Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Template Vat 201

Caricato da

mrsk1801Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Template Vat 201

Caricato da

mrsk1801Copyright:

Formati disponibili

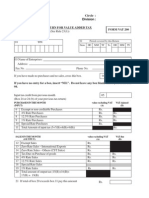

Remittance received on

PART 1

Always quote this

registration number in

correspondence and

during interviews

VAT 201

Please use this telephone number for any enquiries

Tax period

VAT registration number

Area

Fold here for cash register

Amount of payment

NB. Read notes overleaf

See general notes 4, 6 and 7 overleaf for amount due to be deducted by electronic bank transfer

BANKING DETAILS:

This receipt is not valid unless printed in cash register figures

Trading or other name

Method of payment / indicate with an X below

Cash

1 2

Date received

Area

PART 2

VAT 201

Tax period

ending

RETURN FOR REMITTANCE

R C

Cheque

7

X

100 + r

r

VAT

23

14

Other

21

15

8 X

100

r

VAT

9

10 11

CONSIDERATION (INCLUDING VAT)

B. CALCULATION OF INPUT TAX

I certify that the particulars in this return are true and correct.

Change in use and export of second-hand goods

TOTAL

22

Tax on adjustments:

Adjustments:

Not exceeding 45 days

This block must be completed

C =

Other goods or services imported by and / or supplied to you (not capital goods and / or services)

Capital goods or services imported by and / or supplied to you

Input tax in respect of:

12

(20 - 21 + 22)

TOTAL AMOUNT (EXCLUDING VAT)

RANDS ONLY

X

100 + r

C R

4A

1

5

2

3

1A

CONSIDERATION (INCLUDING VAT)

X

100 + r

r

VAT

4

r

x 60%

A. CALCULATION OF OUTPUT TAX

Supply of accommodation: TAXABLE VALUE (EXCLUDING VAT)

6

Zero rate

Exempt and non-supplies

Exceeding 45 days

Standard rate (only capital goods and / or services)

Standard rate (excluding capital goods and / or services and accommodation)

Supply of goods and / or services by you:

20

13

TOTAL OUTPUT TAX (4 + 4A + 9 + 11 + 12) TOTAL A

17 Bad debts

18

Change in use

Other

16

VAT PAYABLE / REFUNDABLE (Total A- Total B)

Add penalty R C + interest R

19

TOTAL INPUT TAX (14 + 15 + 16 + 17 + 18) TOTAL B

AMOUNT PAYABLE (TAX + PENALTY + INTEREST)

Signature

Less credit

Date Capacity

VALUE-ADDED TAX

Return for remittance of

value-added tax

24

Potrebbero piacerti anche

- Rich Dad Poor DadDocumento16 pagineRich Dad Poor DadPrateek Singla100% (3)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Da EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Valutazione: 3.5 su 5 stelle3.5/5 (17)

- Nhlanhla Ngcobo Wilmonts Organization ChartDocumento1 paginaNhlanhla Ngcobo Wilmonts Organization ChartNHLANHLA TREVOR NGCOBONessuna valutazione finora

- New Form 2550 M - Monthly VAT Return P 1-2Documento3 pagineNew Form 2550 M - Monthly VAT Return P 1-2Pearl Reyes64% (14)

- Bir Form 1701Documento12 pagineBir Form 1701miles1280Nessuna valutazione finora

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionDa EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNessuna valutazione finora

- Blood Type BDocumento3 pagineBlood Type Bmrsk1801100% (4)

- 2550MDocumento9 pagine2550MAngel AlfaroNessuna valutazione finora

- VAT On Merchandise Purchased and SoldDocumento5 pagineVAT On Merchandise Purchased and SoldBernadette Solis100% (1)

- VAT FormDocumento2 pagineVAT FormGbenga Ogunsakin67% (3)

- Bir Form 2000Documento4 pagineBir Form 2000Ricca Pearl SulitNessuna valutazione finora

- Form 1600Documento4 pagineForm 1600KialicBetito50% (2)

- Accounting and Finance Formulas: A Simple IntroductionDa EverandAccounting and Finance Formulas: A Simple IntroductionValutazione: 4 su 5 stelle4/5 (8)

- Bir EtformDocumento3 pagineBir EtformrjgingerpenNessuna valutazione finora

- 2550 Bir FormDocumento48 pagine2550 Bir FormKisu ShuteNessuna valutazione finora

- Value Added Tax Returns Form 002Documento5 pagineValue Added Tax Returns Form 002JUDY OSUSUNessuna valutazione finora

