Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Dell Working Capital Solution

Caricato da

IIMnotesCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Dell Working Capital Solution

Caricato da

IIMnotesCopyright:

Formati disponibili

Dell's DSI about half the level of its competitors.

leading to huge savings in working capital Jan-95 Dell Compaq Inventory to cover 32 days of Sales 73 days of Sales

Addnl. Inventory reqd. by Dell at Compaq's DSI of 73: 1995 Dell's COS 2,737 7.60 311.71 Addnl. Inventory 312 M 20 M increase in PBT leading to Conservation of Capital

Low component inventory reduces obsolescence risk and lowers inventory cost. Value of inventory reduces 30% p.a.

Lower inventory losses imply higher profits. Compaq had to market both new & older systems. Older systems were discounted, leading to cannibalization of sales of new systems. Dell able to grow sales by offering faster systems at prices of competitors' slower machines. Component shortages had order backlogs, leading to cancellation of some orders. Overall, rapid technological changes in industry made advantages of Dell's approach outweigh the disadvantages.

Dell

10.71% 3.212%

Compaq 20.30% Inventory as % of COS 6.090% Inventory loss as % of COS Addnl. Contribution to Profit for Dell due to lower component inventory & effect of price 78.8 reductions

ower machines.

approach outweigh the disadvantages.

Incremental Sales in 1996 Addnl. Operating Assets (32%) (Total Assets - ST Invest.)

In USD M 1,821 582

5296 52% 4.29% 227

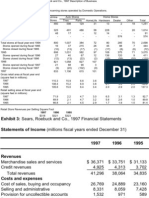

Forecasted 1996 Balance Sheet (In USD M) 1995 Actual Y.E. Jan 29, 1995 % 0f 1995 Sales Current Assets: Cash ST Investments A/R, net Inventories Other Total Current Assets P, P & E, net Other Total Assets Addnl. Funding Needed Current Liabilities: A/P Accrued & Other Liabilities Total Current Liabilities Long Term Debt Other Liabilities Total Liabilities Stockholders' Equity: Preferred Stock Common Stock Retained Earnings Other Total Stockholders' Equity 43 484 538 293 112 1,470 117 7 1,594 1.24% 13.93% 15.48% 8.43% 3.22% 42.30% 3.37% 0.20% 45.87% 31.94%

403 349 752 113 77 942

11.60% 10.04% 21.64% 3.25% 2.22% 27.11%

120 242 311 -21 652 1,594

18.76% 45.87%

As of 1995, Dell would be projected to be able to grow at 52% without increasing its leverage and Actual 1996 Balance Sheet Compared to Projections Y.E. Jan 28, 1996 Current Assets: Cash ST Investments A/R, net Inventories Other Total Current Assets P, P & E, net Other 29% Total Assets

Forecast for 1996 Fixed Liabilities 66 484 820 447 171 1,987 178 11 2,176

55 591 726 429 156 1,957 179 12 2,148

Addnl. Funding Needed Current Liabilities: A/P Accrued & Other Liabilities Total Current Liabilities Long Term Debt Other Liabilities Total Liabilities

354

466 473 939 113 123 1,175

403 349 752 113 77 942

Stockholders' Equity: Preferred Stock 6 Common Stock 430 Retained Earnings 570 Other -33 49 Total Stockholders' Equity 973 879 Common stock to employees 2,148 2,176 5.10% 45 227 Dell internally funded a 52% growth in sales largely by increasing its asset efficiency and profitab

of Sales in 1996, as compare 924 49

additional equity issued

Growth in 1996 sales Actual net profit margin in 1995

4.29% 1995 Actual Net Profit Margin 227 Projected Net Profit for 1996 227

2,176 Forecast for 1996 with Actual 1996 Sales Fixed Liabilities Prop. Liabilities 66 484 820 447 171 1,987 178 11 2,176 354 66 484 820 447 171 1,987 178 11 2,176 (80)

1,692 582

582 (80)

403 349 752 113 77 942

614 532 1,146 113 117 1,376

211

879 2,176

879 2,176

ithout increasing its leverage and issuing further equity shares.

