Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Pay Slip

Caricato da

Anonymous QrLiISmpF100%(1)Il 100% ha trovato utile questo documento (1 voto)

10K visualizzazioni1 paginaBABU IBM PAY slip

Titolo originale

PAY SLIP

Copyright

© Attribution Non-Commercial (BY-NC)

Formati disponibili

RTF, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoBABU IBM PAY slip

Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato RTF, PDF, TXT o leggi online su Scribd

100%(1)Il 100% ha trovato utile questo documento (1 voto)

10K visualizzazioni1 paginaPay Slip

Caricato da

Anonymous QrLiISmpFBABU IBM PAY slip

Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato RTF, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 1

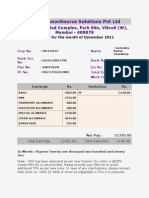

IBM DAKSH BUSINESS PROCESS SERVICES PVT. LTD.

PAYSLIP FOR THE MONTH OF AUGUST-2012

Employee Code Employee Name Date of Joining PF No. Payable Days Non Payable Days 181991 BABU N 07 Sep 2011 PY/KRP/35802/18597 31 0 EARNINGS Description BASIC HRA FBP Statutory Bonus Transport Allowance Incentive Over Time Total Earnings Net Pay : For the Month 6,500.00 2,146.00 0.50 Arrear Total Description 6,500.00PF 2,146.00 P TAX 0.50 ESI 700.00 174.19 2,098.75 1,491.95 13,111.39 Total Deductions Designation Attd. Arrear days Bank A/c No /Name PAN Joining Arrear Days Business Unit Practitioner- F&A Operatio 0 00771140291712 / HDFC ARSPB2970K 0 F&A DEDUCTIONS Amount 780.00 150.00 230.00 700.00 174.19 2,098.75 1,491.95 1,160.00 11,951

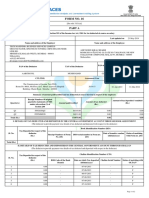

Income Tax Planning Sheet for the Year 2012-2013

1.TOTAL BASIC 2.TOTAL HRA 3.TOTAL FBP 4.ALL OTHER INCOME 5.ADD : INCOME FROM PREVIOUS EMPLOYER 6.ADD : PERQUISITE VALUE OF LOAN 7.ADD : INCOME FROM HOUSE PROPERTY 8.LESS : HRA EXEMPTION 9.LESS : CONVEYANCE EXEMPTION 10.LESS : OTHER RECOVERY 11.ADD : PERQUISITE VALUE OF CLA 12.LESS : TOTAL PROFESSIONAL TAX 13.LESS :LOSS FROM H/P & DEDUCTIONS 80S 14.TOTAL TAXABLE INCOME 15.TAX ON THE ABOVE 16.SURCHARGE 17.EDUCATION CESS 18.NET TAX PAYABLE (15+16+17) 19.TAX DEDUCTED SO FAR 20.TAX ON ONE TIME PAYMENT 21.TAX DEDUCTION FOR THIS MONTH 750.00 PERQUISITE VALUE(LEAST OF THE ABOVE) 9,090.00 U/S 113,770.00 U/S80D U/S80U, 80G LIC NSC NSC INTEREST HOUSING LOAN PRINCIPAL BOND UTI/ULIP/MUTUAL FUND EXP. ON CHILD EDUCATION FIXED DEPOSITS RECEIPT PENSION FUND PUBLIC PROVIDENT FUND LIC JEEVAN SURAKSHA PREV. EMPLOYER PF NATIONAL SAVING SCHEME MUTUAL FUNDS PENSION ANY OTHER INVEST. U/S 80C VPF Total Corporate Office: 4th Floor, Building 8, DLF Phase 2, Sector 25A, Gurgaon 122002 Regd Office: Birla Towers, 1st Floor, 25 Barakhamba Road, New Delhi 110001 This is a system generated statement and it does not require any signatures. Personal and Confidential For any query on Salary, Please login your ticket on http://116.90.243.58:9080/OneTouch U/S80CCG Section 80C Investment PF Amount 9,090.00 U/S80E U/S80DDB Chapter VI Deductions U/S80DD Amount 75,750.00 HRA Exemption 25,731.00 824.33 21,479.62 174.00 CLA GROSS SALARY 1.RENT PAID BY THE COMPANY 2.15% OF SALARY BASIC FOR HRA CALCULATION 1.HRA RECEIVED 2.RENT PAID OVER 10% OF SALARY 3.50/40% OF SALARY HRA EXEMPTION(LEAST OF THE ABOVE) CLA Calculation 0.00 0.00 0.00 0.00 0.00

