Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Definition of Vouching

Caricato da

TUSHER147Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Definition of Vouching

Caricato da

TUSHER147Copyright:

Formati disponibili

Definition of Vouching

An act of comparing entries in the books of accounts with documentary evidence in support thereof. -- Lawrence Dicksee Vouching is the examination of the underlying evidence which is in support of the accuracy of the transaction. The process of vouching is intended to substantiate an entry by providing authority, ownership, existence and accuracy. -- Arthur W Holmes Vouching does not mean merely the inspection of receipts with the cash book, but includes the examination of the transactions of a business together with documentary and other evidence of sufficient validity to satisfy an auditor that such transactions are in order, have been properly authorized and are correctly recorded in the books. --F R M De Paula, Vouching is a method of examination to not only substantiate an entry in the books of account with documentary evidences, but also to see that these evidences are adequate, reliable and really connected with the business.

Definition of Voucher

A voucher is a documentary evidence in support of a transaction in the books of account. A document recording a liability or allowing for the payment of a liability, or debt. A voucher would be held by the person or company who will receive payment. Any documentary evidence supporting the entries recorded in the books of accounts, establishing the arithmetic accuracy of the transaction, may also be referred to as a voucher. Example - A bill, an invoice, receipt, Salary and wages sheet, Memorandum of Association, Trust deed, Bought Note, Sold Note, an agreement, correspondence etc.

Objectives Of Vouching

Main objective of vouching is to find out the regularity or irregularity of transactions, frauds and errors. Regularity means maintaining record and performing the work compliance with the rules, regulation and law. But irregularity means doing the work crossing to the line of rules, regulation and laws. Some of the major objectives of vouching are given below: 1. To Detect Errors And Frauds:- All transactions are to be supported by evidence. Each document should be proved by authorized authority. With the help of vouching we can detect errors and frauds by verifying each transaction. Planned fraud can be detected through vouching. 2. To Know The Truth Of Account:- Each and every transaction is checked and ratified on the basis of support document. So, we can easily know the truth of account. 3. To Find The Unrecorded Transactions:- Each and every transaction is checked and ratified on the basis of document. Vouching helps 4. To Know That All The Transactions Are Authorized :- If the transactions are made on the consent of concerned authority, such transactions are known as authorized transactions. If transactions are not authorized, such transactions can be fictitious transactions. So, such fictitious transactions can be found with the help of vouching. 5. To Know That Only The Business Transactions Are Recorded :- Sometimes, transactions are performed for individual purpose but payment is made out of business. Such transactions should not be recorded in account of business. If such transactions are recorded, we can find it with the help of vouching. To know the real profit or loss of business, such transactions are to be separated

Importance of vouching

1. Vouching Is The Backbone Of Auditing :- Main aim of auditing is to detect errors and frauds for proving the true and fairness of results presented by income statement and balance sheet. Vouching is only the way of detecting all sorts of errors and planned frauds. So, it is the backbone of auditing. 2. Vouching Is The Essence Of Auditing :- Auditing not only checks the accuracy of books of accounts but also checks whether the transactions are related to business or not. All the transactions are performed after the

prior approval of concerned authority or not, transactions are real or not because an accountant may include fictitious transactions to commit frauds. All these facts can be found with the help of vouching. So, vouching is essential for auditing. 3. Vouching Is Important To See Whether Evidences Are Correct Or Not:- An auditor checks the books of accounts to detect errors and frauds. Frauds may be committed presenting duplicate vouchers. All the small and big amounts of frauds can be detected with the help of vouching. So, all the evidential documents and records are to be checked carefully and in detail by an auditor which is the scope of vouching..

VOUCHING OF CASH BOOK

System of internal check as regards receipt & payment of cash is suggested:

Printed receipt which should have a counterfoil or by a carbon receipt Rough cash book or diary Presence of a responsible officer who should not be connected with the cashiers office. Automatic tills or cash registers All the receipts of the day should be deposited in the bank at the end of the day or the next morning.

