Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

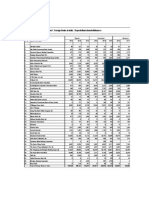

Statement I: Public Sector Banks: Deposits/Investments/Advances

Caricato da

Nekta PinchaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Statement I: Public Sector Banks: Deposits/Investments/Advances

Caricato da

Nekta PinchaCopyright:

Formati disponibili

Statement I : Public Sector Banks : Deposits/Investments/Advances

As on March 31

S.N.

Banks

NATIONALISED BANKS

Allahabad Bank

Andhra Bank

Deposits

2010

2011

Investments

2012

2010

2011

Advances

2012

2010

2011

106056

131887

159593

38429

43247

54283

71605

77688

92156

105851

20881

24204

29629

56114

93625

71435

Bank of Baroda

241262

305439

384871

61182

71397

83209

175035

228676

Bank of India

229762

298886

318216

67080

85872

86754

168491

213096

Bank of Maharashtra

63304

66845

76529

21324

22491

22911

40315

46881

Canara Bank

234651

293437

327054

69677

83636

102057

169335

211268

Central Bank of India

162107

179356

196173

50563

54504

59243

105383

129725

Corporation Bank

92734

116747

136142

34523

43453

47475

63203

86850

44828

Dena Bank

51344

64210

77167

15694

18769

23028

35462

10

Indian Bank

88228

105804

120804

28268

34784

37976

62146

75250

11

Indian Overseas Bank

110795

145229

178434

37651

48610

55566

78999

111833

12

Oriental Bank of Commerce

120258

139054

155965

35785

49545

52101

83489

95908

13

Punjab & Sind Bank

49155

59723

63124

17887

18644

20064

32639

42638

14

Punjab National Bank

249330

312899

379588

77724

95162

122629

186601

242107

15

Syndicate Bank

117026

135596

157941

33011

35068

40815

90406

106782

16

UCO Bank

122416

145278

154003

43521

42927

45771

82505

99071

17

Union Bank of India

170040

202461

222869

54404

58399

62364

119315

150986

18

19

II

III

United Bank of India

Vijaya Bank

TOTAL OF 19 NATIONALISED BANKS

State Bank of India (SBI)

ASSOCIATES OF SBI

68180

61932

2416267

804116

77845

73248

2946100

933933

89116

83056

3386497

1043647

26068

21107

754779

295785

26259

25139

882111

295601

29059

28644

1003579

312198

42330

41507

1704880

631914

53502

48719

2153181

756719

State Bank of Bikaner & Jaipur

46059

53852

61572

13601

13521

16669

35176

41207

State Bank of Hyderabad

72971

88628

98732

24009

28447

29242

52825

64720

State Bank of Indore*

30624

8575

23677

State Bank of Mysore

38880

43225

50186

11494

12927

14733

29536

34030

State Bank of Patiala

64552

68066

79147

18165

17275

22043

46347

51433

State Bank of Travancore

50883

58158

71470

15844

17927

22438

38461

46044

303969

311930

361107

91688

90096

105125

226023

237434

TOTAL OF STATE BANK GROUP [II + III]

Other Public Sector Bank

IDBI Ltd.

1108086

1245862

1404754

387473

385697

417322

857937

994154

167667

180486

210493

73345

68269

83175

138202

157098

TOTAL OF PUBLIC SECTOR BANKS[ I+II+III+IV ]

3692019

4372449

5001743

1215598

1336076

1504077

2701019

3304433

TOTAL OF ASSOCIATES [ III ]

IV

1

*Merged with SBI in 2010

( Crore)

Advances

2012

111145

83642

287377

248833

56060

232490

147513

100469

56693

90324

140724

111978

46151

293775

123620

115540

177882

63043

57904

2545163

867579

49244

77052

39835

62934

55346

284412

1151991

181158

3878312

Statement II : Public Sector Banks : Assets/Gross and Net Non-Performing Assets

As on March 31

S.N.

( Crore)

Banks

I

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

Total Assets

Gross NPA

Net NPA

NATIONALISED BANKS

Allahabad Bank

Andhra Bank

Bank of Baroda

Bank of India

Bank of Maharashtra

Canara Bank

Central Bank of India

Corporation Bank

Dena Bank

Indian Bank

Indian Overseas Bank

Oriental Bank of Commerce

Punjab & Sind Bank

Punjab National Bank

Syndicate Bank

UCO Bank

Union Bank of India

United Bank of India

Vijaya Bank

TOTAL OF 19 NATIONALISED BANKS

II State Bank of India (SBI)

III ASSOCIATES OF SBI

1 State Bank of Bikaner & Jaipur

2 State Bank of Hyderabad

3 State Bank of Indore*

4 State Bank of Mysore

5 State Bank of Patiala

6 State Bank of Travancore

TOTAL OF ASSOCIATES [ III ]

2010

121699

90342

278317

274966

71056

264741

182672

111667

57587

101389

131092

137431

56665

296633

139051

137319

195162

77005

70207

2795001

1053414

2011

151286

108901

358397

351173

76442

335945

209757

143509

70838

121718

178784

161343

68550

378325

156539

163398

235984

90041

82013

3442945

1223736

2012

182935

124964

447321

384535

88017

374160

229800

163560

87388

141419

219648

178130

72905

458194

182468

180498

262211

102010

95764

3975930

1335519

2010

1222

488

2401

4883

1210

2590

2458

651

642

510

3611

1469

206

3214

2007

1666

2671

1372

994

34265

19535

2011

1648

996

3153

4812

1174

3137

2394

790

842

740

3090

1921

424

4379

2599

3150

3623

1356

1259

41486

25326

2012

2059

1798

4465

5894

1297

4032

7273

1274

957

1851

3920

3580

763

8720

3183

4086

5450

2176

1718

64497

39676

2010

470

96

602

2207

662

1800

727

197

428

145

1995

724

117

982

963

966

965

779

582

15407

10870

2011

736

274

791

1945

619

2330

847

398

549

397

1328

938

238

2039

1031

1825

1803

757

741

19586

12347

2012

1092

756

1544

3656

470

3386

4557

869

572

1197

1907

2459

548

4454

1185

2264

3025

1076

998

36014

15819

54190

88386

35369

45409

76077

59455

62954

106698

52032

81286

70977

72528

118315

60404

98498

85949

612

649

493

595

1007

642

835

1150

864

1382

835

1651

2007

1503

1888

1489

270

289

268

300

483

350

341

563

468

621

451

945

1002

768

848

854

358886

373948

435695

3998

5066

8538

1960

2444

4418

TOTAL OF STATE BANK GROUP [II + III]

