Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Investment Guide

Caricato da

Gage Floyd BitayoCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Investment Guide

Caricato da

Gage Floyd BitayoCopyright:

Formati disponibili

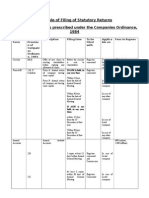

As of: 1/23/2014

Ticker

Company Name

Price

COL

Rating

Date of

Update

COL

FV

Buy

Below

Outstanding

Shares (Mil)

Market Cap

(PhpMil)

2011

1,289,162

286,470

352,424

84,232

27,533

219,035

106,177

57,277

75,836

80,178

252,712

54,678

41,758

12,744

7,304

48,980

27,518

26,968

11,659

21,103

281,233

60,625

47,384

13,960

9,784

55,868

28,579

29,823

14,048

21,163

1,959,582

25,721

272,268

54,064

94,779

30,237

160,126

101,063

10,549

53,688

29,577

199,833

8,039

51,774

62,322

288,988

110,610

47,339

20,783

44,488

133,126

47,988

112,219

2,121,420

317,695

300,942

277,285

35,528

135,083

291,564

194,785

568,538

141,193

585,691

25,107

178,200

175,762

109,273

16,844

17,888

265,925

837,570

233,478

604,092

733,468

25,144

54,476

697

0

33,935

47,803

24,540

8,775

58,303

11,157

28,784

3,846

17,279

0

48,315

22,070

12,004

7,742

12,695

273,956

16,134

25,814

642,356

86,834

68,915

53,650

69,751

7,179

123,057

32,688

200,282

535,775

196,175

3,502

16,995

62,555

38,988

17,129

10,336

67,168

229,997

81,518

148,479

1,081,416

390,474

13,366

32,495

115,729

81,795

402,815

44,743

7,874,842

Banks and Financials

BDO

BPI

CHIB

EW

MBT

PNB

RCB

SECB

UBP

BANCO DE ORO

BANK OF PHILIPPINE ISLANDS

CHINA BANKING CORP

EASTWEST BANKING CORP

METROPOLITAN BANK & TRUST

PHILIPPINE NATIONAL BANK

RIZAL COMMERCIAL BANKING CORP c

SECURITY BANK CORP

UNION BANK OF PHILIPPINES c

80.00

89.75

59.00

24.40

79.80

85.00

44.90

125.80

125.00

BUY

HOLD

HOLD

BUY

BUY

HOLD

N/A

BUY

N/A

01/06/14

01/13/14

01/06/14

01/06/14

01/06/14

01/13/14

N/A

01/06/14

N/A

94.00

95.00

56.00

36.00

100.00

87.00

N/A

145.00

N/A

81.70

82.60

48.70

31.30

87.00

75.70

N/A

126.10

N/A

3,581

3,624

1,428

1,128

2,745

673

1,141

603

641

30.00

37.00

5.12

8.95

49.90

60.30

5.39

10.18

15.96

8.80

98.25

6.70

8.89

14.08

256.40

4.25

23.50

12.60

17.66

14.20

9.72

315.00

BUY

HOLD

N/A

BUY

HOLD

HOLD

BUY

BUY

BUY

N/A

HOLD

N/A

N/A

HOLD

HOLD

HOLD

Under Review

HOLD

HOLD

N/A

N/A

HOLD

01/23/14

01/06/14

N/A

01/13/14

01/06/14

01/06/14

01/23/14

01/06/14

01/23/14

N/A

01/06/14

N/A

N/A

