Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Financial Derivatives LP

Caricato da

Rama PrasanthDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Financial Derivatives LP

Caricato da

Rama PrasanthCopyright:

Formati disponibili

ISSUE1.0/10/10.

01/2011

QP08/11-12/XX/LEP/05

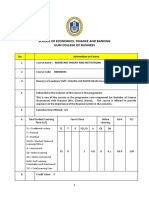

SRI RAMAKRISHNA ENGINEERING COLLEGE, COIMBATORE-22 DEPARTMENT: DEPARTMENT OF MANAGEMENT STUDIES SUBJECT CODE & TITLE: 10DCF06 FINANCIAL DERIVATIVES CLASS: Aim: This course aims to provide an understanding of the dynamics of derivative market and will familiarize students to the usage of various instruments of derivatives, pricing and valuation. Name of the Faculty: Dr.S.Krishnaprabha LESSON PLAN Unit/ Topics II MBA SEMESTER: III

Particulars

Portions to be covered

Duration

Unit-1

DERIVATIVES AN INTRODUCTION

1.1 Definition of Derivatives - Types of Derivatives 1.1.1 Deliverable Meaning of Derivatives Definition of Derivatives Types of Derivatives 1.1.2 Discussion Introduction of Derivatives in India 1.1.3 Exercise Collection of different Derivative Products

2008., 6-15.

Readings: S. L. Gupta, Financial Derivatives, Theory, Concepts and Problems, PHI, 1.2 Participants in the Derivatives Markets 1.2.1 Deliverable Meaning of Hedgers, Speculators and Arbitrageurs 1.2.2 Discussion Various functions of the Participants 1.2.3 Exercise Analysing the importance of Derivatives Market in India 1.3 Economic Functions of Derivative Market - Hedging, Speculation and

Arbitration

1.3.1 Deliverable 1.3.2 Discussion 1.3.3 Exercise

Economic Functions of Derivative Market Hedging, Speculation and Arbitration mechanisms

Importance of Hedging & need for speculation Risk Reward scenario in current derivative Markets

1.4 Risks in Derivatives Trading

ISSUE1.0/10/10.01/2011

QP08/11-12/XX/LEP/05

Unit/ Topics

Particulars

Portions to be covered Risks & objectives in Derivative Trading Types of Risk Risks in Derivative Market in India Myths in Derivatives FIMMDA Derivative Markets in India

Duration 2 (5)

1.4.1 1.4.2 1.4.3 1.5

Deliverable Discussion Exercise Deliverable Discussion

Myths of Derivatives - Derivative Market in India, FIMMDA

Readings: S. L. Gupta, Financial Derivatives, Theory, Concepts and Problems, PHI, 2008, 13-15,17-23 Unit 2 FORWARDS 2.1 Forward Contracts - Types

2.1.1 Deliverable 2.1.2 Discussion

Objectives & types of Forward Contract Importance of FC Methods of Forward Contract and its drawbacks

Readings: S. L. Gupta, Financial Derivatives, Theory, Concepts and Problems, PHI, 2008.,64-67. 2.2 Forward Trading Mechanism - Assumptions and Notations

2.2.2 Discussion 2.2.3 Exercise

Requisites for Effective Forward Trading Mechanisms Assumption of forward trading Analyse the need for forwarding

Readings:S. L. Gupta, Financial Derivatives, Theory, Concepts and Problems, PHI, 2008, 68-71 2.3 Forward Rate Agreements - Pricing of FRA(67)

2.3.1 Deliverable 2.3.2 Discussion 2.3.3 Exercise

2008. 67,68

Definition of Forward Pricing Requirement of forward rates Over the Contract between parties Risks involved in Forward rating

Current scenario of FRA

Readings: S. L. Gupta, Financial Derivatives, Theory, Concepts and Problems, PHI,

2.4 Determination of Forward Price 2.4. Deliverable Factors affecting forward pricing 1 2.4.2 Discussion Spot price and forward Price

2 (8)

ISSUE1.0/10/10.01/2011

QP08/11-12/XX/LEP/05

Unit/ Topics

Particulars

Portions to be covered

Duration

Readings: S. L. Gupta, Financial Derivatives, Theory, Concepts and Problems, PHI, 2008, 69. 2.5 Valuation of Forward Contracts on Income and Nonincome bearing securities Meaning of forward contracts 2.5.1 Long forward contract Deliverable Short forward contract

2.5.2

Discussion

Risk involved in Long & short positions

ISSUE1.0/10/10.01/2011

QP08/11-12/XX/LEP/05

Unit/ Topics

Particulars

Portions to be covered

Duration

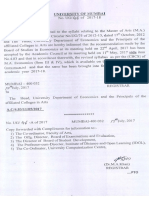

Unit - 3

MECHANICS OF FUTURES

ISSUE1.0/10/10.01/2011

3.1 Futures Terminologies - Forwards Vs Futures QP08/11-12/XX/LEP/05 3.1.1 Deliverable Futures Terminologies difference between

Forwards Vs Futures (51)

3.1.2 Discussion Exercise

Benefits of future contracts Indian Future Market

Readings: S. L. Gupta, Financial Derivatives, Theory, Concepts and

Problems, PHI, 2008.28-31.