IV Other Public Sector Bank

1 IDBI Ltd.

1412299

1597684

1771214

23533

30393

48214

12830

14791

20237

233572

253377

290837

2129

2785

4551

1406

1678

2911

4440872

5294006

6037982

59927

74664

117262

29644

36055

59162

TOTAL OF PUBLIC SECTOR BANKS[ I+II+III+IV ]

Statement III : Public Sector Banks : Income

As on March 31

S.N.

( Crore)

Banks

Interest Income

Other Income

Total Income

I

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

NATIONALISED BANKS

Allahabad Bank

Andhra Bank

Bank of Baroda

Bank of India

Bank of Maharashtra

Canara Bank

Central Bank of India

Corporation Bank

Dena Bank

Indian Bank

Indian Overseas Bank

Oriental Bank of Commerce

Punjab & Sind Bank

Punjab National Bank

Syndicate Bank

UCO Bank

Union Bank of India

United Bank of India

Vijaya Bank

2010

8369

6373

16698

17878

4736

18752

12064

6988

4010

7714

10246

10257

3934

21422

10047

9526

13303

5249

5201

2011

11015

8291

21886

21752

5563

22940

15221

9135

5034

9361

12101

12088

4933

26986

11451

11371

16453

6341

5844

2012

15523

11339

29674

28481

7214

30851

19149

13018

6794

12231

17897

15815

6475

36428

15268

14632

21144

7961

7988

2010

1516

965

2806

2617

591

2858

1735

1493

589

1316

1143

1200

412

3610

1167

966

1975

559

679

2011

1370

897

2809

2642

531

2811

1265

1256

534

1182

1225

960

437

3613

915

925

2039

637

533

2012

1299

860

3422

3321

641

2928

1395

1493

582

1232

1681

1240

417

4203

1076

966

2332

733

528

2010

9885

7337

19505

20495

5327

21610

13800

8481

4599

9031

11389

11457

4346

25032

11215

10492

15277

5808

5880

2011

12385

9188

24695

24393

6094

25752

16486

10391

5567

10543

13327

13048

5370

30599

12366

12296

18491

6979

6377

2012

16822

12199

33096

31802

7855

33778

20545

14510

7376

13463

19578

17055

6892

40631

16344

15598

23477

8694

8516

II

III

1

2

3

4

5

6

TOTAL OF 19 NATIONALISED BANKS

State Bank of India (SBI)

ASSOCIATES OF SBI

State Bank of Bikaner & Jaipur

State Bank of Hyderabad

State Bank of Indore*

State Bank of Mysore

State Bank of Patiala

State Bank of Travancore

TOTAL OF ASSOCIATES [ III ]

192768

70994

237765

81394

317882

106521

28198

14968

26582

15825

30348

14351

220965

85962

264347

97219

348231

120873

3977

6334

2736

3559

5975

4378

4796

7851

4079

6478

5229

6291

10647

5078

8121

6829

583

841

373

426

674

528

640

984

455

756

581

599

1024

516

751

648

4560

7175

3109

3985

6650

4906

5436

8835

4534

7234

5810

6890

11671

5595

8872

7477

26960

28434

36966

3425

3415

3539

30385

31849

40505

97954

109828

143488

18394

19240

17890

116347

129068

161378

15261

18541

23370

2302

2143

2119

17563

20684

25489

305983

366135

484740

48893

47965

50358

354876

414099

535098

IV

1

TOTAL OF STATE BANK GROUP [II + III]

Other Public Sector Bank

IDBI Ltd.

TOTAL OF PUBLIC SECTOR BANKS [ I+II+III+IV ]

Statement IV : Public Sector Banks : Expenditure

As on March 31

S.N.

( Crore)

Banks

I

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

NATIONALISED BANKS

Allahabad Bank

Andhra Bank

Bank of Baroda

Bank of India

Bank of Maharashtra

Canara Bank

Central Bank of India

Corporation Bank

Dena Bank

Indian Bank

Indian Overseas Bank

Oriental Bank of Commerce

Punjab & Sind Bank

Punjab National Bank

Syndicate Bank

UCO Bank

Union Bank of India

United Bank of India

Vijaya Bank

TOTAL OF 19 NATIONALISED BANKS

II State Bank of India (SBI)

III ASSOCIATES OF SBI

1 State Bank of Bikaner & Jaipur

2 State Bank of Hyderabad

3 State Bank of Indore*

4 State Bank of Mysore

5 State Bank of Patiala

6 State Bank of Travancore

TOTAL OF ASSOCIATES [ III ]

TOTAL OF STATE BANK GROUP [II + III]

IV Other Public Sector Bank

1 IDBI Ltd.

TOTAL OF PUBLIC SECTOR BANKS [I+II+III+IV]

