Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

2014 Volume 2 CH 1 Answers

Caricato da

Louiegie Thomas San Juan0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

41 visualizzazioni10 pagineanswer key

Titolo originale

2014 Volume 2 Ch 1 Answers

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoanswer key

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

41 visualizzazioni10 pagine2014 Volume 2 CH 1 Answers

Caricato da

Louiegie Thomas San Juananswer key

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 10

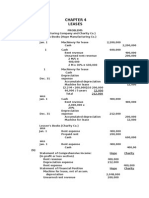

CHAPTER 1

CURRENT LIABILITIES, PROVISIONS AND CONTINGENCIES

PROBLEMS

1-1. (Washington Company)

Accounts Payable, 12/31/13, before adjustments P 1,000,000

Unrecorded checks in payment to creditors (350,000)

Unrecorded purchases (150,000 x 98%)

Unrecorded goods purchased FOB shipping point

147,000

120,000

Accounts Payable, 12/31/13, as adjusted P 917,000

1-2. (Adams Company)

Accounts Payable, 12/31/13, before adjustments P1,500,000

Goods purchased FOB shipping point, lost in transit 240,000

Returned to supplier (80,000)

Accounts Payable, 12/31/13, as adjusted P1,660,000

1-3. (Jefferson Corporation)

(a) (1) Gross Method

Dec. 16 Purchases 66,000

Freight in 1,400

Accounts Payable Intel Company 67,400

19 Purchases 72,000

Accounts Payable Celeron Corporation 72,000

26 Accounts Payable- Intel Company 67,400

Purchase Discount (2% x 66,000) 1,320

Cash 66,080

31 Accounts Payable Celeron Corporation 72,000

Purchase Discount (2% x 72,000) 1,440

Cash 70,560

(a) (2) Net Method

Dec. 16 Purchases 64,680

Freight in 1,400

Accounts Payable Intel Company 66,080

19 Purchases 69,840

Accounts Payable Celeron Corporation 69,840

26 Accounts Payable Intel Company 66,080

Cash 66,080

31 Accounts Payable Celeron Corporation 69,840

Purchase Discounts Lost 720

Cash 70,560

Chapter 1 Current Liabilities, Provisions and Contingencies

2

(b)

Dec. 31 Purchase Discounts Lost 720

Accounts Payable Celeron Corporation 720

1-4. (Madison Company)

(a)

10/01/13 Automobiles (1,747,200 112%) 1,560,000

Discount on Notes Payable 187,200

Notes Payable 1,747,200

12/31/13 Interest Expense 46,800

Discount on Notes Payable 46,800

1,560,000 x 12% x 3/12

10/01/14 Interest Expense 140,400

Discount on Notes Payable 140,400

187,200 46,800

Notes Payable 1,747,200

Cash 1,747,200

(b) At December 31, 2013:

Current Liabilities:

Notes Payable, net of P140,400 Discount P1,606,800

1-5. (Monroe Corporation)

(a)

06/01/13 Cash 1,080,000

Discount on Notes Payable 120,000

Notes Payable 1,200,000

12/31/13 Interest Expense 70,000

Discount on Notes Payable 70,000

120,000 x 7/12

05/31/14 Interest Expense 50,000

Discount on Notes Payable 50,000

120,000 70,000

Notes Payable 1,200,000

Cash 1,200,000

(b) At December 31, 2013:

Current Liabilities:

Notes Payable, net of P50,000 Discount P 1,150,000

1-6. (Unison Company)

(a) Market interest rate is 5%

Principal P8,000,000

Stated interest (8,000,000 x 9%) 720,000

Maturity value P8,720,000

PV factor at 5% for 1 period 0.9524

Present value at May 1, 2012 P8,304,928

Face value of the note 8,000,000

Premium on Notes Payable P 304,928

Chapter 1 Current Liabilities, Provisions and Contingencies

3

05/01/13 Equipment 8,304,928

Notes Payable 8,000,000

Premium on Notes Payable 304,928

12/31/13 Interest Expense 276,715

Premium on Notes Payable (304,928 x 8/12) 203,285

Interest Payable(8,000,000 x 9% x 8/12) 480,000

4/30/14 Interest Expense 138,537*

Premium on Notes Payable (304,928 203,285) 101,643

Interest Payable 480,000

Notes Payable 8,000,000

Cash 8,720,000

*balancing figure (difference is due to rounding off of present value factor)

Carrying value as of December 31, 2013

Notes Payable P8,000,000

Premium on Notes Payable 101,643

Interest Payable 480,000

Total (or 8,304,928 + 276,715) P8,581,643

b. Market rate of interest is 12%.

