Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

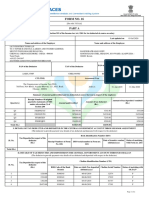

Application No

Caricato da

Jorge GuerreroDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Application No

Caricato da

Jorge GuerreroCopyright:

Formati disponibili

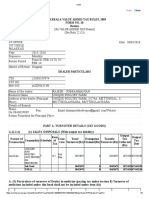

Application No:320802/WR01/444/2008

THE KERALA VALUE ADDED TAX RULES, 2005

FORM NO. 10

Return

[for VALUE ADDED TAX Dealer]

(See Rule 22 (1))

To,

AC (ASSESSMENT)

SPECIAL CIRCLE

TRISSUR

2008-

Year

2009

Seque

Monthly

nce

From 01- DEALER PARTICULARS

Return APR-08

Period To 30-

APR-08 32080204

TIN

495

Nature

of Original CST

Return NO

Name of the dealer LEO DISTRIBUTORS

Address of the dealer LEO DISTRIBUTERS PHARMACEUTICAL

(Principal Place) WHOLESALERS

Details of Branch

Phone No: Fax: Email: Website:

Return Furnished for Principal Place

PART A. TURNOVER DETAILS (VAT GOODS)

A.(1,2,4) (1) SALES /DISPOSALS (With output tax liability)

O

Co

A. (3) Particulars of turnover of Dealer in medicine (paying tax under section 8)

Turnover of medicines included under this head shall not be included under item A(i)

Rate Output Output tax

Sl. Schedule Total Exemption Taxable MRP

Commodity of tax Due on

No No Turnover Claimed Turnover Value

Tax Collected MRP

1 DRUGS III 4 36085754 12149736 23936018 36069662 1387295 1387294.69

COSMETICS -

2 MEDICATED V 12.5 528564 0 528564 0 66444 0

OR NOT

TOTAL 36614318 12149736 24464582 36069662 1453739 1387294.69

Rate Output Output tax

Sl. Schedule Total Exemption Taxable MRP

Commodity of tax Due on

No No Turnover Claimed Turnover Value

Tax Collected MRP

Part J – Tax payment details *

Instrument No/Date /

Amount Treasury/Bank Sub Treasury/Branch

Type

111967/09-MAY-

1468277 Dhanalakshmi Bank THRISSUR

2008/CHEQUE

TOTAL 1468277.00

Potrebbero piacerti anche

- JanuaryDocumento8 pagineJanuaryRohama TullaNessuna valutazione finora

- FeburaryDocumento8 pagineFeburaryRohama TullaNessuna valutazione finora

- MarchDocumento7 pagineMarchRohama TullaNessuna valutazione finora

- DUB360723Documento1 paginaDUB360723SALES 123Nessuna valutazione finora

- AnkitDocumento4 pagineAnkitsitNessuna valutazione finora

- Customer Receipt for Just Dial ServicesDocumento2 pagineCustomer Receipt for Just Dial ServicesSurinder GhattauraNessuna valutazione finora

- Income Tax Payment Challan: PSID #: 138458243Documento1 paginaIncome Tax Payment Challan: PSID #: 138458243naeem1990Nessuna valutazione finora

- GST-RFD-01 Application for Refund of ITC on Export of Goods & ServicesDocumento3 pagineGST-RFD-01 Application for Refund of ITC on Export of Goods & ServiceskotisanampudiNessuna valutazione finora

- Computation of Total Income Income From Business or Profession (Chapter IV D) 556790Documento3 pagineComputation of Total Income Income From Business or Profession (Chapter IV D) 556790nABSAMNNessuna valutazione finora

- Nagendra Singh Thekedar-100219Documento2 pagineNagendra Singh Thekedar-100219petergr8t1Nessuna valutazione finora

- The Remaining Reports and KPIsDocumento11 pagineThe Remaining Reports and KPIsElie DiabNessuna valutazione finora

- It 000134579920 2022 00 PDFDocumento1 paginaIt 000134579920 2022 00 PDFMuhammad AslamNessuna valutazione finora