Variance

Y.E. Jan 28, 1996

Forecast for 1996 Proportional Liabilities 66 484 820 447 171 1,987 178 11 2,176

Variance

-11 107 -94 -18 -15 (30) 1 1 (28)

55 542 726 429 156 1,957 179 12 2,148

-11 58 -94 -18 -15 -30 1 1 -28

-135

(80)

63 124 187 46 233

466 473 939 113 123 1175

614 532 1146 113 117 1376

-148 -59 -207 0 6 -201

17.7%

94 (28)

6 430 570 -33 973 2148

879 2,176

94 (28)

973

ng its asset efficiency and profitability. Total Operating assets at 29% 5.1% vs. 4.3% of Sales in 1996, as compared to projected 32%

5.14% NP Margin 1996 20.15% GP Margin 1996 21.24% GP Margin 1995

107

135

582 447

58 Extra Actual Funding in 1996

forecast vs. actuals -67

63 124

505 Total Increase in Funding in 1996 over 1995

46

45

272 Increase in Equity w/o 49 -22

Addnl. Sales Addnl. Operating assets Forecasted 1997 Balance Sheet (In USD M) 1996 Actual

2,648 779

Y.E. Jan 28, 1996 Current Assets: Total Assets Addnl. Funding Needed Current Liabilities: 2,148 To fund the shortfall of 984 M 44 days of sales through increased asset efficiency, Dell needs 56 days of COGS Current CCC 40 days CCC has to become negative to fund the shortfall of 984 M HOW? Savings from Hypothetical WC improvements DSI 1997 Projected Hypothetical improvements * Daily Savings Annual Savings Total Savings in USD M 14 17 17.6 299.55 983 2,148

% 0f 1996 Sales 41% 29.40%

41%

DSO 27 15 22.1 331.00 904

Improvement in Profitability in 1997 can also eliminate the shortfall of 984 M - 1% increase in margin will inc Margin improvements reduce the required working capital improvements as above - A combination of both seems to be the only reasonable alternative to fund the shortfall. Repurchase of Stock indicates under valuation in the market and leads to increase in value. Actual profit margin 1997

6.68% ST Inv. Increased to 1237 M from 5 LT debt reduced to 18 M from 113 M Common stock reduced from 430 M Inventories 251 M 903 M A/C Rec., 1040 M A/c payab 37

Actual 1997 CCC

13

408 Projected 1997 Net Profit 5.1% Daily COGS 17.6 56 Forecast for 1997 with a 50% Sales Increase Debt repaid & $500 Equity Fixed Liabilities Prop. Liabilities Buyback 779 2,927 371 2,927 (161) 2,927 984

2,927

2,927

2,927

DPO 53 20 17.6 352.42

CCC -12

% increase in margin will increase net income by 79 M. ove - A combination of both profitability & WC improvements

ase in value.

7759 M sales, 518 M v. Increased to 1237 M from 591 M bt reduced to 18 M from 113 M mon stock reduced from 430 M to 195 M tories 251 M A/C Rec., 1040 M A/c payable 54 (4)

Potrebbero piacerti anche

- Dell's Working CapitalDocumento20 pagineDell's Working Capitalapi-371968795% (21)

- Dell Working CapitalDocumento3 pagineDell Working CapitalShashank Agarwal89% (9)

- DELL’S WORKING CAPITAL CASEDocumento9 pagineDELL’S WORKING CAPITAL CASEAdiansyach PatonangiNessuna valutazione finora

- Dell's Working Capital - Case Analysis - G05Documento2 pagineDell's Working Capital - Case Analysis - G05Srikanth Kumar Konduri100% (11)

