Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

CFTC Commitments of Traders Report - CME (Futures Only) 06082013

Caricato da

Md YusofDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

CFTC Commitments of Traders Report - CME (Futures Only) 06082013

Caricato da

Md YusofCopyright:

Formati disponibili

11/08/2013

CFTC Commitments of Traders Report - CME (Futures Only)

BUTTER (CASH SETTLED) - CHICAGO MERCANTILE EXCHANGE

Code-050642

FUTURES ONLY POSITIONS AS OF 08/06/13

|

--------------------------------------------------------------| NONREPORTABLE

NON-COMMERCIAL

| COMMERCIAL

|

TOTAL

| POSITIONS

--------------------------|-----------------|-----------------|----------------LONG | SHORT |SPREADS | LONG | SHORT | LONG | SHORT | LONG | SHORT

-------------------------------------------------------------------------------(CONTRACTS OF 20,000 POUNDS)

OPEN INTEREST:

5,200

COMMITMENTS

956

627

17

3,792

4,294

4,765

4,938

435

262

CHANGES FROM 07/30/13 (CHANGE IN OPEN INTEREST:

-758)

-181

-32

-63

-469

-671

-713

-766

-45

PERCENT OF OPEN INTEREST FOR EACH CATEGORY OF TRADERS

18.4

12.1

0.3

72.9

82.6

91.6

95.0

8.4

5.0

NUMBER OF TRADERS IN EACH CATEGORY (TOTAL TRADERS:

6

2

3

17

10

24

30)

14

MILK, Class III - CHICAGO MERCANTILE EXCHANGE

Code-052641

FUTURES ONLY POSITIONS AS OF 08/06/13

|

--------------------------------------------------------------| NONREPORTABLE

NON-COMMERCIAL

| COMMERCIAL

|

TOTAL

| POSITIONS

--------------------------|-----------------|-----------------|----------------LONG | SHORT |SPREADS | LONG | SHORT | LONG | SHORT | LONG | SHORT

-------------------------------------------------------------------------------(CONTRACTS OF 200,000 POUNDS)

OPEN INTEREST:

21,861

COMMITMENTS

4,456

5,194

1,259 13,409 11,065 19,124 17,518

2,737

4,343

CHANGES FROM 07/30/13 (CHANGE IN OPEN INTEREST:

-1,856)

-93

148

-438 -1,162 -1,497 -1,693 -1,787

-163

-69

PERCENT OF OPEN INTEREST FOR EACH CATEGORY OF TRADERS

20.4

23.8

5.8

61.3

50.6

87.5

80.1

12.5

19.9

NUMBER OF TRADERS IN EACH CATEGORY (TOTAL TRADERS:

19

20

15

23

22

49

74)

51

LEAN HOGS - CHICAGO MERCANTILE EXCHANGE

Code-054642

FUTURES ONLY POSITIONS AS OF 08/06/13

|

--------------------------------------------------------------| NONREPORTABLE

NON-COMMERCIAL

| COMMERCIAL

|

TOTAL

| POSITIONS

--------------------------|-----------------|-----------------|----------------LONG | SHORT |SPREADS | LONG | SHORT | LONG | SHORT | LONG | SHORT

-------------------------------------------------------------------------------(CONTRACTS OF 40,000 POUNDS)

OPEN INTEREST:

308,708

COMMITMENTS

120,324 51,972 53,453 100,914 156,451 274,691 261,876 34,017 46,832

CHANGES FROM 07/30/13 (CHANGE IN OPEN INTEREST:

7,333)

4,814

-455

1,914 -1,439

5,459

5,289

6,918

PERCENT OF OPEN INTEREST FOR EACH CATEGORY OF TRADERS

39.0

16.8

17.3

32.7

50.7

89.0

www.cftc.gov/dea/futures/deacmesf.htm

84.8

2,044

415

11.0

15.2

1/10

11/08/2013

CFTC Commitments of Traders Report - CME (Futures Only)

NUMBER OF TRADERS IN EACH CATEGORY (TOTAL TRADERS:

132

75

120

88

114

291

365)

265

LIVE CATTLE - CHICAGO MERCANTILE EXCHANGE

Code-057642

FUTURES ONLY POSITIONS AS OF 08/06/13

|

--------------------------------------------------------------| NONREPORTABLE

NON-COMMERCIAL

| COMMERCIAL

|

TOTAL

| POSITIONS

--------------------------|-----------------|-----------------|----------------LONG | SHORT |SPREADS | LONG | SHORT | LONG | SHORT | LONG | SHORT

-------------------------------------------------------------------------------(CONTRACTS OF 40,000 POUNDS)

OPEN INTEREST:

279,718

COMMITMENTS

88,626 78,186 30,338 127,410 133,081 246,374 241,605 33,344 38,113

CHANGES FROM 07/30/13 (CHANGE IN OPEN INTEREST:

-3,767)

-3,574

-223 -2,624

981

-617 -5,217 -3,464

PERCENT OF OPEN INTEREST FOR EACH CATEGORY OF TRADERS

31.7

28.0

10.8

45.5

47.6

88.1

86.4

NUMBER OF TRADERS IN EACH CATEGORY (TOTAL TRADERS:

77

107

76

114

136

236

375)

286

1,450

-303

11.9

13.6

RANDOM LENGTH LUMBER - CHICAGO MERCANTILE EXCHANGE

Code-058643

FUTURES ONLY POSITIONS AS OF 08/06/13

|

--------------------------------------------------------------| NONREPORTABLE

NON-COMMERCIAL

| COMMERCIAL

|

TOTAL

| POSITIONS

--------------------------|-----------------|-----------------|----------------LONG | SHORT |SPREADS | LONG | SHORT | LONG | SHORT | LONG | SHORT

-------------------------------------------------------------------------------(CONTRACTS OF 110,000 BOARD FEET)

OPEN INTEREST:

5,945

COMMITMENTS

2,131

2,146

662

2,190

1,541

4,983

4,349

962

1,596

CHANGES FROM 07/30/13 (CHANGE IN OPEN INTEREST:

-48

215

213

152

-393

241)

317

35

-76

206

PERCENT OF OPEN INTEREST FOR EACH CATEGORY OF TRADERS

35.8

36.1

11.1

36.8

25.9

83.8

73.2

16.2

26.8

NUMBER OF TRADERS IN EACH CATEGORY (TOTAL TRADERS:

21

23

11

18

19

48

74)