Internal Check as regards Cash

Bank reconciliation statement should be prepared frequently by the cashier and also by someone else The cashier should not have any control over the ledgers Petty cash should be organized under the Imprest system Before a cheque is issued, it should be presented along with the account of the payee to a responsible officer, who should not have any access to accounting records or securities, for his signature Casting of cash book should be independently checked Internal control over the preparation of wages sheets Payments should be made by cheques The issue of receipts and deposits of collected money into the bank by travelers should be carefully controlled The method recording the cash sales has been dealt with below in detail. Cashier should not sanction the payments of special nature

Duty of an Auditor in connection with credit purchases

Only a responsible officer should be allowed to place order; The date of the invoice should relate to the period under review; The clerk check the invoice with the order book to see that only those goods have been sent for which the order was placed; The auditor should also see that the goods mentioned in the invoice are not capital goods; The auditor should do a test check, compare some invoice with the goods inward book or the gatekeepers inward book; The auditor should check the cast and cross-casts of the purchases book He should see whether trade discount has been deducted from the invoice before making the entry in the purchase book; He should compare the goods inward book and the stock sheets with the purchase book; The auditor should stamp the invoice or cancel it after he has compared it with the entries in the purchase book to prevent its being produced again; Auditor should check the goods whether it is purchased for business or personal purposes while the payment is made through the company. In order to be sure that all invoices are included, the auditor should ask his client to write to all the creditors to send their statements of account; If an invoice run into several pages auditor should see that the grant total is correct.

The duties of an Auditor in connection with credit sales

The auditor should see that the internal check system is efficient, if it is not so, he should disown his responsibility, if it is efficient he should apply a few test check, He should compare the data of the copy of the invoice with the data in the sales book,

He should see that the sales are not omitted from being entered in the sales book, He should further see that the sale of an asset is not created as ordinary sale, otherwise profit will be inflated, With the permission of the client, the auditor should send statements of account to the customers to confirm the accuracy of the balance, He should check the sales book for the last days or weeks of the financial period and the return inwards book for a few days, He should check the casts and cross casts of the sales book, The cancelled invoice should be checked with the duplicate copy of the invoice, Sales to allied or sister concerns should be carefully examined, If there is a significant difference of trade discount allowed to two different purchasers.

Points should be carefully considered while examining the evidence of expenses

That the name of client is stated as the payer. That the date in the payee's acknowledgement agrees with the corresponding entry in the cash book. That the payee's name is correctly stated in the cash book. The amount of the payment together with the head of account debited is correctly entered in the cash book. The allocation in respect of the head of account is correctly done. The payment is duly authorized and is properly chargeable as business expenditures

Audit procedure for Expenses

Check that the expenses have been properly allocated whether to Capital, deferred revenue or revenue as the case may be. Examine the supporting documents to ensure that the expenses relates to the clients business. Review and examination of the complete list of indicating the dates, location, timing etc., along with the amounts paid in respect of each category. Examination of the receipts of the amounts paid Reviewing the contracts with the different agencies and ensuring the billing conforms to the term and conditions specified therein Ensuring that all such outstanding expenses have been properly accounted for otherwise any material omission will results in overstatement of profits.

Procedure in Regard to Vouching the Debit Side of Cash Book

Auditor

Check Internal System

Proceed to Vouch the Debit Side of the Cash

It is difficult to vouch the receipt of cash because some entries might have been omit altogether. Only indirect evidence is available. Checking a few items at random. If they are correct, auditor assumes that others are correct. If it is found time lag between two dates, auditor should go deeper.

Important Items to be Checked on the Debit of the Cash Book:

Opening Balance: To check the previous years balance in the duly audited balance sheet. Cash Sales: Salesman may not make entry in the cash book. More than one cash memo system should be followed.

Receipt from Debtors: To check the received from debtors to whom goods had been sold on credit in the past. > To check the counterfoils. >Teeming and Lading Method of Fraud to detect- Checking partial payments, Checking amounts deposited in banks, Checking carbon copies of receipts, Checking statements of accounts. Income from Interest, Dividends, etc.: > To check interest from fixed deposits. > To check dividends, warrants. ( Dates of issues should be checked properly) Loans: Examine the rate of interest, terms, interest due etc. Rents Received: Examine the lease deeds, rent payable, rent due, etc. Bills Receivables: Bills receivables should be checked with cash and pass book. Bills have been mature but not received should be checked. Commission: To examine the rate of commission, calculation, parties. Sale of Investments: To examine the brokers sold note, profit and loss by the sale. Bad Debt Dividends: To check the dividend warrants, amount paid and amount due. Subscriptions: Subscription received by club or school should be checked with the register of subscribers. Sales of Fixed Assets: To examine that proper account has been credited with the amount. If there is any profit or loss, that should be adjusted with capital reserve account.

