Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Middleware Tax Issues

Caricato da

trustngsCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Middleware Tax Issues

Caricato da

trustngsCopyright:

Formati disponibili

CRM Middleware Tax Definition and Tax Assigning:

Check whether the tax type with error message were defined properly under the following path SPRO _ CRM _ BASIC FUNCTIONS _ TAXES _ BASIC SETTINGS _ TAX TYPES AND TAX GROUPS _ DEFINE TAX TYPES AND TAX GROUPS

Check here whether all the entries were defined correctly or not? If not please define them. Note: Please check the Sequence number while defining the new entries, sequence number Should not be repeated.

After defining the entries successfully, following tables should be maintained using the transaction TCODE: SM30. 1. CRMC_TAX_MAP_BP for business partners 2. CRMC_TAX_MAP for products (Material)

1. CRMC_TAX_MAP_BP for business partners in CRM

2. CRMC_TAX_MAP for products (Material) in CRM

Tax Type: CRM Table: (TB070) Here, LFDNR field is Sequence of Taxes. Sequence Number of tax should be same for both end (CRM and ECC).

ECC Table: (TSTL) Here, LFDNR field is Sequence of Taxes. Sequence Number of tax should be same for both end (CRM and ECC).

BP TAX GROUPS: CRM Table: (TB071)

ECC Table: (TB071_CM)

Mapping of business partner relevant information of Condition records: CRM TABLE: CRMC_TAX_MAP_BP

ECC TABLE: TB072_CM

Checking Tax customizing data Execute the transaction code CRM_TAXCUST_VALIDATE to check the data all the required Countries values should be in green. TCODE: CRM_TAXCUST_VALIDATE

Table Details for tax in CRM and ECC.

Description Tax Types BP Tax Groups Mapping of business partner relevant information of Condition records

ERP System TSTL TB071_CM TB072_CM

CRM System TB070 TB071 CRMC_TAX_MAP_BP

Potrebbero piacerti anche

- Master General Ledger Account CodesDocumento34 pagineMaster General Ledger Account CodesSoru SaxenaNessuna valutazione finora

- Taxation Sap Explain With An ExampleDocumento18 pagineTaxation Sap Explain With An Examplejitendraverma8Nessuna valutazione finora

- SUBTOTAL - Subtotal Field Is Used To Store The Intermediate CalculationDocumento5 pagineSUBTOTAL - Subtotal Field Is Used To Store The Intermediate CalculationANILNessuna valutazione finora

- Hide Button or Icon in The ABAP ReportDocumento17 pagineHide Button or Icon in The ABAP ReportGautam MalhotraNessuna valutazione finora

- Fundamentals of SAP SD PricingDocumento13 pagineFundamentals of SAP SD Pricingrajendrakumarsahu100% (3)

- PMP Mock Exam 200 Q ADocumento31 paginePMP Mock Exam 200 Q ALuis Olavarrieta100% (5)

- CRM Settings Configuration For Master Data ReplicationDocumento11 pagineCRM Settings Configuration For Master Data Replicationshyamg4uNessuna valutazione finora

- Setting Up CRM Middleware: Step 1 - Define Logical Systems (CRM)Documento7 pagineSetting Up CRM Middleware: Step 1 - Define Logical Systems (CRM)fsimovic100% (1)

- Tax Procedure Configuration For GSTDocumento11 pagineTax Procedure Configuration For GSTJyotiraditya BanerjeeNessuna valutazione finora

- SAP HR and Payroll ProcessingDocumento4 pagineSAP HR and Payroll ProcessingBharathk KldNessuna valutazione finora

- SAP Material Management Case StudyDocumento51 pagineSAP Material Management Case StudyObarArighi100% (1)

- 16 Fields in MM Pricing ProcedureDocumento9 pagine16 Fields in MM Pricing Procedureashish sawantNessuna valutazione finora

- SAP Treasury MGMT Basic Setting Partial DocumentDocumento48 pagineSAP Treasury MGMT Basic Setting Partial DocumentBiku BikuNessuna valutazione finora

- SQL Server Functions and tutorials 50 examplesDa EverandSQL Server Functions and tutorials 50 examplesValutazione: 1 su 5 stelle1/5 (1)

- Master Data - SAP SDDocumento9 pagineMaster Data - SAP SDAnandNessuna valutazione finora

- CRM MiddlewareDocumento68 pagineCRM MiddlewareMallikArjunNessuna valutazione finora

- 8+ Years SAP CRM ExpertiseDocumento1 pagina8+ Years SAP CRM ExpertisetrustngsNessuna valutazione finora

- RoundingDocumento65 pagineRoundingSourav Kumar100% (1)

- Purchasing Tables Sapreader: Message Determination DeactivatedDocumento11 paginePurchasing Tables Sapreader: Message Determination DeactivatedraynojNessuna valutazione finora