47

FEEDER CATTLE - CHICAGO MERCANTILE EXCHANGE

Code-061641

FUTURES ONLY POSITIONS AS OF 08/06/13

|

--------------------------------------------------------------| NONREPORTABLE

NON-COMMERCIAL

| COMMERCIAL

|

TOTAL

| POSITIONS

--------------------------|-----------------|-----------------|----------------LONG | SHORT |SPREADS | LONG | SHORT | LONG | SHORT | LONG | SHORT

-------------------------------------------------------------------------------(CONTRACTS OF 50,000 POUNDS)

OPEN INTEREST:

35,317

COMMITMENTS

9,079

6,856

5,455 11,672

7,919 26,206 20,230

9,111 15,087

CHANGES FROM 07/30/13 (CHANGE IN OPEN INTEREST:

387

-762

183

111

377

www.cftc.gov/dea/futures/deacmesf.htm

1,075)

681

-202

394

1,277

2/10

11/08/2013

CFTC Commitments of Traders Report - CME (Futures Only)

PERCENT OF OPEN INTEREST FOR EACH CATEGORY OF TRADERS

25.7

19.4

15.4

33.0

22.4

74.2

57.3

NUMBER OF TRADERS IN EACH CATEGORY (TOTAL TRADERS:

37

42

39

51

66

114

173)

128

25.8

42.7

CHEESE (CASH-SETTLED) - CHICAGO MERCANTILE EXCHANGE

Code-063642

FUTURES ONLY POSITIONS AS OF 08/06/13

|

--------------------------------------------------------------| NONREPORTABLE

NON-COMMERCIAL

| COMMERCIAL

|

TOTAL

| POSITIONS

--------------------------|-----------------|-----------------|----------------LONG | SHORT |SPREADS | LONG | SHORT | LONG | SHORT | LONG | SHORT

-------------------------------------------------------------------------------(CONTRACTS OF 20,000 POUNDS)

OPEN INTEREST:

7,539

COMMITMENTS

2,234

2,610

414

4,190

4,490

6,838

7,514

701

25

CHANGES FROM 07/30/13 (CHANGE IN OPEN INTEREST:

25

129

-141

83

101

-14)

-33

89

19

-103

PERCENT OF OPEN INTEREST FOR EACH CATEGORY OF TRADERS

29.6

34.6

5.5

55.6

59.6

90.7

99.7

9.3

0.3

NUMBER OF TRADERS IN EACH CATEGORY (TOTAL TRADERS:

11

5

6

14

12

28

36)

20

RUSSIAN RUBLE - CHICAGO MERCANTILE EXCHANGE

Code-089741

FUTURES ONLY POSITIONS AS OF 08/06/13

|

--------------------------------------------------------------| NONREPORTABLE

NON-COMMERCIAL

| COMMERCIAL

|

TOTAL

| POSITIONS

--------------------------|-----------------|-----------------|----------------LONG | SHORT |SPREADS | LONG | SHORT | LONG | SHORT | LONG | SHORT

-------------------------------------------------------------------------------(CONTRACTS OF RUB 2,500,000)

OPEN INTEREST:

42,869

COMMITMENTS

6,727

6,302

2,252 33,574 33,758 42,553 42,312

316

557

CHANGES FROM 07/30/13 (CHANGE IN OPEN INTEREST:

-296

-124

0

268

117

-30)

-28

-7

-2

-23

PERCENT OF OPEN INTEREST FOR EACH CATEGORY OF TRADERS

15.7

14.7

5.3

78.3

78.7

99.3

98.7

0.7

1.3

NUMBER OF TRADERS IN EACH CATEGORY (TOTAL TRADERS:

5

2

2

12

18

17

25)

22

CANADIAN DOLLAR - CHICAGO MERCANTILE EXCHANGE

Code-090741

FUTURES ONLY POSITIONS AS OF 08/06/13

|

--------------------------------------------------------------| NONREPORTABLE

NON-COMMERCIAL

| COMMERCIAL

|

TOTAL

| POSITIONS

--------------------------|-----------------|-----------------|----------------LONG | SHORT |SPREADS | LONG | SHORT | LONG | SHORT | LONG | SHORT

-------------------------------------------------------------------------------(CONTRACTS OF CAD 100,000)

OPEN INTEREST:

106,787

COMMITMENTS

22,629 33,065

1,528 62,191 41,327 86,348 75,920 20,439 30,867

CHANGES FROM 07/30/13 (CHANGE IN OPEN INTEREST:

www.cftc.gov/dea/futures/deacmesf.htm

-4,218)

3/10

11/08/2013

1,900

CFTC Commitments of Traders Report - CME (Futures Only)

902

-1,434

-4,353

-2,835

-3,887

-3,367

-331

-851

PERCENT OF OPEN INTEREST FOR EACH CATEGORY OF TRADERS

21.2

31.0

1.4

58.2

38.7

80.9

71.1

19.1

28.9

NUMBER OF TRADERS IN EACH CATEGORY (TOTAL TRADERS:

23

27

8

22

22

47

85)

55

SWISS FRANC - CHICAGO MERCANTILE EXCHANGE

Code-092741

FUTURES ONLY POSITIONS AS OF 08/06/13

|

--------------------------------------------------------------| NONREPORTABLE

NON-COMMERCIAL

| COMMERCIAL

|

TOTAL

| POSITIONS

--------------------------|-----------------|-----------------|----------------LONG | SHORT |SPREADS | LONG | SHORT | LONG | SHORT | LONG | SHORT

-------------------------------------------------------------------------------(CONTRACTS OF CHF 125,000)

OPEN INTEREST:

34,942

COMMITMENTS

8,756

9,081

482 14,831 14,150 24,069 23,713 10,873 11,229

CHANGES FROM 07/30/13 (CHANGE IN OPEN INTEREST:

843)

-775 -1,711

161

253

3,353

-361

1,803

PERCENT OF OPEN INTEREST FOR EACH CATEGORY OF TRADERS

25.1

26.0

1.4

42.4

40.5

68.9

67.9

NUMBER OF TRADERS IN EACH CATEGORY (TOTAL TRADERS:

12

8

4

9

10

22

37)

21

1,204

-960

31.1

32.1

MEXICAN PESO - CHICAGO MERCANTILE EXCHANGE

Code-095741

FUTURES ONLY POSITIONS AS OF 08/06/13

|

--------------------------------------------------------------| NONREPORTABLE

NON-COMMERCIAL

| COMMERCIAL

|

TOTAL

| POSITIONS

--------------------------|-----------------|-----------------|----------------LONG | SHORT |SPREADS | LONG | SHORT | LONG | SHORT | LONG | SHORT

