Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Bir - Form 1903

Caricato da

Jennifer DeleonTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Bir - Form 1903

Caricato da

Jennifer DeleonCopyright:

Formati disponibili

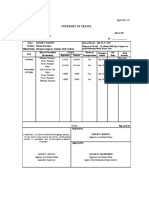

(To be filled up by BIR)

DLN:

Republika ng Pilipinas Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

For Corporations / Partnerships (Taxable / Non-Taxable), Including GAIs and LGUs

Application for Registration

1903

New TIN to be issued, if applicable (To be filled up by BIR)

BIR Form No.

January 2000 (ENCS)

Fill in applicable spaces. Mark all appropriate boxes with an "X".

1 REGISTERING OFFICE Head Office 3 TAXPAYER TYPE Partnership in General General Professional Partnership Joint Venture Domestic Corporation in General Resident Foreign Corporation in General 4 TAXPAYER IDENTIFICATION NUMBER (TIN)

(For Non-Individual Taxpayer with existing TIN or applying for a branch)

2 Branch Office

DATE OF REGISTRATION

(To be filled up by BIR)

(MM

DD

YYYY)

Government Corporation Government Agency and Instrumentality (GAI) Insurance - mutual life Non-profit Hospital Proprietary Educational Institutions 5

International Carrier Offshore Banking Unit/ Foreign Currency Deposit Unit (OBU/ FCDU) Non-stock Non-profit Organization Local Government Unit (LGU) RDO CODE

(To be filled up by BIR)

TAXPAYER'S NAME

DATE OF INCORPORATION OR ORGANIZATION NATIONALITY Domestic

SEC Registered Name/ Agency/ LGU Charter Name 8 DESCRIPTION OF MAIN ACTIVITY

(MM / DD / YYYY)

Engaged in Business

Not Engaged in Business

Resident Foreign

10 PRIMARY/ SECONDARY INDUSTRIES (Attach additional sheets, if necessary) Facility Type PSIC Industry Primary Primary Secondary Trade/Business Name

(To be filled up by BIR)

Line of Business

with no independent tax types Number of WH Facilities PP SP

Facility Types : PP - Place of Production; SP - Storage Place; WH - Warehouse 11 TAXABLE YEAR/ ACCOUNTING PERIOD Calendar Year 12 LOCAL ADDRESS

No. (Include Building Name) Street Barangay/Subdivision

Fiscal Year

Starting Date of Fiscal Year

District/Municipality

City/Province

13 ZIP CODE 16 FOREIGN BUSINESS ADDRESS

14 MUNICIPALITY CODE

(To be filled up by the BIR)

15 TELEPHONE NUMBER

No. (Include Building Name)

Street

City

State

Country

Zip Code

17 FOREIGN BUSINESS PHONE NUMBER

17A Country Code Area Code Telephone Number

17B FAX Number 19 TELEPHONE NUMBER

18 CONTACT PERSON / ACCREDITED TAX AGENTS (if different from taxpayer)

Last Name, First Name, Middle Initial (if individual) / Registered Name (if non-individual)

BIR FORM NO. 1903 (ENCS) - PAGE 2

19

Tax Types (choose only the tax types that are applicable to you) Income Tax Value-added Tax Percentage Tax - Stocks Percentage Tax - Stocks (IPO) Other Percentage Taxes Under the National Internal Revenue Code (Specify)

FORM TYPE

(To be filled up by BIR)

ATC

(To be filled up by BIR)

Percentage Tax Payable Under Special Laws Withholding Tax - Compensation Withholding Tax - Expanded Withholding Tax - Final Withholding Tax - Fringe Benefits Withholding Tax - Banks and Other Financial Institutions Withholding Tax - Others (One-time Transaction not subject to Capital Gains Tax) Withholding Tax - VAT and Other Percentage Taxes Withholding Tax - Percentage Tax on Winnings and Prizes Paid by Racetrack Operators Excise Tax - Ad Valorem Excise Tax - Specific Tobacco Inspection and Monitoring Fees Documentary Stamps Tax Capital Gains Tax - Real Property Capital Gains Tax - Stocks Donor's Tax Registration Fees Miscellaneous Tax (Specify) Others (Specify)

