Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Proiect Management Financiar

Caricato da

Veselina PavloviciDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Proiect Management Financiar

Caricato da

Veselina PavloviciCopyright:

Formati disponibili

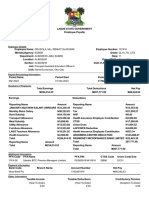

Prof.

Coordonator:

Asist.Univ.Dracea Nicoleta

Studenta:

Savca Victoria

1

Economic Crisis in Europe:

Causes, Consequences

and Responses

EXECUTIVE SUMMARY

1. A CRISIS OF HISTORIC PROPORTIONS

The financial crisis that hit the global economy

since the summer of 2007 is without precedent in

post-war economic history. Although its size and

extent are exceptional, the crisis has many features

in common with similar financial-stress drien

2

EUROPEAN COMMISSION

recession episodes in the past. The crisis was

preceded by long period of rapid credit growth,

low ris! premiums, abundant aailability of

li"uidity, strong leeraging, soaring asset prices

and the deelopment of bubbles in the real estate

sector. #er-stretched leeraging positions

rendered financial institutions extremely

ulnerable to corrections in asset mar!ets. As a

result a turn-around in a relatiely small corner of

the financial system $the %& subprime mar!et' was

sufficient to topple the whole structure. &uch

episodes hae happened before $e.g. (apan and the

)ordic countries in the early *++0s, the Asian

crisis in the late-*++0s'. ,oweer, this time is

different, with the crisis being global a!in to the

eents that triggered the -reat .epression of the

*+/0s.

0hile it may be appropriate to consider the -reat

.epression as the best benchmar! in terms of its

financial triggers, it has also sered as a great

lesson. At present, goernments and central ban!s

are well aware of the need to aoid the policy

mista!es that were common at the time, both in the

1% and elsewhere. 2arge-scale ban! runs hae

been aoided, monetary policy has been eased

aggressiely, and goernments hae released

substantial fiscal stimulus. %nli!e the experience

during the -reat .epression, countries in 1urope

or elsewhere hae not resorted to protectionism at

the scale of the *+/0s. 3t demonstrates the

importance of 1% coordination, een if this crisis

proides an opportunity for further progress in this

regard.

3n its early stages, the crisis manifested itself

as an acute li"uidity shortage among financial

institutions as they experienced eer stiffer mar!et

conditions for rolling oer their $typically shortterm'

debt. 3n this phase, concerns oer the

solency of financial institutions were increasing,

but a systemic collapse was deemed unli!ely. This

perception dramatically changed when a ma4or %&

inestment ban! $2ehman 5rothers' defaulted in

&eptember 2006. 7onfidence collapsed, inestors

massiely li"uidated their positions and stoc!

mar!ets went into a tailspin. 8rom then onward the

1% economy entered the steepest downturn on

record since the *+/0s. The transmission of

financial distress to the real economy eoled at

record speed, with credit restraint and sagging

confidence hitting business inestment and

3

household demand, notably for consumer durables

and housing. The cross-border transmission was

also extremely rapid, due to the tight connections

within the financial system itself and also the

strongly integrated supply chains in global product

mar!ets. 1% real -.9 is pro4ected to shrin! by

some :; in 200+, the sharpest contraction in its

history. And although signs of an incipient

recoery abound, this is expected to be rather

sluggish as demand will remain depressed due to

deleeraging across the economy as well as painful

ad4ustments in the industrial structure. %nless

policies change considerably, potential output

growth will suffer, as parts of the capital stoc! are

obsolete and increased ris! aersion will weigh on

capital formation and <=..

The ongoing recession is thus li!ely to leae deep

and long-lasting traces on economic performance

and entail social hardship of many !inds.

(ob losses can be contained for some time by

flexible unemployment benefit arrangements,

but eentually the impact of rapidly rising

unemployment will be felt, with downturns

in housing mar!ets occurring simultaneously

affecting $notably highly-indebted' households.

The fiscal positions of goernments will continue

to deteriorate, not only for cyclical reasons, but

also in a structural manner as tax bases shrin! on a

permanent basis and contingent liabilities of

goernments stemming from ban! rescues may

materialise. An open "uestion is whether the crisis

will wea!en the incenties for structural reform

and thereby adersely affect potential growth

further, or whether it will proide an opportunity

to underta!e far-reaching policy actions.

2. VAST POLICY CHALLENGES

The current crisis has demonstrated the importance

of a coordinated framewor! for crisis management.

3t should contain the following building bloc!s>

7risis preention to preent a repeat in the

future. This should be mapped onto a collectie

1

European Comm!!on

E"onom" Cr!! n Europe# Cau!e!$ Con!e%uen"e! an& Re!pon!e!

4udgment as to what the principal causes

of the crisis were and how changes in

macroeconomic, regulatory and superisory

policy framewor!s could help preent their

recurrence. 9olicies to boost potential

economic growth and competitieness could

4

also bolster the resilience to future crises.

7risis control and mitigation to minimise the

damage by preenting systemic defaults or by

containing the output loss and easing the social

hardship stemming from recession. 3ts main

ob4ectie is thus to stabilise the financial

system and the real economy in the short run. 3t

must be coordinated across the 1% in order to

stri!e the right balance between national

preoccupations and spilloer effects affecting

other ?ember &tates.

7risis resolution to bring crises to a lasting

close, and at the lowest possible cost for the

taxpayer while containing systemic ris! and

securing consumer protection. This re"uires

reersing temporary support measures as well

action to restore economies to sustainable

growth and fiscal paths. 3nter alia, this includes

policies to restore ban!s@ balance sheets, the

restructuring of the sector and an orderly policy

@exit@. An orderly exit strategy from

expansionary macroeconomic policies is also

an essential part of crisis resolution.

The beginnings of such a framewor! are emerging,

building on existing institutions and legislation,

and complemented by new initiaties. 5ut of

course policy ma!ers in 1urope hae had no

choice but to employ the existing mechanisms and

procedures. A framewor! for financial crisis

preention appeared, with hindsight, to be

underdeeloped A otherwise the crisis would most

li!ely not hae happened. The same held true to

some extent for the 1% framewor! for crisis

control and mitigation, at least at the initial stages

of the crisis.

Buite naturally, most 1% policy efforts to date

hae been in the pursuit of crisis control and

mitigation. 5ut first steps hae also been ta!en to

redesign financial regulation and superision A

both in 1urope and elsewhere A with a iew to

crisis preention. 5y contrast, the adoption of

crisis resolution policies has not begun in earnest

yet. This is now becoming urgent A not least

because it should underpin the effectieness of

control policies ia its impact on confidence.

2.1. Cr!! "on'ro( an& m')a'on

Aware of the ris! of financial and economic meltdown

central ban!s and goernments in the

1uropean %nion embar!ed on massie and

coordinated policy action. 8inancial rescue policies

5

hae focused on restoring li"uidity and capital of

ban!s and the proision of guarantees so as to get

the financial system functioning again. .eposit

guarantees were raised. 7entral ban!s cut policy

interest rates to unprecedented lows and gae

financial institutions access to lender-of-last-resort

facilities. -oernments proided li"uidity facilities

to financial institutions in distress as well, along

with state guarantees on their liabilities, soon

followed by capital in4ections and impaired asset

relief. 5ased on the coordinated 1uropean

1conomy recoery 9lan $11<9', a discretionary

fiscal stimulus of some 2; of -.9 was released A

of which two-thirds to be implemented in 200+ and

the remainder in 20*0 A so as to hold up demand

and ease social hardship. These measures largely

respected agreed principles of being timely and

targeted, although there are concerns that in some

cases measures were not of a temporary nature and

therefore not easily reersed. 3n addition, the

&tability and -rowth 9act was applied in a flexible

and supportie manner, so that in most ?ember

&tates the automatic fiscal stabilisers were allowed

to operate unfettered. The dispersion of fiscal

stimulus across ?ember &tates has been

substantial, but this is generally A and

appropriately A in line with differences in terms of

their needs and their fiscal room for manoeure. 3n

addition, to aoid unnecessary and irreersible

destruction of $human and entrepreneurial' capital,

support has been proided to hard-hit but iable

industries while part-time unemployment claims

were allowed on a temporary basis, with the 1%

ta!ing the lead in deeloping guidelines on the

design of labour mar!et policies during the crisis.

