Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Petrol Oil Sector Who Owns Who in South Africa

Caricato da

Aboo KhanCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Petrol Oil Sector Who Owns Who in South Africa

Caricato da

Aboo KhanCopyright:

Formati disponibili

JOHANNESBURG OFFICE BALLYOAKS OFFICE PARK, BUILDING B, 35 BALLYCLARE DRIVE, BRYANSTON EXT 7 P O BOX 3044, RANDBURG, 2125 TEL:

+27 11 513 -1450 FAX: +27 11 463-2771 PORT ELIZABETH OFFICE 1ST FLOOR, BLOCK F, SOUTHERN LIFE GARDENS, 70 2ND AVENUE, NEWTON PARK P O BOX 505, HUNTERS RETREAT, 6017 TEL: +27 41 394-0600 FAX: +27 41 363-2869 WEBSITE: WWW.WHOOWNSWHOM.CO.ZA REG NO: 1986/003014/07

Essential Business Information

MANUFACTURE OF PETROL AND LUBRICANTS Siccode 332

February 2012

COMPILED BY: Guy McGregor

research@whoownswhom.co.za

DIRECTORS: MAUREEN MPHATSOE (CHAIRPERSON), JIM FICK (EXPERIAN), GLEN BALS (EXPERIAN), ANDREW MCGREGOR (MANAGING) Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Contents

Contents

1 2 3 3.1 3.2 3.3 4 4.1 INTRODUCTION DESCRIPTION SIZE OF THE INDUSTRY Oil Companies Refineries Lubricant Blending Plants STATE OF THE INDUSTRY Local 4.1.1 4.1.2 4.2 4.3 5 6 7 Regulations BEE 1 1 6 6 7 8 10 10 13 19 19 21 21 22 23 24 24 25 25 26 28 28 29 31 32 35 37 38 40 42 44 46 48 50 53 55 57 59 62 64

Regional International SWOT ANALYSIS FUTURE OUTLOOK ASSOCIATIONS AND REFERENCES Typical Refinery Operation Coal to Liquid Fuels Synthetic Refining Process Natural Gas to Liquid Fuels Synthetic Refining Process

APPENDIX 1

ORGANOGRAM COMPANY PROFILES BLUE CHIP LUBRICANTS (PTY) LTD CHEVRON SOUTH AFRICA (PTY) LTD DEOJAY PETROLEUM KZN (PTY) LTD ENGEN PETROLEUM LTD FUCHS LUBRICANTS (SOUTH AFRICA) (PTY) LTD GERM AFRICA (PTY) LTD H AND R SOUTH AFRICA (PTY) LTD INDY OIL SA (PTY) LTD KZN OILS (PTY) LTD LUBRITENE (PTY) LTD NATIONAL PETROLEUM REFINERS OF SOUTH AFRICA (PTY) LTD PETROLEUM MARKETING ORGANIZATION (PTY) LTD PETROLEUM OIL & GAS CORPORATION OF SOUTH AFRICA (PTY) LTD, THE PISTON POWER CHEMICALS CC SASOL WAX (DIVISION OF SASOL CHEMICAL INDUSTRIES LTD) SHELL & BP SOUTH AFRICAN PETROLEUM REFINERIES (PTY) LTD SPANJAARD LTD TOTAL SOUTH AFRICA (PTY) LTD VALVOLINE SOUTH AFRICA (PTY) LTD

Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 1 of 66

INTRODUCTION

The Liquid Fuels sector is a sophisticated one, with the only commercial synthetic coal-to-liquid fuel refinery in the world and a distribution infrastructure meeting the challenges of a large country with an industrial heartland six hundred kilometres from the coast. This report explores the downstream and upstream value chain of the South African Oil industry, which contributes around 2% of Gross Domestic Product (GDP). The report also examines the distribution of refined petroleum products across the 1.2 million square kilometres that comprise South Africa. The Liquid Fuels Industry is at an interesting stage with the existing refineries operating at capacity with economic growth catching the Industry off guard, in that demand is stretching supply. As a result, new distribution and refining capacity is needed sooner than expected.

DESCRIPTION

No significant reserves of crude oil have been discovered in South Africa, or its territorial waters, despite a sustained search by Soekor, the state-owned oil exploration company, established in 1965. Limited natural gas deposits, and small oil fields, have been discovered off the South coast. According to the most recent statistics, nearly 80% of South Africas crude oil is imported through the single buoy mooring (SBM) system off the coast of Durban. Shell, BP, Sasol and Engen own the SBM, which is managed by SAPREF, the countrys largest oil refiner. The remainder of the crude oil imports are landed at Saldana Bay and piped to the Caltex refinery in Cape Town. Primary Sources of Crude Oil - 2010

Major Sources of Crude Oil (2010)

Iran Saudi Arabia Nigeria Angola United Arab Emirates Argentina Iraq Spain Switzerland Cote d'Ivoire Oman Mozambique Norway United States of America Equatorial Guinea Cuba TOTAL Source: South African Revenue Services

000' of metric tons 5528 4584 3594 3409 1018 297 244 134 126 88 72 44 37 36 35 9 19255

% of total 29% 24% 19% 18% 5% 2% 1% 1% 1% 0% 0% 0% 0% 0% 0% 0% 100%

Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 2 of 66

Refining involves the procurement of crude oil and refining it, so that a range of final petroleum products is produced. It is the first component of the downstream segment of the oil industry value chain and the most capital intensive. The diagrams in Appendix 1 illustrate the different refining processes. The refined products typically comprise the following six groups as shown in the table below. RSA Crude Oil Refinery Yield Data Group Gases Light Distillates Middle Distillates Main Products LPG Petrol Paraffin Jet Fuel Diesel Residuals Fuel Oil Bitumen Other Fuel and Loss % of the Barrel 2.0 30.5 2.9 6.7 31.7 13.0 2.0 5.0 6.2

Currently there are six private sector oil companies and seven brands. These can be classified into three categories. The first category consists of the five large brands, Engen, Shell, Chevron, Total and BP, whose individual share of the petroleum market varies between 13% and 30%. They also own refineries. The second category comprises the independent wholesalers. These are largely Black Empowerment Companies which are not branded but who distribute refined product mainly in the Central, Eastern and North Eastern parts of South Africa to their customers. However this is not a significant amount of product at this stage. The third category of oil companies is the synfuel industry, comprising two companies, Sasol and PetroSA. PetroSA is primarily a refiner, producing petroleum products to be marketed by the other oil companies, through their service stations and their corporate, farmer and government customers. However Sasol markets refined products through a significant network of service stations it has built up since the termination of the Main Supply Agreement in 2003. The two basically use different inputs: Sasol uses coal and PetroSA natural gas, to produce petroleum products. The synthetic fuel industry supplies around 35% of South Africas refined product requirements. The synfuel industry produces more Gases and Light Distillates than the crude oil refiners. This helps meet petroleum product demand, as more petrol than diesel is sold in South Africa. As Sasol shares the crude oil refinery, Natref, it is able to produce a more balanced barrel of refined

Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 3 of 66

petroleum products. However, this is not the case with PetroSA, which does not provide a crude equivalent saving. Sasol Synfuel Refinery Yield Data Group Gases Light Distillates Middle Distillates Main Products LPG Petrol Paraffin Diesel % of the Barrel 4,0 65,0 5,0 26,0

The Lubricants market is a different segment of the Liquid Fuels Industry. While the mainstream Liquid Fuels Industry petroleum products produce hydrocarbons which principally facilitate movement in some sort of combustion engine or provide light or heat, the main task of a lubricant and grease is to protect moving parts. Lubricants are primarily made from base oil which comes from the fuel oil distillation at the bottom of the crude oil yield in the refining process, after which additives are inserted for the lubricant at the lube oil blending plants to meet the required specification for the various applications. The lubricants market consists of two parts, automotive and industrial, with the former making up approximately 60% of the sales and the industrial market comprising the balance of 40%. The total market in South Africa is around 400 million litres. The other components of the downstream value chain are the distribution and marketing of refined products. The 1953 bottle-necks on the Durban-Reef supply chain resulted eventually in a 700km pipeline, 30.5cm in diameter being constructed in order to transport the refined product to the Reef. It was commissioned in 1965 and is used to transport petrol, diesel, kerosene and naphtha. The products are pumped to eight pipeline terminals from where they are transported by rail and road to their final destination. The different oil companies, including Sasol, market petroleum products throughout the country. To improve efficiencies and prevent transport duplication, products are exchanged between oil companies in certain areas. The Durban refineries (Enref and SAPREF) normally supply the Natal area, Free State, neighbouring states as well as parts of the Cape Province. Chevref supplies most of the Cape Province, whilst Sasol and Natref supply the Inland Area of Gauteng, Limpopo, North West and Mpumalanga. Refined products are distributed through around 55 oil company depots throughout South Africa. They receive the products via the Durban/Reef pipeline in Natal, the Free State and the Inland Area, with road and rail transport extending the distribution chain to other depots. The products are then transported to their final destination: service stations, farms, mines, corporate or government customers, by road and rail tanker. Due to the inefficiencies of the rail system, 85% is transported

Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 4 of 66

by road. Transnet controls the pipelines and the cost of moving refined products from the coast inland is based on Transnet rail tariffs. There are now four pipelines from Durban at the coast to the inland areas: The product pipeline referred to above; A crude oil pipeline to supply Natref with its crude oil feedstock; A third pipeline through Richards Bay, which currently brings the methane-rich gas from Sasols Secunda Synthetic plants to customers on the coast; and The New Multi Products Pipeline (NMPP) which is taking the place of the previous product pipeline from the coast to the inland areas. and it is currently being fully commissioned The marketing of refined product is done in the following two ways: indirectly through service stations (Oil Company Retail Stream); and directly to farmers, mines, corporate customers, government or third party distributors (Oil Company Commercial Stream). This stream comprises the wholesale activities of the Oil Industry. There are some 4173 retail service stations in South Africa which sell petrol, diesel and lubricants as well as IP and even LPG in some cases. In the case of petrol, prices are controlled by government at the level of pump prices, while there is a maximum price for diesel and IP at the wholesale price level. Lubricant prices are not controlled. No discounting of service station petrol pump prices is allowed. Service stations may not be run directly by oil companies. The dealers are paid a service station dealer margin of 85.2 cents per litre which amounts to 7.9% of the 95 unleaded inland pump price as at November 2011 on top of the oil company wholesale price, to enable them to run the service stations. The retail sector of the value chain has very different characteristics to other parts of the value chain. There used to be as many as 4900 retail service stations in South Africa in 2000. As at 2008 as mentioned above, this number dropped to 4173 as the oil companies rationalised their retail site networks and withdrew particularly from rural areas where sales turnover has been low. Logistics costs in supplying these far-flung sites were also high. There are broadly three different levels or types of service stations operating in the local market varying from high volume, value add service stations with fast food outlets, convenience stores and car wash facilities to the lowest volume service stations. The types of service stations will vary with location (McGregor, Peddie, Warnett, Jawoodeen, Said, 2009). Urban Sites tend to be high-pumpers with high volumes sold and vary according to location and traffic flows. Additional income is earned through car-washes and convenience stores and fast food restaurants. The investment costs range between R5m and R10m. Costs are largely

Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 5 of 66

driven by the price paid for the land. Motor repair workshops are generally not found at these service stations as this service facility is provided by the motor dealership. Rural Sites tend to be lower pumpers than urban sites. Most of the rural service stations have motor repair shops as part of their operations. The convenience stores concept has not taken off in the rural areas because the needs of the consumer tend to be met by general dealers. Also the low concentration of people in the rural areas would adversely impact on the viability of convenience stores. Capital cost would be much lower than the urban sites because of lower cost of land and limited facilities on the site. Investment in rural service stations would range between R1m and R3m. Transient / Highway service stations are a relatively recent concept that has been introduced in the market. It is a high investment business with an initial capital investment of between R20m and R30m. It caters for both light (Motor cars) and heavy vehicles (Trucks). The convenience store and restaurants are integral parts of the transient service stations. The concept of overnight hotels/motels is also being introduced. This is a seasonal business meaning high through flow occurs during the holiday seasons. The ownership of the branded sites differs and falls into four main classes. Dealer owned / Dealer operated Here the service station is both owned and operated by the owner. The owner would have a branding, product supply and marketing support agreement with an oil company. Oil company owned / Dealer operated As the oil companies in terms of government regulations are not allowed to operate the service stations the site owned by them are leased to private operators. In terms of the lease they are obliged to purchase their supplies and marketing support from the oil company owning the service station. Property developer owned / Oil company leased / Dealer operated In recent times oil companies have leased sites developed by Property Developers. The property is leased to oil companies on a long-term basis. The operation of the site is then subleased to private operators. Oil company owned / Oil company operated In terms of the regulatory framework oil companies are allowed to own and operate a maximum of one site per province for training and business development purposes.

Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 6 of 66

The Oil Industry Supply/Activity Chain

OilIndustry value chain

UpstreamSector DownstreamSector

Transportation

The downstream oil sector comprises all aspects of the oil industry from oil refining to filling petrol into a motorists tank on a service station forecourt or an overhead tank on a farm. The upstream sector in comparison comprises identifying oil fields, drilling for oil and shipping crude oil to refineries. The crude oil industry in South Africa can only be defined as downstream as South Africa currently has no reserves of crude oil. However the synthetic oil industry of coal to refined petroleum products and natural gas to refined petroleum products comprises the full value chain, but rather than locating and exploiting crude oil, these refineries use coal and natural gas.

SIZE OF THE INDUSTRY

The Liquid Fuels sector, which manufactures petrol, diesel and fuel oil as its primary outputs, produced over 28 700 million litres of refined product in South Africa in 2009. This was down from 35 300 million litres in 2008. This is done through six refineries. Four are crude oil refineries and two are synthetic refineries which convert natural gas and coal into refined petroleum products. The six refineries have a capacity of just over 700 000 barrels per day with the crude oil refineries consuming around 20 million metric tons of crude oil per annum. This compares to a world consumption around 3 900 million metric tons, which puts South African consumption at 0.5% of the global total.

3.1

Oil Companies

The South African crude oil industry is dominated by foreign owned multinationals which have all been proactive in seeking local Black Economic Empowerment partners to comply with the Oil Industry Charter. The synthetic fuel industry is locally owned, by Government in the case of PetroSA, while Sasol is listed on the Johannesburg and New York Stock Exchanges.

Copyright Who Owns Whom (Pty) Ltd

Marketingto endusers

Development

Supply& Distribution

Exploration

Production

Wholesale

Refining

Trading

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 7 of 66

Companies and Controlling Shareholding in the Oil Industry RSA Company Chevron Engen Owner Chevron Petronas WAIH Shell BP Royal Dutch/Shell BP plc MIC WDB Total TotalFinaElf Rembrandt Tosaco Sasol Oil Sasol Ltd % Ownership 100% 80% 20% 100% 75% 15% 10% 50,1% 24,9% 25% 100% Sasol Synthetic Fuels, 64% of Natref

[Source: SAPIA]

Refinery Used Chevref Enref

50% of SAPREF 50% of SAPREF

36% of Natref

3.2

Refineries

The Mobil refinery, the first in South Africa, was completed in January 1954 and is located in Wentworth, Durban. Now renamed Enref, it is 69% the size of the SAPREF (the BP/Shell refinery). SAPREF, jointly owned by BPSA (50%) and Shell (50%) is also located in Durban and is the biggest refinery in Southern Africa. refinery: processes 24 000 tons of crude oil a day; makes 10 main products in 46 different grades; and produces 2.7 billion of petrol per annum. Natref, the inland refinery at Sasolburg is jointly owned by Sasol and Total. Chevref, the Chevron refinery, is located in Cape Town at the request of Government. The initial plan was to locate it in Durban. It is 56% of the size of SAPREF and when it came on stream in July 1966, South Africa became for the first time completely independent of imported refined products. These refineries are relatively small by world standards where new refinery capacities tend to be greater than 350 000 barrels per day. The location and capacities of the South African refineries are shown in Graph 2 below. It came on stream in October 1963. According to the website, the

Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 8 of 66

South African Refineries, their Capacities and Locations

Refinery Locations in South Africa

Zimbabwe Walvis Bay Windhoek Botswana Gaborone Namibia Johannesburg

NATREF 108 kbpd (Sasol & Total)

Pande & Temane Gas Fields

Mozambique Witbank

Sasol 2&3 eq 150 kbpd

Maputo Swaziland

Sasolburg

Kudu Gas Field

South Africa

Lesotho

Richards Bay

Engen 120 kbpd

Durban

SBM

SAPREF 180 kbpd (Shell & BP)

Saldahna Bay

Caltex 100 kpbd

Mossgas equiv. 45 kbpd

Cape Town

Mossel Bay

East London Port Elizabeth

Crude Oil Refinery Synfuel Plant Pipelines Major markets

0 500 km

Mossgas Field

[Source: BPSA]

3.3

Lubricant Blending Plants

As mentioned, the total market for automotive and industrial lubricants in South Africa is around 400 million litres. Gauteng is the biggest market for lubricants with a market share of around 60%. The Western Cape and KwaZulu Natal come in at around 15% each with the other provinces making up the remaining 10%. Lubricants, because of the personal service of technical people, have higher margins than fuels. The major lubricant blending plants in South Africa are: LOBP (BP Island View, Durban) supplier to Castrol, BP and Shell; Engen/Caltex joint venture at Island View, Durban; and Sasol/Total joint venture also at Island View, Durban. There are also minor lubricant oil blending plants such as: Fuchs Lubricants Johannesburg; Blendrite, Durban; Indy Oils, Cape Town; and H&R Blenders, Durban.

Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 9 of 66

Independent blend plants include: Lubritine, Durban; Motorlube, Durban; Piston Products, Cape Town; Petromark, Johannesburg; Spanjaard, Johannesburg; Germ Lubricants, Johannesburg; and KZN Oils Durban. Summary of Players

Production Company Employees Revenue Capacity (Barrels /day) Blue Chip Lubricants (Pty) Ltd Chevron South Africa (Pty) Ltd Deojay Petroleum KZN (Pty) Ltd Engen Petroleum Ltd Fuchs Lubricants (South Africa) (Pty) Ltd Germ Africa (Pty) Ltd H and R South Africa (Pty) Ltd Indy Oil SA (Pty) Ltd KZN Oils (Pty) Ltd Lubritene (Pty) Ltd National Petroleum Refiners of South Africa (Pty) Ltd t/a NATREF Petroleum Oil and Gas Corporation of South Africa (PetroSA) Petroleum Marketing Organization (Pty) Ltd t/a Petromark Piston Power Chemicals cc Sasol Wax (Div of Sasol Chemical Industries Ltd) 500 R2.5m (2011) X X 42 X 1 836 R10,565.0m (2011) 45 000 X X 573 108 500 X 57 84 27 36 3 379 117 135 000 X X 10 1 200 100 000 X X 30

Oil company

Refinery Lubricants

X X X X X X X X

Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 10 of 66

Production Company Employees Revenue Capacity (Barrels /day) Shell & B P South African Petroleum Refineries (Pty) Ltd Spanjaard Ltd 107 R102.1m (2011) Total South Africa (Pty) Ltd Valvoline South Africa (Pty) Ltd 15 800 730 180 000

Oil company

Refinery Lubricants

4

4.1

STATE OF THE INDUSTRY

Local

The volumes of major petroleum products produced in the last decade are shown below. Extent of Production of Petroleum Products during the last Decade

RSA Consumption by Major Fuel ML 2000 2001 2002 2003 2004 2005 2006 Petrol 10 396 10 340 10 335 10 667 10 985 11 165 11 279 Diesel 6 254 6 488 6 831 7 263 7 679 8 115 8 708 Paraffin 857 786 745 769 797 761 738 Avtur 2 020 1 924 1 967 2 099 2 076 2 180 2 260 Fuel Oil 555 555 536 528 569 489 476 LPG 567 599 586 558 563 550 605 TOTAL 20 649 20 692 21 000 21 884 22 669 23 260 24 066 % Change 2000 2001 2002 2003 2004 2005 2006 Petrol -4.3% -0.5% 0.0% 3.2% 3.0% 1.6% 1.0% Diesel 4.4% 3.7% 5.3% 6.3% 5.7% 5.7% 7.3% Paraffin -18.7% -8.3% -5.2% 3.2% 3.6% -4.5% -3.0% Avtur 1.3% -4.8% 2.2% 6.7% -1.1% 5.0% 3.7% Fuel Oil -1.1% 0.0% -3.4% -1.5% 7.8% -14.1% -2.7% LPG 5.0% 5.6% -2.2% -4.8% 0.9% -2.3% 10.0% TOTAL -1.7% 0.2% 1.5% 4.2% 3.6% 2.6% 3.5% Source: Sapia and DME; AAI is

2007

11 558 9 755 696 2 402 465 636 25 512

2008

11 069 9 762 532 2 376 555 613 24 907

2009 % of Total

11 311 9 109 544 2 186 593 528 24 271 2.2% -6.7% 2.3% -8.0% 6.8% -13.9% -2.6% 46.6% 37.5% 2.2% 9.0% 2.4% 2.2% 100.0% 0.9% 4.3% -4.9% 0.9% 0.7% -0.8% 1.8%

2007

2.5% 12.0% -5.7% 6.3% -2.3% 5.1% 6.0%

2008

-4.2% 0.1% -23.6% -1.1% 19.4% -3.6% -2.4%

2009 AAI 00-09

Average Annual Increase

The issue of fuel security is an important one. Recent shortages have been as a result of unplanned shutdowns at some refineries. According to the Fuel Retailers Association, the recent shortages in Gauteng were blamed on the ongoing unplanned shutdown at SAPREF in Durban. Shell, joint owner of SAPREF had to ration its customers and implement contingency measures, which included, Procuring cargoes of refined product for import into South Africa and co-ordinating efforts with other petroleum suppliers to supplement product shortfalls. At the end of January 2012, SAPREF reported that it had restarted its refining operations, so production was expected to be back at full capacity within a few days.

Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 11 of 66

According to the South African Petroleum Industry Association (Sapia), Government and the industry were tackling the security of fuel supply. A Sapia executive director was reported as saying, A petroleum products planning team, which comprises the petroleum industry, the National Energy Regulator of South Africa (NERSA) and the Department of Energy (DOE) and pipeline owners Transnet, is meeting on a regular basis to assess the situation and minimise supply disruptions. The new multi-product pipeline (NMPP) used for the first time on 11 January 2012, is expected to help speed up supply to the inland regions. According to the Transnet group CEO Brian Molefe, "We are now able to concurrently run the Durban to Johannesburg pipeline and the NMPP with petroleum products that will see some three million litres per hour ... flowing between Durban and Johannesburg every week." The diesel took a week to travel 555km, passing through three pump stations and over the Drakensberg escarpment, from the Durban port to the Jameson Park inland terminal in Heidelberg, at a speed of 6kph to 7kph. Two more terminals have to be constructed but once complete, probably within the next 18 months, the pipeline will be able to transport 95-octane and 93-unleaded petrol, 500ppm and 50ppm diesel, jet fuel and gas. The entire project is expected to cost at least R23.4bn. Sasol has now built an 800km natural gas feeder pipeline from the natural gas fields in Pande and Temane in Mozambique, which it also uses as feedstock. Government subsidies used to be needed, as synthetic production is more expensive than crude oil refining at world crude oil prices of $18 to $20 a barrel. However at current prices of around $100 to $120 a barrel, Sasols plants are experiencing large profits. Despite these recent investments, the petrol and lubricants sector is at a crossroads. Currently the sector faces daunting challenges similar to the electricity sector in that demand is outstripping supply. The six refineries in the country are operating at full capacity. Increasing use of imports has become necessary and the crude oil refineries are aging, most built in the early 1960s and there is need for extensive investment particularly to meet cleaner fuel specifications. Thus, decisions will need to be made soon as to the future of the sector.

Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 12 of 66

South African Refineries and Their Capacities

South African Refining Capacity (bbl/day) 1992 1997 2007 Sapref 120 000 165 000 180 000 Enref 70 000 105 000 125 000 Chevref 100 000 100 000 100 000 Natref 78 000 86 000 108 000 Secunda 150 000 150 000 150 000 PetroSA 45 000 45 000 45 000 Coega/Western Cape Mafutha TOTAL 563 000 651 000 708 000 ML/Annum 32 664 37 769 41 076 Imports/Biofuels ML/Annum TOTAL 563 000 651 000 708 000 2009 2017 Base 180 000 180 000 125 000 125 000 100 000 100 000 92 000 92 000 150 000 150 000 45 000 45 000 Refinery Expansion Scenarios 2017a 2017b 2017c 360 000 180 000 180 000 125 000 100 000 92 000 92 000 92 000 150 000 150 000 150 000 45 000 45 000 45 000 400 000 310 000 80 000 872 000 867 000 857 000 50 591 50 301 49 721 500 500 500 880 618 875 618 865 618 2017d 360 000

92 000 150 000 250 000 852 000 49 430 1 000 869 236

692 000 40 148 4 000 760 945

692 000 40 148 10 000 864 363

[Source: SAPIA]

There are five possible configurations for the future. 1. A grassroots refinery would be built with a capacity of around 350 000 barrels per day in order to achieve the economies of scale required of international markets. Hence the proposed refinery at Coega is mooted at 400 000 barrels per day. 2. The Base case in the table above shows that to achieve the estimated demand of 865 000 barrels a day, with no additional refining capacity, South Africa would require 10 000 megalitres of main fuels (petrol, diesel and kerosene) to be imported into the country by 2017. This appears to be the preferred case of the owners of the crude oil refineries in the country as significant export refining capacity is coming on stream in the Arabian Gulf and India which could supply the countrys needs at the minimal cost of increasing import facilities. 3. Expansion scenario 2017a in the table envisages no new build at Coega but a substantial brownfields expansion at SAPREF and investment at the aging refineries of Chevref and Enref to meet new clean fuels specifications and environmental upgrades which are expected to be very costly. These two plants were built 50 and 60 years ago and are now located within urban areas and need significant investment. 4. Scenarios 2017b and 2017c see the closing of both Chevref and Enref and the building of either the full envisaged Coega at 400 000 barrels per day or a smaller Coega, but still with sufficient scale and the mooted coal to liquids plant in Limpopo. However Mafutha in Limpopo will need government support and due to its process of coal gasification, is environmentally problematic. Both these scenarios are accompanied with a measure of imports. 5. Finally 2017d envisages a smaller Coega, at less cost but with less economies of scale, and a significant brownfields investment at SAPREF. The marginal refineries at Enref and Chevref are also to be closed as in scenarios 2017b and 2017c. More imports are envisaged here as well. 2017d is likely to be the most capital cost effective. However the operational costs of moving refined petroleum product from Coega to the main markets still needs to be factored in.

Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 13 of 66

The regulations covering the Liquid Fuels Industry in South Africa are being overhauled. The current MPAR-based regulation comprising the MPAR, Service Differential and Dealer Margin is being replaced with mechanisms based on the Capital Asset Pricing Model (CAPM) and the Weighted Average Cost of Capital (WACC) applied to a rate base calculated by using activity based regulatory accounts and similarly based costs. This is explained in greater detail under Regulations. The market for lubricants in South Africa is diverse and for this reason it is difficult to establish industry growth or decline. However vehicle sales have recovered strongly in the past couple of years although drainage periods are more drawn out. Car sales are leading indicators of upswings in the economic cycle and GDP in South Africa is expected to grow out of the recession of 2009 and hover around the 3.5% to 4% level for the medium term. Forecast South African Economic Performance

Real GDPandit'sspendingcomposition(%Change) Forecast 2010 2011 GDP 2.8 3.5 Private Consumption 4.6 4.8 GovernmentConsumption 4.6 4 GrossFixedInvestment 3.6 2 ExportGoods&Services 5.4 7 ImportGoods&Services 10.4 11 Change inStocks 0.5 1 DomesticDemand 4.1 4.5

2012 2013 2014 3.7 3.9 4 4.5 4.2 4.5 4 4 5 5 7 10 5 6 5 10 10 10 1 0.5 0.5 4.6 4.7 5 Source:FirstNational Bank

The lubricant sector is more labour-intensive than fuels as technical skills are important in ensuring that the appropriate product is applied to the relevant application. Most major lubricant brands have their own laboratories where used oil is analysed to understand the potential and actual problems of an engine. The retail market in South Africa is close to maturity as there is little room for an increase in the number of service stations. There is, though, dynamism in this market, characterised by the closure of marginal sites (low volume sites) and the opening up of new sites in prime positions. These new sites, as is the global trend, are characterised by larger forecourts and new services that are not necessarily petroleum related, such as convenience stores and car washes. 4.1.1 Regulations

Due to the oil embargo imposed on South Africa in the Apartheid era, oil procurement was largely done by the Governments' Strategic Fuel Fund or SFF. With the disappearance of apartheid and the lifting of sanctions, oil companies now purchase their own crude oil supplies directly from international markets. Each company has its own trading division which secures any crude oil or

Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 14 of 66

refined product it needs and arranges for this to be fed into their refineries or on shore distribution networks. No regulations govern the procurement of crude oil. The SFF still exists to secure Parastatal needs such as PetroSA, but trading activity is limited. The current regulatory framework around the oil industry evolved over the past fifty years. An important part of Governments control of the Oil Industry is control of the margins that can be earned across the value chain. Initially Government controlled the entire oil industry value chain including refining. However as outlined in the diagram below, this regulation now starts at the refinery gate and ends at the retail service station. Current/Outgoing Government Regulation of the Oil industry

OUTGOING REGULATION

Mechanisms Costs + 25% profit margin Cost recovery; seconry distr 15% ROA triggered outside 20% & 10% DEALER MARGIN 24.5 c/l DEALER MARGIN SERVICE DIFFERENTIAL

WHOLESALE MARGIN

Beneficiaries Service Station Dealer Oil Companies Oil Companies Government - Oil Industry collects 20% of all indirect taxes Changes as prices move in a month Transnet and Oil Companies Crude Oil & Synthetic Fuel Producers and Refiners

Government

GOVERNMENT DUTIES AND TAXES

UNDERRECOVERY or OVERRECOVERY

Transnet tariffs; primary distr

ZONE DIFFERENTIAL

No competition between refiners and importers

BFP

This highly regulated sector is currently undergoing transition from an outdated regulatory margin system based primarily on what is known as the Marketing of Petroleum Activities Return (MPAR) to transparent margin mechanisms based on widely accepted theoretical models such as the Capital Asset Pricing Model (CAPM) and the Weighted Average Cost of Capital (WACC). In the past the target rate of return was set by a black box where nobody was clear of the rate of returns derivation. However the new system is founded on clearly visible criteria such as Equity Market Risk Premiums, Risk Free Rates as published in the press and company betas derived from share prices.

Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 15 of 66

New Proposed Oil Industry Regulatory Mechanisms 2011

CURRENT REGULATION VS TASK 141 - November 2011

CURRENTREGULATION

(DEALERMARGIN 85.2c/l) WholesaleMargin 54.1c/l`

Petrol ULP95

TASK141PROPOSEDREGULATION

(RetailOpMargin 59.7c/l) (RetailInvestorMargin 55.8c/l)

WholesaleMargin 27.7c/l

SecondaryDistributionMargin 8.4c/l

141

ServiceDifferential11.4c/l ZoneDifferential22.9c/l

SecondaryStorageMargin 12.6c/l TRANSPORTCOST PRIMARY22.9c/l

GOVERNMENTDUTIESANDTAXES 274.25c/lULP95Petrol

UNDERRECOVERY OROVERRECOVERY

GOVERNMENTDUTIESANDTAXES 274.25c/lULP95Petrol

UNDERRECOVERY or OVERRECOVERY

CoastalStorageMargin 1.4c/l

BASICFUELPRICE 629.15c/l

BASICFUELPRICE 629.15c/l

PumpPrice=1077c/l

Difference 15c/l PumpPrice=1092c/l

[Source: DOE]

The process is being implemented, but is not expected to be fully applied until the end of 2012. The following explains the current petrol price build up as at November 2011. The Dealer Margin was based on a survey of costs of a sample of 100 service stations undertaken by the Small Business Advisory Bureau (SBAB) of the North West University, the basis of which is that operating costs should be 80% of gross profit. This methodology was developed from the SBABs 1997 report. The guideline related to costs in relation to gross profit was defined as follows: The SBABs guideline is that costs should not absorb more than 80% of the gross profit. The report proceeds to say that: The average, according to the investigation, is 95,28%. This is well above the norm, but a substantial improvement to the previous investigation is realised. This is also due to the fact that there was an increase in the gross profit margin1

Small Business Advisory Bureau (NWU): Retail Margin Investigation, November 1998, Page 15

Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 16 of 66

The dealer margin comprised 7.9% of the Price Build-Up in November 2011 and is a greater amount than the Industry Margin which stood at 5.0% in the same month. The new regulation being introduced by government is predicated on what is known as a Benchmark Service Station (BSS). Here a benchmark fuel only site has been designed and the operating costs and assets evaluated. The BSS margin contains a reward for building the service station, for running the service station, any entrepreneurial reward and any other costs (repayment of key money) that the dealer or oil company may have incurred or will incur in running the service station. The BSS margin is a lot higher than the old dealer margin because the capital outlay in building the service station now rests in the BSS margin and not the wholesale margin. Those dealers that own their own sites will make a handsome margin and oil companies need to negotiate with their franchisees to extract the margin that is due to them. The dealer under the new regulation is in a powerful position. Industry/Wholesale Margin. The composition and derivation of the Industry Margin via the MPAR Mechanism where the Oil Industry earns a 15% return on assets and an adjustment is made to the margin should this return fall below 10% or rise above 20%. Suffice to say that the Industry Margin mechanism is being changed. History of Petrol Wholesale Margin

PetrolWholesaleMargin

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005** 2006 2007 2008 2009 2010***

MPAR return (%) Indicated margin increase (c/l) Increase granted (in succeeding year) Margin at year end (c/l)* (1,6) 4,0 _ 5,6 3,4 4,0 4,0 9,6 8,7 2,3 4,0 13,6 13,9 0,0 0,5 14,1 12,0 0,0 0,0 14,1 9,2 2,7 0,0 14,1 6,8 4,9 0,0 14,1 8,8 3,6 2,0 16,1 9,7 2,5 1,0 17,1 7,3 3,81 0,5 17,6 4,0 6,75 1,23 18,8 3,8 6,93 2,58 21,4 1,9 8,97 6,93 28,3 9,72 3,21 8.97 37,3 21,22 (4,21) 2,0 39,3 _ _ _ 39,3 _ _ _ 39,3 _ _ _ 39.3 _ _ 5.4 6.2 3.0 44.7 50.87 53.869

*Petrol 93 Octane **The Marketing of Petroleum Activities Return (MPAR) system was no longer in use from 2005. A new system is being developed. ***The Minister of Minerals and Energy approved a wholesale margin increase of 3.0 c/l from 1 December 2010

[Source: SAPIA Annual Report]

The service differential is an actual average of depot storage and distribution costs from the depots to service stations and bulk commercial customers, and is determined by the DOE on audited figures supplied by the petroleum industry and averaged for the whole country. Thus, this element of the regulated pricing regime compensates the oil marketing companies for the actual cost of operating the depot and the costs for distributing the product to the service stations and other commercial customers. It is calculated by using total fuels volumes uplifted and delivered from oil company depots for regulated products, namely petrol, diesel, and illuminating paraffin. Furthermore, it is calculated on actual historic cost for the previous year for the whole Industry, averaged country-wide. The capital costs in respect of storage and handling at depots are compensated through the MPAR formula or the wholesale margin. Therefore exactly the same amount in SA cents per

Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 17 of 66

litre is included in the wholesale price, independent of the actual distance between the depots and the customer. The service differential was increased in 2010 to 11.4 cents per litre and as at November 2011 comprised 1.1% of the Price Build-Up. This element has been reviewed under Task 141 and the capital costs and operating costs have been consolidated into the new margins. No longer is the capital cost sourced from the wholesale margin. Furthermore the Service Differential has been split into its two components of Secondary Storage and Handling and Secondary Distribution with a margin in cents per litre for each. The combined margin for these two mechanisms is currently 21 c/l compared to the Service Differential at 11.4 c/l as mentioned above. The objective of government in this new process is to encourage investment in these avenues as stand alone, transparent activities rather than dominated by the integrated oil companies. Government Duties and Levies are set by the authorities. Government Duties & Levies 95 Octane Unleaded in November 2011

