Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

LERMS

Caricato da

chandran0567Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

LERMS

Caricato da

chandran0567Copyright:

Formati disponibili

Liberalized Exchange Rate Management System (LERMS) RBI introduced a new system of exchange rates known as LERMS on 1st

t March 1992 The introduction of the new system was a step to eliminate bureaucratic licensing controls Set up a self-balancing mechanism to deal with Foreign Exchange scarcity, bring about self-reliance by giving boost to exports, inward remittances and other forms of foreign earnings.

The basic elements of the system were To bring equilibrium between demand and supply To confine market operations to authorized and approved transactions and operate within the framework of import regulatory regime To establish an orderly market mechanism, with a built-in provision to intervene in the market The main features of the system were All receipts under current transactions were required to be surrendered to authorize dealers While 40% of the proceeds would be converted into rupees at RBI official rate, the remaining 60% would be converted at the free market rate quoted by authorized dealers

The foreign exchange received by RBI at official exchange rate was meant to cover import of essential commodities namely life saving drugs, crude oil, diesel, kerosene and fertilizers as authorized by the GOI through its Foreign Exchange Budget All other import transactions were to be met out of foreign exchange available in the free market

Modified Liberalized Exchange Rate Management System (MLERMS) The rupee became fully floating with effect from 1st March 1993 with the introduction of the Modified Liberalized Exchange Rate Management System Features All foreign transactions permitted to be transacted by authorized dealers The authorized dealers have been given the freedom to retain the entire foreign exchange RBI is required to sell to any authorized person the US Dollars, for meeting foreign exchange payments on the exchange rates based on the market rates only, for the approved purposes.

Potrebbero piacerti anche

- Introduction of India's Liberalised Exchange Rate Management System (LERMSDocumento4 pagineIntroduction of India's Liberalised Exchange Rate Management System (LERMSOjasvee Khanna0% (1)

- Assessment of Various EntitiesDocumento31 pagineAssessment of Various Entitiesinsathi0% (1)

- Composition SchemeDocumento10 pagineComposition SchemeAnonymous xH9VFaNUNessuna valutazione finora

- Investment Law Project Nisha Gupta Rajshri Singh and Raj Vardhan Agarwal (BBA - LLB (H) ) 8th SemesterDocumento20 pagineInvestment Law Project Nisha Gupta Rajshri Singh and Raj Vardhan Agarwal (BBA - LLB (H) ) 8th Semesterraj vardhan agarwalNessuna valutazione finora

- Understanding India's Financial SystemDocumento46 pagineUnderstanding India's Financial SystemAkshay AhirNessuna valutazione finora

- Effects of Foreign Exchange Rates On Indian EconomyDocumento43 pagineEffects of Foreign Exchange Rates On Indian EconomyMohamed Rizwan0% (1)

- FEMA Rules & Policies: Government of India World Trade OrganisationDocumento2 pagineFEMA Rules & Policies: Government of India World Trade OrganisationPradeep KumarNessuna valutazione finora

- Monetary and Fiscal Policies in IndiaDocumento5 pagineMonetary and Fiscal Policies in Indiarakeshgopinath4999Nessuna valutazione finora

- Quantitative and Qualitative Instruments of Monetary PolicyDocumento11 pagineQuantitative and Qualitative Instruments of Monetary PolicyVenkat SaiNessuna valutazione finora

- Evolution of The Indian Financial SectorDocumento18 pagineEvolution of The Indian Financial SectorVikash JontyNessuna valutazione finora

- Exchange Control in IndiaDocumento3 pagineExchange Control in Indianeemz1990100% (5)

- Final Blackbook by Sanju PDF VARSHADocumento67 pagineFinal Blackbook by Sanju PDF VARSHAYukta SalviNessuna valutazione finora

- Business LawDocumento6 pagineBusiness LawAnmol AroraNessuna valutazione finora

- A Presentation On: Role of Reserve Bank of India in Indian EconomyDocumento25 pagineA Presentation On: Role of Reserve Bank of India in Indian EconomyVimal SinghNessuna valutazione finora

- Technical Education & Research Institute: Department of Business AdministrationDocumento53 pagineTechnical Education & Research Institute: Department of Business AdministrationAnimesh Tiwari100% (1)

- A Research Paper On Impact of Goods and Service Tax (GST) On Indian Gross Domestic Product (GDP)Documento8 pagineA Research Paper On Impact of Goods and Service Tax (GST) On Indian Gross Domestic Product (GDP)archerselevatorsNessuna valutazione finora

- Indian Depository RecieptDocumento24 pagineIndian Depository Recieptadilfahim_siddiqi100% (1)