* excludes provisions & contingencies

Interest Expended

Operating Expenses

Total Expenditure *

2010

5719

4178

10759

12122

3439

13071

9519

5084

2910

4553

7078

7350

2750

12944

7307

7202

9110

3858

3752

132706

47322

2011

6992

5070

13084

13941

3595

15241

9895

6196

3270

5325

7893

7910

3372

15179

7068

7526

10236

4172

3897

149863

48868

2012

10361

7579

19357

20167

4697

23161

13981

9871

4693

7813

12881

11599

4973

23014

10183

10730

14235

5482

6085

220863

63230

2010

1618

1350

3811

3668

1073

3478

2222

1260

848

1730

2466

1686

718

4762

2034

1584

2508

1074

1072

38961

20319

2011

2338

1705

4630

5068

1644

4419

3999

1642

1073

1926

2572

1892

984

6364

2548

2075

3950

1299

1433

51565

23015

2012

2691

1804

5159

4941

1643

4674

3749

1784

1155

2187

3163

2315

1159

7003

2814

2056

3988

1383

1201

54867

26069

2010

7337

5528

14569

15790

4512

16549

11741

6344

3758

6283

9544

9036

3468

17706

9341

8787

11618

4932

4823

171667

67641

2011

9331

6775

17713

19009

5239

19660

13894

7837

4344

7251

10466

9803

4356

21543

9616

9601

14186

5472

5331

201428

71883

2012

13052

9384

24515

25108

6339

27835

17730

11654

5848

10000

16044

13915

6132

30016

12997

12787

18223

6865

7286

275730

89299

2766

4471

1928

2322

4441

2978

3027

5003

2443

4145

3533

4070

7282

3494

5776

4998

890

984

508

725

901

956

1269

1513

917

1330

1101

1331

1736

1041

1333

1230

3656

5455

2436

3047

5342

3934

4296

6516

3361

5474

4634

5401

9018

4535

7109

6228

18906

18150

25621

4964

6130

6671

23870

24280

32291

66229

67018

88851

25283

29146

32740

91511

96164

121591

13005

14272

18825

1831

2255

2607

14837

16527

21433

211940

231153

328539

66075

82965

90214

278015

314118

418754

Statement V : Public Sector Banks : Profit

As on March 31

S.N.

I

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

II

III

1

2

3

4

5

6

( Crore)

Banks

NATIONALISED BANKS

Allahabad Bank

Andhra Bank

Bank of Baroda

Bank of India

Bank of Maharashtra

Canara Bank

Central Bank of India

Corporation Bank

Dena Bank

Indian Bank

Indian Overseas Bank

Oriental Bank of Commerce

Punjab & Sind Bank

Punjab National Bank

Syndicate Bank

UCO Bank

Union Bank of India

United Bank of India

Vijaya Bank

TOTAL OF 19 NATIONALISED BANKS

State Bank of India (SBI)

ASSOCIATES OF SBI

State Bank of Bikaner & Jaipur

State Bank of Hyderabad

State Bank of Indore*

State Bank of Mysore

State Bank of Patiala

State Bank of Travancore

TOTAL OF ASSOCIATES [ III ]

TOTAL OF STATE BANK GROUP [II + III]

IV Other Public Sector Bank

1 IDBI Ltd.

TOTAL OF PUBLIC SECTOR BANKS [I+II+III+IV]

Operating Profit

Provisions & Contingencies

Net Profit

2010

2,549

1,810

4,935

4,705

815

5,061

2,059

2,137

841

2,747

1,845

2,422

878

7,326

1,874

1,706

3,659

876

1,057

49,298

18,321

2011

3,055

2,413

6,982

5,384

855

6,091

2,591

2,554

1,224

3,292

2,861

3,245

1,013

9,056

2,750

2,695

4,305

1,507

1,047

62,919

25,336

2012

3,770

2,815

8,581

6,694

1,515

5,943

2,815

2,856

1,528

3,463

3,534

3,141

760

10,614

3,347

2,811

5,254

1,829

1,230

72,501

31,574

2010

1,342

764

1,877

2,964

375

2,039

1,000

966

329

1,192

1,138

1,287

369

3,421

1,060

693

1,584

553

550

23,506

9,155

2011

1,631

1,146

2,740

2,896

525

2,066

1,339

1,141

612

1,578

1,788

1,742

487

4,622

1,702

1,788

2,223

983

523

31532

17,071

2012

1,903

1,470

3,574

4,016

1,084

2,660

2,282

1,350

725

1,716

2,484

1,999

309

5,730

2,033

1,703

3,467

1,196

649

40352

19866.25

2010

1,206

1,046

3,058

1,741

440

3,021

1,058

1,170

511

1,555

707

1,135

509

3,905

813

1,012

2,075

322

507

25,793

9,166

2011

1,423

1,267

4,242

2,489

330

4,026

1,252

1,413

612

1,714

1,073

1,503

526

4,433

1,048

907

2,082

524

524

31,388

8,265

2012

1,867

1,345

5,007

2,678

431

3,283

533

1,506

803

1,747

1,050

1,142

451

4,884

1,313

1,109

1,787

633

581

32,149

11,707

904

1,721

673

937

1,308

972

6,515

24,836

1,140

2,319

1,174

1,759

1,176

7,569

32,904

1,490

2,653

1,060

1,763

1,249

8,214

39,787

449

898

365

492

757

288

3,248

12,403

589

1,153

673

1,106

448

3,970

21,041

838

1355

-

551

1,166

501

653

728

3,598

11,863

652

1,298

4,588

24,454

455

823

308

446

551

684

3,267

12,433

3,626

15,334

2,726

4,158

4,056

1,695

2,508

2025

1031

1650

2032

76,861

99,981

116,344

37,604

55,080

66,830

39,257

44,901

49,514

690

966

738

369

796

510

Statement VI : Public Sector Banks : Ratios

As on March 31

S.N.

I

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

( Crore)