20 Registration of Books of Accounts PSIC TYPE OF BOOKS TO BE REGISTERED

(To be filled up by BIR)

VOLUME QNTY. FROM TO

NO. OF PAGES

21 DECLARATION I declare, under the penalties of perjury, that this application has been made in good faith, verified by me, and to the best of my knowledge and belief, is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

Stamp of BIR Receiving Office and Date of Receipt

Attachments complete? TAXPAYER/AUTHORIZED AGENT (Signature over printed name) TITLE/POSITION OF SIGNATORY

(To be filled up by BIR)

Yes ATTACHMENTS: (Photocopy only) I. For Corporations / Partnerships 1. SEC Certificate of Registration (Certificate of Incorporation/ Certificate of Co-partnership) 2. Mayor's Permit - to be submitted prior to the issuance of Certificate of Registration. II. For GAIs and LGUs - Unit or Agency's Charter NOTE: Taxpayer should attend the required taxpayer briefing before the release of the BIR Certificate of Registration.

No

POSSESSION OF MORE THAN ONE TAXPAYER IDENTIFICATION NUMBER (TIN) IS CRIMINALLY PUNISHABLE PURSUANT TO THE PROVISIONS OF THE NATIONAL INTERNAL REVENUE CODE OF 1997, AS AMENDED.

Potrebbero piacerti anche

- International Taxation In Nepal Tips To Foreign InvestorsDa EverandInternational Taxation In Nepal Tips To Foreign InvestorsNessuna valutazione finora

- Appendix 45 IoTDocumento1 paginaAppendix 45 IoTBARANGAY LAMPAYAN100% (1)

- Holy Angel University: Office of The RegistrarDocumento1 paginaHoly Angel University: Office of The RegistrarSam RoblesNessuna valutazione finora

- Mayor's Permit QC 2 - 2Documento2 pagineMayor's Permit QC 2 - 2Zachary YapNessuna valutazione finora

- Final Draft Constitution and By-Laws January, 2011Documento9 pagineFinal Draft Constitution and By-Laws January, 2011Hazel Torres BadayosNessuna valutazione finora

- Form 2307Documento2 pagineForm 2307Dino Garzon OcinoNessuna valutazione finora

- Affidavit of Loss: IN WITNESS WHEREOF, I Have Hereunto Set My Hands This 1st Day of July 2019 atDocumento1 paginaAffidavit of Loss: IN WITNESS WHEREOF, I Have Hereunto Set My Hands This 1st Day of July 2019 atJheyps VillarosaNessuna valutazione finora

- Employer'S Virtual Pag-Ibig Enrollment FormDocumento2 pagineEmployer'S Virtual Pag-Ibig Enrollment FormJhonna Magtoto100% (2)

- Sample of Budget PreparationDocumento14 pagineSample of Budget PreparationCasey Del Gallego EnrileNessuna valutazione finora

- NSTP Registration FormDocumento3 pagineNSTP Registration Formjhondhel torresNessuna valutazione finora

- SEC Cover Sheet For AFSDocumento1 paginaSEC Cover Sheet For AFSLorenz Samuel GomezNessuna valutazione finora

- Electronic Payment Payor Enrollment Form: Landbank of The Philippines - BranchDocumento1 paginaElectronic Payment Payor Enrollment Form: Landbank of The Philippines - BranchKilikili East100% (1)

- 70534BIR Form 1921 - Annex B PDFDocumento1 pagina70534BIR Form 1921 - Annex B PDFJunar MadaliNessuna valutazione finora

- Expanded Withholding TaxDocumento3 pagineExpanded Withholding TaxCordero TJNessuna valutazione finora

- Philippine Health Insurance Corporation Regional Office: LetterheadDocumento1 paginaPhilippine Health Insurance Corporation Regional Office: LetterheadMarilyn CidroNessuna valutazione finora

- Deed of Conditional Sale (Sccribed)Documento2 pagineDeed of Conditional Sale (Sccribed)Bong RoqueNessuna valutazione finora

