Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Alternative Strategies in Financing Working Capital

Caricato da

Charm Mendoza0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

41 visualizzazioni16 paginealternative strategies in financing capital

Titolo originale

financing capital

Copyright

© Attribution Non-Commercial (BY-NC)

Formati disponibili

PPT, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoalternative strategies in financing capital

Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PPT, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

41 visualizzazioni16 pagineAlternative Strategies in Financing Working Capital

Caricato da

Charm Mendozaalternative strategies in financing capital

Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PPT, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 16

ALTERNATIVE STRATEGIES IN FINANCING WORKING CAPITAL

BROAD CATEGORIES OF ASSETS

Long Term/ Fluctuating or Permanent Assets Seasonal Assets

LONG TERM/ PERMANENT ASSETS

-Portion of assets remain unchanged over the year.

Property, Plant and Equipment

Long term investments

inventories, receivables, etc.,

FLUCTUATING OR SEASONAL ASSETS

-These are current assets that vary over the year due to seasonal or cyclical needs.

inventories before Christmas (Christmas decors) School supplies during opening of classes Flowers during Valentines Day

TOTAL ASSET REQUIREMENT OVERTIME

Seasonal Variation

Total Asset Requirement

Assets

General Growth in fixed assets and permanent Current assets

DIFFERENT POLICIES FOR FINANCING CURRENT ASSETS

Policy I Flexible Financing Policy

Policy II Restricted Financing Policy

Policy III Compromise Financing Policy

POLICY I FLEXIBLE FINANCING POLICY

-This involves the decision to finance the peaks of asset requirement with longterm debt and equity.

FOR SCHOOL SUPPLIES FIRM:

Rise

Inventory and current asset

Decline

Sell

Marketable Securities

Reinvest

POLICY I FLEXIBLE FINANCING POLICY

Total Asset Requirement

Seasonal Variation

Long-term Debt and Equity

General Growth in fixed assets and permanent Current assets

Marketable Securities

Time

POLICY II RESTRICTED FINANCING POLICY

-This involves the decision to finance the valleys or troughs of asset, with long term debt and equity.

POLICY II RESTRICTED FINANCING POLICY Total

Asset Requirement

Short term Financing

Seasonal Variation Pesos

General Growth in fixed assets and permanent Current assets

Long-term Debt and Equity

Time

POLICY III COMPROMISE FINANCING POLICY

involves a firm financing the seasonally adjusted average level of asset demand with long term debt and equity.

-This

POLICY III COMPROMISE FINANCING POLICY

Short term Financing

Seasonal Variation Pesos

General Growth in fixed assets and permanent Current assets Long-term Debt and Equity

Marketable Securities

Time

Which Financing Policy Should be Chosen?

There is no definitive answer.

The following should be considered:

Maturity Hedging Cash Reserves Relative Interest Rates

Availability and Costs of Alternative Financing

Impact on Future Sales

Potrebbero piacerti anche

- Ricardo Pangan CompanyDocumento38 pagineRicardo Pangan CompanyAndrea Tugot67% (15)

- Profit & Loss Statement: O' Lites GymDocumento8 pagineProfit & Loss Statement: O' Lites GymNoorulain Adnan100% (5)

- Financial Management 1 - Chapter 17Documento5 pagineFinancial Management 1 - Chapter 17lerryroyce100% (1)

- Chapter 2 - The Asset Allocation DecisionDocumento41 pagineChapter 2 - The Asset Allocation DecisionPrince Rajput67% (3)

- Addressing Working Capital Policies and Management of ShortDocumento17 pagineAddressing Working Capital Policies and Management of ShortAnne Morales100% (1)

- Basic Questions To Answer-: The Asset Allocation DecisionDocumento52 pagineBasic Questions To Answer-: The Asset Allocation DecisionKazi FahimNessuna valutazione finora

- Acquisition of Property 1 1Documento50 pagineAcquisition of Property 1 1Jefferson Penino100% (1)

- Economics Chapter 8 Study GuideDocumento22 pagineEconomics Chapter 8 Study GuideJon RossNessuna valutazione finora