The 1% has played an important role to proide

guidance as to how state aid policies A including to

the financial sector A could be shaped so as to pay

respect to competition rules. ?oreoer, the 1% has

proided balance-of payments assistance 4ointly

with the 3?8 and 0orld 5an! to ?ember &tates in

7entral and 1astern 1urope, as these hae been

exposed to reersals of international capital flows.

2

E*e"u'+e Summar,

8inally, direct 1% support to economic actiity

was proided through substantially increased loan

support from the 1uropean 3nestment 5an! and

the accelerated disbursal of structural funds.

These crisis control policies are largely achieing

6

their ob4ecties. Although ban!s@ balance sheets

are still ulnerable to higher mortgage and credit

default ris!, there hae been no defaults of ma4or

financial institutions in 1urope and stoc! mar!ets

hae been recoering. 0ith short-term interest

rates near the zero mar! and @non-conentional@

monetary policies boosting li"uidity, stress in

interban! credit mar!ets has receded. 8iscal

stimulus proes relatiely effectie owing to the

li"uidity and credit constraints facing households

and businesses in the current enironment.

1conomic contraction has been stemmed and the

number of 4ob losses contained relatie to the size

of the economic contraction.

2.2. Cr!! re!o(u'on

0hile there is still ma4or uncertainty surrounding

the pace of economic recoery, it is now essential

that exit strategies of crisis control policies be

designed, and committed to. This is necessary both

to ensure that current actions hae the desired

effects and to secure macroeconomic stability.

,aing an exit strategy does not inole

announcing a fixed calendar for the next moes,

but rather defines those moes, including their

direction and the conditions that must be satisfied

for ma!ing them. 1xit strategies need to be in

place for financial, macroeconomic and structural

policies ali!e>

8inancial policies. An immediate priority is to

restore the iability of the ban!ing sector.

#therwise a icious circle of wea! growth,

more financial sector distress and eer stiffer

credit constraints would inhibit economic

recoery. 7lear commitments to restructure and

consolidate the ban!ing sector should be put in

place now if a (apan-li!e lost decade is to be

aoided in 1urope. -oernments may hope that

the financial system will grow out of its

problems and that the exit from ban!ing

support would be relatiely smooth. 5ut as

long as there remains a lac! of transparency as

to the alue of ban!s@ assets and their

ulnerability to economic and financial

deelopments, uncertainty remains. 3n this

context, the reluctance of many ban!s to reeal

the true state of their balance sheets or to

exploit the extremely faourable earning

conditions induced by the policy support to

repair their balance sheets is of concern. 3t is

important as well that financial repair be done

7

at the lowest possible long-term cost for the tax

payer, not only to win political support, but

also to secure the sustainability of public

finances and aoid a long-lasting increase in

the tax burden. 8inancial repair is thus essential

to secure a satisfactory rate of potential growth

A not least also because innoation depends on

the aailability of ris! financing.

?acroeconomic policies. ?acroeconomic

stimulus A both monetary and fiscal A has been

employed extensiely. The challenge for

central ban!s and goernments now is to

continue to proide support to the economy and

the financial sector without compromising their

stability-oriented ob4ecties in the medium

term. 0hile withdrawal of monetary stimulus

still loo!s some way off, central ban!s in the

1% are determined to unwind the supportie

stance of monetary policies once inflation

pressure begins to emerge. At that point a

credible exit strategy for fiscal policy must be

firmly in place in order to pre-empt pressure on

goernments to postpone or call off the

consolidation of public finances. The fiscal exit

strategy should spell out the conditions for

stimulus withdrawal and must be credible, i.e.

based on pre-committed reforms of

entitlements programmes and anchored in

national fiscal framewor!s. The withdrawal of

fiscal stimulus under the 11<9 will be "uasi

automatic in 20*0-**, but needs to be followed

up by ery substantial A though differentiated

across ?ember &tates A fiscal consolidation to

reerse the aderse trends in public debt. An

appropriate mix of expenditure restraint and tax

increases must be pursued, een if this is

challenging in an enironment where

distributional conflicts are li!ely to arise. The

"uality of public finances, including its impact

on wor! incenties and economic efficiency at

large, is an oerarching concern.

&tructural policies. 1en prior to the financial

crisis, potential output growth was expected to

roughly hale to as little as around *; by the

-

European Comm!!on

E"onom" Cr!! n Europe# Cau!e!$ Con!e%uen"e! an& Re!pon!e!

2020s due to the ageing population. 5ut such

low potential growth rates are li!ely to be

recorded already in the years ahead in the wa!e

8

of the crisis. As noted, it is important to

decisiely repair the longer-term iability of

the ban!ing sector so as to boost productiity

and potential growth. 5ut this will not suffice

and efforts are also needed in the area of

structural policy proper. A sound strategy

should include the exit from temporary

measures supporting particular sectors and the

preseration of 4obs, and resist the adoption or

expansion of schemes to withdraw labour

supply. 5eyond these defensie ob4ecties,

structural policies should include a reiew of

social protection systems with the emphasis on

the preention of persistent unemployment and

the promotion of a longer wor! life. 8urther

labour mar!et reform in line with a flexicuritybased

approach may also help aoid the

experiences of past crises when hysteresis

effects led to sustained period of ery high

unemployment and the permanent exclusion of

some from the labour force. 9roduct mar!et

reforms in line with the priorities of the 2isbon

strategy $implementation of the single mar!et

programme especially in the area of serices,

measures to reduce administratie burden and

to promote <=. and innoation' will also be

!ey to raising productiity and creating new

employment opportunities. The transition to a

low-carbon economy should be pursued

through the integration of enironmental

ob4ecties and instruments in structural policy

choices, notably taxation. 3n all these areas,

policies that carry a low budgetary cost should

be prioritised.

2.-. Cr!! pre+en'on

A broad consensus is emerging that the ultimate

causes of the crisis reside in the functioning of

financial mar!ets as well as macroeconomic

deelopments. 5efore the crisis bro!e there was a

strong belief that macroeconomic instability had

been eradicated. 2ow and stable inflation with

sustained economic growth $the -reat ?oderation'

were deemed to be lasting features of the

deeloped economies. 3t was not sufficiently

appreciated that this owed much to the global

disinflation associated with the faourable supply

conditions stemming from the integration of

surplus labour of the emerging economies, in

particular in 7hina, into the world economy. This

prompted accommodatie monetary and fiscal

9

policies. 5uoyant financial conditions also had

microeconomic roots and these tended to interact

with the faourable macroeconomic enironment.

The list of contributing factors is long, including

the deelopment of complex A but poorly

superised A financial products and excessie

short-term ris!-ta!ing.

7risis preention policies should tac!le these

deficiencies in order to aoid repetition in the

future. There are again agendas for financial,

macroeconomic and structural policies>

8inancial policies. The agenda for regulation

and superision of financial mar!ets in the 1%

is ast. A number of initiaties hae been ta!en

already, while in some areas ma4or efforts are

still needed. Action plans hae been put

forward by the 1% to strengthen the regulatory

framewor! in line with the -20 regulatory

agenda. 0ith the ma4ority of financial assets

held by cross-border ban!s, an ambitious

reform of the 1uropean system of superision,

based on the recommendations made by the

,igh-2eel -roup chaired by ?r (ac"ues de

2arosiCre, is under discussion. 3nitiaties to

achiee better remuneration policies, regulatory

coerage of hedge funds and priate e"uity

funds are being considered but hae yet to be

legislated. 3n many other areas progress is

lagging. <egulation to ensure that enough

proisions and capital be put aside to cope with

difficult times needs to be deeloped, with

accounting framewor!s to eole in the same

direction. A certain degree of commonality and

consistency across the rule boo!s in ?ember

&tates is important and a single regulatory rule

boo!, as soon as feasible, desirable. 3t is

essential that a robust and effectie ban!

stabilisation and resolution framewor! is

deeloped to goern what happens when

superision fails, including effectie deposit

protection. 7onsistency and coherence across

the 1% in dealing with problems in such

institutions is a !ey re"uisite of a much

improed operational and regulatory

framewor! within the 1%.