2011 RSA c/litre Nov Equalisation fund levy Road Pipeline accident Levy fund 0.15 80 Transport Recovery Pump Levy Rounding 3 -0.4

Customs Fuel tax & excise 177.5 4

Slate levy -

DSML 10

TOTAL

64.7%

1.5%

0.1%

29.2%

3.6%

1.1%

0.1%

274.25 100.0%

[Source: DOE]

The Zone Differential is the cost of moving petroleum products to Inland Areas away from the Coast. It is based on rail tariffs and increases progressively as the petroleum product moves inland. The cost of 22.9 c/l shown in South African Price Build-Up November 2011 above reflects the cost of movement of refined product from the Durban coast to Gauteng. Over and Under-recovery reflects the difference between the cost of purchasing refined petroleum product and the price paid for that petroleum product by the motorist. As the cost of petroleum product changes daily, while the price to the motorist or consumer only changes monthly there is a mismatch between procurement and sales. This difference is especially great when petroleum product prices are rising or falling quickly as was seen in 2008 when prices spiked prior to the global economic meltdown caused by the credit crunch. No value has been attached to this element in the diagram as it could be a negative or positive, or it could be inconsequential. Basic Fuel Price (BFP). The two biggest components of the price build-up are Government taxes at 25.5% of the pump price and the Basic Fuel Price or BFP, which stood at 58.4% of the pump price in November 2010. The bulk of South African products are refined locally. Where there are shortages, products are imported. The crude oil refineries' profitability derives from the difference between the cost of crude oil and the cost of refining versus the BFP.

Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 18 of 66

BFP is the price at which the refiners hand over their product to the Marketers. This is the price that an importer of refined product into South Africa would pay for fuel. It includes freight, insurance, ocean loss, landing, wharfage, coastal storage, the financing of that coastal storage and demurrage from refining centres in the Mediterranean, Arab Gulf and Singapore as shown in the diagram below. The IP and diesel prices are weighted 50% of the spot prices originating from the Mediterranean and 50% of those prices from the Arabian Gulf, while the petrol price is derived from 50% Mediterranean and 50% Singapore. The aim is to obtain the most competitive prices from the most competitive refining centres. The other components of BFP are based principally on international prices formulated in international markets. At current high prices of crude oil BFP makes the synthetic fuel industry more viable. Components of the Basic Fuel Price

Basic Fuel Price

Med

Platts Product Prices (Spot) Med & Arabian Gulf for Diesel & IP Singapore and Med for Petrol

AG

Singapore

BFP South Africa

Shipping Costs �Freight �Insurance �Landing �Wharfage �Finance �Storage �Demurrage

FOB Values USc/Ag 100% Spot

[Source: BPSA]

Illuminating Paraffin and diesel have a maximum government controlled price at the wholesale price level in the case of the commercial marketers, (that is, there is no additional service station dealer margin). While no discounting of service station petrol pump prices is allowed, the different oil company commercial marketers are allowed to compete for customers by discounting the price of their products.

Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 19 of 66

4.1.2

BEE

Recent developments include the licensing of all players to promote Black Economic Empowerment, investment and create employment opportunities and small business BEE - The South African crude oil industry is dominated by foreign owned multinationals which have all been proactive in seeking local Black Economic Empowerment partners to comply with the Oil Industry Charter. The Oil Industry Charter was one of the first BEE initiatives and it is not seen as progressive. As a result, the Government has challenged the Oil Industry to come up with better plans on BEE.

4.2

Regional

The Liquid Fuels Industry is regional with most companies represented within the South African Customs Union (SACU) and the bigger players also having a presence in the Southern African Development Community (SADC). The biggest oil companies in the world are represented in South Africa, with the exception of Exxon/Mobil, which exited South Africa in the late 1980s with the strengthening of sanctions against Apartheid. However, they have started to build a presence in the lubricant market. Recently BP and Shell sold several of their Africa operations North of the Limpopo to concentrate on their global exploration and production divisions. As mentioned earlier, the estimated size of the South African lubricants market is 400 million litres. The other countries in the Region are a lot smaller than this. Estimated size of Lubricants Market of selected African Countries

Lubrica nts 2008 2009

Botswa na ML

Ma la wi T a nza nia Za mbia ML ML ML

Retail Commercial

47 40 18% 82%

3 5 21% 79%

12 9 22% 78%

14 16 20% 80%

The table below shows that Botswana is a relatively rich country with a per capita income of around $6500. This higher level of development is evidenced by its relatively high consumption of lubricants and is a function of its diamond mine output and relatively higher vehicle levels. The global economic collapse in 2009 affected diamond production and hence lubricant sales declined in 2009. Zambia has a sizable copper mining industry and this countrys lubricant consumption is also relatively high. Copper prices did not fall much in the global credit crunch of 2009 and hence lubricant volumes remained at high levels in 2009.

Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 20 of 66

Malawi and Tanzania are relatively undeveloped countries although there is potential for growth in both countries. The market share of the marketers of lubricants in selected African countries is shown in the table below. The information is relatively dated, but it takes time to build market share in a country so that the major market players are unlikely to have changed. Estimated Market Share of Selected African Countries

South & East Africa Lubricants

Botswa na E st Ma rke t Sha re Ma la wi Est Ma rke t Sha re Moza mbique Est Ma rke t Sha re N a mibia Est Ma rke t S ha re T a nza nia Est Ma rke t S ha re Za mbia Est Ma rke t Sha re

E stimate d 2000 M arke t Share

BP CALT E X CFP EN GEN S H E LL CAST R OL 27.4% 14.8% 6.4% 20.4% 30.6% 0.4% BP 55.4% BP 57.9% BP 17.5% BP 27.2% BP 70.8% Mobil 29.0% P 'Moc 10.2% S H E LL 31.2% Agip 40.8% Ca lte x 11.0% Ca lte x 7.5% Mobil 12.8% CALT EX 22.7% Ga pco 1.1% Agip 4.0% T ota l Int. 8.1% T ota l 7.9% EN GEN 13.5% Ga poil 4.7% T ota l 5.0% Moa cor Othe rs 0.7% OT H ER 8.7% T ota l 20.5% Mobil 9.1% 10.5% T OT AL 6.4% N a toil 0.4% Jove nna 0.2% Elf Oil 4.4% Ody's 0.0% Mobil 0.8% E nge n 0.0%

The following table shows the relative socio-economic performance of South Africa and its fellow member countries in the Southern African Development Community. SADC relative Socio-Economic Performance

SADC Statistics GNI PER CAPITA 2008 US$ SEYCHELLES BOTSWANA MAURITIUS RSA NAMIBIA ANGOLA SWAZILAND LESOTHO ZAMBIA TANZANIA MADAGASCAR MOZAMBIQUE MALAWI CONGO, DEM REP ZIMBABWE AVERAGE SADC TOTAL SADC EURO AREA $ 10 290 $ 6 470 $ 6 400 $ 5 820 $ 4 200 $ 3 450 $ 2 520 $ 1 080 $ 950 $ 440 $ 410 $ 370 $ 290 $ 150 $ 3 060 GDP GDP GROWTH POPULATION INFLATION (GDP DEFLATOR) 2008% 25.0% 17.0% 8.0% 11.0% 12.0% 20.0% 3.0% 10.0% 11.0% 9.0% 10.0% 7.0% 9.0% 19.0% 12% 3.0% LIFE EXPECTANCY AT BIRTH 2007 years 73 51 72 50 53 47 46 43 45 55 60 42 48 46 44 52 80 LAND AREA km2 000's 0.5 581.7 2.0 1 219.1 824.3 1 246.7 17.3 30.4 752.6 945.1 587.0 801.6 118.5 2 344.9 390.8 657.5 9 280.3 2 585.2

2008 2008% on US$billion 2007 $ 0.8 $ 13.0 $ 8.7 $ 276.8 $ 8.6 $ 83.4 $ 2.6 $ 1.6 $ 14.3 $ 20.5 $ 9.0 $ 9.7 $ 4.3 $ 11.6 3.0% -1.0% 5.0% 3.0% 3.0% 15.0% 2.0% 4.0% 6.0% 7.0% 7.0% 6.0% 10.0% 6.0% 5% 1.0%

2008 millions 0.1 1.9 1.3 48.7 2.1 18.0 1.2 2.0 12.6 42.5 19.1 21.8 14.3 64.2 12.5 17.5 260.3 325.9

$ 33 $ 451.1 $ 38 821 $ 13 565.5

Source: World Bank, World Development Indicators 2008

Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 21 of 66

The demand growth and drivers in the next five years in the Southern African Region will hinge on progress of the demand for the output for the products in the Retail and Commercial sectors which consume lubricants. Vehicle sales in most countries particularly north of the Limpopo come off a very low base and there is huge potential for a structural shift upwards as these economies continue to grow as they have in the past couple of years. Similarly industry is underdeveloped and if the countries are able to break out of the poverty cycle there is much potential. The barriers to entry comprise the poor infrastructure and underdeveloped markets, as well as the lack of scale. It is important for a lubricants marketer to have a firm foothold in South Africa from which to base any move into Africa north of the Limpopo.