Principal P8,000,000

Stated interest (8,000,000 x 9%) 720,000

Maturity value P8,720,000

PV factor at 12% for 1 period 0.8929

Present value at May 1, 2012 P7,786,088

Face value of the note 8,000,000

Discount on Notes Payable P 213,912

05/01/13 Equipment 7,786,088

Discount on Notes Payable 213,912

Notes Payable 8,000,000

12/31/13 Interest Expense 622,608

Discount on Notes Payable (213,912 x

8/12)

142,608

Interest Payable(8,000,000 x 9% x 8/12) 480,000

4/30/14 Interest Expense 311,304*

Interest Payable 480,000

Notes Payable 8,000,000

Discount on Notes Payable 71,304

Cash 8,720,000

*balancing figure (difference is due to rounding off of present value factor)

Carrying value as of December 31, 2013

Notes Payable P8,000,000

Discount on Notes Payable (71,304)

Interest Payable 480,000

Total (or 7,786,088 + 622,608) P8,408,696

Chapter 1 Current Liabilities, Provisions and Contingencies

4

1-7. (Harrison Company)

Amount to be accrued on 12/31/13 (the best estimate of the obligation) P800,000

No obligation is recognized for the suit filed in September 2013 nor for the suit filed

in October. However, disclosure is necessary in the notes to the financial statements

for the suit filed in October 2013 by Pasig City government since it is reasonably

possible the Pasig City government will be successful.

1-8. ( Tyler Corporation)

a. Premium Inventory 225,000

Cash / Accounts Payable 225,000

b. Premium Expense 100,000

Cash (1,000 x 50) 50,000

Premium Inventory (1,000 x 150) 150,000

c. Premium Expense 300,000

Estimated Liability for Premium Claims Outstanding 300,000

(40% x 1,000,000)/ 100 = 4,000

4,000 1,000 = 3,000; 3,000 x (150 50) = 300,000

1-9. (Polk Company)

(a) Premium Expense (300,000 x 30%)/20 x 28 P126,000

Cost of mugs already distributed (4,000 x 28) 112,000

Estimated liability for premium claims outstanding P 14,000

(b) Premium Expense for 2013 (see a) P126,000

1-10. Taylor Company

(a) 2012 2013

Expected future redemption, beg - (30,000)

Redeemed during the year 40,000 90,000

Expected future redemption, end 30,000 80,000

Total 70,000 140,000

5 5

14,000 28,000

Net cost of premium (120 50) x P70 x P70

Premium expense P980,000 P1,960,000

(b) Provision for premium claims outstanding

12/31/12 (30,000/5) x P70 P 420,000

12/31/13 (80,000/5) x P70 P1,120,000

Chapter 1 Current Liabilities, Provisions and Contingencies

5

1-11. (Van Department Store)

(a)

Allocation of original consideration received:

Sales revenue (98% x P5,000,000)

P4,900,000

Liability for Customer Loyalty Awards (2% x P5,000,000) P 100,000

Revenue in 2012 as a result of redemption

100,000 x 25/90

P 27,778

Revenue in 2013 as a result of redemption

Total accumulated revenue from redemption as of

12/31/12 (100,000 x 60/95)

P 63,158

Less revenue earned in 2012 27,778

Revenue in 2013 as a result of redemption P 35,380

(b)

Liability as of 12/31/12 (100,000 27,778) P 72,222

Liability as of 12/31/13 (100,000 63,158) P 36,842

1-12. (Jackson Company)

2011 2012 2013

Sale of product

Accts. Receivable/Cash 1,000,000 2,500,000 3,500,000

Sales 1,000,000 2,500,000 3,500,000

Accrual of repairs

Warranty Expense 60,000 150,000 210,000

Warranty Liability 60,000 150,000 210,000

6% x 1M

6% x 2.5M

6% x 3.5M

Actual repairs

Warranty Liability 8,000 38,000 112,500

Cash/ AP, etc. 8,000 38,000 112,500

1-13. (Fillmore Company)