Procedure in regard to vouching the credit side of the cash book

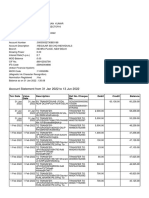

ITEMS 1. Opening Balance: 2. Cash Sales: 3. Cash Received from Debtors: VOUCHING CONSIDERATIONS Examine the balance shown in the audited balance sheet of the previous year. Examine carbon copies of the cash receipt or cash sales invoices. Examine Method of allowing the discount Unusual discount , Numbers of cheques and their amount Check the sale proceeds with contracts of sale Check The arithmetical accuracy of the bank statement Rate of interest agreed and charged Date of payment of interest and due dates Interest received on securities . Lease deeds and agreements should be examined in respect of amounts of rent payable, the date, provision regarding repairs etc. Examine The Bye-Laws of the organization carbon copy receipt and the register of subscribers. any unusual amount of subscription received. Check the bill receivable book, Receipts from bankrupt debtors should be vouched Examine Correspondence exchanged with the insurance company, The amount left by the broker or company, Original claim actually presented.

4. Capital Receipts : 5. Interest Income:

6. Rent Income Received: 7. Subscription Received:

8. Bill Receivable: 9. Bad Debts Dividend: 10. Insurance Claim Money Received:

Factors To Be Considered While Vouching

Vouching helps to prove the truth and fairness of account by detecting errors and frauds. So, while conducting the test of vouchers, following factors are to be taken into consideration: An auditor should check the records whether they are supported by evidential documents or not. All the documents related to income and expenditures are to be separated and separate files should be maintained. If not, auditor should ask to do so. An auditor should use special sign in tested vouchers so that they cannot be used again. While vouching, an auditor should check whether the general principles of accounting have been followed or not and clear cut demarcation of capital and revenue is made or not. Whether the documents presented for testing are related to the current year or not. All the documents which are presented for auditing must be authorized by the concerned authority. An auditor should check whether it is done or not. An auditor should ask duplicate copies of missing vouchers, but if important vouchers have been missed and auditor is not satisfied with the reasons presented, s/he should write in report to this fact. If an auditor finds the correction in the evidential document, then such figures should be verified with documents and to be noted down in audit note book for consideration while preparing report. All the documents are to be reviewed before closing the work of audit which helps to check again those facts where special sign is given.

Differences between Vouching & Verification

Vouching: vouching is the process of recognition obligation and authorizing cash disbursement. It deals with the examination of PROFIT AND LOSS items. Verification: Verification is the process of checking title, Possession and valuation of the assets. It deals usually with the FINAL BALANCE in the final accounts i.e. balance sheet items Points of Vouching Verification differences 1. Meaning. Vouching is the act of checking of records with Verification is the act of checking the help of evidential documents. title, Possession and valuation of the assets. 2.Nature. Vouching is related to all the accounting But verification is only related to the documents. assets and liabilities. 3. Person. Generally, Assistant staff, or auditor performs But The auditor himself performs the the works of vouching. work of vouching. 4.Time. Vouching is made at the beginning of auditing But Verification is made at the end of auditing or at the time checking Balance Sheet. Whereas, verification usually deals with the FINAL BALANCE in the final accounts viz, Balance sheet and Profit and loss account.

5.Working area.

Vouching is the substantive testing/ examination of transaction at their POINT OF ORIGIN.

Potrebbero piacerti anche

- Audit Smart Notea PDFDocumento324 pagineAudit Smart Notea PDFTheLatentGamer100% (1)

- Affidavit Forgery2Documento8 pagineAffidavit Forgery2nootkabearNessuna valutazione finora

- FORM 43 Declaration by Member About Ultimate Beneficial OwnersDocumento3 pagineFORM 43 Declaration by Member About Ultimate Beneficial OwnersbehindthelinkNessuna valutazione finora

- Appointment Letter TemplateDocumento3 pagineAppointment Letter TemplateManoj KumarNessuna valutazione finora

- Bank ConfirmationDocumento2 pagineBank ConfirmationKimberly DyNessuna valutazione finora

- Ov QPR GIVBp at 5 Q8 MDocumento15 pagineOv QPR GIVBp at 5 Q8 ManuranjankumarNessuna valutazione finora

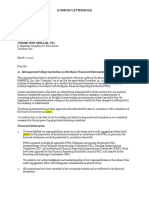

- Management Representation LetterDocumento10 pagineManagement Representation LetterJOHN MARK ARGUELLESNessuna valutazione finora

- Vouching of Cash and Trade TransactionsDocumento2 pagineVouching of Cash and Trade TransactionsAnonymous Xv4sDoDNessuna valutazione finora