01/06/14

01/06/14

01/06/14

01/06/14

01/06/14

01/06/14

N/A

N/A

01/06/14

40.50

37.30

N/A

11.20

60.00

50.50

7.60

12.70

28.40

N/A

108.00

N/A

N/A

14.25

252.00

4.83

N/A

15.60

12.18

N/A

N/A

322.00

35.20

32.40

N/A

9.70

48.00

43.90

6.61

11.00

24.70

N/A

93.90

N/A

N/A

12.40

219.10

4.20

13.60

10.60

N/A

N/A

280.00

780

7,359

10,559

10,590

606

2,655

18,750

1,036

3,350

3,364

1,942

1,178

5,824

412

1,127

24,614

2,041

1,448

2,517

9,375

4,933

356

530.00

54.50

27.00

64.30

775.00

41.55

18.00

714.00

59.40

BUY

N/A

Under Review

BUY

HOLD

BUY

N/A

HOLD

N/A

01/06/14

N/A

01/06/14

01/23/14

01/06/14

01/17/14

N/A

01/06/14

N/A

689.00

N/A

N/A

119.60

805.00

48.00

N/A

739.00

N/A

599.10

N/A

104.00

700.00

41.70

N/A

642.60

N/A

594

5,522

10,110

605

174

6,797

8,981

778

2,373

7.03

11.88

167.00

39.50

4.56

5.66

121.90

BUY

HOLD

HOLD

HOLD

N/A

N/A

HOLD

01/06/14

01/06/14

01/06/14

01/06/14

N/A

N/A

01/06/14

9.10

11.33

126.00

41.00

N/A

N/A

117.00

7.91

9.90

109.60

35.70

N/A

N/A

101.70

3,571

15,000

1,047

2,766

3,694

3,160

2,182

GLOBE TELECOM INC

PHILIPPINE LONG DISTANCE TEL

1,761.00

2,796.00

HOLD

BUY

01/06/14

01/06/14

1,470.00

3,260.00

1,278.30

2,834.80

132

213

AYALA LAND INC

CENTURIES PROPERTIES GROUP

FILINVEST LAND INC

MEGAWORLD CORP

ROBINSONS LAND

SM PRIME HOLDINGS

VISTA LAND & LIFESCAPES INC

27.55

1.38

1.34

3.62

19.98

14.48

5.24

BUY

BUY

BUY

BUY

BUY

BUY

BUY

01/06/14

01/06/14

01/06/14

01/06/14

01/06/14

01/06/14

01/06/14

36.08

2.60

2.29

4.54

25.30

19.41

6.83

31.40

2.26

1.99

3.95

22.00

16.90

5.94

13,752

8,900

24,250

32,371

4,094

17,374

8,405

Commercial and Industrial

ABS

AP

BEL

BLOOM

CEB

DMC

EDC

EEI

FGEN

GMA7

ICT

LR

LRI

MCP

MER

MPI

MWC

MWIDE

NIKL

PCOR

PX

SCC

ABS-CBN BROADCASTING CORP

ABOITIZ POWER CORP

BELLE CORP c

BLOOMBERY RESORTS CORP

CEBU AIR INC

DMCI HOLDINGS INC

PNOC ENERGY DEV CORP

EEI CORPORATION

FIRST GEN CORPORATION

GMA NETWORK INC c

INTL CONTAINER TERM SVCS

LIESURE & RESORTS WORLD CORP c

c

LAFARGE REPUBLIC INC

MELCO CROWN PHILS RESORTS CORP

MANILA ELECTRIC COMPANY

METRO PACIFIC INVESTMENTS

MANILA WATER COMPANY

MEGAWIDE CONSTRUCTION CORP

NICKEL ASIA CORP

c

PETRON CORP

PHILEX MINING CORP c

SEMIRARA MINING

Conglomerates

AC

AEV

AGI

FPH

GTCAP

JGS

LTG

SM

SMC

AYALA CORPORATION

ABOITIZ EQUITY VENTURES INC c

ALLIANCE GLOBAL

FIRST PHILIPPINE HLDGS