(a)

2012 2013

Warranty Liability, January 1 P 0 P187,200

Warranty expense (8% x 4,200,000)/(8% x 6,960,000) 336,000 556,800

Actual repair costs incurred (148,800) (180,000)

Warranty liability, December 31 P187,200 P564,000

(b)

On 2012 sales (4,200,000 x 5% x !) P105,000

On 2013 sales [(1/2 of 3%) + 5%] x 6,960,000 452,400

Warranty Liability, December 31, 2013, as analyzed P557,400

1-14. (Pierce Corporation)

Cash 2,000,000

Unearned Revenue from Gift Certificates Outstanding 2,000,000

Unearned Revenue from Gift Certificates Outstanding 1,280,000

Sales 1,280,000

Note: The gift certificates estimated to expire will be recognized as revenue at the

date of actual expiration.

Chapter 1 Current Liabilities, Provisions and Contingencies

6

1-15. (Buchanan Company)

Cash 3,000,000

Unearned Revenue from Gift Certificates Outstanding 3,000,000

Unearned Revenue from Gift Certificates Outstanding 2,750,000

Sales 2,750,000

Unearned Revenue from Gift Certificates Outstanding 150,000

Revenue from Forfeited Gift Certificates 150,000

1-16. (Lincoln Company)

Refundable Deposits, January 1, 2013 P250,000

Deposits received during the year 200,000

Deposits refunded during the year (267,000)

Deposits forfeited during the year (100,000 82,000) (18,000)

Refundable Deposits, December 31, 2013 P165,000

1-17. (Johnson Company)

(a) 2012 2013

Cash 720,000 864,000

Unearned Service Contract Revenue 720,000 864,000

Cost of Service Contract 25,000 100,000

Cash, Accounts Payable, etc. 25,000 100,000

Unearned Service Contract Revenue 72,000 266,400

Service Contract Revenue 72,000 266,400

2012: 720,000 x 20% x !=72,000

2013: 720,000 x 20% x !=72,000

720,000 x 30% x !=108,000

864,000 x 30% x !=86,400

72,000+108,000+86,400=266,400

(b) 2012 2013

Unearned Service Contract Revenue, Jan. 1 ----- P648,000

Sale of contracts during the year P720,000 864,000

Service contracts earned during the year (72,000) (266,400)

Unearned Service Contract Revenue, Dec. 31 P648,000 P1,245,600

Unearned Service Contract Revenue at December 31, 2013 may also be computed as:

720,000 x 65% 468,000

864,000 x 20% x ! 86,400

864,000 x 80% 691,200

Total 1,245,600

(c) 2012 2013

Revenue from service contracts P72,000 P266,400

Cost of service contracts 25,000 100,000

Profit from service contracts P47,000 P166,400

Chapter 1 Current Liabilities, Provisions and Contingencies

7

1-18. (Grant Publication)

(a)

Subscriptions sold in 2010 and 2011

(5,000,000 + 4,500,000) P9,500,000

Expired subscriptions in

2010 P1,000,000

2011 (2,800,000 + 1,200,000) 4,000,000 5,000,000

Unearned subscriptions, Jan. 1, 2012 P4,500,000

(b) 2012

Cash 5,500,000

Unearned Subscription Revenue 5,500,000

Unearned Subscription Revenue 5,000,000

Subscription Revenue 5,000,000

1,200,000 + 2,000,000 + 1,800,000

(b) 2013

Cash 7,000,000

Unearned Subscription Revenue 7,000,000

Unearned Subscription Revenue 5,700,000

Subscription Revenue 5,700,000

1,300,000 + 2,400,000 + 2,000,000

(c) 2012 2013

Unearned Subscription Revenue, January 1 P4,500,000 P5,000,000

Subscription received during the year 5,500,000 7,000,000

Subscription revenue for the year (5,000,000) (5,700,000)

Unearned Subscription Revenue, December 31 P5,000,000 P6,300,000

1-19. (Hayes Co.)