-------------------------------------------------------------------------------(CONTRACTS OF MXN 500,000)

OPEN INTEREST:

94,275

COMMITMENTS

62,230 30,105

800 24,726 61,630 87,756 92,535

6,519

1,740

CHANGES FROM 07/30/13 (CHANGE IN OPEN INTEREST:

-2,860)

1,181 -6,056

305 -3,555

2,861 -2,069 -2,890

PERCENT OF OPEN INTEREST FOR EACH CATEGORY OF TRADERS

66.0

31.9

0.8

26.2

65.4

93.1

98.2

NUMBER OF TRADERS IN EACH CATEGORY (TOTAL TRADERS:

47

19

5

14

20

62

97)

43

-791

30

6.9

1.8

BRITISH POUND STERLING - CHICAGO MERCANTILE EXCHANGE

Code-096742

FUTURES ONLY POSITIONS AS OF 08/06/13

|

--------------------------------------------------------------| NONREPORTABLE

NON-COMMERCIAL

| COMMERCIAL

|

TOTAL

| POSITIONS

--------------------------|-----------------|-----------------|----------------LONG | SHORT |SPREADS | LONG | SHORT | LONG | SHORT | LONG | SHORT

-------------------------------------------------------------------------------(CONTRACTS OF GBP 62,500)

OPEN INTEREST:

145,387

COMMITMENTS

22,097 68,130

2,929 101,039 44,843 126,065 115,902 19,322 29,485

www.cftc.gov/dea/futures/deacmesf.htm

4/10

11/08/2013

CFTC Commitments of Traders Report - CME (Futures Only)

CHANGES FROM 07/30/13 (CHANGE IN OPEN INTEREST:

-948)

1,942 -1,488

-108 -5,118

1,056 -3,284

-540

PERCENT OF OPEN INTEREST FOR EACH CATEGORY OF TRADERS

15.2

46.9

2.0

69.5

30.8

86.7

79.7

NUMBER OF TRADERS IN EACH CATEGORY (TOTAL TRADERS:

25

38

8

28

32

56

112)

75

2,336

-408

13.3

20.3

JAPANESE YEN - CHICAGO MERCANTILE EXCHANGE

Code-097741

FUTURES ONLY POSITIONS AS OF 08/06/13

|

--------------------------------------------------------------| NONREPORTABLE

NON-COMMERCIAL

| COMMERCIAL

|

TOTAL

| POSITIONS

--------------------------|-----------------|-----------------|----------------LONG | SHORT |SPREADS | LONG | SHORT | LONG | SHORT | LONG | SHORT

-------------------------------------------------------------------------------(CONTRACTS OF JPY 12,500,000)

OPEN INTEREST:

172,059

COMMITMENTS

19,421 99,634

2,709 134,398 26,560 156,528 128,903 15,531 43,156

CHANGES FROM 07/30/13 (CHANGE IN OPEN INTEREST:

-2,813)

1,205

-717

381 -3,190 -3,031 -1,604 -3,367

PERCENT OF OPEN INTEREST FOR EACH CATEGORY OF TRADERS

11.3

57.9

1.6

78.1

15.4

91.0

74.9

NUMBER OF TRADERS IN EACH CATEGORY (TOTAL TRADERS:

24

61

11

24

28

52

131)

96

-1,209

554

9.0

25.1

EURO FX - CHICAGO MERCANTILE EXCHANGE

Code-099741

FUTURES ONLY POSITIONS AS OF 08/06/13

|

--------------------------------------------------------------| NONREPORTABLE

NON-COMMERCIAL

| COMMERCIAL

|

TOTAL

| POSITIONS

--------------------------|-----------------|-----------------|----------------LONG | SHORT |SPREADS | LONG | SHORT | LONG | SHORT | LONG | SHORT

-------------------------------------------------------------------------------(CONTRACTS OF EUR 125,000)

OPEN INTEREST:

228,726

COMMITMENTS

85,239 79,178

5,302 90,858 86,556 181,399 171,036 47,327 57,690

CHANGES FROM 07/30/13 (CHANGE IN OPEN INTEREST:

5,769)

7,028 -7,537

422 -5,836 13,317

1,614

6,202

PERCENT OF OPEN INTEREST FOR EACH CATEGORY OF TRADERS

37.3

34.6

2.3

39.7

37.8

79.3

74.8

NUMBER OF TRADERS IN EACH CATEGORY (TOTAL TRADERS:

46

63

17

49

44

106

179)

113

4,155

-433

20.7

25.2

BRAZILIAN REAL - CHICAGO MERCANTILE EXCHANGE

Code-102741

FUTURES ONLY POSITIONS AS OF 08/06/13

|

--------------------------------------------------------------| NONREPORTABLE

NON-COMMERCIAL

| COMMERCIAL

|

TOTAL

| POSITIONS

--------------------------|-----------------|-----------------|----------------LONG | SHORT |SPREADS | LONG | SHORT | LONG | SHORT | LONG | SHORT

-------------------------------------------------------------------------------(CONTRACTS OF BRL 100,000)

OPEN INTEREST:

23,744

www.cftc.gov/dea/futures/deacmesf.htm

5/10

11/08/2013

COMMITMENTS

5,013

3,965

CFTC Commitments of Traders Report - CME (Futures Only)

3,141

14,740

15,489

22,894

22,595

850

1,149

CHANGES FROM 07/30/13 (CHANGE IN OPEN INTEREST:

-2,766)

-1,648

-424

-33 -1,132 -2,398 -2,813 -2,855

47

89

3.6

4.8

PERCENT OF OPEN INTEREST FOR EACH CATEGORY OF TRADERS

21.1

16.7

13.2

62.1

65.2

96.4

95.2

NUMBER OF TRADERS IN EACH CATEGORY (TOTAL TRADERS:

6

5

2

6

6

13

23)

12

NEW ZEALAND DOLLAR - CHICAGO MERCANTILE EXCHANGE

Code-112741

FUTURES ONLY POSITIONS AS OF 08/06/13

|

--------------------------------------------------------------| NONREPORTABLE

NON-COMMERCIAL

| COMMERCIAL

|

TOTAL

| POSITIONS

--------------------------|-----------------|-----------------|----------------LONG | SHORT |SPREADS | LONG | SHORT | LONG | SHORT | LONG | SHORT

-------------------------------------------------------------------------------(CONTRACTS OF NZD 100,000)

OPEN INTEREST:

11,572

COMMITMENTS

4,595

6,134

204

4,667

1,899

9,466

8,237

2,106

3,335

CHANGES FROM 07/30/13 (CHANGE IN OPEN INTEREST:

-581)

-998

21

21

751

-848

-226

-806

-355

225

PERCENT OF OPEN INTEREST FOR EACH CATEGORY OF TRADERS

39.7

53.0

1.8

40.3

16.4

81.8

71.2

18.2

28.8

NUMBER OF TRADERS IN EACH CATEGORY (TOTAL TRADERS:

10

18

2

7

10

17

45)

30

3-MONTH EURODOLLARS - CHICAGO MERCANTILE EXCHANGE

Code-132741

FUTURES ONLY POSITIONS AS OF 08/06/13

|

--------------------------------------------------------------| NONREPORTABLE

NON-COMMERCIAL

| COMMERCIAL

|

TOTAL

| POSITIONS

--------------------------|-----------------|-----------------|----------------LONG | SHORT |SPREADS | LONG | SHORT | LONG | SHORT | LONG | SHORT

-------------------------------------------------------------------------------(CONTRACTS OF $1,000,000)

OPEN INTEREST:

9,073,939

COMMITMENTS

919,153 1024535 1918461 5401308 5014462 8238922 7957458 835,017 1116481

CHANGES FROM 07/30/13 (CHANGE IN OPEN INTEREST:

185,642)

52,855 39,891 55,224 44,602 76,934 152,681 172,049

PERCENT OF OPEN INTEREST FOR EACH CATEGORY OF TRADERS

10.1

11.3

21.1

59.5

55.3

90.8

87.7

NUMBER OF TRADERS IN EACH CATEGORY (TOTAL TRADERS:

53

45

82

113

115

218

236)

206

32,961

13,593

9.2

12.3

S&P 500 Consolidated - CHICAGO MERCANTILE EXCHANGE

Code-13874+

FUTURES ONLY POSITIONS AS OF 08/06/13

|

--------------------------------------------------------------| NONREPORTABLE

NON-COMMERCIAL

| COMMERCIAL

|

TOTAL

| POSITIONS

--------------------------|-----------------|-----------------|----------------LONG | SHORT |SPREADS | LONG | SHORT | LONG | SHORT | LONG | SHORT

www.cftc.gov/dea/futures/deacmesf.htm

6/10

11/08/2013

CFTC Commitments of Traders Report - CME (Futures Only)

-------------------------------------------------------------------------------(S&P 500 INDEX X $250.00)

OPEN INTEREST:

732,142

COMMITMENTS

96,566 67,664 23,688 496,364 555,366 616,618 646,718 115,524 85,424

CHANGES FROM 07/30/13 (CHANGE IN OPEN INTEREST:

1,304)

-8,821

8,439

5,689

2,701 -11,016

-431

3,112

PERCENT OF OPEN INTEREST FOR EACH CATEGORY OF TRADERS

13.2

9.2

3.2

67.8

75.9

84.2

88.3

NUMBER OF TRADERS IN EACH CATEGORY (TOTAL TRADERS:

126

97

68

219

235

375

560)

372

1,735

-1,808

15.8

11.7

S&P 500 STOCK INDEX - CHICAGO MERCANTILE EXCHANGE

Code-138741

FUTURES ONLY POSITIONS AS OF 08/06/13

|

--------------------------------------------------------------| NONREPORTABLE

NON-COMMERCIAL

| COMMERCIAL

|

TOTAL

| POSITIONS

--------------------------|-----------------|-----------------|----------------LONG | SHORT |SPREADS | LONG | SHORT | LONG | SHORT | LONG | SHORT

-------------------------------------------------------------------------------(S&P 500 INDEX X $250.00)

OPEN INTEREST:

163,175

COMMITMENTS

13,183

3,771

835 94,460 119,392 108,478 123,998 54,697 39,177

CHANGES FROM 07/30/13 (CHANGE IN OPEN INTEREST:

485)

577

1,537

-374 -1,368

450 -1,165

1,613

PERCENT OF OPEN INTEREST FOR EACH CATEGORY OF TRADERS

8.1

2.3

0.5

57.9

73.2

66.5

76.0

NUMBER OF TRADERS IN EACH CATEGORY (TOTAL TRADERS:

14

11

4

46

42

61

93)

56

1,650

-1,128

33.5

24.0

E-MINI S&P 500 STOCK INDEX - CHICAGO MERCANTILE EXCHANGE

Code-13874A

FUTURES ONLY POSITIONS AS OF 08/06/13

|

--------------------------------------------------------------| NONREPORTABLE

NON-COMMERCIAL

| COMMERCIAL

|

TOTAL

| POSITIONS

--------------------------|-----------------|-----------------|----------------LONG | SHORT |SPREADS | LONG | SHORT | LONG | SHORT | LONG | SHORT

-------------------------------------------------------------------------------($50 X S&P 500 INDEX)

OPEN INTEREST:

2,844,836

COMMITMENTS

433,534 336,087 97,645 2009520 2179869 2540699 2613601 304,137 231,235

CHANGES FROM 07/30/13 (CHANGE IN OPEN INTEREST:

4,096)

-40,524 40,978 23,848 20,346 -57,330

3,670

7,496

PERCENT OF OPEN INTEREST FOR EACH CATEGORY OF TRADERS

15.2

11.8

3.4

70.6

76.6

89.3

91.9

NUMBER OF TRADERS IN EACH CATEGORY (TOTAL TRADERS:

122

96

61

204

220

355

538)

349

426

-3,400

10.7

8.1

E-MINI S&P 400 STOCK INDEX - CHICAGO MERCANTILE EXCHANGE

Code-33874A

FUTURES ONLY POSITIONS AS OF 08/06/13

|

--------------------------------------------------------------| NONREPORTABLE

NON-COMMERCIAL

| COMMERCIAL

|

TOTAL

| POSITIONS

www.cftc.gov/dea/futures/deacmesf.htm

7/10

11/08/2013

CFTC Commitments of Traders Report - CME (Futures Only)

--------------------------|-----------------|-----------------|----------------LONG | SHORT |SPREADS | LONG | SHORT | LONG | SHORT | LONG | SHORT

-------------------------------------------------------------------------------(S&P 400 INDEX X $100)

OPEN INTEREST:

121,886

COMMITMENTS

22,033

3,754

1,216 88,690 113,562 111,939 118,532

9,947

3,354

CHANGES FROM 07/30/13 (CHANGE IN OPEN INTEREST:

-2,341

1,394

649

2,544

-700

852

423)

1,343

-429

-920

PERCENT OF OPEN INTEREST FOR EACH CATEGORY OF TRADERS

18.1

3.1

1.0

72.8

93.2

91.8

97.2

8.2

2.8

NUMBER OF TRADERS IN EACH CATEGORY (TOTAL TRADERS:

20

5

4

46

47

67

103)

55

NASDAQ-100 Consolidated - CHICAGO MERCANTILE EXCHANGE

Code-20974+

FUTURES ONLY POSITIONS AS OF 08/06/13

|

--------------------------------------------------------------| NONREPORTABLE

NON-COMMERCIAL

| COMMERCIAL

|

TOTAL

| POSITIONS

--------------------------|-----------------|-----------------|----------------LONG | SHORT |SPREADS | LONG | SHORT | LONG | SHORT | LONG | SHORT

-------------------------------------------------------------------------------(NASDAQ 100 INDEX X $100)

OPEN INTEREST:

81,170

COMMITMENTS

28,570

3,651

374 46,262 72,138 75,206 76,164

5,964

5,006

CHANGES FROM 07/30/13 (CHANGE IN OPEN INTEREST:

1,387)

717

-192

-171

684

1,290

1,230

928

157

459

PERCENT OF OPEN INTEREST FOR EACH CATEGORY OF TRADERS

35.2

4.5

0.5

57.0

88.9

92.7

93.8

7.3

6.2

NUMBER OF TRADERS IN EACH CATEGORY (TOTAL TRADERS:

77

21

7

68

69

147

223)

95

NASDAQ-100 STOCK INDEX (MINI) - CHICAGO MERCANTILE EXCHANGE

Code-209742

FUTURES ONLY POSITIONS AS OF 08/06/13

|

--------------------------------------------------------------| NONREPORTABLE

NON-COMMERCIAL

| COMMERCIAL

|

TOTAL

| POSITIONS

--------------------------|-----------------|-----------------|----------------LONG | SHORT |SPREADS | LONG | SHORT | LONG | SHORT | LONG | SHORT

-------------------------------------------------------------------------------(NASDAQ 100 STOCK INDEX X $20)

OPEN INTEREST:

405,851

COMMITMENTS

142,849 18,257

1,872 231,308 360,691 376,029 380,820 29,822 25,031

CHANGES FROM 07/30/13 (CHANGE IN OPEN INTEREST:

6,934)

3,583

-958

-854

3,420

6,451

6,149

4,639

785

2,295

PERCENT OF OPEN INTEREST FOR EACH CATEGORY OF TRADERS

35.2

4.5

0.5

57.0

88.9

92.7

93.8

7.3

6.2

NUMBER OF TRADERS IN EACH CATEGORY (TOTAL TRADERS:

77

21

7

68

69

147

223)

95

AUSTRALIAN DOLLAR - CHICAGO MERCANTILE EXCHANGE

FUTURES ONLY POSITIONS AS OF 08/06/13

www.cftc.gov/dea/futures/deacmesf.htm

Code-232741

|

8/10

11/08/2013

CFTC Commitments of Traders Report - CME (Futures Only)

--------------------------------------------------------------| NONREPORTABLE

NON-COMMERCIAL

| COMMERCIAL

|

TOTAL

| POSITIONS

--------------------------|-----------------|-----------------|----------------LONG | SHORT |SPREADS | LONG | SHORT | LONG | SHORT | LONG | SHORT

-------------------------------------------------------------------------------(CONTRACTS OF AUD 100,000)

OPEN INTEREST:

201,885

COMMITMENTS

16,566 93,345

1,254 167,002 64,766 184,822 159,365 17,063 42,520

CHANGES FROM 07/30/13 (CHANGE IN OPEN INTEREST:

3,613)

-2,961

1,245

307

7,692

-663

5,038

889

PERCENT OF OPEN INTEREST FOR EACH CATEGORY OF TRADERS

8.2

46.2

0.6

82.7

32.1

91.5

78.9

NUMBER OF TRADERS IN EACH CATEGORY (TOTAL TRADERS:

24

45

13

23

24

52

104)

77

-1,425

2,724

8.5

21.1

NIKKEI STOCK AVERAGE - CHICAGO MERCANTILE EXCHANGE

Code-240741

FUTURES ONLY POSITIONS AS OF 08/06/13

|

--------------------------------------------------------------| NONREPORTABLE

NON-COMMERCIAL

| COMMERCIAL

|

TOTAL

| POSITIONS

--------------------------|-----------------|-----------------|----------------LONG | SHORT |SPREADS | LONG | SHORT | LONG | SHORT | LONG | SHORT

-------------------------------------------------------------------------------(NIKKEI INDEX X $5.00)

OPEN INTEREST:

58,672

COMMITMENTS

17,945

9,036

221 30,239 45,306 48,405 54,563 10,267

4,109

CHANGES FROM 07/30/13 (CHANGE IN OPEN INTEREST:

579)

1,658

371

114

-137

-299

1,635

186

PERCENT OF OPEN INTEREST FOR EACH CATEGORY OF TRADERS

30.6

15.4

0.4

51.5

77.2

82.5

93.0

NUMBER OF TRADERS IN EACH CATEGORY (TOTAL TRADERS:

24

7

2

26

14

51

68)

22

-1,056

393

17.5

7.0

NIKKEI STOCK AVERAGE YEN DENOM - CHICAGO MERCANTILE EXCHANGE

Code-240743

FUTURES ONLY POSITIONS AS OF 08/06/13

|

--------------------------------------------------------------| NONREPORTABLE

NON-COMMERCIAL

| COMMERCIAL

|

TOTAL

| POSITIONS

--------------------------|-----------------|-----------------|----------------LONG | SHORT |SPREADS | LONG | SHORT | LONG | SHORT | LONG | SHORT

-------------------------------------------------------------------------------(NIKKEI INDEX X JPY 500)

OPEN INTEREST:

64,465

COMMITMENTS

27,022

3,335

435 27,645 15,740 55,102 19,510

9,363 44,955

CHANGES FROM 07/30/13 (CHANGE IN OPEN INTEREST:

-4,053)

-1,172

377 -1,380

-629

-599 -3,181 -1,602

-872

-2,451

PERCENT OF OPEN INTEREST FOR EACH CATEGORY OF TRADERS

41.9

5.2

0.7

42.9

24.4

85.5

30.3

14.5

69.7

NUMBER OF TRADERS IN EACH CATEGORY (TOTAL TRADERS:

23

5

3

34

23

59

77)

29

www.cftc.gov/dea/futures/deacmesf.htm

9/10

11/08/2013

CFTC Commitments of Traders Report - CME (Futures Only)

S&P GSCI COMMODITY INDEX - CHICAGO MERCANTILE EXCHANGE

Code-256741

FUTURES ONLY POSITIONS AS OF 08/06/13

|

--------------------------------------------------------------| NONREPORTABLE

NON-COMMERCIAL

| COMMERCIAL

|

TOTAL

| POSITIONS

--------------------------|-----------------|-----------------|----------------LONG | SHORT |SPREADS | LONG | SHORT | LONG | SHORT | LONG | SHORT

-------------------------------------------------------------------------------(GSCI X $250)

OPEN INTEREST:

10,221

COMMITMENTS

6,149

1,580

67

3,076

8,249

9,292

9,896

929

325

CHANGES FROM 07/30/13 (CHANGE IN OPEN INTEREST:

-218)

-325

-13

0

-49

-96

-374

-109

156

-109

PERCENT OF OPEN INTEREST FOR EACH CATEGORY OF TRADERS

60.2

15.5

0.7

30.1

80.7

90.9

9.1

3.2

NUMBER OF TRADERS IN EACH CATEGORY (TOTAL TRADERS:

7

2

1

9

2

16

96.8

20)

5

Updated August 9, 2013

www.cftc.gov/dea/futures/deacmesf.htm

10/10

Potrebbero piacerti anche

- Real Traders II: How One CFO Trader Used the Power of Leverage to make $110k in 9 WeeksDa EverandReal Traders II: How One CFO Trader Used the Power of Leverage to make $110k in 9 WeeksNessuna valutazione finora

- PDFDocumento21 paginePDFkaushikNessuna valutazione finora

- 2022 New Member Report Guide: Crowded Market Report Review By: The CMR TeamDocumento13 pagine2022 New Member Report Guide: Crowded Market Report Review By: The CMR TeamWillem Da Costa GomezNessuna valutazione finora

- Electronic Trading Masters: Secrets from the Pros!Da EverandElectronic Trading Masters: Secrets from the Pros!Nessuna valutazione finora

- Refinitiv WC BrochureDocumento12 pagineRefinitiv WC BrochurejimmiilongNessuna valutazione finora

- What Are Episodic Pivots and How To Find Them: Home Members Only MM Stockbee 50 VideosDocumento6 pagineWhat Are Episodic Pivots and How To Find Them: Home Members Only MM Stockbee 50 VideosXoodmaNessuna valutazione finora

- Small Stocks for Big Profits: Generate Spectacular Returns by Investing in Up-and-Coming CompaniesDa EverandSmall Stocks for Big Profits: Generate Spectacular Returns by Investing in Up-and-Coming CompaniesNessuna valutazione finora

- Futures Trader Spotlight Linda Raschke & How She Made Millions - Warrior TradingDocumento11 pagineFutures Trader Spotlight Linda Raschke & How She Made Millions - Warrior Tradingasdfa zzzytyNessuna valutazione finora

- RTT Trend ShortDocumento4 pagineRTT Trend ShortaivatradeNessuna valutazione finora

- PivotBoss TOS TV IndicatorsDocumento2 paginePivotBoss TOS TV Indicatorsalpha2omega0007Nessuna valutazione finora

- CTA Guide 1-3-08Documento105 pagineCTA Guide 1-3-08Anonymous HtDbszqtNessuna valutazione finora

- A Six Part Study Guide To Market Profile Part 3 - 190654Documento18 pagineA Six Part Study Guide To Market Profile Part 3 - 190654Le Cong Nhat MinhNessuna valutazione finora

- Commodity Traders ClassroomDocumento0 pagineCommodity Traders ClassroomNick ClarkNessuna valutazione finora

- The PEMA Pullback A PivotBoss Signature Setup - KeyDocumento8 pagineThe PEMA Pullback A PivotBoss Signature Setup - KeyShanmugha SundaramNessuna valutazione finora

- Candlestick PatternsDocumento13 pagineCandlestick PatternscollegetradingexchangeNessuna valutazione finora

- Commitment of Traders Report Part 1Documento10 pagineCommitment of Traders Report Part 1andres19712Nessuna valutazione finora

- Tidal Finance Smart Contract Security Audit Halborn v1 0Documento41 pagineTidal Finance Smart Contract Security Audit Halborn v1 0vuongtranvnNessuna valutazione finora

- Catalogue V 16Documento11 pagineCatalogue V 16percysearchNessuna valutazione finora

- Reversals in Minds and MarketsDocumento4 pagineReversals in Minds and MarketsLUCKYNessuna valutazione finora

- Adversity Is Often The Mother of Innovation: by Tom J. ReavisDocumento72 pagineAdversity Is Often The Mother of Innovation: by Tom J. ReavisŞamil CeyhanNessuna valutazione finora

- The Real Nature of Market Behavior Key TakeawaysDocumento1 paginaThe Real Nature of Market Behavior Key TakeawaysjstoutNessuna valutazione finora

- Confp01 07Documento21 pagineConfp01 07crushspreadNessuna valutazione finora

- Market Technician No42Documento16 pagineMarket Technician No42ppfahdNessuna valutazione finora

- Hochtief (A4)Documento4 pagineHochtief (A4)petodrabNessuna valutazione finora

- Market Chat With Shahid Saleem & Richard MoglenDocumento88 pagineMarket Chat With Shahid Saleem & Richard MoglenRICARDONessuna valutazione finora

- Market Outlook Oct 2013Documento4 pagineMarket Outlook Oct 2013eliforu100% (1)

- Darvas Box Explained - Trend Following System For Any Time FrameDocumento11 pagineDarvas Box Explained - Trend Following System For Any Time FrameMae Jumao-asNessuna valutazione finora

- The Max Reversal A PivotBoss Signature Setup - KeyDocumento9 pagineThe Max Reversal A PivotBoss Signature Setup - KeychinnaNessuna valutazione finora

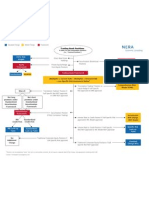

- Market Risk FlowchartDocumento1 paginaMarket Risk FlowchartlardogiousNessuna valutazione finora

- ISM - IsM Report - September 2010 Manufacturing ISM Report On BusinessDocumento9 pagineISM - IsM Report - September 2010 Manufacturing ISM Report On BusinessHåkan RolfNessuna valutazione finora