9,090.00

Potrebbero piacerti anche

- BSNL Salary Slip 1Documento1 paginaBSNL Salary Slip 1empirecot50% (2)

- IBM Payslip April 2012 PDFDocumento1 paginaIBM Payslip April 2012 PDFtaraivanNessuna valutazione finora

- Dec'13Documento1 paginaDec'13ashish10mca9394100% (1)

- Salary SlipDocumento3 pagineSalary Slippankaj singhNessuna valutazione finora

- Perilwise Insurance Broking Pvt. LTD: Salary Payslip - December 2018Documento1 paginaPerilwise Insurance Broking Pvt. LTD: Salary Payslip - December 2018Avinash RamachandranNessuna valutazione finora

- DecDocumento1 paginaDecBhasker Nayak Dharavath100% (1)

- Payslip AprDocumento1 paginaPayslip Aprabhijitj0555100% (1)

- Salaryslip AvdheshDocumento1 paginaSalaryslip AvdheshPradeep PrajapatiNessuna valutazione finora

- September PayslipDocumento1 paginaSeptember PayslipSai GauthamNessuna valutazione finora

- Salary IbmDocumento1 paginaSalary IbmVincent ClementNessuna valutazione finora

- Payslip MarDocumento1 paginaPayslip Marabhijitj0555Nessuna valutazione finora

- Pooja Panika ASM 2.5 Indian Bank Revised Letter.Documento8 paginePooja Panika ASM 2.5 Indian Bank Revised Letter.Abhay Narain SinghNessuna valutazione finora

- C24956 - Jan 201933333333Documento1 paginaC24956 - Jan 201933333333chaitanyaNessuna valutazione finora

- Salary SlipDocumento1 paginaSalary SlipSandip LulekarNessuna valutazione finora

- Navneet Pay SlipDocumento1 paginaNavneet Pay Slipdeepak_sharma9323Nessuna valutazione finora

- Mar 2021Documento1 paginaMar 2021Srinivas HkNessuna valutazione finora

- Societe Generale Global Solution Centre Pvt. LTD.: Net Pay: Rs. 61991.00 Sixty One Thousand Nine Hundred Ninety OneDocumento2 pagineSociete Generale Global Solution Centre Pvt. LTD.: Net Pay: Rs. 61991.00 Sixty One Thousand Nine Hundred Ninety OnePramod Kumar100% (1)

- IBM Salary CalculatorDocumento11 pagineIBM Salary Calculatorapi-3817239100% (7)

- Salary Slip U Can Edit and UseDocumento1 paginaSalary Slip U Can Edit and Useshail100% (1)

- 126687Documento2 pagine126687DiptiNessuna valutazione finora

- Payslip AprDocumento1 paginaPayslip AprAnwar Nishthar100% (1)

- PayslipDocumento1 paginaPayslipAnonymous QYeq3h37Nessuna valutazione finora

- 142Documento1 pagina142Rajeev Bujji100% (1)

- Payslip September '11Documento1 paginaPayslip September '11Shreyash PattewarNessuna valutazione finora

- Income Tax Worksheet For The Financial Year APR-2019 To MAR-2020Documento1 paginaIncome Tax Worksheet For The Financial Year APR-2019 To MAR-2020SHIBANI CHOUDHURYNessuna valutazione finora

- 2412 Payslip JunDocumento1 pagina2412 Payslip JunAnonymous 68rvpJvvNessuna valutazione finora

- Employee Details Payment & Leave Details: Arrears Current AmountDocumento1 paginaEmployee Details Payment & Leave Details: Arrears Current Amountvarunk8275Nessuna valutazione finora

