to above, but upon the

heirs of the husband.

WILLS

Will means a legal declaration of the intention of a testator with respect to his

property which he desires to be carried into effect after his death. It can be

revoked or altered by the maker of it at any time he is competent to dispose of

his property.

A will made by a Hindu, Buddhist, Sikh or Jain is governed by the provisions of

the Indian Succession Act, 1925. However Muslims are not governed by the

Indian Succession Act, 1925 and they can dispose their property according to

Muslim Law.

Origin of Will in India

The origin of Will in India is shrouded in obscurity. There is no Sanskrit text

dealing with this subject. However a Sanskrit term - `Marana Shasanam' is

mentioned in earlier writings. The reason for the scarcity of the Will in those

days could be attributed to the Hindu orthodox view that the children's rights

cannot be debated or questioned. Decision of the Privy Council (during the

British regime) which was the ultimate court then laid down as law whatever the

"Dharmasastran" had empowered - `that a man may give whatever remains after

a certain amount of property is retained for the maintenance of the family'.

Later different states laid down laws concerning the disposition of property. The

power of a Hindu to Will away his property was first recognised in Bengal. The

decision of the High Court of Tamil Nadu confirmed the view that a person

could will his or her property, provided it is not ancestral. Laws relating to the

writing of a Will were finally passed in 1925 - with the passing of the Indian

Succession Act which applies to all wills made by a Hindu, Sikh, Buddhist, Jain

etc.

Competency to make will

Every person who is of sound mind and is not a minor can make a will.

Any married woman can make a will of any property which she could

alienate during her life time.

Persons who are deaf or dumb or blind can make a will provided they are

able to know what they do by it.

A person who is ordinarily insane may make a will during an interval in

which he is of sound mind.

No person can make a will while he is in such a state of mind, whether

arising from intoxication or from illness or from any other cause, that he

does not know what he is doing.

Execution of Will

The testator (person making the will) should sign or fix his mark to the

will or it should be signed by some other person in his presence and by his

direction.

The signature or mark of the testator or the signature of the person

signing should appear clearly and should be legible. It should appear in

the manner that is appropriate and makes the will legal.

The will should be attested by two or more witnesses, each of whom has

seen the testator sign or affix his mark to the will or has seen other person

sign the will, in the presence and by the direction of the testator, or has

received from the testator.

Each of the witnesses should sign the will in the presence of the testator,

but it is not necessary that more than one witness be present at the same

time, and no particular form of attestation is necessary.

Kinds of Wills

Conditional Will: This is a Will made so as to take effect only on a contingency.

For example - the operation of the document may be postponed till after the

death of the testators wife.

Joint Will: Two or more persons may make a joint Will. It will take effect as if

each has properly executed a Will as regards his own property. If a Will is joint

and is intended to take effect after the death of both, it will not be admitted to

probate during the lifetime of either.

Mutual Will: A Will is mutual when two testators confer on each other reciprocal

benefits as by either of them constituting the other his legatee, the is to say, when

the executants fill the roles of both the testator and legatee towards each other.

Mutual Wills are also called Reciprocal Wills.

Holograph Will: A holograph is a Will entirely in the handwriting of the testator.

Naturally there is a greater guarantee of genuineness attached to such a Will. But

in order to be valid it must also satisfy all the statutory requirements.

Concurrent Wills: The general rule is that a man can leave only one will at the

time of his death. But for sake of convenience a testator may dispose off some

properties. e.g., those in one country by one Will and those in another country by

another Will. They may be treated as wholly independent of each other, unless

there is any inter-connection or the incorporation of one in the other. Such Wills

are called concurrent wills.

Duplicate Will: A testator, for the sake of safety, may make a will in duplicate,

one to be kept by him and the other deposited in some safe custody with a bank,

executor or trustee. Each copy must be duly signed and attested in order to be

valid. A Valid revocation of the original would affect a valid revocation of the

duplicate also.

Onerous Will: This is a Will, which imposes an obligation on the legatee that he

gets nothing until he accepts it completely.

