Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

SSS R3 Contribution Collection List in Excel Format

Caricato da

John Cando57%(14)Il 57% ha trovato utile questo documento (14 voti)

25K visualizzazioni2 paginesss form

Copyright

© © All Rights Reserved

Formati disponibili

XLS, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentosss form

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato XLS, PDF, TXT o leggi online su Scribd

57%(14)Il 57% ha trovato utile questo documento (14 voti)

25K visualizzazioni2 pagineSSS R3 Contribution Collection List in Excel Format

Caricato da

John Candosss form

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato XLS, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

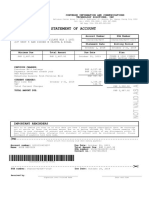

EMPLOYER ID NUMBER REGISTERED EMPLOYER NAME M M Y Y Y Y

TEL. NO. ADDRESS TYPE OF EMPLOYER

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

(MM DD YYYY)

SEPARATION DATE SS NUMBER

2nd Month 3rd Month 1st Month

Deduction from

Previously

Submitted R-3

CERTIFIED CORRECT AND PAID:

Signature Over Printed Name

(Surname) (Given Name) (MI)

ADJUSTMENT TYPE

1st Month

EMPLOYEE COMPENSATION

GRAND TOTAL PAYMENT DETAILS

Appl. Mo. Grand Total Social Security

Employee

Compensation

TOTALS FOR THIS PAGE (to be filled out on every page)

Household Regular

1st

2nd

3rd

Amount Paid

QUARTER ENDING

Pages

2nd Month 3rd Month

NAME OF MEMBER

RECEIVED BY/DATE:

PAGES

Republic of the Philippines

SOCIAL SECURITY SYSTEM

Contribution Collection List

SOCIAL SECURITY

PROCESSED BY/DATE:

Date Official Designation

(Please Read Instructions at the Back. Print All information in Black Ink)

Addition to

Previously

Submitted R-3

OF

R-3

Rev. 08-99

Signature Over Printed Name

ENCODED BY/DATE:

Signature Over Printed Name

OTHER NOTATIONS:

Date Paid TR/SBR NO.

FOR

SSS

USE

1. IF SUBMITTING A REGULAR OR ADJUSTMENT R-3,

1.1 Fill out in two (2) copies and indicate the type of employer by shading the applicable circle.

1.2 Write the month and year of the applicable quarter ending March, June, September and December on the space provided.

1.3 Check applicable box of adjustment.

2. Do not skip any line when filling out the form. Write Nothing Follows in the line immediately after the last employee.

3. Write the correct 10-digit SS number of your employees to ensure that all contributions paid will be credited to them.

4.

5. Write the month, day and year of separation of your employee, if applicable.

6.

7. Fill out the Grand Total and Payment Details of the last page of the R-3 only.

8.

9.

10.

11.

If SUBMITTING THROUGH THE POSTAL SERVICES OFFICE, mail this form with the R-5s and SBRs and prominently mark the envelope with SSS Form R-3 addressed

to the nearest SSS Office.

Note: The amounts contained herein were based on the last R-3 posted & must be corrected corresponding to the actual income of the employees for the period.

IF SUBMITTING A PRE-PRINTED R-3, effect all the necessary correction/adjustment in the form (2 copies).

Employers who fail to comply with the above requirements shall be subject to the provision of Section 28 (e) of the SSS law, as amended which states that Whoever fails or

refuses to comply with the provision of this Act or with the rules and regulations promulgated by the Commission, shall be punished by a fine of not less than Five thousand

pesos (P5,000) nor more than Twenty thousand pesos (P20,000), or imprisonment for not less than six (6) years and one (1) day nor more than twelve (12) years or both, at

the discretion of the court.

INSTRUCTIONS / REMINDER

Write family names as they are pronounced. For instance, Juan DELA CRUZ, Jose DELOS SANTOS, Pedro DE GUIA should be written as DELA CRUZ, Juan; DELOS

SANTOS, Jose; DE GUIA, Pedro. Also, suffixes such as Jr., Sr., II, III should be written after the family name. For example, Lucio San Juan Jr. and Efren De Guzman III

should be written as San Juan Jr., Lucio and De Guzman III, Efren, respectively.