- Lesson 2Documento43 pagineLesson 2WilsonNessuna valutazione finora

- Mbaasset Allocation - 2Documento36 pagineMbaasset Allocation - 2Masirah Muhammed ZernaNessuna valutazione finora

- IPM ReviewerDocumento8 pagineIPM ReviewerPaul Jancen ConcioNessuna valutazione finora

- Personal Finance Chapter 1Documento3 paginePersonal Finance Chapter 1Brittany Jablonski WilliamsNessuna valutazione finora

- Active Equity Portfolio ManagementDocumento5 pagineActive Equity Portfolio ManagementAshleyNessuna valutazione finora

- Net Working Capital and CCCDocumento9 pagineNet Working Capital and CCCJomar TeofiloNessuna valutazione finora

- Management Consultancy Chapter 14 Financial ForecastingDocumento3 pagineManagement Consultancy Chapter 14 Financial Forecastingjhaeus enajNessuna valutazione finora

- Chapter 2 The Asset Allocation DecisionDocumento64 pagineChapter 2 The Asset Allocation DecisionZeeshan SiddiqueNessuna valutazione finora

- Investment Analysis and Portfolio Management: Lecture Presentation SoftwareDocumento44 pagineInvestment Analysis and Portfolio Management: Lecture Presentation SoftwareHamid UllahNessuna valutazione finora

- Asset Allocation DecisionDocumento46 pagineAsset Allocation DecisionJoeritch BullidoNessuna valutazione finora

- Factors Affect Factors Affecting Working Capitaling Working CapitalDocumento24 pagineFactors Affect Factors Affecting Working Capitaling Working Capitalranjita kelageriNessuna valutazione finora

- Monetary Policy and CB Module-4Documento11 pagineMonetary Policy and CB Module-4Eleine AlvarezNessuna valutazione finora

- Asset Allocation Prof: Vinod Agarwal Ibs, MumbaiDocumento29 pagineAsset Allocation Prof: Vinod Agarwal Ibs, Mumbaisanky23Nessuna valutazione finora

- Chapter 2 The Asset Allocation DecisionDocumento54 pagineChapter 2 The Asset Allocation Decisiontjsami100% (1)

- The Ursinus College Student Managed Investment Fund HandbookDocumento17 pagineThe Ursinus College Student Managed Investment Fund HandbookYeraldineNessuna valutazione finora

- Investment Analysis and Portfolio Management: Lecture Presentation SoftwareDocumento43 pagineInvestment Analysis and Portfolio Management: Lecture Presentation SoftwareNoman KhalidNessuna valutazione finora

- Fiscal Planning, Budgeting & Management Expert, With A Strong Background in Finance/economics & Urban ManagementDocumento3 pagineFiscal Planning, Budgeting & Management Expert, With A Strong Background in Finance/economics & Urban ManagementNikhil MohanNessuna valutazione finora

- Meeting3 Workingcapitalinvestmentpolicy 180309191031Documento35 pagineMeeting3 Workingcapitalinvestmentpolicy 180309191031mjay moredoNessuna valutazione finora

- Chapter 4Documento19 pagineChapter 4Michelle DiazNessuna valutazione finora

- 2 Investment ProcessDocumento30 pagine2 Investment ProcessharshitdayalNessuna valutazione finora

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownDocumento44 pagineInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownamsNessuna valutazione finora

- My Portfolio: Step 1: Set Specific GoalsDocumento5 pagineMy Portfolio: Step 1: Set Specific GoalskevallimsNessuna valutazione finora

- Investment Analysis and Portfolio Management: Lecture Presentation SoftwareDocumento44 pagineInvestment Analysis and Portfolio Management: Lecture Presentation SoftwareArun KumarNessuna valutazione finora

- How Can Operating Cycle Be ReducedDocumento2 pagineHow Can Operating Cycle Be ReducedElizabethNessuna valutazione finora

- The Asset Allocation DecisionDocumento29 pagineThe Asset Allocation DecisionNida FatimaNessuna valutazione finora

- Investment Objectives and Strategies of Individual Investors in The Nigerian Capital MarketDocumento6 pagineInvestment Objectives and Strategies of Individual Investors in The Nigerian Capital MarketHabtamu YosephNessuna valutazione finora