Registration of Will

A will need not be registered compulsorily but if so desired it may be registered

by the testator during his lifetime. Will may be deposited with the registering

authority under Sec.42 of the Indian Registration Act, 1908. A Will or Codicil is

not required to be stamped at all.

Wording of a Will

Sec.74 of the Indian Succession Act, 1925 lays down that the use of technical

words or terms of art is not necessary in a will but the wording should be such as

to clearly indicate the intention of the testator.

A will must be construed as a whole to give effect to the manifest intention of the

testator; Nathu v. Debi Singh, AIR 1966 Punj 226.

Codicil

Codicil is an instrument made in relation to a Will and explaining, altering or

adding to its disposition. It shall be deemed to form part of a Will. (Sec.2(b) of

the Indian Succession Act, 1925)

If the Testator wants to change the names of the Executors by adding some other

names, in that case this could be done by making a Codicil in addition to the

Will, as there may not be other changes required to be made in the main text of

the Will.

If the Testator wants to change certain bequests by adding to the names of the

legatees or subtracting some of them in case some Beneficiaries are dead and the

names are required to be removed, all these can be done by making a Codicil.

The Codicil must be in writing. It must be signed by the Testator and attested by

two Witnesses.

Revocation of Will

A Will may be revoked at any time before the death of the testator but a will

executed by two persons jointly cannot be revoked after the death of any one of

them, if the survivor has given effect to the directions of the deceased testator.

In case of two Wills, the latter one will prevail; Badari Basamma v. Kandrikeri,

AIR 1984 NOC 237 (Kant).

In case of revocation, the testator should give it in writing that he has made

certain changes or has revoked the will. It must be signed by the testator and

attested by two or more witnesses. There should be a clause stating that the

present will is the last will of the testator and any will made prior to this would

stand revoked. The testator cannot revoke the will by just striking it off or

scratching it. He must sign it and have it attested by at least two witnesses.

Probate of Will

On the death of the testator, an executor of the will or an heir of the deceased

testator can apply for probate. The court will ask the other heirs of the deceased

if they have any objections to the will. If there are no objections, the court will

grant probate. A probate is a copy of a will, certified by the court. A probate is to

be treated as conclusive evidence of the genuineness of a will.

In case any objections are raised by any of the heirs, a citation has to be served,

calling upon them to consent. This has to be displayed prominently in the court.

Thereafter, if no objection is received, the probate will be granted. It is only after

this that the will comes into effect.

Though executors derive their title from the Will and not the probate, the probate

is still the only proper evidence of the executor's appointment. The grant of

probate to the executor does not confer upon him any title to the property which

the testator himself had no right to dispose off, but only perfects the

representatives title of the executor to the property, which did belong to the

testator and over which he had a disposing power.

WILLS UNDER MUSLIM LAW

Under Muslim Law, every adult Muslim of sound mind can make a will. A

minor or a lunatic is not competent to execute a will. Though under Muslim Law,

a person gets the majority at the age of 15 years, but in India, the case of will is

governed by the Indian Majority Act according to which the minority terminates

at the age of 18 years, but if the guardian has been appointed by the Court for the

minor, the minority will terminate at the age of 21 years. The legatee can be any

person capable of holding property and bequest can be made to non-Muslim,

institution, and charitable purposes. A bequest can be made to an unborn person

and a will in favour of a child who is born within six months of the date of

making the will can be a legatee. But according to Shia Law, a bequest to a child

in the womb is valid, even if the child is in the longest period of gestation i.e., ten

lunar months.

The property bequeathed must be capable of being transferred and the testator

should be the owner of the said property. The property bequeathed should be in

existence at the time of death of the testator, even if it was not in existence at the

time of execution of the will. A Muslim cannot bequest his property in favour of

his own heir, unless the other heirs consent to the bequest after the death of the

testator. The person should be legal heir at the time of the death of the testator.