Banks

NATIONALISED BANKS

Allahabad Bank

Andhra Bank

Bank of Baroda

Bank of India

Bank of Maharashtra

Canara Bank

Central Bank of India

Corporation Bank

Dena Bank

Indian Bank

Indian Overseas Bank

Oriental Bank of Commerce

Punjab & Sind Bank

Punjab National Bank

Syndicate Bank

UCO Bank

Union Bank of India

United Bank of India

Vijaya Bank

Credit Deposit Ratio

Investment Deposit Ratio

Spread as % of Assets

2010

67.52

72.23

72.55

73.33

63.68

72.16

65.01

68.15

69.07

70.44

71.30

69.43

66.40

74.84

77.25

67.40

70.17

62.09

67.02

2011

70.99

77.52

74.87

71.30

70.13

72.00

72.33

74.39

69.82

71.12

77.00

68.97

71.39

77.38

78.75

68.19

74.58

68.73

66.51

2012

69.64

79.02

74.67

78.20

73.25

71.09

75.20

73.80

73.47

74.77

78.87

71.80

73.11

77.39

78.27

75.02

79.81

70.74

69.72

2010

36.23

26.88

25.36

29.20

33.68

29.69

31.19

37.23

30.57

32.04

33.98

29.76

36.39

31.17

28.21

35.55

31.99

38.23

34.08

2011

32.79

26.26

23.38

28.73

33.65

28.50

30.39

37.22

29.23

32.88

33.47

35.63

31.22

30.41

25.86

29.55

28.84

33.73

34.32

2012

34.01

27.99

21.62

27.26

29.94

31.21

30.20

34.87

29.84

31.44

31.14

33.41

31.79

32.31

25.84

29.72

27.98

32.61

34.49

2010

2.18

2.43

2.13

2.09

1.82

2.15

1.39

1.70

1.91

3.12

2.42

2.12

2.09

2.86

1.97

1.69

2.15

1.81

2.06

2011

2.66

2.96

2.46

2.22

2.58

2.29

2.54

2.05

2.49

3.32

2.35

2.59

2.28

3.12

2.80

2.35

2.63

2.41

2.37

2012

2.82

3.01

2.31

2.16

2.86

2.06

2.25

1.92

2.40

3.12

2.28

2.37

2.06

2.93

2.79

2.16

2.63

2.43

1.99

70.56

78.58

73.09

81.03

75.16

83.13

31.24

36.78

29.94

31.65

29.63

29.91

2.15

2.25

2.55

2.66

2.44

3.24

76.37

72.39

77.31

75.97

71.80

75.59

76.52

73.02

78.73

75.56

79.17

79.98

78.04

79.37

79.52

77.44

29.53

32.90

28.00

29.56

28.14

31.14

25.11

32.10

29.91

25.38

30.82

27.07

29.62

29.36

27.85

31.39

2.24

2.11

2.28

2.72

2.02

2.36

2.81

2.67

3.14

2.87

2.39

3.06

2.84

2.62

2.38

2.13

TOTAL OF ASSOCIATES [ III ]

74.36

76.12

78.76

30.16

28.88

29.11

2.24

2.75

2.60

TOTAL OF STATE BANK GROUP [II + III]

77.43

79.80

82.01

34.97

30.96

29.71

2.25

2.68

3.08

IDBI Ltd.

82.43

87.04

86.06

43.74

37.83

39.51

0.97

1.68

1.56

TOTAL OF PUBLIC SECTOR BANKS [I+II+III+IV]

73.16

75.57

77.54

32.93

30.56

30.07

2.12

2.55

2.59

TOTAL OF 19 NATIONALISED BANKS

II State Bank of India (SBI)

III ASSOCIATES OF SBI

1 State Bank of Bikaner & Jaipur

2 State Bank of Hyderabad

3 State Bank of Indore*

4 State Bank of Mysore

5 State Bank of Patiala

6 State Bank of Travancore

IV Other Public Sector Bank

1

Statement VII : Public Sector Banks : Ratios

As on March 31

S.N.

I

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

Banks

( Crore)

Capital Adequacy Ratio - Basel Capital Adequacy Ratio - Basel

I

II

Return on Assets

2010

22.05

24.41

26.15

23.23

23.78

21.01

18.93

19.86

22.56

27.54

25.84

18.66

20.71

26.89

21.77

18.03

21.59

21.78

22.22

2011

25.06

25.16

26.14

26.66

31.38

22.48

28.78

20.95

24.71

26.57

24.58

19.31

22.59

29.54

26.50

21.62

27.84

23.75

26.89

2012

20.62

19.23

21.04

19.68

25.91

16.79

21.15

15.30

19.75

21.87

19.71

16.64

18.89

23.33

21.65

16.08

21.88

20.15

16.48

2010

1.16

1.39

1.21

0.70

0.72

1.30

0.66

1.28

1.01

1.67

0.53

0.91

1.05

1.44

0.62

0.87

1.25

0.45

0.76

2011

1.11

1.36

1.33

0.82

0.47

1.42

0.70

1.21

1.00

1.53

0.71

1.03

0.90

1.34

0.76

0.66

1.05

0.66

0.72

2012

1.02

1.19

1.24

0.72

0.55

0.95

0.26

1.06

1.08

1.31

0.52

0.67

0.65

1.19

0.81

0.69

0.79

0.70

0.66

2010

12.98

13.30

12.84

12.63

11.33

11.47

10.82

15.00

10.65

12.16

14.26

10.88

11.74

12.97

11.20

11.35

11.61

12.80

11.79

2011

NA

13.48

13.02

11.42

11.75

NA

10.74

12.90

11.04

12.83

13.28

12.30

11.94

11.76

11.20

11.87

NA

11.16

12.59

2012

NA

12.34

NA

11.57

11.25

NA

11.96

11.94

NA

12.67

11.95

11.01

12.81

11.59

10.81

11.03

NA

10.48

10.96

2010

13.62

13.93

14.36

12.94

12.78

13.43

12.24

15.37

12.77

NA

14.78

12.54

13.10

14.16

12.70

13.21

12.51

13.05

12.50

2011

12.96

14.38

14.52

12.17

13.35

15.38

11.64

14.11

13.41

13.56

14.55

14.23

12.94

12.42

13.04

13.71

12.95

13.05

13.88

2012

12.83

13.18

14.67

11.95

12.43

13.76

12.40

13.00

11.51

13.47

13.32

12.69

13.26

12.63

12.24

12.35

11.85

12.69

13.06

22.70

30.04

25.60

32.02

19.90

29.19

0.88

0.71

0.88

12.00

10.69

12.05

13.39

11.98

13.86

24.36

18.04

20.86

23.79

16.87

24.30

29.54

23.22

27.30

24.29

23.77

24.64

19.25

22.96

18.75

19.75

0.93

1.03

0.91

1.06

0.79

1.26

0.96

1.22

1.03

0.88

1.12

0.99

1.15

0.67

0.93

0.65

11.94

13.71

12.08

12.12

12.45

11.89

11.32

13.35

12.78

12.25

10.82

12.81

12.39

11.22

10.79

11.18

13.30

14.90

13.53

12.42

13.26

NA

11.68

14.25

13.76

13.41

12.54

13.76

13.56

12.55

12.30

13.55

TOTAL OF ASSOCIATES [ III ]

