Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

BhartiAndMTN Financials

Caricato da

Girish Ramachandra0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

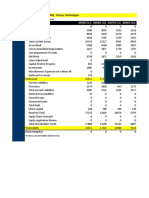

71 visualizzazioni10 pagineNet sales EBITDA EBIT Earnings before Tax Income Tax Earnings after Tax Other, Minority Interests, Exceptionals Net Profit Ordinary Dividends BALANCE SHEET - Assets Cash and Short Term Investments Accounts Receivable Inventories Total Current Assets Net Property Plant and Equipment Goodwill and intangibles Other long Term assets total assets BALANCESHEET - Liabilities Total Current Liabilities Net Long Term Interest-Bearing Debt Total Financial Debt

Descrizione originale:

Copyright

© Attribution Non-Commercial (BY-NC)

Formati disponibili

XLSX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoNet sales EBITDA EBIT Earnings before Tax Income Tax Earnings after Tax Other, Minority Interests, Exceptionals Net Profit Ordinary Dividends BALANCE SHEET - Assets Cash and Short Term Investments Accounts Receivable Inventories Total Current Assets Net Property Plant and Equipment Goodwill and intangibles Other long Term assets total assets BALANCESHEET - Liabilities Total Current Liabilities Net Long Term Interest-Bearing Debt Total Financial Debt

Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato XLSX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

71 visualizzazioni10 pagineBhartiAndMTN Financials

Caricato da

Girish RamachandraNet sales EBITDA EBIT Earnings before Tax Income Tax Earnings after Tax Other, Minority Interests, Exceptionals Net Profit Ordinary Dividends BALANCE SHEET - Assets Cash and Short Term Investments Accounts Receivable Inventories Total Current Assets Net Property Plant and Equipment Goodwill and intangibles Other long Term assets total assets BALANCESHEET - Liabilities Total Current Liabilities Net Long Term Interest-Bearing Debt Total Financial Debt

Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato XLSX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 10