Property Taxes Payable

Property tax expense July 1 to Dec. 31

(72,000 x 6/12)

P 36,000

Payment in 2013 (Nov. payment = 72,000/3) (24,000) P 12,000

Income Tax Payable

Pretax income before accrued property taxes P1,629,000

Less accrued property tax 12,000

Income subject to tax P1,617,000

Income tax rate 30%

Income tax expense P 485,100

2013 payments for 2013 income tax

(480,000190,000)

(290,000)

195,100

VAT Payable

Output VAT (12% x 9,000,000) P 1,080,000

2013 payments of VAT (725,000) 355,000

Total current liabilities for taxes P562,100

1-20. (Garfield Company)

a. B = 8,000,000 x 8% = 640,000

Chapter 1 Current Liabilities, Provisions and Contingencies

8

b. B = 8% (8000,000 B )

B = 640,000 - .08B

B = 640,000/1.08 = 592,593

c. B = .08 (8,000,000 T )

T = .30 (8,000,000 B )

B = .08 {8,000,000 - .30 (8,000,000 B ) }

B = .08 {8,000,000 2,400,000 + .30B}

B = 448,000 + .024B

B = 448,000/0.976 = 459,016

d. B = .08 {8,000,000 B T }

T = .30 (8,000,000 B)

B = .08{8,000,000 B - .30 (8,000,000 B)}

B = .08 {8,000,000 B 2,400,000 + .30B}

B = 448,000 - .056B

B = 448,000/1.056 = 424,242

1-21. (Arthur Corporation)

a. Bonus to sales manager = .08 x 3,000,000 = 240,000

Bonus to each sales agent = .06 x 3,000,000 = 180,000

b. Total Bonus = .36 {3,000,000 B T )

T = .30 {3,000,000 B }

B = .36 {3,000,000 B - .30 (3,000,000 B)}

B = .36 {3,000,000 B 900,000 + .30B}

B = 756,000 - .252B

B = 756,000/1.252 = 603,834 (total)

B (Each): 603,834 / 3 = 201,278

c. B = .32 {3,000,000 B }

B = 960,000 - .32B

B = 960,000/1.32 = 727,273 (total)

B (Sales Manager): 727,273 x 12/32 = 272,727

B (Each Sales Agent): 727,273 x 10/32 = 227,273

1-22. (Cleveland, Inc.)

B = .06 {9,000,000 B T }

T = .30 (9,000,000 B)

B = .06 (9,000,000 B - .30 (9,000,000 B ) }

B = .06 { 9,000,000 B 2,700,000 + .30B }

B = 378,000 - .042B

B = 378,000 / 1.042 = 362,764

T = .30 (9,000,000 362,764)

T = 2,591,171

1-23. (Roosevelt Corporation)

The full amount of P2,000,000 is classified as current liability because on December 31, 2013

(the reporting date), the enterprise has no unconditional right to defer the settlement of the

obligation for a period of at least 12 months.

Chapter 1 Current Liabilities, Provisions and Contingencies

9

1-24. Current Non-current

Case 1 . Taft, Inc.

3,600,000 x 80% P2,880,000

3,000,000 2,880,000 P 120,000

Case 2. Taft, Inc. 2,000,000 0

Case 3. Wilson Corporation

Situation A 6,000,000 0

Situation B 0 6,000,000

Situation C 6,000,000 0

Situation D -0- 6,000,000

1-25. (Harding Company)

Current Liabilities

14% Notes Payable, refinanced on March 10, 2013 P2,500,000

Current portion of 16% notes payable 1,600,000

Total current liabilities P4,100,000

1-26. (Coolidge Company)

Current Liabilities:

Accounts Payable P 270,000

Mortgage Notes Payable 1,300,000

Bank Notes Payable due currently 100,000

Interest Payable 7,500

Value Added Tax Payable 288,000

Income Tax Payable 315,000

Withholding Tax Payable 120,000

Total Current Liabilities P2,400,500

VAT: 2,688,000 / 1.12 = 2,400,000; 2,400,000 x 12% = 288,000

The damages claimed by employees cannot be recognized since the amount is not

reasonably estimable.

