Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Volatility of Bellwether Stocks Pre and Post Indian Budget

Caricato da

Sachin PatilDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Volatility of Bellwether Stocks Pre and Post Indian Budget

Caricato da

Sachin PatilCopyright:

Formati disponibili

A STUDY ON VOLATILITY OF BELLWETHER STOCKS WITH RESPECT TO PRE AND POST BUDGET SESSION

ANNEXURE

ACHARYA INSTITUTE OF TECHNOLOGY, BANGALORE

A STUDY ON VOLATILITY OF BELLWETHER STOCKS WITH RESPECT TO PRE AND POST BUDGET SESSION

INDIAN TOBACCO COMPANY LTD(ITC LTD)

Pre Budget

Date

1-Mar-12

2-Mar-12

3-Mar-12

5-Mar-12

6-Mar-12

7-Mar-12

9-Mar-12

12-Mar-12

13-Mar-12

14-Mar-12

15-Mar-12

PRICE

206.85

205.25

205

207

210.4

209.95

208.25

206.8

209.05

212.5

208.9

risk

2.35

variance

5.54

return

-0.773507

-0.121803

0.9756098

1.6425121

-0.213878

-0.809717

-0.696279

1.0880077

1.6503229

-1.694118

Post Budget

Date

16-Mar-12

19-Mar-12

20-Mar-12

21-Mar-12

22-Mar-12

23-Mar-12

26-Mar-12

27-Mar-12

28-Mar-12

29-Mar-12

30-Mar-12

close

216.15

220.5

223.6

223.85

219.7

222.45

222.7

226.05

226.8

224.55

226.9

risk

2.47

variance

6.10

return

2.012491

1.405896

0.111807

-1.85392

1.251707

0.112385

1.504266

0.331785

-0.99206

1.046538

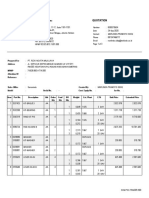

t-Test: Paired Two Sample for Mean

Mean

Variance

Observations

Pearson Correlation

Hypothesized Mean Difference

df

t Stat

P(T<=t) one-tail

t Critical one-tail

P(T<=t) two-tail

t Critical two-tail

Variable 1

0.104715132

1.346300781

10

-0.765487813

0

9

-0.552541859

0.297015995

1.833112923

0.59403199

2.262157158

ACHARYA INSTITUTE OF TECHNOLOGY, BANGALORE

Variable 2

0.49308903

1.45294939

10

correlation

-0.77

A STUDY ON VOLATILITY OF BELLWETHER STOCKS WITH RESPECT TO PRE AND POST BUDGET SESSION

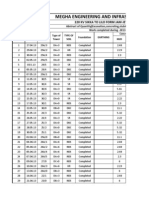

STATE BANK OF INDIA

Pre Budget

Date

1-Mar-12

2-Mar-12

3-Mar-12

5-Mar-12

6-Mar-12

7-Mar-12

9-Mar-12

12-Mar-12

13-Mar-12

14-Mar-12

15-Mar-12

close

2,218.75

2,246.70

2,250.85

2,176.05

2,147.85

2,141.55

2,226.40

2,310.80

2,327.50

2,354.80

2,299.30

risk

75.51

variance

5701.83

return

1.2597183

0.1847154

-3.323189

-1.295926

-0.293317

3.9620835

3.7908732

0.7226934

1.1729323

-2.356888

Post Budget

Date

16-Mar-12

19-Mar-12

20-Mar-12

21-Mar-12

22-Mar-12

23-Mar-12

26-Mar-12

27-Mar-12

28-Mar-12

29-Mar-12

30-Mar-12

close

2,227.90

2,157.55

2,187.35

2,232.85

2,160.60

2,166.75

2,117.45

2,129.15

2,079.25

2,061.35

2,096.35

risk

52.39

variance

2745.12

return

-3.15768

1.381196

2.080143

-3.23577

0.284643

-2.2753

0.552551

-2.34366

-0.86089

1.697916

t-Test: Paired Two Sample for Mean

Mean

Variance

Observations

Pearson Correlation

Hypothesized Mean Difference

df

t Stat

P(T<=t) one-tail

t Critical one-tail

P(T<=t) two-tail

t Critical two-tail

Variable 1

0.382369638

