Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Insurance Note Taking Guide

Caricato da

api-252392987Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Insurance Note Taking Guide

Caricato da

api-252392987Copyright:

Formati disponibili

7.10.1.

L1 Note taking guide

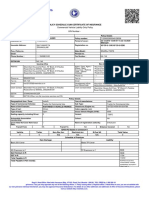

Types of Insurance Essentials Note-Taking Guide

Hayden Spiller Name__________________

39 Total Points Earned Total Points Possible Percentage

INSURANCE Policyholder:

Policyholder is the consumer who purchased the policy.

04/10/14 Date__________________

5th period Class _________________

Risk:

Insurance:

Insurance is an arrangement between an individual and an insurer to protect the individual against risk.

Policy:

Policy is a contract between the individual and the insurer specifying the terms of the insurance arrangements.

Risk is the uncertainty about a situation's outcome.

Premium:

Premium is the fee paid to the insurer to bet covered under the specified terms.

Deductible:

Deductible is the amount paid out of pocket by the policy holder for the initial portion of a loss before the insurance coverage begins.

AUTOMOBILE INSURANCE Liability Medical payment

Medical payment insurance covers injuries sustained by the driver of the insured vehicle or any passenger regardless of fault. It also covers insured family members injured as passengers in any car or if they are injured while on foot as a pedestrian or while riding a bicycle.

Types

Liability insurance- covers the insured if injuries or damages are caused to other people or their property.

Uninsured/under insured

Uninsured or underinsured motorists insurance covers injury or damage to the driver, passengers, or the vehicle caused by a driver with insufficient insurance.

Physical damage

Physical damage insurance covers damages caused to the vehicle.

Collision

Collision covers a collision with another object, car, or from a rollover.

Comprehensive

Comprehensiv e - covers all physical damage losses except collision and other specified losses.

Required by law Who/ what is covered

minimum

injures or damages to other people or their property

injuries sustained by the driver of the insured vehicle. Also covers family members injured as passengers in any car.

Covers injury or damage to the driver, passengers, or the vehicle caused by the driver with insufficient insurance.

collision with another object, car, or from a rollover. physical damages as well.

Family Economics & Financial Education October 2010 The Essentials to Take Charge of Your Finances Types of Insurance Page 10 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences Take Charge America Institute at The University of Arizona

7.10.1.L1 Note taking guide

HEALTH INSURANCE Why is it important to purchase health insurance? Provides protection against: May cover: How may health insurance be purchased?

Health insurance may be purchased by an individual or through their employer.

It is important to purchase health insurance because it provides coverage for emergency or routine medical expenses.

Financial losses resulting from injury, illness, and disability.

Coverage depends upon the policy because the terms vary among different health care policies.

Children may stay on their parents health insurance until:

Some children may be covered under their parents health insurance until they are 19 or while they are in college.

LIFE INSURANCE Life insurance:

Life insurance is a contract between an insurer and policyholder specifying a sum to be paid to a beneficiary upon the insureds death.

Beneficiary:

Dependent:

A beneficiary is the recipient of any policy proceeds if the insured person dies.

A dependent is a person who relies on someone else financially.

Who should purchase life insurance?

Life insurance is necessary for people who have a dependent spouse, dependent children, an aging or disabled dependent relative, or are business owners.

DISABILITY INSURANCE Disability insurance:

Disability insurance replaces a portion of ones income if they become unable to work due to illness or injury.

If needed, how much does disability insurance pay an individual?

The insurance typically pays between 60% 70% of ones full time wage.

HOMEOWNERS AND R ENTERS INSURANCE Peril:

A peril is an event which can cause a financial loss like fire, falling trees, lightning, and others.

Renters insurance:

Renters insurance protects the insured from loss to the contents of the dwelling rather than the dwelling itself.

Homeowners insurance:

Homeowners insurance combines property and liability insurance into one policy to protect a home from damage costs due to perils.

Property insurance:

Property insurance protects the insured from financial losses due to destruction or damage to property or possessions.

Why is it important for a renter to purchase renters insurance?

Renters insurance protects the insured from loss to the contents of the dwelling rather than the dwelling itself.

Liability insurance:

Liability insurance protects the insured party from being held liable for others financial losses.

Covers:

It covers major perils, provides liability protection, and provides for additional living expenses if the dwelling is rendered uninhabitable by one of the covered perils.