Chapter 1 Current Liabilities, Provisions and Contingencies

10

MULTIPLE CHOICE QUESTIONS

Theory

MC1 D MC11 D

MC2 B MC12 B

MC3 C MC13 D

MC4 B MC14 B

MC5 B MC15 B

MC6 A MC16 A

MC7 B MC17 B

MC8 C MC18 A

MC9 C MC19 B

MC10 C MC20 C

MC21 D

MC22 D

Problems

MC23 D 540,000 + 30,000 + 15,000 = 585,000

MC24 C 100,000 + (100,000 x 0.3 x 9/12) = 102,250 x .944 = 96,524

MC25 A Proceeds = 100% - 10% = 90% ; Effective interest = 10%/90% = 11.11%

MC26 D P5,000,000, which is the reasonable estimate

MC27 C Given

MC28 A 130,000 + 1,630,000 1,560,000 = 200,000

MC29 D 6% ( 4,500,000-2,500,000) = 120,000 + (8,500 x ! ) + 2,500 = 126,750

MC30 D 1,080,000 + 1,920,000 1,560,000 = 1,440,000

MC31 C [(67.5% x 2,100,000] + 92.5%(2,730,000) = 3,942,750

MC32 C [! (15% + 35%) x P2,100,000] + (1/2 x 15% x 2,730,000) = 729,750

MC33 A ! (15% + 35%) x P2,730,000 = 682,500

MC34 A (25% x 2,100,000)+(67.5% x 2,730,000)+(92.5% x 2,475,000) = 4,657,125

MC35 D 1,000 x 750 = 750,000

MC36 B 63,000 + (1,125,000 x 3/10) = 400,500

MC37 B {(500,000 x 80%) 300,000} = 100,000; 100,000 x (50+5-40) = 1,500,000

MC38 A { (3,000,000 x 60%) / 10 } 42,000 = 138,000; 138,000 x P0.50 = 69,000

MC39 A (400,000 x 70%) 100,000 = 180,000 ; ( 180,000 /5) x 20 = 720,000

MC40 B (720,000 x 50%) 300,000 = 60,000

MC41 D 24,000 x 300 = 7,200,000

MC42 C 7,200,000 1,700,000 = 5,500,000

MC43 D 1,500,000 x 4% = 60,000

MC44 C B = 0.45 {2,000,000 B - .30 (2,000,000 B}) ; B = 479,087

MC45 C Total B = 0.35 {2,000,000 B} ; total B = 518,519

B to Sales Manager = 518,519 x 15/35 = 222,222

B to Each Sales Agent = 518,519 x 10/35 = 148,148

MC46 B B = 0.10 {2,500,000 - .30 (2,500,000 B)} = 180,412

MC47 C 600,000 + 900,000 + 400,000 = 1,900,000

MC48 A 2,400,000 1,900,000 = 500,000

MC49 D 3,800,000 + 2,000,000 5,000,000 = 800,000 decrease in profit

MC50 A 472,000+200,000+9,600+64,000+380,000+26,000+100,000+50,000+

24,000+48,000+57,500= 1,431,100

Potrebbero piacerti anche

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionDa EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNessuna valutazione finora

- Vol 2 CH 1Documento20 pagineVol 2 CH 1lee jong sukNessuna valutazione finora

- Answers - V2Chapter 1 2012Documento10 pagineAnswers - V2Chapter 1 2012Christopher Diaz0% (1)

- Financial Accounting 2 Chapter 1 SolmanDocumento17 pagineFinancial Accounting 2 Chapter 1 SolmanElijah Lou ViloriaNessuna valutazione finora

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionDa EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNessuna valutazione finora

- Answers - Chapter 1 Vol 2 2009Documento10 pagineAnswers - Chapter 1 Vol 2 2009Shiela PilarNessuna valutazione finora

- CPA Review Notes 2019 - BEC (Business Environment Concepts)Da EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Valutazione: 4 su 5 stelle4/5 (9)

- AP 5902 Liability Supporting NotesDocumento6 pagineAP 5902 Liability Supporting NotesMeojh Imissu100% (1)

- Credit Union Revenues World Summary: Market Values & Financials by CountryDa EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNessuna valutazione finora

- Financial Accounting Baysa and Lupisan 2008 Volume 2 EditionDocumento21 pagineFinancial Accounting Baysa and Lupisan 2008 Volume 2 EditionAsfjaslkf Dsgsdhsd0% (2)