?acroeconomic policies. -oernments in

many 1% ?ember &tates ran a relatiely

.

E*e"u'+e Summar,

accommodatie fiscal policy in the @good times@

10

that preceded the crisis. Although this cannot

be seen as the main culprit of the crisis, such

behaiour limits the fiscal room for manoeure

to respond to the crisis and can be a factor in

producing a future one A by undermining the

longer-term sustainability of public finances in

the face of aging populations. 9olicy agendas

to preent such behaiour should thus be

prominent, and call for a stronger coordinating

role for the 1% alongside the adoption of

credible national medium-term framewor!s.

3ntra-area ad4ustment in the 1conomic and

?onetary %nion $which constitutes two-thirds

of the 1%' will need to become smoother in

order to preent imbalances and the associated

ulnerabilities from building up. This

reinforces earlier calls, such as in the

7ommission@s 1?%D*0 report $1uropean

7ommission, 2006a', to broaden and deepen

the 1% sureillance to include intra-area

competitieness positions.

&tructural policies. &tructural reform is among

the most powerful crisis preention policies in

the longer run. 5y boosting potential growth

and productiity it eases the fiscal burden,

facilitates deleeraging and balance sheet

restructuring, improes the political economy

conditions for correcting cross-country

imbalances, ma!es income redistribution issues

less onerous and eases the terms of the

inflation-output trade-off. 8urther financial

deelopment and integration can help to

improe the effectieness of and the political

incenties for structural reform.

-. A STRONG CALL ON EU COOR/INATION

The rationale for 1% coordination of policy in the

face of the financial crisis is strong at all three

stages A control and mitigation, resolution and

preention>

At the crisis control and mitigation stage, 1%

policy ma!ers became acutely aware that

financial assistance by home countries of their

financial institutions and unilateral extensions

of deposit guarantees entail large and

potentially disrupting spilloer effects. This led

to emergency summits of the 1uropean 7ouncil

at the ,eads of &tate 2eel in the autumn of

2006 A for the first time in history also of the

1urogroup A to coordinate these moes. The

7ommission@s role at that stage was to proide

11

guidance so as to ensure that financial rescues

attain their ob4ecties with minimal

competition distortions and negatie spilloers.

8iscal stimulus also has cross-border spilloer

effects, through trade and financial mar!ets.

&pilloer effects are een stronger in the euro

area ia the transmission of monetary policy

responses. The 11<9 adopted in )oember

2006, which has defined an effectie

framewor! for coordination of fiscal stimulus

and crisis control policies at large, was

motiated by the recognition of these

spilloers.

At the crisis resolution stage a coordinated

approach is necessary to ensure an orderly exit

of crisis control policies across ?ember &tates.

3t would not be enisaged that all ?ember

&tate goernments exit at the same time

$as this would be dictated by the national

specific circumstances'. 5ut it would be

important that state aid for financial institutions

$or other seerely affected industries' not

persist for longer than is necessary in iew of

its implications for competition and the

functioning of the 1% &ingle ?ar!et. )ational

strategies for a return to fiscal sustainability

should be coordinated as well, for which a

framewor! exists in the form of the &tability

and -rowth 9act which was designed to tac!le

spilloer ris!s from the outset. The rationales

for the coordination of structural policies hae

been spelled out in the 2isbon &trategy and

apply also to the exits from temporary

interention in product and labour mar!ets in

the face of the crisis.

At the crisis preention stage the rationale for

1% coordination is rather straightforward in

iew of the high degree of financial and

economic integration. 8or example, regulatory

reform geared to crisis preention, if not

coordinated, can lead to regulatory arbitrage

that will affect location choices of institutions

and may change the direction of international

capital flows. ?oreoer, with many financial

institutions operating cross border there is a

0

European Comm!!on

E"onom" Cr!! n Europe# Cau!e!$ Con!e%uen"e! an& Re!pon!e!

12

1

clear case for exchange of information and

burden sharing in case of defaults.

The financial crisis has clearly strengthened the

case for economic policy coordination in the 1%.

5y coordinating their crisis policies ?ember &tates

heighten the credibility of the measures ta!en, and

thus help restore confidence and support the

recoery in the short term. 7oordination can also

be crucial to fend off protectionism and thus seres

as a safeguard of the &ingle ?ar!et. ?oreoer,

coordination is necessary to ensure a smooth

functioning of the euro area where spilloers of

national policies are particularly strong. And

coordination proides incenties at the national

leel to implement growth friendly economic

policies and to orchestrate a return to fiscal

sustainability. 2ast but not least, coordination of

external policies can contribute to a more rapid

global solution of the financial crisis and global

recoery.

1% framewor!s for coordination already exist in

many areas and could be deeloped further in

some. 3n seeral areas the 1% has a direct

responsibility and thus is the highest authority in

its 4urisdiction. This is the case for notably

monetary policy in the euro area, competition

policy and trade negotiations in the framewor! of

the .#,A <ound. This is now proing more

useful than eer. 3n other areas, @bottom-up@ 1%

coordination framewor!s hae been deeloped and

should be exploited to the full.

The pursuit of the regulatory and superisory

agenda implies the set-up of a new 1%

coordination framewor! which was long oerdue

in iew of the integration of financial systems. An

important framewor! for coordination of fiscal

policies exists under the aegis of the &tability and

-rowth 9act. The reamped 2isbon strategy

should sere as the main framewor! for

coordination of structural policies in the 1%. The

balance of payment assistance proided by the 1%

is another area where a coordination framewor!

has been established recently, and which could be

exploited also for the coordination of policies in

the pursuit of economic conergence.

At the global leel, finally, the 1% can offer a

framewor! for the coordination of positions in e.g.

the -20 or the 3?8. 0ith the %& adopting its own

exit strategy, pressure to raise demand elsewhere

13

will be mounting. The ad4ustment re"uires that

emerging countries such as 7hina reduce their

national saing surplus and changed their

exchange rate policy. The 1% will be more

effectie if it also considers how policies can

contribute to more balanced growth worldwide, by

considering bolstering progress with structural

reforms so as to raise potential output. 3n addition,

the 1% would facilitate the pursuit of this agenda

by leeraging the euro and participating on the

O CRIZA DE PROPORTII ISTORICE

Criza financiara care a lovit economia globala inca din vara anului 2007 este

fara precedent in istoria economiei dupa razboi !esi dimensiunea si amploarea ei

sunt e"ceptionale criza are multe trasaturi in comun cu probleme financiare similare

care au determinat episoade de criza in trecut Criza a fost precedata de o lunga

perioada de crestere rapida a creditelor# risc redus al primelor# o ampla abundenta

de lic$iditate# puternic efect de parg$ie# escaladarea preturilor activelor si

dezvoltarea problemelor in sectorul imobiliar %ntinderea pozitiei de influenta a facut

institutiile financiare e"term de vulnerabile pentru a corecta piata activelor Ca

rezultat# o sc$imbare# intr&un colt relativ mic al sistemului financiar 'piata ()* a fost

suficienta sa clatine intreaga structura +semenea episoade au avut loc inainte 'e"

,aponia si tarile nordice la inceputul anilor 1990# si criza asiana#la sfarsitul anilor

