Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Ratios: Mar ' 14 Dec ' 12 Dec ' 11 Dec ' 10 Dec ' 09

Caricato da

Nikhil JainTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Ratios: Mar ' 14 Dec ' 12 Dec ' 11 Dec ' 10 Dec ' 09

Caricato da

Nikhil JainCopyright:

Formati disponibili

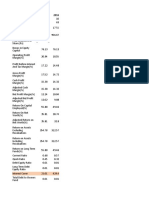

Ratios

(Rs crore)

Mar ' 14

Dec ' 12

Dec ' 11

Dec ' 10

Dec ' 09

Per share ratios

Adjusted EPS (Rs)

-9.38

5.18

17.07

17.45

1.74

Adjusted cash EPS (Rs)

-2.77

9.58

23.56

22.87

5.26

Reported EPS (Rs)

-20.74

-3.84

-72.32

27.28

13.61

Reported cash EPS (Rs)

-14.13

0.56

-65.83

32.71

17.13

2.00

Operating profit per share (Rs)

-7.66

10.47

25.45

29.98

15.49

Book value (excl rev res) per share EPS (Rs)

25.87

45.42

45.60

121.74

94.16

Book value (incl rev res) per share EPS (Rs)

25.87

45.42

45.60

121.74

94.16

161.99

149.05

184.81

134.10

113.73

112.02

88.90

Operating margin (%)

-4.72

7.02

13.77

22.35

13.62

Gross profit margin (%)

-8.80

4.07

10.25

18.31

10.52

-11.49

-2.47

-38.04

19.74

11.72

-1.53

6.17

12.39

16.55

4.53

Adjusted return on net worth (%)

-36.24

11.39

37.43

14.33

1.84

Reported return on net worth (%)

-80.16

-8.45

-158.61

22.41

14.44

5.04

13.25

35.54

15.00

9.02

Long term debt / Equity

2.25

1.02

0.49

0.56

0.68

Total debt/equity

5.46

2.48

2.02

0.83

0.84

15.47

28.73

33.13

54.60

54.17

0.99

1.01

1.03

0.66

0.64

Current ratio

1.13

1.22

1.04

2.04

1.43

Current ratio (inc. st loans)

0.67

0.80

0.75

1.40

1.18

Quick ratio

0.85

0.94

0.84

1.60

0.88

Inventory turnover ratio

4.05

3.64

4.71

3.95

4.05

Dividend per share

Net operating income per share EPS (Rs)

Free reserves per share EPS (Rs)

Profitability ratios

Net profit margin (%)

Adjusted cash margin (%)

Return on long term funds (%)

Leverage ratios

Owners fund as % of total source

Fixed assets turnover ratio

Liquidity ratios

Payout ratios

Mar ' 14

Dec ' 12

Dec ' 11

Dec ' 10

Dec ' 09

Dividend payout ratio (net profit)

8.54

Dividend payout ratio (cash profit)

7.13

Earning retention ratio

86.64

100.00

Cash earnings retention ratio

100.00

100.00

89.81

100.00

11.76

3.91

4.42

15.13

Financial charges coverage ratio

0.84

2.36

4.34

26.44

18.99

Fin. charges cov.ratio (post tax)

-0.09

1.08

-8.29

26.41

19.25

46.35

38.91

32.35

38.63

40.08

7.42

7.74

Exports as percent of total sales

74.20

62.68

71.56

67.06

65.59

Import comp. in raw mat. consumed

57.34

63.93

58.74

50.65

65.79

0.47

0.40

0.37

0.44

0.50

69.37

69.44

69.59

69.75

69.85

Coverage ratios

Adjusted cash flow time total debt

Component ratios

Material cost component (% earnings)

Selling cost Component

Long term assets / total Assets

Bonus component in equity capital (%)

Potrebbero piacerti anche

- Value Added Is The Amount by Which The Value of Goods or Services Are Increased by Each Stage in Its ProductionDocumento2 pagineValue Added Is The Amount by Which The Value of Goods or Services Are Increased by Each Stage in Its Productionparas61189Nessuna valutazione finora

- Asian PaintsDocumento10 pagineAsian PaintsNeer YadavNessuna valutazione finora

- DR Reddy RatiosDocumento6 pagineDR Reddy RatiosRezwan KhanNessuna valutazione finora

- RATIO of MRP-I-2003Documento8 pagineRATIO of MRP-I-2003Yash ShahNessuna valutazione finora

- Column1 Column2 Column3 Column4 Mar '13 Mar '12 Mar '11Documento4 pagineColumn1 Column2 Column3 Column4 Mar '13 Mar '12 Mar '11Sumit ChandNessuna valutazione finora

- Ace AnalyserDocumento4 pagineAce AnalyserRahul MalhotraNessuna valutazione finora

- Yes Bank: Key Financial RatiosDocumento8 pagineYes Bank: Key Financial Ratiosrky1992Nessuna valutazione finora

- Jio Financial Analysis (5 Yrs)Documento2 pagineJio Financial Analysis (5 Yrs)Yash Saxena KhiladiNessuna valutazione finora