5.609976839

10

-0.409275045

0

9

0.825765344

0.215141034

1.833112923

0.430282067

2.262157158

ACHARYA INSTITUTE OF TECHNOLOGY, BANGALORE

Variable 2

-0.587685

4.21136096

10

correlation

-0.41

A STUDY ON VOLATILITY OF BELLWETHER STOCKS WITH RESPECT TO PRE AND POST BUDGET SESSION

TCS

Pre Budget

Date

1-Mar-12

2-Mar-12

3-Mar-12

5-Mar-12

6-Mar-12

7-Mar-12

9-Mar-12

12-Mar-12

13-Mar-12

14-Mar-12

15-Mar-12

close

1,219.60

1,217.25

1,218.40

1,207.30

1,202.00

1,192.85

1,208.55

1,189.05

1,197.00

1,154.55

1,163.70

risk

21.31

variance

454.04

return

-0.192686

0.0944753

-0.911031

-0.438996

-0.761231

1.3161755

-1.613504

0.668601

-3.546366

0.7925166

Post Budget

Date

16-Mar-12

19-Mar-12

20-Mar-12

21-Mar-12

22-Mar-12

23-Mar-12

26-Mar-12

27-Mar-12

28-Mar-12

29-Mar-12

30-Mar-12

close

1,169.55

1,122.00

1,134.85

1,175.75

1,167.75

1,184.65

1,161.60

1,174.75

1,165.10

1,141.20

risk

20.19

variance

407.56

return

correlation

0.04

-4.06567

1.145276

3.604001

-0.68042

1.447228

-1.94572

1.132059

-0.82145

-2.05133

2.418507

1,168.80

t-Test: Paired Two Sample for Mean

Mean

Variance

Observations

Pearson Correlation

Hypothesized Mean Difference

df

t Stat

P(T<=t) one-tail

t Critical one-tail

P(T<=t) two-tail

t Critical two-tail

Variable 1

-0.459204573

1.947451834

10

0.038957321

0

9

-0.564328311

0.293158681

1.833112923

0.586317362

2.262157158

ACHARYA INSTITUTE OF TECHNOLOGY, BANGALORE

Variable 2

0.01824876

5.46483492

10

A STUDY ON VOLATILITY OF BELLWETHER STOCKS WITH RESPECT TO PRE AND POST BUDGET SESSION

National Thermal Power corporation Limited

Pre Budget

Date

14-Feb-13

15-Feb-13

18-Feb-13

19-Feb-13

20-Feb-13

21-Feb-13

22-Feb-13

25-Feb-13

26-Feb-13

27-Feb-13

28-Feb-13

close

149.3

149.95

151.1

153.5

152.4

152

151.55

149.85

151

153.85

150.9

risk

1.35

variance

1.82

return

0.435365

0.7669223

1.5883521

-0.716612

-0.262467

-0.296053

-1.121742

0.7674341

1.8874172

-1.917452

Post Budget

Date

1-Mar-13

4-Mar-13

5-Mar-13

6-Mar-13

7-Mar-13

8-Mar-13

11-Mar-13

12-Mar-13

13-Mar-13

14-Mar-13

15-Mar-13

close

150.05

149.35

149.55

148.45

148.15

149.05

149.6

147.8

146.8

146.85

145.95

risk

1.29

variance

1.65

return

-0.46651

0.133914

-0.73554

-0.20209

0.607492

0.369004

-1.20321

-0.67659

0.03406

-0.61287

t-Test: Paired Two Sample for Mean

Mean

Variance

Observations

Pearson Correlation

Hypothesized Mean Difference

df

t Stat

P(T<=t) one-tail

t Critical one-tail

P(T<=t) two-tail

t Critical two-tail

Variable 1

0.113116448

1.436546383

10

0.162945032

0

9

0.991794228

0.173606111

1.833112923

0.347212222

2.262157158

ACHARYA INSTITUTE OF TECHNOLOGY, BANGALORE

Variable 2

-0.2752339

0.31637257

10

correlation

0.16

A STUDY ON VOLATILITY OF BELLWETHER STOCKS WITH RESPECT TO PRE AND POST BUDGET SESSION

STEEL AUTHORITY OF INDIA LIMITED (SAIL Ltd)