1990* -ricum# de data aceasta este diferit# criza fiind globala asemanatoare cu

evenimente care au declansat .area !epresiune a anilor 1930 %n timp ce poate fi

potrivit sa consideram .area !epresiune ca cea mai buna referinta in ceea ce

priveste factorii financiali declansatori# ea a servit de asemenea ca o lectie %n

prezent# guvernele si bancile centrale sunt constiente de nevoia de a evita politica de

greseli care au fost comune la momentul acela# si in (/ si oriunde 0ancile au fost

evitate# politica monetara a fost facilitata in mod agresiv si guvernele au eliberat

stimuli fiscali substantiali )pre deosebire de e"perientele din timpul .arii !epresiuni#

tarile din /uropa si de oriunde nu au recurs la protectie in timpul anilor 1930 +ceasta

demonstreaza importanta coordonarii (/# c$iar daca criza furnizeaza o oportunitate

pentru un progres indepartat in aceasta privinta

%n primele ei stadii# criza s&a manifestat ca o lipsa acuta de lic$iditate printre

institutiile financiare cum ele au e"perimentat conditii tot mai acerbe de rasturnare a

datoriilor lor 'tipic pe termen scurt* %n aceasta faza ingri1orarile fata de solvabilitatea

financiara au crescut# dar un esec sistemic a fost putin probabil +ceasta perceptie s&

a sc$imbat in mod dramatic cand o investitie bancara ma1ora a () 'fratii 2e$mnan*

nu s&a ac$itat in septembrie 2008 %ncrederea s&a prabusit# investitorii au lic$idat

puternic pozitiile lor si pietele bursiere au a1uns in soc !e aici inainte economia (/ a

intrat in recesiune mai abrupta inregistrata inca din 1930 3ransmisia problemei

financiare la economia reala desfasurata la viteza record# cu limite de credit si

scaderea increderii lovind investitiile de afaceri si cererile de uz casnic# remarcabile

pentru bunurile de consum durabile3ransmisia transfrontaliera de asemenea e"trem

14

de rapida# datorata legaturilor incordate in sistemul financiar si lantul de

aprovizionare pe pietele globale de produse (/# cu adevarat 4!5 este proiectata sa

micsoreze cu 4 6 in 2009# cea mai accentuata contractie din istoria sa )i# desi

semne ale unei refaceri incipiente abunda# aceasta se asteapta sa fie mai degraba

lenta# ca cererea va stagna datorita recuperarii datoriilor in intreaga economie

precum si a1ustari dureroase in structura industriala !aca politica nu se sc$imba

considerabil cresterea potentiala a productiei va suferi cat si parti ale capitalului stoc

sunt iesite din uz si cresterea aversiunii fata de risc va ridica formarea de capital si

78!

7ecesiunea activa in curs de desfasurare este asa de probabil sa lase urme

adanci si permanente pe performanta economiei si implica dificultatea sociala in mai

multe feluri 5ierderile de locuri de munca poate fi retinut de ceva timp de soma1

fle"ibil beneficiat de regimuri dar eventual impactul cresterii rapide a soma1ului va fi

simtit cu declinuri pe piata locuintelor 'constructiilor*care au loc in mod simultan

afectand 'in special e"trem de indatorate* gospodariile

5ozitia fiscala a guvernelor va continua sa deterioreze# nu numai din motive

ciclice# dar de asemenea intr&o maniera structurala ca ta"e de impozitare micsorate

pe o baza permanenta si eventuale datorii ale guvernelor care rezulta din a1utoarele

bancii se pot concretiza - intrebare desc$isa este daca criza va micsora stimulentii

pentru reforma structurala si astfel afecteaza negativ potentiala crestere mai departe

sau daca va aduce o oportunitate sa se intreprinda o politica de actiuni de anvergura

2. MARI PREOCUPARI POLITICE

Criza actuala a demonstrat importanta unui cadru coordonat pentru

conducerea crizei /a ar trebui sa contina urmatoarele 9blocuri de cladire:;

!e prevenirea a crizei pentru a impiedica o repetitie in viitor +ceasta ar trebui

fi planuita de un colectiv de $otarare comun ca sa se identifice care au fost

principalele cauze ale crizei si cum sc$imbarile in macroeconomie# cadruri politice de

recomandare si supravegere pot a1uta la prevenirea si reaparitia ei 5olitica pentru a

stimula posibila crestere economica si concurenta pot de asemenea sa sustina

capacitatea de adaptare a crizelor viitoare

!e control al crizei si atenuare pentru a minimaliza pagubele prevenind lipsuri

sistemice sau retinand pierderile productiei si facilitand dificultati sociale

dedeterminate recesiune -biectivul ei principal este deocamdata sa stabileasca

sistemul finaciar si economia reala in cel mai scurt timp 3rebuie sa fie coordonat prin

intermediul (/ pentru a stabili balanta corecta dintre preocuparile nationale si

e"cedentul de efecte care afecteaza celelalta state membre

!e rezolvarea a crizei sa aduca criza la un sfarsit aprope# la cel mai scazut

cost posibil pentru contribuabili pe timp ce limiteaza riscul sistemic si asigurand

15

protectia consumatorului +ceasta cere intoarcerea .asuri temporare de spri1in cat

si actiuni da stabilire a economiilor pentru a sustine cresterea si ipoteci fiscale %ntre

alianta asta include politici sa stabileasca bilantele # retructurarea sectorului si o

iesire politica ordonata - strategie de iesire oronata din e"pansiunea

macroeconomica este de asemenea o parte esentiala a rezolvarii crizei

%nceputurile unui astfel de cadru iese la iveala construind pe institutii e"istente

si legislatie si complementate de noi initiative !ar bineinteles factorii de decizie

politica in /uropa nu au alta optiune decat sa ac$izitioneze mecanismele si

procedurile e"istente (n cadru pentru prevenirea crizei e"istente a aparut & cu

retrospectie& sa fie nedezvoltat& in caz contrar criza ar fi putut mai bine sa nu aiba

loc +celasi lucru a avut loc intr&o oarecare masura pentru cadrurile /( pentru

controlul si atenuarea crizei# in cele din urma la stadiile initiale ale crizei

!estul de natural# mai multe eforturi politice de a data au fost in urmarirea

controlului si reducerii crizei dar primii pasi au fost de asemenea luati pentru a

redefini reglarea si supraveg$erea financiara < in /uropa si oriunde < cu privire la

prevenirea crizei )pre deosebire +doptarea politicile de rezolvare a crizei nu au

inceput cu seriozitate inca +ceasta incepe acum urgent < nu in ultimul rand pentru

ca ar trebui sa stea la baza efectivitatii controlului politic prin impactul ei asupra

increderii

2.1. COTROLUL SI ATEUAREA CRIZEI

Constiente de riscul finaciar si economic sus&1os# bancile centrale si guvernele

in (/ s&au imbarcat intr&o masiva si coordonata actiune politica +1utorul financiar s&a

centrat pe reintegrarea lic$iditatii si a capitalului bancilor si prevederea garantiilor in

asa fel incat sa functioneze din nou 4arantiile depozitelor au crescut 0ancile

centrale au scos ratele intereselor politice pentru a preveni micsorarile si au dat

institutiilor financiare acces sa imprumute credite de ultima instanta 4uvernele au

asigurat facilitatile lic$idarii institutiilor financiare in pericol precum si impreuna cu

garantiile statului pe datoriile lor# curand urmate de implementari de capital si