- Mark Minervini (@markminervini) - Twitter6Documento1 paginaMark Minervini (@markminervini) - Twitter6LNessuna valutazione finora

- 1 CA K.G.AcharyaDocumento40 pagine1 CA K.G.AcharyaMurthyNessuna valutazione finora

- Home About Service Resources: Articles Academia Glossary Book List LinksDocumento14 pagineHome About Service Resources: Articles Academia Glossary Book List Linkslarry HNessuna valutazione finora

- Hickson-The Nominal Model PDFDocumento2 pagineHickson-The Nominal Model PDFdeztha wirayudhaNessuna valutazione finora

- A Practical Guide To Swing Trading Author Larry SwingDocumento74 pagineA Practical Guide To Swing Trading Author Larry SwingDevendra SinghNessuna valutazione finora

- Positions Overlayed QQQDocumento58 paginePositions Overlayed QQQAlexNessuna valutazione finora

- Information Theory and Market BehaviorDocumento25 pagineInformation Theory and Market BehaviorAbhinavJainNessuna valutazione finora

- Ts Algo SurveyDocumento16 pagineTs Algo Surveyprasadpatankar9Nessuna valutazione finora

- Zahar Udin PHD ThesisDocumento201 pagineZahar Udin PHD ThesisSunny ChaturvediNessuna valutazione finora

- Day Trading and Learning 110217Documento34 pagineDay Trading and Learning 110217abiel_guerraNessuna valutazione finora

- ValueDocumento6 pagineValuemeranaamfakeNessuna valutazione finora

- 56 - 2001 WinterDocumento61 pagine56 - 2001 Winterc_mc2100% (1)

- Price Pattern StudiesDocumento6 paginePrice Pattern StudiesjoeNessuna valutazione finora

- CTF Lecture NotesDocumento105 pagineCTF Lecture NotesMartin Martin MartinNessuna valutazione finora

- TOPBOT Mini Public PDFDocumento18 pagineTOPBOT Mini Public PDFletuanNessuna valutazione finora

- Issue30 PDFDocumento52 pagineIssue30 PDFhyanand100% (1)

- UNIT02VADocumento122 pagineUNIT02VAKIEMCOIN CAPITALNessuna valutazione finora

- Reliable Signals Based On Fisher Transform For Algorithmic TradingDocumento17 pagineReliable Signals Based On Fisher Transform For Algorithmic TradingjramongvNessuna valutazione finora

- MR MarketDocumento64 pagineMR MarketIan CarrNessuna valutazione finora

- Edge Ratio of Nifty For Last 15 Years On Donchian ChannelDocumento8 pagineEdge Ratio of Nifty For Last 15 Years On Donchian ChannelthesijNessuna valutazione finora

- Layers of Protection: Evolving Nature of Cyber-Threats in Payment SystemsDocumento12 pagineLayers of Protection: Evolving Nature of Cyber-Threats in Payment SystemsWilfred DsouzaNessuna valutazione finora

- How To Be 100% Sure of A Chart SignalDocumento5 pagineHow To Be 100% Sure of A Chart SignalbhushanNessuna valutazione finora

- Guppy Multiple Moving AverageDocumento6 pagineGuppy Multiple Moving AverageJaime GuerreroNessuna valutazione finora

- Techinical AnalysisDocumento14 pagineTechinical AnalysisCamille BagadiongNessuna valutazione finora

- Market Technician No38Documento16 pagineMarket Technician No38ppfahdNessuna valutazione finora

- Tim Rayment ArticleDocumento3 pagineTim Rayment ArticleIstiaque AhmedNessuna valutazione finora

- Leader of The Macd PDFDocumento6 pagineLeader of The Macd PDFshlosh7Nessuna valutazione finora

- Cmemagazine SP 08Documento44 pagineCmemagazine SP 08rsaittreyaNessuna valutazione finora

- Excel 10 Automatic GradingDocumento8 pagineExcel 10 Automatic GradingMd YusofNessuna valutazione finora

- Teknik BORCDocumento6 pagineTeknik BORCMd YusofNessuna valutazione finora

- Fibo966 BasicDocumento57 pagineFibo966 BasicMd YusofNessuna valutazione finora

- The System II (Yes With Irony) PostsDocumento243 pagineThe System II (Yes With Irony) PostsMd YusofNessuna valutazione finora

- Search: Mohd Yusof Samsudin HomeDocumento12 pagineSearch: Mohd Yusof Samsudin HomeMd YusofNessuna valutazione finora

- Kamus Candlestick OKDocumento2 pagineKamus Candlestick OKMd YusofNessuna valutazione finora

- Discovering Congruent Triangles ActivityDocumento7 pagineDiscovering Congruent Triangles ActivityMd YusofNessuna valutazione finora

- Thermodynamic Chapter 1Documento96 pagineThermodynamic Chapter 1Md YusofNessuna valutazione finora

- Balan, Robert - Elliott Wave Principle ForexDocumento93 pagineBalan, Robert - Elliott Wave Principle ForexAli Imran Mohamad67% (3)

- CA-Inter-Accounts Iqtdar-MalikDocumento31 pagineCA-Inter-Accounts Iqtdar-MalikSUMANTO BARMANNessuna valutazione finora

- Asset Disposal & Statement of Cash FlowsDocumento3 pagineAsset Disposal & Statement of Cash FlowsShoniqua JohnsonNessuna valutazione finora

- EFF Memorandum To Johannesburg Stock Exchange 27 October 2015Documento3 pagineEFF Memorandum To Johannesburg Stock Exchange 27 October 2015eNCA.comNessuna valutazione finora

- Rajendra Singh Bhamboo Infra Private LimitedDocumento5 pagineRajendra Singh Bhamboo Infra Private LimitedBABU LAL CHOUDHARYNessuna valutazione finora

- How Do Risk and Term Structure Affect Interest Rates?Documento70 pagineHow Do Risk and Term Structure Affect Interest Rates?Meha KohliNessuna valutazione finora

- MCQDocumento6 pagineMCQTariq Hussain Khan100% (1)

- 9722 Fujita Kanko Inc CompanyFinancialSummary 20180314222612Documento5 pagine9722 Fujita Kanko Inc CompanyFinancialSummary 20180314222612DamTokyoNessuna valutazione finora

- Changi Airport Group Annual Report 20122013 Full Version PDFDocumento120 pagineChangi Airport Group Annual Report 20122013 Full Version PDFmulti nirman sewaNessuna valutazione finora

