Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Checks

Caricato da

api-246425869Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Checks

Caricato da

api-246425869Copyright:

Formati disponibili

NAME:

ErPL

DAT E:

HowtoManageYour

CheckinsAceount,ror

Part 1: How to Write a Check

Directions: Take a look at the check below and discuss the following steps to properly use the blank checks provided to practice writing a check.

> Date: Month, Day and Year

t006

32

fill out a check. Then

> Pay to the Order of: This is the person or business you are writing the check to. > Dottar Box: This is the numerical amount of the check you are writing. > Dottars Line: The written out amount of the cheek. For example: $108.34 would be written as: One Hundred Eight Dollars and B4/1O0's

'

For lor "Memo"l: Description ofwhat the check is paying for, such as account numbers, .'cable bill," "electric bill," "groceries," etc. (This is optional)

> Signature: Must match the name of the account hotder tisted at the top of the check

l,lame and

Addrcss of Account

Holder

Bank Name and Branch Location

Account

Number

Check Number

CHAPTER

Foundations in PersonaI Finance High Schoot Edition

Hornr

to Manage Your GheckinsAecouttt o^

@ Popular

P

O f iU out three sample checks for the following transacti.ons:

izza Place, $22.46, D ate

Z/ 12/

Year

@ Auto fnsurance, $97.25, Date 3/15/Year

O Cett Phone Company,

$67.50,

DateS/Z'/Year

Uollara tr **-

'tz3,rcsrB sthEr 4N.y,r9r,rrit;.us . 13f45

LrAl$ 9T'UDEilf.'.

BANK

"*tflu{ t: t I t'O0C1O 5r,r: OO I

r.23Yqrn s]ltEET ANvtou/N. usA .rz34s

{r}&r..rtrf?flS

BOOBO

I.AM STUDEHT

341

,^*if ssf,ry

FOR ETI{'CATIONAL USE ONLY

3l-tr2m

I

tilthe Orderof

Pay

1470 MIN STREET UMPONIA, TENNE$EE

"", f: I e LO0OO 5t,ri

(f

lt rhrFt{

OO

BOOOO

CHAPTER 3

Foundations in Personal Finance High School. Edition

-7

HowtoManageYour

CheekinsAceount

lrrl

cost of

pror

?i l-res[iru-

Y:s

_c_f

.._s[[g

A:s*l} e* {sseite Bsse$-'

Directions: Stayin$ in line with your budget is nearly impossible without tracking your spending. If a check is returned to you because you do not have enough money in your checking account, you will be faced with the

a bounced check, called a nonsufficient funds (NSF) fee. Not to mention the hassle and embarrassment ofhaving to re-send the check.

The bank gives you an organizer with your checks, sometimes called a check register. you may also find general account register forms online, through personal finance software, or you could even create your own. Whichever form you decide to use, keeping a written record of your transactions is important when it comes to managing your fi nances.

What account activities

wil

to write

fJ

t r'*

{4}ffi

&

Write down in your registerwheneveryou: @ write a check

@ Use your debit card @ wtake a deposit

@ Have abank fee

G)

withdraw money

@ Have money refunded to your account

The trick is to record your transactions at the moment you make it instead of trying to remember to fill it in later. It may seem like a lot of work at flrst, but it will be easy once you make a habit of doing it. Don't fall into the trap ofjust going online and checking your account. Banking online is convenient, but without a paper record you']l miss errors in transactions-and it can happen. Also, simply tracking your account online will not give you an accurate balance. T,ransactions that haven't posted, like outstanding debit card purchases or checks, will not have been factored into your available balance. In short, not keeping a written account register is just lazy money management, and it will catch up with you

Fill out a new accountregister for ea,ch, rnonth. At the en-td of the month, reconcile (compare Jbr accuracy) your toritten record with your bank stqtement (either print or online uersion). Be sure to keep both uri,tten and, electronic files of all financio.l records.

Note:

CHAPTER 3

Foundations in Personat Finance High Schoot Edition

Hornrto Manage Your

Checkin$Aceouttt

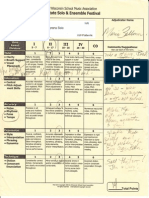

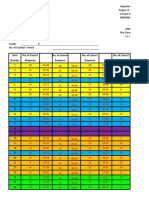

Below is asample account reglister.

wot

Number or Code: If you've written a check, write the check number here (found in the upper right corner of your check). If you have another type of transaction, use a code: DC for Debit Card, ATM for cash withdrawal, T for transfer, D for deposit, etc. Date: Always record the date of all transactions. Description of Transaction: Make a quick note about the transaction so you'Il remember at the end of the month when reconciling your account. Tracking your purchases in this way will also help when writing a budget for the next month.