afectarea reliefului

0azate pe refacerea 5lanului /conomiei /( '//75* a fost eliberat un

stimul fiscal de 26 4!5 < din care 2 treimi sa fie implementate in 2009

si restul in 2010 in asa fel inact sa mentina cererea si sa diminueze

dificultatea sociala +ceste masuri in mare parte respectate au

concordat cu principii de a fi oportune si orientate benefic# desi sunt

preocupari ca in unele cazuri masurile nu au fost de un caracter

temporar si deci nu usor de anulat %n plus# 5actul de )tabilitate si

Crestere a fost aplicat intr&o maniera fle"ibila si sustinatoare# asa ca in

mai multe )tate .embre stabilizatorii fiscali au fost permisi sa

actioneze liber !ispersia stimulului fiscal in )tatele .embre a fost

substantiala# dar acesta este general < si potrivit < in acord cu

diferentele in ceea ce priveste nevoile lor si camera de manevra fiscala

16

%n plus pentru a evita distrugerea care nu e necesara si ireversibila a

capitalului 'uman si antreprenorial* sustinerea a fost prevazuta sa

loveasca tare dar industriile viabile cat si drepturile au fost permise pe o

perioad temporara # (/ luand conducerea in dezvoltarea fractiunii de

norma de soma1 pe modelul pietelor politice de munca in timpul crizei

(/ a 1ucat un rol important in asigurarea conducerii in felul cum statul

a1uta politica < incluzand sectorul financiar < poate fi format in asa fel

incat sa asigure respect regulilor competitiei 5e deasupra (/ a

asigurat balantei de plati de asistenta asociata cu %.= si 0anca

.ondiala pentru )tatele .embre in /uropa Centrala si de /st ca si

acestea au fost e"puse la anularea flu"ului de capital international

%n final suportul direct (/ pentru activitatea economica asigurat prin

cresterea substantiala a imprumutului suportat de 0anca /( de

%nvestitii si a accelerat platile resurselor structurale

+cestea controale ale crizei si&au atins in mare parte obiectivele !esi

balantele bancare sunt inca vulnerabile cu maai mari ipoteci si riscul de

neplata al creditelor nu au fost lipsuri ale institutiilor financiare ma1ore in

/uropa si stocurile pietelor au fost refacute Cu dobanzile ratelor pe

termen scurt aproape de zero si politici monetare 9non&conventional:

marind lic$iditate problema pe piata creditelor interbancare a scazut

)timulul fiscal dovedeste efectivitatea relativa din pricina lic$idarii si

creditele constrang acoperirea si afacerilor in mediul curent

Contragerea economica a fost infranta si numarul 1ob&urilor continute in

raport cu dimensiunea de contractie economica

2.2 REZOL!AREA CRIZEI

%n timp ce este inca o incertitudine ma1ora care incon1oara ritmul refacerii

economice acum este essential ca strategiilede iesire ale controlului politic al

crizei sa fie formate si facute deasemenea +cesta este necesar atat pentru a

asigura ca actiunile curente sa aiba efectele dorite cat si pentru a asigura

stabilitatea macroeconomica +vand o strategie de iesire nu include anuntarea

unui calendar fi"at pentru urmatoarele miscari# dar mai de graba sa defineasca

aceste miscari# incluzand directia lor si conditiile care trebuie indeplinite pentru

realizarea lor )trategiile de iesire au nevoie sa fie in spatiu pentru politici

financiare# macroeconomice si structurale asemenea;

5olitici financiare - prima prioritate este sa reintegreze'redea

viabilitatea sectorului de finante* %n caz contrar un cerc vicios al

cresterii slabe# mai multe probleme in sectorul financiar si c$iar

constrangeri puternice de credit ar opri refacerea economica-bligatii

clare sa restructureze si sa consolideze sectorul de finante poate fi pus

17

la loc acum daca# o decada precum in ,aponia este pe cale sa fie

permisa in /uropa 4uvernele pot spera ca sistemul financiar va depasi

problemele si ca iesirea din suportul de finante ar fi relativ egal !ar atat

timp cat ramane o lipsa de transparenta ca si valoarea bunurilor

financiare si vulnerabilitatea lor cu privire la dezvoltarea economica si

financiara# nesiguranta ramane %n acest conte"t# opozitia in mai multe

banci de a dezvalui adevarata stare a bilanturilor lor sau sa e"ploateze

conditiile de castig foarte favorabile induse de suportul politic pentru a

repara bilanturile lor este o problema /ste important atat ca repararea

financiara sa fie facuta la cel mai scazut cost posibil pentru ta"ele

platnicilor pe termen lung# nu doar sa castige spri1in politic# dar de

asemenea sa asigure sustinerea finantelor publice si sa evite o crestere

permanta in povara ta"ei> 7efacerea financiara este atat de esentiala

sa asigure o rata satisfactorie a cresterii potentiale < nu doar pentru ca

inovatia depinde de disponibilitatea riscului financiar

5olitici macroeconomice )timulul macroeconomic < monetar si fiscal <

a fost folosit intensiv 5reocuparea pentru bancile centrale si guverne

este acum sa continue sa asigure spri1in economiei si sectorului

financiar fara sa compromita stabilitatea obiectivelor in termen mediu

%n timp ce retragerea stimulului monetar ramane inca some ?a@ off

0ancile centrale in /( sunt determinate sa desfaca atitudinea

supportive a politicilor monetare odata ce presiunea inflatiei incepe sa

creasca 5ana la acel punct o strategie de iesire credibila pentru

politica fiscala terbuie sa fie ferma pe loc pentru a pre&elibera presiunea

in guverne # sa amane sau sa call off consolidarea finantelor publice

)trategia de iesire fiscala ar putea preciza conditiile pentrtu retragerea

stimulului si trebuie sa fie credibila# ie bazata pe reforme pre&comise a

programelor si ancorate in cadruri fiscale nationale 7etragerea stimului

fiscal sub //75 va fi cvasi automata in 2010&2011# dar trebuie sa fie

continuata de o foarte substantiala& totusi diferentiata intre )tatele

.embre < conditii fiscale care sa anuleze tendintele negative in datoria

publica (n amestec de c$eltuieli limiteaza si cresterile ta"ei trebuie sa

fie urmate# c$iar daca acesta este solicitat intr&un mediu unde confictele

de repartizare sunt pe cale sa apara Calitatea finantelor publice#

incluzand impactul ei asupra stimulilor de munca si eficienta

economica# in mare este o problema ma1ora

5olitici structurale C$iar mai important pentru criza financiara#

cresterea potentiala a productiei a fost asteptata sa in1umatateasca la

apro"imativ mai putin de 16 aproape d 2020 due to t$e populatie

batrana !ar asemenea crestere a ratelor potential scazuta este

probabil sa fie inregistarta de1a in anii urmatori in timpul crizei !e notat

ca este important sa se refaca decisiv cel mai lung termen de viabilitate

a sectorului de finante astfel incat sa a1ute productivitatea si potentiala

crestere !ar asta nu va multumi si eforturile sunt deasemenea

necesare in aria structural politica propriu&zisa - strategie serioasa ar

trebui sa includa iesirea din masuri temporare spri1inind sectoarele

particulare si pastrarea 1ob&urilor si rezistenta adoptiei sau e"pansiunea

planurilor proiectelor pentru a retrage oferta de munca !incolo de

aceste obiective defensive# politicile structurale ar trebui sa include o

revizuire a sistemelor de protectie sociala cu accentual pe prevenirea

18

soma1ului persistent promovarea unei vieti de munca mai lunga %n plus

reforma pietei muncii in acord cu fle"icuritatea < abordare bazata de

asemenea sa a1ute evitarea e"perientelor crizelor trecute cand efectele

isteriei au condus la sustinerea perioadei foarte ridicate de soma1 si

e"cluderea permanenta unor forte de munca 7eformele productiei

pietei in acord cu prioritatea strategiei 2isabonieni 'implementarea unui

singur program de piata in special in aria serviciilor# masuri pentru a

reduce sarcini administrative si sa promoveze 76! si inovatia*vor fi de

asemenea c$eia pentru a creste productivitatea si crearea de noi

posibilitati de anga1are 3ranzitia la economia carbunelui inferior ar

putea fi urmata prin integrarea obiectivelor de mediu si instrumente in

alegerile structural politice# impozite notabile %n toate aceste arii#

politicile care suporta un cost bugetar scazut ar putea fi prioritare

2." PRE!EIREA CRIZEI

(n consens mai larg se pare ca sunt ultimele cauze ale crizei rezidate din

functionarea pietelor publice# cat si din dezvoltarile macroeconomice %nainte ca criza

sa apara a fost o puternica credinta ca instabilitatea macroeconomica fusese

eradicata %nflatia scazuta si stabila cu cresterea economica sustinuta '.area

.oderare* au considerat a fi trasaturi permanente ale economiilor dezvolatate

+ceasta nu a fost suficient de apreciata incat a datorat mult dezimflatiei globale

asociate cu conditiile ofertelor favorabile provocate de integrarea surplusului de

munca al economiilor aparute# in specific in C$ina# in lumea economiei +ceasta a

sugerat un monetar rezervant si politici fiscale Conditiile financiare care rezista au

avut de asemeanea originile macroeconomice si acestea au tins sa interactioneze cu

mediul macroeconomic favorabil 2ista factorilor contributive este lunga incluzand

dezvoltarea comple"elor < dar supraveg$eate prost& productiile financiare si

asumarea riscurilor e"cesivelor pe termen scurt

5revenirea crizei politice ar putea aborda aceste deficienta pentru a evita repetarea

in viitor /"ista din nou agende pentru politici financiale# macroeonomice si structural