- Cda Red FR 003 Rev7 CaprDocumento32 pagineCda Red FR 003 Rev7 CaprRaina Phia PantaleonNessuna valutazione finora

- Request For TOR UPVDocumento1 paginaRequest For TOR UPVgongsilogNessuna valutazione finora

- Annex D Bir InventoryDocumento17 pagineAnnex D Bir InventoryDada SalesNessuna valutazione finora

- Bir 2306Documento2 pagineBir 2306Caroline Sanchez90% (10)

- NOTICE of AWARD - Construction of Road - 18 April 2012Documento1 paginaNOTICE of AWARD - Construction of Road - 18 April 2012LGUCamaliganNessuna valutazione finora

- Table of ContentsDocumento1 paginaTable of ContentsMacLaw MacOfficeNessuna valutazione finora

- Makati City Business Registration FlowDocumento4 pagineMakati City Business Registration FlowAika Chescka DucaNessuna valutazione finora

- Kabalikat Charity Civic Communicator, Inc.: PresentDocumento2 pagineKabalikat Charity Civic Communicator, Inc.: PresentReabels FranciscoNessuna valutazione finora

- Rejoinder Affidavit - 2010005411Documento12 pagineRejoinder Affidavit - 2010005411Florence C. ManulatNessuna valutazione finora

- Affidavit of AccidentDocumento2 pagineAffidavit of AccidentFrances Anne GamboaNessuna valutazione finora

- Authorization Form For Querying FinalDocumento1 paginaAuthorization Form For Querying FinalApril NNessuna valutazione finora

- SSS Change RequestDocumento3 pagineSSS Change RequestAngelica SarzonaNessuna valutazione finora

- 1604-C Jan 2018 Final Annex A PDFDocumento1 pagina1604-C Jan 2018 Final Annex A PDFAs Li NahNessuna valutazione finora

- 2316Documento1 pagina2316EmmanuelClementCastilloTalimoroNessuna valutazione finora

- Sworn Statement of The True Current and Fair Market Value of Real PropertiesDocumento1 paginaSworn Statement of The True Current and Fair Market Value of Real PropertiesAngela I.Nessuna valutazione finora

- SSS R3 Contribution Collection List in Excel FormatDocumento2 pagineSSS R3 Contribution Collection List in Excel FormatChristopher Daniels0% (2)

- BIR FORM 2307 SampleDocumento6 pagineBIR FORM 2307 SampleEasyHear Philippines by NuGen Hearing Devices, Inc.Nessuna valutazione finora

- Travel OrderDocumento1 paginaTravel OrderMarie Antonette Aco Barba100% (1)

- Membership Application Form: Philippine Chamber of Commerce and IndustryDocumento2 pagineMembership Application Form: Philippine Chamber of Commerce and IndustryJ SalesNessuna valutazione finora

- Republic of The Philippines Province of Pampanga Municipality of San LuisDocumento1 paginaRepublic of The Philippines Province of Pampanga Municipality of San LuisFrecy MirandaNessuna valutazione finora

- SEC-Cover-Sheet-for-AFS BlankDocumento2 pagineSEC-Cover-Sheet-for-AFS BlankAljohn Sebuc100% (1)

- Bpi Endorsement LetterDocumento1 paginaBpi Endorsement LetterLawrence MangaoangNessuna valutazione finora

- PAGCOR Personal Disclosure Statement FormDocumento4 paginePAGCOR Personal Disclosure Statement FormPennyConsunji100% (1)

- Pag-Ibig Employers Data Form - FillDocumento3 paginePag-Ibig Employers Data Form - FillJhen S. Domingo100% (1)

- Annex "D": Submission of E-Mail Addresses and Mobile Numbers (For Corporations)Documento5 pagineAnnex "D": Submission of E-Mail Addresses and Mobile Numbers (For Corporations)Donna Amanda Victorino100% (1)

- Affidavit of Loss - Elbert GabayneDocumento1 paginaAffidavit of Loss - Elbert GabayneAmanda HernandezNessuna valutazione finora