- Income Tax Payment ChallanDocumento1 paginaIncome Tax Payment ChallanAfu MaanNessuna valutazione finora

- Vendor Registration FormDocumento2 pagineVendor Registration FormTtafain TafaNessuna valutazione finora

- Quotation: Customer Code: 81063 Information VAT Number - 300055945410003Documento1 paginaQuotation: Customer Code: 81063 Information VAT Number - 300055945410003Marcial Jr. MilitanteNessuna valutazione finora

- Tax Invoice: Being Amount Paid For Advertising Listings On Just DialDocumento2 pagineTax Invoice: Being Amount Paid For Advertising Listings On Just DialcubadesignstudNessuna valutazione finora

- Taxpayer's GSTIN Legal Name Trade Name, If Any Date of ARN Date of GenerationDocumento9 pagineTaxpayer's GSTIN Legal Name Trade Name, If Any Date of ARN Date of GenerationUmeshNessuna valutazione finora

- Income Declared u/s 44AD Business IncomeDocumento3 pagineIncome Declared u/s 44AD Business IncomeAbhilash M NairNessuna valutazione finora

- Income Tax Payment Challan: PSID #: 138384574Documento1 paginaIncome Tax Payment Challan: PSID #: 138384574naeem1990Nessuna valutazione finora

- GST and VAT Ledger SetupDocumento23 pagineGST and VAT Ledger SetupAkash JainNessuna valutazione finora

- Revised PSID ON SALARY FMO MAY 2023Documento1 paginaRevised PSID ON SALARY FMO MAY 2023Arshad SadeequeNessuna valutazione finora

- 2018 Income TaxDocumento4 pagine2018 Income Taxmoxykho109Nessuna valutazione finora

- Income Tax Payment Challan DetailsDocumento1 paginaIncome Tax Payment Challan DetailsAsif JavidNessuna valutazione finora

- Form 231 Sharp EnterprisesDocumento8 pagineForm 231 Sharp Enterprisesqaid_duraiyaNessuna valutazione finora

- Ajio 1706695192988Documento1 paginaAjio 1706695192988shaelkmr550Nessuna valutazione finora

- Tax ReturnDocumento7 pagineTax Returnsyedfaisal_sNessuna valutazione finora

- Tax Invoice: Customer Details Just Dial DetailsDocumento2 pagineTax Invoice: Customer Details Just Dial DetailsaashiyanacontractorsNessuna valutazione finora

- Computation of Total Income Income From Business or Profession (Chapter IV D) 300000Documento4 pagineComputation of Total Income Income From Business or Profession (Chapter IV D) 300000ramanNessuna valutazione finora

- 1702-MX Annual Income Tax Return: Part IV - Schedules InstructionsDocumento2 pagine1702-MX Annual Income Tax Return: Part IV - Schedules InstructionsVince Alvin DaquizNessuna valutazione finora

- Asif 111Documento4 pagineAsif 111mueed6074Nessuna valutazione finora

- ReturnDocumento1 paginaReturnFaisal Islam ButtNessuna valutazione finora

- invoice-seller-1000000-FP098311148587057Documento1 paginainvoice-seller-1000000-FP098311148587057M Abdullah ManzoorNessuna valutazione finora

- Apartment-201, 2nd Floor Plaza # 43, E-Commercial, Jinnah Boulevard, DHA Phase-II, Islamabad Islamabad Urban Ammar KhatirDocumento3 pagineApartment-201, 2nd Floor Plaza # 43, E-Commercial, Jinnah Boulevard, DHA Phase-II, Islamabad Islamabad Urban Ammar KhatirAnonymous gKfTqXObkDNessuna valutazione finora

- Income Tax Department: Computerized Payment Receipt (CPR - It)Documento1 paginaIncome Tax Department: Computerized Payment Receipt (CPR - It)Mian EnterprisesNessuna valutazione finora