Family Economics & Financial Education October 2010 The Essentials to Take Charge of Your Finances Types of Insurance Page 11 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences Take Charge America Institute at The University of Arizona

Potrebbero piacerti anche

- Property, Liability and Auto Insurance: A Handbook and Guide for Insurance Concepts and Coverage!Da EverandProperty, Liability and Auto Insurance: A Handbook and Guide for Insurance Concepts and Coverage!Valutazione: 5 su 5 stelle5/5 (1)

- Glossary of Insurance Terms: AbcdefghijklmnopqrstuvwxyzDocumento10 pagineGlossary of Insurance Terms: AbcdefghijklmnopqrstuvwxyzsebascianNessuna valutazione finora

- Insurance HandbookDocumento28 pagineInsurance HandbookGreat VivekanandaNessuna valutazione finora

- Frauds in Insurance SectorDocumento74 pagineFrauds in Insurance Sectoranilmourya5100% (1)

- 4b Letter of Award Without Project ConsultantDocumento4 pagine4b Letter of Award Without Project ConsultantManoharan SilvarajanNessuna valutazione finora

- Reliance Private Car Vehicle Certificate Cum Policy ScheduleDocumento3 pagineReliance Private Car Vehicle Certificate Cum Policy ScheduleMatthew Smith100% (5)

- Legal Aspects of Real Estate InvestingDocumento17 pagineLegal Aspects of Real Estate InvestingAPNessuna valutazione finora

- EPC and FEEDDocumento19 pagineEPC and FEEDBaghdadi AbdelillahNessuna valutazione finora

- Motor Accidents Claims Tribunal MACTDocumento18 pagineMotor Accidents Claims Tribunal MACTविशाल चव्हाणNessuna valutazione finora

- Draft: Jurisprudence Learning Module & ExaminationDocumento45 pagineDraft: Jurisprudence Learning Module & ExaminationDeepanshi RajputNessuna valutazione finora

- Shafer v. Hon. Judge of RTC, 1988-FINALDocumento2 pagineShafer v. Hon. Judge of RTC, 1988-FINALRandy SiosonNessuna valutazione finora

- Instructions For Accreditation:: SET RequirementsDocumento3 pagineInstructions For Accreditation:: SET RequirementsMySolutions Inc OfficialNessuna valutazione finora

- Types of Insurance Lesson PlanDocumento8 pagineTypes of Insurance Lesson PlanpcsgdnwuNessuna valutazione finora

- NCLEX-PN Multiple Choice Questions: Legal and Ethical Issues of NursingDocumento6 pagineNCLEX-PN Multiple Choice Questions: Legal and Ethical Issues of NursingJah GatanNessuna valutazione finora

- New Health Insurance Project Swati Sarang (Tybbi) UmDocumento64 pagineNew Health Insurance Project Swati Sarang (Tybbi) UmMikant Fernando63% (8)

- Insurance Note Taking GuideDocumento2 pagineInsurance Note Taking Guideapi-252460708Nessuna valutazione finora

- Insurance Note Taking GuideDocumento2 pagineInsurance Note Taking Guideapi-252384953Nessuna valutazione finora

- Insurance Note Taking GuideDocumento2 pagineInsurance Note Taking Guideapi-252384641Nessuna valutazione finora

- Insurance SheetDocumento2 pagineInsurance Sheetapi-252377967Nessuna valutazione finora

- Insurance Note Taking GuideDocumento2 pagineInsurance Note Taking Guideapi-252988764Nessuna valutazione finora

- Insurance Note Taking GuideDocumento2 pagineInsurance Note Taking Guideapi-252377919Nessuna valutazione finora

- Insurance Note Taking GuideDocumento2 pagineInsurance Note Taking Guideapi-252390333100% (1)

- Insurance Note Taking GuideDocumento2 pagineInsurance Note Taking Guideapi-2523918430% (1)

- InsuranceDocumento2 pagineInsuranceapi-252391740Nessuna valutazione finora

- Insurance Note Taking GuideDocumento2 pagineInsurance Note Taking Guideapi-252387344100% (1)

- Insurance Note Taking GuideDocumento2 pagineInsurance Note Taking Guideapi-252391503Nessuna valutazione finora

- Insurance BasicsDocumento24 pagineInsurance BasicsKomal LalwaniNessuna valutazione finora

- Insurance - Definition and Meaning 2Documento4 pagineInsurance - Definition and Meaning 2ЕкатеринаNessuna valutazione finora

- Insurance and Risk Management w24YgEaPRNe6Documento7 pagineInsurance and Risk Management w24YgEaPRNe6Anupriya HiranwalNessuna valutazione finora

- What Is Insurance by VISHALDocumento6 pagineWhat Is Insurance by VISHALVishalNessuna valutazione finora

- Law of Insurance AnswersheetDocumento55 pagineLaw of Insurance Answersheetkhatriparas71Nessuna valutazione finora

- Insuranc 1Documento10 pagineInsuranc 1zunaira sarfrazNessuna valutazione finora