- Financial StatementDocumento7 pagineFinancial StatementEunice SorianoNessuna valutazione finora

- Auditing Project Sem 3Documento33 pagineAuditing Project Sem 3Vivek Tiwari50% (2)

- AUDIT PROGRAM For Cash Disbursements 2Documento5 pagineAUDIT PROGRAM For Cash Disbursements 2jezreel dela mercedNessuna valutazione finora

- 2018 - COA-Audited-Financial Statements PDFDocumento66 pagine2018 - COA-Audited-Financial Statements PDFAnna Marie AlferezNessuna valutazione finora

- Account Opening Form and Investment FormDocumento5 pagineAccount Opening Form and Investment FormEngr Muhammad Talha IslamNessuna valutazione finora

- Accounting Policy - Cash Receipts and Bounced ChecksDocumento13 pagineAccounting Policy - Cash Receipts and Bounced ChecksneilNessuna valutazione finora

- Engagement Letter (Coop)Documento2 pagineEngagement Letter (Coop)Jasper Andrew Adjarani100% (1)

- Export Documentation and ProceduresDocumento180 pagineExport Documentation and ProceduresTUSHER14767% (3)

- Secretary - S Certificate To Apply For A Loan or Credit AccommodationDocumento2 pagineSecretary - S Certificate To Apply For A Loan or Credit AccommodationJen DCNessuna valutazione finora

- Bank Statement BNIDocumento1 paginaBank Statement BNIRifqi Ar-Rozzaq SubarkhaNessuna valutazione finora

- Reviewer On Inter Accounting CH 1 6 1Documento19 pagineReviewer On Inter Accounting CH 1 6 1Roseyy Galit43% (7)

- Protesting A Tax AssessmentDocumento3 pagineProtesting A Tax AssessmenterinemilyNessuna valutazione finora

- Management Has Universality and TransferabilityDocumento7 pagineManagement Has Universality and TransferabilityTUSHER14740% (5)

- Accounts Receivable Confirmation Letter: March 2014 Agrees With YourDocumento10 pagineAccounts Receivable Confirmation Letter: March 2014 Agrees With Yourmj192Nessuna valutazione finora

- Audit Program For Accounts Receivable and Sales Client Name: Date of Financial Statements: Iii. Accounts Receivable and SalesDocumento6 pagineAudit Program For Accounts Receivable and Sales Client Name: Date of Financial Statements: Iii. Accounts Receivable and SalesFatima MacNessuna valutazione finora

- Secretary's Certificate For Account Opening (Domestic Corporation)Documento3 pagineSecretary's Certificate For Account Opening (Domestic Corporation)JACQUE ARCENALNessuna valutazione finora

- Petty Cash /imprest Reimbursement Post Audit ChecklistDocumento2 paginePetty Cash /imprest Reimbursement Post Audit ChecklistHenry Mapa100% (1)

- Audit Manual 1Documento274 pagineAudit Manual 1Humayoun Ahmad Farooqi100% (2)

- What Is An External AuditDocumento5 pagineWhat Is An External AuditRohit BajpaiNessuna valutazione finora

- Audit Program - Breeding StockDocumento4 pagineAudit Program - Breeding StockNanette Rose HaguilingNessuna valutazione finora

- Auditor's Report - Sole PropDocumento3 pagineAuditor's Report - Sole PropRonn Robby Rosales100% (1)

- Management Representation LetterDocumento2 pagineManagement Representation LetterITR MUMBAI100% (1)

- Banking and Finance PDFDocumento2 pagineBanking and Finance PDFFaculty of Business and Economics, Monash UniversityNessuna valutazione finora

- IAS 16, Property, Plant and Equipment OverviewDocumento3 pagineIAS 16, Property, Plant and Equipment OverviewSpencerNessuna valutazione finora

- H 1981Documento61 pagineH 1981Hal ShurtleffNessuna valutazione finora

- Payroll ICQDocumento1 paginaPayroll ICQvarghese2007100% (1)

- 324 - Foreign Exchange Market-ForEXDocumento74 pagine324 - Foreign Exchange Market-ForEXTamuna BibiluriNessuna valutazione finora

- Independent Auditor ReportDocumento1 paginaIndependent Auditor ReportDaniel Tadeja100% (1)

- Bank Confirmation FormDocumento1 paginaBank Confirmation FormJerikka Anne Dizon BenavidesNessuna valutazione finora