However, under Shia Law, a testator may bequest in favour of his heir so long as

it does not exceed one third of his estate and such bequest is valid even without

the consent of other heirs. The consent can be given before or after the death of

the testator. But if the entire estate is bequeathed to one heir excluding other

heirs entirely from inheritance, the bequest will be void in its entirety. According

to Sunni Law, the consent by the heirs should be given after the death of the

testator and the consent given during the lifetime of the testator is of no legal

effect. Under Shia Law, the consent by the heirs should be free and a consent

given under undue influence fraud, coercion or misrepresentation is no consent

and the person who has given such consent is not bound by such consent. The

consent by the heirs can be given either expressly or impliedly. If the heirs attest

the will and acquiesce in the legatee taking possession of the property

bequeathed, this is considered as sufficient consent. If the heirs do not question

the will for a very long time and the legatees take and enjoy the property, the

conduct of heirs will amount to consent. If some heirs give their consent, the

shares of the consenting heirs will be bound and the legacy in excess is payable

out of the shares of the consenting heirs. When the heir gives his consent to the

bequest, he cannot rescind it later on.

Principle of rateable abatement in case heirs does not give consent

Under Hanafi Law, if a Mohammedan bequests more than one/third of the

property and the heirs does not consent to the same, the shares are reduced

proportionately to bring it down to one/third. Bequests for pious purposes have

no precedence over secular purposes, and are decreased proportionately.

Bequests for pious purposes are classified into three categories:

(i) Bequest for faraiz i.e. purposes expressly ordained in the Koran viz. hajj, zakat

and expiation for prayers missed by a Muslim.

(ii) Bequest for waji-bait i.e. purposes not expressly ordained in the Koran, but

which are proper viz. charity given for breaking rozas.

(iii) Bequest for nawafali i.e. purposes-deemed pious by the testator, viz. bequest

for constructing a mosque, inn for travellers or bequest to poor. The bequests of

the first category take precedence over bequests of the second and the third

category and bequests of the second category take precedence over those of the

third.

Under Shia Law, the principle of rateable abatement is not applicable and the

bequests made prior in date take priority over those later in date. But if the

bequest is made by the same will, the latter bequest would be a revocation of an

earlier bequest.

Oral or written Will

Under Muslim law, a will may be made either orally or in writing and though in

writing, it does not require to be signed or attested. No particular form is

necessary for making a will, if the intention of the testator is sufficiently

ascertained. Though oral will is possible, the burden to establish an oral will is

very heavy and the will should be proved by the person who asserts it with

utmost precision and with every circumstance considering time and place.

But if the marriage of a Muslim has been held under Special Marriage Act, 1954,

the provisions of Indian Succession Act, 1925 will be applicable and he cannot

execute a will under Muslim law.

Revocation of will by a Muslim

The testator can revoke his will at any time either expressly or impliedly. The

express revocation may be either oral or in writing. The will can be revoked

impliedly by testator transferring or destroying completely altering the subject

matter of the will or by giving the same property to someone else by another

will.

About the Author

Rajkumar S. Adukia

B. Com (Hons.), FCA, ACS, AICWA, LL.B, M.B.A, Dip IFRS (UK), Dip LL & LW

Senior Partner, Adukia & Associates, Chartered Accountants

Meridien Apts, Bldg 1, Office no. 3 to 6

Veera Desai Road, Andheri (West)

Mumbai 400 058

Mobile 098200 61049/093230 61049

Fax 26765579

Email rajkumarfca@gmail.com

Mr.Rajkumar S Adukia is an eminent business consultant, academician, writer, and

speaker. A senior partner of Adukia & Associates he has authored more than 34 books on

a wide range of subjects. His books on IFRS namely, Encyclopedia on IFRS (3000

pages) and The Handbook on IFRS (1000 pages) has served number of professionals who

are on the lookout for a practical guidance on IFRS. The book on Professional

Opportunities for Chartered Accountants is a handy tool and ready referencer to all

Chartered Accountants.