GT CAPITAL HLDGS

JG SUMMIT HLDGS

LT GROUP INC c

SM INVESTMENTS CORP

SAN MIGUEL CORP c

Consumer

DNL

EMP

JFC

PGOLD

PIP

RFM

URC

D&L INDUSTRIES INC

EMPERADOR INC

JOLLIBEE FOODS CORPORATION

PUREGOLD PRICE CLUB INC

PEPSI-COLA PRODUCTS PHILS. INC c

c

RFM CORPORATION

UNIVERSAL ROBINA CORPORATION

Telecoms

GLO

TEL

Property

ALI

CPG

FLI

MEG

RLC

SMPH

VLL

MARKET

PSEi

PSEi ex-TEL, GLO

*

c

Source: Bloomberg

Consensus Forecast

Revenue

2012

2013E

Revenue Growth

2012

2013E

2014E

2011

309,109

71,549

54,067

15,304

13,177

69,286

28,367

23,857

13,332

20,170

318,532

75,245

58,717

17,035

16,285

63,771

27,948

24,578

14,669

20,284

4%

5%

7%

-4%

-1%

2%

-1%

8%

-9%

25%

11%

11%

13%

10%

34%

14%

4%

11%

20%

0%

10%

18%

14%

10%

35%

24%

-1%

-20%

-5%

-5%

2014E

3%

5%

9%

11%

24%

-8%

-1%

3%

10%

1%

930,454

28,395

62,153

421

0

37,904

51,740

28,369

13,691

67,952

11,834

32,454

4,429

19,935

0

50,923

27,807

14,553

8,205

11,607

424,795

9,137

24,150

763,306

104,134

77,635

95,095

72,410

20,029

135,253

30,568

228,182

698,868

230,219

6,375

22,812

71,059

57,467

19,494

10,998

71,202

249,930

86,446

163,484

1,028,072

32,415

59,564

1,744

18,045

48,176

48,339

27,568

13,445

89,269

12,575

39,837

2,846

24,848

53,655

31,117

15,921

10,200

11,118

451,735

9,519

26,137

920,785

129,077

83,302

125,633

95,298

37,425

154,547

43,506

251,997

725,625

269,799

11,944

27,652

79,447

76,350

22,130

10,160

81,712

250,147

86,989

163,158

1,130,842

32,664

60,405

3,435

37,132

57,001

53,956

28,613

14,767

91,641

12,880

46,977

3,273

28,281

12,877

55,803

34,717

17,295

11,547

12,502

477,139

11,568

26,367

1,036,163

141,918

84,759

142,833

98,213

41,409

207,036

47,267

272,728

743,759

299,810

12,914

31,993

87,257

85,182

24,517

11,106

91,748

253,289

89,931

163,358

12%

-10%

-9%

-45%

17%

10%

-1%

27%

9%

-7%

21%

0%

-10%

27%

19%

9%

71%

52%

20%

20%

13%

12%

6%

-4%

45%

13%

20%

1%

184%

12%

118%

19%

-65%

113%

17%

34%

6%

14%

16%

3%

24%

-6%

27%

13%

14%

-39%

12%

8%

16%

56%

17%

6%

13%

15%

15%

5%

26%

21%

6%

-9%

55%

-43%

-6%

19%

20%

13%

77%

4%

179%

10%

-6%

14%

30%

17%

82%

34%

14%

47%

14%

6%

6%

9%

6%

10%

10%

14%

-4%

314%

27%

-7%

-3%

-2%

31%

6%

23%

-36%

25%

5%

12%

9%

24%

-4%

6%

4%

8%

21%

24%

7%

32%

32%

87%

14%

42%

10%

4%

17%

87%

21%

12%

33%

14%

-8%