- Guidelines On Compliances and DocumentationDocumento4 pagineGuidelines On Compliances and DocumentationJfm A Dazlac100% (1)

- K AP 3 Capital Work in ProgressDocumento5 pagineK AP 3 Capital Work in Progresssibuna151Nessuna valutazione finora

- Sample Managment Representation LetterDocumento3 pagineSample Managment Representation LetterSONITANessuna valutazione finora

- 9 StatementOfAccount-September2023Documento3 pagine9 StatementOfAccount-September2023cailinghoneygenNessuna valutazione finora

- Notes To FS EncodingDocumento11 pagineNotes To FS EncodingPappi JANessuna valutazione finora

- VouchingDocumento61 pagineVouchingTeja Ravi67% (3)

- 2019 ICREATE Audit ReportDocumento3 pagine2019 ICREATE Audit ReportJoanna GarciaNessuna valutazione finora

- Vouching Meaning: Vouching Means The Examination of Documentary Evidence in Support of Entries ToDocumento4 pagineVouching Meaning: Vouching Means The Examination of Documentary Evidence in Support of Entries ToShubhangi GuptaNessuna valutazione finora

- CH 4 VouchingDocumento19 pagineCH 4 VouchingHimanshu UtekarNessuna valutazione finora

- Unit Iv-Vouching, Verification and ValuationDocumento25 pagineUnit Iv-Vouching, Verification and ValuationJABEZ SMITH100% (1)

- Vouching of IncomeDocumento8 pagineVouching of IncomeMuthu Swamy100% (1)

- FULL PFRS - Unqualified Auditors Report (Capital Deficiency) 2016 TemplateDocumento3 pagineFULL PFRS - Unqualified Auditors Report (Capital Deficiency) 2016 TemplateMyda RafaelNessuna valutazione finora

- Revised Statement of Management Responsibility 2017Documento1 paginaRevised Statement of Management Responsibility 2017MackyNessuna valutazione finora

- Bank Release OrderDocumento2 pagineBank Release Ordercallvk50% (2)

- CAR 2D Expanded Engagement Ltr-Compilation (5-17)Documento8 pagineCAR 2D Expanded Engagement Ltr-Compilation (5-17)Andy RossNessuna valutazione finora

- Audit of Forex TransactionsDocumento4 pagineAudit of Forex Transactionsnamcheang100% (2)

- Audit Reports and Professional EthicsDocumento20 pagineAudit Reports and Professional EthicsMushfiq SaikatNessuna valutazione finora

- Monitoring Icq PDFDocumento3 pagineMonitoring Icq PDFPatrick GoNessuna valutazione finora

- PHC-BOA UpdatesDocumento67 paginePHC-BOA UpdatesMaynard Mirano100% (1)

- Auditing Fundamentals Unit 1 Meaning of Auditing: Financial StatementsDocumento14 pagineAuditing Fundamentals Unit 1 Meaning of Auditing: Financial StatementsNandhakumarNessuna valutazione finora

- Board Resolution For Change in DesignationDocumento1 paginaBoard Resolution For Change in DesignationManish ReddyNessuna valutazione finora

- Principles of VerificationDocumento3 paginePrinciples of Verificationpathan1990Nessuna valutazione finora

- Audit of Cash and Cash AccountsDocumento15 pagineAudit of Cash and Cash AccountsvangieNessuna valutazione finora

- Sample Management Rep LetterDocumento3 pagineSample Management Rep LetterMiharu TachibanaNessuna valutazione finora

- Audit Project TAX AUDITDocumento34 pagineAudit Project TAX AUDITkhairejoNessuna valutazione finora

- Chap 5 VouchingDocumento20 pagineChap 5 VouchingAkash GuptaNessuna valutazione finora

- CFPB ManualDocumento171 pagineCFPB ManualveereshchiremathNessuna valutazione finora

- Verification of Cash Payment To SubscriptionDocumento2 pagineVerification of Cash Payment To SubscriptionAlexNessuna valutazione finora

- Qualification of An Auditor 2Documento8 pagineQualification of An Auditor 2sidraayaz_84Nessuna valutazione finora

- 1903 January 2018 ENCS FinalDocumento4 pagine1903 January 2018 ENCS FinalJames E. NogoyNessuna valutazione finora

- Definition of AuditingDocumento13 pagineDefinition of AuditingRoseyy GalitNessuna valutazione finora

- Voching NotesDocumento14 pagineVoching NotesVishruthi MuruganNessuna valutazione finora