In addition to being a Chartered Accountant, Company Secretary, Cost Accountant,

MBA, Dip IFR (UK), Mr. Adukia also holds a Degree in Law and Diploma in

LaborLaws. He has been involved in the activities of the Institute of Chartered

Accountants of India (ICAI) since 1984 as a convenor of Kalbadevi CPE study circle. He

was the Chairman of the Western Region of Institute of Chartered Accountants of India

in 1997 and has been actively involved in various committees of ICAI. He became a

member of the Central Council in 1998 and ever since he has worked tirelessly towards

knowledge sharing, professional development and enhancing professional opportunities

for members. He is a regular contributor to the various committees of the ICAI. He is

currently the Chairman of Committee for Members in Industry and Internal Audit

Standard Board of ICAI.

Mr. Adukia is a rank holder from Bombay University. He did his graduation from

Sydenham College of Commerce & Economics. He received a Gold Medal for highest

marks in Accountancy & Auditing in the Examination. He passed the Chartered

Accountancy with 1st Rank in Inter CA & 6th Rank in Final CA, and 3rd Rank in Final

Cost Accountancy Course in 1983. He started his practice as a Chartered Accountant on

1st July 1983, in the three decades following which he left no stone unturned, be it

academic expertise or professional development. His level of knowledge, source of

information, professional expertise spread across a wide range of subjects has made him a

strong and sought after professional in every form of professional assignment.

He has been coordinating with various professional institutions, associations

universities, University Grants Commission and other educational institutions. Besides

he has actively participated with accountability and standards-setting organizations in

India and at the international level. He was a member of J.J. Irani committee which

drafted Companies Bill 2008. He is also member of Secretarial Standards Board of ICSI.

He represented ASSOCHAM as member of Cost Accounting Standards Board of

ICWAI. He was a member of working group of Competition Commission of India,

National Housing Bank, NABARD, RBI, CBI etc.

He has served on the Board of Directors in the capacity of independent director at BOI

Asset management Co. Ltd, Bharat Sanchar Nigam Limited and SBI Mutual Funds

Management Pvt Ltd. He was also a member of the London Fraud Investigation Team.

Mr. Rajkumar Adukia specializes in IFRS, Enterprise Risk Management, Internal Audit,

Business Advisory and Planning, Commercial Law Compliance, XBRL, Labor Laws,

Real Estate, Foreign Exchange Management, Insurance, Project Work, Carbon Credit,

Taxation and Trusts. His clientele include large corporations, owner-managed

companies, small manufacturers, service businesses, property management and

construction, exporters and importers, and professionals. He has undertaken specific

assignments on fraud investigation and reporting in the corporate sector and has

developed background material on the same.

Based on his rich experience, he has written numerous articles on critical aspects of

finance-accounting, auditing, taxation, valuation, public finance. His authoritative

articles appear regularly in financial papers like Business India, Financial Express,

Economic Times and other professional / business magazines. He has authored several

accounting and auditing manuals. He has authored books on vast range of topics

including IFRS, Internal Audit, Bank Audit, Green Audit, SEZ, CARO, PMLA,

Antidumping, Income Tax Search, Survey and Seizure, Real Estate etc. His books are

known for their practicality and for their proactive approaches to meeting practice needs.

Mr. Rajkumar is a frequent speaker on trade and finance at seminars and conferences

organized by the Institute of Chartered Accountants of India, various Chambers of

Commerce, Income Tax Offices and other Professional Associations. He has also lectured

at the S.P. Jain Institute of Management, Intensive Coaching Classes for Inter & Final

CA students and Direct Taxes Regional Training Institute of CBDT. He also develops

and delivers short courses, seminars and workshops on changes and opportunities in

trade and finance. He has extensive experience as a speaker, moderator and panelist at

workshops and conferences held for both students and professionals both nationally and

internationally.. Mr. Adukia has delivered lectures abroad at forums of International

Federation of Accountants and has travelled across countries for professional work.

Professional Association: Mr. Rajkumar S Adukia with his well chartered approach

towards professional assignments has explored every possible opportunity in the fields of

business and profession. Interested professionals are welcome to share their thoughts in

this regard.