15%

0%

1%

0%

10%

1%

1%

97%

106%

18%

12%

4%

10%

3%

2%

18%

15%

14%

4%

12%

9%

13%

12%

6%

22%

1%

13%

10%

2%

14%

3%

11%

34%

9%

8%

2%

11%

8%

16%

10%

12%

11%

9%

12%

1%

3%

0%

126,988

41,231

3,952

8,482

20,106

12,807

26,897

13,513

2,181,697

153,491

49,904

8,804

10,576

23,630

13,515

30,726

16,336

2,608,634

217,830

69,085

11,660

10,706

27,711

15,700

63,041

19,927

2,995,742

243,921

75,106

13,376

12,759

32,221

17,319

69,476

23,664

3,282,556

19%

16%

42%

20%

25%

21%

13%

19%

11%

21%

21%

123%

25%

18%

6%

14%

21%

20%

42%

38%

32%

1%

17%

16%

105%

22%

15%

12%

9%

15%

19%

16%

10%

10%

19%

10%

6,688,123

2,278,440

2,806,717

3,149,907

3,391,669

25%

23%

12%

8%

5,850,553

2,048,443

2,556,787

2,899,760

3,138,380

29%

25%

13%

8%

2011

Net Income

2012

2013E

2014E

2011

Net Income Growth

2012

2013E

2014E

2011

2012

EPS

2013E

2014E

2011

EPS Growth

2012

2013E

3.91

3.61

3.51

2.52

3.86

7.05

4.45

11.12

10.28

4.46

4.58

3.54

1.76

5.44

7.02

5.09

12.42

11.83

5.86

5.72

3.85

2.07

8.70

7.26

4.62

10.24

12.74

5.87

6.42

4.26

2.50

6.69

6.93

4.54

11.81

11.90

11%

16%

7%

0%

-4%

20%

75%

10%

-6%

23%

18%

14%

27%

1%

-30%

41%

0%

14%

12%

15%

3.26

2.94

0.03

0.03

5.93

3.61

-0.01

0.71

0.32

0.35

2.73

-0.04

0.42

0.22

11.73

0.23

1.74

0.68

1.76

0.90

1.17

16.93

2.30

3.32

0.05

-0.07

5.89

3.69

0.46

0.94

2.07

0.33

2.49

0.29

0.48

-0.08

15.10

0.26

2.21

0.91

1.10

0.13

0.05

17.85

2.10

2.53

0.08

0.25

4.33

4.16

0.38

0.94

1.14

0.34

3.22

0.26

0.66

-0.76

17.53

0.28

2.51

0.78

1.12

0.34

0.34

18.24

1.67

2.06

0.18

0.66

4.98

4.43

0.36

1.04

1.30

0.36

4.02

0.70

0.79

-0.54

19.14

0.30

2.61

0.95

1.41

0.41

0.61

17.89

14.53

3.84

1.18

3.10

26.60

1.26

0.68

34.60

4.97

17.15

4.33

1.38

16.74

44.27

1.99

0.85

31.29

9.05

22.86

3.93

1.46

8.00

49.10

1.45

0.86

35.54

4.19

26.37

3.93

1.61

8.57

54.66

2.65

1.01

39.69

4.84

0.40

0.15

3.14

0.97

0.08

0.16

2.25

0.41

0.33

3.58

1.11

0.23

0.22

3.70

0.38

0.41

4.32

1.51

0.27

0.24

4.53

0.44

0.48

5.15

1.71

0.30

0.28

4.86

74.02

163.24

51.54

163.86

87.70

177.84

93.20

181.49

-7%

-23%

-14%

-57%

-50%

22%

13%

-66%

-40%

16%

-41%

37%

58%

7%

48%

18%

17%

45%

40%

-14%

-15%

-3%

66%

-92%

11%

-45%

280%

49%

-20%

-18%

43%

36%

4%

141%

-60%

-19%

-40%

-21%

1%

-23%

P/E (x)