1 5olitici financiare +genda pentru reglarea si supraveg$erea crizei pietelor

financiare in (/ este vasta (n numar de initiative au fost luate de1a# in timp

ce in unele arii eforturi ma1ore sunt inca necesare 5lanuri de actiune au fost

puse inainte de (/ pentru a intari cadrul reglatoriu in acord cu agenda

reglatorie 420 Cu ma1oritatea bunurilor financiare pastrate de bancile

transfrontaliere# o reforma ambitioasa a sistemului /uropean de

supraveg$ere# bazata pe o recomandare facuta de 4rupul de %nalt Aivel

prezidat de .r ,acBues de 2arosiere# este in discutie %nitiative pentru a obtine

renumeratii politice mai bune# coverage reglatorie a surselor $edge si resurse

private egale sunt considerate dar mai au inca pana sa fie legislate %n multe

arii progresul este in urma 7eglarea pentru a asigura atat de multe provizii si

capitalul sa fie pus de&o parte pentru a face fata la dificultatea timpului

necesita sa fie dezvoltata cu cadrele 1ustificate sa se desfasoare in aceeasi

directie (n anumit grad de comunalitate si consistenta printre regula cartii in

19

)tatele .embre este importanta o singura regula a cartii# pe cat mai curand

posibil de dorit /ste esential ca o stabilitate bancara viguroasa si efectiva si

fermitatea cadrului este dezvoltata sa guverneze ceea ce se intampla cu

conducerea esueaza# incluzand depozitele effective de productie Consistenta

si claritatea printre tarile (/ in legatura cu problemele in astfel de institutii este

o c$eie necessara a unui cadru operational si reglatoriu mai mult improvizat in

cadrul tarilor (/

2 5olitici macroeconomice 4uvernele in multe )tate .embre (/ risca o

politica fiscala rezervanta in Ctimpurile bune: care au precedat criza !esi

aceasta nu poate fi vazuta ca principalul vinovat al crizei si poate fi factorul in

producerea in viitor a uneia < subminand sustinerea pe termen mai lung a

finantelor publice in fata imbatranirii populatiei +gendele politice pentru a

preveni asemenea comportament ar trebui se fie atat de proeminente

3- c$emare puternica catre coordonarea /(

,ustificare pentru coordonarea /( a politicii in fata crizei financiare este

puternica la toate trei stadiile < control si atenuare# rezolvare si prevenire;

2a etapa de control si atenuare a crizei# factorii de decizie politica /( a

devenit e"treme de constienta ca asistenta financiara de tarile de origine a

institutiilor lor financiare si e"tensiilor unilaterale a depozitului de garantii

determina mari si posibile efecte ale e"cedentelor de perturbari +ceasta

conduce la summit&ul de urgenta a Consiliului /uropean la Deads of )tate

2evel in toamna anului 2008 < pentru prima data in istorie de asemenea

pentru /urogroup < sa coordoneze aceste miscari 7olul Comisiei la

aceasta etapa a fost sa asigure indrumare in asa fel incat sa asigure ca

a1utoarele financiare ating obiectivele lor cu denaturari minime ale

competitiei si abundente negative )timulul fiscal de asemenea a depasit

efectele spillover printre pietele comerciale si financiare /fectele de

revarsare sunt inca puternice in aria /uro prin transmisia raspunsurilor

politicii monetare //75 adoptat in noiembrie 2008# care a fost definit un

cadru efectiv pentru coordonarea stimulului fiscal si controlul crizei politice

pe larg# a fost motivate de recunoasterea acestor spilovers

2a etapa de rezolvarea a crizei o abordare coordonata este necesara sa

asigure o iesire ordonata a controlului crizei politice peste )tatele .embre

)&ar putea sa nu se fi avut in vedere ca toate guvernele )tatelor .embre

ies in acelasi timp ' ca si cum asta ar fi putut fi dictat de circumstante

nationale specifice* !ar aceasta poate fi important ca a1utorul statelor

pentru institutiile financiare 'sau alte industrii afectate sever * sa nu

persiste pentru mult timp decat este necesar in ceea ce priveste implicatiile

sale pentru competitie si functionarea unei )ingure 5iete /( )trategiile

nationale pentru pentru o revenire la durabilitatea fiscala poate fi

coordonata la fel de bine # pentru fiecare cadru care e"ista in forma

)tabilitatii 5actul Cresterii care a fost creat sa abordeze riscurile spilover

de la inceput ,ustificarile pentru coordonarea politicilor structurale au fost

precizate in )trategia 2isaboniana si aplicat de asemenea la iesirile din

interventie temporara in piata productiei si a muncii in fata crizei

2a etapa de prevenire a crizei pentru coordonare /( este mai de graba

drep inainte in ceea ce priveste gradul ridicat al integrarii financiale si

economice !e e"emplu# o reforma reglatorie orientata pentru prevenirea

20

crizei# poate conduce la un arbitra1 reglatoriu care va afecta alegerea

locatiilor institutiilor si poate sc$imba directia flu"ului de capital

international 3otusi# cu multe institutii financiale operand transfrontalier

e"ista un proces clar de sc$imb de informatie si impartirea sarcinilor in caz

de lipsuri

Criza financiara a consolidat procesul pentru coordonarea economic politica in

/( Coordonand crizele lor politice )tatele .embre au ridicat credibilitatea

masurilor luate# si asta a1uta sa redea incredrea si suportul refacerii in termen

scurt Coordonarea poate de asemenea sa fie cruciala pentru a se ingri1i de

protectionism si acesta serveste ca o garantie a 5ietii (nice 3otusi#

coordonarea este necesara sa asigure o functionare buna in aria /uro unde

revarsarea politicilor nationale sunt foarte puternice )i coordonarea asigura

stimuli la nivel national pentru a implementa cresterea prietenoasa a politicilor

economice si sa coordoneze o intoarcere la sustinerea fiscala (ltimul dar nu

cel din urma# coordonarea politicilor e"terne poate contribui la o mai rapida

solutie a crizei financiare si refacerea globala

)tructurile /( pentru coordonare de1a e"ista in multe arii si pot fi dezvoltate in

continuare in unele %n anumite arii /( are o responsabilitate directa si

aceasta este cea mai mare autoritate in 1urisdictia ei +ceste este procesul

pentru politica monetara remarcabila in aria euro# competitie si politica si

negocieri comerciale in cadrul !-D+ 7ound +ceasta se dovedeste acum mai

folositoare ca oricand %n alte arii coordonarea cadrurilor /( cu susul in 1os a

fost dezvoltata si poate fi e"ploatata la ma"im (rmarile unei agende reglatorii

si supervizorii implica set&up unui nou cadru de coordonare /( care a fost

intarziat in vederea integrarii sistemelor financiale (n cadru important pentru

coordonarea politicilor fiscale e"ista sub aegis )tabilitatii si 5actului de

crestere )trategia 2isaboniana reinnoita ar putea servi ca cel mai important

cadru pentru coordonarea politicilor structurale in /( 0alanta de plati a

asistentei asigurata de /( in alta arie unde un cadru coordonat a fost stabilit

recent# si care poate fi e"ploatat de asemenea pentru coordonarea politicilor in

scopul convergence economice

2a nivel global# in final# /u poate oferi un cadru pentru coordonarea pozitiilor

in 420 sau %.= Cu () adoptand propria sa strategie de iesire# presiunea sa

creasca cererea oriunde va fi mounting %nfluentele cer ca tarile emergente

precum C$ina sa reduca politica ratei de sc$imb /( va fi mult mai efectiva

daca de asemenea considera cum politicile pot contribui la o crestere mult mai

ec$ilibrata in lumea intreaga# considerand procesul de spri1inire cu reforme

structurale# in asa fel incat sa ridice productivitatea potentiala 5rin urmare# /(

va ar putea facilita scopurile agendei sale influentand euro si participand la

baza unei singure pozitii

21

22

Potrebbero piacerti anche

- Navigating the Global Storm: A Policy Brief on the Global Financial CrisisDa EverandNavigating the Global Storm: A Policy Brief on the Global Financial CrisisNessuna valutazione finora

