Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

General Principles of Taxation

Caricato da

Claude PeñaDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

General Principles of Taxation

Caricato da

Claude PeñaCopyright:

Formati disponibili

PHILIPPINE LAWS ON INCOME TAXATION

GENERAL PRINCIPLES

OF TAXATION

Inherent Powers of the State

1. Power of Taxation

- Power of the state to exact an enforced

contribution upon persons, property or

rights for the purpose of generating

revenues for the use and support of the

government.

- Exercised only by the government or its

political subdivision.

- Generally no limit to the amount of tax

that may be imposed.

2. Power of Eminent Domain

- Power of the state to expropriate private

property for public purpose in return for a

just or reasonable compensation.

- May be granted by the government to

public service companies or public utilities.

3. Police Power

- Power of the state to promote the general

welfare of the people by limiting or

regulating the rights or properties of any

person.

- Relatively free from the constitutional

limitations and is superior to the non-

impairment clause provisions on obligations

of contracts.

Similarities among the Inherent Powers of

the Government

1. They all underlie and exist independently

with the constitution although the

conditions for their exercise maybe

prescribed by the constitution and by law

2. They are ways or means by which the

government interferes with private rights

and properties

3. They all rest upon necessity because there

can be no effective government without

them

4. They all presuppose an equivalent

compensation received, directly or

indirectly, by the persons affected by the

exercise of any of these governmental

powers

Distinctions between Power of Taxation and

Power of Eminent Domain

POWER OF

TAXATION

POWER OF

EMINENT DOMAIN

Directed against

persons, properties, or

rights

Directed against real

property

Purpose is to raise

revenues to support the

government

Purpose is to have real

property for public

purpose

(Taxpayer) gives money

representing his taxes in

consideration for

services and protections

presumed furnished by

the government.

(Taxpayer) gives away

his real property in

consideration for a just

or reasonable monetary

consideration.

Distinctions between Power of Taxation and

Police Power

POWER OF

TAXATION

POLICE POWER

To raise revenues to

support the government

To regulate or limit the

rights of persons for

public welfare

Directed against

persons, properties, or

rights

Directed against a

taxpayers rights or

property

The amount of tax

imposition may be

unlimited

The amount of

regulation fee must be

limited what is needed

to carry out the

regulation

Limitations on the Power of Taxation

1. Constitutional Limitations

a. Due process of the law

b. Equal protection of the law

c. Non-imprisonment for non-payment

of a debt or poll tax

d. Non-impairment of the provisions

on Obligations of Contracts

e. The rule of taxation shall be uniform

and equitable

- Progressive system of

Taxation

f. No public money shall be

appropriated for a religious or

private purpose

PHILIPPINE LAWS ON INCOME TAXATION

g. Exemption from Taxation of

Educational, Religious and

Charitable Organizations

- Basis is the use of

property, not ownership.

h. No law granting any tax exemption

shall be passed without the

concurrence of a majority of all the

members of congress.

i. Non-impairment of the Jurisdiction

of the Supreme Court on Tax Cases

j. The Philippine President has the

Power to approve or veto a Tax Bill

approved and passed by the

Congress.

- Veto may be overridden by

a 213 vote by Congress

2. Inherent Limitations

a. Taxes may be levied only for public

purpose

b. Non-delegation of the power to tax

except to local government

c. Exemptions from taxation of

government entities

d. Tax laws must be within the states

territorial jurisdiction

e. Tax laws must be subject to

international comity, convention, pr

agreements

f. Prohibition of double taxation

Definitions of Taxation

Taxation refers to the inherent power of the

state to exact an enforced contribution upon

persons, properties or rights for the

purpose of generating revenues for the use

of the government.

Taxation is a way or means of apportioning

the operational cost of the government and

all its public needs among those who, in

some measures, are privileged to enjoy its

benefits and therefore must bear the

burden.

Taxation is the act of levying a tax or the

process by which the government, through

its law-making body, raises revenues to

defray its necessary expenses.

Nature of Taxation

1. Authority

- Theory of Taxation / Lifeblood Theory

- Taxation rests upon necessity and is

inherent in every government or sovereignty

- Power is legislative in nature and essential

to the existence of any independent

government

- Government cannot exist without

taxation, thus taxation is an important

necessity.

