Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Garrison (Asian Edition) Practice Exam - Chapter 10

Caricato da

Ryan Nixon SalimTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Garrison (Asian Edition) Practice Exam - Chapter 10

Caricato da

Ryan Nixon SalimCopyright:

Formati disponibili

Garrison (Asian Edition) Practice Exam Chapter 10

Print these pages. Answer each of the following questions, explaining your answers or showing your work, as appropriate, and then compare your solutions to those provided at the end of the practice exam. 1. Fifty percent of the sales of Hanson Company sales are for cash; the rest are on credit. Seventy percent of the credit sales are collected in the month of sale, twenty percent in the month following sale, and five percent in the second month following sale. The remainder is expected to be uncollectible. Monthly sales are budgeted as follows: $280,000 for January, $240,000 for February, and $320,000 for March. Prepare a schedule of expected cash collections for the month of March.

2. Paragon Picture Gallery manufactures picture frames. Management believes that an ending inventory equal to 20% of the next month's sales strikes the appropriate balance between excessive and insufficient inventories. Each picture frame requires 1.5 direct labor hours. The average direct labor rate is $10.00 per hour. Budgeted sales of picture frames are 3,200 units in January, 4,800 units in February, and 4,000 in March. Part (a) Prepare a production budget for February.

Part (b) Prepare a direct labor budget for February.

3. Master Manufacturing Company has budgeted production for next year as follows: First Quarter 80,000 Second Quarter 96,000 Third Quarter 128,000 Fourth Quarter 112,000

Production in units

Ten pounds of raw materials are required for each unit produced. Raw materials on hand at the beginning of the year total 20,000 lbs. The raw materials inventory at the end of each quarter should equal 10% of the next quarter's production needs. Prepare a direct materials budget for the second quarter.

GNBCY Practice Exam Solutions Chapter 10

1. Solution: Collected during March $112,000 160,000 272,000 24,000 7,000 $303,000

Month of Sale March: Credit Cash February January Total cash collections

Calculations ($320,000 x .50 x .70) ($320,000 x .50) ($240,000 x .50 x .20) ($280,000 x .50 x .05)

2. Part (a) Solution: Budgeted production for February would be determined as follows: Sales Plus planned ending inventory (4,000 x .20) Less beginning inventory (4,800 x .20) Units to be produced Part (b) Solution: Required production in frames Direct labor hours required per frame Total direct labor hours needed Direct labor cost per hour Total direct labor cost 3. Solution: Required for: Second quarter production (96,000 x 10 lbs.) Planned ending inventory (128,000 x .10 x 10 lbs.) Less planned beginning inventory (96,000 x .10 x 10 lbs.) Raw materials to be purchased (pounds) 960,000 128,000 (96,000) 992,000 4,800 800 (960) 4,640 4,640 1.5 6,960 $10.00 $69,600

Potrebbero piacerti anche

- Garrison 14e Practice Exam - Chapter 8Documento3 pagineGarrison 14e Practice Exam - Chapter 8Titas Khan100% (1)

- March cash collections and Paragon picture frame budgetsDocumento2 pagineMarch cash collections and Paragon picture frame budgetsJohnsen PratamaNessuna valutazione finora

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsDa EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsNessuna valutazione finora

- GNB14eCh08ExamDocumento3 pagineGNB14eCh08ExamFicky ZulandoNessuna valutazione finora

- Economic & Budget Forecast Workbook: Economic workbook with worksheetDa EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNessuna valutazione finora

- Brewer 6e Practice Exam – Chapter 7 SolutionsDocumento3 pagineBrewer 6e Practice Exam – Chapter 7 Solutionsreal johnNessuna valutazione finora

- Cost and Management Accounting -II - Work SheetDocumento7 pagineCost and Management Accounting -II - Work SheetBeamlak WegayehuNessuna valutazione finora

- Chapter 07 - Exercises - Part IIDocumento4 pagineChapter 07 - Exercises - Part IIRawan YasserNessuna valutazione finora

- Keys in Manacc Seatwork - BUDGETINGDocumento2 pagineKeys in Manacc Seatwork - BUDGETINGRoselie Barbin50% (2)

- Chapter 9 Multiple Choice and Practice Problems Budget Review"TITLE"Budgeting Chapter 9 MCQs and Practice Problems" TITLE"Master Budget Chapter 9 Questions and ExercisesDocumento5 pagineChapter 9 Multiple Choice and Practice Problems Budget Review"TITLE"Budgeting Chapter 9 MCQs and Practice Problems" TITLE"Master Budget Chapter 9 Questions and ExercisesHotcheeseramyeonNessuna valutazione finora