4.3

International

The likelihood is that crude oil prices will remain high with the emerging economy giants of China and India having 40% of the worlds population and growing at around 7% to 10% per annum. Both require imported crude oil as they have little reserves of their own and political uncertainty in oil-producing countries continues to cause uncertainty and rising costs. This means that liquid fuel import costs will continue to displace other factors of production and reap economic rent for countries with reserves of crude oil and impoverish countries that need to import this commodity.

SWOT ANALYSIS

The liquid fuels sector is world class and is operated by most of the worlds largest multinational corporations. o The logistics of this sector adequately provides fuel and lubricants across the wide expanse of South Africa and its closest neighbouring countries. o This sector provides fuel and lubricants which meet international specifications in terms of quality and safety.

Strengths o

Weaknesses o o o The newest crude oil refinery was built 40 years ago and the oldest 60 years ago. Little investment in logistics and infrastructure has taken place in the past 20 years. A refinery is capital intensive and carries high fixed costs and it must therefore be run at high capacity to cover these costs. o All refineries are operating at full capacity and more and more imports are necessary. Opportunities o The regulatory regime has been revised to a more transparent and fair system to encourage investment by all parties not merely oil multinationals. o Investment in refining and/or import facilities.

Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 22 of 66

Oil multinationals are divesting of pieces of their businesses allowing local/BEE companies to enter the oil arena.

Threats o Crude oil and petroleum product prices have remained high and threaten to lower oil intensity in production and lead to more oil efficiency. o o Biofuels are likely to increase in usage in the next 20 to 30 years. Oil reserves will peak and then fall and production will begin to decline as big consumers such as China and India take the place of previous large markets such as the USA and Europe.

FUTURE OUTLOOK

The new regulatory structure discussed above should encourage more players to enter the liquid fuels industry which will assist in meeting the goals of providing refined petroleum products at the cheapest possible cost to the consumer with a fair return to the Petroleum Industry. South Africa needs significant investment in the Liquid Fuels Sector. All refineries are operating at capacity and significant refined petroleum product is being imported. The problem of supply inland has recently been solved with the introduction of the NMPP from Durban to Gauteng. However, not before extensive, expensive road bridging had to take place. A new refinery is needed and PetroSA seeks to build a 400,000 barrel a day crude refinery at Coega, to be ready in 2017. It is expected to cost $11 billion and is currently at the pre-feasibility stage. However this will not be before some 8 to 10 billion litres or 25% of demand is being imported annually. The challenges of burgeoning demand requiring urgent investment particularly in logistics to cope with higher imports and competitive reward for this investment via the regulatory system, while still maintaining the lowest possible price to the consumer, make this strategic sector vulnerable to underperformance in the short to medium term. In the medium to longer term decisions must be made about domestic refinery capacity and the relative cost of building a new refinery versus importing refined petroleum product on a large scale and the security of supply issues that comes with this. South Africa is a developing country and questions concerning whether or not can it afford to spend $11bn building a new refinery which would have to export refined petroleum product at a loss at times have been raised.

Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 23 of 66

ASSOCIATIONS AND REFERENCES

Mr Avhapfani Tshifularo Tel: +27 11 783 7664 Website: http://www.sapia.co.za

South African Petroleum Industry Association (SAPIA)

Fuel Retailers Association Mr Reggie Sibiya Tel: +27 11 886 2664 Email: reggie.sibiya@fra.org.za National Electricity Regulator Mr Nhlanhla Cebekhulu Tel: +27 12 401 4768 Department of Energy Mr Ntuthuzelo Fikela Tel: +27 12 317 8647 Website: http://www.energy.gov.za http://www.fischertropsch.org/primary_documents/presentations/acs2001_chicago/chic_slide01.htm Sasol 2011 Annual Report

Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 24 of 66

APPENDIX 1

Typical Refinery Operation

what is a refinery?

Energy Products +$ LPG Petrol Naphtha Kerosene Diesel/Gas Oil Lubes Waxes Bitumen Heavy Fuel Oil/ MFO Losses Fixed Costs -$

[Source: BPSA]

Increasing Boiling Pt & Molecular wt

Crude Oil Other Feeds

Fuel Gas and Oil

The Sasol synfuel plants at Secunda in Mpumalanga operate the worlds only commercial coalbased synfuels manufacturing facilities. These produce synthesis gas through coal gasification and natural gas reforming using the Fischer-Tropsch conversion technology. Syngas is a mixture of carbon monoxide and hydrogen. Using a catalyst, the Fischer-Tropsch reaction coverts syngas into feedstock to produce liquid fuels. PetroSA converts natural gas into liquid fuels. These two processes produce far more high octane and thus more valuable products and little fuel oil. The diagrams below outline the two synthetic processes.

Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 25 of 66

Coal to Liquid Fuels Synthetic Refining Process

Coal to Liquids Refining

Oxygen Gas feedstock for Petrochemicals

LPG

Coal

Coal Gasification

Gas

Clean Gas Gas HTFT Clean-up Synthol Process

Syn Crude

Conventional Refining:

Cat Reforming Cat Poly Hydrogenation

Petrol

Jet / Paraffin Diesel Fuel Oil

Steam

Alcohols

[Source: IPSR]

Natural Gas to Liquid Fuels Synthetic Refining Process

Gas to Liquids Refining

Gas feedstock for Petrochemicals

Oxygen

LPG

Syn Crude

Natural Gas

Gas Reforming

Clean Gas

HTFT Synthol Process

Conventional Refining:

Cat Reforming COD Alkylation Isomerisation Hydrogenation

Petrol

Jet / Paraffin Diesel Fuel Oil Alcohols

[Source: IPSR]

Steam

Copyright Who Owns Whom (Pty) Ltd

MANUFACTURE OF PETROL AND LUBRICANTS SICCODE 332 February 2012

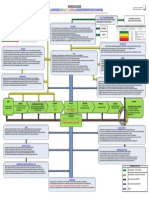

Worldwide African Investment Holdings (Pty) Ltd (WAIH) 100% Petronas International Afric Energy Corporation Ltd Resources (Pty) Ltd 80% Engen Ltd 100% 50% ENGEN PETROLEUM LTD Employees : 3 379 Est. Turnover: R73,003.0m (2009) Production: 125 000 barrels / day 20% Shell South Africa Holdings (Pty) Ltd BP Plc - 75% Mineworkers Investment Company (Pty) Ltd - 17.5% Womens Development Bank - 7.5%

Total Overseas Holding (Pty) Ltd - 50.1% Main Street 87 (Pty) Ltd - 25% Industrial Partnership Investments Ltd - 24.9% BP Southern Africa (Pty) Ltd 50% SHELL & BP SA PETROLEUM REFINERY (PTY) LTD Employees : 730 Production: 180 000 barrels / day The largest complex oil refinery in South Africa and produces leaded and unleaded fuels, low sulphur diesel, lubricants, asphalt product slate, aliphatic hydrocarbon solvents and industrial processing oils and sulphur. Capacity is 35% of SA total. Brand Names:

ORGANOGRAM

TOTAL SOUTH AFRICA (PTY) LTD Employees : 800

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Copyright Who Owns Whom (Pty) Ltd

Produces, through the process of refining crude oil, primary refined petroleum products, including gas, oils, fuels, petrols, diesels, paraffins, furnace oils, liquid petroleum gas, lubricants, specialised lubricants, greases, greases with synthetic additives, coolants and brake fluids. Products are sold through the Engen Marketing division of Engen Petroleum. Brand Names: Sasol Ltd Chevron Corporation USA 100% Chevron Global BEE Consortium Employees Share Trust Energy Inc SASOL WAX (Div of Sasol Chemical Industries Ltd) Employees : 500 Est. Turnover: R2.5m (2011) Involved in the manufacture of wax and paraffin, which is retailed to local candle manufacturers and also exports wax to overseas clients who manufacture inks, adhesives and paraffin. Ashland Inc 23% 2% 75% CHEVRON SOUTH FRICA (PTY) LTD Employees : 1 500 Est. Turnover: R67,125.4m (2009) Production: 110 000 barrels / day VALVOLINE SOUTH AFRICA (PTY) LTD Employees : 15 Involved in the manufacture, marketing and distribution of petroleum products as well as the manufacture and distribution of lubricating oils and grease. Involved in the refining and distribution of petroleum products such as petrol, diesel, power paraffin, oils, and grease which are sold under the brand name, Caltex, to filling stations, retail outlets, and cooperatives. They have 50 to 60 depots situated countrywide. The company also operates laboratories at the refinery and other plants. Brand Names:

Involved in the manufacture, marketing and distribution of petroleum products as well as the manufacture and distribution of lubricating oils and grease.

Government Employees Pension Fund - 13.3% Industrial Development Corporation of South Africa Ltd - 7.9%

75%

Sasol Oil (Pty) Ltd

36.36%

63.64%

NATIONAL PETROLEUM REFINERIES OF SA (PTY) LTD Employees : 573 Production: 108 500 barrels / day

Undertakes the refining of crude oil, on behalf of its shareholders, for a processing fee. It is equipped with sophisticated conversion units which transform crude oil to petrol, jet fuel and diesel. The refinery is located about 500km inland and within a hundred kilometers of Johannesburg. Crude oil is transported to Sasolburg by means of a pipeline which runs from Durban. Brand Names:

Page 26 of 66

Copyright Who Owns Whom (Pty) Ltd

Page 1 of 2

Whilst every care has been taken in compiling this organogram, the company does not accept liability of any nature in the event of errors or omissions.