- Insurance and Pension FundDocumento44 pagineInsurance and Pension FundFiaz Ul HassanNessuna valutazione finora

- Frauds in Insurance Sector PDF FreeDocumento74 pagineFrauds in Insurance Sector PDF FreeJai GaneshNessuna valutazione finora

- Family Risk ManagementDocumento12 pagineFamily Risk ManagementAakash ReddyNessuna valutazione finora

- Insurance CompaniesDocumento5 pagineInsurance CompaniesangelicamadscNessuna valutazione finora

- Insurance and Risk ManagementDocumento10 pagineInsurance and Risk Managementhitesh gargNessuna valutazione finora

- Lesson 7Documento3 pagineLesson 7shadowlord468Nessuna valutazione finora

- Aid To Trade Insurance: Aditva SharmaDocumento20 pagineAid To Trade Insurance: Aditva Sharmaaditva SharmaNessuna valutazione finora

- UGA RMIN 4000 Exam 2 Study GuideDocumento13 pagineUGA RMIN 4000 Exam 2 Study GuideBrittany Danielle ThompsonNessuna valutazione finora

- Subject: Risk & Insurance Management: Submitted By: Nitin Mahindroo Roll-No-617 Submitted To: Mr. Naresh SharmaDocumento18 pagineSubject: Risk & Insurance Management: Submitted By: Nitin Mahindroo Roll-No-617 Submitted To: Mr. Naresh SharmaNitin MahindrooNessuna valutazione finora

- 5-Insurance Planning (Insurance Planning)Documento35 pagine5-Insurance Planning (Insurance Planning)Farahliza RosediNessuna valutazione finora

- Remaining ProjectDocumento81 pagineRemaining ProjectvickychapterNessuna valutazione finora

- Insurance PDFDocumento16 pagineInsurance PDFNANDHINI MNessuna valutazione finora

- Insurance BasicsDocumento23 pagineInsurance BasicsChamandeep SinghNessuna valutazione finora

- What Is Insurance - Meaning, Types, Importance & BenefitsDocumento7 pagineWhat Is Insurance - Meaning, Types, Importance & BenefitsAyush VermaNessuna valutazione finora

- Principles & Types of InsuranceDocumento6 paginePrinciples & Types of InsuranceSudhansu Shekhar pandaNessuna valutazione finora

- Daniel AyoolaDocumento10 pagineDaniel AyoolaSalim SulaimanNessuna valutazione finora

- Classification of InsuranceDocumento10 pagineClassification of InsuranceKhalid MehmoodNessuna valutazione finora

- Insurance and Risk ManagementDocumento6 pagineInsurance and Risk ManagementSolve AssignmentNessuna valutazione finora

- COMPANY PprrooffileDocumento12 pagineCOMPANY PprrooffileKai MK4Nessuna valutazione finora

- Presentation On InsuranceDocumento40 paginePresentation On InsurancedevvratNessuna valutazione finora

- Finance ReportDocumento4 pagineFinance ReportKatrina FregillanaNessuna valutazione finora

- Module V-2Documento12 pagineModule V-2kashifidaplNessuna valutazione finora

- Unit FourDocumento35 pagineUnit FourBI SH ALNessuna valutazione finora

- InsuranceDocumento4 pagineInsuranceElle BadussyNessuna valutazione finora

- Introduction of Mediclaim InsuranceDocumento17 pagineIntroduction of Mediclaim InsuranceKunal KaduNessuna valutazione finora

- 5-RISK MANAGEMENT AND LIFE INSURANCE (Insurance Planning)Documento45 pagine5-RISK MANAGEMENT AND LIFE INSURANCE (Insurance Planning)Haliyana HamidNessuna valutazione finora

- Insurance & Risk Management JUNE 2022Documento11 pagineInsurance & Risk Management JUNE 2022Rajni KumariNessuna valutazione finora

- Law Economics Risk Management Hedge Risk Uncertain: Types of InsuranceDocumento3 pagineLaw Economics Risk Management Hedge Risk Uncertain: Types of InsuranceEdvergMae VergaraNessuna valutazione finora

- New Microsoft Word DocumentDocumento3 pagineNew Microsoft Word DocumentShantam GulatiNessuna valutazione finora

- What Is InsuranceDocumento2 pagineWhat Is InsuranceLatifa ElfadilNessuna valutazione finora

- Institution That Offers A Person, Company, or Other Entity Reimbursement or Financial Protection Against Possible Future Losses or DamagesDocumento16 pagineInstitution That Offers A Person, Company, or Other Entity Reimbursement or Financial Protection Against Possible Future Losses or DamagesHrishikesh DharNessuna valutazione finora