- Basic Operating BudgetDocumento6 pagineBasic Operating BudgetalyNessuna valutazione finora

- Chapter 07 - Exercises - Part IDocumento2 pagineChapter 07 - Exercises - Part IRawan YasserNessuna valutazione finora

- PR Akmen 3Documento3 paginePR Akmen 3Achmad Faizal AzmiNessuna valutazione finora

- Case Analysis (1 30)Documento3 pagineCase Analysis (1 30)manishadaaNessuna valutazione finora

- Budgeting For Profit PlanningDocumento6 pagineBudgeting For Profit Planningmamannish7902Nessuna valutazione finora

- Auditing 2019 P S CH 8Documento16 pagineAuditing 2019 P S CH 8barakat801Nessuna valutazione finora

- BudgetDocumento6 pagineBudgetshobuzfeni100% (1)

- Cash Sales Credit Sales: ACCT201B Practice Questions Chapter 8Documento9 pagineCash Sales Credit Sales: ACCT201B Practice Questions Chapter 8GuinevereNessuna valutazione finora

- Exam 7Documento15 pagineExam 7mohit verrmaNessuna valutazione finora

- Chapter 9 Review QuestionsDocumento8 pagineChapter 9 Review QuestionsKanika DahiyaNessuna valutazione finora

- Ex06 - Comprehensive BudgetingDocumento14 pagineEx06 - Comprehensive BudgetingANa Cruz100% (2)

- Short Term Budgeting PDF FreeDocumento15 pagineShort Term Budgeting PDF FreeKei CambaNessuna valutazione finora

- Cash BudgetingDocumento6 pagineCash BudgetingTalha Idrees100% (1)

- Quiz 6 - Topics 11 & 12 George ChenDocumento7 pagineQuiz 6 - Topics 11 & 12 George ChenKevin LuoNessuna valutazione finora

- CHƯƠNG 1 - 10đ - 4Documento5 pagineCHƯƠNG 1 - 10đ - 4Trần Khánh VyNessuna valutazione finora

- Chap 009Documento99 pagineChap 009WOw Wong100% (1)

- CH 23 Exercises ProblemsDocumento4 pagineCH 23 Exercises ProblemsAhmed El KhateebNessuna valutazione finora

- Practical QuestionsDocumento5 paginePractical QuestionsBui Thi Lan Anh (FGW HCM)Nessuna valutazione finora

- Quiz On BudgetDocumento2 pagineQuiz On BudgetShamittaaNessuna valutazione finora

- Week 7 - Master Budget Activity IVDocumento11 pagineWeek 7 - Master Budget Activity IVgabrielNessuna valutazione finora

- Review Myron Corporation's seasonal product sales budget and production requirementsDocumento8 pagineReview Myron Corporation's seasonal product sales budget and production requirementsmohammad bilalNessuna valutazione finora

- Exercice - 01Documento2 pagineExercice - 01aldira jasmineNessuna valutazione finora

- Utf8''Lec4 Inclass ProblemsDocumento2 pagineUtf8''Lec4 Inclass ProblemsudbhavNessuna valutazione finora

- Seminar 11answer Group 10Documento75 pagineSeminar 11answer Group 10Shweta Sridhar40% (5)

- Budgeting Quizer - MASDocumento5 pagineBudgeting Quizer - MASPrincess Joy VillaNessuna valutazione finora

- Cash Budgeting TutorialDocumento4 pagineCash Budgeting Tutorialmichellebaileylindsa100% (1)

- MACP.L II Question April 2019Documento5 pagineMACP.L II Question April 2019Taslima AktarNessuna valutazione finora

- Kuis UTS Genap 21-22 ACCDocumento3 pagineKuis UTS Genap 21-22 ACCNatasya FlorenciaNessuna valutazione finora

- Master Budgeting & Costing TechniquesDocumento2 pagineMaster Budgeting & Costing TechniquesAsti EristiasaNessuna valutazione finora

- Mid Term Exam - MBA - Management Accounting - MBAT 202 - OnlineDocumento2 pagineMid Term Exam - MBA - Management Accounting - MBAT 202 - OnlineDullStar MOTONessuna valutazione finora

- CH 9Documento35 pagineCH 9Marysun Tlengr67% (3)

- 3 - Example Problems Ch. 9 10 1Documento35 pagine3 - Example Problems Ch. 9 10 1danjay2792100% (9)

- Sales, Production, and Cash Budgets for Manufacturing CompanyDocumento17 pagineSales, Production, and Cash Budgets for Manufacturing Companynotes.mcpu100% (1)