Potrebbero piacerti anche

- Sources of Hindu LawDocumento10 pagineSources of Hindu LawAryan GargNessuna valutazione finora

- Hindu Succession-Male & FemaleDocumento11 pagineHindu Succession-Male & FemaleNasma Abidi0% (1)

- Women S Property RightsDocumento2 pagineWomen S Property RightsGuidance ValueNessuna valutazione finora

- Islam: in A Nutshell Types - or "Denominations" of Islam: Classical Islamists - Follow The Exact Example of MohammedDocumento4 pagineIslam: in A Nutshell Types - or "Denominations" of Islam: Classical Islamists - Follow The Exact Example of MohammedDerrick HartNessuna valutazione finora

- Cruelty As A Ground For DivorceDocumento14 pagineCruelty As A Ground For Divorcevishal more100% (1)

- Legal Status of Animals, Unborn Person & Dead ManDocumento12 pagineLegal Status of Animals, Unborn Person & Dead ManHare Krishna RevolutionNessuna valutazione finora

- Hindu Family Law: An Overview of the Laws Governing Hindu Marriage, Divorce, Maintenance, Custody of Children, Adoption and GuardianshipDa EverandHindu Family Law: An Overview of the Laws Governing Hindu Marriage, Divorce, Maintenance, Custody of Children, Adoption and GuardianshipValutazione: 3.5 su 5 stelle3.5/5 (4)

- Muslim Family Law in India (Part 1: Sources of Law, Marriage, Divorce, Maintenance, Guardianship)Da EverandMuslim Family Law in India (Part 1: Sources of Law, Marriage, Divorce, Maintenance, Guardianship)Valutazione: 4 su 5 stelle4/5 (6)

- Deed Contents 2011Documento24 pagineDeed Contents 2011Vidya Adsule100% (1)

- Indian SucessionDocumento23 pagineIndian SucessionArunaMLNessuna valutazione finora

- Partition Under Hindu LawDocumento17 paginePartition Under Hindu Lawishita agrawalNessuna valutazione finora

- Unani MedicineDocumento5 pagineUnani MedicineDinbilimNessuna valutazione finora

- Hindu Succession-Male & FemaleDocumento14 pagineHindu Succession-Male & FemaleKumar MangalamNessuna valutazione finora

- Concept of PartitionDocumento13 pagineConcept of PartitionSAMBIT KUMAR PATRINessuna valutazione finora

- Partition Under Hindu Law Submitted As PDocumento7 paginePartition Under Hindu Law Submitted As PGuru charan ReddyNessuna valutazione finora

- India Business Law DirectoryDocumento41 pagineIndia Business Law DirectoryVidya AdsuleNessuna valutazione finora

- Countries & CapitalsDocumento8 pagineCountries & Capitalsmr_harshahsNessuna valutazione finora

- Succession To The Property of Hindu FemaleDocumento30 pagineSuccession To The Property of Hindu FemaleEhsas ManikantNessuna valutazione finora

- Hindu Undivided Family & CoparcenaryDocumento6 pagineHindu Undivided Family & CoparcenaryPrashantKumarNessuna valutazione finora

- English Diary 2019 PDFDocumento149 pagineEnglish Diary 2019 PDFVidya AdsuleNessuna valutazione finora

- Classical Music GharanafDocumento355 pagineClassical Music Gharanafvinaygvm0% (1)

- General Principles of Succession Under Christian LawDocumento15 pagineGeneral Principles of Succession Under Christian LawNarmada Devi0% (1)

- Joint Hindu Family PropertyDocumento16 pagineJoint Hindu Family PropertyMohammad ArishNessuna valutazione finora

- Family Law NotesDocumento18 pagineFamily Law NotesVidya Adsule67% (3)

- DECLARATION Cum Indemnity - Shital MoreDocumento4 pagineDECLARATION Cum Indemnity - Shital MoreVidya AdsuleNessuna valutazione finora

- Family PartitionDocumento11 pagineFamily PartitionNitin SherwalNessuna valutazione finora