- Hariharan Natarajan CRM Workflow Consaltant DubaiDocumento3 pagineHariharan Natarajan CRM Workflow Consaltant DubaitrustngsNessuna valutazione finora

- PMP Question BankDocumento54 paginePMP Question BankAneesh Mohanan71% (7)

- PMP Question BankDocumento54 paginePMP Question BankAneesh Mohanan71% (7)

- Creating Tax Groups For TaxesDocumento17 pagineCreating Tax Groups For TaxesAristeu CunhaNessuna valutazione finora

- Dynamic TableDocumento13 pagineDynamic TableserluperNessuna valutazione finora

- UntitledDocumento3 pagineUntitledChiranjeevi MeesaNessuna valutazione finora

- SAP HR and Payroll Wage Type StatementDocumento2 pagineSAP HR and Payroll Wage Type StatementBharathk KldNessuna valutazione finora

- SAP CRM Tax ConfigurationDocumento18 pagineSAP CRM Tax Configurationtushar_kansaraNessuna valutazione finora

- Business AgreementDocumento3 pagineBusiness AgreementGaurav ChughNessuna valutazione finora

- MW issues and resolutionsDocumento6 pagineMW issues and resolutionssridharNessuna valutazione finora

- SDDocumento125 pagineSDSourav KumarNessuna valutazione finora

- Metalink Developer'S GuideDocumento11 pagineMetalink Developer'S GuideskakachNessuna valutazione finora

- Set Up & Loag Guide For BP Agreements - Contract Accounts - SLG - GP - ISU - V2Documento3 pagineSet Up & Loag Guide For BP Agreements - Contract Accounts - SLG - GP - ISU - V2rushikesh28Nessuna valutazione finora

- System Documentation For Malaysia GSTDocumento10 pagineSystem Documentation For Malaysia GSTviru2allNessuna valutazione finora

- Transfer From CRM Bill Doc To Accounting DocumentDocumento2 pagineTransfer From CRM Bill Doc To Accounting DocumentRakesh RaiNessuna valutazione finora

- 10 steps move Tax Codes between SAP clientsDocumento1 pagina10 steps move Tax Codes between SAP clientsEdmondNessuna valutazione finora

- CRM Service DebuggingDocumento2 pagineCRM Service DebuggingRavibabu KoduriNessuna valutazione finora

- Payment Program Development - ABAP Development - Community WikiDocumento5 paginePayment Program Development - ABAP Development - Community WikiAlexandre da SilvaNessuna valutazione finora

- Note Parallel Currency 1Documento5 pagineNote Parallel Currency 1tariNessuna valutazione finora

- Sapnote - 0000052852 - Transporting Tax Codes Between SystemsDocumento4 pagineSapnote - 0000052852 - Transporting Tax Codes Between SystemsandrefkatoNessuna valutazione finora

- Disccusion and Suggestion For SmartForm and FD3Documento4 pagineDisccusion and Suggestion For SmartForm and FD3CHAN KA FEYNessuna valutazione finora

- TC Admin ReynoldsDocumento8 pagineTC Admin Reynoldstho huynhtanNessuna valutazione finora

- Conversion Validate Customer SAPDocumento8 pagineConversion Validate Customer SAPgmirchaNessuna valutazione finora

- CONTROLLING AREA - OKKP SettingsDocumento7 pagineCONTROLLING AREA - OKKP SettingsMohammed Nawaz ShariffNessuna valutazione finora

- Whats Is The Line ItemDocumento54 pagineWhats Is The Line Itemcrazybobby007Nessuna valutazione finora

- Default Pay Scale/Grade Structure From Table V - 001P - CDocumento7 pagineDefault Pay Scale/Grade Structure From Table V - 001P - CDeepa ShiligireddyNessuna valutazione finora

- Configure Asset AccountingDocumento34 pagineConfigure Asset AccountingMarge Pranit0% (1)

- Downpayments SAPDocumento11 pagineDownpayments SAPRaza_Kashif_1713Nessuna valutazione finora

- Definitions of Fields in Pricing ProcedureDocumento3 pagineDefinitions of Fields in Pricing ProcedureWaaKaaWNessuna valutazione finora

- 05 Intro ERP Using GBI Case Study MM (A4) en v2.01Documento38 pagine05 Intro ERP Using GBI Case Study MM (A4) en v2.01Debapriya Swain50% (2)

- Error Message "Fill in All Required Entry Fields" (Error Message No. 00055)Documento2 pagineError Message "Fill in All Required Entry Fields" (Error Message No. 00055)KarthiNessuna valutazione finora

- Sap Logistic Case of StudyDocumento20 pagineSap Logistic Case of StudyMiodrag Nicolici100% (1)

- Case Study On How Payables Open Interface Works With EbtaxDocumento13 pagineCase Study On How Payables Open Interface Works With EbtaxsidfreestylerNessuna valutazione finora