20.80

25.25

20.66

TOTAL OF STATE BANK GROUP [II + III]

27.63

30.31

26.93

12.34

13.64

12.17

0.53

0.73

0.82

10.83

12.16

12.84

11.31

13.64

14.58

23.77

26.41

21.54

NATIONALISED BANKS

Allahabad Bank

Andhra Bank

Bank of Baroda

Bank of India

Bank of Maharashtra

Canara Bank

Central Bank of India

Corporation Bank

Dena Bank

Indian Bank

Indian Overseas Bank

Oriental Bank of Commerce

Punjab & Sind Bank

Punjab National Bank

Syndicate Bank

UCO Bank

Union Bank of India

United Bank of India

Vijaya Bank

TOTAL OF 19 NATIONALISED BANKS

II

III

1

2

3

4

5

6

Opr.Exp as % to Total Expenses

State Bank of India (SBI)

ASSOCIATES OF SBI

State Bank of Bikaner & Jaipur

State Bank of Hyderabad

State Bank of Indore*

State Bank of Mysore

State Bank of Patiala

State Bank of Travancore

IV Other Public Sector Bank

1 IDBI Ltd.

TOTAL OF PUBLIC SECTOR BANKS [I+II+III+IV]

Statement VIII : Public Sector Banks : Ratios

As on March 31

S.N.

( Crore)

Banks

Net NPA as % to Net Advances

2010

2011

2012

0.66

0.79

0.98

0.17

0.38

0.91

0.34

0.35

0.54

1.31

0.91

1.47

1.64

1.32

0.84

1.06

1.10

1.46

0.69

0.65

3.09

0.31

0.46

0.87

1.21

1.22

1.01

0.23

0.53

1.33

2.52

1.19

1.36

0.87

0.98

2.21

0.36

0.56

1.19

0.53

0.85

1.52

1.07

0.97

0.96

1.17

1.84

1.96

0.81

1.19

1.70

1.84

1.42

1.71

1.40

1.52

1.72

I

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

Allahabad Bank

Andhra Bank

Bank of Baroda

Bank of India

Bank of Maharashtra

Canara Bank

Central Bank of India

Corporation Bank

Dena Bank

Indian Bank

Indian Overseas Bank

Oriental Bank of Commerce

Punjab & Sind Bank

Punjab National Bank

Syndicate Bank

UCO Bank

Union Bank of India

United Bank of India

Vijaya Bank

II

III

1

2

3

4

5

6

TOTAL OF 19 NATIONALISED BANKS

State Bank of India (SBI)

ASSOCIATES OF SBI

State Bank of Bikaner & Jaipur

State Bank of Hyderabad

State Bank of Indore

State Bank of Mysore

State Bank of Patiala

State Bank of Travancore

0.90

1.72

0.91

1.63

0.78

0.55

1.13

1.02

1.04

0.91

TOTAL OF ASSOCIATES [III]

IV

1

Business per employee

( in lakhs)

Profit per employee

2010

8.45

9.39

9.81

10.11

7.62

9.82

7.11

12.69

8.27

7.61

7.12

13.31

9.63

8.08

7.47

8.64

8.53

7.14

8.36

2011

10.63

11.65

12.29

12.84

8.25

11.99

8.35

15.73

10.77

9.30

10.05

14.18

11.90

10.18

8.75

10.69

10.43

8.60

9.28

2012

12.17

12.62

14.66

13.60

9.67

13.74

8.62

17.13

12.84

11.14

11.76

14.62

13.02

11.32

10.74

11.64

10.7

9.71

11.28

2010

5.76

7.00

8.00

4.39

3.21

7.35

3.30

9.52

4.86

7.92

2.63

7.39

6.00

7.31

3.18

4.43

7.47

2.11

4.50

2011

6.70

9.00

11.00

6.20

2.38

9.76

3.96

10.92

6.15

8.88

4.16

9.04

6.00

8.35

3.99

4.19

8.00

3.48

6.30

2012

8.36

9.00

12.00

6.40

3.12

8.21

1.51

10.90

7.87

9.3

3.84

6.21

6.00

8.42

5.29

5.09

6.00

4.08

5.00

1.42

1.82

6.36

7.04

7.98

4.46

3.84

5.31

0.83

0.87

1.38

1.21

0.98

1.92

1.30

1.93

1.35

1.54

6.28

7.55

7.64

6.72

8.95

6.96

7.51

10.38

7.95

9.56

8.88

8.27

11.69

8.81

10.56

10.66

4.00

5.58

4.83

4.41

4.45

6.00

5.00

7.89

5.00

5.20

8.00

5.00

8.63

4.00

5.87

4.20

0.87

1.03

1.55

TOTAL OF STATE BANK GROUP [II + III]

Other Public Sector Bank

IDBI Ltd.

1.50

1.49

1.76

1.02

1.06

1.61

24.17

23.46

23.87

8.44

11.93

13.16

TOTAL OF PUBLIC SECTOR BANKS [ I+II+III+IV ]

1.10

1.09

1.53

Potrebbero piacerti anche

- Regional Rural Banks of India: Evolution, Performance and ManagementDa EverandRegional Rural Banks of India: Evolution, Performance and ManagementNessuna valutazione finora

- Private Sec BanksDocumento9 paginePrivate Sec BanksMohsin TamboliNessuna valutazione finora

- PVT Sec BKS 2012 14Documento32.767 paginePVT Sec BKS 2012 14Shital AndhariaNessuna valutazione finora

- Private Sec BanksDocumento9 paginePrivate Sec BankskarunNessuna valutazione finora

- 2009 2010 2011 Bills Purchased and Discounted Name of The Bank S.NoDocumento14 pagine2009 2010 2011 Bills Purchased and Discounted Name of The Bank S.NomuruganvgNessuna valutazione finora