- OECD 2010 paper examines counter-cyclical economic policiesDocumento9 pagineOECD 2010 paper examines counter-cyclical economic policiesAdnan KamalNessuna valutazione finora

- Chipping Away at Public Debt: Sources of Failure and Keys to Success in Fiscal AdjustmentDa EverandChipping Away at Public Debt: Sources of Failure and Keys to Success in Fiscal AdjustmentValutazione: 1 su 5 stelle1/5 (1)

- Enspecial Series On Covid19monetary and Financial Policy Responses For Emerging Market and DevelopinDocumento5 pagineEnspecial Series On Covid19monetary and Financial Policy Responses For Emerging Market and DevelopinAlip FajarNessuna valutazione finora

- Foreword PDFDocumento2 pagineForeword PDFTushar DoshiNessuna valutazione finora

- Comparative Analysis of CrisesDocumento11 pagineComparative Analysis of CrisesPhine TanayNessuna valutazione finora

- IMF Staff Note Offers Policy Options for Emerging Economies Coping with Global CrisisDocumento30 pagineIMF Staff Note Offers Policy Options for Emerging Economies Coping with Global CrisisLinh HoNessuna valutazione finora

- The Theme of The ReportDocumento6 pagineThe Theme of The ReportAnkit SharmaNessuna valutazione finora

- Financial System Resilience Lessons From A Real Stress Speech by Jon CunliffeDocumento12 pagineFinancial System Resilience Lessons From A Real Stress Speech by Jon CunliffeHao WangNessuna valutazione finora

- !!! Macroeconomics and Stagnation - Keynesian-Schumpeterian WarsDocumento7 pagine!!! Macroeconomics and Stagnation - Keynesian-Schumpeterian Warsalcatraz2008Nessuna valutazione finora

- Ch1 PDFDocumento26 pagineCh1 PDFrhizelle19Nessuna valutazione finora

- Azis-Macro Post GFCDocumento22 pagineAzis-Macro Post GFCAnggerNessuna valutazione finora

- 1 Poverty Reduction and Economic ManagementDocumento25 pagine1 Poverty Reduction and Economic ManagementErinda MalajNessuna valutazione finora

- Dela Cruz - Financial MarketsDocumento1 paginaDela Cruz - Financial MarketsMa. Ana Dela CruzNessuna valutazione finora

- Wren-Lewis (2010) - Macroeconomic Policy in Light of The Credit Crunch - The Return of Counter-Cyclical Fiscal Policy?Documento16 pagineWren-Lewis (2010) - Macroeconomic Policy in Light of The Credit Crunch - The Return of Counter-Cyclical Fiscal Policy?Anonymous WFjMFHQNessuna valutazione finora

- Effects of Global Financial CrisisDocumento10 pagineEffects of Global Financial CrisisHusseinNessuna valutazione finora

- Central Banking: Before, During, and After The CrisisDocumento22 pagineCentral Banking: Before, During, and After The CrisisCoolidgeLowNessuna valutazione finora

- Global Financial Stability Report - 2020Documento43 pagineGlobal Financial Stability Report - 2020Xara ChamorroNessuna valutazione finora

- Exes UmDocumento2 pagineExes UmBehemoth00Nessuna valutazione finora

- Global Financial Turbulence and Financial Sector in India: A Practitioner's PerspectiveDocumento15 pagineGlobal Financial Turbulence and Financial Sector in India: A Practitioner's PerspectiveRamasundaram TNessuna valutazione finora

- DownloadDocumento3 pagineDownloadnickedia17Nessuna valutazione finora

- General Assessment of The Macroeconomic Situation: The Recovery Is Strengthening Albeit Slowly and UnevenlyDocumento82 pagineGeneral Assessment of The Macroeconomic Situation: The Recovery Is Strengthening Albeit Slowly and UnevenlygbbajajNessuna valutazione finora

- Macroeconomic and Financial Sector Policies in EMDEs Before and After the Global RecessionDocumento43 pagineMacroeconomic and Financial Sector Policies in EMDEs Before and After the Global RecessionGfi ConexionNessuna valutazione finora

- Monetary Policy in A Pandemic EmergencyDocumento6 pagineMonetary Policy in A Pandemic EmergencyTrần ThiNessuna valutazione finora

- 2007 Meltdown of Structured FinanceDocumento41 pagine2007 Meltdown of Structured FinancejodiebrittNessuna valutazione finora

- Europe Under StressDocumento4 pagineEurope Under StressurbanovNessuna valutazione finora

- The Hayek Rule - Federal - Reserve - Monetary - Policy - Hayek - RuleDocumento56 pagineThe Hayek Rule - Federal - Reserve - Monetary - Policy - Hayek - RuleDavid BayoNessuna valutazione finora

- Understanding Financial Crisis of 2007 08Documento3 pagineUnderstanding Financial Crisis of 2007 08Mahesh MohurleNessuna valutazione finora

- Regional Economic Outlook: Dealing With Shocks Evidence From Old EU Members and Serbia by Abdelmoneim YoussefDocumento9 pagineRegional Economic Outlook: Dealing With Shocks Evidence From Old EU Members and Serbia by Abdelmoneim Youssefabdelmoneim_youssefNessuna valutazione finora

- ElerianDocumento3 pagineElerianDileep Kumar MaheshwariNessuna valutazione finora

- F 2807 SuerfDocumento11 pagineF 2807 SuerfTBP_Think_TankNessuna valutazione finora

- Considerations Regarding Monetary and Fiscal Exit Strategies From The CrisisDocumento5 pagineConsiderations Regarding Monetary and Fiscal Exit Strategies From The CrisisDănutsa BănişorNessuna valutazione finora

- How To Save The WorldDocumento12 pagineHow To Save The WorldbowssenNessuna valutazione finora

- UAS Macroeconomy CaseDocumento10 pagineUAS Macroeconomy Caserichiealdo7Nessuna valutazione finora

- Global Economic Crisis Part 1Documento8 pagineGlobal Economic Crisis Part 1Phine TanayNessuna valutazione finora

- Draghi SpeechDocumento12 pagineDraghi Speechzach_kurzNessuna valutazione finora

- Neil Angelo C. Halcon Leah Melissa T. de Leon: ExpectationsDocumento12 pagineNeil Angelo C. Halcon Leah Melissa T. de Leon: ExpectationsWitchy MyeNessuna valutazione finora

- Drfoong30 03 2009Documento2 pagineDrfoong30 03 2009Onisha GeorgeNessuna valutazione finora

- Government Saving Has Not Grown Much in The Developing Countries and Corporate Saving Is Relatively SmallDocumento6 pagineGovernment Saving Has Not Grown Much in The Developing Countries and Corporate Saving Is Relatively SmalljoooNessuna valutazione finora

- The financial crisis in Greece and its impact on the euro areaDocumento18 pagineThe financial crisis in Greece and its impact on the euro areaAndrei SpqNessuna valutazione finora

