Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Fcffvsfcfe

Caricato da

api-37631380 valutazioniIl 0% ha trovato utile questo documento (0 voti)

12 visualizzazioni2 pagineTitolo originale

fcffvsfcfe

Copyright

© Attribution Non-Commercial (BY-NC)

Formati disponibili

XLS, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato XLS, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

12 visualizzazioni2 pagineFcffvsfcfe

Caricato da

api-3763138Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato XLS, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

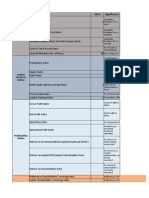

Inputs

Earnings before interest and taxes = 100

Expected growth for next 5 years = 10%

Expected growth after year 5 = 5%

Tax rate = 40%

Debt ratio for the firm = 20%

Cost of equity = 12%

Pre-tax cost of debt = 7%

Return on capital in high growth= 12%

Return on capital in stable growth = 10%

0 1 2 3 4 5

Expected Growth rate 10% 10% 10% 10% 10%

Reinvestment rate 83.33% 83.33% 83.33% 83.33% 83.33%

EBIT $100.00 $110.00 $121.00 $133.10 $146.41 $161.05

Taxes $44.00 $48.40 $53.24 $58.56 $64.42

EBIT(1-t) $66.00 $72.60 $79.86 $87.85 $96.63

- Reinvestment $55.00 $60.50 $66.55 $73.21 $80.53

FCFF $11.00 $12.10 $13.31 $14.64 $16.11

Terminal Value $932.56

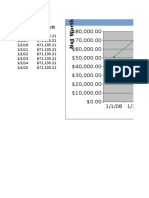

Present Value $9.96 $9.92 $9.88 $9.84 $577.40

Value of Firm = $617.01 $670.42 728.31 791.04 858.98 $932.56

Value of Equity = $493.61 ! Equity as % of value

Value of Debt = $123.40 ! Debt as % of value

EBIT $100.00 $110.00 $121.00 $133.10 $146.41 $161.05

Interest Exp $8.64 $9.39 $10.20 $11.07 $12.03

EBT $101.36 $111.61 $122.90 $135.34 $149.03

Taxes $40.54 $44.65 $49.16 $54.13 $59.61

Net Income $60.82 $66.97 $73.74 $81.20 $89.42

- Reinvestment $55.00 $60.50 $66.55 $73.21 $80.53

+ New Debt Issued $10.68 $11.58 $12.55 $13.59 $14.71

FCFE $16.50 $18.05 $19.74 $21.58 $23.60

Terminal Value of Equity $746.05

Present Value $14.73 $14.39 $14.05 $13.72 $436.72

Value of Equity = $493.61

Capital Structure

Debt at end of year $123.40 $134.08 $145.66 $158.21 $171.80 $186.51

Cost of Equity 12.00% 12% 12.00% 12.00% 12.00%

Pre-tax Cost of Debt 7.00% 7% 7.00% 7.00% 7.00%

After-tax Cost of Debt 4.20% 4% 4.20% 4.20% 4.20%

Cost of Capital 10.44% 10.44% 10.44% 10.44% 10.44%

Terminal Year

5%

50.0%

$169.10

$67.64

$101.46

$50.73

$50.73

! This is the present value of the cash flows to the firm

starting in each year; year 2, year 3…

$169.10

$13.06

$156.05

$62.42

$93.63

$50.73

$9.33 ! This is the new debt issued each year

$52.22

$195.84 ! This is 30% of each year's firm value

12.00%

7.00%

4.20%

10.44% ! Computed using a 70% Equity; 30% Debt

ratio.

Potrebbero piacerti anche

- Cpa A2.1 - Strategic Corporate Finance - Study ManualDocumento206 pagineCpa A2.1 - Strategic Corporate Finance - Study ManualDamascene100% (2)

- Ben Graham and The Growth Investor: Presented To Bryant College April 10, 2008Documento115 pagineBen Graham and The Growth Investor: Presented To Bryant College April 10, 2008bernhardfNessuna valutazione finora

- Pengaruh Struktur Kepemilikan Terhadap Keputusan Keuangan Dan Nilai PerusahaanDocumento29 paginePengaruh Struktur Kepemilikan Terhadap Keputusan Keuangan Dan Nilai PerusahaanFajar ChristianNessuna valutazione finora