- DEED OF DONATION Real Property Sample Tax DecDocumento4 pagineDEED OF DONATION Real Property Sample Tax DecSibs Academic ServicesNessuna valutazione finora

- Certification of Travel CompletedDocumento2 pagineCertification of Travel CompletedLourdes UrgellesNessuna valutazione finora

- 6b Manila Trafffice and Parking BureauDocumento12 pagine6b Manila Trafffice and Parking BureauRobin de VegaNessuna valutazione finora

- Fine Arts Program, Up Baguio ChecklistDocumento1 paginaFine Arts Program, Up Baguio ChecklistKelsch DiamondNessuna valutazione finora

- DEED OF ABSOLUTE SALE - EquipmentDocumento3 pagineDEED OF ABSOLUTE SALE - EquipmentEloisa Moaje AtienzaNessuna valutazione finora

- Bir Form 2307Documento2 pagineBir Form 2307Geraldine BacoNessuna valutazione finora

- AuthorizationDocumento1 paginaAuthorizationBiboy BiboyNessuna valutazione finora

- Esrs Employer Enrollment Form: Employer ID Number Employer/Business Name Pag-IBIG Servicing Branch Employer TypeDocumento1 paginaEsrs Employer Enrollment Form: Employer ID Number Employer/Business Name Pag-IBIG Servicing Branch Employer TypeGina Garcia100% (1)

- Service Agreement - Arnel TaburdanDocumento3 pagineService Agreement - Arnel TaburdanJacquelyn RamosNessuna valutazione finora

- Certificate of Residency: To Whom It May ConcernDocumento3 pagineCertificate of Residency: To Whom It May ConcernMyla Oira CaneteNessuna valutazione finora

- CTA 8459 (CADPI) - No DST On Bank Loans, Year-End BalanceDocumento74 pagineCTA 8459 (CADPI) - No DST On Bank Loans, Year-End BalanceJerwin DaveNessuna valutazione finora

- COA12 Memo Jan2016Documento3 pagineCOA12 Memo Jan2016aliahNessuna valutazione finora

- Petition For Change of Name (Myka)Documento4 paginePetition For Change of Name (Myka)Myka FloresNessuna valutazione finora

- Birth EditableDocumento1 paginaBirth Editablegian baseNessuna valutazione finora

- Application For Closure of BusinessDocumento2 pagineApplication For Closure of BusinessallanNessuna valutazione finora

- Atd For PNPDocumento1 paginaAtd For PNPAba DeeNessuna valutazione finora

- Bir Form 1903 - Registration Corp (Blank)Documento2 pagineBir Form 1903 - Registration Corp (Blank)Dennis Tolentino100% (3)

- BIR Form 1903Documento2 pagineBIR Form 1903Earl LarroderNessuna valutazione finora

- Prop Cases Digests 1Documento9 pagineProp Cases Digests 1Jennifer DeleonNessuna valutazione finora

- Letter of Proposal To AffiliateDocumento2 pagineLetter of Proposal To AffiliateJennifer DeleonNessuna valutazione finora

- GreyhoundDocumento4 pagineGreyhoundJennifer DeleonNessuna valutazione finora

- Scabook FinalDocumento101 pagineScabook FinalJennifer DeleonNessuna valutazione finora

- 6th AssignmentDocumento4 pagine6th AssignmentJennifer DeleonNessuna valutazione finora

- ConstiRev Cases Full Text Privacy of Comm and CorrespondenceDocumento16 pagineConstiRev Cases Full Text Privacy of Comm and CorrespondenceJennifer DeleonNessuna valutazione finora

- LabRev Collective BRGNGDocumento4 pagineLabRev Collective BRGNGJennifer DeleonNessuna valutazione finora

- People V Cuenca 33 SCRA 522Documento3 paginePeople V Cuenca 33 SCRA 522Jennifer DeleonNessuna valutazione finora

- Civil Code Arts 1176-1269Documento5 pagineCivil Code Arts 1176-1269Jennifer DeleonNessuna valutazione finora