2. Basis

- Benefits Received Principle

- Taxes are imposed upon persons,

properties or rights for the support of the

government in return for the general

advantages and protections which the

government affords the taxpayers, their

protections and rights.

- Where there is no benefit, there is no

power to tax.

- Reciprocal duties of protection and

support between the state and those that are

subject to its authority (symbiotic

relationship between the state and its

citizen).

Purposes of Taxation

1. To raise revenues for the use and support of

the government to enable it to carry out its

appropriate functions

2. It is a means to contend or promote the

general welfare, social and economic

development of a country and its people

Scope of Taxation (CUPS)

1. Comprehensive

2. Unlimited without restrictions, except

constitutional

3. Plenary whole power

4. Supreme strongest inherent power

Nature of Tax Laws/Internal Revenue Laws

Civil in nature

Not political or penal (although there are

penalties for violations)

Tax laws remain even if the government

changes.

National Internal Revenue Code (a

special law) prevails over a general law.

Construction of Tax Laws

PHILIPPINE LAWS ON INCOME TAXATION

Construed strictly against the government

and liberally in favor of the taxpayer

Tax Exemptions & Deductions construed

strictly against the taxpayer asserting the

claims for exemptions/deductions (there is

loss of revenue against the government)

Construed as to include the power to

destroy (imposing higher taxes on sin

products and on imported goods)

Applications of Tax Laws

Prospective in operation

May operate retroactively, if expressly

declared or it is the legislative intent.

Basic Principles of a Sound Tax System

(FAT)

1. Fiscal Adequacy

- Sources of revenues must be adequate to

meet the expenditures of the government

regardless of business or economic

conditions.

2. Administrative Feasibility

- Capable of reasonable and convenient

enforcement, just and effective

administration.

3. Theoretical Justice / Equality

- Tax burden shall be shouldered by those

who have the ability to pay.

- There must be an equitable or

proportionate distribution of tax burden

Tax

Enforced burden or mandatory

contribution imposed by the government

based on its power of taxation, upon

persons, properties, or rights.

Tax is the bread and butter or the lifeblood

of the government hence, no court shall be

empowered to interfere with or restrain the

collections of taxes.

Essential Characteristics of Tax

1. Enforced contribution

2. Legislative in nature

3. In accordance with/based on law

4. For public purpose

5. Proportionate in character

6. Pecuniary in character/payment in kind

7. Paid at regular intervals

8. Imposed upon persons, properties, or rights

9. To raise government revenues

Classifications of Taxes

1. As to Subject Matter

a. Personal ax / Capitation Tax /

Poll Tax

- Fixed amount of taxes, regardless

of property, professions, or

occupations.

- e.g., Community Tax

b. Property Tax

- Imposed on taxpayers property

(real or personal), situated within

the territorial jurisdiction of the

state

- e.g., Real Property/Estate Tax

c. Excise Tax / Privilege Tax

- Imposed on taxpayers exercising

of rights and privileges of

performing an act or engaging in an

occupation

- e.g., Donors Tax, Income Tax

2. As to Scope or Authority

a. National Tax

- Imposed by the national

government, enforced by the BIR, or

Bureau of Customs, under the Dept.

of Finance

- e.g., Corporate Income Tax,

Customs duties, Tariffs

b. Local Tax

- Imposed by the local government

(barangays, cities, municipalities, or

provinces)

- e.g., Real Estate Tax, Community

Tax

3. As to Purpose

a. General Tax

- For general purposes, which go to

the national/general funds

- e.g., Estate Tax

b. Special Tax

- Imposed for a special purpose,

which go to certain special funds

- e.g., Gasoline Tax, Flood Tax

4. As to Liabilities

a. Direct Tax

- Cannot be passed on or shifted to

other persons for payment

- e.g., Income Taxes

PHILIPPINE LAWS ON INCOME TAXATION

b. Indirect Tax

- Permitted by law to be shifted or

passed on to other persons for

payment

- e.g., Value Added Tax

5. As to Determination of Amounts

a. Specific Tax

- Determined based on weight or

volume capacity or any physical unit

of measurements

- e.g., Excise Tax on liquors and

cigarettes

b. Ad Valorem Tax

- According to Value

- Amounts are determined based on

the sales price or other specified

values of the property

- e.g., Value Added Tax (12%)