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionDa EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNessuna valutazione finora

- CH 18 ADocumento9 pagineCH 18 AAlex YaoNessuna valutazione finora

- Consumer Lending Revenues World Summary: Market Values & Financials by CountryDa EverandConsumer Lending Revenues World Summary: Market Values & Financials by CountryNessuna valutazione finora

- CH 3 Vol 1 AnswersDocumento17 pagineCH 3 Vol 1 AnswersGeomari D. Bigalbal100% (2)

- Commercial Bank Revenues World Summary: Market Values & Financials by CountryDa EverandCommercial Bank Revenues World Summary: Market Values & Financials by CountryNessuna valutazione finora

- CH 3 Vol 1 AnswersDocumento17 pagineCH 3 Vol 1 Answersjayjay112275% (4)

- Fast-Track Tax Reform: Lessons from the MaldivesDa EverandFast-Track Tax Reform: Lessons from the MaldivesNessuna valutazione finora

- Batch 17 1st Preboard (P1)Documento13 pagineBatch 17 1st Preboard (P1)mjc24100% (7)

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionDa EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNessuna valutazione finora

- Accounting Principles 10th Edition Weygandt Kimmel Chapter 3 PDFDocumento139 pagineAccounting Principles 10th Edition Weygandt Kimmel Chapter 3 PDFbeenie manNessuna valutazione finora

- FM Paper Solution (2012)Documento6 pagineFM Paper Solution (2012)Prreeti ShroffNessuna valutazione finora

- Unit 1 - Essay QuestionsDocumento7 pagineUnit 1 - Essay QuestionsJaijuNessuna valutazione finora

- ACCADocumento12 pagineACCAAbdulHameedAdamNessuna valutazione finora

- AP 5902Q Liabs Supporting NotesDocumento2 pagineAP 5902Q Liabs Supporting NotesEmms Adelaine TulaganNessuna valutazione finora

- Workshop Solutions T1 2014Documento78 pagineWorkshop Solutions T1 2014sarah1379Nessuna valutazione finora

- CMA April - 14 Exam Question SolutionDocumento55 pagineCMA April - 14 Exam Question Solutionkhandakeralihossain50% (2)

- Chapter 11 Advacc 1 DayagDocumento17 pagineChapter 11 Advacc 1 Dayagchangevela67% (6)

- Intermediate Accounting CH 8 Vol 1 2012 AnswersDocumento6 pagineIntermediate Accounting CH 8 Vol 1 2012 AnswersPrincessAngelaDeLeon100% (5)

- Cheat SheetDocumento9 pagineCheat SheetKhushi RaiNessuna valutazione finora

- Non-Financial Liabilities HomeworDocumento6 pagineNon-Financial Liabilities HomeworIsabelle Guillena60% (5)

- AnswersDocumento8 pagineAnswersTareq ChowdhuryNessuna valutazione finora

- SMCH 12Documento101 pagineSMCH 12FratFool33% (3)

- Financial Accounting 2 Chapter 4Documento27 pagineFinancial Accounting 2 Chapter 4Elijah Lou ViloriaNessuna valutazione finora

- AC550 Week Four AssigmentDocumento8 pagineAC550 Week Four Assigmentsweetpr22Nessuna valutazione finora

- Ac557 W3 HW HBDocumento2 pagineAc557 W3 HW HBHasan Barakat100% (2)

- CHP 3 Problems Student TemplateDocumento28 pagineCHP 3 Problems Student TemplateDarkeningoftheLightNessuna valutazione finora

- Exercise Chapter 14Documento9 pagineExercise Chapter 14hassah fahadNessuna valutazione finora

- Exercise Chapter 14Documento9 pagineExercise Chapter 14hassah fahadNessuna valutazione finora

- Suggested SolutionsDocumento7 pagineSuggested SolutionsSunder ChaudharyNessuna valutazione finora

- FinAcc 2 Problem PresentationDocumento8 pagineFinAcc 2 Problem PresentationJirah May D. MeimNessuna valutazione finora

- Week3 Homework AC557Documento2 pagineWeek3 Homework AC557seniorr001100% (1)