- Vouching DefinitionDocumento8 pagineVouching DefinitionMariam AfzalNessuna valutazione finora

- Shishir PresentationDocumento8 pagineShishir PresentationTUSHER147Nessuna valutazione finora

- Chapter 4: Bangladesh's Trade PoliciesDocumento14 pagineChapter 4: Bangladesh's Trade PoliciesTUSHER147Nessuna valutazione finora

- Import Policy2Documento62 pagineImport Policy2TUSHER147Nessuna valutazione finora

- Emerging China: 2020 Report Published in 1997. Although Most of Its Exports Were Once Directed Toward The EuropeanDocumento5 pagineEmerging China: 2020 Report Published in 1997. Although Most of Its Exports Were Once Directed Toward The EuropeanTUSHER147Nessuna valutazione finora

- Bangladesh's Trade Policy Towards IndiaDocumento4 pagineBangladesh's Trade Policy Towards IndiaTUSHER147Nessuna valutazione finora

- Interim and Continuous AuditDocumento4 pagineInterim and Continuous AuditTUSHER147Nessuna valutazione finora

- MF-Reference MaterialDocumento69 pagineMF-Reference MaterialRESHMA AJITH RCBSNessuna valutazione finora

- Lecture 5Documento1 paginaLecture 5JohnNessuna valutazione finora

- Chapter 8 Debentures and ChargesDocumento2 pagineChapter 8 Debentures and ChargesNahar Sabirah100% (1)

- Saito Solar-Teaching Notes ExhibitsDocumento10 pagineSaito Solar-Teaching Notes Exhibitssebastien.parmentierNessuna valutazione finora

- Shaheed Taylor 2223 Florey LN Apt. E8 ROSLYN PA 19001: Return Service RequestedDocumento3 pagineShaheed Taylor 2223 Florey LN Apt. E8 ROSLYN PA 19001: Return Service Requestedshaheed taylorNessuna valutazione finora

- Employer Contributions Payment Form R-5: Social Security SystemDocumento2 pagineEmployer Contributions Payment Form R-5: Social Security SystemUncle Cheffy - MalateNessuna valutazione finora

- Hundaol ProposalDocumento22 pagineHundaol ProposalletahundaolkasaNessuna valutazione finora

- International Finance Multiple Choice QuDocumento24 pagineInternational Finance Multiple Choice QuSaurabh JhaNessuna valutazione finora

- CH 09Documento27 pagineCH 09Imtiaz PiasNessuna valutazione finora

- Study Plan For JaiibDocumento21 pagineStudy Plan For JaiibMahirNessuna valutazione finora

- Economics 1BDocumento91 pagineEconomics 1BsinghjpNessuna valutazione finora

- Multinational Business Finance 14th Edition Eiteman Test BankDocumento36 pagineMultinational Business Finance 14th Edition Eiteman Test Bankrecolletfirework.i9oe100% (23)

- CHAPTER 10 Intermediate Acctng 1Documento49 pagineCHAPTER 10 Intermediate Acctng 1Tessang OnongenNessuna valutazione finora

- First Optima Realty Corporation vs. Securitron Security Services, Inc., 748 SCRA 534, January 28, 2015Documento20 pagineFirst Optima Realty Corporation vs. Securitron Security Services, Inc., 748 SCRA 534, January 28, 2015Mark ReyesNessuna valutazione finora

- Nov 19Documento43 pagineNov 19Prabhat Kumar MishraNessuna valutazione finora

- Barclays PDFDocumento1 paginaBarclays PDFdmitryyakovlev481Nessuna valutazione finora

- IFS - Chapter 4Documento28 pagineIFS - Chapter 4riashahNessuna valutazione finora

- Account Closure Form2 PDFDocumento1 paginaAccount Closure Form2 PDFdigant daveNessuna valutazione finora

- Program btc2bDocumento2 pagineProgram btc2bbtc2b2Nessuna valutazione finora

- Credit Risk Management Practice in Private Banks Case Study Bank of AbyssiniaDocumento85 pagineCredit Risk Management Practice in Private Banks Case Study Bank of AbyssiniaamogneNessuna valutazione finora

- Invoice KindleDocumento1 paginaInvoice KindleNishant DuggalNessuna valutazione finora

- Acccob2 Quiz 2 1203 Acccob2 k44 Financial AccountingDocumento18 pagineAcccob2 Quiz 2 1203 Acccob2 k44 Financial AccountingChelcy Mari GugolNessuna valutazione finora