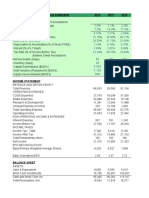

MTN Financials

2008 2007 2006

31-Dec-08 31-Dec-07 31-Dec-06

ZAR ZAR ZAR

USD'000 USD'000 USD'000

INCOME STATEMENT

Net Sales 102 526 00073 145 000 51 595 000

EBITDA 76 733 000 32 065 000 22 465 000

EBIT 63 749 000 22 880 000 16 146 000

Earnings before Tax 28 490 000 19 707 000 14 690 000

Income Tax -11 355 000 -7 791 000 -2 591 000

Earnings after Tax 17 135 000 11 916 000 12 099 000

Other, Minority Interests, Exceptionals -1 820 000 -1 308 000 -1 489 000

Net Profit 15 315 000 10 608 000 10 610 000

Ordinary Dividends -4 525 000 -1 678 318 -1 674 241

BALANCE SHEET - Assets

Cash & Short Term Investments 26 968 000 16 868 000 9 961 000

Accounts Receivable 11 794 000 9 036 000 6 619 000

Inventories 2 372 000 1 167 000 1 043 000

Total Current Assets 54 787 000 33 501 000 20 635 000

Net Property Plant & Equipment 64 193 000 39 463 000 30 647 000

Goodwill & Intangibles 45 786 000 38 797 000 40 105 000

Other Long Term Assets 657 000 1 332 000 2 605 000

Total Assets 170 106 000115 586 00096 917 000

BALANCE SHEET - Liabilities

Total Current Liabilities 5 786 646 5 175 560 2 871 844

Total Long Term Interest-Bearing Debt 3 084 600 3 405 036 4 107 952

Total Financial Debt 4 408 540 4 981 236 4 739 082

Minorities 440 536 619 676 579 542

Provisions 0 0 0

Total Liabilities & Debt 9 934 320 10 104 108 8 366 358

Book Value - Total Shareholders' Equity 8 096 916 7 002 620 5 560 615

Total Liabilities & Equity 18 031 236 17 106 728 13 926 973

CASH FLOW

Net Profit (starting line) 3 019 940 2 916 636 2 110 953

Cash From Operating Activities 3 629 016 3 825 800 2 532 281

Cash From Investing Activities -2 880 762 -2 538 496 -5 547 682

Cash From Financing Activities 30 952 -315 980 2 729 294

Net Change Cash 1 065 300 967 624 -151 029

Capital Expenditure -3 007 538 -2 417 136 -1 407 685

Free Cash Flow 621 478 1 408 664 1 124 596

METRICS

Net Debt 1 549 932 2 484 772 3 307 687

Number of Employees 16 452 14 878 14 067

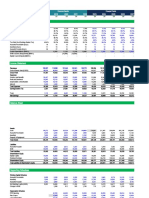

2004 2003

31-Mar-05 31-Mar-04

ZAR ZAR

USD'000 USD'000

28 994 000 23 871 000

12 343 000 9 249 000

9 391 000 6 194 000

8 816 000 5 413 000

-1 502 000 -1 101 000

7 314 000 4 312 000

-907 000 -612 000

6 407 000 3 700 000

-680 000 0

6 429 000 5 336 000

2 715 000 2 058 000

649 000 515 000

10 637 000 8 643 000

15 623 000 11 042 000

1 719 000 11 399 000

1 081 000 658 000

29 364 000 32 000 000

1 194 496 1 005 836

480 254 586 922

514 866 656 372

370 678 224 328

0 0

2 142 244 1 922 446

2 541 314 3 139 954

4 683 558 5 062 400

1 406 152 856 337

1 515 410 1 360 045

-1 204 384 -774 864

-137 010 36 861

183 106 522 060

-1 208 372 -798 594

307 038 561 452

-510 560 -187 783

6 258 5 390

Firm Fiscal Period End DaReturn on Return on Return on EBITDA mar

(%) (%) (%) (%)

MTN Group 31 Dec 08 10.72 29.55 24.76 42.53

Peer Median 31 Dec 08 7.06 13.89 15.16 32.47

Bharti Airtel Ltd. 31 Mar 09 14.31 19.78 30.91 51.58

EBIT margiPretax inc After tax Net MarginSales to ac Sales to in Sales to woQuick ratioCash ratio Current rat

(%) (%) (%) (%) (x) (x) (x) (%) (%) (%)

29.66 27.79 16.71 14.94 9.84 57.94 -161.08 72.4 50.79 110.36

17.77 11.29 7.51 11.6 10.2 50.21 -2.91 34.3 16.56 70.63

38.29 23 21.54 21.04 22.64 354.89 -5.01 30.52 14.9 64.47

Financial l Total finanNet Debt / Total assets

(%) (%) (%)

54.61 24.52 8.22

47.09 25.3 19.46

46.41 21.65 17.22

Enterprise Value EV/Net Sales

Current (USDm) Last USD-M 2009(e) 2010(e) 2011(e)

MTN Group 30071 2 1.84 1.64

Peer Median 16 206 1.91 1.89 1.87

Bharti Airtel Ltd. 30324 3.61 3.35 3.01

EV/EBITDA EV/EBIT Market Cap P/Earnings (PE)

2009(e) 2010(e) 2011(e) 2009(e) 2010(e) 2011(e) Current(USD-M 2009(e) 2010(e)

4.71 4.37 3.85 6.82 6.42 5.73 27652 12.44 10.58

5.5 5.98 6.08 8.58 10.21 10.28 10.09 10 531 11.32

8.77 871 8.01 13.73 14.23 12.95 27765 1471 14.88

/Earnings (PE)

2011(e)

9

11.14

13.28

Potrebbero piacerti anche

- Senior High School S.Y. 2019-2020Documento4 pagineSenior High School S.Y. 2019-2020Cy Dollete-Suarez100% (1)