- Evidence - Final HandoutDocumento5 pagineEvidence - Final HandoutJennifer DeleonNessuna valutazione finora

- LabRev Collective BRGNGDocumento4 pagineLabRev Collective BRGNGJennifer DeleonNessuna valutazione finora

- Privacy of Comm and CorrespondenceDocumento24 paginePrivacy of Comm and CorrespondenceJennifer DeleonNessuna valutazione finora

- San Beda: The 2012 Public International Law Moot Court CompetitionDocumento1 paginaSan Beda: The 2012 Public International Law Moot Court CompetitionJennifer DeleonNessuna valutazione finora

- People V Dator 344 SCRA 222Documento7 paginePeople V Dator 344 SCRA 222Jennifer DeleonNessuna valutazione finora

- ConstiRev Cases Full Text Privacy of Comm and CorrespondenceDocumento16 pagineConstiRev Cases Full Text Privacy of Comm and CorrespondenceJennifer DeleonNessuna valutazione finora

- People V AguilosDocumento13 paginePeople V AguilosJennifer DeleonNessuna valutazione finora

- People V Bayambao 32 Phil 309Documento2 paginePeople V Bayambao 32 Phil 309Albertito C. GarciaNessuna valutazione finora

- Canon 14-17 DigestsDocumento8 pagineCanon 14-17 DigestsJennifer DeleonNessuna valutazione finora

- People V AbutDocumento16 paginePeople V AbutJennifer DeleonNessuna valutazione finora

- Oblicon Codal1318-1457Documento5 pagineOblicon Codal1318-1457Jennifer DeleonNessuna valutazione finora

- Canon 10 (Dela Cruz)Documento2 pagineCanon 10 (Dela Cruz)Jennifer DeleonNessuna valutazione finora

- Lim V Court of Appeals 222 SCRA 279Documento5 pagineLim V Court of Appeals 222 SCRA 279Jennifer DeleonNessuna valutazione finora

- Canon 14-17 DigestsDocumento8 pagineCanon 14-17 DigestsJennifer DeleonNessuna valutazione finora

- Sterling Bank Sample Loan App FormDocumento2 pagineSterling Bank Sample Loan App FormJennifer DeleonNessuna valutazione finora

- SSS Salary Loan 02-2013Documento3 pagineSSS Salary Loan 02-2013Jon Allan Buenaobra100% (2)

- Oblicon Tanay vs. Fausto DigestDocumento2 pagineOblicon Tanay vs. Fausto DigestJennifer DeleonNessuna valutazione finora

- Oblicon Riviera vs. CA DigestDocumento2 pagineOblicon Riviera vs. CA DigestJennifer DeleonNessuna valutazione finora

- Consti2 39and40Documento2 pagineConsti2 39and40Jennifer DeleonNessuna valutazione finora

- Visa Application Form KoreaDocumento3 pagineVisa Application Form KoreaPrissy AlbertoNessuna valutazione finora

- Security Bank Sample Loan App FormDocumento1 paginaSecurity Bank Sample Loan App FormJennifer DeleonNessuna valutazione finora

- AppellantDocumento26 pagineAppellantVarsha ThampiNessuna valutazione finora

- Asbury (2011) Anti-Snitching Norms and Community LoyaltyDocumento56 pagineAsbury (2011) Anti-Snitching Norms and Community LoyaltySuryo HapsoroNessuna valutazione finora

- A Theory of BioethicsDocumento330 pagineA Theory of BioethicsNomeNessuna valutazione finora

- Lolita Concepcion Vs Minex Import GR No 153569Documento1 paginaLolita Concepcion Vs Minex Import GR No 153569michelledugsNessuna valutazione finora

- Angara V Fedman Development Corp. (Group5)Documento2 pagineAngara V Fedman Development Corp. (Group5)Stephanie Ann LopezNessuna valutazione finora

- Pioneer Insurance and Surety Corporation VsDocumento1 paginaPioneer Insurance and Surety Corporation VsIrish VillamorNessuna valutazione finora

- Civil Society in Gramsci and HabermasDocumento2 pagineCivil Society in Gramsci and HabermasShabnam BarshaNessuna valutazione finora