- Not Collectible Within The Normal Operating Cycle Hence Amount To Be Collected Beyond 12 Months Shall Be Classified As A Noncurrent ReceivableDocumento1 paginaNot Collectible Within The Normal Operating Cycle Hence Amount To Be Collected Beyond 12 Months Shall Be Classified As A Noncurrent ReceivablecutieaikoNessuna valutazione finora

- CH 01 Review and Discussion Problems SolutionsDocumento11 pagineCH 01 Review and Discussion Problems SolutionsArman BeiramiNessuna valutazione finora

- CH 3 Answers Vol 1 - ReceivablesDocumento15 pagineCH 3 Answers Vol 1 - Receivablesadorableperez50% (2)

- Chapter 16Documento13 pagineChapter 16Andi Luo100% (1)

- BONEO Pup Receivables3 SRC 2 1Documento13 pagineBONEO Pup Receivables3 SRC 2 1hellokittysaranghaeNessuna valutazione finora

- Suggested Solutions Receivable Financing 1. A: "Weighted Average Time To Maturity"Documento2 pagineSuggested Solutions Receivable Financing 1. A: "Weighted Average Time To Maturity"cutieaikoNessuna valutazione finora

- Problem 2-26 (IAA)Documento19 pagineProblem 2-26 (IAA)gghyo88Nessuna valutazione finora

- Particulars Amount Amount Rs. (DR.) Rs. (DR.)Documento14 pagineParticulars Amount Amount Rs. (DR.) Rs. (DR.)Alka DwivediNessuna valutazione finora

- G-1 Template NewDocumento5 pagineG-1 Template NewShucheng NieNessuna valutazione finora

- Answers - V2Chapter 3 2012 PDFDocumento17 pagineAnswers - V2Chapter 3 2012 PDFkea paduaNessuna valutazione finora

- AC4301 FinalExam 2020-21 SemA AnsDocumento9 pagineAC4301 FinalExam 2020-21 SemA AnslawlokyiNessuna valutazione finora

- Chapter 25 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Documento15 pagineChapter 25 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNessuna valutazione finora

- Final AccountsDocumento6 pagineFinal AccountsGaurav NahataNessuna valutazione finora

- Batch 17 1st Preboard (P1)Documento13 pagineBatch 17 1st Preboard (P1)Jericho Pedragosa100% (1)

- Accy 517 HW PB Set 1Documento30 pagineAccy 517 HW PB Set 1YonghoChoNessuna valutazione finora

- ACAE 15 Activity Receivable FinancingDocumento3 pagineACAE 15 Activity Receivable FinancingNick ivan AlvaresNessuna valutazione finora

- Merger & Acquisition Accounting & Auditing Impact - Liquidation and Reorganisation - Jawaban Tugas Week 10Documento10 pagineMerger & Acquisition Accounting & Auditing Impact - Liquidation and Reorganisation - Jawaban Tugas Week 10Ragil Kuning ManikNessuna valutazione finora

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsDa EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNessuna valutazione finora

- Lower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderDa EverandLower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderNessuna valutazione finora

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesDa EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNessuna valutazione finora

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyDa EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNessuna valutazione finora

- How to get US Bank Account for Non US ResidentDa EverandHow to get US Bank Account for Non US ResidentValutazione: 5 su 5 stelle5/5 (1)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProDa EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProValutazione: 4.5 su 5 stelle4.5/5 (43)

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesDa EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesValutazione: 4 su 5 stelle4/5 (9)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCDa EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCValutazione: 4 su 5 stelle4/5 (5)

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyDa EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyValutazione: 4 su 5 stelle4/5 (52)

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationDa EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNessuna valutazione finora

- Beat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012Da EverandBeat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012Nessuna valutazione finora

- Public Finance: Legal Aspects: Collective monographDa EverandPublic Finance: Legal Aspects: Collective monographNessuna valutazione finora

- The Hidden Wealth of Nations: The Scourge of Tax HavensDa EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensValutazione: 4 su 5 stelle4/5 (11)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessDa EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessValutazione: 5 su 5 stelle5/5 (5)

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipDa EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipNessuna valutazione finora

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionDa EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionValutazione: 5 su 5 stelle5/5 (27)