- tổng hợp đề KTQT 2Documento60 paginetổng hợp đề KTQT 2NHI HUYNH MANNessuna valutazione finora

- Drills - Comprehensive BudgetingDocumento11 pagineDrills - Comprehensive BudgetingDan RyanNessuna valutazione finora

- Practice Problems 1Documento16 paginePractice Problems 1James AguilarNessuna valutazione finora

- Problem 1: It Is Required To PrepareDocumento7 pagineProblem 1: It Is Required To PrepareGaurav ChauhanNessuna valutazione finora

- 202E06Documento21 pagine202E06foxstupidfoxNessuna valutazione finora

- BASTRCSX-Learning-Activity-5_with-answersDocumento10 pagineBASTRCSX-Learning-Activity-5_with-answersChel EscuetaNessuna valutazione finora

- 1Documento3 pagine1Thomas ErrichettiNessuna valutazione finora

- Calculate Working Capital Requirements from Financial Data ProblemsDocumento3 pagineCalculate Working Capital Requirements from Financial Data ProblemsPriyanka RajendraNessuna valutazione finora

- CVP Analysis Questions ExplainedDocumento5 pagineCVP Analysis Questions ExplainedArtee GuptaNessuna valutazione finora

- Chapter 07 Instructor Homework & AnswersDocumento5 pagineChapter 07 Instructor Homework & AnswersMary Glee Amparo AldayNessuna valutazione finora

- Budgets Exercises StudentDocumento5 pagineBudgets Exercises Studentديـنـا عادل0% (1)

- AF102 Revision Package - Student PackDocumento5 pagineAF102 Revision Package - Student PackMusuota l benjizNessuna valutazione finora

- Chapter 7-QuestionsDocumento8 pagineChapter 7-Questionssunnitd10Nessuna valutazione finora

- Managerial Accounting Problems on Budgets and Budgetary ControlDocumento10 pagineManagerial Accounting Problems on Budgets and Budgetary ControlParthasarathi MishraNessuna valutazione finora

- Q3. Master Budget For Manufacturing Problem 3Documento2 pagineQ3. Master Budget For Manufacturing Problem 3Robbob JahloveNessuna valutazione finora

- B2B Rental Sale Checklist - LGEP - 5 - ReviewedDocumento5 pagineB2B Rental Sale Checklist - LGEP - 5 - Reviewedsunlife zeoilenNessuna valutazione finora

- Integrated Handloom Cluster Development Programme: Is It Responding To The Learning's From UNIDO Approach?Documento9 pagineIntegrated Handloom Cluster Development Programme: Is It Responding To The Learning's From UNIDO Approach?Mukund VermaNessuna valutazione finora

- XET 301-CEC 305 October-Jan 2022 ExaminantionDocumento5 pagineXET 301-CEC 305 October-Jan 2022 ExaminantionABDULLAHI MUSA MOHAMEDNessuna valutazione finora

- Topic No 2Documento2 pagineTopic No 2javeria nazNessuna valutazione finora

- Cic - C Ode Model: ED478 EFR-566DB-1AVUDFDocumento49 pagineCic - C Ode Model: ED478 EFR-566DB-1AVUDFSiddhiraj AgarwalNessuna valutazione finora

- Interior Styling - NOTESDocumento54 pagineInterior Styling - NOTESAthira NairNessuna valutazione finora

- H R N N TH T: Recording Transactions of Sample Data of Swayam Agencies Pvt. LTDDocumento140 pagineH R N N TH T: Recording Transactions of Sample Data of Swayam Agencies Pvt. LTDDeepakNessuna valutazione finora

- Hilega Milega ConseptsDocumento8 pagineHilega Milega Consepts01ankuNessuna valutazione finora

- Travel: Reading Skill: Ielts Course 1Documento3 pagineTravel: Reading Skill: Ielts Course 1NGA NGUYEN HANGNessuna valutazione finora

- 6 S' Audit - Practical Audit Steps To Implement Each S'Documento6 pagine6 S' Audit - Practical Audit Steps To Implement Each S'R.BALASUBRAMANINessuna valutazione finora

- Cbis Yr 12 Economics E - Note 20203Documento24 pagineCbis Yr 12 Economics E - Note 20203chisimdirinNessuna valutazione finora

- Handout Romer SolowDocumento4 pagineHandout Romer Solowperson4115Nessuna valutazione finora

- Determinants of Urban Form VENICEDocumento7 pagineDeterminants of Urban Form VENICEjashndeep100% (1)

- Visit To MIDC JalgaonDocumento9 pagineVisit To MIDC JalgaonSanjay TalegaonkarNessuna valutazione finora