- Financial Shenanigans Checklist - Hurricane CapitalDocumento10 pagineFinancial Shenanigans Checklist - Hurricane CapitalTrinh NgocNessuna valutazione finora

- Financial AnalysisDocumento44 pagineFinancial AnalysisEnrica SalursoNessuna valutazione finora

- Investing Is An Art Not A ScienceDocumento4 pagineInvesting Is An Art Not A SciencemeetwithsanjayNessuna valutazione finora

- MSFT 10yr OSV Stock Valuation SpreadsheetDocumento15 pagineMSFT 10yr OSV Stock Valuation SpreadsheetOld School ValueNessuna valutazione finora

- Formulas #1: Future Value of A Single Cash FlowDocumento4 pagineFormulas #1: Future Value of A Single Cash FlowVikram Sathish AsokanNessuna valutazione finora

- How To Generate Stock IdeasDocumento5 pagineHow To Generate Stock IdeasKannanNessuna valutazione finora

- Presented By: Prajal, Prateekshya, Pravin, Priya, Rikesh and RubinaDocumento27 paginePresented By: Prajal, Prateekshya, Pravin, Priya, Rikesh and RubinaRightchoice BooksNessuna valutazione finora

- Pre and Post Merger P-E RatiosDocumento5 paginePre and Post Merger P-E RatiosPeter OnyangoNessuna valutazione finora

- Piotroski F Score Spreadsheet FreeDocumento7 paginePiotroski F Score Spreadsheet FreephaibaNessuna valutazione finora

- Reverse Discounted Cash FlowDocumento11 pagineReverse Discounted Cash FlowSiddharthaNessuna valutazione finora

- Quiz # 14 Pre-Test Time Value of MoneyDocumento1 paginaQuiz # 14 Pre-Test Time Value of MoneyDarren Jacob EspinaNessuna valutazione finora

- Value Investing - A Presentation by Prof Sanjay BakshiDocumento22 pagineValue Investing - A Presentation by Prof Sanjay BakshisubrataberaNessuna valutazione finora

- The 23 Winning Investment HabitsDocumento3 pagineThe 23 Winning Investment HabitsbiscodylNessuna valutazione finora

- Cash Accounting, Accrual Accounting, and Discounted Cash Flow ValuationDocumento32 pagineCash Accounting, Accrual Accounting, and Discounted Cash Flow ValuationHanh Mai TranNessuna valutazione finora

- Eka Setifani AfrianahDocumento135 pagineEka Setifani Afrianahmirtha aulia salfaNessuna valutazione finora

- Dampak Struktur Modal Pada Sensitivitas PenerapanDocumento21 pagineDampak Struktur Modal Pada Sensitivitas PenerapanHana Aafiyanti MarzukiNessuna valutazione finora

- Value Investing Grapich NovelDocumento16 pagineValue Investing Grapich NovelSebastian Zwph100% (1)

- Overconfidence Under Reaction BuffettDocumento43 pagineOverconfidence Under Reaction BuffettDevan PramuragaNessuna valutazione finora

- AAPL 5yr OSV Stock Valuation SpreadsheetDocumento14 pagineAAPL 5yr OSV Stock Valuation SpreadsheetOld School ValueNessuna valutazione finora

- Investment QuestionnaireDocumento6 pagineInvestment QuestionnaireRohit AggarwalNessuna valutazione finora

- Rakesh Jhunjhunwala's Model Portfolio For 2012Documento9 pagineRakesh Jhunjhunwala's Model Portfolio For 2012rakeshjhunjhunwalaNessuna valutazione finora

- Damodaran's Optimal Capital StructureDocumento17 pagineDamodaran's Optimal Capital StructureRajaram IyengarNessuna valutazione finora

- Financial FormationDocumento60 pagineFinancial FormationSandeep Soni100% (1)

- Rammurti DandDocumento1 paginaRammurti DandAjay BhatnagarNessuna valutazione finora

- Acquisition and Valuation of Business VentureDocumento48 pagineAcquisition and Valuation of Business VentureMarie ManansalaNessuna valutazione finora

- Axis Bank ValuvationDocumento26 pagineAxis Bank ValuvationGermiya K JoseNessuna valutazione finora