- VATPT For PicpaDocumento73 pagineVATPT For PicpaJoy Superales SalaoNessuna valutazione finora

- Assessment Year Indian Income Tax Return: I - IndividualDocumento6 pagineAssessment Year Indian Income Tax Return: I - IndividualManjunath YvNessuna valutazione finora

- NNNDocumento4 pagineNNNJemely BagangNessuna valutazione finora

- Vat Monthly ReturnDocumento2 pagineVat Monthly ReturnJayadeep VuppalaNessuna valutazione finora

- Monthly Value-Added Tax Declaration: Kawanihan NG Rentas InternasDocumento4 pagineMonthly Value-Added Tax Declaration: Kawanihan NG Rentas InternasjamquintanesNessuna valutazione finora

- Monthly Value-Added Tax Declaration: Kawanihan NG Rentas InternasDocumento9 pagineMonthly Value-Added Tax Declaration: Kawanihan NG Rentas InternasAdriel Torreda NaturalNessuna valutazione finora

- Vat Lecture ThreeDocumento28 pagineVat Lecture ThreeAbdulkarim Hamisi KufakunogaNessuna valutazione finora

- Form VAT - 17: Return by A Registered PersonDocumento3 pagineForm VAT - 17: Return by A Registered PersonYf WoonNessuna valutazione finora

- 2015 VAT in Cambodia Sesion II 22aug 2015Documento27 pagine2015 VAT in Cambodia Sesion II 22aug 2015Sovanna HangNessuna valutazione finora

- Petroleum CompleteDocumento4 paginePetroleum CompleteAngela ArleneNessuna valutazione finora

- Bir 53Documento4 pagineBir 53toofuuNessuna valutazione finora

- Monthly VAT ReturnDocumento34 pagineMonthly VAT ReturnEdris MatovuNessuna valutazione finora

- Quarterly Tax Value-Added Return: Kawanihan NG Rentas InternasDocumento5 pagineQuarterly Tax Value-Added Return: Kawanihan NG Rentas InternasStephanie LayloNessuna valutazione finora

- TOBACCO CompleteDocumento3 pagineTOBACCO CompleteAngela ArleneNessuna valutazione finora

- Sales Tax Return 16353854Documento1 paginaSales Tax Return 163538547799349Nessuna valutazione finora

- 2550Mv 2Documento7 pagine2550Mv 2nelsonNessuna valutazione finora

- FTP FTP - Bir.gov - PH Webadmin Forms 2551mDocumento1 paginaFTP FTP - Bir.gov - PH Webadmin Forms 2551mPeter John M. LainezNessuna valutazione finora

- New Form 2550 Q - Quarterly VAT Return P 1-2 (2005 Version)Documento4 pagineNew Form 2550 Q - Quarterly VAT Return P 1-2 (2005 Version)Michelle G. Minor0% (1)

- Bangladesh Withholding Tax Return FormDocumento15 pagineBangladesh Withholding Tax Return FormMahbubur RahmanNessuna valutazione finora

- Unit 6: Value Added Tax (Proclamation 285/2002 Regulation 79/2002 Proclamation 609/2008)Documento23 pagineUnit 6: Value Added Tax (Proclamation 285/2002 Regulation 79/2002 Proclamation 609/2008)Bizu AtnafuNessuna valutazione finora

- Chapter 19 & 20Documento23 pagineChapter 19 & 20Kershey Salac100% (6)

- Monthly Percentage Tax ReturnDocumento3 pagineMonthly Percentage Tax ReturnAu B ReyNessuna valutazione finora

- NTN Top 10 Share Holder's Name Percentage Capital NTN Top 10 Share Holder's Name Percentage CapitalDocumento5 pagineNTN Top 10 Share Holder's Name Percentage Capital NTN Top 10 Share Holder's Name Percentage Capitalhati1Nessuna valutazione finora

- Income TaxDocumento6 pagineIncome TaxKuldeep HoodaNessuna valutazione finora

- ITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamDocumento11 pagineITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamcachandhiranNessuna valutazione finora

- Monthly Value-Added Tax DeclarationDocumento17 pagineMonthly Value-Added Tax DeclarationMIRAHNELNessuna valutazione finora

- Bir46 PDFDocumento2 pagineBir46 PDFJulia SmithNessuna valutazione finora

- Bir Form Percentage TaxDocumento3 pagineBir Form Percentage TaxEc MendozaNessuna valutazione finora