Pre Budget

Date

14-Feb-13

15-Feb-13

18-Feb-13

19-Feb-13

20-Feb-13

21-Feb-13

22-Feb-13

25-Feb-13

26-Feb-13

27-Feb-13

28-Feb-13

close

77.6

77.85

78

78.5

78.85

75.95

76.5

74.95

72.75

74.35

70.9

risk

2.63

variance

6.92

return

0.3221649

0.1926782

0.6410256

0.4458599

-3.677869

0.7241606

-2.026144

-2.93529

2.1993127

-4.640215

Post Budget

Date

1-Mar-13

4-Mar-13

5-Mar-13

6-Mar-13

7-Mar-13

8-Mar-13

11-Mar-13

12-Mar-13

13-Mar-13

14-Mar-13

15-Mar-13

close

71.6

68.2

69.5

70.45

69.1

70.35

70.45

70.9

70.9

70.55

68.75

risk

0.96

variance

0.92

return

-4.7486

1.906158

1.366906

-1.91625

1.808973

0.142146

0.638751

0

-0.49365

-2.55138

t-Test: Paired Two Sample for Mean

Mean

Variance

Observations

Pearson Correlation

Hypothesized Mean Difference

df

t Stat

P(T<=t) one-tail

t Critical one-tail

P(T<=t) two-tail

t Critical two-tail

Variable 1

-0.875431652

5.136411856

10

-0.036879623

0

9

-0.490398241

0.317792863

1.833112923

0.635585726

2.262157158

ACHARYA INSTITUTE OF TECHNOLOGY, BANGALORE

Variable 2

-0.3846956

4.52189521

10

correlation

-0.04

A STUDY ON VOLATILITY OF BELLWETHER STOCKS WITH RESPECT TO PRE AND POST BUDGET SESSION

Raymond Limited

Pre Budget

Date

14-Feb-13

15-Feb-13

18-Feb-13

19-Feb-13

20-Feb-13

21-Feb-13

22-Feb-13

25-Feb-13

26-Feb-13

27-Feb-13

28-Feb-13

close

341.65

341.5

349.6

356.4

358.6

343.65

337.75

338.3

333.15

329.15

311.15

risk

13.85

variance

191.95

return

-0.043905

2.3718887

1.9450801

0.617284

-4.168991

-1.716863

0.1628423

-1.522317

-1.20066

-5.468631

Post Budget

Date

1-Mar-13

4-Mar-13

5-Mar-13

6-Mar-13

7-Mar-13

8-Mar-13

11-Mar-13

12-Mar-13

13-Mar-13

14-Mar-13

15-Mar-13

close

317.05

310.85

321.2

325.55

321.1

321.1

321.2

320.4

313.05

309.3

299.3

risk

7.99

variance

63.86

return

-1.95553

3.32958

1.354296

-1.36692

0

0.031143

-0.24907

-2.29401

-1.19789

-3.23311

t-Test: Paired Two Sample for Mean

Mean

Variance

Observations

Pearson Correlation

Hypothesized Mean Difference

df

t Stat

P(T<=t) one-tail

t Critical one-tail

P(T<=t) two-tail

t Critical two-tail

Variable 1

-0.902427224

6.185332623

10

0.638675081

0

9

-0.561197257

0.294180709

1.833112923

0.588361418

2.262157158

ACHARYA INSTITUTE OF TECHNOLOGY, BANGALORE

Variable 2

-0.5581498

3.63454025

10

correlation

0.64

A STUDY ON VOLATILITY OF BELLWETHER STOCKS WITH RESPECT TO PRE AND POST BUDGET SESSION

TATA MOTORS

Pre Budget

Date

4-Feb-14

5-Feb-14

6-Feb-14

7-Feb-14

10-Feb-14

11-Feb-14

12-Feb-14

13-Feb-14

14-Feb-14

17-Feb-14

18-Feb-14

close

345.85

355.1

357.65

360.2

364.05

374.5

376.65

375.95

388.8

386.6

391.4

Risk

13.32

variance

177.48

return

2.6745699

0.7181076

0.7129876

1.0688506

2.8704848

0.5740988

-0.185849

3.4180077

-0.565844

1.2415934

Post Budget

Date

19-Feb-14

20-Feb-14

21-Feb-14

24-Feb-14

25-Feb-14

26-Feb-14

28-Feb-14

3-Mar-14

4-Mar-14

5-Mar-14

6-Mar-14

close

391.5

391.85

396.2

396.55

398.5

401.2

416.95

410.7

412.9

409.6

408.45

Risk

9.20

variance

84.64

return

0.0894

1.110119

0.088339

0.491741

0.677541

3.925723

-1.49898

0.535671

-0.79922

-0.28076

t-Test: Paired Two Sample for Mean

Mean

Variance

Observations

Pearson Correlation

Hypothesized Mean Difference

df

t Stat

P(T<=t) one-tail

t Critical one-tail