6. As to Graduation or Rates

a. Progressive/Graduated Tax

- Amount of taxes increase as the

bracket/layer increases

- e.g., Gift Tax, Estate Tax

b. Regressive Tax

- Amount of tax decreases as the

bracket/layer increases

- NO REGRESSIVE TAX in the

Philippines

c. Proportionate Tax / Flat Tax

- Amount of tax may be higher or

lower depending upon the bracket

Distinctions between Tax and License Fee

License - payment require to exercise a

certain right, e.g., Drivers License

TAX LICENSE

For the purpose of

raising revenues

For the purpose of

regulation

Based on the Power of

Taxation

Based on the Police

Power

Direct authority from

Congress levies a tax

License fee is imposed

under a delegated power

to the local government

Generally no limit to the

amount collectible

Enough only to cover

the cost of services or

regulation

Failure to pay does not

render the business /

occupation illegal (Taxes

cannot be collected

Failure to pay renders

the business /

occupation illegal

unless business is legally

registered)

Distinction between Tax and Toll

Toll - the compensation charged by the

owner for the use of his property and

improvements, e.g., Toll Fee

TAX TOLL

Demand of sovereignty

(pursuant to political

authority)

Demand of

proprietorship

(pursuant to right of

ownership)

Government-imposed Imposed by the

government or private

persons

To raise revenues for the

support and use of the

government

To recover the cost of

property and its

improvements

Distinction between Tax and Special

Assessment

Special Assessment (BELL) - local

imposition upon property in the immediate

vicinity of municipal improvements,

predicated upon the theory of benefits from

such improvements, e.g., drainage system

- Benefits

- Exceptional as to time &

place

- Levied on Land only

- Liability of a person

assessed (not)

TAX

SPECIAL

ASSESSMENT

Imposed upon persons,

properties, or rights

Imposed only on land

and its improvements

Imposed by national or

local government

Imposed only by local

government

Enforced contribution

for the use and support

of the government

Enforced contribution to

recover the cost of the

public improvements

Ordinary and general Extra-ordinary and

situational as to time

and locality

Distinction between Tax and Customs

Duties

PHILIPPINE LAWS ON INCOME TAXATION

TAX CUSTOMS DUTIES

Not all taxes are

customs duties

All customs duties are

taxes

Imposed upon persons,

properties, or rights

Imposed only upon

articles imported to or

exported from the

country

Distinction between Tax and Debt

TAX DEBT

Based on law Based on contract

Non-assignable Assignable

Generally payable in

terms of money

Payment is in terms of

money or property

(Dacion en Pago -

payment of movable or

immovable property)

In case of non-payment,

there is a possibility of

imprisonment

In case of non-payment,

there is no possibility of

imprisonment (unless

criminal or fraudulent)

May not be subject to

the right of offset

May be subject to offset

(Compensatio Morae)

Tax Situs / Place of Taxation

1. Persons

- Inhabitants or residents of the state,

whether citizens or not

2. Real Property

- State in which it is located, whether owner

is a resident or non-resident

3. Tangible Personal Property

- Wherever property is located (?)

4. Intangible Personal Property

- Domicile of the owner

5. Income

- From persons who are residents or citizens

in the taxing jurisdiction

6. Business, Occupation, and

Transaction

- Place where business was conducted

7. Gratuitous Transfer of Property

- based on citizenship, residency, location

Phases or Aspects of Taxation

1. Levying / Imposition of Tax

- Legislative process

- determining the persons, properties,

transactions, or rights to be taxed

- determining the purpose of said tax (as

long as for public purpose)

- sum to be raise

- Tax rate to be implied

2. Assessment and Collections of Tax

- Administrative process

- vested in Department of Finance, thru

BIR, Bureau of Customs, and LGUs

International Comity

Fundamental rule of taxation that no law

shall be passed to impose taxation on the

property owned by a foreign government

or sovereignty.