O fiU out the three sample checks for the following transactions:

fp ., F

optlar P izza Place, $22.46, D ate 3 / 72 I Y e ar

luto Insurance, $97.25,Date 3/15/Year

Company, $67.50, DateS/2\/Year

O Cetlphone

) Place $478 in the beginning balance box.

O In order of date, flll in your check transactions from #1 along with the following transactions. Update the

balance ofyour account after each transaction

ffDebitCard, -7,QfWitnarawal,

$

Clothing store, new jeans, $56.23, Date3/74/Year Football game admission and concession, $20"0O, DateS/L9/Year

o

3

iftatm fee, 2. o, D ate / te / Y ear Paycheck, $288.OO, 3/ 75/ Year afr "o"sit,

Plntr$tsEr

D6t

IrEn$tr$sn

ne3satptls.r1

F"A'$mevI!

ry fiod*

AEBUnI

IIGF*$il &rrisunl

s

BSLA}$CE.

#+t

DC

A!41

tftt

'rM

3{J,l

'm22fi w#{s 2Z Llb 5b ')We ''idfr| q') z5 3t trrxw.qfi.c8 'bpnrysj& 22 3,llshh

:B{E#f#Jf HrA 3//qp clolhtna 3

478

fr

{,

Nth

{4ll' PhtrM,,{'frtrt

K1M F4-?

tr.

5S frL' bqq bl so2 v.u

5.t

5(,

E.F

2 tlD

07

5t

fi{n a-0 5lo

CHAPTER

Foundations in Personal Finance High 5choot Edition

Potrebbero piacerti anche

- Build a $1,000 Emergency Fund in 10 Steps: Financial Freedom, #82Da EverandBuild a $1,000 Emergency Fund in 10 Steps: Financial Freedom, #82Nessuna valutazione finora

- How To Create An Account in The Payoneer SystemDocumento1 paginaHow To Create An Account in The Payoneer SystemZdravko BambovNessuna valutazione finora

- Direct Deposit Tut 2023Documento16 pagineDirect Deposit Tut 2023montanafeezyNessuna valutazione finora

- Cashapp Glitch 2023 RcashappscamsDocumento1 paginaCashapp Glitch 2023 Rcashappscamsanacatala03021Nessuna valutazione finora

- Our FloridaDocumento13 pagineOur FloridaFilip AndrejevicNessuna valutazione finora

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeDa EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNessuna valutazione finora

- FAQ v1.2Documento20 pagineFAQ v1.2Utkarsh TalmaleNessuna valutazione finora

- Same Day Ach Debit ReportingDocumento1 paginaSame Day Ach Debit ReportingMARSHA MAINESNessuna valutazione finora

- Oakland14chipandskim PDFDocumento16 pagineOakland14chipandskim PDFAm RaiNessuna valutazione finora

- Check Printing Specifications BusinessDocumento2 pagineCheck Printing Specifications BusinessLiza GeorgeNessuna valutazione finora

- EG-ACH Direct Credit Payment Advice ReportDocumento1 paginaEG-ACH Direct Credit Payment Advice ReportAlbert FaragNessuna valutazione finora

- Check Tampering: Accounting Data Analytics Accounting 420Documento11 pagineCheck Tampering: Accounting Data Analytics Accounting 420Shahid MumtazNessuna valutazione finora

- Notary Id Verification FormDocumento1 paginaNotary Id Verification FormSandra BenjaminNessuna valutazione finora

- Banking ApplicationsDocumento4 pagineBanking Applicationsapi-270602999Nessuna valutazione finora

- F 110 Void Reprint CheckDocumento32 pagineF 110 Void Reprint CheckratenmozenNessuna valutazione finora

- PDF V Chequ#Documento1 paginaPDF V Chequ#Nelly100% (1)

- Guidelines To Write A ChequeDocumento6 pagineGuidelines To Write A Chequebhavi kocharNessuna valutazione finora

- Cardholder Request FormDocumento1 paginaCardholder Request FormMarissa Gallenero-CalabinesNessuna valutazione finora

- Incoming Wire Instructions: Questions?Documento2 pagineIncoming Wire Instructions: Questions?Niknjim PoseyNessuna valutazione finora

