Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

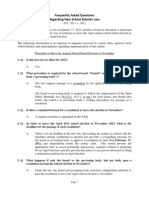

Monarch Tax Abatement Worksheet

Caricato da

dandamonCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Monarch Tax Abatement Worksheet

Caricato da

dandamonCopyright:

Formati disponibili

MONARCH TAX ABATEMENT IMPACT

AVERAGE SELLING PRICE $279,259

279,259 X 34.98%

RATIO = $97,684.80

ASSESSED VALUE

AD VALOREM TAX =

$97,684.8 X 6.209

RATE / 100 =

$6,065.25

ABATEMENT BENEFIT

YEAR NO ABATEMENT 20% METHOD 40% METHOD 20% METHOD 40% METHOD

1 $ 6,065.25 $ 2,426.10 $ (6,065.25) $ (3,639.15)

2 $ 6,065.25 $ 1,213.05 $ 2,426.10 $ (4,852.20) $ (3,639.15)

3 $ 6,065.25 $ 2,426.10 $ 2,426.10 $ (3,639.15) $ (3,639.15)

4 $ 6,065.25 $ 3,639.15 $ 2,426.10 $ (2,426.10) $ (3,639.15)

5 $ 6,065.25 $ 4,852.20 $ 2,426.10 $ (1,213.05) $ (3,639.15)

TOTAL FOR 1 UNIT $ 30,326.25 $ 12,130.50 $ 12,130.50 $ (18,195.75) $ (18,195.75)

X 63 X 63 X 63 X 63 X 63

5 YEARS (63 UNITS) $ 1,910,553.75 $ 764,221.50 $ 764,221.50 $ (1,146,332.25) $(1,146,332.25)

ANNUAL COLLECTION WITHOUT ABATEMENT: 63 X $6,065.25: $382,110.75 TIMES 5 EQUAL $ 1,910,553.75

ANNUAL COLLECTION WITH ABATEMENT: 63 X $2,426.10: $152,844.30 TIMES 5 EQUAL $ 764,221.50

PLAINFIELD'S TAX PAYERS WOULD LOSE $ 1,146,332.25

COST TO ALL HOMEOWNERS BASED ON AN AVERAGE ASSESSMENT OF $113,000 $ 102.03

Potrebbero piacerti anche

- PMUA Minutes Committee 2012 0209Documento4 paginePMUA Minutes Committee 2012 0209dandamonNessuna valutazione finora

- Briggs Vs Council: 2012, March 2Documento16 pagineBriggs Vs Council: 2012, March 2dandamonNessuna valutazione finora

- Chapter 72, 2011: Concerning Boards of EducationDocumento6 pagineChapter 72, 2011: Concerning Boards of EducationdandamonNessuna valutazione finora

- DOE: Moving BOE Elections To November FAQDocumento6 pagineDOE: Moving BOE Elections To November FAQdandamonNessuna valutazione finora

- PMUA Letter NeffToMitchell 120301Documento2 paginePMUA Letter NeffToMitchell 120301dandamonNessuna valutazione finora

- SRB Release CourtRulesOnCouncilFine 120626Documento1 paginaSRB Release CourtRulesOnCouncilFine 120626dandamonNessuna valutazione finora

- S3148: Moving BOE Elections To NovemberDocumento39 pagineS3148: Moving BOE Elections To NovemberdandamonNessuna valutazione finora

- PMUA Settlement: JohnsonDocumento7 paginePMUA Settlement: JohnsondandamonNessuna valutazione finora

- Council: WBLS Investigators ReportDocumento18 pagineCouncil: WBLS Investigators ReportdandamonNessuna valutazione finora

- Flyer Community Appreciation Day RescheduledDocumento1 paginaFlyer Community Appreciation Day RescheduleddandamonNessuna valutazione finora

- PMUA Settlement: RobinsonDocumento7 paginePMUA Settlement: RobinsondandamonNessuna valutazione finora