- Financial Statement AnalysisDocumento25 pagineFinancial Statement AnalysisAldrin CustodioNessuna valutazione finora

- 3 Statement Financial Analysis TemplateDocumento14 pagine3 Statement Financial Analysis TemplateCười Vê LờNessuna valutazione finora

- Comp Vs IndustryDocumento3 pagineComp Vs IndustryAjay SutharNessuna valutazione finora

- Chapter 3. Exhibits y AnexosDocumento24 pagineChapter 3. Exhibits y AnexosJulio Arroyo GilNessuna valutazione finora

- DCF 2 CompletedDocumento4 pagineDCF 2 CompletedPragathi T NNessuna valutazione finora

- Recap: Profitability:ROE - Dupont Solvency Capital Employed DER Debt/TA Interest Coverage RatioDocumento7 pagineRecap: Profitability:ROE - Dupont Solvency Capital Employed DER Debt/TA Interest Coverage RatioSiddharth PujariNessuna valutazione finora

- Supreme Annual Report 15 16Documento104 pagineSupreme Annual Report 15 16adoniscalNessuna valutazione finora

- We Are Not Above Nature, We Are A Part of NatureDocumento216 pagineWe Are Not Above Nature, We Are A Part of NaturePRIYADARSHI GOURAVNessuna valutazione finora

- Tesla Company AnalysisDocumento83 pagineTesla Company AnalysisStevenTsaiNessuna valutazione finora

- ATH Case CalculationDocumento4 pagineATH Case CalculationsasNessuna valutazione finora

- CH-3 Finance (Parth)Documento11 pagineCH-3 Finance (Parth)princeNessuna valutazione finora

- Tesla FinModelDocumento58 pagineTesla FinModelPrabhdeep DadyalNessuna valutazione finora

- ForecastingDocumento9 pagineForecastingQuỳnh'ss Đắc'ssNessuna valutazione finora

- John M CaseDocumento10 pagineJohn M Caseadrian_simm100% (1)

- Performance AGlanceDocumento1 paginaPerformance AGlanceHarshal SawaleNessuna valutazione finora

- Tata MotorsDocumento24 pagineTata MotorsApurvAdarshNessuna valutazione finora

- Group 14 - Bata ValuationDocumento43 pagineGroup 14 - Bata ValuationSUBHADEEP GUHA-DM 20DM218Nessuna valutazione finora

- 05-03-22 Focal Cma DataDocumento6 pagine05-03-22 Focal Cma DataShivam SharmaNessuna valutazione finora

- Add Dep Less Tax OCF Change in Capex Change in NWC FCFDocumento5 pagineAdd Dep Less Tax OCF Change in Capex Change in NWC FCFGullible KhanNessuna valutazione finora

- Tata MotorsDocumento5 pagineTata Motorsinsurana73Nessuna valutazione finora

- Nishat 2004-2009Documento1 paginaNishat 2004-2009Sufyan CheemaNessuna valutazione finora

- Total Operating Expenses Operating Income or Loss: BreakdownDocumento9 pagineTotal Operating Expenses Operating Income or Loss: BreakdownAhmed EzzNessuna valutazione finora

- D489 Abhishek JSWphase 2Documento44 pagineD489 Abhishek JSWphase 2Yash KalaNessuna valutazione finora

- Astra Otoparts Tbk. (S) : Balance SheetDocumento18 pagineAstra Otoparts Tbk. (S) : Balance SheetsariNessuna valutazione finora

- 02 04 EndDocumento6 pagine02 04 EndnehaNessuna valutazione finora

- Performance at A GlanceDocumento7 paginePerformance at A GlanceLima MustaryNessuna valutazione finora

- Ratios and WACCDocumento70 pagineRatios and WACCABHIJEET BHUNIA MBA 2021-23 (Delhi)Nessuna valutazione finora