- PROJECT of Service TaxDocumento34 paginePROJECT of Service TaxPRIYANKA GOPALE100% (2)

- Understand Customs Duty in IndiaDocumento17 pagineUnderstand Customs Duty in IndiaMubbashir Khan RanaNessuna valutazione finora

- Foreign CapitalDocumento12 pagineForeign Capitalkevin ahmed100% (1)

- Exim PolicyDocumento21 pagineExim PolicyRitu RanjanNessuna valutazione finora

- Call Money Market in IndiaDocumento37 pagineCall Money Market in IndiaDivya71% (7)

- No Sale Agreement To Sell: 1 Meaning: Where The Meaning: Where The TransferDocumento2 pagineNo Sale Agreement To Sell: 1 Meaning: Where The Meaning: Where The TransferHarneet KaurNessuna valutazione finora

- Monetary Policy ManagementDocumento25 pagineMonetary Policy ManagementMian Ahmad Sajjad Shabbir100% (1)

- International Marketing Intelligence: Factors to Consider When Analyzing Foreign MarketsDocumento4 pagineInternational Marketing Intelligence: Factors to Consider When Analyzing Foreign MarketsPrathamesh PrabhutendolkarNessuna valutazione finora

- Foreign Exchange Management Act, 1999 (FEMA) : Prof. Dhaval BhattDocumento22 pagineForeign Exchange Management Act, 1999 (FEMA) : Prof. Dhaval BhattMangesh KadamNessuna valutazione finora

- Monetary Policy in IndiaDocumento8 pagineMonetary Policy in Indiaamitwaghela50Nessuna valutazione finora

- Commodity AgreementsDocumento8 pagineCommodity AgreementsshamshamanthNessuna valutazione finora

- IDR Mechanism for Foreign Firms to Raise Funds in IndiaDocumento11 pagineIDR Mechanism for Foreign Firms to Raise Funds in IndiaZoheb SayaniNessuna valutazione finora

- FEMA Replaces Draconian FERADocumento24 pagineFEMA Replaces Draconian FERAmukeshshivranNessuna valutazione finora

- Composition and Direction of Trade and Foreign Trade PolicyDocumento34 pagineComposition and Direction of Trade and Foreign Trade PolicySnehithNessuna valutazione finora

- GATS-General Agreement On Trade in Services: Agricultural Marketing, Trade & Prices (AEC-203) Credit Hours: 1+1Documento18 pagineGATS-General Agreement On Trade in Services: Agricultural Marketing, Trade & Prices (AEC-203) Credit Hours: 1+1Anonymous g90fKyhP9kNessuna valutazione finora

- Currency Convertibility and Its Impact On BOPDocumento34 pagineCurrency Convertibility and Its Impact On BOPAditya Avasare100% (3)

- Assignment - Explain Income From Other SourcesDocumento9 pagineAssignment - Explain Income From Other SourcesPraveen SNessuna valutazione finora

- What Is The RERA (Real Estate Regulatory Act) ?Documento6 pagineWhat Is The RERA (Real Estate Regulatory Act) ?willsproNessuna valutazione finora

- Costing Methods ExplainedDocumento4 pagineCosting Methods ExplainedMehar BhagatNessuna valutazione finora

- Foreign Exchange Management Act - 2Documento48 pagineForeign Exchange Management Act - 2Vaibhav VermaNessuna valutazione finora

- Over The Counter Exchange of IndiaDocumento3 pagineOver The Counter Exchange of IndiaShweta ShrivastavaNessuna valutazione finora

- Valuation Methods GuideDocumento15 pagineValuation Methods GuideVivek SinghNessuna valutazione finora

- PwC summarizes key changes in India's new overseas investment rulesDocumento5 paginePwC summarizes key changes in India's new overseas investment rulesVishwas SharmaNessuna valutazione finora

- Foreign Direct Investment (Fdi)Documento20 pagineForeign Direct Investment (Fdi)rohanNessuna valutazione finora

- Business CycleDocumento39 pagineBusiness CycleTanmayThakurNessuna valutazione finora

- RBI Regulates Financial System & Maintains Monetary StabilityDocumento66 pagineRBI Regulates Financial System & Maintains Monetary StabilitysejalNessuna valutazione finora

- On RfaDocumento14 pagineOn RfaSatheshaNessuna valutazione finora

- RATNADEEP Corporate Profile For Web ViewDocumento18 pagineRATNADEEP Corporate Profile For Web ViewMukesh100% (1)

- Rent Control Act 1Documento16 pagineRent Control Act 1krishna garg100% (1)