2012

2013E

2014E

PEG

2013

P/BV

2013E

ROE

2013E

Div Yield

2013E

12.5

13.7

15.7

15.3

11.8

9.2

11.7

9.7

12.3

9.8

12.6

13.6

14.0

13.8

9.8

11.9

12.3

9.9

10.7

10.5

1.3

0.9

0.9

1.6

0.6

0.8

0.0

0.0

0.0

34.2

1.9

1.7

2.9

1.8

1.4

1.6

1.3

1.3

1.9

1.6

16.9

13.1

19.7

12.4

12.6

18.7

9.3

13.3

19.7

22.2

2.1%

2.6%

2.6%

2.0%

0.0%

1.0%

0.0%

2.7%

1.9%

2.8%

18.7

13.0

11.1

94.8

8.5

16.3

11.7

10.8

7.7

26.4

39.5

18.5

17.0

16.4

10.6

13.8

16.1

109.2

211.3

17.6

18.8

30.9

12.6

19.6

3.8

17.5

20.9

21.2

22.8

6.6

40.0

17.1

36.0

46.7

35.6

19.8

26.1

32.9

18.3

34.2

17.1

18.7

14.3

14.6

61.7

11.5

14.5

14.3

10.8

14.0

25.9

30.5

13.5

14.6

15.4

9.4

16.2

15.8

41.5

28.3

17.3

19.2

23.2

13.9

18.5

8.0

15.8

28.7

20.9

20.1

14.2

32.5

18.6

29.0

38.7

26.2

16.7

24.1

26.9

16.2

20.1

15.7

16.5

18.0

18.0

28.9

13.6

10.0

13.6

14.8

9.8

12.2

24.4

24.5

11.3

13.4

14.2

9.0

13.3

12.6

34.8

16.0

17.6

16.7

20.1

13.9

16.8

7.5

14.2

15.7

17.9

18.0

12.3

29.1

16.0

24.8

32.4

23.1

15.0

20.6

25.1

15.8

18.9

15.4

2.9

0.0

0.0

0.8

0.0

1.5

0.0

2.1

0.0

6.5

1.1

0.5

1.2

2.0

1.1

7.4

1.2

0.5

0.1

3.2

1.0

0.0

2.3

0.0

1.4

1.9

2.4

1.6

0.0

1.9

5.3

1.4

1.9

1.1

1.1

1.9

1.8

0.6

3.0

3.0

1.3

3.1

2.8

4.8

1.2

2.6

2.2

1.6

32.7

124.6

2.8

3.4

1.2

1.8

3.7

1.9

2.3

2.0

5.3

2.3

2.3

2.9

3.0

0.5

2.2

1.7

1.7

3.0

5.5

2.8

7.2

3.5

2.3

2.7

5.1

4.1

4.7

4.0

15.3

8.9

15.3

16.4

14.6

10.6

17.1

19.0

16.3

9.0

19.9

12.8

19.9

6.6

25.2

8.3

21.6

23.5

12.2

5.4

7.6

31.6

14.0

10.1

20.9

16.0

6.8

15.6

8.6

10.8

15.5

15.7

15.8

39.7

18.5

14.3

14.1

11.9

18.8

25.5

24.2

25.7

1.7%

3.3%

3.4%

0.1%

0.0%

0.0%

0.8%

2.1%

2.0%

2.0%

0.7%

5.4%

0.0%

4.4%

0.7%

4.1%

1.6%

1.7%

0.6%

1.2%

3.2%

1.4%

0.9%

3.1%

1.3%

3.1%

1.1%

0.4%

0.9%

1.4%

1.8%

1.2%

1.4%

1.7%

0.8%

0.8%

3.5%

1.2%

1.9%

6.1%

4.5%

6.4%

2014E

2011

21%

31%

25%

9%

17%

60%

3%

-9%

-18%

8%

-1%

0%

12%

11%

21%

-23%

-5%

-2%

15%

-7%

17.8

20.5

24.9

16.8

9.7

20.7

12.1

10.1

11.3

12.2

15.1

17.9

19.6

16.7

13.8

14.7

12.1

8.8

10.1

10.6

16%

-29%

13%

66%

-1%

2%

32%

545%

-5%

-9%

14%

29%

15%

27%

34%

-38%

-86%

-96%

5%

23%

18%

13%

17%

440%

66%

58%

25%

-10%

82%

42%

2%

120%

14%

14%

188%

35%

64%

-3%

-30%

0%

0%

-9%

-24%

54%

-26%

13%

-18%

0%

-45%

2%

29%

37%

16%

6%

14%

-14%

2%

163%

646%

2%

-2%

33%

-9%

6%

-52%

11%

-27%

1%

14%

-54%

23%

-8%

24%

21%

36%

19%

8%

22%

13%

70%

9%

13%

-20%