MANUFACTURE OF PETROL AND LUBRICANTS SICCODE 332 February 2012

Deojay Holdings (Pty) Ltd 100%

PISTON POWER CHEMICALS CC

DEOJAY PETROLEUM KZN (PTY) LTD Employees : 10

GERM AFRICA (PTY) LTD Employees : 27

PETROLEUM MARKETING ORGANIZATION (PTY) LTD Employees : 42

independent manufacturer of lubricants with automotive, agricultural and industrial applications. Specialize in the marketing and distribution of internationally branded lubricants. Involved in the importation, blending and distribution of specialised industrial lubricants

Manufactures and distributes compounded and blended lubricating oils as well as greases.

Manufacture of Petrol and Lubricants Siccode 332 & 63500

The Scarborough Family Trust Kathgar Trust 100% 74% KZN OILS (PTY) LTD Employees : 84 26% BLUE CHIP LUBRICANTS (PTY) LTD Employees : 30 Mr R Reddy Phaphama

Copyright Who Owns Whom (Pty) Ltd

FUCHS LUBRICANTS (SOUTH AFRICA) (PTY) LTD Employees : 117 Manufacturer of industrial and specialised oil lubricants, which are supplied to the mining, automotive and other industries. Involved in the wholesale and distribution of industrial, marine and automotive fuel and oil. Independent manufacturer and distributor of specialised automotive and industrial lubricants and greases, supplying clients in the automotive and mining industries. Department of Minerals & Energy 100% CEF (Pty) Ltd 100% H AND R SOUTH AFRICA (PTY) LTD Employees : 36 H & R Wasag AG 100 % THE PETROLEUM OIL & GAS CORPORATION OF SA (PTY) LTD t/a PETROSA Employees : 1 836 Est. Turnover: R10,565.0m (2011) Production: 45 000 barrels / day Involved in the exploration and production of oil and gas, and the production and marketing of synthetic fuels and petrochemicals. Major clients include Caltex, Engen and Shell. involved in the manufacture and wholesale of core petroleum products, comprising: Base oils Petroleum jelly Process oils Agricultural spray oils Wax products

100%

INDY OIL SA (PTY) LTD Employees : 57

Involved in the manufacture of automotive oils and industrial lubricants, as well as chemical cleaners and organic oils.

Spanjaard Group Ltd - 55.3% Ms E Nepgen - 8.7% Mr RJW Spanjaard - 8.4%

SPANJAARD LTD Employees : 107 Est. Turnover: R102.1m (2011)

Manufacturer and distributor of specialised lubricants and allied chemical products for the industrial, automotive, marine and mining markets.

Page 27 of 66

Copyright Who Owns Whom (Pty) Ltd

Page 2 of 2

Whilst every care has been taken in compiling this organogram, the company does not accept liability of any nature in the event of errors or omissions.

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 28 of 66

COMPANY PROFILES

BLUE CHIP LUBRICANTS (PTY) LTD Reg. Number: 1983/001294/07 VAT Number: 4690105061 BEE Rating: Level 4 BBBEE Rating Agency Postal Address: P O Box 940, North Riding 2162 Tel: Email: Shareholders Shareholder Kathgar Trust Management Name Ms Chrissie Froneman Ms Kathleen Marais Mr Gary Victor Marais History of Business Blue Chip Lubricants (Pty) Ltd was registered in February 1983 as Stryde Lubricants (Pty) Ltd. The company underwent a name change on 29 September 1989 to Blue Chip Lubricants (Pty) Ltd. Nature of Business Blue Chip Lubricants (Pty) Ltd is a manufacturer of industrial and specialised oil lubricants, which are supplied to the mining, automotive and other industries. Nr. of Employees Banks Auditors Brandnames Blue Chip Lubricants 30 Standard Bank of South Africa Ltd Alchemy Financial Services Position Franchise & Marketing Manager Executive Director Managing Director kathleen@bcl.co.za Email Appointed Percentage 100.00 +27 11 462 1829 info@bcl.co.za Physical Address: Units 10, 11 & 12, First Floor, Executive City Industrial Road, Kya Sand, 2169 Fax.: Website: +27 11 704 1367 www.bcl.co.za Updated: 2012-02-03

Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 29 of 66

CHEVRON SOUTH AFRICA (PTY) LTD Trading As: Caltex Reg. Number: 1911/001154/07 VAT Number: 4460101563 Postal Address: PO Box 714, Cape Town 8000 Tel: Email: +27 21 403 7911 queries@chevron.com Physical Address: Chevron House, 19 DF Malan Street Foreshore, Cape Town, 8001 Fax.: Website: +27 21 403 0550 www.chevron.com Updated: 2012-02-09

Shareholders Shareholder Chevron Corporation USA via Chevron Global Energy Inc BEE Consortium Employee Trust Management Name Mr B Forbes Ms Yoliswa Pumla Balfour Ms Teresa Booth-Oliveira Ms Colleen Carr Mr Martin Nigel Andrew Donohue Mr Kevin John Mulder Mr SPA Parker Mr Shashi Rabbipal Mr Mashudu Elias Ramano Mr Mpho Innocent Scott Mr James Kiki Seutloadi Mr Trevor John Stallbom Mr Arthur Peter Wilson Position Director Non-Executive Director Commercial Manager Human Resources Manager Chief Executive Officer Executive Director Director Alternate Director Non-Executive Director Non-Executive Director Executive Chairman Executive Director Financial Director 2010-07-01 2010-09-10 2008-11-01 2003-03-10 2003-03-10 2010-05-01 2003-03-10 Email Appointed Percentage 75.00 23.00 2.00

Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 30 of 66

History of Business Chevron South Africa (Pty) Ltd was established in May 1911 as The Texas Company (South Africa) Ltd. On 27 December 1940, the name was changed to Caltex (Africa) Ltd. A further name change occurred on 4 November 1964 to Caltex Oil (SA) Ltd. However, on 15 June 1975, the company converted to a private company and on 1 October 2005 Caltex Oil (SA) (Pty) Ltd underwent a name change to Chevron South Africa (Pty) Ltd t/a Caltex. Nature of Business Chevron South Africa (Pty) Ltd t/a Caltex is involved in the refining and distribution of petroleum products such as petrol, diesel, power paraffin, oils, and grease which are sold under the brand name Caltex, to filling stations, retail outlets and co-operatives. The company has 50 to 60 depots, 800 retail outlets, 21 terminals and a fleet of 90 tanker trucks situated countrywide. It also operates laboratories at the refinery and other plants. The refinery produces approximately 100 000 barrels of crude oil per day of which 95% becomes petroleum. Nr. of Employees Empowerment Stake Secretary Banks Auditors 1 200 25% (Black Empowerment Consortium - 23%; Employees Share Trust 2%) Mr Nazeem Hendricks First National Bank (a division of FirstRand Bank Ltd) PricewaterhouseCoopers

Corporate Governance in Relation to AIDS Policy Chevron South Africa (Pty) Ltd t/a Caltex has an HIV/AIDS awareness programme that supports and educates employees and their families. The company offers voluntary HIV/AIDS testing and encourages staff that test negative to stay that way. Those who test positive are educated how to stay healthy and productive for longer. Production Capacity 100 000 barrels of fuel per day Brandnames Caltex, Chevron, Techron, Texaco Trademarks Caltex, Chevron, Techron, Texaco Distribution Rights Caltex, Chevron, Techron, Texaco Subsidiaries, Associates & Investments Name Coal Resources (Pty) Ltd Percentage 100.00

Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 31 of 66

DEOJAY PETROLEUM KZN (PTY) LTD Reg. Number: 2004/007140/07 VAT Number: 4950143992 BEE Rating: Level 2 Emex Postal Address: PO Box 201654, Durban North 4016 Tel: Email: +27 31 569 1276 jackie@deojay.co.za Physical Address: Unit 3A, Rinaldo Industrial Park 50 Moreland Drive, Durban North, 4051 Fax.: Website: +27 31 569 1277 www.deojay-petroleum.co.za Updated: 2012-02-06