- MBA-405 - Topic 3 - Financial ForecastingDocumento4 pagineMBA-405 - Topic 3 - Financial ForecastingHanna Vi B. PolidoNessuna valutazione finora

- Sapm 1Documento21 pagineSapm 1Divya BhadriNessuna valutazione finora

- Working Capital-WPS OfficeDocumento6 pagineWorking Capital-WPS Officemjay moredoNessuna valutazione finora

- Pas AssignmentDocumento12 paginePas AssignmentJayson TasarraNessuna valutazione finora

- Unit 1Documento78 pagineUnit 1Himanshi SinghNessuna valutazione finora

- A Project Report On Mutual Fuds: Use Sip As A Tool To Build Wealth in The Long TermDocumento12 pagineA Project Report On Mutual Fuds: Use Sip As A Tool To Build Wealth in The Long Termadarshsaini2580Nessuna valutazione finora

- Sapm Investment ObjectivesDocumento16 pagineSapm Investment ObjectivesBrindha RajuNessuna valutazione finora

- Set A Firm Foundation With Asset Allocation: Step 1-Understanding The ClientDocumento5 pagineSet A Firm Foundation With Asset Allocation: Step 1-Understanding The ClientPalha KhannaNessuna valutazione finora

- Institutional Investment Management NotesDocumento13 pagineInstitutional Investment Management NotesFineman TlouNessuna valutazione finora

- Investment PolicyDocumento10 pagineInvestment PolicyAvani SisodiyaNessuna valutazione finora

- Finman 2aDocumento3 pagineFinman 2aChloe Ann CabayloNessuna valutazione finora

- Investment Fundamentals and Portfolio ManagementDocumento30 pagineInvestment Fundamentals and Portfolio ManagementMahmood KhanNessuna valutazione finora

- Inbound 2013356462027161565Documento4 pagineInbound 2013356462027161565Axel Dave OrcuseNessuna valutazione finora

- Module 1Documento5 pagineModule 1Dana MobayedNessuna valutazione finora

- Why Study Money, Banking, and Financial Markets?Documento28 pagineWhy Study Money, Banking, and Financial Markets?Joe PatrickNessuna valutazione finora

- FIM Week 1Documento37 pagineFIM Week 1teakjyyNessuna valutazione finora

- Cima F3 - Financial Strategy: Determining Policy in Respect of Investment and Financing of Working CapitalDocumento5 pagineCima F3 - Financial Strategy: Determining Policy in Respect of Investment and Financing of Working CapitalZain FatimaNessuna valutazione finora

- Lecture Presentation Software: Investment Analysis and Portfolio ManagementDocumento31 pagineLecture Presentation Software: Investment Analysis and Portfolio ManagementOptimistic EyeNessuna valutazione finora

- Asset Allocation & Portfolio Management Process - Lecture 2 - 2011Documento45 pagineAsset Allocation & Portfolio Management Process - Lecture 2 - 2011phanquang144Nessuna valutazione finora

- Chapter 5 AnswersDocumento13 pagineChapter 5 Answersjanajani2012_3761915100% (1)

- The Asset Allocation DecisionDocumento24 pagineThe Asset Allocation DecisionAnkur JainNessuna valutazione finora

- Working CapitalDocumento24 pagineWorking CapitalTrisha LimNessuna valutazione finora

- Understanding The Financial Planning Process: © 2008 Thomson South-WesternDocumento24 pagineUnderstanding The Financial Planning Process: © 2008 Thomson South-WesternHamis Rabiam MagundaNessuna valutazione finora

- Chapter 1Documento8 pagineChapter 1thete.ashishNessuna valutazione finora

- Notes For First-Time Investors-CgDocumento22 pagineNotes For First-Time Investors-Cgronysk90Nessuna valutazione finora

- Brookfield Asset Management - "Real Assets, The New Essential"Documento23 pagineBrookfield Asset Management - "Real Assets, The New Essential"Equicapita Income TrustNessuna valutazione finora

- Portfolio Management - Part 2: Portfolio Management, #2Da EverandPortfolio Management - Part 2: Portfolio Management, #2Valutazione: 5 su 5 stelle5/5 (9)

- Wealth Management Module PDFDocumento109 pagineWealth Management Module PDFAnujBhanot100% (1)