- Revision Application for Section 264 Tax AssessmentDocumento1 paginaRevision Application for Section 264 Tax AssessmentCma Saurabh AroraNessuna valutazione finora

- 86806-RBI Comm PolicyDocumento5 pagine86806-RBI Comm PolicyrbrNessuna valutazione finora

- The Negotiable Instruments Act, 1881 - E-Notes - Udesh Regular - Group 1Documento37 pagineThe Negotiable Instruments Act, 1881 - E-Notes - Udesh Regular - Group 1Uday TomarNessuna valutazione finora

- Income From Other SourcesDocumento7 pagineIncome From Other Sourcesshankarinadar100% (1)

- Preparation of Final AccountsDocumento31 paginePreparation of Final AccountsChowdhury Mobarrat Haider AdnanNessuna valutazione finora

- Basics of Income Tax of India PDFDocumento19 pagineBasics of Income Tax of India PDFJai VermaNessuna valutazione finora

- Role of NGO's in Micro FinanceDocumento13 pagineRole of NGO's in Micro FinanceBalaji100% (1)

- LEVY AND COLLECTION OF GST - AbhiDocumento14 pagineLEVY AND COLLECTION OF GST - AbhiAbhishek Abhi100% (1)

- Mobile Marketing: By:-Ayush Singh Tushar SharmaDocumento24 pagineMobile Marketing: By:-Ayush Singh Tushar Sharmaayush singhNessuna valutazione finora

- Path to Rupee ConvertibilityDocumento10 paginePath to Rupee ConvertibilityRohit JainNessuna valutazione finora

- Forex Quotation in India: Quoting ConventionDocumento11 pagineForex Quotation in India: Quoting ConventionRuta MhatreNessuna valutazione finora

- International Finance Unit-IDocumento7 pagineInternational Finance Unit-ITuki Das100% (1)

- Rupee ConvertabiliryDocumento6 pagineRupee ConvertabilirySanthosh PrabhuNessuna valutazione finora

- MECHANICS OF SECURITY TRADINGDocumento5 pagineMECHANICS OF SECURITY TRADINGJaywanti Akshra GurbaniNessuna valutazione finora

- Importance of Marketing ChannelsDocumento23 pagineImportance of Marketing Channelschandran0567100% (1)

- Corporate GovernanceDocumento9 pagineCorporate Governancechandran0567Nessuna valutazione finora

- Vendor Managed InventoryDocumento5 pagineVendor Managed Inventorychandran0567Nessuna valutazione finora

- Cross Border TransactionsDocumento11 pagineCross Border Transactionschandran0567Nessuna valutazione finora

- Project ManagmentDocumento9 pagineProject Managmentchandran0567Nessuna valutazione finora

- Types of Mergers & AcquisitionsDocumento16 pagineTypes of Mergers & Acquisitionschandran0567Nessuna valutazione finora

- TRADEMARKSDocumento9 pagineTRADEMARKSchandran0567Nessuna valutazione finora

- ECGCDocumento22 pagineECGCchandran0567Nessuna valutazione finora

- Role of IT in SCMDocumento17 pagineRole of IT in SCMchandran0567Nessuna valutazione finora

- Economy & Financial TermsDocumento2 pagineEconomy & Financial Termschandran0567Nessuna valutazione finora

- BUDGET 2012-13 HighlightsDocumento5 pagineBUDGET 2012-13 Highlightschandran0567Nessuna valutazione finora

- Corporate Culture of InfoDocumento7 pagineCorporate Culture of Infochandran0567Nessuna valutazione finora

- Basic Rules of BankingDocumento6 pagineBasic Rules of BankingBabla MondalNessuna valutazione finora

- Basic Rules of BankingDocumento6 pagineBasic Rules of BankingBabla MondalNessuna valutazione finora

- E.buyer Behaviour 5Documento10 pagineE.buyer Behaviour 5rajprincepibmNessuna valutazione finora

- Financial Management ConceptsDocumento10 pagineFinancial Management Conceptschandran0567Nessuna valutazione finora

- Business Research Methods UZ Assignment Milton Chinhoro R199952XDocumento3 pagineBusiness Research Methods UZ Assignment Milton Chinhoro R199952XMilton ChinhoroNessuna valutazione finora

- Agricultural and Industrial Development in the PhilippinesDocumento33 pagineAgricultural and Industrial Development in the PhilippinesNyle's BresenNessuna valutazione finora

- International Finance - Past Year June 2022Documento5 pagineInternational Finance - Past Year June 2022Yin Hao WongNessuna valutazione finora

- Problems of Indian Economy, PPTDocumento16 pagineProblems of Indian Economy, PPTRicha GargNessuna valutazione finora