- Ratio AnalysisDocumento26 pagineRatio AnalysisDeep KrishnaNessuna valutazione finora

- 06-Valuation & Cash Flow AnalysisDocumento7 pagine06-Valuation & Cash Flow AnalysisPooja RatraNessuna valutazione finora

- INVESTMENT JOURNEY - Kiran Dhanawada - VP CHINTAN BAITHAK - GOA 2015Documento11 pagineINVESTMENT JOURNEY - Kiran Dhanawada - VP CHINTAN BAITHAK - GOA 2015sureshvadNessuna valutazione finora

- Fundamental of ValuationDocumento39 pagineFundamental of Valuationkristeen1211Nessuna valutazione finora

- Use The Benjamin Graham Investing Checklist To Invest Like Him by Jay JayDocumento8 pagineUse The Benjamin Graham Investing Checklist To Invest Like Him by Jay JayLuiz SobrinhoNessuna valutazione finora

- Analysis of Financial StatementsDocumento46 pagineAnalysis of Financial StatementsJim GohNessuna valutazione finora

- EV To EBIT Valuation SpreadsheetDocumento2 pagineEV To EBIT Valuation SpreadsheetHoang HaNessuna valutazione finora

- Fcffsimpleginzu ITCDocumento62 pagineFcffsimpleginzu ITCPravin AwalkondeNessuna valutazione finora

- Annual Report 2014Documento115 pagineAnnual Report 2014paNessuna valutazione finora

- Workshop Financial Modelling-ShareDocumento58 pagineWorkshop Financial Modelling-ShareIdham Idham Idham100% (1)

- IRDAI Journal Quarterly Jan-March 2017Documento68 pagineIRDAI Journal Quarterly Jan-March 2017pramod_kmr73Nessuna valutazione finora

- Free Cash Flow ValuationDocumento46 pagineFree Cash Flow ValuationLayNessuna valutazione finora

- Ratio AnalysisDocumento11 pagineRatio AnalysisPrashant BhadauriaNessuna valutazione finora

- AC3103 Biz Val BibleDocumento131 pagineAC3103 Biz Val BibleR100% (1)

- Stock Analysis - Learn To Analyse A Stock In-DepthDocumento19 pagineStock Analysis - Learn To Analyse A Stock In-DepthLiew Chee KiongNessuna valutazione finora

- Morningstar Equities Research MethodologyDocumento2 pagineMorningstar Equities Research Methodologykanika sengarNessuna valutazione finora

- Why Simplicity Wins Abbreviated Saurabh MukherjeaDocumento46 pagineWhy Simplicity Wins Abbreviated Saurabh Mukherjeapushpa sNessuna valutazione finora

- Valuation of FirmsDocumento53 pagineValuation of FirmsAmit Bose0% (1)

- How To Screen Stocks: Be A Wise Investor and Not A Day TraderDocumento67 pagineHow To Screen Stocks: Be A Wise Investor and Not A Day Traderppate100% (1)

- Shareholders Value CreationDocumento22 pagineShareholders Value CreationSameer GopalNessuna valutazione finora

- Chapter 11 Valuation Using MultiplesDocumento22 pagineChapter 11 Valuation Using MultiplesUmar MansuriNessuna valutazione finora

- Interest Rate Risk in Global Market AnalysisDocumento4 pagineInterest Rate Risk in Global Market AnalysisAnushree BumbNessuna valutazione finora

- Who Are India's Best Equity Investors Who Invest For Themselves - QuoraDocumento3 pagineWho Are India's Best Equity Investors Who Invest For Themselves - QuoraHemjeet BhatiaNessuna valutazione finora

- Financial Statements, Cash Flow, and TaxesDocumento27 pagineFinancial Statements, Cash Flow, and Taxeszohaib25Nessuna valutazione finora

- Think Equity Think QGLP Contest 2019: Application FormDocumento20 pagineThink Equity Think QGLP Contest 2019: Application Formvishakha100% (1)

- India Pharma Sector - Sector UpdateDocumento142 pagineIndia Pharma Sector - Sector Updatekushal-sinha-680Nessuna valutazione finora

- Project NPV Sensitivity AnalysisDocumento54 pagineProject NPV Sensitivity AnalysisAsad Mehmood100% (3)