- Dell Working CapitalDocumento6 pagineDell Working CapitalNavi Spl50% (2)

- Dell's Working Capital SolutionDocumento22 pagineDell's Working Capital SolutionShaikh Saifullah KhalidNessuna valutazione finora

- Dell Working Capital CaseDocumento2 pagineDell Working Capital CaseIshan Rishabh Kansal100% (2)

- Dell's Working Capital: Case BriefDocumento6 pagineDell's Working Capital: Case BriefTanya Ahuja100% (1)

- Case 7 - Dell's Working Capital (Syndicate 3) PDFDocumento14 pagineCase 7 - Dell's Working Capital (Syndicate 3) PDFfullataniaNessuna valutazione finora

- Analysis of DELLDocumento12 pagineAnalysis of DELLMuhammad Afzal100% (1)

- Dell's Working Capital v0.2Documento6 pagineDell's Working Capital v0.2MrDorakonNessuna valutazione finora

- Dell CaseDocumento22 pagineDell CaseShaikh Saifullah KhalidNessuna valutazione finora

- Case 7 - An Introduction To Debt Policy and ValueDocumento5 pagineCase 7 - An Introduction To Debt Policy and ValueAnthony Kwo100% (2)

- Fonderia Di Torino (Final)Documento4 pagineFonderia Di Torino (Final)Tracye Taylor100% (2)

- Dell's Working Capital StrategyDocumento9 pagineDell's Working Capital StrategyTalluri HarikaNessuna valutazione finora

- List of Case Questions: Case #5: Fonderia Di Torino S.P.A Questions For Case PreparationDocumento4 pagineList of Case Questions: Case #5: Fonderia Di Torino S.P.A Questions For Case Preparationdd100% (2)

- Dell's Working Capital ManagementDocumento12 pagineDell's Working Capital ManagementShashank Kanodia100% (2)

- Nike Inc Cost of Capital - Syndicate 1 (Financial Management)Documento26 pagineNike Inc Cost of Capital - Syndicate 1 (Financial Management)natya lakshitaNessuna valutazione finora

- Dell Working Capital Solution ExplainedDocumento15 pagineDell Working Capital Solution ExplainedFarabi AhmedNessuna valutazione finora

- Fonderia Di Torino Case Study GroupDocumento15 pagineFonderia Di Torino Case Study GroupFarhan SoepraptoNessuna valutazione finora

- Nike INCDocumento7 pagineNike INCUpendra Ks50% (2)

- (DMN GM 10) Mid-Term Exam - Bianda Puspita SariDocumento6 pagine(DMN GM 10) Mid-Term Exam - Bianda Puspita SariBianda Puspita SariNessuna valutazione finora

- Fonderia Di Torino's Case - Syndicate 5Documento20 pagineFonderia Di Torino's Case - Syndicate 5Yunia Apriliani Kartika0% (1)

- Dell Working CapitalDocumento7 pagineDell Working CapitalARJUN M KNessuna valutazione finora

- Fonderia Di Torino ExcelDocumento10 pagineFonderia Di Torino Excelpeachrose12100% (1)

- Nike Case AnalysisDocumento11 pagineNike Case AnalysisastrdppNessuna valutazione finora

- Tire - City AnalysisDocumento17 pagineTire - City AnalysisJustin HoNessuna valutazione finora

- Nike CaseDocumento7 pagineNike CaseNindy Darista100% (1)

- Investment Detective CaseDocumento3 pagineInvestment Detective CaseWidyawan Widarto 闘志50% (2)

- Fonderia Di Torina SpADocumento10 pagineFonderia Di Torina SpARoberta AyalingoNessuna valutazione finora

- Case QuestionsDocumento10 pagineCase QuestionsJeremy SchweizerNessuna valutazione finora

- Case AnalysisDocumento11 pagineCase AnalysisSagar Bansal50% (2)