- IBAN Checker - Validate & Check IBAN Number For Errors PDFDocumento1 paginaIBAN Checker - Validate & Check IBAN Number For Errors PDFPoma Bin laisaNessuna valutazione finora

- SWIFT Codes & BIC Codes For All The Banks in TheDocumento1 paginaSWIFT Codes & BIC Codes For All The Banks in TheGhanem AlamroNessuna valutazione finora

- Virtual Account - J Law - 23 June 2022Documento4 pagineVirtual Account - J Law - 23 June 2022Viraj NahireNessuna valutazione finora

- Ultimate' Payment Method, Widely Accepted', Safe & Secure' Etc. But It Looks Like It HasDocumento9 pagineUltimate' Payment Method, Widely Accepted', Safe & Secure' Etc. But It Looks Like It HasSimón UrbanoNessuna valutazione finora

- Review of Some SMS Verification Services and Virtual Debit/Credit Cards Services for Online Accounts VerificationsDa EverandReview of Some SMS Verification Services and Virtual Debit/Credit Cards Services for Online Accounts VerificationsValutazione: 5 su 5 stelle5/5 (1)

- Bailopan@Exploit - Im: Fraud DictionaryDocumento1 paginaBailopan@Exploit - Im: Fraud DictionaryAditya SinglaNessuna valutazione finora

- Grub Hub SettlementDocumento1 paginaGrub Hub SettlementJoe SmithNessuna valutazione finora

- Payment MethodDocumento6 paginePayment MethodAshishNessuna valutazione finora

- UntitledDocumento2 pagineUntitledJACK CARTERNessuna valutazione finora

- Lockboxes753745incoming Payments20051093print PDFDocumento1 paginaLockboxes753745incoming Payments20051093print PDFSavka SavkaNessuna valutazione finora

- CheckDocumento1 paginaCheckAndrea HernándezNessuna valutazione finora

- Terms and Conditions For Online-Payments: Privacy PolicyDocumento5 pagineTerms and Conditions For Online-Payments: Privacy PolicyKhush TaterNessuna valutazione finora

- Business Checks: Wells Fargo Bank, N.A. Member FDICDocumento24 pagineBusiness Checks: Wells Fargo Bank, N.A. Member FDICMilton RaymondNessuna valutazione finora

- Cash App LoadingDocumento2 pagineCash App Loadinga.s.hollingsworthvNessuna valutazione finora

- Monica Montiel-WUMT - Dept: Rom: Sent: Wednesday, November 16, 2011 7:52 AM To: Subject: RE: Dear Valued CustomerDocumento4 pagineMonica Montiel-WUMT - Dept: Rom: Sent: Wednesday, November 16, 2011 7:52 AM To: Subject: RE: Dear Valued CustomerMarcos Paulo Do NascimentoNessuna valutazione finora

- Questions and AnswersDocumento5 pagineQuestions and AnswersCharles OvensNessuna valutazione finora

- Varo Money ReviewDocumento6 pagineVaro Money ReviewyadavrajeNessuna valutazione finora

- Qashout Quick Start Guide PDFDocumento82 pagineQashout Quick Start Guide PDFRifkyc'RyderNyalindunxNessuna valutazione finora

- Alternative Payment MethodsDocumento5 pagineAlternative Payment MethodsDedik DermadyNessuna valutazione finora

- CHECK SPAMMING TUTORIAL by AfolabiDocumento24 pagineCHECK SPAMMING TUTORIAL by AfolabiAfolabi JesseNessuna valutazione finora

- 1 4922668794851099327Documento3 pagine1 4922668794851099327Adjei SamuelNessuna valutazione finora

- Best Buy Business Advantage Account Application: Company InformationDocumento5 pagineBest Buy Business Advantage Account Application: Company InformationGlendaNessuna valutazione finora

- DAY 2 of AddsDocumento80 pagineDAY 2 of AddsAllwyn georgeNessuna valutazione finora

- Registration Via My Account Website - en - UpdatedDocumento9 pagineRegistration Via My Account Website - en - UpdatedpazhanimalaNessuna valutazione finora

- Sba Paycheck Protection Program (PPP Loans) Tutorial Method Part 2Documento14 pagineSba Paycheck Protection Program (PPP Loans) Tutorial Method Part 2james chastainNessuna valutazione finora

- 5 6183591383874404675Documento3 pagine5 6183591383874404675Dev BhandariNessuna valutazione finora

- Cred Card Fraud ChhapaDocumento5 pagineCred Card Fraud ChhapaSomeoneNessuna valutazione finora