Categories of Double Taxation

Double Taxation - act of taxing the same

taxpayer twice by the same kind and

character of tax, by the same taxing

authority, for the same purpose and during

the same taxable period

1. Direct Double Taxation

- direct act of taxing the same taxpayer twice

during the same period

- NOT ALLOWED

2. Indirect Double Taxation

- A burden of two or more pecuniary

impositions

There is no constitutional limitation on

double taxation. It is merely subject to the

inherent limitation, hence it is not

prohibited legally speaking

Classification of Tax Escapes

1. Tax Credit

- payments made directly by the taxpayer

through withholding agents

2. Tax Exemption

- grant of immunity (express or implied)

3. Tax Evasion / Tax Dodging

- fraudulent act of using pretenses or

forbidden devices to lessen the tax liability

- understate income, overstate expenses

4. Tax Avoidance

- Legitimate means [permitted by laws to

minimize / avoid ones tax liability

5. Tax Shifting

- Legitimately passing ones tax liability for

payment to other persons in accordance

with provisions on tax laws

Potrebbero piacerti anche

- General Principles of Taxation PDFDocumento79 pagineGeneral Principles of Taxation PDFJed Bacyugon Apada100% (1)

- General Principles of TaxationDocumento10 pagineGeneral Principles of TaxationJustineMaeMillanoNessuna valutazione finora

- Taxation Law ReviewerDocumento62 pagineTaxation Law ReviewerAdelaine Faith Zerna96% (23)

- Income Taxation ReviewerDocumento65 pagineIncome Taxation ReviewerShiela100% (10)

- G. Nature, Construction, Application, and Sources of Tax LawsDocumento12 pagineG. Nature, Construction, Application, and Sources of Tax LawsDon Dupio100% (1)

- HQ01 - General Principles of TaxationDocumento12 pagineHQ01 - General Principles of TaxationAl Joshua Ü Pidlaoan86% (7)

- Income TaxationDocumento31 pagineIncome Taxationbenjamintee86% (7)

- Taxation Law Reviewer-2019Documento38 pagineTaxation Law Reviewer-2019Katherine Alexandra Taran60% (5)

- General Principles of TaxationDocumento11 pagineGeneral Principles of TaxationSheen Dela Cruz100% (3)

- Income Taxation NotesDocumento3 pagineIncome Taxation NotesMa. Valerie LabareñoNessuna valutazione finora

- Income Taxation - General PrinciplesDocumento1 paginaIncome Taxation - General PrinciplesJubert DimakataeNessuna valutazione finora

- II Income TaxationDocumento8 pagineII Income TaxationNatasha MilitarNessuna valutazione finora

- 2 General Principles of Income TaxationDocumento9 pagine2 General Principles of Income TaxationDenise ZurbanoNessuna valutazione finora

- 1 Income Tax ReviewerDocumento69 pagine1 Income Tax ReviewerPrincess Galang100% (1)

- General Principles of Taxation and Income TaxationDocumento79 pagineGeneral Principles of Taxation and Income TaxationJoeban R. Paza100% (2)

- Tax 1 ReviewerDocumento52 pagineTax 1 Reviewerms_k_a_y_e96% (25)

- Income Tax ReviewerDocumento99 pagineIncome Tax ReviewerJoy Navaja Dominguez100% (1)

- Gross Income: Module No. 3-4 Inclusive Week: August 23-27, 2021 Module Overview Reference / Research LinksDocumento13 pagineGross Income: Module No. 3-4 Inclusive Week: August 23-27, 2021 Module Overview Reference / Research LinksHeigh Ven100% (1)

- Cpa Review - CGTDocumento10 pagineCpa Review - CGTKenneth Bryan Tegerero TegioNessuna valutazione finora

- Tax1 1 Basic Principles of Taxation 01.30.11-Long - For Printing - Without AnswersDocumento10 pagineTax1 1 Basic Principles of Taxation 01.30.11-Long - For Printing - Without AnswersCracker Oats83% (6)

- Compilation of QuizzesDocumento37 pagineCompilation of QuizzesHazel MoradaNessuna valutazione finora

- Inclusions in Gross IncomeDocumento2 pagineInclusions in Gross Incomeloonie tunesNessuna valutazione finora

- Summary Notes - Property Relations & Estate Tax Credit and Distributable EstateDocumento3 pagineSummary Notes - Property Relations & Estate Tax Credit and Distributable EstateKiana FernandezNessuna valutazione finora

- Taxation ReviewerDocumento19 pagineTaxation ReviewerjwualferosNessuna valutazione finora

- Chapter 1 - Gen. Principles in TaxationDocumento20 pagineChapter 1 - Gen. Principles in TaxationMatta, Jherrie MaeNessuna valutazione finora