- Monetary Policy May Promote Financial Stability by Responding to OutputDocumento40 pagineMonetary Policy May Promote Financial Stability by Responding to OutputxeniachrNessuna valutazione finora

- Monetary Economics AssignmentDocumento6 pagineMonetary Economics AssignmentNokutenda Kelvin ChikonzoNessuna valutazione finora

- The Creation of Euro Area Financial Safety Nets: HighlightsDocumento27 pagineThe Creation of Euro Area Financial Safety Nets: HighlightsBruegelNessuna valutazione finora

- JUL 20 UniCredit Market SenseDocumento8 pagineJUL 20 UniCredit Market SenseMiir ViirNessuna valutazione finora

- 1456892183BSE P5 M34 E-Text PDFDocumento9 pagine1456892183BSE P5 M34 E-Text PDFsahil sharmaNessuna valutazione finora

- Book Review: Trinity College, Hartford, CT, USADocumento3 pagineBook Review: Trinity College, Hartford, CT, USASantiago PérezNessuna valutazione finora

- IMF World Economic and Financial Surveys Consolidated Multilateral Surveillance Report Sept 2011Documento12 pagineIMF World Economic and Financial Surveys Consolidated Multilateral Surveillance Report Sept 2011babstar999Nessuna valutazione finora

- Lars E O Svensson Discusses Monetary Policy Lessons from Financial CrisisDocumento6 pagineLars E O Svensson Discusses Monetary Policy Lessons from Financial CrisisDamien PuyNessuna valutazione finora

- Questioni Di Economia e FinanzaDocumento34 pagineQuestioni Di Economia e Finanzawerner71Nessuna valutazione finora

- The Role of Financial RegulationDocumento15 pagineThe Role of Financial RegulationTanu GautamNessuna valutazione finora

- E14519 e TarjomeDocumento36 pagineE14519 e Tarjomem rNessuna valutazione finora

- Don't Let Fiscal Brakes Stall Global Recovery: by Christine LagardeDocumento3 pagineDon't Let Fiscal Brakes Stall Global Recovery: by Christine Lagardeapi-63605683Nessuna valutazione finora

- Speech by MR Ben S Bernanke Chairman of The Board of Governors of The US Federal Reserve System at Princeton 09242010 1Documento10 pagineSpeech by MR Ben S Bernanke Chairman of The Board of Governors of The US Federal Reserve System at Princeton 09242010 1kumaranprasadNessuna valutazione finora

- Global Economy To Slow Further Amid Signs of Resilience and China Re-OpeningDocumento5 pagineGlobal Economy To Slow Further Amid Signs of Resilience and China Re-Openinggulunakhan0Nessuna valutazione finora

- Unconventional Monetary Policy Measures - A Comparison of The Ecb, FedDocumento38 pagineUnconventional Monetary Policy Measures - A Comparison of The Ecb, FedDaniel LiparaNessuna valutazione finora

- Monetary Policy Research Paper Stanley Fischer Nov2021Documento25 pagineMonetary Policy Research Paper Stanley Fischer Nov2021sagita fNessuna valutazione finora

- Policy Insight 68Documento13 paginePolicy Insight 68unicycle1234Nessuna valutazione finora

- Project SyndacateDocumento2 pagineProject SyndacatecorradopasseraNessuna valutazione finora

- Bachelor Thesis Euro CrisisDocumento4 pagineBachelor Thesis Euro Crisisafjrydnwp100% (1)

- 2b. Bauran Kebijakan Bank SentralDocumento25 pagine2b. Bauran Kebijakan Bank SentralVicky Achmad MNessuna valutazione finora

- Over Not Over Tax: Basic Income Table (Tax Code, Section 24 A)Documento2 pagineOver Not Over Tax: Basic Income Table (Tax Code, Section 24 A)Juliana ChengNessuna valutazione finora

- FYCE BM1804 - Income Taxation HandoutDocumento17 pagineFYCE BM1804 - Income Taxation HandoutLisanna DragneelNessuna valutazione finora

- Introduction to Federal Taxation in CanadaDocumento40 pagineIntroduction to Federal Taxation in CanadaDonna So100% (2)

- Business MathDocumento15 pagineBusiness MathIvy RabidaNessuna valutazione finora

- TaxOptimizer© From TaxSpannerDocumento14 pagineTaxOptimizer© From TaxSpanneryeswanthNessuna valutazione finora

- Multiple Choice: Chapter 16 - SolvingDocumento19 pagineMultiple Choice: Chapter 16 - SolvingElla LopezNessuna valutazione finora

- ODUSOLA RISIKAT OLADUNNI - Mar - 2023 PDFDocumento1 paginaODUSOLA RISIKAT OLADUNNI - Mar - 2023 PDFOluwayemisi EbijimiNessuna valutazione finora

- Unit 2 - Jamaican TaxationDocumento27 pagineUnit 2 - Jamaican TaxationKaycia HyltonNessuna valutazione finora

- US Internal Revenue Service: Iw2 - 1999Documento12 pagineUS Internal Revenue Service: Iw2 - 1999IRSNessuna valutazione finora

- 2307Documento16 pagine2307Marjorie JotojotNessuna valutazione finora

- Corporate Tax Chapter 2 HomeworkDocumento3 pagineCorporate Tax Chapter 2 HomeworkAndrew Steven0% (1)

- FRS 112 Defered Tax AnswersDocumento10 pagineFRS 112 Defered Tax AnswersMed DausNessuna valutazione finora

- Tax Protest MemorandumDocumento16 pagineTax Protest MemorandumGil PinoNessuna valutazione finora

- 709 Form 2005 SampleDocumento4 pagine709 Form 2005 Sample123pratus91% (11)

- Accounting For Income TaxDocumento14 pagineAccounting For Income TaxJasmin Gubalane100% (1)

- ACC 311 Income Taxation QuizDocumento3 pagineACC 311 Income Taxation QuizHilarie JeanNessuna valutazione finora

- January BillDocumento1 paginaJanuary Billy4919952Nessuna valutazione finora

- Valencia Chap 5 Estate TaxDocumento11 pagineValencia Chap 5 Estate TaxCha DumpyNessuna valutazione finora

- BIR Form 0605Documento2 pagineBIR Form 0605Kathleen Anne CabreraNessuna valutazione finora

- Business Tax - Prelim Exam - Set BDocumento6 pagineBusiness Tax - Prelim Exam - Set BRenalyn ParasNessuna valutazione finora

- CA Final Direct Tax Laws - MCQ On HUFDocumento3 pagineCA Final Direct Tax Laws - MCQ On HUFAadish JainNessuna valutazione finora

- Binder1 PDFDocumento5 pagineBinder1 PDFSaad Raza KhanNessuna valutazione finora

- MJ17 - Hybrids - P6UK - AMENDED AnswersDocumento12 pagineMJ17 - Hybrids - P6UK - AMENDED AnswersHassan jalilNessuna valutazione finora

- Income Tax Payment Challan: PSID #: 172247415Documento1 paginaIncome Tax Payment Challan: PSID #: 172247415fast fbrNessuna valutazione finora

- Batangas State University College of Accountancy QuizDocumento5 pagineBatangas State University College of Accountancy QuizBABY JOY SEGUINessuna valutazione finora

- IRS Form W-9Documento4 pagineIRS Form W-9Gary S. Wolfe100% (1)

- Accounting For Income Tax Valix StudentDocumento4 pagineAccounting For Income Tax Valix Studentvee viajeroNessuna valutazione finora

- Netaji Subhas Open University: Learning ObjectivesDocumento48 pagineNetaji Subhas Open University: Learning ObjectivesMr. Tanmoy Pal ChowdhuryNessuna valutazione finora

- Mod 7Documento1 paginaMod 7Renz Joshua Quizon MunozNessuna valutazione finora

- Pas 12Documento5 paginePas 12elle friasNessuna valutazione finora