- Business CombinationDocumento40 pagineBusiness Combinationjulia4razoNessuna valutazione finora

- 1.1.1partnership FormationDocumento12 pagine1.1.1partnership FormationCundangan, Denzel Erick S.Nessuna valutazione finora

- Sapphire Corporation Limited Annual Report 2015Documento118 pagineSapphire Corporation Limited Annual Report 2015WeR1 Consultants Pte LtdNessuna valutazione finora

- Financial AnalysisDocumento9 pagineFinancial Analysisgem paolo lagranaNessuna valutazione finora

- Valuation and Financial Forecasting A Handbook For Academics and Practitioners (294 Pages) (Ben Sopranzetti Braun Kiess) (Z-Library)Documento295 pagineValuation and Financial Forecasting A Handbook For Academics and Practitioners (294 Pages) (Ben Sopranzetti Braun Kiess) (Z-Library)normando vikingo100% (2)

- Analisis Sumber Dan Penggunaan Kas Pada Pt. Sepatu Bata TBK Yang Terdaftar Di Bursa Efek Indonesia Tahun 2014 - 2018Documento11 pagineAnalisis Sumber Dan Penggunaan Kas Pada Pt. Sepatu Bata TBK Yang Terdaftar Di Bursa Efek Indonesia Tahun 2014 - 2018Feby SinagaNessuna valutazione finora

- List of Formulas Used in Different Financial CalculationsDocumento2 pagineList of Formulas Used in Different Financial CalculationsRaja Muaz Ahmad KhanNessuna valutazione finora

- SM 5Documento27 pagineSM 5wtfNessuna valutazione finora

- Lesson Plan in Abm: Curriculum Guide)Documento5 pagineLesson Plan in Abm: Curriculum Guide)Aigene PinedaNessuna valutazione finora

- Tally Under GroupDocumento7 pagineTally Under Groupmohammedakbar88100% (3)

- Business Finance - 5 - 24 - 23Documento8 pagineBusiness Finance - 5 - 24 - 23Angel LopezNessuna valutazione finora

- Palamon Capital PartnersDocumento9 paginePalamon Capital PartnersIngridHoernigCubillos0% (1)

- Cost AccntgDocumento36 pagineCost AccntgRoselynne GatbontonNessuna valutazione finora

- ROIC Greenblatt and Fool ArticlesDocumento11 pagineROIC Greenblatt and Fool Articlesjcv2010100% (1)

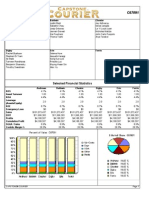

- Capstone Round 0 ReportDocumento16 pagineCapstone Round 0 Reportcricket1223100% (1)

- 17 - Investment-In Associate (Basic Principles)Documento44 pagine17 - Investment-In Associate (Basic Principles)KhenNessuna valutazione finora

- Accounts and Statistics 4Documento41 pagineAccounts and Statistics 4BrightonNessuna valutazione finora

- Corporate Tax Instructions - FinalDocumento15 pagineCorporate Tax Instructions - Finalapi-306226330Nessuna valutazione finora

- Amalgamation SummaryDocumento26 pagineAmalgamation SummaryPrashant SharmaNessuna valutazione finora

- Easy Problem Chapter 6Documento4 pagineEasy Problem Chapter 6Natally LangfeldtNessuna valutazione finora

- Mba ProjectDocumento75 pagineMba Projectmicky101010Nessuna valutazione finora

- MCQ Accounting StandardDocumento13 pagineMCQ Accounting StandardNgân GiangNessuna valutazione finora

- Replacement Analysis: Lecturer: Msc. Nguyen Hoang HuyDocumento22 pagineReplacement Analysis: Lecturer: Msc. Nguyen Hoang HuyHạnh NhiNessuna valutazione finora

- FIN202 - SU23 - Individual AssignmentDocumento5 pagineFIN202 - SU23 - Individual AssignmentÁnh Dương NguyễnNessuna valutazione finora

- Test 2 Jan2023 - Tapah Q2 FS SSDocumento4 pagineTest 2 Jan2023 - Tapah Q2 FS SSNajmuddin AzuddinNessuna valutazione finora