- Apgvb Insurance Consent LetterDocumento1 paginaApgvb Insurance Consent LetterMahesh PasupuletiNessuna valutazione finora

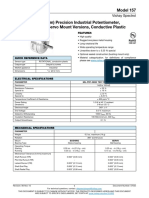

- Model 157: Vishay SpectrolDocumento4 pagineModel 157: Vishay SpectrolJulio Vazquez MorenoNessuna valutazione finora

- Order details for SDK t-shirtDocumento37 pagineOrder details for SDK t-shirtDharmesh ManiyaNessuna valutazione finora

- Senarai Pemaju Gagal Membayar Kompaun 19.08 .2022Documento9 pagineSenarai Pemaju Gagal Membayar Kompaun 19.08 .2022Muhd FaizNessuna valutazione finora

- Fleet Status Report OdfjellDocumento2 pagineFleet Status Report OdfjellAgungNessuna valutazione finora

- Travel Extra Pack T Cs - UkDocumento4 pagineTravel Extra Pack T Cs - Ukjamieagilbert94Nessuna valutazione finora

- U Wall 2 (25-01-2022) - Sheet1Documento1 paginaU Wall 2 (25-01-2022) - Sheet1Suneel BalaniNessuna valutazione finora

- DevelopmentDocumento6 pagineDevelopmentAKSHITA THAKURNessuna valutazione finora

- Latest Social Science ReviewerDocumento7 pagineLatest Social Science ReviewerAkmad Ali AbdulNessuna valutazione finora

- MT0690 - Abhishek - Check UpDocumento1 paginaMT0690 - Abhishek - Check UpAbhishek KhandelwalNessuna valutazione finora

- Gaining valuable experience through internships abroadDocumento1 paginaGaining valuable experience through internships abroadTuyết HoaNessuna valutazione finora

- Letter No1103Documento3 pagineLetter No1103Raju GambhirNessuna valutazione finora

- Tybcom Economics Sem V (Prelims-Heramb)Documento2 pagineTybcom Economics Sem V (Prelims-Heramb)A BPNessuna valutazione finora

- Certificate of Tenancy for Agricultural Land in Camarines SurDocumento2 pagineCertificate of Tenancy for Agricultural Land in Camarines SurBenjie Moriño100% (9)

- 10$ Free Bonus: Trading With Market Statistics - II The Volume Weighted Average Price (VWAP)Documento1 pagina10$ Free Bonus: Trading With Market Statistics - II The Volume Weighted Average Price (VWAP)siddhant parkheNessuna valutazione finora

- List of Pending Activities (Ground Floor)Documento2 pagineList of Pending Activities (Ground Floor)Abdur RehmanNessuna valutazione finora

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Da EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Valutazione: 4.5 su 5 stelle4.5/5 (12)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Da EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Valutazione: 4.5 su 5 stelle4.5/5 (14)

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsDa EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNessuna valutazione finora

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItDa EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItValutazione: 5 su 5 stelle5/5 (13)

- Profit First for Therapists: A Simple Framework for Financial FreedomDa EverandProfit First for Therapists: A Simple Framework for Financial FreedomNessuna valutazione finora

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindDa EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindValutazione: 5 su 5 stelle5/5 (231)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassDa EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNessuna valutazione finora

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantDa EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantValutazione: 4.5 su 5 stelle4.5/5 (146)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Da EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Valutazione: 4.5 su 5 stelle4.5/5 (5)

- Financial Accounting For Dummies: 2nd EditionDa EverandFinancial Accounting For Dummies: 2nd EditionValutazione: 5 su 5 stelle5/5 (10)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanDa EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanValutazione: 4.5 su 5 stelle4.5/5 (79)

- Finance Basics (HBR 20-Minute Manager Series)Da EverandFinance Basics (HBR 20-Minute Manager Series)Valutazione: 4.5 su 5 stelle4.5/5 (32)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesDa EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNessuna valutazione finora

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetDa EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNessuna valutazione finora

- Sacred Success: A Course in Financial MiraclesDa EverandSacred Success: A Course in Financial MiraclesValutazione: 5 su 5 stelle5/5 (15)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesDa EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesValutazione: 4.5 su 5 stelle4.5/5 (30)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyDa EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyValutazione: 5 su 5 stelle5/5 (1)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?Da EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Valutazione: 5 su 5 stelle5/5 (1)

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantDa EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantValutazione: 4 su 5 stelle4/5 (104)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsDa EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsValutazione: 4 su 5 stelle4/5 (7)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelDa Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNessuna valutazione finora