- QUIZ 2 Sufyan Sarwar 02-112192-060Documento1 paginaQUIZ 2 Sufyan Sarwar 02-112192-060Sufyan SarwarNessuna valutazione finora

- Case 28 AutozoneDocumento39 pagineCase 28 AutozonePatcharanan SattayapongNessuna valutazione finora

- Balance Sheet of WiproDocumento3 pagineBalance Sheet of WiproRinni JainNessuna valutazione finora

- Hindustan Petrolium Corporation LTD: ProsDocumento9 pagineHindustan Petrolium Corporation LTD: ProsChandan KokaneNessuna valutazione finora

- Tesla DCF Valuation by Ihor MedvidDocumento105 pagineTesla DCF Valuation by Ihor Medvidpriyanshu14Nessuna valutazione finora

- MSFTDocumento83 pagineMSFTJohn wickNessuna valutazione finora

- Equity ResearchDocumento40 pagineEquity Researchchetan chauhanNessuna valutazione finora

- Key Ratios 5yrs 3yrs Latest: Sales Other Income Total Income Total Expenditure Ebit Interest Tax Net ProfitDocumento2 pagineKey Ratios 5yrs 3yrs Latest: Sales Other Income Total Income Total Expenditure Ebit Interest Tax Net ProfitmohithNessuna valutazione finora

- OVL English Annual Report 19-20-24!11!2020Documento394 pagineOVL English Annual Report 19-20-24!11!2020hitstonecoldNessuna valutazione finora

- DCF 3 CompletedDocumento3 pagineDCF 3 CompletedPragathi T NNessuna valutazione finora

- .+Energy+and+Other+gross+profit AfterDocumento41 pagine.+Energy+and+Other+gross+profit AfterAkash ChauhanNessuna valutazione finora

- 6.+Energy+and+Other+revenue BeforeDocumento37 pagine6.+Energy+and+Other+revenue BeforeThe SturdyTubersNessuna valutazione finora

- 2.+average+of+price+models BeforeDocumento23 pagine2.+average+of+price+models BeforeMuskan AroraNessuna valutazione finora

- 6.+Energy+and+Other+Revenue AfterDocumento37 pagine6.+Energy+and+Other+Revenue AftervictoriaNessuna valutazione finora

- 8.+opex BeforeDocumento45 pagine8.+opex BeforeThe SturdyTubersNessuna valutazione finora

- Stock Cues: Amara Raja Batteries Ltd. Company Report Card-StandaloneDocumento3 pagineStock Cues: Amara Raja Batteries Ltd. Company Report Card-StandalonekukkujiNessuna valutazione finora

- 5 EstadosDocumento15 pagine5 EstadosHenryRuizNessuna valutazione finora

- 40 CrosDocumento11 pagine40 CrosAijaz AslamNessuna valutazione finora

- Mehak Bluntly MediaDocumento18 pagineMehak Bluntly Mediahimanshu sagarNessuna valutazione finora

- Balance Sheet of Axis Bank: - in Rs. Cr.Documento37 pagineBalance Sheet of Axis Bank: - in Rs. Cr.rampunjaniNessuna valutazione finora

- Adani Port P&L, BS, CF - IIMKDocumento6 pagineAdani Port P&L, BS, CF - IIMKabcdefNessuna valutazione finora

- Ultra Tech Cement CreatingDocumento7 pagineUltra Tech Cement CreatingvikassinghnirwanNessuna valutazione finora

- Rockwell Land CorporationDocumento15 pagineRockwell Land CorporationaravillarinoNessuna valutazione finora

- Analysis of Financial Statements: Bs-Ba 6Documento13 pagineAnalysis of Financial Statements: Bs-Ba 6Saqib LiaqatNessuna valutazione finora

- Pacific Grove Spice CompanyDocumento3 paginePacific Grove Spice CompanyLaura JavelaNessuna valutazione finora