- Alienation of PropertyDocumento17 pagineAlienation of Propertysarthak mohan shukla100% (1)

- Metropolitan Region Development Authority: Dr. Amit Saini, District Collector, KolhapurDocumento24 pagineMetropolitan Region Development Authority: Dr. Amit Saini, District Collector, KolhapurVidya AdsuleNessuna valutazione finora

- Hindu Succession Act 1956Documento47 pagineHindu Succession Act 1956Danika JoplinNessuna valutazione finora

- Laws of Maintenance in IndiaDocumento32 pagineLaws of Maintenance in Indiaamrendrakarn100% (1)

- Main File 1Documento348 pagineMain File 1Vidya Adsule67% (3)

- THIS AGREEMENT OF TRANSFER OF TENANCY Is Made at - OnDocumento3 pagineTHIS AGREEMENT OF TRANSFER OF TENANCY Is Made at - OnVidya AdsuleNessuna valutazione finora

- Consumer RefDocumento5 pagineConsumer RefVidya Adsule0% (1)

- Succession Under Muslim Law Faimly Law IIDocumento10 pagineSuccession Under Muslim Law Faimly Law IIKhan Aqueel AhmadNessuna valutazione finora

- Christian Law of Succession in Indian LawDocumento5 pagineChristian Law of Succession in Indian LawSuman ChandaNessuna valutazione finora

- Family Law ProjectDocumento22 pagineFamily Law ProjectShahrukh hassnaNessuna valutazione finora

- Hindu Law Notes For ExamesDocumento52 pagineHindu Law Notes For Examescanaryhill33% (3)

- Family Law 2-1Documento67 pagineFamily Law 2-1Ramey Krishan RanaNessuna valutazione finora

- Family Law Project 1.2Documento27 pagineFamily Law Project 1.2gaurav singhNessuna valutazione finora

- Female As KartaDocumento19 pagineFemale As KartaAnkit Anand100% (1)

- Hindu Inheritance Law PDFDocumento9 pagineHindu Inheritance Law PDFMohammed AminNessuna valutazione finora

- Understanding The Law of Inheritance of The Quran PDFDocumento11 pagineUnderstanding The Law of Inheritance of The Quran PDFSalekin KhanNessuna valutazione finora

- Teaching Notes-Family Law IDocumento50 pagineTeaching Notes-Family Law ISagar ChoudharyNessuna valutazione finora

- Oparcenary: S S SAP - 500054906 R - R154216093 BA., LL. B. (H .) S C L (2016 - 2021) B - 2Documento10 pagineOparcenary: S S SAP - 500054906 R - R154216093 BA., LL. B. (H .) S C L (2016 - 2021) B - 2Mridul Yash DwivediNessuna valutazione finora

- What Is Hindu Joint Family and KartaDocumento9 pagineWhat Is Hindu Joint Family and KartaRishabh KumarNessuna valutazione finora

- Family Law IIDocumento18 pagineFamily Law IIAgrima VermaNessuna valutazione finora

- Partition: I) IntroductionDocumento15 paginePartition: I) IntroductionMohammad FariduddinNessuna valutazione finora

- Family Law - GROUNDS OF DIVORCE UNDER INDIAN DIVORCE ACTDocumento6 pagineFamily Law - GROUNDS OF DIVORCE UNDER INDIAN DIVORCE ACTMayank SharmaNessuna valutazione finora

- Muslim Law of SuccessionDocumento27 pagineMuslim Law of SuccessionNidhi Navneet0% (1)

- Family LawDocumento13 pagineFamily LawPriyamvada YadavNessuna valutazione finora

- Adoption Under Hindu LawDocumento12 pagineAdoption Under Hindu LawashishNessuna valutazione finora

- Maintenance HinduLawDocumento10 pagineMaintenance HinduLawmmnamboothiri100% (1)

- Maintenance Under CRPCDocumento12 pagineMaintenance Under CRPCShubham Phophalia100% (1)