P(T<=t) two-tail

t Critical two-tail

Variable 1

1.252700783

1.752836143

10

0.151289136

0

9

1.434868091

0.092573785

1.833112923

0.18514757

2.262157158

ACHARYA INSTITUTE OF TECHNOLOGY, BANGALORE

Variable 2

0.43395659

2.08095791

10

correlation

0.15

A STUDY ON VOLATILITY OF BELLWETHER STOCKS WITH RESPECT TO PRE AND POST BUDGET SESSION

ASHOK LEYLAND LIMITED

Pre Budget

Date

4-Feb-14

5-Feb-14

6-Feb-14

7-Feb-14

10-Feb-14

11-Feb-14

12-Feb-14

13-Feb-14

14-Feb-14

17-Feb-14

18-Feb-14

close

16.45

16

15.95

16.1

15.65

15.7

15.6

15.5

15.6

15.35

15.35

risk

0.26

variance

0.07

return

-2.735562

-0.3125

0.9404389

-2.795031

0.3194888

-0.636943

-0.641026

0.6451613

-1.602564

0

Post Budget

Date

19-Feb-14

20-Feb-14

21-Feb-14

24-Feb-14

25-Feb-14

26-Feb-14

28-Feb-14

3-Mar-14

4-Mar-14

5-Mar-14

6-Mar-14

close

15.65

15.65

15.7

15.5

15.5

15.7

15.65

15.55

15.6

16.15

16

risk

0.21

variance

0.05

return

correlation

-0.26

0

0.319489

-1.27389

0

1.290323

-0.31847

-0.63898

0.321543

3.525641

-0.92879

t-Test: Paired Two Sample for Mean

Mean

Variance

Observations

Pearson Correlation

Hypothesized Mean Difference

df

t Stat

P(T<=t) one-tail

t Critical one-tail

P(T<=t) two-tail

t Critical two-tail

Variable 1

-0.68185368

1.725718289

10

-0.257135916

0

9

-1.3571884

0.103888735

1.833112923

0.207777471

2.262157158

ACHARYA INSTITUTE OF TECHNOLOGY, BANGALORE

Variable 2

0.22968689

1.86312617

10

A STUDY ON VOLATILITY OF BELLWETHER STOCKS WITH RESPECT TO PRE AND POST BUDGET SESSION

LARSEN & TOUBRO LIMITED

Pre Budget

Date

4-Feb-14

5-Feb-14

6-Feb-14

7-Feb-14

10-Feb-14

11-Feb-14

12-Feb-14

13-Feb-14

14-Feb-14

17-Feb-14

18-Feb-14

close

983

985.4

975.25

984.15

995.9

993.65

1,010.50

986.95

992.75

998.3

1,017.40

risk

12.54

variance

157.32

return

0.2441506

-1.030039

0.9125865

1.1939237

-0.225926

1.6957681

-2.330529

0.5876691

0.5590531

1.9132525

Post Budget

Date

19-Feb-14

20-Feb-14

21-Feb-14

24-Feb-14

25-Feb-14

26-Feb-14

28-Feb-14

3-Mar-14

4-Mar-14

5-Mar-14

6-Mar-14

close

1,031.30

1,034.65

1,055.15

1,084.65

1,087.90

1,096.65

1,109.65

1,097.55

1,116.70

1,123.35

1,142.50

risk

31.87

variance

1015.80

return

0.324833

1.981346

2.795811

0.299636

0.804302

1.185428

-1.09043

1.744795

0.595505

1.704722

t-Test: Paired Two Sample for Mean

Mean

Variance

Observations

Pearson Correlation

Hypothesized Mean Difference

df

t Stat

P(T<=t) one-tail

t Critical one-tail

P(T<=t) two-tail

t Critical two-tail

Variable 1

0.351990934

1.646261222

10

0.498144885

0

9

-1.795691893

0.053055779

1.833112923

0.106111559

2.262157158

ACHARYA INSTITUTE OF TECHNOLOGY, BANGALORE

Variable 2

1.03459445

1.19777073

10

correlation

0.50

Potrebbero piacerti anche

- Stock Reco 23042020 OgDocumento5 pagineStock Reco 23042020 OgManmohan TiwariNessuna valutazione finora

- Correlation RealDocumento2 pagineCorrelation RealSonal Bandaware18Nessuna valutazione finora

- INTRUDING BULL's Stock Tracker - Recommended StocksDocumento1 paginaINTRUDING BULL's Stock Tracker - Recommended StocksYash SakpalNessuna valutazione finora

- bs1000-2015 04Documento4 paginebs1000-2015 04premalgandhi10Nessuna valutazione finora

- A1 Office 1690697977931Documento1 paginaA1 Office 1690697977931Tax IndiaNessuna valutazione finora