- It 000111825668 2020 00Documento1 paginaIt 000111825668 2020 00Muhammad IrfanNessuna valutazione finora

- Income Tax Payment Challan: PSID #: 37536860Documento1 paginaIncome Tax Payment Challan: PSID #: 37536860Mohsin Ali Shaikh vlogsNessuna valutazione finora

- Inv - Mifty Kit 12.04.13 PDFDocumento1 paginaInv - Mifty Kit 12.04.13 PDFDeepakNessuna valutazione finora

- GST Rfd-01 07aabcw4620l1z8 Expwop 202204 FormDocumento3 pagineGST Rfd-01 07aabcw4620l1z8 Expwop 202204 FormSANDEEP SINGHNessuna valutazione finora

- Income Tax Payment ChallanDocumento1 paginaIncome Tax Payment ChallanzeshanNessuna valutazione finora

- RandomDocumento4 pagineRandomComplaint CellNessuna valutazione finora

- It 000142942160 2024 09Documento1 paginaIt 000142942160 2024 09tayyabNessuna valutazione finora

- Income Tax Payment Challan: PSID #: 164056997Documento1 paginaIncome Tax Payment Challan: PSID #: 164056997M ZubairNessuna valutazione finora

- BSBPG6820L 2020-21Documento2 pagineBSBPG6820L 2020-21Arun PVNessuna valutazione finora

- Income Tax Department: Computerized Payment Receipt (CPR - It)Documento1 paginaIncome Tax Department: Computerized Payment Receipt (CPR - It)Mian EnterprisesNessuna valutazione finora

- It 2014051303601062551Documento1 paginaIt 2014051303601062551Mian EnterprisesNessuna valutazione finora

- Musthtaq Azeem Atl Challan PDFDocumento1 paginaMusthtaq Azeem Atl Challan PDFFarhan AliNessuna valutazione finora

- Form I - 1Documento2 pagineForm I - 1Mohamed YousufNessuna valutazione finora

- Tax Invoice (12-038)Documento1 paginaTax Invoice (12-038)Julie Libiano Green Kraft Pte LtdNessuna valutazione finora

- 24 X 7 KOEL CARE Helpdesk: 8806334433/18002333344: InvoiceDocumento2 pagine24 X 7 KOEL CARE Helpdesk: 8806334433/18002333344: InvoiceSunil PatelNessuna valutazione finora

- INCOME TAX PAYMENTDocumento1 paginaINCOME TAX PAYMENTSkjhkjhkjhNessuna valutazione finora

- Solid Q 50 KW InvoiceDocumento1 paginaSolid Q 50 KW InvoiceTrisha RawatNessuna valutazione finora

- Acknowledgement Slip for Income Tax ReturnDocumento5 pagineAcknowledgement Slip for Income Tax ReturnUkasha GulNessuna valutazione finora

- North Trend Marketing PaystubDocumento1 paginaNorth Trend Marketing PaystubMike Rowen BanaresNessuna valutazione finora

- Income Tax Payment Challan: PSID #: 146916470Documento1 paginaIncome Tax Payment Challan: PSID #: 146916470Madiah abcNessuna valutazione finora

- Form16.part A 630430Documento2 pagineForm16.part A 630430mohammadNessuna valutazione finora

- It 000095721007 2019 00Documento1 paginaIt 000095721007 2019 00Haroon ButtNessuna valutazione finora

- Kanya KarungalDocumento13 pagineKanya KarungalramNessuna valutazione finora

- Advance Sales Invoice-SI - 28128-27-Jan-2023 15 - 27 - 06 - 230128 - 103459Documento3 pagineAdvance Sales Invoice-SI - 28128-27-Jan-2023 15 - 27 - 06 - 230128 - 103459Vidyanti AnggraeniNessuna valutazione finora

- Narayan Motors Invoice - 566 - 02 - 02 - 2023Documento1 paginaNarayan Motors Invoice - 566 - 02 - 02 - 2023Saransh PalNessuna valutazione finora

- Marginal CostingDocumento42 pagineMarginal CostingAbdifatah SaidNessuna valutazione finora