-19%

113%

15%

6%

-3%

11%

15%

6%

25%

19%

9%

9%

4%

22%

26%

19%

77%

-2%

15%

15%

0%

10%

7%

11%

83%

17%

12%

16%

12%

16%

17%

19%

13%

11%

17%

7%

3%

6%

2%

21.8

9.2

12.6

8.4

16.7

14.2

49.8

25.1

36.0

21.1

64.9

21.9

18.9

13.5

18.5

10.0

15.8

8.3

18.6

23.1

36.5

14.2

22.9

20.7

29.1

33.0

26.5

20.6

12.0

56.7

17.6

79.2

53.2

40.7

57.0

35.2

54.2

17.8

23.8

17.1

64,119

10,531

12,822

5,009

1,731

11,031

4,669

5,029

6,701

6,595

78,785

14,283

16,291

5,049

1,817

15,399

4,652

6,220

7,489

7,585

101,455

21,308

20,337

5,493

2,335

24,363

7,556

5,721

6,170

8,172

100,062

21,359

22,835

6,088

2,822

18,844

7,527

5,834

7,121

7,631

17%

19%

13%

0%

-4%

32%

75%

18%

-6%

23%

23%

36%

27%

1%

5%

40%

0%

24%

12%

15%

29%

49%

25%

9%

28%

58%

62%

-8%

-18%

8%

-1%

0%

12%

11%

21%

-23%

0%

2%

15%

-7%

96,606

2,509

21,608

201

3

3,624

9,595

-167

741

1,516

1,705

5,651

-36

2,456

90

13,227

5,059

4,266

750

3,536

8,469

5,771

6,031

83,155

9,395

21,191

11,608

2,117

3,324

8,477

5,818

21,225

17,518

10,212

670

2,306

3,232

1,545

289

510

4,636

41,529

9,832

31,697

108,405

1,709

24,407

556

-688

3,570

9,792

8,659

975

7,853

1,617

6,044

280

2,805

-33

17,016

6,388

5,440

1,012

2,221

2,199

225

6,358

110,464

10,574

23,929

13,904

9,552

6,555

13,533

7,513

24,904

27,579

15,738

1,052

5,000

3,728

2,718

844

686

7,763

42,311

6,857

35,454

113,061

1,834

18,606

2,958

2,685

2,626

11,053

7,072

976

5,639

1,672

7,511

307

4,277

-3,372

19,409

7,133

6,213

1,312

2,537

3,878

2,239

6,497

110,705

14,204

21,723

14,989

4,488

8,558

10,197

8,860

27,686

9,939

20,372

1,350

6,204

4,535

4,178

1,002

782

9,875

50,157

11,687

38,470

123,692

1,459

15,128

2,137

6,993

3,017

11,760

6,833

1,080

6,201

1,749

9,114

844

5,055

-2,371

21,189

7,775

6,460

1,423

3,542

4,941

2,991

6,375

128,904

15,801

20,667

16,527

4,809

9,527

18,581

10,894

32,098

11,471

22,772

1,568

7,272

5,414

4,735

1,112

913

10,599

51,680

12,422

39,258

-1%

-22%

-14%

-57%

-48%

22%

13%

-52%

-40%

28%

-118%

-41%

37%

76%

7%

124%

129%

7%

46%

53%

-19%

-16%

-3%

68%

-91%

11%

-46%

805%

15%

-13%

-20%

-4%

38%

5%

203%

-61%

-18%

-41%

-17%

1%

-21%

12%

-32%

13%

177%

-2%

2%

32%

418%

-5%

7%

-870%

14%

29%

26%

28%

35%

-37%

-74%

-96%

5%

33%

13%

13%

20%

351%

97%

60%

29%

17%

57%

54%

57%

117%

15%

76%

192%

35%

67%

2%

-30%

12%

4%

7%

-24%

432%

-26%

13%

-18%

0%

-28%

3%

24%

10%

52%

14%

12%

14%

30%