The monthly Social Security (SS) and Employee Compensation (EC) contributions for an employee are based on his total actual remuneration for such month. Actual

remunerations include the mandated cost of living allowances as well as the cash value of any remuneration paid in any medium other than cash, except that part of the

remuneration in excess of the maximum contribution base. In filling out the SS and EC contributions, follow the sample below:

Submit the original and duplicate copies of the accomplished form together with the corresponding extra copies of Form R-5s and SBRs to the NEAREST SSS OR POSTAL

SERVICES OFFICE within the first (10) days of the month after the applicable quarter. The duplicate copy of this form is given back to the employer.

Potrebbero piacerti anche

- Endorsement Letter For ATMDocumento2 pagineEndorsement Letter For ATMKristine Fabiala100% (1)

- Cover Sheet (BLANK)Documento2 pagineCover Sheet (BLANK)Bea91% (11)

- PLDT Request LetterDocumento2 paginePLDT Request LetterMonci Reyes Cuadero100% (2)

- Dear SmartDocumento1 paginaDear Smarthannah100% (1)

- Company IdDocumento2 pagineCompany IdPrincessAntonetteDeCastroNessuna valutazione finora

- VAT & EVAT Computation-ADocumento14 pagineVAT & EVAT Computation-AGuilbert CimeneNessuna valutazione finora

- Social Security System: Collection List Thru UsbDocumento8 pagineSocial Security System: Collection List Thru UsbLala MagayanesNessuna valutazione finora

- Request To Change GuardDocumento1 paginaRequest To Change Guardjennifer roslinNessuna valutazione finora

- Pagibig File GeneratorDocumento2 paginePagibig File GeneratorMatthew NiñoNessuna valutazione finora

- Buaya Ii 4103 Imus Cavite Philippines and An Active Subscriber of SMARTDocumento1 paginaBuaya Ii 4103 Imus Cavite Philippines and An Active Subscriber of SMARTAnneCanapiNessuna valutazione finora

- SBMA ID Card Infosheet (RENEWAL)Documento1 paginaSBMA ID Card Infosheet (RENEWAL)Renan Roque100% (1)

- Letter of EFPS For BIRDocumento2 pagineLetter of EFPS For BIRLetty Tamayo100% (1)

- INTRO LETTER For MerchandiserDocumento1 paginaINTRO LETTER For MerchandiserMark Henry100% (3)

- Authorization LetterDocumento1 paginaAuthorization LetterKenneth CalzadoNessuna valutazione finora

- Transmittal 2316Documento2 pagineTransmittal 2316Angelo Labios100% (1)

- Schedule of ACCOUNTS RECEIVABLESDocumento1 paginaSchedule of ACCOUNTS RECEIVABLESSyzygy Consultancy20% (5)

- MSRF (Hqp-pff-053)Documento8 pagineMSRF (Hqp-pff-053)Angel PunzalanNessuna valutazione finora

- 09.30.2020 - RFID Authorization LetterDocumento1 pagina09.30.2020 - RFID Authorization LetterPonching OriosteNessuna valutazione finora

- Rarejob Endorsement Letter For BpiDocumento1 paginaRarejob Endorsement Letter For Bpiejg26100% (2)

- L1 B4 Dońa Azucena ST., Cor. Sto. Nińo St. Greenfields III San Agustin, Quezon CityDocumento8 pagineL1 B4 Dońa Azucena ST., Cor. Sto. Nińo St. Greenfields III San Agustin, Quezon Citycatherine alegriaNessuna valutazione finora

- AwolDocumento5 pagineAwolcatherine alegriaNessuna valutazione finora

- Soa 0020230429297Documento1 paginaSoa 0020230429297Redilyn Corsino Agub0% (1)

- Letter For Correction of SSS ContributionsDocumento1 paginaLetter For Correction of SSS ContributionsFreann Sharisse Austria100% (1)

- Sample Template For Exemption CertificateDocumento1 paginaSample Template For Exemption Certificatemagdalena angeles33% (3)