- 1 67 8 (A) Tax Amount in Box 8 (A) 2 68 8 (A) Tax Amount in Box 8 (A) 3 67,68 8 Duplicate Tax Rates in Line Nos 67,68Documento12 pagine1 67 8 (A) Tax Amount in Box 8 (A) 2 68 8 (A) Tax Amount in Box 8 (A) 3 67,68 8 Duplicate Tax Rates in Line Nos 67,68Ganesh ChavanNessuna valutazione finora

- Description: BIR Form 2550M BIR Form No. 2307Documento17 pagineDescription: BIR Form 2550M BIR Form No. 2307Montessa GuelasNessuna valutazione finora

- IT Return 2011 2012Documento3 pagineIT Return 2011 2012swapnil6121986Nessuna valutazione finora

- (Return To Index) : DescriptionDocumento13 pagine(Return To Index) : DescriptionTara ManteNessuna valutazione finora

- BasDocumento2 pagineBasJill GeorgeNessuna valutazione finora

- Form 26QB: Income Tax DepartmentDocumento3 pagineForm 26QB: Income Tax DepartmentAnand JaiswalNessuna valutazione finora

- Chapter 11 - Vat On Services 2013Documento10 pagineChapter 11 - Vat On Services 2013Jean Chel Perez Javier100% (3)

- Quarterly Value-Added Tax Return: 333-337 Quezon Ave., Quezon City, Metro ManilaDocumento5 pagineQuarterly Value-Added Tax Return: 333-337 Quezon Ave., Quezon City, Metro ManilaJacinto TanNessuna valutazione finora

- Gra Nhil ReturnDocumento2 pagineGra Nhil ReturnpapapetroNessuna valutazione finora

- Very Awkward Tax: A bite-size guide to VAT for small businessDa EverandVery Awkward Tax: A bite-size guide to VAT for small businessNessuna valutazione finora

- 1040 Exam Prep: Module II - Basic Tax ConceptsDa Everand1040 Exam Prep: Module II - Basic Tax ConceptsValutazione: 1.5 su 5 stelle1.5/5 (2)

- Federal Income Tax: a QuickStudy Digital Law ReferenceDa EverandFederal Income Tax: a QuickStudy Digital Law ReferenceNessuna valutazione finora

- Account Name: African Academy For The Built EnvironmentDocumento2 pagineAccount Name: African Academy For The Built Environmentmrsk1801Nessuna valutazione finora

- Exam Booking FormDocumento1 paginaExam Booking Formmrsk1801Nessuna valutazione finora

- 21 Day Daniel Fast-JournalDocumento22 pagine21 Day Daniel Fast-Journalmrsk1801100% (1)

- School Fees Structure 2014: Method of PaymentDocumento3 pagineSchool Fees Structure 2014: Method of Paymentmrsk1801Nessuna valutazione finora

- K2A Trading Journal FXDocumento11 pagineK2A Trading Journal FXmrsk1801Nessuna valutazione finora

- Memo 15 of 2009 Report 191 2010 TTDocumento68 pagineMemo 15 of 2009 Report 191 2010 TTmrsk1801Nessuna valutazione finora

- ECD 2013 Contact SessionsDocumento1 paginaECD 2013 Contact Sessionsmrsk1801Nessuna valutazione finora

- Payment Options For ECD CoursesDocumento1 paginaPayment Options For ECD Coursesmrsk1801Nessuna valutazione finora

- Blood Type oDocumento3 pagineBlood Type omrsk1801100% (3)

- ECD NQF 4 Programme Layout NewDocumento7 pagineECD NQF 4 Programme Layout Newmrsk18010% (1)

- Application For Refund2013Documento1 paginaApplication For Refund2013mrsk1801Nessuna valutazione finora

- Property Condition ReportDocumento73 pagineProperty Condition Reportmrsk1801Nessuna valutazione finora

- HRM5SGMod2-V2 1 PDFDocumento0 pagineHRM5SGMod2-V2 1 PDFmrsk1801100% (1)

- Guidelines Version 2 3 of Summative Assignment End Module 2Documento2 pagineGuidelines Version 2 3 of Summative Assignment End Module 2mrsk1801Nessuna valutazione finora

- Property Condition ReportDocumento63 pagineProperty Condition Reportmrsk1801Nessuna valutazione finora

- Oracle: Johannesburg Daytime ScheduleDocumento1 paginaOracle: Johannesburg Daytime Schedulemrsk1801Nessuna valutazione finora

- Myregistration Unisa 2013 CSETDocumento204 pagineMyregistration Unisa 2013 CSETengsam777Nessuna valutazione finora

- Admission Procedure 2013-2014Documento1 paginaAdmission Procedure 2013-2014mrsk1801Nessuna valutazione finora