- Business & Transfer Taxation: Rex B. Banggawan, Cpa, MbaDocumento38 pagineBusiness & Transfer Taxation: Rex B. Banggawan, Cpa, Mbajustine reine cornicoNessuna valutazione finora

- Transfer TaxesDocumento24 pagineTransfer TaxesAlexis Dela Cruz100% (2)

- Income Taxation - General Principles Review NotesDocumento8 pagineIncome Taxation - General Principles Review NotesJohn Lemuel CabiliNessuna valutazione finora

- Deductions From Gross IncomeDocumento5 pagineDeductions From Gross IncomeWenjunNessuna valutazione finora

- Philippine Income TaxationDocumento179 paginePhilippine Income TaxationiLoveMarshaNessuna valutazione finora

- Introduction To Estate TaxDocumento71 pagineIntroduction To Estate TaxMiko ArniñoNessuna valutazione finora

- Taxation Reviewer - SAN BEDADocumento128 pagineTaxation Reviewer - SAN BEDAMark Lawrence Guzman93% (28)

- Doctrines in TaxationDocumento68 pagineDoctrines in TaxationAling Kinai80% (10)

- HQ02 - Taxes, Tax Laws and Tax AdministrationDocumento10 pagineHQ02 - Taxes, Tax Laws and Tax AdministrationJimmyChaoNessuna valutazione finora

- What Is Gross Income (Or Taxable Gross Income) ?Documento24 pagineWhat Is Gross Income (Or Taxable Gross Income) ?Joe P PokaranNessuna valutazione finora

- General Principles of TaxationDocumento5 pagineGeneral Principles of Taxationmync89100% (3)

- General Principles of TaxationDocumento12 pagineGeneral Principles of TaxationMatt Marqueses PanganibanNessuna valutazione finora

- 1st Exam - TaxDocumento4 pagine1st Exam - TaxAlvin YercNessuna valutazione finora

- Chapter 12 Transfer TaxationDocumento14 pagineChapter 12 Transfer TaxationCamila MolinaNessuna valutazione finora

- Tax 2 Reviewer LectureDocumento12 pagineTax 2 Reviewer LectureAnonymous aRheeMNessuna valutazione finora

- Income Taxation CHAPTER 6Documento14 pagineIncome Taxation CHAPTER 6Mark67% (3)

- Tax2 - Ch1-5 Estate Taxes ReviewerDocumento8 pagineTax2 - Ch1-5 Estate Taxes ReviewerMaia Castañeda100% (15)

- LECTURE 10 Dealings in PropertiesDocumento33 pagineLECTURE 10 Dealings in PropertiesJeane Mae BooNessuna valutazione finora

- Taxation Law UST Golden NotesDocumento307 pagineTaxation Law UST Golden NotesLeomard SilverJoseph Centron Lim100% (2)

- Chapter 6 Income Tax by Banggawan Chapter 6 Income Tax by BanggawanDocumento11 pagineChapter 6 Income Tax by Banggawan Chapter 6 Income Tax by BanggawanEarth PirapatNessuna valutazione finora

- General Principles of Taxation June 2019 College of LawDocumento89 pagineGeneral Principles of Taxation June 2019 College of LawJoanna Marie100% (1)

- Exclusions To Gross IncomeDocumento8 pagineExclusions To Gross IncomeNishikata MaseoNessuna valutazione finora

- GROSS INCOME Inclusions and Exclusions: Tel. Nos. (043) 980-6659Documento24 pagineGROSS INCOME Inclusions and Exclusions: Tel. Nos. (043) 980-6659MaeNessuna valutazione finora

- General Principles of Taxation ReviewerDocumento62 pagineGeneral Principles of Taxation ReviewerAB Cloyd100% (1)

- Computed Using Classification and Globalization Rule: or Business Income Such As Passive IncomeDocumento10 pagineComputed Using Classification and Globalization Rule: or Business Income Such As Passive IncomelcNessuna valutazione finora

- The Concept of Succession and Estate Tax: Pamantasan NG Lungsod NG MuntinlupaDocumento24 pagineThe Concept of Succession and Estate Tax: Pamantasan NG Lungsod NG MuntinlupaRizza OmalinNessuna valutazione finora

- Tax II Reviewer and NotesDocumento26 pagineTax II Reviewer and NotesJett Chuaquico100% (1)