- SSS RTPLDocumento124 pagineSSS RTPLgarcia_ronaNessuna valutazione finora

- DRAFT Application Letter Tax ExemptDocumento2 pagineDRAFT Application Letter Tax ExemptPrincess Regala100% (1)

- New Pagibig STLRF FormatDocumento6 pagineNew Pagibig STLRF FormatNen Mar0% (2)

- Sss LCL File Writer ManualDocumento6 pagineSss LCL File Writer ManualSirch Rudolf20% (5)

- AUTHORIZATION LETTER - Pag IbigDocumento1 paginaAUTHORIZATION LETTER - Pag IbigFeliz NavidadNessuna valutazione finora

- Bir Form 2307Documento3 pagineBir Form 2307Salve Dela Cruz100% (5)

- Authorization Letter Cheque CollectDocumento1 paginaAuthorization Letter Cheque CollectNayeem Ahmed100% (3)

- Annex F RR 11-2018 (Sample)Documento2 pagineAnnex F RR 11-2018 (Sample)amara corp100% (1)

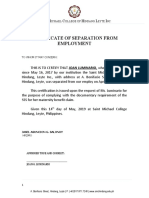

- Certificate of Separation From Employment SSSDocumento1 paginaCertificate of Separation From Employment SSSHOPE HUMAN100% (3)

- Employer'S Change of Information Form (Ecif) : Instructions RequirementsDocumento2 pagineEmployer'S Change of Information Form (Ecif) : Instructions RequirementsGen EcargNessuna valutazione finora

- COE For Resigned EmployeeDocumento1 paginaCOE For Resigned Employeelove pazarcoNessuna valutazione finora

- SSS Member Loan Application FormDocumento2 pagineSSS Member Loan Application FormJr Sam90% (49)

- Certificate of Employment DraftDocumento1 paginaCertificate of Employment DraftElibert ManuelNessuna valutazione finora

- Filing of BIR Refund ExampleDocumento1 paginaFiling of BIR Refund ExampleChristopher John AgueloNessuna valutazione finora

- Memo For Application of LeaveDocumento1 paginaMemo For Application of LeaveRic Vince100% (1)

- Certificate-Of-Employment-And-Compensation SampleDocumento1 paginaCertificate-Of-Employment-And-Compensation SamplePauljam Onamor80% (5)

- DOLE - Application For Certificate of No Pending CaseDocumento1 paginaDOLE - Application For Certificate of No Pending CaseCristian Pabon83% (6)

- Termination Letter For PLDTDocumento1 paginaTermination Letter For PLDTClimz Aether100% (1)

- Globe Authorization LetterDocumento2 pagineGlobe Authorization Letterofelia guinitaran100% (1)

- Awol Letter 1stDocumento7 pagineAwol Letter 1stBiboy BiboyNessuna valutazione finora

- Certificate-No RecordDocumento1 paginaCertificate-No RecordMEDILEN O. BORRESNessuna valutazione finora

- Employer'S Virtual Pag-Ibig Enrollment FormDocumento2 pagineEmployer'S Virtual Pag-Ibig Enrollment FormRobert Paul A Moreno0% (2)

- Waiver For Non-Deductible FormDocumento2 pagineWaiver For Non-Deductible FormQueenileen Arindaeng67% (3)

- TardinessDocumento1 paginaTardinessRegin Ree Reyes0% (1)

- Pag IBIG Specimen Signature FormDocumento2 paginePag IBIG Specimen Signature FormSebastian Garcia50% (2)

- Section 2Documento2 pagineSection 2Robert FergustoNessuna valutazione finora

- Certificate of EmploymentDocumento1 paginaCertificate of EmploymentBrianne TiffanyNessuna valutazione finora

- HRF-2021-001 Change Day-Off and Change Shift FormDocumento1 paginaHRF-2021-001 Change Day-Off and Change Shift FormEmy Salvador100% (1)

- Memo For TardinessDocumento1 paginaMemo For TardinessSerggie Tabanao100% (1)

- Peer FormDocumento1 paginaPeer Formgina_manrique0963% (8)

- Change of Authorized Managing Officer Application: Philippine Contractors Accreditation BoardDocumento5 pagineChange of Authorized Managing Officer Application: Philippine Contractors Accreditation BoardAugust Ponge100% (1)