- Lums Leveragingthestyloshoesexperience 130119101835 Phpapp01Documento20 pagineLums Leveragingthestyloshoesexperience 130119101835 Phpapp01Bushra UmarNessuna valutazione finora

- WalmartDocumento30 pagineWalmartNitin RawatNessuna valutazione finora

- Building and Sustaining Relationships in Retailing: Retail Management: A Strategic ApproachDocumento34 pagineBuilding and Sustaining Relationships in Retailing: Retail Management: A Strategic ApproachebustosfNessuna valutazione finora

- Resume 1Documento2 pagineResume 1api-298164137Nessuna valutazione finora

- Transforming Traditional Retailers for the New Retail EraDocumento27 pagineTransforming Traditional Retailers for the New Retail EraShyam KiranNessuna valutazione finora

- TPS of The Body ShopDocumento6 pagineTPS of The Body ShopAashi GargNessuna valutazione finora

- Trade Sales PromotionDocumento29 pagineTrade Sales PromotionashishNessuna valutazione finora

- Mission of Dell CompanyDocumento40 pagineMission of Dell Companyxyz skillNessuna valutazione finora

- Beginner's Guide to Understanding the Stock MarketDocumento7 pagineBeginner's Guide to Understanding the Stock MarketTaif KhanNessuna valutazione finora

- Brand Positioning - (WWW - Students3k.com)Documento86 pagineBrand Positioning - (WWW - Students3k.com)varun goel33% (3)

- Mercantile Bar Review Material 1Documento209 pagineMercantile Bar Review Material 1shintaronikoNessuna valutazione finora

- Sale of Land Agreement For ManiDocumento4 pagineSale of Land Agreement For Maniisaac setabiNessuna valutazione finora

- Business CommunicationDocumento49 pagineBusiness CommunicationGuruKPO100% (5)

- PHT and KooistraDocumento4 paginePHT and KooistraNilesh PrajapatiNessuna valutazione finora

- 157 Scra 648 (GR 72443) Cir vs. Air IndiaDocumento9 pagine157 Scra 648 (GR 72443) Cir vs. Air IndiaRuel FernandezNessuna valutazione finora

- Contract To SellDocumento3 pagineContract To SellTheodore0176Nessuna valutazione finora

- Chapter - 1 Marketing ManagementDocumento25 pagineChapter - 1 Marketing Managementciara WhiteNessuna valutazione finora

- JENJENDocumento5 pagineJENJENKim FloresNessuna valutazione finora

- Market Structure Original Unit 3Documento32 pagineMarket Structure Original Unit 3Priya SonuNessuna valutazione finora

- Japanese Apparel DistributionDocumento4 pagineJapanese Apparel Distributionsaumil parikh100% (1)

- Sales Process GuideDocumento2 pagineSales Process GuideHarsh Vijay Singh100% (1)

- SCL - I. Letters of CreditDocumento5 pagineSCL - I. Letters of CreditlealdeosaNessuna valutazione finora

- Answers Chapter 5 Quiz.s13Documento3 pagineAnswers Chapter 5 Quiz.s13Aurcus JumskieNessuna valutazione finora

- GEI Industrial Systems. CMP: Rs.138.20Documento6 pagineGEI Industrial Systems. CMP: Rs.138.20Sellappan MuthusamyNessuna valutazione finora

- FenderDocumento14 pagineFenderEdward PerkinsNessuna valutazione finora

- ErpcrmscmDocumento31 pagineErpcrmscmYogesh BansalNessuna valutazione finora

- Shoppers Drug Mart Analysis - ResubmitDocumento10 pagineShoppers Drug Mart Analysis - ResubmitPhannarat PhomphadungcheepNessuna valutazione finora

- Cocacola BrazilDocumento18 pagineCocacola BrazilPortnovaINessuna valutazione finora

- Strategic Analysis of TescoDocumento23 pagineStrategic Analysis of TescolokeshNessuna valutazione finora