- Taxation 1 Transcript Part 4 (3 of 3) SyllabusDocumento10 pagineTaxation 1 Transcript Part 4 (3 of 3) SyllabuscristiepearlNessuna valutazione finora

- 6 - Deductions From Gross IncomeDocumento9 pagine6 - Deductions From Gross IncomeSamantha Nicole Hoy100% (2)

- Income Taxation Notes On BanggawanDocumento5 pagineIncome Taxation Notes On BanggawanHopey100% (4)

- TaxationDocumento10 pagineTaxationJash Angelo Garcia100% (2)

- Shabu Batak TaxationDocumento41 pagineShabu Batak TaxationJOSHUA M. ESCOTONessuna valutazione finora

- Chapter 1 TaxationDocumento13 pagineChapter 1 TaxationGlomarie Gonayon100% (1)

- TaxationDocumento17 pagineTaxationyawi diskatersNessuna valutazione finora

- Fundamental Principles of Taxation: ObjectivesDocumento12 pagineFundamental Principles of Taxation: ObjectivesChristelle JosonNessuna valutazione finora

- FTP - Corporation 2021Documento2 pagineFTP - Corporation 2021Claude PeñaNessuna valutazione finora

- No Pardon For MeDocumento1 paginaNo Pardon For MeClaude Peña0% (1)

- K+12 Program in The PhilippinesDocumento2 pagineK+12 Program in The PhilippinesClaude PeñaNessuna valutazione finora

- Clyde Ian Brett C. ZEN115 - 2MB January 28, 2015 "What Does That Imply?"Documento3 pagineClyde Ian Brett C. ZEN115 - 2MB January 28, 2015 "What Does That Imply?"Claude PeñaNessuna valutazione finora

- Merrill Lynch Futures Inc Vs Court of Appeals Spouses Pedro M Lara and Elisa G LaraDocumento2 pagineMerrill Lynch Futures Inc Vs Court of Appeals Spouses Pedro M Lara and Elisa G LaraClaude PeñaNessuna valutazione finora

- Zuiden V GVTLDocumento2 pagineZuiden V GVTLClaude PeñaNessuna valutazione finora

- Spermatogenesis and OogenesisDocumento14 pagineSpermatogenesis and OogenesisClaude PeñaNessuna valutazione finora

- Respiratory - Circulatory SystemDocumento3 pagineRespiratory - Circulatory SystemClaude PeñaNessuna valutazione finora

- Case 030615Documento2 pagineCase 030615Claude PeñaNessuna valutazione finora

- BBL 112 012715Documento3 pagineBBL 112 012715Claude PeñaNessuna valutazione finora

- BCM 112 Application LetterDocumento1 paginaBCM 112 Application LetterClaude PeñaNessuna valutazione finora

- Case Digests - Corporation LawDocumento134 pagineCase Digests - Corporation LawLemuel R. Campiseño80% (10)

- NS 102-Reproductive SystemDocumento1 paginaNS 102-Reproductive SystemClaude PeñaNessuna valutazione finora

- Heart Rate: ObjectivesDocumento4 pagineHeart Rate: ObjectivesClaude PeñaNessuna valutazione finora

- Bio 1Documento3 pagineBio 1Claude PeñaNessuna valutazione finora

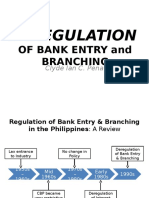

- Deregulation: of Bank Entry and BranchingDocumento6 pagineDeregulation: of Bank Entry and BranchingClaude PeñaNessuna valutazione finora

- PenaDocumento2 paginePenaClaude PeñaNessuna valutazione finora

- GR 155731 DigestDocumento2 pagineGR 155731 DigestClaude PeñaNessuna valutazione finora

- Sworn Statement: Annex " C "Documento13 pagineSworn Statement: Annex " C "Stephanie Mariz Khan100% (1)

- CSR Matrix (Example Only)Documento24 pagineCSR Matrix (Example Only)hmp90100% (1)

- Prohibition of Strikes and Lock-Outs General Prohibition of StrikesDocumento3 pagineProhibition of Strikes and Lock-Outs General Prohibition of StrikesFatema VoraNessuna valutazione finora