- Budget Line Date Voucher No Net Original Amount Budget Line Budget NoDocumento20 pagineBudget Line Date Voucher No Net Original Amount Budget Line Budget NoRajeh AliNessuna valutazione finora

- Laboratory Test Results: RemarkDocumento31 pagineLaboratory Test Results: RemarkTewodros TadesseNessuna valutazione finora

- 18marh ReportsDocumento5 pagine18marh ReportsSunil JoshiNessuna valutazione finora

- Project Shubham HistoricalDataDocumento111 pagineProject Shubham HistoricalDataArbaz MalikNessuna valutazione finora

- CIMB Commodities Daily Briefing 20130205Documento6 pagineCIMB Commodities Daily Briefing 20130205r3iherNessuna valutazione finora

- WorkingDocumento5 pagineWorkingsugunec2013Nessuna valutazione finora

- Res EschDocumento3 pagineRes EschAbhishek gwariNessuna valutazione finora

- 03K065 Portfolio Date WiseDocumento2 pagine03K065 Portfolio Date Wisef20213093Nessuna valutazione finora

- Account Statement: For The Period of 22-Dec-2019 To 21-Dec-2020Documento13 pagineAccount Statement: For The Period of 22-Dec-2019 To 21-Dec-2020Khan AfghanNessuna valutazione finora

- Ar-Due To Guards-Smc Global Power: Security Masters Investigation, IncDocumento6 pagineAr-Due To Guards-Smc Global Power: Security Masters Investigation, IncRicardo DelacruzNessuna valutazione finora

- Capital Gains - Stocks-GrowwDocumento11 pagineCapital Gains - Stocks-Growwriyagupta10122000Nessuna valutazione finora

- Procedure Now Available To Test The Position Sensor of A Hydraulic Cylinder (1439, 7562)Documento2 pagineProcedure Now Available To Test The Position Sensor of A Hydraulic Cylinder (1439, 7562)Odai AlsaafinNessuna valutazione finora

- CIMFR Uploading TemplateDocumento27 pagineCIMFR Uploading Templaterabindra lalNessuna valutazione finora

- UGSS Progress Report - MSCL - 26.01.23Documento6 pagineUGSS Progress Report - MSCL - 26.01.23saravananNessuna valutazione finora

- Megha Engineering and Infrastructure - LTD: 220 KV Sikka To Lilo Form Jam-Jetpur LineDocumento4 pagineMegha Engineering and Infrastructure - LTD: 220 KV Sikka To Lilo Form Jam-Jetpur LineKatukuri RaviNessuna valutazione finora

- AIM Factsheet: January 2015Documento33 pagineAIM Factsheet: January 2015ThoreauNessuna valutazione finora

- Capstone Project - 2 DeepakDocumento4 pagineCapstone Project - 2 DeepakVivek DaultaNessuna valutazione finora

- Balajikrupa Projects PVT LTD Project: Date: Petrol & DieselDocumento52 pagineBalajikrupa Projects PVT LTD Project: Date: Petrol & Dieselyashas sNessuna valutazione finora

- PatroDocumento17 paginePatroDr. MSNessuna valutazione finora

- Post Audit On CV (Dec 2022) - OjtDocumento43 paginePost Audit On CV (Dec 2022) - OjtSHEENANessuna valutazione finora

- M/S. K J S Cement Limited, Maihar: 6000 TPD Greenfield Cement Plant Summary of Audit Statement For Aditi EngineeringDocumento1 paginaM/S. K J S Cement Limited, Maihar: 6000 TPD Greenfield Cement Plant Summary of Audit Statement For Aditi Engineeringvinod_eicsNessuna valutazione finora

- Cheque ListDocumento8 pagineCheque ListArsalan Feroz KhanNessuna valutazione finora

- Faktur Sep 22Documento6 pagineFaktur Sep 22jamjamNessuna valutazione finora

- 26071-100-V20A-000-00007 - 004 - Piling Test (PDA, PIT, Static Load Test Dan VMT) Procedure by Third PartyDocumento118 pagine26071-100-V20A-000-00007 - 004 - Piling Test (PDA, PIT, Static Load Test Dan VMT) Procedure by Third Partycrystian NapitupuluNessuna valutazione finora

- 10 - Two Week Look AheadDocumento21 pagine10 - Two Week Look AheadErickson MalicsiNessuna valutazione finora

- ACADEMIC CALENDAR 2023 SCHEDULE ACTIVITIES BKI ACADEMYDocumento1 paginaACADEMIC CALENDAR 2023 SCHEDULE ACTIVITIES BKI ACADEMYDolok Joko KenconoNessuna valutazione finora