- Dealer Manual - Webtool: I. Starting Out As A DealerDocumento7 pagineDealer Manual - Webtool: I. Starting Out As A DealerJan Maverick AgbunagNessuna valutazione finora

- E Payment SystemsDocumento17 pagineE Payment SystemsdeekshaNessuna valutazione finora

- Presented By:: Rupali Nayak and Swetalina Mohanty Under Guidance: K.K. AcharyaDocumento18 paginePresented By:: Rupali Nayak and Swetalina Mohanty Under Guidance: K.K. Acharyanur atyraNessuna valutazione finora

- Does Cash App Have Business Accounts - Google SeaDocumento1 paginaDoes Cash App Have Business Accounts - Google SeaAdedayo CrownNessuna valutazione finora

- Insta Loan On CardDocumento3 pagineInsta Loan On Cardabhi7744Nessuna valutazione finora

- Remove Duplicate LinesDocumento69 pagineRemove Duplicate LinesMoises CervantesNessuna valutazione finora

- Self Service Direct DepositDocumento18 pagineSelf Service Direct DepositJordan WebbNessuna valutazione finora

- Paypal MethodDocumento1 paginaPaypal Methodfrancis tedescoNessuna valutazione finora

- Axix Bank AccountsDocumento18 pagineAxix Bank AccountsSindhu PriyaNessuna valutazione finora

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDocumento4 pagineEmployer's Annual Federal Unemployment (FUTA) Tax ReturnRepeat BeatsNessuna valutazione finora

- Retailer Manual - Webtool: I. Starting Out As A RetailerDocumento5 pagineRetailer Manual - Webtool: I. Starting Out As A RetailerJenahmae LucasNessuna valutazione finora

- Uncashed Benefit Payment Check or Unclaimed Electronic Benefit Payment Claim FormDocumento2 pagineUncashed Benefit Payment Check or Unclaimed Electronic Benefit Payment Claim Formemily ambrosinoNessuna valutazione finora

- All About Banking: Amy FontinelleDocumento24 pagineAll About Banking: Amy FontinelleSai Prasad Iyer JNessuna valutazione finora

- How To Apply NPCSDocumento15 pagineHow To Apply NPCSjaycee venturaNessuna valutazione finora

- OutlineDocumento3 pagineOutlineapi-246425869Nessuna valutazione finora

- Interview EvaluationDocumento1 paginaInterview Evaluationapi-246425869Nessuna valutazione finora

- Page 2Documento1 paginaPage 2api-246425869Nessuna valutazione finora

- Page 3Documento1 paginaPage 3api-246425869Nessuna valutazione finora

- Mentor EvalDocumento2 pagineMentor Evalapi-246425869Nessuna valutazione finora

- App MathDocumento1 paginaApp Mathapi-246425869Nessuna valutazione finora

- English PaperDocumento2 pagineEnglish Paperapi-246425869Nessuna valutazione finora

- And Upper: ChestDocumento1 paginaAnd Upper: Chestapi-246425869Nessuna valutazione finora

- Phy Ed q1Documento1 paginaPhy Ed q1api-246425869Nessuna valutazione finora

- Plan ProposalDocumento2 paginePlan Proposalapi-246425869Nessuna valutazione finora

- BulletinsDocumento5 pagineBulletinsapi-246425869Nessuna valutazione finora

- ScheduleDocumento1 paginaScheduleapi-246425869Nessuna valutazione finora

- Day 2 Opening ClosingDocumento2 pagineDay 2 Opening Closingapi-246425869Nessuna valutazione finora

- Day 1 Opening ClosingDocumento2 pagineDay 1 Opening Closingapi-246425869Nessuna valutazione finora

- Project Hour LogDocumento4 pagineProject Hour Logapi-246425869Nessuna valutazione finora

- Crafts Day 3Documento1 paginaCrafts Day 3api-246425869Nessuna valutazione finora

- Crafts Day 1Documento1 paginaCrafts Day 1api-246425869Nessuna valutazione finora

- State SeDocumento1 paginaState Seapi-246425869Nessuna valutazione finora

- The Rise of Political Fact CheckingDocumento17 pagineThe Rise of Political Fact CheckingGlennKesslerWPNessuna valutazione finora

- Oral Oncology: Jingyi Liu, Yixiang DuanDocumento9 pagineOral Oncology: Jingyi Liu, Yixiang DuanSabiran GibranNessuna valutazione finora