- Statement of Profit or Loss and Other Comprehensive Income For The Year Ended 31 December 2018Documento11 pagineStatement of Profit or Loss and Other Comprehensive Income For The Year Ended 31 December 2018Tinatini BakashviliNessuna valutazione finora

- National Foods by Saqib LiaqatDocumento14 pagineNational Foods by Saqib LiaqatAhmad SafiNessuna valutazione finora

- Balance December 2004 Difference Rp'000 Rp'000: OctoberDocumento10 pagineBalance December 2004 Difference Rp'000 Rp'000: OctoberAchmad MudaniNessuna valutazione finora

- This Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksDocumento32 pagineThis Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksSukanya Shridhar 1 9 9 0 3 5Nessuna valutazione finora

- Project 1 - Match My Doll Clothing Line: WC Assumption: 2010 2011 2012 2013 2014 2015Documento4 pagineProject 1 - Match My Doll Clothing Line: WC Assumption: 2010 2011 2012 2013 2014 2015rohitNessuna valutazione finora

- Zylog SystemsDocumento2 pagineZylog SystemsGirish RamachandraNessuna valutazione finora

- Date or Subtitle: Spiderlogic OverviewDocumento31 pagineDate or Subtitle: Spiderlogic OverviewGirish RamachandraNessuna valutazione finora

- Balance Sheet (2009-2003) of TCS (US Format)Documento15 pagineBalance Sheet (2009-2003) of TCS (US Format)Girish RamachandraNessuna valutazione finora

- Balance Sheet (2009-2000) in US Format For Tata Motors: All Numbers Are in INR and in x10MDocumento16 pagineBalance Sheet (2009-2000) in US Format For Tata Motors: All Numbers Are in INR and in x10MGirish RamachandraNessuna valutazione finora

- Balance Sheet (2009-2001) of Maruti Suzuki: All Numbers Are in INR and in x10MDocumento16 pagineBalance Sheet (2009-2001) of Maruti Suzuki: All Numbers Are in INR and in x10MGirish RamachandraNessuna valutazione finora

- Balance Sheet (2009-2000) - Infosys Technologies: All Numbers Are in INR and in x10MDocumento18 pagineBalance Sheet (2009-2000) - Infosys Technologies: All Numbers Are in INR and in x10MGirish RamachandraNessuna valutazione finora

- All Numbers Are in INR and in x10MDocumento6 pagineAll Numbers Are in INR and in x10MGirish RamachandraNessuna valutazione finora

- WhiteMonk HEG Equity Research ReportDocumento15 pagineWhiteMonk HEG Equity Research ReportGirish Ramachandra100% (1)

- Sensex To Touch 1800 in December 2009Documento4 pagineSensex To Touch 1800 in December 2009Girish RamachandraNessuna valutazione finora

- Add Users To Office 365 With Windows PowerShellDocumento3 pagineAdd Users To Office 365 With Windows PowerShelladminakNessuna valutazione finora

- 10 Chapter 8 Financial Plan 4Documento12 pagine10 Chapter 8 Financial Plan 4moniquemagsanay5Nessuna valutazione finora

- Nature of Marketing PlanDocumento2 pagineNature of Marketing PlanengrauyonNessuna valutazione finora

- Offer Letter - Appointment Order Sample FormatDocumento1 paginaOffer Letter - Appointment Order Sample Formatmohammedammeen0% (1)

- 1406 and 1550 - Law of Corporate Finance ProjectDocumento25 pagine1406 and 1550 - Law of Corporate Finance ProjectIsha Sen100% (1)

- Income Tax Calculator Calculate Income Tax For FY 2022-23Documento1 paginaIncome Tax Calculator Calculate Income Tax For FY 2022-23Vivek LakkakulaNessuna valutazione finora

- Competing On The Edge: Strategy As Structured ChaosDocumento18 pagineCompeting On The Edge: Strategy As Structured ChaosMariano ZorrillaNessuna valutazione finora