- DN No 710 H K SERVICES - MANDYADocumento3 pagineDN No 710 H K SERVICES - MANDYAGangaraju T CNessuna valutazione finora

- List of Rbi Registered Micro Finance As On 31-01-2021Documento8 pagineList of Rbi Registered Micro Finance As On 31-01-2021aman3327Nessuna valutazione finora

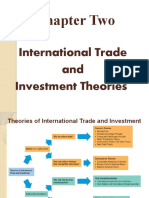

- Chapter Two: International Trade and Investment TheoriesDocumento42 pagineChapter Two: International Trade and Investment TheoriesAlayou TeferaNessuna valutazione finora

- Escuela Superio Politécnica de Chimborazo Facultad de Administración de Empresas Carrera de FinanzasDocumento3 pagineEscuela Superio Politécnica de Chimborazo Facultad de Administración de Empresas Carrera de FinanzasAlem GlNessuna valutazione finora

- Economics (2281) Chapter 4Documento20 pagineEconomics (2281) Chapter 4Hashir ShaheerNessuna valutazione finora

- History of India's Leading Stock Exchange NSEDocumento6 pagineHistory of India's Leading Stock Exchange NSEShivam MauryaNessuna valutazione finora

- Case Ocean CarriersDocumento2 pagineCase Ocean CarriersMorsal SarwarzadehNessuna valutazione finora

- FactorDocumento2 pagineFactormaznahNessuna valutazione finora

- ActionAid Factsheet - Special Drawing Rights The Global Reserve SystemDocumento7 pagineActionAid Factsheet - Special Drawing Rights The Global Reserve SystemShani MughalNessuna valutazione finora

- 7 Econ Dev (How Economies Grow and DevelopDocumento46 pagine7 Econ Dev (How Economies Grow and DeveloppumpiyumpiyummmNessuna valutazione finora

- IB History Guide: Causes of The Great DepressionDocumento2 pagineIB History Guide: Causes of The Great DepressionKatelyn CooperNessuna valutazione finora

- Microsoft Sales and Net Income 2008-2013Documento11 pagineMicrosoft Sales and Net Income 2008-2013yebegashetNessuna valutazione finora

- Quiz 523Documento17 pagineQuiz 523Haris NoonNessuna valutazione finora

- Exam 6 March 2018 Questions and AnswersDocumento10 pagineExam 6 March 2018 Questions and AnswersErika May RamirezNessuna valutazione finora

- India Bank Ifsc CodeDocumento3.466 pagineIndia Bank Ifsc CodespakumaranNessuna valutazione finora

- US China Trade WarDocumento28 pagineUS China Trade WarNagabhushan Rajashekarappa67% (3)

- Session 5 - India - Policy Crop Ethanol - Siddharth Amin DR Amin Controllers - Original.1550055423Documento12 pagineSession 5 - India - Policy Crop Ethanol - Siddharth Amin DR Amin Controllers - Original.1550055423iljanNessuna valutazione finora

- World Trade Organization (WTO) (UPSC International Organizations)Documento1 paginaWorld Trade Organization (WTO) (UPSC International Organizations)Sagar JainNessuna valutazione finora

- Overview of The BSPDocumento22 pagineOverview of The BSPelaineNessuna valutazione finora

- GlobalizationassignmentDocumento2 pagineGlobalizationassignmentghieyan solomonNessuna valutazione finora

- Adbi Bahasa Inggris NiagaDocumento2 pagineAdbi Bahasa Inggris NiagaFatur FazmiNessuna valutazione finora

- The Great Depression (1929Documento4 pagineThe Great Depression (1929qinque artNessuna valutazione finora

- Business Intelligence and Visualization: A18, A19, A21, A22, A23 11906601, 11912503, 11906598, 11906616, 11906669Documento9 pagineBusiness Intelligence and Visualization: A18, A19, A21, A22, A23 11906601, 11912503, 11906598, 11906616, 11906669Shubham SinghNessuna valutazione finora

- Super Chem: Certified That The Particulars Given Above Are True and CorrectDocumento1 paginaSuper Chem: Certified That The Particulars Given Above Are True and CorrectAman PrajapatiNessuna valutazione finora

- Bahaging Ginagampanan NG Igo'sDocumento24 pagineBahaging Ginagampanan NG Igo'sEdrei Jehezekel Javier100% (1)

- Spotlight On Spending #16: Sparta World Shooting and Recreation ComplexDocumento2 pagineSpotlight On Spending #16: Sparta World Shooting and Recreation ComplexIllinois PolicyNessuna valutazione finora