- Guardianship Under Hindu LawDocumento15 pagineGuardianship Under Hindu LawIMRAN ALAMNessuna valutazione finora

- 623 - COPARCENARY UNDER HINDU LAW - Tanya GuptaDocumento13 pagine623 - COPARCENARY UNDER HINDU LAW - Tanya Guptayashvardhan guptaNessuna valutazione finora

- Assignment On Transfer of Property Act, 1882Documento14 pagineAssignment On Transfer of Property Act, 1882Ayush AgrawalNessuna valutazione finora

- Family Law II Hindu Joint FamilyDocumento6 pagineFamily Law II Hindu Joint FamilyNisha NishaNessuna valutazione finora

- Schools of Hindu LawDocumento4 pagineSchools of Hindu LawMuhammad Zakir HossainNessuna valutazione finora

- Family Law MuslimDocumento13 pagineFamily Law MuslimNARU PMNessuna valutazione finora

- Female Intestate Succession Under HinduDocumento3 pagineFemale Intestate Succession Under HinduAadhityaNessuna valutazione finora

- Section 8 of Hindu Succession ActDocumento26 pagineSection 8 of Hindu Succession ActMano Gnya50% (2)

- Sucession of Hindu MaleDocumento18 pagineSucession of Hindu MaleMayank SrivastavaNessuna valutazione finora

- Adoption & Maintenance (Family Law)Documento17 pagineAdoption & Maintenance (Family Law)Karthik100% (1)

- FAMILY Law Final DraftDocumento26 pagineFAMILY Law Final DraftSarvjeet KumarNessuna valutazione finora

- The Dowry Prohibition ActDocumento40 pagineThe Dowry Prohibition ActSoujanyaa MannaNessuna valutazione finora

- CPC NotesDocumento10 pagineCPC NotesHarsh Vardhan Singh HvsNessuna valutazione finora

- Application of Hindu LawDocumento2 pagineApplication of Hindu LawRachit Goel83% (6)

- Chapter 2 Hindu Joint FamilyDocumento21 pagineChapter 2 Hindu Joint FamilySAMBIT KUMAR PATRINessuna valutazione finora

- Hindu Law AdoptionDocumento5 pagineHindu Law AdoptionEhthaitNessuna valutazione finora

- 207th Report of Law Commission of IndiaDocumento10 pagine207th Report of Law Commission of IndiaNishantNessuna valutazione finora

- The Bombay Environment Action Vs State of Maharashtra and Ors On 29 July 2015Documento23 pagineThe Bombay Environment Action Vs State of Maharashtra and Ors On 29 July 2015Vidya AdsuleNessuna valutazione finora

- Note On GST For Builders and Developers CA Yashwant KasarDocumento30 pagineNote On GST For Builders and Developers CA Yashwant KasarVidya AdsuleNessuna valutazione finora

- 12 Chapter 6Documento67 pagine12 Chapter 6Vidya AdsuleNessuna valutazione finora

- Vidya A PDFDocumento13 pagineVidya A PDFVidya AdsuleNessuna valutazione finora

- 2016 Chief Legal Officer Survey: An Altman Weil Flash SurveyDocumento44 pagine2016 Chief Legal Officer Survey: An Altman Weil Flash SurveyVidya AdsuleNessuna valutazione finora

- EY Step Up To Ind AsDocumento35 pagineEY Step Up To Ind AsRakeshkargwalNessuna valutazione finora

- Central Government Act: Section 433 in The Companies Act, 1956Documento2 pagineCentral Government Act: Section 433 in The Companies Act, 1956Vidya AdsuleNessuna valutazione finora

- EGovernance in Maharashtra 2013Documento206 pagineEGovernance in Maharashtra 2013Amit Chatterjee100% (1)

- BBA MT 05 Banani MentorsDocumento6 pagineBBA MT 05 Banani MentorsfuckyouNessuna valutazione finora

- Biography of Imam Muhammad Bin Ali (A.S.) (AL-TAQI)Documento31 pagineBiography of Imam Muhammad Bin Ali (A.S.) (AL-TAQI)MubahilaTV Books & Videos OnlineNessuna valutazione finora