- UEZ HomeArts BrochureDocumento6 pagineUEZ HomeArts BrochuredandamonNessuna valutazione finora

- PMUA Settlement: DixonDocumento7 paginePMUA Settlement: DixondandamonNessuna valutazione finora

- Flyer ScarletLetter 2011Documento1 paginaFlyer ScarletLetter 2011dandamonNessuna valutazione finora

- BOE Reso GallonSuspension 100507Documento3 pagineBOE Reso GallonSuspension 100507dandamonNessuna valutazione finora

- InvestorsBank 2010FireworksSupport PressRls 100615Documento1 paginaInvestorsBank 2010FireworksSupport PressRls 100615dandamonNessuna valutazione finora

- Plainfield Nonprofits Due To Lose Exempt Status (2010)Documento4 paginePlainfield Nonprofits Due To Lose Exempt Status (2010)dandamonNessuna valutazione finora

- Plainfield July 4 Parade - New Dems LineupDocumento4 paginePlainfield July 4 Parade - New Dems LineupdandamonNessuna valutazione finora

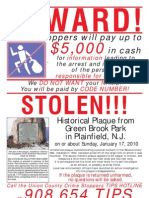

- CrimeStoppers Flyer - Green Brook Park PlaqueDocumento1 paginaCrimeStoppers Flyer - Green Brook Park PlaquedandamonNessuna valutazione finora

- Plainfield Democratic City Committee: Bylaws 1999Documento5 paginePlainfield Democratic City Committee: Bylaws 1999dandamonNessuna valutazione finora

- Plainfield July 4 Parade - New Dems LineupDocumento4 paginePlainfield July 4 Parade - New Dems LineupdandamonNessuna valutazione finora

- Visioning Study Committee and ScheduleDocumento1 paginaVisioning Study Committee and ScheduledandamonNessuna valutazione finora

- 2010primary Burney FinalMailerDocumento2 pagine2010primary Burney FinalMailerdandamonNessuna valutazione finora

- Plainfield Community Outreach/Grace's Kitchen Feeding Program SummitDocumento4 paginePlainfield Community Outreach/Grace's Kitchen Feeding Program SummitdandamonNessuna valutazione finora

- Letter DCA On Plainfield CFO Situation 091008Documento2 pagineLetter DCA On Plainfield CFO Situation 091008dandamonNessuna valutazione finora

- Dornoch-UCIA AgreementDocumento30 pagineDornoch-UCIA AgreementdandamonNessuna valutazione finora

- Jerry Sold Us OutDocumento1 paginaJerry Sold Us OutdandamonNessuna valutazione finora

- Flyer: Sleepy Hollow BreakIns MeetingDocumento1 paginaFlyer: Sleepy Hollow BreakIns MeetingdandamonNessuna valutazione finora

- Solaris: Letter To Council, Mayor, AssemblymanDocumento2 pagineSolaris: Letter To Council, Mayor, AssemblymandandamonNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- A Study of Cognitive Human Factors in Mascot DesignDocumento16 pagineA Study of Cognitive Human Factors in Mascot DesignAhmadNessuna valutazione finora

- Myasthenia Gravis in The Elderly: NeurologyDocumento4 pagineMyasthenia Gravis in The Elderly: NeurologyAirin QueNessuna valutazione finora

- Feminist Standpoint As Postmodern StrategyDocumento21 pagineFeminist Standpoint As Postmodern StrategySumit AcharyaNessuna valutazione finora

- OS W2020 3140702 APY MaterialDocumento2 pagineOS W2020 3140702 APY MaterialPrince PatelNessuna valutazione finora

- TWC AnswersDocumento169 pagineTWC AnswersAmanda StraderNessuna valutazione finora

- Measures of Variability For Ungrouped DataDocumento16 pagineMeasures of Variability For Ungrouped DataSharonNessuna valutazione finora