- CBC - Converter - HDMF 1.3Documento448 pagineCBC - Converter - HDMF 1.3Jonald Narzabal100% (1)

- R3 Form Download Contribution Collection ListDocumento2 pagineR3 Form Download Contribution Collection ListRvn Nvr33% (3)

- SSS R3 Contribution Collection List in Excel FormatDocumento2 pagineSSS R3 Contribution Collection List in Excel FormatChristopher Daniels0% (2)

- SSS R3 Contribution Collection List in Excel FormatDocumento2 pagineSSS R3 Contribution Collection List in Excel FormatJaniene Secuya100% (2)

- Sss r3 PDFDocumento2 pagineSss r3 PDFbn_dcks9105Nessuna valutazione finora

- Daily Time Record: Name: Sarah Mae Manuel Employee Number: Position: Staff SignatureDocumento1 paginaDaily Time Record: Name: Sarah Mae Manuel Employee Number: Position: Staff SignatureJohn CandoNessuna valutazione finora

- Daily Time Record: Name: Michael Tanchoco Employee Number: Position: Rider SignatureDocumento1 paginaDaily Time Record: Name: Michael Tanchoco Employee Number: Position: Rider SignatureJohn CandoNessuna valutazione finora

- Daily Time Record: Name: Arvin Jake C. Caballero Employee Number: Position: Staff/Admin SignatureDocumento2 pagineDaily Time Record: Name: Arvin Jake C. Caballero Employee Number: Position: Staff/Admin SignatureJohn CandoNessuna valutazione finora

- Daily Time Record: Name: J-Ar Manalus Employee Number: Position: Rider SignatureDocumento2 pagineDaily Time Record: Name: J-Ar Manalus Employee Number: Position: Rider SignatureJohn CandoNessuna valutazione finora

- 12 Ways To Make Your Husband HappyDocumento2 pagine12 Ways To Make Your Husband HappyJohn CandoNessuna valutazione finora

- Daily Time Record: Name: Paolo Tanchoco Employee Number: Position: Rider SignatureDocumento1 paginaDaily Time Record: Name: Paolo Tanchoco Employee Number: Position: Rider SignatureJohn CandoNessuna valutazione finora

- Job OrderCosting 000Documento8 pagineJob OrderCosting 000raesharorooNessuna valutazione finora

- Magnesium Oil Uses - Skin Care, Performance & More - DRDocumento11 pagineMagnesium Oil Uses - Skin Care, Performance & More - DRJohn CandoNessuna valutazione finora

- Certificate of Marriage: Republic of The Philippines Office of The Civil Registrar GeneralDocumento2 pagineCertificate of Marriage: Republic of The Philippines Office of The Civil Registrar GeneralJohn Cando100% (1)

- Amido Betaine C 45Documento1 paginaAmido Betaine C 45John CandoNessuna valutazione finora

- ST - Linus MbaDocumento1 paginaST - Linus MbaJohn CandoNessuna valutazione finora

- Resume FormatDocumento5 pagineResume FormatJohn CandoNessuna valutazione finora

- Deed of Assignment and Transfer of RightsDocumento7 pagineDeed of Assignment and Transfer of RightsJohn Cando100% (2)

- TULADocumento2 pagineTULAJohn CandoNessuna valutazione finora

- Villena v. Batangas (Retirement Pay)Documento9 pagineVillena v. Batangas (Retirement Pay)Ching ApostolNessuna valutazione finora

- Partnership CE W Control Ans PDFDocumento10 paginePartnership CE W Control Ans PDFRedNessuna valutazione finora

- Jollibee Audited FsDocumento88 pagineJollibee Audited FsCedric Adams50% (2)

- Manila Bulletin, Aug. 20, 2019, Congress Determined To Avert Budget Delay PDFDocumento2 pagineManila Bulletin, Aug. 20, 2019, Congress Determined To Avert Budget Delay PDFpribhor2Nessuna valutazione finora

- Ceres Gardening Company Graded QuestionsDocumento4 pagineCeres Gardening Company Graded QuestionsSai KumarNessuna valutazione finora