- Introduction To Emerging TechnologiesDocumento145 pagineIntroduction To Emerging TechnologiesKirubel KefyalewNessuna valutazione finora

- Weird Tales v14 n03 1929Documento148 pagineWeird Tales v14 n03 1929HenryOlivr50% (2)

- ANNAPURNA Sanitary Work 3 FinalDocumento34 pagineANNAPURNA Sanitary Work 3 FinalLaxu KhanalNessuna valutazione finora

- Dye-Sensitized Solar CellDocumento7 pagineDye-Sensitized Solar CellFaez Ahammad MazumderNessuna valutazione finora

- Ev Wireless Charging 5 PDFDocumento27 pagineEv Wireless Charging 5 PDFJP GUPTANessuna valutazione finora

- Applications of Tensor Functions in Solid MechanicsDocumento303 pagineApplications of Tensor Functions in Solid Mechanicsking sunNessuna valutazione finora

- Vickram Bahl & Anr. v. Siddhartha Bahl & Anr.: CS (OS) No. 78 of 2016 Casе AnalysisDocumento17 pagineVickram Bahl & Anr. v. Siddhartha Bahl & Anr.: CS (OS) No. 78 of 2016 Casе AnalysisShabriNessuna valutazione finora

- Military - British Army - Clothing & Badges of RankDocumento47 pagineMilitary - British Army - Clothing & Badges of RankThe 18th Century Material Culture Resource Center94% (16)

- Lesson 17 Be MoneySmart Module 1 Student WorkbookDocumento14 pagineLesson 17 Be MoneySmart Module 1 Student WorkbookAry “Icky”100% (1)

- Topic 6Documento6 pagineTopic 6Conchito Galan Jr IINessuna valutazione finora

- Supply Chain Management: A Framework of Understanding D. Du Toit & P.J. VlokDocumento14 pagineSupply Chain Management: A Framework of Understanding D. Du Toit & P.J. VlokchandanaNessuna valutazione finora

- The Future of Psychology Practice and Science PDFDocumento15 pagineThe Future of Psychology Practice and Science PDFPaulo César MesaNessuna valutazione finora

- TrematodesDocumento95 pagineTrematodesFarlogy100% (3)

- School Games Calendar Part-1Documento5 pagineSchool Games Calendar Part-1Ranadhir Singh100% (2)

- Specification - Pump StationDocumento59 pagineSpecification - Pump StationchialunNessuna valutazione finora

- 1INDEA2022001Documento90 pagine1INDEA2022001Renata SilvaNessuna valutazione finora

- MEAL DPro Guide - EnglishDocumento145 pagineMEAL DPro Guide - EnglishkatlehoNessuna valutazione finora

- Aqualab ClinicDocumento12 pagineAqualab ClinichonyarnamiqNessuna valutazione finora

- Intro To Law CasesDocumento23 pagineIntro To Law Casesharuhime08Nessuna valutazione finora

- The Eaglet - Vol. 31, No. 3 - September 2019Documento8 pagineThe Eaglet - Vol. 31, No. 3 - September 2019Rebecca LovettNessuna valutazione finora

- Abnormal PsychologyDocumento4 pagineAbnormal PsychologyTania LodiNessuna valutazione finora

- Responsive Docs - CREW Versus Department of Justice (DOJ) : Regarding Investigation Records of Magliocchetti: 11/12/13 - Part 3Documento172 pagineResponsive Docs - CREW Versus Department of Justice (DOJ) : Regarding Investigation Records of Magliocchetti: 11/12/13 - Part 3CREWNessuna valutazione finora

- Item AnalysisDocumento7 pagineItem AnalysisJeff LestinoNessuna valutazione finora

- A - Persuasive TextDocumento15 pagineA - Persuasive TextMA. MERCELITA LABUYONessuna valutazione finora

- Photo Essay (Lyka)Documento2 paginePhoto Essay (Lyka)Lyka LadonNessuna valutazione finora

- Is Electronic Writing or Document and Data Messages Legally Recognized? Discuss The Parameters/framework of The LawDocumento6 pagineIs Electronic Writing or Document and Data Messages Legally Recognized? Discuss The Parameters/framework of The LawChess NutsNessuna valutazione finora

- LEWANDOWSKI-olso 8.11.2015 OfficialDocumento24 pagineLEWANDOWSKI-olso 8.11.2015 Officialmorpheus23Nessuna valutazione finora

- Contract of Lease (711) - AguilarDocumento7 pagineContract of Lease (711) - AguilarCoy Resurreccion Camarse100% (2)