- Statement I: Public Sector Banks: Deposits/Investments/AdvancesDocumento8 pagineStatement I: Public Sector Banks: Deposits/Investments/AdvancesNirmal SinghNessuna valutazione finora

- Fund Release During June-2011Documento2 pagineFund Release During June-2011rattanbansalNessuna valutazione finora

- Public Sec Banks 1Documento8 paginePublic Sec Banks 1ajsharma8Nessuna valutazione finora

- Table B6: Movement of Non-Performing Assets (Npas) of Scheduled Commercial Banks - 2012 and 2013Documento3 pagineTable B6: Movement of Non-Performing Assets (Npas) of Scheduled Commercial Banks - 2012 and 2013Hitesh MittalNessuna valutazione finora

- Desert Public Sec SinglDocumento49 pagineDesert Public Sec SinglPankaj KumarNessuna valutazione finora

- Top 10 Private Sector Banks by AssetsDocumento129 pagineTop 10 Private Sector Banks by AssetsrohitcshettyNessuna valutazione finora

- Table B5: Bank-Wise Non-Performing Assets (Npas) of Scheduled Commercial Banks - 2006Documento2 pagineTable B5: Bank-Wise Non-Performing Assets (Npas) of Scheduled Commercial Banks - 2006Rekha BaiNessuna valutazione finora

- Statement I: Public Sector Banks: Deposits/Investments/AdvancesDocumento8 pagineStatement I: Public Sector Banks: Deposits/Investments/AdvancesChristopher ParkerNessuna valutazione finora

- Branch and ATM Data March 2010Documento3 pagineBranch and ATM Data March 2010Kapil Dev KumarNessuna valutazione finora

- Appendix: Table 8.1: Non Performing Assets of Different BanksDocumento8 pagineAppendix: Table 8.1: Non Performing Assets of Different Banksshreeya salunkeNessuna valutazione finora

- Appendix Table Iv.6: Branches and Atms of Scheduled Commercial Banks (Continued)Documento3 pagineAppendix Table Iv.6: Branches and Atms of Scheduled Commercial Banks (Continued)swaraj_07Nessuna valutazione finora

- Data Analysis: Pradhan Mantri Jan-Dhan Yojana (Pmjdy)Documento13 pagineData Analysis: Pradhan Mantri Jan-Dhan Yojana (Pmjdy)vivek adkineNessuna valutazione finora

- Demand Forecasting - Economics Exam Date: 08/05/2022 Roll No. Student NameDocumento12 pagineDemand Forecasting - Economics Exam Date: 08/05/2022 Roll No. Student NameAakash WaliaNessuna valutazione finora

- Economics - Demand ForecastingDocumento23 pagineEconomics - Demand ForecastingKLN CHUNessuna valutazione finora

- Source: Department of Banking Supervision, RBIDocumento6 pagineSource: Department of Banking Supervision, RBIgayatri9324814475Nessuna valutazione finora

- RBI Banking/PoS/ATM DataDocumento4 pagineRBI Banking/PoS/ATM Datajay_mehta277Nessuna valutazione finora

- Structure and Functions of Commercial BanksDocumento6 pagineStructure and Functions of Commercial BanksShanky RanaNessuna valutazione finora

- Statement I: Private Sector Banks: Deposits/Investments/AdvancesDocumento8 pagineStatement I: Private Sector Banks: Deposits/Investments/AdvancesanandbhawanaNessuna valutazione finora

- Statement I: Private Sector Banks: Deposits/Investments/AdvancesDocumento8 pagineStatement I: Private Sector Banks: Deposits/Investments/AdvancesGyanendra AgrawalNessuna valutazione finora

- Statement I: Private Sector Banks: Deposits/Investments/AdvancesDocumento8 pagineStatement I: Private Sector Banks: Deposits/Investments/Advancesprakasht_1Nessuna valutazione finora

- Statistics For Planning 2009: Co-Operation and BankingDocumento24 pagineStatistics For Planning 2009: Co-Operation and BankinggramamukhyaNessuna valutazione finora

- Bank Wise RTGS Inward and Outward - August 2013Documento8 pagineBank Wise RTGS Inward and Outward - August 2013Santosh KardakNessuna valutazione finora

- ATM POS April 2013Documento137 pagineATM POS April 2013gautam_hariharanNessuna valutazione finora

- AIBEA Press Release Disclosing List of Loan DefaultersDocumento13 pagineAIBEA Press Release Disclosing List of Loan DefaultersAakash GuptaNessuna valutazione finora

- Table B7: Bank-Wise and Bank Group-Wise Gross Non-Performing Assets, Gross Advances, and Gross NPA Ratio of Scheduled Commercial Banks - 2012Documento5 pagineTable B7: Bank-Wise and Bank Group-Wise Gross Non-Performing Assets, Gross Advances, and Gross NPA Ratio of Scheduled Commercial Banks - 2012shipra1305Nessuna valutazione finora

- International Journal of Business and Management Invention (IJBMI)Documento37 pagineInternational Journal of Business and Management Invention (IJBMI)inventionjournalsNessuna valutazione finora

- Statement I: Private Sector Banks: Deposits/Investments/AdvancesDocumento8 pagineStatement I: Private Sector Banks: Deposits/Investments/AdvancesShajin SanthoshNessuna valutazione finora

- MICR CodesDocumento663 pagineMICR CodesDurai MuruganNessuna valutazione finora

- TB6 STST1118Documento3 pagineTB6 STST1118rajsirwaniNessuna valutazione finora

- Proc No. 129-155 dt.14.12.2018Documento7 pagineProc No. 129-155 dt.14.12.2018Maku RajkumarNessuna valutazione finora

- Performance Analysis of Public Sector Banks in India: March 2015Documento12 paginePerformance Analysis of Public Sector Banks in India: March 2015Abhijeet JaiswalNessuna valutazione finora

- Results Tracker: Saturday, 28 July 2012Documento13 pagineResults Tracker: Saturday, 28 July 2012Mansukh Investment & Trading SolutionsNessuna valutazione finora