- Insurance ManagementDocumento25 pagineInsurance ManagementDeepak ParidaNessuna valutazione finora

- Insurance ....Documento8 pagineInsurance ....SanyaNessuna valutazione finora

- COMM 229 Notes Chapter 6Documento5 pagineCOMM 229 Notes Chapter 6Cody ClinkardNessuna valutazione finora

- Summer Training Report: in Partial Fulfillment of The Requirements For The Award of The Degree ofDocumento74 pagineSummer Training Report: in Partial Fulfillment of The Requirements For The Award of The Degree ofrahul19myNessuna valutazione finora

- UNIT 3 InsuranceDocumento10 pagineUNIT 3 InsuranceAroop PalNessuna valutazione finora

- Hayden Spiller Hospital Cover LetterDocumento1 paginaHayden Spiller Hospital Cover Letterapi-252392987Nessuna valutazione finora

- Hayden Spiller Paystub Project QuestionsDocumento2 pagineHayden Spiller Paystub Project Questionsapi-252392987Nessuna valutazione finora

- Hayden Spiller MmsDocumento2 pagineHayden Spiller Mmsapi-252392987Nessuna valutazione finora

- 4-Year PlanDocumento1 pagina4-Year Planapi-252392987Nessuna valutazione finora

- Kuder Navigator Achievement Assessment ResultsDocumento1 paginaKuder Navigator Achievement Assessment Resultsapi-252392987Nessuna valutazione finora

- Sample Job ApplicationDocumento3 pagineSample Job Applicationapi-252392987Nessuna valutazione finora

- Mr. A. Santha Rao - (NIAAG00024380) : The New India Assurance Co. Ltd. (Wholly Owned by The Govt. of India)Documento2 pagineMr. A. Santha Rao - (NIAAG00024380) : The New India Assurance Co. Ltd. (Wholly Owned by The Govt. of India)seshu 2010Nessuna valutazione finora

- Sample Question Paper For Licensing - Ver 1Documento24 pagineSample Question Paper For Licensing - Ver 1nkNessuna valutazione finora

- Bond Performa MSCDocumento3 pagineBond Performa MSCVijay Bhure67% (3)

- Brussels Regulation 1 PDFDocumento23 pagineBrussels Regulation 1 PDFAditya GuptaNessuna valutazione finora

- Bridge Magazine 100Documento48 pagineBridge Magazine 100rprafalNessuna valutazione finora

- American Red Cross HandbookDocumento40 pagineAmerican Red Cross HandbookKelsie Marie FinniganNessuna valutazione finora

- 2016 Penc V Ncae Comparison ChartDocumento2 pagine2016 Penc V Ncae Comparison Chartapi-271885581Nessuna valutazione finora

- Ins NewDocumento59 pagineIns NewcoolashhNessuna valutazione finora

- Car Insurance Auto GlossaryDocumento9 pagineCar Insurance Auto GlossaryHuynh Van NguyenNessuna valutazione finora

- Ammas - JAFZA RulesDocumento50 pagineAmmas - JAFZA RulesArun PrasadhNessuna valutazione finora

- Tata Agi D&ODocumento3 pagineTata Agi D&Oghostriderr29Nessuna valutazione finora

- 08 Section 8Documento43 pagine08 Section 8Prasenjit DeyNessuna valutazione finora

- StrataReport15290 PDFDocumento139 pagineStrataReport15290 PDFStephen StantonNessuna valutazione finora

- Ecommerce Bba Complete Notes (1) WatermarkDocumento30 pagineEcommerce Bba Complete Notes (1) WatermarkMalathi SankarNessuna valutazione finora

- 100 Business Boosting Ideas For Growth SuccessDocumento19 pagine100 Business Boosting Ideas For Growth SuccessJames FNessuna valutazione finora

- PPIDocumento150 paginePPIshuklaNessuna valutazione finora

- What Are The Benefits of Business InsuranceDocumento3 pagineWhat Are The Benefits of Business InsuranceSamantha JohnsonNessuna valutazione finora

- Car Insurance PDSDocumento85 pagineCar Insurance PDSOsprey SkeerNessuna valutazione finora

- Chapter 2 - Defining The Insurable EventDocumento31 pagineChapter 2 - Defining The Insurable EventJean Pierre NaamanNessuna valutazione finora

- FIDIC Suite of ContractsDocumento3 pagineFIDIC Suite of ContractsValue ForccNessuna valutazione finora

- Essentia Sports Medicine and Sponsorship ContractsDocumento14 pagineEssentia Sports Medicine and Sponsorship ContractsDuluth News TribuneNessuna valutazione finora