- Accenture PaySlip PDFDocumento1 paginaAccenture PaySlip PDFRohit KumarNessuna valutazione finora

- Salary Slip For The Month of OctDocumento1 paginaSalary Slip For The Month of OctPatrick Johnson67% (3)

- Pay Slip Oct 10Documento1 paginaPay Slip Oct 10vshet43% (7)

- Pay Slip 201117614Documento2 paginePay Slip 201117614Jeetendra Kumar Chaudhury86% (7)

- Salary SlipDocumento1 paginaSalary SlipDipankar Mandal100% (3)

- 1033553563Documento1 pagina1033553563Virendra Nalawde100% (1)

- Appraisal Letter 2Documento1 paginaAppraisal Letter 2csreddyatsapbiNessuna valutazione finora

- Offer LetterDocumento1 paginaOffer LetterRajesh PaniNessuna valutazione finora

- June SalaryDocumento1 paginaJune Salaryaruna nadagouniNessuna valutazione finora

- Deloitte Financial Advisory Services India Private LimitedDocumento1 paginaDeloitte Financial Advisory Services India Private LimitedPRASHANT BANDAWARNessuna valutazione finora

- Salary Slip AirtelDocumento3 pagineSalary Slip Airtelapi-200075170% (6)

- Future Retail Limited: Salary Statement For The Month of MAY-2019Documento1 paginaFuture Retail Limited: Salary Statement For The Month of MAY-2019Himanshu MalikNessuna valutazione finora

- Appointment LetterDocumento7 pagineAppointment LetterArun Mohanty100% (1)

- Pay Slip ParleDocumento4 paginePay Slip ParleAmber Willis0% (1)

- Salary Slip Format For HCLDocumento1 paginaSalary Slip Format For HCLAmar Rajput58% (12)

- Tata Business Support Services LTD: 00082737 Karunya SDocumento1 paginaTata Business Support Services LTD: 00082737 Karunya Skarunteza0% (1)

- Salaryslip YM2023013686 December 2023Documento1 paginaSalaryslip YM2023013686 December 2023jessypriyadharshini9Nessuna valutazione finora

- Accenture Solutions PVT LTD: Payslip For OCTOBER 2020Documento1 paginaAccenture Solutions PVT LTD: Payslip For OCTOBER 2020shreya arunNessuna valutazione finora

- Dell International Services India PVT LTDDocumento1 paginaDell International Services India PVT LTDpankaj_kolekar33333Nessuna valutazione finora

- Salary Slip Deepak Upadhyay: Daewoo ST India Private LimitedDocumento1 paginaSalary Slip Deepak Upadhyay: Daewoo ST India Private LimitedDeepak UpadhayayNessuna valutazione finora

- Payslip For The Month of JUN-2011Documento1 paginaPayslip For The Month of JUN-2011Binay K SrivastawaNessuna valutazione finora

- Offer LatterDocumento3 pagineOffer Latterjagdish lonareNessuna valutazione finora

- Delhi Information Technology Park, Shastri Park, INDIA: Income Tax Worksheet For The Financial Year APRIL-2011 - MARCH-2012Documento1 paginaDelhi Information Technology Park, Shastri Park, INDIA: Income Tax Worksheet For The Financial Year APRIL-2011 - MARCH-2012tippu09Nessuna valutazione finora

- FNDWRRDocumento1 paginaFNDWRRsreenidsNessuna valutazione finora

- Income Tax Calculator For MaleDocumento19 pagineIncome Tax Calculator For MaleAlok SaxenaNessuna valutazione finora

- Summary of Tax Deducted at Source: Part-ADocumento5 pagineSummary of Tax Deducted at Source: Part-Achakrala_sirishNessuna valutazione finora

- Salary SlipDocumento3 pagineSalary Slipsagerofgyan0% (1)

- Tax CalculatorDocumento10 pagineTax Calculatorgsagar879Nessuna valutazione finora

- FORM16Documento5 pagineFORM16sunnyjain19900% (1)