- Maximizing Shareholder Value Through Optimal Dividend and Buyback PolicyDocumento2 pagineMaximizing Shareholder Value Through Optimal Dividend and Buyback PolicyRichBrook7Nessuna valutazione finora

- The Investment Detective Case StudyDocumento3 pagineThe Investment Detective Case StudyItsCj100% (1)

- The Investment Detective (Answer)Documento2 pagineThe Investment Detective (Answer)Eddy ErmanNessuna valutazione finora

- 29116520Documento6 pagine29116520Rendy Setiadi MangunsongNessuna valutazione finora

- Nike Case Final Group 4Documento15 pagineNike Case Final Group 4Monika Maheshwari100% (1)

- Nike, Inc. - Cost of CapitalDocumento9 pagineNike, Inc. - Cost of CapitalPutriNessuna valutazione finora

- TN6 The Financial Detective 2005Documento14 pagineTN6 The Financial Detective 2005Thomas Lydon100% (15)

- Analyze Capital Projects Using NPV, IRR, Payback for Highest ReturnDocumento10 pagineAnalyze Capital Projects Using NPV, IRR, Payback for Highest Returnwiwoaprilia100% (1)

- Fonderia DI TorinoDocumento19 pagineFonderia DI TorinoA100% (3)

- Case Primus Automation Division 2002Documento16 pagineCase Primus Automation Division 2002Sasha Khalishah50% (2)

- The Financial DetectiveDocumento7 pagineThe Financial DetectivearifhafiziNessuna valutazione finora

- Pros and Cons of Operating LeverageDocumento3 paginePros and Cons of Operating LeverageAntonius CliffSetiawanNessuna valutazione finora

- Eastboro Case SolutionDocumento22 pagineEastboro Case Solutionuddindjm100% (2)

- Continental Carriers Debt vs EquityDocumento10 pagineContinental Carriers Debt vs Equitynipun9143Nessuna valutazione finora

- An Introduction to the Impact of Debt on Firm ValueDocumento9 pagineAn Introduction to the Impact of Debt on Firm ValueBernadeta PramudyaWardhaniNessuna valutazione finora

- Investment DetectiveDocumento5 pagineInvestment DetectiveNadya Rizkita100% (1)

- Corporate Finance - PresentationDocumento14 pagineCorporate Finance - Presentationguruprasadkudva83% (6)

- Dell Working CapitalDocumento12 pagineDell Working Capitalsankul50% (1)

- Soluciones MERKMar10Documento3 pagineSoluciones MERKMar10Lissette ArreagaNessuna valutazione finora

- Dell's Working Capital: Click To Edit Master Subtitle Style B.B.Chakrabarti Professor of Finance IIM CalcuttaDocumento20 pagineDell's Working Capital: Click To Edit Master Subtitle Style B.B.Chakrabarti Professor of Finance IIM CalcuttaOmkar DeshpandeNessuna valutazione finora

- Dells Working Capital1Documento20 pagineDells Working Capital1Saurabh PratihastaNessuna valutazione finora

- Dell S Working Capital 1Documento20 pagineDell S Working Capital 1deni1456Nessuna valutazione finora

- Full-Information Forecasting, Valuation, and Business Strategy AnalysisDocumento56 pagineFull-Information Forecasting, Valuation, and Business Strategy AnalysisRitesh Batra100% (4)

- Attachments To: Mid-Term ExamDocumento7 pagineAttachments To: Mid-Term Examveda20Nessuna valutazione finora

- Citigroup Q4 2012 Financial SupplementDocumento47 pagineCitigroup Q4 2012 Financial SupplementalxcnqNessuna valutazione finora

- Polaroid's Capital Structure and 1996 CaseDocumento51 paginePolaroid's Capital Structure and 1996 CaseShelly Jain100% (2)

- Introduction L&T FinalDocumento31 pagineIntroduction L&T Finaltushar kumarNessuna valutazione finora