- Demand TheoryDocumento10 pagineDemand TheoryVinod KumarNessuna valutazione finora

- Activity Based Costing - Practice QuestionsDocumento8 pagineActivity Based Costing - Practice QuestionsSuchita GaonkarNessuna valutazione finora

- 2023 Internal Audit Plan For The CrewDocumento4 pagine2023 Internal Audit Plan For The CrewLateef LasisiNessuna valutazione finora

- MarkfedDocumento30 pagineMarkfedKarampreet KaurNessuna valutazione finora

- Principles of Marketing Kotler 15th Edition Solutions ManualDocumento32 paginePrinciples of Marketing Kotler 15th Edition Solutions ManualShannon Young100% (33)

- Hyundai Motors: Operations and Sourcing of Hyundai ProductsDocumento15 pagineHyundai Motors: Operations and Sourcing of Hyundai ProductsAditya JaiswalNessuna valutazione finora

- Ent 12 Holiday HWDocumento4 pagineEnt 12 Holiday HWsamNessuna valutazione finora

- MKT Assignment Factory ReportDocumento7 pagineMKT Assignment Factory ReportTsadik Hailay100% (2)

- IMPACT OF AI (Artificial Intelligence) ON EMPLOYMENT: Nagarjuna V 1NH19MCA40 DR R.SrikanthDocumento24 pagineIMPACT OF AI (Artificial Intelligence) ON EMPLOYMENT: Nagarjuna V 1NH19MCA40 DR R.SrikanthNagarjuna VNessuna valutazione finora

- Check AccountabilityDocumento12 pagineCheck Accountabilityjoy elizondoNessuna valutazione finora

- Case Study Barclays FinalDocumento13 pagineCase Study Barclays FinalShalini Senglo RajaNessuna valutazione finora

- CAF - Autumn 2021 Sessional DataDocumento7 pagineCAF - Autumn 2021 Sessional DataMuhammad FaisalNessuna valutazione finora

- 1.1 Background of The EnterpriseDocumento25 pagine1.1 Background of The EnterpriseBARBO, KIMBERLY T.Nessuna valutazione finora

- Mumbai Metro Rail Project: Group - 1 PGPFDocumento30 pagineMumbai Metro Rail Project: Group - 1 PGPFakash srivastavaNessuna valutazione finora

- Horizontal Vertical AnalysisDocumento4 pagineHorizontal Vertical AnalysisAhmedNessuna valutazione finora

- Berkshire HathawayDocumento25 pagineBerkshire HathawayRohit SNessuna valutazione finora

- Private Company ValuationDocumento35 paginePrivate Company ValuationShibly0% (1)

- New Microsoft Word DocumentDocumento10 pagineNew Microsoft Word DocumentMukit-Ul Hasan PromitNessuna valutazione finora

- Forms of Business Organization in NepalDocumento10 pagineForms of Business Organization in Nepalsuraj banNessuna valutazione finora

- Integrating SDGsDocumento24 pagineIntegrating SDGsRuwandi KuruwitaNessuna valutazione finora

- 15 LasherIM Ch15Documento14 pagine15 LasherIM Ch15advaniamrita67% (3)

- Claiming Back Tax Paid On A Lump Sum: What To Do Now If The Form Is Filled in by Someone ElseDocumento9 pagineClaiming Back Tax Paid On A Lump Sum: What To Do Now If The Form Is Filled in by Someone ElseErmintrudeNessuna valutazione finora

- Fin Aw7Documento84 pagineFin Aw7Rameesh DeNessuna valutazione finora

- The Ethical and Social Responsibilities of The Entrepreneur: Reported By: Berceles, Manuel, Toledo, VillanuevaDocumento3 pagineThe Ethical and Social Responsibilities of The Entrepreneur: Reported By: Berceles, Manuel, Toledo, VillanuevaJojenNessuna valutazione finora

- 2013 Deutsche Bank Operational Due Diligence SurveyDocumento48 pagine2013 Deutsche Bank Operational Due Diligence SurveyRajat CNessuna valutazione finora

- On Companies Act 2013Documento23 pagineOn Companies Act 2013Ankit SankheNessuna valutazione finora

- Solved Jan Owns The Mews Bar and Grill Every Year atDocumento1 paginaSolved Jan Owns The Mews Bar and Grill Every Year atAnbu jaromiaNessuna valutazione finora

- Tax 102 Prelim ExamDocumento5 pagineTax 102 Prelim ExamDonna TumalaNessuna valutazione finora