- Income Tax Sheet Bmoi 2012 13Documento2 pagineIncome Tax Sheet Bmoi 2012 13rincepNessuna valutazione finora

- Form 16Documento3 pagineForm 16Alla VijayNessuna valutazione finora

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesDa EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNessuna valutazione finora

- Fast-Track Tax Reform: Lessons from the MaldivesDa EverandFast-Track Tax Reform: Lessons from the MaldivesNessuna valutazione finora

- Chapter 4Documento65 pagineChapter 4Anonymous QrLiISmpFNessuna valutazione finora

- Welfare Mittal FinalDocumento101 pagineWelfare Mittal FinalAnonymous QrLiISmpFNessuna valutazione finora

- Chapter-1 Industry and Company Profile: Introduction To Transport CompanyDocumento43 pagineChapter-1 Industry and Company Profile: Introduction To Transport CompanyAnonymous QrLiISmpFNessuna valutazione finora

- Safety Welfare KSRTC Final (Recovered)Documento106 pagineSafety Welfare KSRTC Final (Recovered)Anonymous QrLiISmpFNessuna valutazione finora

- 1 & 2 HariniDocumento93 pagine1 & 2 HariniAnonymous QrLiISmpFNessuna valutazione finora

- Kishor Pay SlipDocumento1 paginaKishor Pay SlipAnonymous QrLiISmpFNessuna valutazione finora

- Introduction About Internship: Gain Valuable Experience in The Career Field of InterestDocumento1 paginaIntroduction About Internship: Gain Valuable Experience in The Career Field of InterestAnonymous QrLiISmpFNessuna valutazione finora

- Certificate: BESCOM" With Identification From BESCOM GUDIBANDEDocumento1 paginaCertificate: BESCOM" With Identification From BESCOM GUDIBANDEAnonymous QrLiISmpFNessuna valutazione finora

- MahalakshmiDocumento26 pagineMahalakshmiAnonymous QrLiISmpFNessuna valutazione finora

- COoperative Bank ProfileDocumento7 pagineCOoperative Bank ProfileAnonymous QrLiISmpFNessuna valutazione finora

- List of Contents: Chapter - 1Documento3 pagineList of Contents: Chapter - 1Anonymous QrLiISmpFNessuna valutazione finora

- Whom So Ever It May Concern1Documento1 paginaWhom So Ever It May Concern1Anonymous QrLiISmpFNessuna valutazione finora

- Rajesh ResumeDocumento2 pagineRajesh ResumeAnonymous QrLiISmpFNessuna valutazione finora

- Dedicated To Beloved Parents and FriendsDocumento3 pagineDedicated To Beloved Parents and FriendsAnonymous QrLiISmpFNessuna valutazione finora

- Qá - Péæãrgàauà Àà Àpáðj Pàët Àäºá Záå®Aiàä Apàì Áî Àågà-562Documento6 pagineQá - Péæãrgàauà Àà Àpáðj Pàët Àäºá Záå®Aiàä Apàì Áî Àågà-562Anonymous QrLiISmpFNessuna valutazione finora

- Practice Question 1 VATDocumento2 paginePractice Question 1 VATPhilan Zond Philan ZondNessuna valutazione finora

- Form No. 16: Part ADocumento2 pagineForm No. 16: Part AasifNessuna valutazione finora

- Mads Rialubin Travel Agency WORKSHEET FS TRIAL BALANCEDocumento3 pagineMads Rialubin Travel Agency WORKSHEET FS TRIAL BALANCEJowe Ringor Casignia100% (1)

- Taxable Salary Problem With Solution Part 1Documento2 pagineTaxable Salary Problem With Solution Part 1NagadeepaNessuna valutazione finora

- Commissioner of Internal Revenue (Cir) V. de La Salle University, Inc. (DLSU)Documento3 pagineCommissioner of Internal Revenue (Cir) V. de La Salle University, Inc. (DLSU)Violet Parker100% (1)

- Calculating GDP-Practice Problems 19-20Documento3 pagineCalculating GDP-Practice Problems 19-20Jill CNessuna valutazione finora