- Combined Admin Approval On AWPs 2020-21Documento55 pagineCombined Admin Approval On AWPs 2020-21kartikNessuna valutazione finora

- Topic: Exhaust Fan InstallationDocumento4 pagineTopic: Exhaust Fan InstallationAsad Laab DinNessuna valutazione finora

- Mar. PurchasesDocumento8 pagineMar. PurchasesNicolee Rein AndayaNessuna valutazione finora

- Abhishek Enterprises sales and commission details by monthDocumento1 paginaAbhishek Enterprises sales and commission details by monthabhishekNessuna valutazione finora

- Unlisted Companies Market PricesDocumento1 paginaUnlisted Companies Market PricesSiddharth Rai SuranaNessuna valutazione finora

- July billing and payment recordsDocumento10 pagineJuly billing and payment recordsIsaiah L ArrietaNessuna valutazione finora

- Indmoney AnnualPnlReport 6YJ2396RYZ 11 Sep 2023Documento2 pagineIndmoney AnnualPnlReport 6YJ2396RYZ 11 Sep 2023latest updateNessuna valutazione finora

- L&T Geostructure Outstanding Statement Flood Protection WorksDocumento1 paginaL&T Geostructure Outstanding Statement Flood Protection Workskartick sanatiNessuna valutazione finora

- S18974 - SITRAIN Apr-Jun 23 CalendarDocumento4 pagineS18974 - SITRAIN Apr-Jun 23 Calendarkrishna kumarNessuna valutazione finora

- Case Solution VegetronDocumento9 pagineCase Solution VegetrondhirarboyNessuna valutazione finora

- MacBook battery recall approval sheetDocumento256 pagineMacBook battery recall approval sheetRajmaniNessuna valutazione finora

- WindDocumento15 pagineWindrohanZorbaNessuna valutazione finora

- John Neff 09 Mar 2023 1719Documento5 pagineJohn Neff 09 Mar 2023 1719minjutNessuna valutazione finora

- My TradesDocumento4 pagineMy TradesAnsh KaushikNessuna valutazione finora

- CMP Daily 08282022 33661211Documento2 pagineCMP Daily 08282022 33661211Ibrahim MorshedyNessuna valutazione finora

- CMP Daily 08142022 33511489Documento2 pagineCMP Daily 08142022 33511489Ibrahim MorshedyNessuna valutazione finora

- View Account Statement Under 40 CharactersDocumento4 pagineView Account Statement Under 40 CharactersIJeoma KellyNessuna valutazione finora

- BSE Traded Stocks 03.09.2021fullDocumento308 pagineBSE Traded Stocks 03.09.2021fullM StagsNessuna valutazione finora

- Topic: Refrigerant Piping Support InstallationDocumento4 pagineTopic: Refrigerant Piping Support InstallationAsad Laab DinNessuna valutazione finora

- PT Trakindo Utama Quotation for PT Rizki Novita Maju JayaDocumento3 paginePT Trakindo Utama Quotation for PT Rizki Novita Maju JayaHuda HudaNessuna valutazione finora

- 2024 Zesa NTC Approved Training CalendersDocumento8 pagine2024 Zesa NTC Approved Training CalendershumphreyneketeNessuna valutazione finora

- Walter Schloss 09 Mar 2023 1717Documento6 pagineWalter Schloss 09 Mar 2023 1717minjutNessuna valutazione finora

- Tax 2223Documento16 pagineTax 2223ravi lingamNessuna valutazione finora

- Financial transaction report summaryDocumento1 paginaFinancial transaction report summaryMuhd RabbaniNessuna valutazione finora

- Transactions and Values by Price RangeDocumento25 pagineTransactions and Values by Price RangeRock Bro Rock BroNessuna valutazione finora

- Datetime Tunal Pm10 Co So2 Vel Viento Dir Viento Temp - 4M Precipitaci NoDocumento2 pagineDatetime Tunal Pm10 Co So2 Vel Viento Dir Viento Temp - 4M Precipitaci Nocristian jose lopez gallegoNessuna valutazione finora

- Abhishek Enterprise Sales & Commn STTMDocumento2 pagineAbhishek Enterprise Sales & Commn STTMabhishekNessuna valutazione finora

- UAE Stock Market Returns and Correlations 2007Documento37 pagineUAE Stock Market Returns and Correlations 2007Farah Farah Essam Abbas HamisaNessuna valutazione finora

- Asia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsDa EverandAsia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsNessuna valutazione finora

- User ManagementDocumento14 pagineUser ManagementSachin PatilNessuna valutazione finora