- Registration No. 512 Date of Registration With IRDAI: 01.01.2001 Name of The Insurer: Life Insurance Corporation of IndiaDocumento3 pagineRegistration No. 512 Date of Registration With IRDAI: 01.01.2001 Name of The Insurer: Life Insurance Corporation of Indianigam34Nessuna valutazione finora

- Full Name in English Bank Name Ifsccode Account NumberDocumento7 pagineFull Name in English Bank Name Ifsccode Account NumberVarun MarwahaNessuna valutazione finora

- Statement I: Foreign Banks in India: Deposits/Investments/AdvancesDocumento8 pagineStatement I: Foreign Banks in India: Deposits/Investments/Advancespankajp100Nessuna valutazione finora

- Analysis EcoDocumento7 pagineAnalysis EcoAbhay KhandelwalNessuna valutazione finora

- SR - No: Nationalised Banks 2011Documento4 pagineSR - No: Nationalised Banks 2011swap2390Nessuna valutazione finora

- Bank Fees Gen 200412Documento1 paginaBank Fees Gen 200412dineshvihanNessuna valutazione finora

- Table No. 1.1 - Progress of Commercial Banking at A GlanceDocumento1 paginaTable No. 1.1 - Progress of Commercial Banking at A GlanceRahulNessuna valutazione finora

- Determinants of Profitability of Banks in India: A Multivariate AnalysisDocumento19 pagineDeterminants of Profitability of Banks in India: A Multivariate AnalysisNeelNessuna valutazione finora

- My Bank Has Better NPA Than Your BankDocumento7 pagineMy Bank Has Better NPA Than Your Bankhk_scribdNessuna valutazione finora

- Alchemy The Emerald Tabletpdf CompressDocumento2 pagineAlchemy The Emerald Tabletpdf CompresspalharjeetNessuna valutazione finora

- Acp 2015 16 March16Documento2 pagineAcp 2015 16 March16L Sudhakar ReddyNessuna valutazione finora

- 51 Acp-March2015Documento3 pagine51 Acp-March2015Projects ScholarsDenNessuna valutazione finora

- Source: Annual Accounts of BanksDocumento6 pagineSource: Annual Accounts of BanksARVIND YADAVNessuna valutazione finora

- UntitledDocumento12 pagineUntitledshrikrushna javanjalNessuna valutazione finora

- Weekly Market Outlook 25.03.13Documento5 pagineWeekly Market Outlook 25.03.13Mansukh Investment & Trading SolutionsNessuna valutazione finora

- Ace AnalyserDocumento2 pagineAce Analyservinash1988Nessuna valutazione finora

- Non-Performing Assets, Capital Adequacy and Bank Profitability A Study of Selected Indian Commercial BanksDocumento6 pagineNon-Performing Assets, Capital Adequacy and Bank Profitability A Study of Selected Indian Commercial BanksarcherselevatorsNessuna valutazione finora

- Company Name Allahabad Bank Hdfcbankltd. Icicibankltd. Oriental Bank of Commerce Standard Chartered Bank State Bank of IndiaDocumento15 pagineCompany Name Allahabad Bank Hdfcbankltd. Icicibankltd. Oriental Bank of Commerce Standard Chartered Bank State Bank of IndiaSiddhartha GuptaNessuna valutazione finora

- Table 1: Indian Bank Association Analysis of Banks, 2003 Year Indian Banks Foreign Banks Total BanksDocumento17 pagineTable 1: Indian Bank Association Analysis of Banks, 2003 Year Indian Banks Foreign Banks Total BanksWasil AliNessuna valutazione finora

- p02 - Agricultural Field Officer (Scale I)Documento58 paginep02 - Agricultural Field Officer (Scale I)Donbor Shisha PohsngapNessuna valutazione finora

- 1st Allotment IBPS PO3 DetailsDocumento484 pagine1st Allotment IBPS PO3 DetailsSreejith Sundar PalavilaNessuna valutazione finora

- Bank FinstatementDocumento19 pagineBank FinstatementCool BuddyNessuna valutazione finora

- New Listing For PublicationDocumento2 pagineNew Listing For PublicationAathira VenadNessuna valutazione finora

- Advertisement English MGDocumento2 pagineAdvertisement English MGNekta PinchaNessuna valutazione finora

- CDoc - Admission and CancellationE - Mail ID NoticeDocumento1 paginaCDoc - Admission and CancellationE - Mail ID NoticeNekta PinchaNessuna valutazione finora

- Teaching Is So WEIRDDocumento1 paginaTeaching Is So WEIRDNekta PinchaNessuna valutazione finora

- Business LawDocumento19 pagineBusiness LawNekta PinchaNessuna valutazione finora

- Business Law Business LawDocumento19 pagineBusiness Law Business LawNekta PinchaNessuna valutazione finora

- Result - of - Essay CompetitionDocumento2 pagineResult - of - Essay CompetitionNekta PinchaNessuna valutazione finora

- Roll No. Year of AdmissionDocumento6 pagineRoll No. Year of AdmissionNekta PinchaNessuna valutazione finora

- KPMG ICC Indian Banking The Engine For Sustaining Indias Growth AgendaDocumento52 pagineKPMG ICC Indian Banking The Engine For Sustaining Indias Growth AgendaNekta PinchaNessuna valutazione finora

- Dissertation Topic - : Synopsis Submitted By: SHUME BANERJEE (ROLL NO.-R450210115)Documento6 pagineDissertation Topic - : Synopsis Submitted By: SHUME BANERJEE (ROLL NO.-R450210115)Nekta PinchaNessuna valutazione finora

- Apropos CustService FREE WorkbookDocumento25 pagineApropos CustService FREE WorkbookNekta PinchaNessuna valutazione finora

- Credit Scoring - USAID PDFDocumento17 pagineCredit Scoring - USAID PDFbicijaniNessuna valutazione finora

- Final Questionnaire Print OutDocumento2 pagineFinal Questionnaire Print OutNekta PinchaNessuna valutazione finora