- Tips For Fast Message Determination SetupDocumento12 pagineTips For Fast Message Determination SetupRAMAKRISHNA.GNessuna valutazione finora

- Tax Replication From SAP CRM To SAP ECC - CRM - SCN WikiDocumento10 pagineTax Replication From SAP CRM To SAP ECC - CRM - SCN WikiloribeNessuna valutazione finora

- Purchasing Configuration TipsDocumento7 paginePurchasing Configuration TipsAnirban LahaNessuna valutazione finora

- CATTS 166961 - CATS Error LR121 Durng Transfer in Target ApplicatnDocumento2 pagineCATTS 166961 - CATS Error LR121 Durng Transfer in Target Applicatnest.sbarturoNessuna valutazione finora

- Integration Case Study LO: Sap Erp Ecc 5.0Documento19 pagineIntegration Case Study LO: Sap Erp Ecc 5.0Rajesh Dhan100% (1)

- SAP CRM Billing SettingsDocumento38 pagineSAP CRM Billing SettingsashwingvNessuna valutazione finora

- Tax Determination in SAP SDDocumento23 pagineTax Determination in SAP SDMMayoor1984Nessuna valutazione finora

- Sap MM 1689330587Documento8 pagineSap MM 1689330587Soumya PandaNessuna valutazione finora

- XK99VendorMassChange PDFDocumento14 pagineXK99VendorMassChange PDFGino SpagnoloNessuna valutazione finora

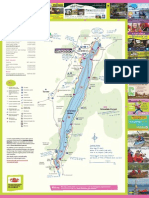

- Coniston MapDocumento1 paginaConiston MaptrustngsNessuna valutazione finora

- Bassenthwaite MapDocumento1 paginaBassenthwaite Mapvenkatbabu1983Nessuna valutazione finora

- Ullswater MapDocumento1 paginaUllswater MaptrustngsNessuna valutazione finora

- Implementing SAP WorkflowDocumento6 pagineImplementing SAP Workflowtrustngs0% (1)

- Ullswater MapDocumento1 paginaUllswater MaptrustngsNessuna valutazione finora

- Testimonial From Icsi Students - Dec2012Documento5 pagineTestimonial From Icsi Students - Dec2012trustngsNessuna valutazione finora

- Hariharan N (233632)Documento7 pagineHariharan N (233632)trustngsNessuna valutazione finora

- CRM Call List GenerationDocumento1 paginaCRM Call List GenerationtrustngsNessuna valutazione finora

- BSNL - Telecom Technical Assistant Tamil Nadu Telecom Circle Job Notification 2013Documento15 pagineBSNL - Telecom Technical Assistant Tamil Nadu Telecom Circle Job Notification 2013CareerNotifications.comNessuna valutazione finora

- Summary of Income TaxDocumento38 pagineSummary of Income TaxtrustngsNessuna valutazione finora

- Teradata Performance and Capacity ServicesDocumento3 pagineTeradata Performance and Capacity ServicestrustngsNessuna valutazione finora

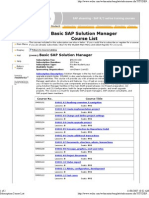

- Basic SAP Solution Manager PDFDocumento2 pagineBasic SAP Solution Manager PDFtrustngsNessuna valutazione finora

- Cooling Water PumP HOUSEDocumento1 paginaCooling Water PumP HOUSEtrustngsNessuna valutazione finora

- Index of FilesDocumento62 pagineIndex of FilesPhani Pinnamaneni0% (1)

- One Page Profile - OmprakashDocumento2 pagineOne Page Profile - Omprakashtrustngs0% (1)

- Cehnnai Madurai Bus Ticket 2012Documento1 paginaCehnnai Madurai Bus Ticket 2012trustngsNessuna valutazione finora

- A.V.C College of Engg OfficeDocumento1 paginaA.V.C College of Engg OfficetrustngsNessuna valutazione finora

- How To Guide Workflow BCSDocumento21 pagineHow To Guide Workflow BCStrustngsNessuna valutazione finora

- Summary of Income TaxDocumento38 pagineSummary of Income TaxtrustngsNessuna valutazione finora

- Replication of Company Code Data From CRM To ECCDocumento9 pagineReplication of Company Code Data From CRM To ECCtrustngsNessuna valutazione finora

- Resolve CRM Inbound Queue Error of LOGSYS_FOR_GUID_CHANGEDDocumento3 pagineResolve CRM Inbound Queue Error of LOGSYS_FOR_GUID_CHANGEDtrustngsNessuna valutazione finora

- SAP WorkflowDocumento25 pagineSAP WorkflowtrustngsNessuna valutazione finora

- Samhita Medical ClaimDocumento1 paginaSamhita Medical ClaimtrustngsNessuna valutazione finora