- RatiosDocumento2 pagineRatiosnishantNessuna valutazione finora

- Atlas Copco (India) LTD Balance Sheet: Sources of FundsDocumento19 pagineAtlas Copco (India) LTD Balance Sheet: Sources of FundsnehaNessuna valutazione finora

- Ratios: Mar ' 12 Mar ' 11 Mar ' 10 Mar ' 09 Mar ' 08Documento5 pagineRatios: Mar ' 12 Mar ' 11 Mar ' 10 Mar ' 09 Mar ' 08Prajapati HiteshNessuna valutazione finora

- COMPANY/FINANCE/CASH FLOW/175/Nestle IndiaDocumento1 paginaCOMPANY/FINANCE/CASH FLOW/175/Nestle IndiabhuvaneshkmrsNessuna valutazione finora

- Bajaj AutoDocumento2 pagineBajaj AutoSonali BiyaniNessuna valutazione finora

- Syndicate BankDocumento5 pagineSyndicate BankpratikNessuna valutazione finora

- Balance Sheet: Sources of FundsDocumento4 pagineBalance Sheet: Sources of FundsYogesh GuwalaniNessuna valutazione finora

- MarutiDocumento2 pagineMarutiVishal BhanushaliNessuna valutazione finora

- Particulars: Mar. 12 Amt. (RS.) Mar. 13 Amt. (RS.)Documento4 pagineParticulars: Mar. 12 Amt. (RS.) Mar. 13 Amt. (RS.)reena MahadikNessuna valutazione finora

- Particulars Mar 2016 Mar 2015 Mar 2014 Mar 2013 Mar 2012: Operational & Financial RatiosDocumento7 pagineParticulars Mar 2016 Mar 2015 Mar 2014 Mar 2013 Mar 2012: Operational & Financial RatiosHardik PatelNessuna valutazione finora

- Dabur India: Key Financial RatiosDocumento5 pagineDabur India: Key Financial RatiosHiren ShahNessuna valutazione finora

- Key Financial Ratios of Bharat Heavy Electricals - in Rs. Cr.Documento6 pagineKey Financial Ratios of Bharat Heavy Electricals - in Rs. Cr.Virangad SinghNessuna valutazione finora

- Previous Years: Larse N and Toubr o - in Rs. Cr.Documento12 paginePrevious Years: Larse N and Toubr o - in Rs. Cr.Parveen BabuNessuna valutazione finora

- Profit LossDocumento9 pagineProfit LossAnshika AgarwalNessuna valutazione finora

- Attock Oil RefineryDocumento2 pagineAttock Oil RefineryOvais HussainNessuna valutazione finora

- Particulars Operational & Financial Ratios Mar 2014 Mar 2013 Jun 2012Documento4 pagineParticulars Operational & Financial Ratios Mar 2014 Mar 2013 Jun 2012saboorakheeNessuna valutazione finora

- Previous Years: Canar A Bank - in Rs. Cr.Documento12 paginePrevious Years: Canar A Bank - in Rs. Cr.kapish1014Nessuna valutazione finora

- Key RatiosDocumento6 pagineKey RatiosSumeet ChaurasiaNessuna valutazione finora

- J K Cement LTD.: Consolidated Income & Expenditure Summary: Mar 2009 - Mar 2018: Non-Annualised: Rs. CroreDocumento21 pagineJ K Cement LTD.: Consolidated Income & Expenditure Summary: Mar 2009 - Mar 2018: Non-Annualised: Rs. CroreMaitreyee GoswamiNessuna valutazione finora

- Customised Profit & Loss (Rs - in Crores) Mar 18 17-Mar 16-Mar 15-Mar 14-Mar 5,592.29 5,290.65 5,750.00 5,431.28 4,870.08Documento20 pagineCustomised Profit & Loss (Rs - in Crores) Mar 18 17-Mar 16-Mar 15-Mar 14-Mar 5,592.29 5,290.65 5,750.00 5,431.28 4,870.08Akshay Yadav Student, Jaipuria LucknowNessuna valutazione finora

- Final ExamDocumento10 pagineFinal ExamMustafa Azeem MunnaNessuna valutazione finora

- Mar '14 Mar '13 Mar '12 Mar '11 Mar '10Documento7 pagineMar '14 Mar '13 Mar '12 Mar '11 Mar '10jalpa1432Nessuna valutazione finora

- Financial RatiosDocumento3 pagineFinancial Ratiosvignesh_sundaresan_1Nessuna valutazione finora

- Key Financial Ratios of JK Tyre and IndustriesDocumento3 pagineKey Financial Ratios of JK Tyre and IndustriesAchal JainNessuna valutazione finora

- Shinansh TiwariDocumento11 pagineShinansh TiwariAnuj VermaNessuna valutazione finora

- 1 - Abhinav - Raymond Ltd.Documento5 pagine1 - Abhinav - Raymond Ltd.rajat_singlaNessuna valutazione finora

- Key Financial Ratios of ACCDocumento2 pagineKey Financial Ratios of ACCcool_mani11Nessuna valutazione finora

- NestleDocumento4 pagineNestleNikita GulguleNessuna valutazione finora

- Recommendation of Advisory CommitteeDocumento1 paginaRecommendation of Advisory Committeemadhumay23Nessuna valutazione finora