- Mergers and AcquisationsDocumento33 pagineMergers and AcquisationsAnku SharmaNessuna valutazione finora

- Marketing Research in NTBDocumento57 pagineMarketing Research in NTBJagat Singh DhamiNessuna valutazione finora

- 1 200604 Vietnam Consumer Finance Report 2020 Standard 5 Tran My Nhu 20200610151736Documento88 pagine1 200604 Vietnam Consumer Finance Report 2020 Standard 5 Tran My Nhu 20200610151736Tuấn Tú VõNessuna valutazione finora

- GIA Application Form.2018Documento9 pagineGIA Application Form.2018Charles Lim100% (1)

- Aviation Investment Economic Appraisal For Airports - Air Traffic Management - Airlines and AeronauticsDocumento259 pagineAviation Investment Economic Appraisal For Airports - Air Traffic Management - Airlines and AeronauticsDipendra ShresthaNessuna valutazione finora

- Loan Defaults and Credit Default Swaps: Tee Chwee MingDocumento42 pagineLoan Defaults and Credit Default Swaps: Tee Chwee Mingyip33Nessuna valutazione finora

- Chapter 15Documento27 pagineChapter 15Busiswa MsiphanyanaNessuna valutazione finora

- Bar Questions Civil Law 2006-2018Documento34 pagineBar Questions Civil Law 2006-2018Ruth Hazel GalangNessuna valutazione finora

- Deed of Sale FinalDocumento3 pagineDeed of Sale FinalChrise TalensNessuna valutazione finora

- (Epelbaum) Vol Risk PremiumDocumento25 pagine(Epelbaum) Vol Risk PremiumrlindseyNessuna valutazione finora

- Oracle EBS R12 Payables R2 - TRAINDocumento575 pagineOracle EBS R12 Payables R2 - TRAINappsloaderNessuna valutazione finora

- ch08 Financial Accounting, 7th EditionDocumento72 paginech08 Financial Accounting, 7th Editionrobbi ajaNessuna valutazione finora

- Gibson10e ch02Documento23 pagineGibson10e ch02SHAMRAIZKHANNessuna valutazione finora

- Semester - Iii Core Financial Accounting PDFDocumento38 pagineSemester - Iii Core Financial Accounting PDFDhritiNessuna valutazione finora

- Financial Inclusion Policy - An Inclusive Financial Sector For AllDocumento118 pagineFinancial Inclusion Policy - An Inclusive Financial Sector For AllwNessuna valutazione finora

- Risk and Returns Questions With AnswersDocumento19 pagineRisk and Returns Questions With AnswersyoussefNessuna valutazione finora

- Letter From Sacred Heart Cathedral Preparatory President To FacultyDocumento4 pagineLetter From Sacred Heart Cathedral Preparatory President To FacultyNational Catholic ReporterNessuna valutazione finora

- Guidance Note On Audit of Abridged Financial StatementsDocumento13 pagineGuidance Note On Audit of Abridged Financial Statementsstarrydreams19Nessuna valutazione finora

- 10 Illustration of Ledger 24.10.08Documento7 pagine10 Illustration of Ledger 24.10.08denish gandhi100% (1)

- AI - Materi 9 Analisis LK InternasDocumento21 pagineAI - Materi 9 Analisis LK Internasbams_febNessuna valutazione finora

- Account FINAL Project With FRNT PageDocumento25 pagineAccount FINAL Project With FRNT PageMovies downloadNessuna valutazione finora

- The Effect of Investor Sentiment On Stock Return in Norway and Vietnam - Master ThesisDocumento48 pagineThe Effect of Investor Sentiment On Stock Return in Norway and Vietnam - Master ThesisTruc PhanNessuna valutazione finora

- Unit+8 (Block 2)Documento24 pagineUnit+8 (Block 2)Nitish BhaskarNessuna valutazione finora

- BCG CII India Future of Jobs Mar 2017Documento48 pagineBCG CII India Future of Jobs Mar 2017Learning EngineerNessuna valutazione finora

- Introduction To Accounting: Financial Statements AnalysisDocumento15 pagineIntroduction To Accounting: Financial Statements AnalysisFaizal AbdullahNessuna valutazione finora