- N1 N2 N3 N4 N5: Pencapaian Kompetensi Ketrampilan Mata Pelajaran Prakarya Kelas ViiiaDocumento2 pagineN1 N2 N3 N4 N5: Pencapaian Kompetensi Ketrampilan Mata Pelajaran Prakarya Kelas ViiiaAnik WidyawatiNessuna valutazione finora

- AbburDocumento23 pagineAbburPrahalad Karnam100% (2)

- Juliane S. Macasinag Bsba MM 1. What Is The Video About?Documento3 pagineJuliane S. Macasinag Bsba MM 1. What Is The Video About?Bryan Ivann MacasinagNessuna valutazione finora

- Making Space Sufis and Settlers in Early Modern India (Nile Green, 2012, BOOK)Documento296 pagineMaking Space Sufis and Settlers in Early Modern India (Nile Green, 2012, BOOK)msteele242185Nessuna valutazione finora

- Atiq Ur RehmanDocumento11 pagineAtiq Ur RehmanMirza AatifNessuna valutazione finora

- District Naushero FerozeDocumento17 pagineDistrict Naushero FerozeAdeel AttaNessuna valutazione finora

- Ar RahnuDocumento18 pagineAr RahnuAtfi Mohd RazaliNessuna valutazione finora

- G.H.A Juynboll and His Methodology in Dealing With Prophetic Tradition: A Re-AppraisalDocumento9 pagineG.H.A Juynboll and His Methodology in Dealing With Prophetic Tradition: A Re-AppraisalmeltNessuna valutazione finora

- Wiegand 2009Documento13 pagineWiegand 2009Luke BradleyNessuna valutazione finora

- Censorship in Pakistani Urdu Textbooks by Ajmal KamalDocumento9 pagineCensorship in Pakistani Urdu Textbooks by Ajmal KamalAamir MughalNessuna valutazione finora

- IHDocumento64 pagineIHhmndinNessuna valutazione finora

- Cummins Diesel Engine Qsb6 7 Cm2250 Operation and Maintenance Manual 4022265Documento22 pagineCummins Diesel Engine Qsb6 7 Cm2250 Operation and Maintenance Manual 4022265xyhaw100% (41)

- Business and Salaah by Hazrat Maulana Yunus Patel Saheb (Rahmatullah Alayh) WWW - Yunuspatel.co - ZaDocumento3 pagineBusiness and Salaah by Hazrat Maulana Yunus Patel Saheb (Rahmatullah Alayh) WWW - Yunuspatel.co - ZatakwaniaNessuna valutazione finora

- Upload Aio CBTDocumento11 pagineUpload Aio CBTMuhammad AnasNessuna valutazione finora

- Questions Questions Questions QuestionsDocumento17 pagineQuestions Questions Questions Questionsik001Nessuna valutazione finora

- Math For Matric PDFDocumento8 pagineMath For Matric PDFShaarwin RajaratnamNessuna valutazione finora

- Distributor Wise Cylinder Carrying Cost Per CylinderDocumento42 pagineDistributor Wise Cylinder Carrying Cost Per CylinderMohamed Shakawat HossainNessuna valutazione finora

- CertificatesDocumento58 pagineCertificatesmaah1728230% (1)

- SacharDocumento424 pagineSacharRik ChowdhuryNessuna valutazione finora

- Contact Us: Media Enquiries / Press Office Membership InformationDocumento6 pagineContact Us: Media Enquiries / Press Office Membership InformationCarl BrownNessuna valutazione finora

- Democratic Parliamentary MonarchiesDocumento13 pagineDemocratic Parliamentary MonarchiesBahrul setiawanNessuna valutazione finora

- Difa e Pak 1Documento7 pagineDifa e Pak 1sachtilekarNessuna valutazione finora

- Attendence Register IXDocumento3 pagineAttendence Register IXSayeed100% (1)

- Result CardDocumento39 pagineResult Cardrana aqeelNessuna valutazione finora