14%

76%

895%

2%

0%

34%

-9%

8%

-53%

31%

-25%

18%

11%

-64%

29%

28%

24%

22%

54%

19%

14%

27%

19%

70%

9%

9%

-20%

-19%

-28%

160%

15%

6%

-3%

11%

10%

5%

21%

175%

18%

9%

9%

4%

8%

40%

27%

34%

-2%

16%

11%

-5%

10%

7%

11%

82%

23%

16%

15%

12%

16%

17%

19%

13%

11%

17%

7%

3%

6%

2%

35,537

7,140

864

2,942

8,032

3,974

9,056

3,528

331,157

40,751

9,038

1,843

3,431

7,294

4,239

10,530

4,376

396,455

52,823

10,607

2,225

3,754

8,017

4,783

18,176

5,260

448,572

59,683

12,234

2,576

4,214

9,103

5,279

20,248

6,030

486,794

26%

31%

284%

0%

60%

11%

15%

17%

-4%

15%

27%

113%

17%

-9%

7%

16%

24%

20%

30%

17%

21%

9%

10%

13%

73%

20%

13%

13%

15%

16%

12%

14%

10%

11%

15%

9%

0.55

0.10

0.12

0.32

1.16

0.65

0.42

0.68

0.21

0.14

0.28

1.04

0.61

0.52

0.75

0.23

0.16

0.25

1.17

0.65

0.62

0.86

0.27

0.17

0.28

1.30

0.72

0.71

20%

34%

62%

0%

60%

-11%

11%

17%

-6%

5%

24%

107%

17%

-12%

-10%

-7%

24%

16%

7%

10%

9%

11%

-11%

13%

6%

20%

7%

13%

15%

16%

12%

12%

11%

12%

15%

9%

24.1

50.1

13.5

11.2

11.3

17.2

22.2

12.5

21.7

22.8

40.5

6.5

9.6

12.9

19.2

23.9

10.1

18.7

21.3

36.7

6.0

8.6

14.4

17.1

22.4

8.5

17.5

18.8

32.0

5.2

7.7

12.8

15.4

20.0

7.4

16.1

2.1

2.9

0.5

0.8

81.1

1.4

2.4

0.5

2.3

2.0

2.4

1.1

0.7

1.3

1.6

3.3

0.9

2.5

9.1

7.1

24.0

8.0

9.1

10.0

11.7

11.1

16.0

1.4%

1.2%

1.7%

2.1%

1.1%

1.8%

1.0%

3.4%

2.2%

278,343

336,044

366,839

397,730

1%

21%

9%

8%

281

322

327

352

-12%

14%

2%

8%

21.1

18.5

18.2

16.9

2.0

2.7

16.0

2.2%

236,814

293,733

316,682

346,049

5%

24%

8%

9%

8%

18%

9%

9%

24.0

20.3

18.6

17.1

2.0

2.6

14.4

1.6%

Potrebbero piacerti anche

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- CH 10 Hull Fundamentals 8 The DDocumento20 pagineCH 10 Hull Fundamentals 8 The DjlosamNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Lotusxbt Trading ModelDocumento8 pagineLotusxbt Trading ModelNassim Alami MessaoudiNessuna valutazione finora

- PETRONASDocumento14 paginePETRONASaqudie100% (1)

- Garanti Bank - Leveraging Technology To Advance in BusinessDocumento20 pagineGaranti Bank - Leveraging Technology To Advance in BusinessKorhan CoskunNessuna valutazione finora

- APEC - Infrastructure PPP Case StudiesDocumento354 pagineAPEC - Infrastructure PPP Case StudiesDaniel JungNessuna valutazione finora

- Asset Management Series Part 2Documento59 pagineAsset Management Series Part 2Ismet Eliskal67% (3)

- Benihana ReportDocumento33 pagineBenihana ReportAnuradhaSaliyaAmarathungaNessuna valutazione finora