- Annex A.1 - Checklist Per Sec 112ADocumento1 paginaAnnex A.1 - Checklist Per Sec 112AGlaze LlagasNessuna valutazione finora

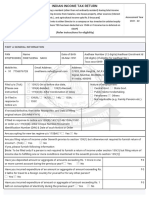

- Indian Income Tax Return: Part A General InformationDocumento8 pagineIndian Income Tax Return: Part A General Informationsushilprajapati10_77Nessuna valutazione finora

- Mod1 - 4 - G.R. No. 78133 Pascual V CIR - DigestDocumento2 pagineMod1 - 4 - G.R. No. 78133 Pascual V CIR - DigestOjie Santillan100% (1)

- Laporan Keuangan PT KAIDocumento135 pagineLaporan Keuangan PT KAIrizal yusNessuna valutazione finora

- Unofficial Answers To The Uniform Certified Public Accountants Ex PDFDocumento254 pagineUnofficial Answers To The Uniform Certified Public Accountants Ex PDFSweet EmmeNessuna valutazione finora

- APT Satellite (1045 HK) Time To Revisit PDFDocumento7 pagineAPT Satellite (1045 HK) Time To Revisit PDFJocelynNessuna valutazione finora

- W16494 XLS EngDocumento36 pagineW16494 XLS EngAmanNessuna valutazione finora

- Case Study: Dreamworld Amusement Park Dreamworld: Initial Years of OperationDocumento3 pagineCase Study: Dreamworld Amusement Park Dreamworld: Initial Years of OperationArnav MittalNessuna valutazione finora

- Cpa Review School of The Philippines ManilaDocumento9 pagineCpa Review School of The Philippines ManilaAbraham Marco De Guzman100% (4)

- SCALP Handout 044Documento10 pagineSCALP Handout 044Angelica PatagNessuna valutazione finora

- Solution To Assignment Problem Eighteen - 4: Part A - Income InclusionDocumento1 paginaSolution To Assignment Problem Eighteen - 4: Part A - Income Inclusionsanaha786Nessuna valutazione finora

- Ventura, Mary Mickaella R - Noncurrentassetsheldforsale - Group3Documento2 pagineVentura, Mary Mickaella R - Noncurrentassetsheldforsale - Group3Mary VenturaNessuna valutazione finora

- Absorption and Variable Costing: Quiz #1Documento2 pagineAbsorption and Variable Costing: Quiz #1Nicole Anne Santiago SibuloNessuna valutazione finora

- Suggestion Direct & Indirect TaxDocumento2 pagineSuggestion Direct & Indirect TaxPratik ShahNessuna valutazione finora

- Assignno3 Incometax-LiwagjaicelberniceDocumento3 pagineAssignno3 Incometax-LiwagjaicelberniceShane KimNessuna valutazione finora

- Case 2 - Acco 420Documento7 pagineCase 2 - Acco 420Wasif SethNessuna valutazione finora

- Form 15CADocumento4 pagineForm 15CAManoj MahimkarNessuna valutazione finora

- Donegan S Lawn Care Service Began Operations in July 2011 TheDocumento1 paginaDonegan S Lawn Care Service Began Operations in July 2011 Thetrilocksp SinghNessuna valutazione finora

- Acctng.1 Midterm W2 A.adanza EquationfsDocumento9 pagineAcctng.1 Midterm W2 A.adanza EquationfsHanabusa Kawaii IdouNessuna valutazione finora

- Garfield (1) VAT Tax QuestionDocumento2 pagineGarfield (1) VAT Tax QuestionSerena JainarainNessuna valutazione finora

- Port Covington Preliminary Limited OfferingDocumento1.238 paginePort Covington Preliminary Limited OfferingBaltimore Business JournalNessuna valutazione finora

- Ats Taxation PDFDocumento372 pagineAts Taxation PDFOlawaleNessuna valutazione finora

- TM 3 PDFDocumento6 pagineTM 3 PDFJai VermaNessuna valutazione finora

- Tax Fraud Evidence On 5046 S Greenwood AveDocumento5 pagineTax Fraud Evidence On 5046 S Greenwood Avecharlene cleo eibenNessuna valutazione finora