- Lesson 3Documento29 pagineLesson 3Anh MinhNessuna valutazione finora

- Amazon ValuationDocumento22 pagineAmazon ValuationDr Sakshi SharmaNessuna valutazione finora

- High GrowthDocumento30 pagineHigh GrowthAbhinav PandeyNessuna valutazione finora

- I. Income StatementDocumento27 pagineI. Income StatementNidhi KaushikNessuna valutazione finora

- Flop BudgetDocumento42 pagineFlop BudgetPro ResourcesNessuna valutazione finora

- Amphibi Animalchirping PDFDocumento2 pagineAmphibi Animalchirping PDFPro ResourcesNessuna valutazione finora

- Free Business Analysiss TemplateDocumento8 pagineFree Business Analysiss TemplatePro ResourcesNessuna valutazione finora

- Financial Forecast Template ExcelDocumento43 pagineFinancial Forecast Template ExcelPro Resources100% (1)

- LiqdiscDocumento4 pagineLiqdiscPro ResourcesNessuna valutazione finora

- Gridlinesalt 1Documento4 pagineGridlinesalt 1Pro ResourcesNessuna valutazione finora

- FCFFSTDocumento10 pagineFCFFSTapi-3701114Nessuna valutazione finora

- FcffginzulambdaDocumento43 pagineFcffginzulambdaPro ResourcesNessuna valutazione finora

- Fcffsimpleginzu 2014Documento54 pagineFcffsimpleginzu 2014Pro Resources100% (1)

- FirmmultDocumento2 pagineFirmmultPro ResourcesNessuna valutazione finora

- Fcffginzu 2014Documento43 pagineFcffginzu 2014Pro ResourcesNessuna valutazione finora

- Family Budget PlannerDocumento44 pagineFamily Budget PlannerPro ResourcesNessuna valutazione finora

- FlexvalDocumento6 pagineFlexvalPro ResourcesNessuna valutazione finora

- FcffnegDocumento14 pagineFcffnegPro ResourcesNessuna valutazione finora

- Employee Shift Schedule Generator in ExcelDocumento20 pagineEmployee Shift Schedule Generator in ExcelPro ResourcesNessuna valutazione finora

- FCFF 3 STDocumento3 pagineFCFF 3 STPro ResourcesNessuna valutazione finora

- FcffgenDocumento17 pagineFcffgenPro ResourcesNessuna valutazione finora

- FcffevaDocumento6 pagineFcffevaPro ResourcesNessuna valutazione finora

- Electricity Bill Calculator Template ExcelDocumento5 pagineElectricity Bill Calculator Template ExcelPro Resources0% (2)

- FcffevaDocumento6 pagineFcffevaPro Resources100% (1)

- FcfevsddmDocumento6 pagineFcfevsddmPro ResourcesNessuna valutazione finora

- FcfestDocumento5 pagineFcfestPro ResourcesNessuna valutazione finora

- FCFF 2 STDocumento12 pagineFCFF 2 STPro ResourcesNessuna valutazione finora

- Dividend Discount Model: AssumptionsDocumento36 pagineDividend Discount Model: AssumptionsPro ResourcesNessuna valutazione finora

- Fcfe 3 STDocumento16 pagineFcfe 3 STapi-3763138Nessuna valutazione finora

- Excel Pivot Tables TutorialDocumento51 pagineExcel Pivot Tables TutorialPro ResourcesNessuna valutazione finora

- Fcfe 2 STDocumento12 pagineFcfe 2 STPro ResourcesNessuna valutazione finora

- Excel Invoice Numbers TutorialDocumento5 pagineExcel Invoice Numbers TutorialPro ResourcesNessuna valutazione finora

- ExpandDocumento2 pagineExpandPro ResourcesNessuna valutazione finora

- Decline of Spain SummaryDocumento4 pagineDecline of Spain SummaryNathan RoytersNessuna valutazione finora

- Cgtmse MDocumento82 pagineCgtmse MAnonymous EtnhrRvz0% (1)

- Syndicate 6 - Gainesboro Machine Tools CorporationDocumento12 pagineSyndicate 6 - Gainesboro Machine Tools CorporationSimon ErickNessuna valutazione finora