- April 2013 Electronics Engineer Licensure ExaminationDocumento13 pagineApril 2013 Electronics Engineer Licensure ExaminationRobert SatorreNessuna valutazione finora

- ACME PresentationDocumento6 pagineACME Presentationrockincathy17Nessuna valutazione finora

- April 2013 Electrical Engineer Board Exam ResultsDocumento24 pagineApril 2013 Electrical Engineer Board Exam ResultsEli Benjamin Nava TaclinoNessuna valutazione finora

- GSB Mba DlsuDocumento1 paginaGSB Mba DlsuMidi GenticaNessuna valutazione finora

- Restructuring Public Entities in Pakistan - Establish An Appointment Commission FirstDocumento7 pagineRestructuring Public Entities in Pakistan - Establish An Appointment Commission Firstsmzafar101Nessuna valutazione finora

- An Introduction To Investment TheoryDocumento7 pagineAn Introduction To Investment Theorynazeer8384100% (1)

- Coca-Cola Financial AnalysisDocumento6 pagineCoca-Cola Financial AnalysisAditya Pal Singh Mertia RMNessuna valutazione finora

- MFS Syllabus - April 2024Documento3 pagineMFS Syllabus - April 2024akila vickramNessuna valutazione finora

- ACIIA July NewsletterDocumento14 pagineACIIA July NewsletterAdedeji AjadiNessuna valutazione finora

- Homework 2Documento3 pagineHomework 2Charlie RNessuna valutazione finora

- Business Finance - Brainnest Lecture 3Documento28 pagineBusiness Finance - Brainnest Lecture 3Amira Abdulshikur JemalNessuna valutazione finora

- Ch09 Solutions ManualDocumento10 pagineCh09 Solutions ManualwangyuNessuna valutazione finora

- Marketing Textbook Answers To Study QuestionsDocumento3 pagineMarketing Textbook Answers To Study QuestionsNicole McCoy Wilson100% (3)

- ASNB MasterProspectus 2011Documento169 pagineASNB MasterProspectus 2011David Ten Kao YuanNessuna valutazione finora

- Dissolution 2024 SPCC PDFDocumento66 pagineDissolution 2024 SPCC PDFdollpees01Nessuna valutazione finora

- Eduardo Serrão - Potential Business For Chickens and Pigs and Their Products in Timor-LesteDocumento6 pagineEduardo Serrão - Potential Business For Chickens and Pigs and Their Products in Timor-LestePapers and Powerpoints from UNTL-VU Joint Conferenes in DiliNessuna valutazione finora

- Mudharabah Assignment - Muhammad Fadlil Kirom - AIB-17-IPDocumento4 pagineMudharabah Assignment - Muhammad Fadlil Kirom - AIB-17-IPAdil KiromNessuna valutazione finora

- Absurd Monetary SystemDocumento3 pagineAbsurd Monetary SystemMubashir HassanNessuna valutazione finora

- Zambia Kwacha Currency Rebasing Brochure BarclaysDocumento12 pagineZambia Kwacha Currency Rebasing Brochure BarclaysBen MusimaneNessuna valutazione finora

- Bridgecreek Investment Management Firm Tops $1 Billion in Assets Under ManagementDocumento3 pagineBridgecreek Investment Management Firm Tops $1 Billion in Assets Under ManagementPR.comNessuna valutazione finora

- Report On Pidilite Industry Ltd.Documento38 pagineReport On Pidilite Industry Ltd.Rocky Syal75% (4)

- Forms To SECPDocumento8 pagineForms To SECPm_hasanazizNessuna valutazione finora

- Project 2Documento137 pagineProject 2Ankit SrivastavaNessuna valutazione finora

- Target Presentation SlidesDocumento28 pagineTarget Presentation Slidesapi-216800269Nessuna valutazione finora

- Financial Management: Project ONDocumento32 pagineFinancial Management: Project ONUsman Ali100% (1)

- Spark Research 18 June 2018 PDFDocumento37 pagineSpark Research 18 June 2018 PDFAdroit WaterNessuna valutazione finora