- Sears Vs Wal-Mart Case ExhibitsDocumento8 pagineSears Vs Wal-Mart Case ExhibitscharlietoneyNessuna valutazione finora

- McKinsey & Company Managing Knowledge and LearningDocumento9 pagineMcKinsey & Company Managing Knowledge and LearningIIMnotes100% (11)

- M&MDocumento8 pagineM&MIIMnotes100% (1)

- Egon Zehnder InternationalDocumento9 pagineEgon Zehnder InternationalIIMnotes100% (2)

- Vermont TeddybearDocumento6 pagineVermont TeddybearIIMnotes100% (1)

- Does IT Pay Off HSBC and Citi Case StudyDocumento8 pagineDoes IT Pay Off HSBC and Citi Case StudyIIMnotesNessuna valutazione finora

- Big Bazaar FinalDocumento8 pagineBig Bazaar FinalIIMnotesNessuna valutazione finora

- ProbabilityDocumento45 pagineProbabilityIIMnotesNessuna valutazione finora

- Vermont Teddy Bear Case StudyDocumento9 pagineVermont Teddy Bear Case StudyIIMnotes100% (3)

- Iggy's Bread of The WorldDocumento5 pagineIggy's Bread of The WorldIIMnotesNessuna valutazione finora

- Zara CaseDocumento9 pagineZara CaseIIMnotesNessuna valutazione finora

- Charles Schwab Corporation (A)Documento4 pagineCharles Schwab Corporation (A)IIMnotes100% (4)

- Does IT Pay Off HSBC and CitiDocumento6 pagineDoes IT Pay Off HSBC and CitiIIMnotes100% (1)

- TVM TablesDocumento2 pagineTVM Tablesanmol_sidNessuna valutazione finora

- MRP Exercise1Documento1 paginaMRP Exercise1IIMnotesNessuna valutazione finora

- Cathay PacificDocumento6 pagineCathay PacificIIMnotes100% (1)

- A New Mandate For Human ResourceDocumento4 pagineA New Mandate For Human ResourceMitesh PatelNessuna valutazione finora

- ProbabilityDocumento45 pagineProbabilityIIMnotesNessuna valutazione finora

- Exercise Aggregate PlanningDocumento1 paginaExercise Aggregate PlanningIIMnotesNessuna valutazione finora

- Improving Customer Service in SunpharmaDocumento5 pagineImproving Customer Service in SunpharmaIIMnotes100% (7)

- Types of FinancingDocumento30 pagineTypes of FinancingIIMnotesNessuna valutazione finora

- Time Value of MoneyDocumento18 pagineTime Value of MoneyIIMnotesNessuna valutazione finora

- Newell CompanyDocumento8 pagineNewell CompanyIIMnotesNessuna valutazione finora

- Maruti Suzuki India Limited HRM IIMDocumento5 pagineMaruti Suzuki India Limited HRM IIMIIMnotes100% (1)

- Google HRM IIM Case AnalysisDocumento9 pagineGoogle HRM IIM Case AnalysisIIMnotesNessuna valutazione finora

- Depreciation Methods - Sinking Fund and Declining BalanceDocumento12 pagineDepreciation Methods - Sinking Fund and Declining Balancemark flores100% (1)

- Chapter 1 Basic AccountingDocumento39 pagineChapter 1 Basic AccountingkakaoNessuna valutazione finora

- Financial Accounting 6th Edition Weygandt Test Bank 1Documento36 pagineFinancial Accounting 6th Edition Weygandt Test Bank 1barbara100% (36)

- Slides Tan (2017) - AFA - 3e - PPT - Chap06Documento51 pagineSlides Tan (2017) - AFA - 3e - PPT - Chap06Uyên Phạm PhươngNessuna valutazione finora

- Module 3Documento22 pagineModule 3ANGEL ROBIN RCBSNessuna valutazione finora

- Chapter 4Documento6 pagineChapter 4Fatemah MohamedaliNessuna valutazione finora