- 48168321-2013-International Hotel Corp. v. Joaquin Jr.Documento16 pagine48168321-2013-International Hotel Corp. v. Joaquin Jr.Christine Ang CaminadeNessuna valutazione finora

- Doing Business in UAEDocumento16 pagineDoing Business in UAEHani SaadeNessuna valutazione finora

- Management Letter Mattsenkumar Services PVT LTD 2021-22Documento12 pagineManagement Letter Mattsenkumar Services PVT LTD 2021-22Sudhir Kumar DashNessuna valutazione finora

- Investment Slide 1Documento17 pagineInvestment Slide 1ashoggg0% (1)

- Credit and CollectionDocumento18 pagineCredit and CollectionJACA, John Lloyd B.Nessuna valutazione finora

- Airline Operating CostsDocumento27 pagineAirline Operating Costsawahab100% (7)

- Advance Paper Corporation V Arma Traders Corporation G.R. 176897Documento11 pagineAdvance Paper Corporation V Arma Traders Corporation G.R. 176897Dino Bernard LapitanNessuna valutazione finora

- Altaf Ali - Cashier CVDocumento3 pagineAltaf Ali - Cashier CVAzam Baig100% (2)

- Money MarketDocumento20 pagineMoney Marketmanisha guptaNessuna valutazione finora

- International Trading Regulation Hannan Aminatami AlkatiriDocumento11 pagineInternational Trading Regulation Hannan Aminatami AlkatiriAlyssa Khairafani GandamihardjaNessuna valutazione finora

- Oberoi Realty Initiation ReportDocumento16 pagineOberoi Realty Initiation ReportHardik GandhiNessuna valutazione finora

- Sample Statement of AccountDocumento1 paginaSample Statement of AccountKipo JenefferNessuna valutazione finora

- XXXX Sap Implementation Project Exercise Book: FI110-Enterprise Controlling - ConsolidationDocumento18 pagineXXXX Sap Implementation Project Exercise Book: FI110-Enterprise Controlling - ConsolidationShyam JaganathNessuna valutazione finora

- Nealon, Inc. Solutions (All Questions Answered + Step by Step)Documento7 pagineNealon, Inc. Solutions (All Questions Answered + Step by Step)AndrewVazNessuna valutazione finora

- Acct Statement XX5203 16122023Documento3 pagineAcct Statement XX5203 16122023sa6307756Nessuna valutazione finora

- Final Project Report of Summer Internship (VK)Documento56 pagineFinal Project Report of Summer Internship (VK)Vikas Kumar PatelNessuna valutazione finora

- Acct 284 Clem Exam One - Doc Fall 2004Documento3 pagineAcct 284 Clem Exam One - Doc Fall 2004noranycNessuna valutazione finora

- Assertions of Compliance With Accountability RequirementsDocumento2 pagineAssertions of Compliance With Accountability RequirementslouvelleNessuna valutazione finora

- L& T Buy BackDocumento4 pagineL& T Buy BackteammrauNessuna valutazione finora

- Financial Summary of Google's Acquisition of YouTubeDocumento4 pagineFinancial Summary of Google's Acquisition of YouTubecmcandrew21Nessuna valutazione finora

- Overview of Mutual Fund Ind. HDFC AMCDocumento67 pagineOverview of Mutual Fund Ind. HDFC AMCSonal DoshiNessuna valutazione finora

- Container Market PDFDocumento3 pagineContainer Market PDFDhruv AgarwalNessuna valutazione finora

- PT Mega Perintis TBK Dan Entitas AnakDocumento90 paginePT Mega Perintis TBK Dan Entitas AnakGesti saputra SaputraNessuna valutazione finora

- Inflation and UnemploymentDocumento55 pagineInflation and UnemploymentShubham AgarwalNessuna valutazione finora

- MGT-521 Human Resource Management: HRM: End Term Evaluation AssignmentDocumento8 pagineMGT-521 Human Resource Management: HRM: End Term Evaluation AssignmentKaran TrivediNessuna valutazione finora

- Chapter 7 Risk and Return Question and Answer From TitmanDocumento2 pagineChapter 7 Risk and Return Question and Answer From TitmanMd Jahid HossainNessuna valutazione finora

- EurobondDocumento11 pagineEurobondMahirNessuna valutazione finora