- CCN4 - Wired Lans EthernetDocumento20 pagineCCN4 - Wired Lans EthernetSachin PatilNessuna valutazione finora

- Anatomy of SSSD User LookupDocumento4 pagineAnatomy of SSSD User LookupSachin PatilNessuna valutazione finora

- Vindya Info-Tech Process UsersDocumento1 paginaVindya Info-Tech Process UsersSachin PatilNessuna valutazione finora

- CCN Notes For Unit 1. VTU Students. Prof - Suresha VDocumento38 pagineCCN Notes For Unit 1. VTU Students. Prof - Suresha VSuresha V Sathegala85% (13)

- Internet of Things in Industries A SurveyDocumento7 pagineInternet of Things in Industries A SurveySachin PatilNessuna valutazione finora

- Fpga ProjectsDocumento5 pagineFpga ProjectsSachin PatilNessuna valutazione finora

- Digital Switching SystemsDocumento174 pagineDigital Switching SystemsOmar Hellel100% (1)

- A+,N+ Interview QuestionDocumento15 pagineA+,N+ Interview QuestionSachin PatilNessuna valutazione finora

- YEARDocumento12 pagineYEARPradeep K ChaharNessuna valutazione finora

- Intelligent Device To Device CommunicationDocumento7 pagineIntelligent Device To Device CommunicationSachin Patil100% (2)

- Analog LinksDocumento18 pagineAnalog LinksAshok GudivadaNessuna valutazione finora

- A Smart Sensor Interface For Industrial Monitoring Using ARMDocumento46 pagineA Smart Sensor Interface For Industrial Monitoring Using ARMSachin PatilNessuna valutazione finora

- Internet of Things in Industries: A Survey: Li Da Xu (Senior Member, IEEE), Wu He, Shancang LiDocumento11 pagineInternet of Things in Industries: A Survey: Li Da Xu (Senior Member, IEEE), Wu He, Shancang LiSachin PatilNessuna valutazione finora

- Ni2013 Development of Labview Based Gesture Driven Robotic ArmDocumento4 pagineNi2013 Development of Labview Based Gesture Driven Robotic ArmSachin PatilNessuna valutazione finora

- Vlsi CollegeDocumento45 pagineVlsi CollegeSachin PatilNessuna valutazione finora

- C11 Principles and Practice of InsuranceDocumento9 pagineC11 Principles and Practice of InsuranceAnonymous y3E7ia100% (2)

- Rites of RtoDocumento74 pagineRites of RtoSachin Patil100% (1)

- Sujapur MaldaDocumento2 pagineSujapur Maldarajikul islamNessuna valutazione finora

- Program for System Calls of Unix Operating SystemsDocumento7 pagineProgram for System Calls of Unix Operating SystemsdevasenapathyNessuna valutazione finora

- Website Publication For Asst CPDocumento6 pagineWebsite Publication For Asst CPKavya M BhatNessuna valutazione finora

- Automatic Drunken Drive Avoiding System For LesDocumento99 pagineAutomatic Drunken Drive Avoiding System For LesBasi Shyam100% (1)

- Sensorless BLDCControl S08 MP16Documento52 pagineSensorless BLDCControl S08 MP16Sachin PatilNessuna valutazione finora

- 2 Nalina KB 3083 Research Article VSRDIJBMR March 2014Documento8 pagine2 Nalina KB 3083 Research Article VSRDIJBMR March 2014Sachin PatilNessuna valutazione finora

- Synopsis SwetaGoelDocumento36 pagineSynopsis SwetaGoelLokesh JainNessuna valutazione finora

- Automatic Drunken Drive Avoiding System For LesDocumento99 pagineAutomatic Drunken Drive Avoiding System For LesBasi Shyam100% (1)

- MentorDocumento22 pagineMentoriC60Nessuna valutazione finora

- Field Theory 2Documento43 pagineField Theory 2Sachin PatilNessuna valutazione finora

- IC33 Sample QuestionsDocumento13 pagineIC33 Sample QuestionsKamleshwar SinghNessuna valutazione finora

- Controlled RectifiersDocumento60 pagineControlled RectifiersSachin PatilNessuna valutazione finora

- Watch Our Demo Class on Data Science & Machine LearningDocumento15 pagineWatch Our Demo Class on Data Science & Machine LearningMafuz HossainNessuna valutazione finora

- R Commander PaperDocumento42 pagineR Commander PapermoosavyNessuna valutazione finora

- Risks Faced by Auto Mechanics at Repair CentresDocumento12 pagineRisks Faced by Auto Mechanics at Repair CentressajinNessuna valutazione finora