- Nykaa - Fundamental Technical AnalysisDocumento6 pagineNykaa - Fundamental Technical Analysiskhyati kaulNessuna valutazione finora

- Finance Case Study SolutionDocumento4 pagineFinance Case Study SolutionOmar MosalamNessuna valutazione finora

- Ledger Posting/ Trial Balance / Financial StatementsDocumento6 pagineLedger Posting/ Trial Balance / Financial StatementsSora 1211Nessuna valutazione finora

- Financial Management-Module 2 NewDocumento29 pagineFinancial Management-Module 2 New727822TPMB005 ARAVINTHAN.SNessuna valutazione finora

- Ind As 34Documento3 pagineInd As 34qwertyNessuna valutazione finora

- Assignment-4 and 8Documento15 pagineAssignment-4 and 8Carla Sader0% (1)

- Ch09 BudgetingDocumento118 pagineCh09 Budgetingemanmaryum7Nessuna valutazione finora

- Various Dividends Carlyon Company Listed The Following Items in ItsDocumento1 paginaVarious Dividends Carlyon Company Listed The Following Items in ItsTaimour HassanNessuna valutazione finora

- Ratios QDocumento1 paginaRatios Qkashif.ali60001Nessuna valutazione finora

- Answer All Questions in Part A. Answer Three Questions Only in Part BDocumento13 pagineAnswer All Questions in Part A. Answer Three Questions Only in Part BHazim BadrinNessuna valutazione finora

- Cash Flow in Capital Budgeting KeownDocumento37 pagineCash Flow in Capital Budgeting Keownmad2kNessuna valutazione finora

- Summative Test-FABM2 2018-2019Documento2 pagineSummative Test-FABM2 2018-2019Raul Soriano Cabanting88% (8)

- This Study Resource WasDocumento4 pagineThis Study Resource WasDerista septhiana100% (1)

- The Classified Balance SheetDocumento17 pagineThe Classified Balance SheetNeha NaliniNessuna valutazione finora

- Acct 320 Ch8Documento4 pagineAcct 320 Ch8michaelguloyan7Nessuna valutazione finora

- Journal Entries for Inventory Purchases, Sales, Returns and PaymentsDocumento7 pagineJournal Entries for Inventory Purchases, Sales, Returns and PaymentsRabie HarounNessuna valutazione finora

- Afar Income Recognition Installment Sales Franchise Long Term Construction PDFDocumento10 pagineAfar Income Recognition Installment Sales Franchise Long Term Construction PDFKim Nicole ReyesNessuna valutazione finora

- CH 14&15 TheoriesDocumento13 pagineCH 14&15 TheoriesAnna AntonioNessuna valutazione finora

- Accounting QuestionsDocumento2 pagineAccounting QuestionsEdward BellNessuna valutazione finora

- Test Bank For Basic Finance An Introduction To Financial Institutions, Investments, and Management, 11th Edition - Herbert B. MayoDocumento8 pagineTest Bank For Basic Finance An Introduction To Financial Institutions, Investments, and Management, 11th Edition - Herbert B. MayoamiraNessuna valutazione finora

- A211 Syllabus BKAR1013-StudentDocumento7 pagineA211 Syllabus BKAR1013-StudentVinoshini DeviNessuna valutazione finora

- Far - QuizDocumento3 pagineFar - QuizRitchel CasileNessuna valutazione finora

- How To Value A Business - Presentation For Sustainable Business Network of Philadelphia - February 25, 2014Documento36 pagineHow To Value A Business - Presentation For Sustainable Business Network of Philadelphia - February 25, 2014Michael CunninghamNessuna valutazione finora

- Managerial Economics in A Global Economy, 5th Edition by Dominick SalvatoreDocumento16 pagineManagerial Economics in A Global Economy, 5th Edition by Dominick SalvatoreAR finance ID Ex BOGORNessuna valutazione finora