Shareholders Shareholder Deojay Holdings (Pty) Ltd Management Name Mr Jacobus (Jackie) Frederick le Roux Ms Nisha Reddy Mr Colin Wright History of Business Deojay Consultants cc was established in July 1994. In March 2004, the company converted to a private company and underwent a name change to Deojay Petroleum KZN (Pty) Ltd. Nature of Business Deojay Petroleum KZN (Pty) Ltd specialises in the marketing and distribution of internationally branded lubricants including its own Deojay Brand range of Automotive and Industrial Lubricants. Nr. of Employees Banks Auditors Brandnames Deojay 10 Permanent Standard Bank of South Africa Ltd Grant Thornton Position Managing Director Financial Manager Technical & Sales Manager Email Appointed Percentage 100.00

jackie@deojay.co.za 2004-03-16

Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 32 of 66

ENGEN PETROLEUM LTD Reg. Number: 1989/003754/06 VAT Number: 4820101451 BEE Rating: Level 3 AQRate Postal Address: PO Box 35, Cape Town 7525 Tel: Email: Branches Branch Engen Petroleum - Bloemfontein Engen Petroleum - Durban Oil Refinery Engen Petroleum - Durban Regional Office Engen Petroleum - Johannesburg Engen Petroleum - Port Elizabeth District Office Divisions Division Communications Corporate Affairs Corporate Planning Enterprise Risk & Assurance Financial Service HSEQ Human Capital International Business Development Lubricants Refinery Sales & Marketing Supply, Trading & Optimisation Shareholders Shareholder Engen Ltd (Held by Petronas International Corporation Ltd - 80%; Pembani) Percentage Undisclosed Area Head Tel Area Free State KwaZulu-Natal KwaZulu-Natal Gauteng Eastern Cape Head Tel +27 21 403 4911 info@engen.com Physical Address: Engen Court, Thibault Square, Cnr Riebeeck & Long Streets, Cape Town, 8001 Fax.: Website: +27 21 403 4067 www.engen.co.za Updated: 2012-02-09

Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 33 of 66

Management Name Mr Mogamat Adnan Adams Mr Kamal Bahrin Bin Ahmad Mr Andrew Muir Bryce Mr Lungile Adonijah Dumse Mr Wayne Patrick Hartmann Ms Tania Landsberg Mr Nkosinathi (Natie) Martin Maphanga Ms Bulelwa Payi Dr Thangaratnam (Bea) Ponnudurai Ms Ivershini Reddy Position General Manager: Enterprise Risk & Assurance General Manager: Refinery General Manager: Financial Services General Manager: Human Capital General Manager: International Business Development Group Communications Manager tania.lansberg@ engenoil.com 2008-04-01 Email Appointed 2007-12-01

2011-01-14 2006-12-01 2004-12-01

2001-09-09

General Manager: Corporate Affairs Executive: Communications General Manager: HSEQ General Manager: Supply, Trading & Optimisation Chief Executive Officer & Managing Director Executive: BEE & Government Relations General Manager: Lubricants General Manager: Corporate Planning General Manager: Engen Sales & Marketing vuyelwa.sono@ engenoil.com

2008-04-01

2007-10-01

Mr Nizam Salleh

Ms Vuyelwa Sono Mr Stephen (Steve) Paul Williams Mr David (Dave) William Wright Mr Vukile Vezithemba Zondani History of Business

2009-01-01

2006-03-24

2006-12-01

The company was established in 1989 as Unicorn Petroleum Ltd and underwent a name change to Genref Ltd at a later stage. In January 1990, the name was changed to Engen Petroleum Ltd. In 1993, Trek Petroleum, Sonap and Mobil were consolidated into the company. In February 2007, the assets and operations of Zenex Oil (Pty) Ltd were acquired and incorporated.

Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 34 of 66

Nature of Business Engen Petroleum Ltd produces through the process of refining crude oil, primary refined petroleum products which include LPG, chemicals, oils, fuels, petrols, diesels, paraffins, furnace oils, liquid petroleum gas, lubricants, specialised lubricants, greases, greases with synthetic additives, coolants and brake fluids. Products are sold locally through the Engen Sales & Marketing Division in South Africa and internationally through its International Business Division which has a wider footprint in sub-Saharan Africa. Engen processes approximately 135 000 barrels of fuel per day and has 1 400 service station dealers. Nr. of Employees Secretary Banks Auditors 3 379 (Group) 617 - Refinery Ms Fiona Gumede Standard Bank of South Africa Ltd Ernst & Young

Corporate Governance in Relation to AIDS Policy Engen has an HIV/AIDS policy that: Provides programmes and activities aimed at HIV/AIDS prevention. Provides support services ensuring affordable and accessible HIV-related healthcare to all employees. Comprehensively manages and supports those infected. Protects the rights of employees with HIV/AIDS, including access to work and privacy of information. Production Capacity 135 000 barrels of fuel per day. Brandnames 1 Plus, 1 Stop, Dieselube, Dynamic, Engen, Engen Diesel Club (EDC), Engen Xtreme, Gearlube, Quickshop, Truckstop, Xtreme

Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 35 of 66

FUCHS LUBRICANTS (SOUTH AFRICA) (PTY) LTD Reg. Number: 1979/003105/07 VAT Number: 4010101253 BEE Rating: Level 8 BEE Rating Solutions Postal Address: 07 Diesel Road, Isando Gauteng,1609 Tel: Email: Branches Branch Fuchs Bulawayo Fuchs Durban Fuchs Lusaka Fuchs Port Elizabeth Fuchs Welkom Fuchs Zimbabwe Management Name Mr Stefan Fuchs Dr Lutz Lideman Dr Georg Lingg Dr Ralph Rheinboldt Dr Alexander Selent History of Business Maxei Oil Refineries (Pty) Ltd was established in June 1979 and was subsequently sold to Mr Frank Kleinman, who changed the name to National Oil (Pty) Ltd. During 1992 the company's name was again changed to Fuchs Lubricants (South Africa) (Pty) Ltd, when the German based multinational company Fuchs PetroLub AG (which is listed on both the Frankfurt and Swiss stock exchanges) acquired 100% of the shares in National Oil (Pty) Ltd. At the same time the local operations of the multinational company Century Oils (Pty) Ltd were merged into the local Fuchs operations. At this time the Noxal Company (Pty) Ltd, a specialist grease manufacturing company, that has been in existence in South Africa since 1921, was also acquired by Fuchs PetroLub AG and merged with the local Fuchs operations. All trading operations ceased in Century Oils (Pty) Ltd and Noxal Company (Pty) Ltd, and the latter companies currently only hold property. Deputy Chairman Position Chairman Email Appointed Area Zimbabwe Durban Zambia Port Elizabeth Welkom Zimbabwe Head Tel +26 39 62434 +27 31 2040700 +26 12 38411 +27 41 5411586 +27 57 3964221 +26 34 751304 +27 11 565 9600 Physical Address: PO Box, Isando Kempton Park, Johannesburg, 1600 Fax.: Website: +27 11 392 5686 www.fuchsoil.co.za Updated: 0000-00-00

Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 36 of 66

Nature of Business Fuchs Lubricants (South Africa) (Pty) Ltd is the largest independent manufacturer and distributor of specialised automotive and industrial lubricants and greases, supplying clients in the automotive and mining industries. The company also undertakes the manufacture of Valvoline, Case and New Holland products on a toll blending basis. Brand names utilised include WM Penn, Fuchs, Titan, Reniso, Planto, Silkolane, Lublex, Renolin and Ceplatyn. Clients include Valvoline SA, Special Products, The Oil Shoppe, Harmony Gold Mining Company and Fincham Industrial Supplies. Nr. of Employees Banks Auditors 117 Standard Bank of South Africa Ltd KPMG Inc

Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 37 of 66

GERM AFRICA (PTY) LTD Reg. Number: 1938/011133/07 VAT Number: 4880118569 BEE Rating: Level 4 Postal Address: PO BOX 2, Linmeyer 2105 Tel: Email: Branches Branch Durban Branch Management Name Ms C Gomes Mr JC Haslam Mr RJC Haslam Mr DB Mulinder History of Business Germ Africa (Pty) Ltd was established in May 1938 as Germ Lubricants Africa (Pty) Ltd. The name was changed to Germ Africa (Pty) Ltd in December 1996. Nature of Business Germ Africa (Pty) Ltd is involved in the importation, blending and distribution of specialised industrial lubricants in the Southern African region. It operates three divisions namely, Industrial Lubricants, Filtration and Pumps. Nr. of Employees Banks Auditors Distribution Rights Caltex, Chevron, Techron, Texaco Subsidiaries, Associates & Investments Name Filterwell Industrials (Pty) Ltd Percentage 100.00 27 First National Bank (a division of FirstRand Bank Ltd) Horwath Leverton Boner Position Director Director Director Director Email Appointed 2011-12-05 2011-12-05 2011-12-05 1977-09-12 Area Kwazulu- Natal Head Tel +27 11 435 0348 Physical Address: 3 Sandown Valley Crescent, Benmore Gauteng, 2010 Fax.: Website: +27 11 435 4059 www.germafrica.co.za Updated: 2012-02-21

Copyright Who Owns Whom (Pty) Ltd

Manufacture of Petrol and Lubricants Siccode 332 & 63500

Page 38 of 66

H AND R SOUTH AFRICA (PTY) LTD Reg. Number: 2004/004800/07 VAT Number: 4130213079 Postal Address: PO Box 21575, Bluff 4036 Tel: Email: Shareholders Shareholder H & R Wasag AG Management Name Mr Neils Heinz Hansen Mr Deyar Natha Position Group Chief Executive Officer Non-Executive Director Email Appointed 2004-07-01 2006-07-01 2007-07-02 rudi.vanniekerk@ hur.com clive.wood@hur.com 2009-01-28 Percentage 100.00 +27 31 466 8700 sasales@hur.com Physical Address: 113 Trinidad Road, Island View Bluff, 4052 Fax.: Website: +27 31 466 8716 www.hur.com Updated: 2012-02-03

Mr Stephan James Parkinson Non-Executive Director Mr Rudi van Niekerk Sales & Marketing Manager Regional Chief Executive Officer

Mr Clive Richard Wood History of Business