- Balance Sheet: Sources of FundsDocumento8 pagineBalance Sheet: Sources of Fundssushilb_20Nessuna valutazione finora

- Key Financial Ratios of Tata Consultancy ServicesDocumento13 pagineKey Financial Ratios of Tata Consultancy ServicesSanket KhairnarNessuna valutazione finora

- Ratio Analysis of Suzlon EnergyDocumento3 pagineRatio Analysis of Suzlon EnergyBharat RajputNessuna valutazione finora

- Berger Paints RatiosDocumento1 paginaBerger Paints RatiosDeepNessuna valutazione finora

- Horizontal Analysis Balance Sheet Profit & Loss Key RatiosDocumento18 pagineHorizontal Analysis Balance Sheet Profit & Loss Key Ratiosvinayjain221Nessuna valutazione finora

- Are RatiosDocumento3 pagineAre RatioslakhipatelNessuna valutazione finora

- RatiosDocumento2 pagineRatiosKishan KeshavNessuna valutazione finora

- RatiosDocumento2 pagineRatiosEthan Hunt NadimNessuna valutazione finora

- 17691e0002 Assignment 2Documento4 pagine17691e0002 Assignment 2Ajay KumarNessuna valutazione finora

- Tata RatiosDocumento1 paginaTata RatiosSaurabh ChipadeNessuna valutazione finora

- 2017 1Documento7 pagine2017 1Asif sheikhNessuna valutazione finora

- in Rs. Cr.Documento19 paginein Rs. Cr.Ashish Kumar SharmaNessuna valutazione finora

- Excel Brittaniya 2Documento3 pagineExcel Brittaniya 2Adnan LakdawalaNessuna valutazione finora

- All RatiosDocumento6 pagineAll RatiosAkshat JainNessuna valutazione finora

- Christ University Christ UniversityDocumento3 pagineChrist University Christ Universityvijaya senthilNessuna valutazione finora

- Quarterly Results Quarterly Results Q3 FY 2012: The Banker To Every Indian The Banker To Every IndianDocumento44 pagineQuarterly Results Quarterly Results Q3 FY 2012: The Banker To Every Indian The Banker To Every IndianAmreen KhanNessuna valutazione finora

- Comapny GlanceDocumento1 paginaComapny GlancebhuvaneshkmrsNessuna valutazione finora

- HAL Annual ReportDocumento103 pagineHAL Annual ReportAnirudh A Damani0% (1)

- Tata MotorsDocumento3 pagineTata MotorsSiddharth YadiyapurNessuna valutazione finora

- Eps N LevrageDocumento7 pagineEps N LevrageShailesh SuranaNessuna valutazione finora

- Bajaj Claim Form ADLDDocumento2 pagineBajaj Claim Form ADLDNikhil JainNessuna valutazione finora

- The Enabling Role of Web Services in Information System Development Practices: A Grounded Theory StudyDocumento27 pagineThe Enabling Role of Web Services in Information System Development Practices: A Grounded Theory StudyNikhil JainNessuna valutazione finora

- Parts of SpeechDocumento32 pagineParts of SpeechNikhil JainNessuna valutazione finora

- IDOL AdmissionDocumento1 paginaIDOL AdmissionNikhil JainNessuna valutazione finora

- Balance Sheet of Ranbaxy LaboratoriesDocumento3 pagineBalance Sheet of Ranbaxy LaboratoriesNikhil JainNessuna valutazione finora

- Account Recharge: Home A/C Details View/Modify Packages Everywhere TV Order Showcase Record Shows Actve HelpdeskDocumento2 pagineAccount Recharge: Home A/C Details View/Modify Packages Everywhere TV Order Showcase Record Shows Actve HelpdeskNikhil JainNessuna valutazione finora

- The International Accounting Standards BoardDocumento4 pagineThe International Accounting Standards BoardNikhil JainNessuna valutazione finora

- Strategic Management Project Details For Year 2013Documento4 pagineStrategic Management Project Details For Year 2013Nikhil JainNessuna valutazione finora

- Sem I: Economics of Global Trade and FinanceDocumento1 paginaSem I: Economics of Global Trade and FinanceNikhil JainNessuna valutazione finora

- Resume Quality Report - Your Resume Score Is 47Documento2 pagineResume Quality Report - Your Resume Score Is 47Nikhil JainNessuna valutazione finora

- Smt. Sukhibai Deepchand Munot Alias JainDocumento4 pagineSmt. Sukhibai Deepchand Munot Alias JainNikhil JainNessuna valutazione finora

- SM IndexDocumento1 paginaSM IndexNikhil JainNessuna valutazione finora

- Index: SR No Topic PG NoDocumento1 paginaIndex: SR No Topic PG NoNikhil JainNessuna valutazione finora

- Frito Lay S Production ProcessDocumento7 pagineFrito Lay S Production ProcessNikhil JainNessuna valutazione finora

- University of Mumbai Institute of Distance and Open LearningDocumento1 paginaUniversity of Mumbai Institute of Distance and Open LearningNikhil JainNessuna valutazione finora