- Plaintiff-Appellee Vs Vs Accused-Appellant: First DivisionDocumento18 paginePlaintiff-Appellee Vs Vs Accused-Appellant: First DivisionquasideliksNessuna valutazione finora

- ED LIV 45 161119 Making Sense of The Ayodhya VerdictDocumento1 paginaED LIV 45 161119 Making Sense of The Ayodhya VerdictabhinavNessuna valutazione finora

- RafananPaolaCCL Room202 Mon&Sat530pmDocumento3 pagineRafananPaolaCCL Room202 Mon&Sat530pmMimiNessuna valutazione finora

- Joint Case Management StatementDocumento14 pagineJoint Case Management StatementyogaloyNessuna valutazione finora

- Canon 8 Case DigestsDocumento4 pagineCanon 8 Case DigestsRywelle BravoNessuna valutazione finora

- 09230908jsk Sutton V StateDocumento8 pagine09230908jsk Sutton V StatewarriorsevenNessuna valutazione finora

- LAW Salient Features Forms of Violations Remedy: Ra 3883 Business Name LAWDocumento13 pagineLAW Salient Features Forms of Violations Remedy: Ra 3883 Business Name LAWTan TanNessuna valutazione finora

- CS Form No. 212 Personal Data Sheet RevisedDocumento4 pagineCS Form No. 212 Personal Data Sheet RevisedCarla Villoria SolomonNessuna valutazione finora

- Macarthur Malicdem Vs Marulas Industrial CorporationDocumento6 pagineMacarthur Malicdem Vs Marulas Industrial CorporationisraeljamoraNessuna valutazione finora

- R.B. Michael Press and Annalene Reyes Escobia Vs Nicasio C. Galit G.R. No. 153510, February 13, 2008, VELASCO, JR., J.Documento2 pagineR.B. Michael Press and Annalene Reyes Escobia Vs Nicasio C. Galit G.R. No. 153510, February 13, 2008, VELASCO, JR., J.Tiff DizonNessuna valutazione finora

- Lawrence Township OPRA Request FormDocumento4 pagineLawrence Township OPRA Request FormThe Citizens CampaignNessuna valutazione finora

- Essay 2 - Two Types of FamiliesDocumento3 pagineEssay 2 - Two Types of Familieskhanhngoc89Nessuna valutazione finora

- A Review of RPC's Article 253Documento9 pagineA Review of RPC's Article 253Gretel R. Madanguit100% (2)

- MFR Nara - T1a - FBI - FBI Special Agent 17 - 1-6-04 - 00421Documento1 paginaMFR Nara - T1a - FBI - FBI Special Agent 17 - 1-6-04 - 004219/11 Document ArchiveNessuna valutazione finora

- People V SandiganbayanDocumento7 paginePeople V SandiganbayanMp CasNessuna valutazione finora

- Sports Act MTDocumento48 pagineSports Act MTInger CiniNessuna valutazione finora

- Data Processing Addendum PDFDocumento22 pagineData Processing Addendum PDFStar GirlNessuna valutazione finora

- Summary of Judgment - Roberts V The Queen (2020) VSCA 277Documento3 pagineSummary of Judgment - Roberts V The Queen (2020) VSCA 277Richard HughesNessuna valutazione finora

- Civ Pro Compiled February 14 Case No 276 OnwardsDocumento358 pagineCiv Pro Compiled February 14 Case No 276 OnwardsRockyCalicaMosadaNessuna valutazione finora

- Sample Club ConstitutionDocumento4 pagineSample Club ConstitutionDizerine Mirafuentes RolidaNessuna valutazione finora

- Full Text: APS Settlement With Don MoyaDocumento11 pagineFull Text: APS Settlement With Don MoyaAlbuquerque JournalNessuna valutazione finora

- City of Manila v. Arellano Law DigestDocumento2 pagineCity of Manila v. Arellano Law Digestkathrynmaydeveza100% (1)

- Motion For in Camera InspectionDocumento5 pagineMotion For in Camera InspectionJohn Carroll0% (1)