- Shipboard Operations Manual: 1 Purpose and ScopeDocumento3 pagineShipboard Operations Manual: 1 Purpose and ScopeEmrah Agi-AcaiNessuna valutazione finora

- Charlotte Nash Response To Joe Newton ComplaintDocumento6 pagineCharlotte Nash Response To Joe Newton ComplaintTyler EstepNessuna valutazione finora

- IvarcomDocumento446 pagineIvarcomZoldyck KilluaNessuna valutazione finora

- OECD 2016 SOEs Issues Paper Transparency and Disclosure MeasuresDocumento20 pagineOECD 2016 SOEs Issues Paper Transparency and Disclosure MeasuresArviany Retno NingrumNessuna valutazione finora

- Shares Suspended For TradingDocumento1 paginaShares Suspended For TradingPushparaj ThangarajNessuna valutazione finora

- Maharashtra Real Estate Regulatory Authority: Certificate For Extension of Registration of Project Form 'F'Documento1 paginaMaharashtra Real Estate Regulatory Authority: Certificate For Extension of Registration of Project Form 'F'sakshi meherNessuna valutazione finora

- An Introduction To CCAR: Comprehensive Capital Analysis & Review (CCAR)Documento10 pagineAn Introduction To CCAR: Comprehensive Capital Analysis & Review (CCAR)Chun Kit ChanNessuna valutazione finora

- COSO Placemat DeloitteDocumento2 pagineCOSO Placemat DeloitteFridolinYudithaMassoraNessuna valutazione finora

- Tender OfferDocumento5 pagineTender OfferkiranaishaNessuna valutazione finora

- Bihar Special Survey and Settlement Act2011Documento14 pagineBihar Special Survey and Settlement Act2011Latest Laws Team0% (1)

- Government Expenditure and TaxationDocumento21 pagineGovernment Expenditure and TaxationJutt TheMagicianNessuna valutazione finora

- Figuerdo DFS Affirmation PDFDocumento337 pagineFiguerdo DFS Affirmation PDFjimmy_vielkind6146Nessuna valutazione finora

- Test Bank For Principles of Auditing and Other Assurance Services 21st Edition WhittingtonDocumento14 pagineTest Bank For Principles of Auditing and Other Assurance Services 21st Edition WhittingtonDavid Langley100% (33)

- Good Regulatory PracticeDocumento48 pagineGood Regulatory PracticeShaenie Lou GatilloNessuna valutazione finora

- Singer Sewing Company Vs NLRC DigestDocumento1 paginaSinger Sewing Company Vs NLRC DigestALee BudNessuna valutazione finora

- Public Procurement LectureDocumento37 paginePublic Procurement LectureMr DamphaNessuna valutazione finora

- Refinement of The Ecb Guide To Internal ModelsDocumento16 pagineRefinement of The Ecb Guide To Internal ModelsjayaNessuna valutazione finora

- AB InBev Responsible Sourcing Policy PDFDocumento7 pagineAB InBev Responsible Sourcing Policy PDFcristian quelmis vilca huarachiNessuna valutazione finora

- OilDocumento51 pagineOiladamNessuna valutazione finora

- 118 - Fleischer V Botica NolascoDocumento3 pagine118 - Fleischer V Botica Nolascomimiyuki_Nessuna valutazione finora

- Roland Berger Truck Industry 2020 20110215dfbfhDocumento44 pagineRoland Berger Truck Industry 2020 20110215dfbfhShashikant MishraNessuna valutazione finora

- Strategic Management PaperDocumento36 pagineStrategic Management Paperwenkyganda100% (2)

- Thorough Examination and Testing of Lifts: Simple Guidance For Lift OwnersDocumento5 pagineThorough Examination and Testing of Lifts: Simple Guidance For Lift OwnersAlex Sandro Borges PereiraNessuna valutazione finora

- African Ministers On RailwayDocumento240 pagineAfrican Ministers On Railwaytilahuns1125Nessuna valutazione finora

- International Shoe Co. v. WashingtonDocumento2 pagineInternational Shoe Co. v. WashingtonRonnie Barcena Jr.Nessuna valutazione finora

- Civil Engineer Resume TemplateDocumento2 pagineCivil Engineer Resume TemplateTol Man Shrestha100% (1)

- Finacial InstitutionDocumento62 pagineFinacial InstitutionjdsamarocksNessuna valutazione finora