- FM - Course PlanDocumento3 pagineFM - Course PlanAsfawosen DingamaNessuna valutazione finora

- 1 The Black-Scholes Formula For A European Call or Put: 1.1 Evaluation of European OptionsDocumento15 pagine1 The Black-Scholes Formula For A European Call or Put: 1.1 Evaluation of European Optionshenry37302Nessuna valutazione finora

- Growth Pole and Other Urban Economic TheoriesDocumento1 paginaGrowth Pole and Other Urban Economic TheoriesJudeJunuis100% (1)

- 111Documento2 pagine111Joyce TenorioNessuna valutazione finora

- Special Transact - Almario Ass #3Documento4 pagineSpecial Transact - Almario Ass #3Es ToryahieeNessuna valutazione finora

- Strathmore Times May 20, 2010Documento24 pagineStrathmore Times May 20, 2010Strathmore TimesNessuna valutazione finora

- FEMA Overview and FDI Policy Harshal BhutaDocumento68 pagineFEMA Overview and FDI Policy Harshal BhutaJitendra MadhanNessuna valutazione finora

- All Template Chapter 6 As of September 10 2019Documento32 pagineAll Template Chapter 6 As of September 10 2019Aira Dizon50% (2)

- 3.0 Sales & Marketing Management - 1Documento731 pagine3.0 Sales & Marketing Management - 1Nirmal Kumar K83% (6)

- Joint Venture AgreementDocumento12 pagineJoint Venture AgreementPeter K Njuguna100% (1)

- Ducati Realease Investindustrial 20120418Documento2 pagineDucati Realease Investindustrial 20120418cherikokNessuna valutazione finora

- SI, CI WS SolutionDocumento6 pagineSI, CI WS SolutionKhushal Bhanderi33% (3)

- Chapter 1 MCQs On Income Tax Rates and Basic Concept of Income TaxDocumento28 pagineChapter 1 MCQs On Income Tax Rates and Basic Concept of Income TaxMeenal Luther100% (1)

- Rob Parson Morgan StanleyDocumento1 paginaRob Parson Morgan StanleyLuis Javier Naval ParraNessuna valutazione finora

- Yashwant Sinha's Families Rs.50,000 Crore Black Money - 117 CosDocumento2 pagineYashwant Sinha's Families Rs.50,000 Crore Black Money - 117 Cosaroopam1636Nessuna valutazione finora

- Case Study Salem TelephoneDocumento3 pagineCase Study Salem Telephoneahbahk100% (2)

- Case Study - : The Chubb CorporationDocumento6 pagineCase Study - : The Chubb Corporationtiko bakashviliNessuna valutazione finora

- VodafoneDocumento26 pagineVodafoneManisha BishtNessuna valutazione finora

- Mergers & Acquisitions: Merger Evaluation: RIL & Network 18Documento13 pagineMergers & Acquisitions: Merger Evaluation: RIL & Network 18DilipSamantaNessuna valutazione finora

- Payment Receipt: All Cheque / DD Subject To RealisationDocumento1 paginaPayment Receipt: All Cheque / DD Subject To RealisationAshokNessuna valutazione finora

- Nature and Importance of Business PolicyDocumento11 pagineNature and Importance of Business PolicySanguine MurkNessuna valutazione finora

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsDa EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNessuna valutazione finora

- The Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorseDa EverandThe Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorseNessuna valutazione finora

- Legal Guide to Social Media, Second Edition: Rights and Risks for Businesses, Entrepreneurs, and InfluencersDa EverandLegal Guide to Social Media, Second Edition: Rights and Risks for Businesses, Entrepreneurs, and InfluencersValutazione: 5 su 5 stelle5/5 (1)

- How to Win Your Case In Traffic Court Without a LawyerDa EverandHow to Win Your Case In Traffic Court Without a LawyerValutazione: 4 su 5 stelle4/5 (5)

- Contract Law for Serious Entrepreneurs: Know What the Attorneys KnowDa EverandContract Law for Serious Entrepreneurs: Know What the Attorneys KnowValutazione: 1 su 5 stelle1/5 (1)

- The Perfect Stage Crew: The Complete Technical Guide for High School, College, and Community TheaterDa EverandThe Perfect Stage Crew: The Complete Technical Guide for High School, College, and Community TheaterNessuna valutazione finora

- Legal Forms for Everyone: Leases, Home Sales, Avoiding Probate, Living Wills, Trusts, Divorce, Copyrights, and Much MoreDa EverandLegal Forms for Everyone: Leases, Home Sales, Avoiding Probate, Living Wills, Trusts, Divorce, Copyrights, and Much MoreValutazione: 3.5 su 5 stelle3.5/5 (2)

- Law of Contract Made Simple for LaymenDa EverandLaw of Contract Made Simple for LaymenValutazione: 4.5 su 5 stelle4.5/5 (9)

- Profitable Photography in Digital Age: Strategies for SuccessDa EverandProfitable Photography in Digital Age: Strategies for SuccessNessuna valutazione finora

- Learn the Essentials of Business Law in 15 DaysDa EverandLearn the Essentials of Business Law in 15 DaysValutazione: 4 su 5 stelle4/5 (13)

- Digital Technical Theater Simplified: High Tech Lighting, Audio, Video and More on a Low BudgetDa EverandDigital Technical Theater Simplified: High Tech Lighting, Audio, Video and More on a Low BudgetNessuna valutazione finora

- How to Win Your Case in Small Claims Court Without a LawyerDa EverandHow to Win Your Case in Small Claims Court Without a LawyerValutazione: 5 su 5 stelle5/5 (1)

- Sales & Marketing Agreements and ContractsDa EverandSales & Marketing Agreements and ContractsNessuna valutazione finora

- Contracts: The Essential Business Desk ReferenceDa EverandContracts: The Essential Business Desk ReferenceValutazione: 4 su 5 stelle4/5 (15)

- What Are You Laughing At?: How to Write Humor for Screenplays, Stories, and MoreDa EverandWhat Are You Laughing At?: How to Write Humor for Screenplays, Stories, and MoreValutazione: 4 su 5 stelle4/5 (2)

- Technical Theater for Nontechnical People: Second EditionDa EverandTechnical Theater for Nontechnical People: Second EditionNessuna valutazione finora

- The Business of Broadway: An Insider's Guide to Working, Producing, and Investing in the World's Greatest Theatre CommunityDa EverandThe Business of Broadway: An Insider's Guide to Working, Producing, and Investing in the World's Greatest Theatre CommunityNessuna valutazione finora