- Skans Schools of Accountancy CAF-8: Product Units RsDocumento2 pagineSkans Schools of Accountancy CAF-8: Product Units RsmaryNessuna valutazione finora

- MANILA HOTEL CORP. vs. NLRCDocumento5 pagineMANILA HOTEL CORP. vs. NLRCHilary MostajoNessuna valutazione finora

- NIVEA Umbrella BrandingDocumento28 pagineNIVEA Umbrella BrandingAnamikaSenguptaNessuna valutazione finora

- Sourabh ResumeDocumento2 pagineSourabh ResumeVijay RajNessuna valutazione finora

- Forge Innovation Handbook Submission TemplateDocumento17 pagineForge Innovation Handbook Submission Templateakil murugesanNessuna valutazione finora

- CT, PT, IVT, Current Transformer, Potential Transformer, Distribution Boxes, LT Distribution BoxesDocumento2 pagineCT, PT, IVT, Current Transformer, Potential Transformer, Distribution Boxes, LT Distribution BoxesSharafatNessuna valutazione finora

- The Role of The Board of Directors in Corporate GovernanceDocumento12 pagineThe Role of The Board of Directors in Corporate GovernancedushyantNessuna valutazione finora

- Music Theory Secrets 94 Strategies For The Startin... - (Chapter 5 Scale Degree Names and Intervals)Documento7 pagineMusic Theory Secrets 94 Strategies For The Startin... - (Chapter 5 Scale Degree Names and Intervals)Daniel BarónNessuna valutazione finora

- The Impact of Social Media: AbstractDocumento7 pagineThe Impact of Social Media: AbstractIJSREDNessuna valutazione finora

- Restaurant Business PlanDocumento20 pagineRestaurant Business PlandavidNessuna valutazione finora

- Taxation During Commonwealth PeriodDocumento18 pagineTaxation During Commonwealth PeriodLEIAN ROSE GAMBOA100% (2)

- CASE STUDY GGHDocumento4 pagineCASE STUDY GGHSanthi PriyaNessuna valutazione finora

- Sibeko Et Al. 2020Documento16 pagineSibeko Et Al. 2020Adeniji OlagokeNessuna valutazione finora

- BE 601 Class 2Documento17 pagineBE 601 Class 2Chan DavidNessuna valutazione finora

- Elevex ENDocumento4 pagineElevex ENMirko Mejias SotoNessuna valutazione finora

- RPMDocumento35 pagineRPMnisfyNessuna valutazione finora

- Silo - Tips - Datex Ohmeda S 5 Collect Users Reference ManualDocumento103 pagineSilo - Tips - Datex Ohmeda S 5 Collect Users Reference Manualxiu buNessuna valutazione finora

- Los Angeles County Sheriff's Department InvestigationDocumento60 pagineLos Angeles County Sheriff's Department InvestigationBen Harper0% (1)

- MBA Negotiable Instruments Act 1881 F2Documento72 pagineMBA Negotiable Instruments Act 1881 F2khmahbub100% (1)

- Peralta v. Philpost (GR 223395, December 4, 2018Documento20 paginePeralta v. Philpost (GR 223395, December 4, 2018Conacon ESNessuna valutazione finora

- 4.2 Master Schedule - ACMP 4.0, Summar 2020 - 28 Aug 2020Documento16 pagine4.2 Master Schedule - ACMP 4.0, Summar 2020 - 28 Aug 2020Moon Sadia DiptheeNessuna valutazione finora

- Two Dimensional Flow of Water Through SoilDocumento28 pagineTwo Dimensional Flow of Water Through SoilMinilik Tikur SewNessuna valutazione finora

- FR Cayat Vs COMELEC PDFDocumento38 pagineFR Cayat Vs COMELEC PDFMark John Geronimo BautistaNessuna valutazione finora

- E-Commerce Lecture NotesDocumento572 pagineE-Commerce Lecture NotesMd Hassan100% (2)