- Project Mvfklbls DG LDSLDocumento4 pagineProject Mvfklbls DG LDSLNekta PinchaNessuna valutazione finora

- Headingdavm - Mdas/lvm/zm V/LZMDSV/ MDocumento23 pagineHeadingdavm - Mdas/lvm/zm V/LZMDSV/ MNekta PinchaNessuna valutazione finora

- A Study of Consumer Experience in Central MallDocumento112 pagineA Study of Consumer Experience in Central MallNekta PinchaNessuna valutazione finora

- A Study of Consumer Experience in Central MallDocumento112 pagineA Study of Consumer Experience in Central MallNekta PinchaNessuna valutazione finora

- Standard Advances Sub-Standard Advances Doubtful Advances: Public Sector BanksDocumento2 pagineStandard Advances Sub-Standard Advances Doubtful Advances: Public Sector BanksNekta PinchaNessuna valutazione finora

- Strategic Implication of Mobile Banking in India-: Bankers' PerspectiveDocumento9 pagineStrategic Implication of Mobile Banking in India-: Bankers' PerspectiveNekta PinchaNessuna valutazione finora

- Overview of Banking IndustryDocumento18 pagineOverview of Banking IndustryNekta PinchaNessuna valutazione finora

- Cover LetterDocumento1 paginaCover LetterSanjida Rahman EshaNessuna valutazione finora

- Evidencia 19.7Documento11 pagineEvidencia 19.7lorenaNessuna valutazione finora

- 英文合同印尼 泰国23 05 27Documento3 pagine英文合同印尼 泰国23 05 27ard.durianNessuna valutazione finora

- Renewal Premium Receipt: Har Pal Aapke Sath!!Documento1 paginaRenewal Premium Receipt: Har Pal Aapke Sath!!krishna krishNessuna valutazione finora

- Nov-Dec 2011Documento9 pagineNov-Dec 2011Usuf JabedNessuna valutazione finora

- The 2022 Guide To Number Coding in The Philippines AutodealDocumento1 paginaThe 2022 Guide To Number Coding in The Philippines AutodealjsraguilonNessuna valutazione finora

- Massey & Gail Fee Petition - LTLDocumento74 pagineMassey & Gail Fee Petition - LTLKirk HartleyNessuna valutazione finora

- Litio GeotermaDocumento10 pagineLitio GeotermaLucas CuezzoNessuna valutazione finora

- Conceptual Framework ReviewerDocumento4 pagineConceptual Framework ReviewerMA. MIGUELA MACABALESNessuna valutazione finora

- Pass4sure: Everything You Need To Prepare, Learn & Pass Your Certification Exam EasilyDocumento8 paginePass4sure: Everything You Need To Prepare, Learn & Pass Your Certification Exam Easilysherif adfNessuna valutazione finora

- Acc Quiz Class 12thDocumento3 pagineAcc Quiz Class 12thTilak DudejaNessuna valutazione finora

- Reasons For Not Getting A COVID-19 Vaccine.Documento536 pagineReasons For Not Getting A COVID-19 Vaccine.Frank MaradiagaNessuna valutazione finora

- Management AccountingDocumento2 pagineManagement AccountingVampire0% (1)

- Bba2 Eco2 Asg 2023 PDFDocumento6 pagineBba2 Eco2 Asg 2023 PDFIzelle Ross GreenNessuna valutazione finora

- Vendor Non-Compete Agreement Example FormatDocumento3 pagineVendor Non-Compete Agreement Example FormatOlive Dago-ocNessuna valutazione finora

- Wayne Johnson AnnouncementDocumento5 pagineWayne Johnson AnnouncementAlexandria DorseyNessuna valutazione finora

- ACTIVITY DESIGN - Labor For Asean Scout JamboreeDocumento1 paginaACTIVITY DESIGN - Labor For Asean Scout JamboreeLuigie BagoNessuna valutazione finora

- UCC D106 Communication Skills Notes - TvetsDocumento35 pagineUCC D106 Communication Skills Notes - TvetsraynerngureNessuna valutazione finora

- Exhibit B - Compensation and MethodDocumento4 pagineExhibit B - Compensation and MethodAsep FirmansyahNessuna valutazione finora

- Tankeh Vs DBP (G.R. No. 171428, November 11, 2013)Documento35 pagineTankeh Vs DBP (G.R. No. 171428, November 11, 2013)Ezra RamajoNessuna valutazione finora

- Dgex Form20180521Documento1 paginaDgex Form20180521Arif Tawil PrionoNessuna valutazione finora

- ISO-CASCO - ISO - IEC 17060 (2022) - Conformity Assessment - Code of Good PracticeDocumento23 pagineISO-CASCO - ISO - IEC 17060 (2022) - Conformity Assessment - Code of Good PracticeKatherine chirinosNessuna valutazione finora

- Lululemon Athletica Case AnalysisDocumento19 pagineLululemon Athletica Case Analysiskuntodarpito100% (2)

- PR PlanDocumento12 paginePR Planapi-664422332Nessuna valutazione finora

- Solid Pin Conversion Kits: Equipment: Cat Loaders To Suit Machines: 990, 992C, 992G, 992K, 994C, 994D & 994FDocumento2 pagineSolid Pin Conversion Kits: Equipment: Cat Loaders To Suit Machines: 990, 992C, 992G, 992K, 994C, 994D & 994FMax SashikhinNessuna valutazione finora

- Long-Run Economic Growth: Intermediate MacroeconomicsDocumento23 pagineLong-Run Economic Growth: Intermediate MacroeconomicsDinda AmeliaNessuna valutazione finora

- 5 10 pp.62 66Documento6 pagine5 10 pp.62 66timesave240Nessuna valutazione finora

- CYBERPRENEURSHIPDocumento13 pagineCYBERPRENEURSHIPMash ScarvesNessuna valutazione finora

- LIst of CA AgentDocumento12 pagineLIst of CA AgentParikshit SalvepatilNessuna valutazione finora

- NATO STO CPoW 2021Documento71 pagineNATO STO CPoW 2021iagaruNessuna valutazione finora