- Taro Paper Bags as Eco-Friendly AlternativeDocumento9 pagineTaro Paper Bags as Eco-Friendly AlternativeJoule Cheval Talco Passi100% (5)

- Two-Sample Tests of Hypothesis: Mcgraw-Hill/IrwinDocumento14 pagineTwo-Sample Tests of Hypothesis: Mcgraw-Hill/Irwinmaanka aliNessuna valutazione finora

- Relationship Between Parental Attachment and Autonomy Among AdolescentsDocumento38 pagineRelationship Between Parental Attachment and Autonomy Among AdolescentsPhoebe Bart100% (1)

- 0.018 Versus 0.022 SlotDocumento5 pagine0.018 Versus 0.022 Slotruchi jha100% (1)

- Critical Appraisal Module - MRCpsychDocumento14 pagineCritical Appraisal Module - MRCpsychimperiallightNessuna valutazione finora

- Nonparametric TestDocumento54 pagineNonparametric TestRajesh Dwivedi0% (1)

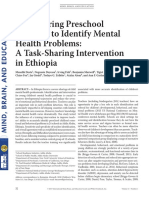

- (2017) Empowering Preschool Teachers To Identify Mental Health Problems A Task-Sharing Intervention in EthiopiaDocumento11 pagine(2017) Empowering Preschool Teachers To Identify Mental Health Problems A Task-Sharing Intervention in EthiopiaJulián A. RamírezNessuna valutazione finora

- Repeated Measures ANOVADocumento41 pagineRepeated Measures ANOVANilaamChowNessuna valutazione finora

- Dessertation PPT ShubhangiDocumento15 pagineDessertation PPT ShubhangiShubhangi SaxenaNessuna valutazione finora

- ASTM G 16 - 95 r99 - Rze2ltk1ujk5rteDocumento14 pagineASTM G 16 - 95 r99 - Rze2ltk1ujk5rteCordova RaphaelNessuna valutazione finora

- SPSS AnalysisDocumento12 pagineSPSS AnalysisNolram LeuqarNessuna valutazione finora

- Adhesive Strength of Pitch Glue Group 4Documento13 pagineAdhesive Strength of Pitch Glue Group 4Annalie LobianoNessuna valutazione finora

- Individual Homework #3 Design of Experiment AnalysisDocumento6 pagineIndividual Homework #3 Design of Experiment AnalysisstudycamNessuna valutazione finora

- Gender & Caste Differences in Students' Physical Activity AttitudesDocumento6 pagineGender & Caste Differences in Students' Physical Activity Attitudesidumely2012Nessuna valutazione finora

- Regional Spending AnalysisDocumento16 pagineRegional Spending AnalysisRanadip GuhaNessuna valutazione finora

- The Sign TestDocumento12 pagineThe Sign TestRumaisyahNessuna valutazione finora

- Improving The Multiplication Skills Using Egg Carton MathDocumento3 pagineImproving The Multiplication Skills Using Egg Carton MathCorong RoemarNessuna valutazione finora

- Inference - Exampls and Calculator GuideDocumento6 pagineInference - Exampls and Calculator GuideMadalyn StisherNessuna valutazione finora

- Getting+Started+ +Sample+SessionDocumento157 pagineGetting+Started+ +Sample+SessionappniNessuna valutazione finora

- Introduction to Quantitative Research MethodsDocumento74 pagineIntroduction to Quantitative Research MethodsSaranya SekharNessuna valutazione finora

- Ahmad R. Nasr, Asghar Soltani K. - 2011 - Attitude Towards Biology and Its Effects On Student's AchievementDocumento5 pagineAhmad R. Nasr, Asghar Soltani K. - 2011 - Attitude Towards Biology and Its Effects On Student's AchievementRaidah AdhamNessuna valutazione finora

- Ej 1079521Documento15 pagineEj 1079521Jhoanna Castro-CusipagNessuna valutazione finora

- Cleanroom Surface ContaminationDocumento4 pagineCleanroom Surface ContaminationTim SandleNessuna valutazione finora

- GB MockexamDocumento24 pagineGB MockexamAnonymous 7K9pzvziNessuna valutazione finora

- Data Analyst Interview Questions and AnswersDocumento118 pagineData Analyst Interview Questions and Answerssamuel100% (1)

- Sociology 2020 Final Exam - W19 (Answers)Documento11 pagineSociology 2020 Final Exam - W19 (Answers)samiaNessuna valutazione finora

- Non Parametric GuideDocumento5 pagineNon Parametric GuideEnrico_LariosNessuna valutazione finora