- Quantitative Analysis Lecture - 1-Introduction: Associate Professor, Anwar Mahmoud Mohamed, PHD, Mba, PMPDocumento41 pagineQuantitative Analysis Lecture - 1-Introduction: Associate Professor, Anwar Mahmoud Mohamed, PHD, Mba, PMPEngMohamedReyadHelesyNessuna valutazione finora

- Case Studies GilletteDocumento3 pagineCase Studies GilletteknowsauravNessuna valutazione finora

- A Study of Advertising Strategies of LG Research Report MarketingDocumento83 pagineA Study of Advertising Strategies of LG Research Report MarketingSami Zama100% (2)

- Romania 2013Documento11 pagineRomania 2013Emilia StoicaNessuna valutazione finora

- Unit 1: The Big Picture: Week 1: Introduction - Abap Restful Application Programming ModelDocumento12 pagineUnit 1: The Big Picture: Week 1: Introduction - Abap Restful Application Programming ModelAmir MardaniNessuna valutazione finora

- Term Paper: Bangladesh University of Professionals (Bup)Documento5 pagineTerm Paper: Bangladesh University of Professionals (Bup)Muslima Mubashera Reza RupaNessuna valutazione finora

- Kashmir Festival - FinalsDocumento27 pagineKashmir Festival - FinalsAhmed Mazhar KhanNessuna valutazione finora

- DocxDocumento12 pagineDocxDianneNessuna valutazione finora

- Best Practice For Solar Roof Top Projects in IndiaDocumento172 pagineBest Practice For Solar Roof Top Projects in Indiaoptaneja48Nessuna valutazione finora

- Elec Midterm ReviewerDocumento16 pagineElec Midterm ReviewerArgie DeguzmanNessuna valutazione finora

- New Cad Cam Prodjects ListDocumento2 pagineNew Cad Cam Prodjects ListDhanish KumarNessuna valutazione finora

- Assignment (26 Batch)Documento6 pagineAssignment (26 Batch)Brand AtoZNessuna valutazione finora

- 024-Industrial Refractories Corporation of The Philippines vs. CA, Et Al G.R. No. 122174 October 3, 2002Documento5 pagine024-Industrial Refractories Corporation of The Philippines vs. CA, Et Al G.R. No. 122174 October 3, 2002wewNessuna valutazione finora

- Economics Notes (2022 Pattern) : Instagram: @sscpreparations Whatsapp Group:95550-65590Documento173 pagineEconomics Notes (2022 Pattern) : Instagram: @sscpreparations Whatsapp Group:95550-65590Saikumar DevapatlaNessuna valutazione finora

- TOI Brochure - Final Design - 060722Documento2 pagineTOI Brochure - Final Design - 060722Sho VictoriaNessuna valutazione finora

- ActionPlan8D ModifiedDocumento23 pagineActionPlan8D ModifiedwilkesgillinghamNessuna valutazione finora

- Government AccountingDocumento28 pagineGovernment AccountingRazel TercinoNessuna valutazione finora

- SAP Integration Guide v1.1 PDFDocumento11 pagineSAP Integration Guide v1.1 PDFVamsikrishnarjyNessuna valutazione finora

- 07-Software DevelopmentDocumento40 pagine07-Software DevelopmentClairin LiadiNessuna valutazione finora

- LMI Presenatation 1Documento36 pagineLMI Presenatation 1HoLinhNessuna valutazione finora

- Advantages and Disadvantages of The Fisheries Trade: Yoshiaki MatsudaDocumento11 pagineAdvantages and Disadvantages of The Fisheries Trade: Yoshiaki MatsudaMiko barizoNessuna valutazione finora

- ABC Automotive Inc Collective AgreementDocumento43 pagineABC Automotive Inc Collective AgreementshawnNessuna valutazione finora

- Cecchetti 5e Chapter02Documento45 pagineCecchetti 5e Chapter02Gail Marie VasquezNessuna valutazione finora