3.2 Relationship between Spot and Futures price 3.2.1 Deliverable Meaning of spot price and futures price Reasons -Difference Between spot and future price 3.2.2 Discussion

Lead - lag relationship between the futures and spot prices

3.3 Market Participants - Specification of Futures Contract - Margin Requirements 3.3.1 Deliverable Participants in the future contract market 3 Specifications of future contract Meaning Margin & requirements Types of Margin 3.3.2 Discussion Factors determining the prices of future market 3.3.3 Exercise

Analysis of Future Prices for few currencies

Readings: S. L. Gupta, Financial Derivatives, Theory, Concepts and

Problems, PHI, 2008. 31-49.

3.4 Marking-to-Market - Types of Futures - Stock, Index, Currency, Commodity 3.4.1 Deliverable Marking to market meaning 3 (10) Types of futures First in First out 3.4.2 Discussion Institutions Facilitating Futures Trading Structure of Futures Exchanges Clearinghouses Role in Futures Markets 3.5 Case Study

Casestudy : Whole Foods Market was the biggest retailer of organic and natural foods in the world

Readings: S. L. Gupta, Financial Derivatives, Theory, Concepts and Problems, PHI, 2008. 30 3.6 Hedging Using Futures - Trading Mechanism in Futures 3.6.1 Deliverables

Hedging Using Futures Trading Mechanism Leverage with future pricing Financial future pricing

Hedging Principle Interest Rate Futures as a Hedging Device Readings: Bishnupriya Mishra & Sathya Swaroop Debasish, Financial Derivatives, Excel Books, 2007.85-106 3.7 Clearing and Settlement Mechanism - Cash-and-Carry Model. (Theoretical concepts only) Deliverables Cash and carry model Cash carry Arbitrage

Discussion

ISSUE1.0/10/10.01/2011

QP08/11-12/XX/LEP/05

Content Beyond the syllabus Lecture Hours Text Book/ Reference Book

Teaching Methodology planned Activity Planned for Learners

Portions to be Covered

1. 2. 3.

Inflation and gold investment analysis Euro Crisis Inflation and stock market analysis

PPT PPT PPT

Group Discussion

Text Books: 1. John C Hull, Options, Futures and Other Derivatives, Pearson, 2009. 2. S. L. Gupta, Financial Derivatives, Theory, Concepts and Problems, PHI, 2008. Reference Books: 1. Bishnupriya Mishra & Sathya Swaroop Debasish, Financial Derivatives, Excel

Books, 2007.

2. Jayanth Rama Varma, Derivatives and Risk Management, McGraw Hill, 2009. 3. David Dubofsky & Thomas Miller, Derivatives, Valuation & Risk Management,

Oxford, 2009. 4. SSS Kumar, Financial Derivatives, Prentice Hall of India, 2007. 5. Study Material of National Stock Exchange of India Ltd (NSE).

Jourals: 1.

Potrebbero piacerti anche

- Wyckoff e BookDocumento43 pagineWyckoff e BookIan Moncrieffe95% (22)

- Earl The Complete Volume Spread Analysis System ExplainedDocumento7 pagineEarl The Complete Volume Spread Analysis System ExplainedSardar Amrik Singh MallNessuna valutazione finora

- Traders Magazine August 2000 IssueDocumento53 pagineTraders Magazine August 2000 Issueashlogic100% (1)

- ULTIMATE HAMMER - Holy Grail Edition - PreviewDocumento126 pagineULTIMATE HAMMER - Holy Grail Edition - PreviewRobert Muniz-CETPNessuna valutazione finora

- M9A 2nd Ed V1.2 CH2 (Summarised Ok)Documento14 pagineM9A 2nd Ed V1.2 CH2 (Summarised Ok)XuaN XuanNessuna valutazione finora

- WQU Financial Markets Module 1 Compiled Content PDFDocumento29 pagineWQU Financial Markets Module 1 Compiled Content PDFJaeN_Programmer67% (3)

- 3 Ways To Speculate The MarketsDocumento3 pagine3 Ways To Speculate The MarketsStockMarket AnalystNessuna valutazione finora

- 10 Commandments of Investing in The Stock MarketDocumento9 pagine10 Commandments of Investing in The Stock MarketcptnnemoNessuna valutazione finora

- Commodity PDFDocumento85 pagineCommodity PDFSuyash Kumar100% (2)

- Level III Mock Exam Questions 2017ADocumento24 pagineLevel III Mock Exam Questions 2017AElie Yabroudi0% (1)

- Saloni Si Project ReportDocumento77 pagineSaloni Si Project ReportSALONI JaiswalNessuna valutazione finora

- Admas University Faculty of Business: Department of Accounting and Finance Course OutlineDocumento5 pagineAdmas University Faculty of Business: Department of Accounting and Finance Course Outlineeyob astatkeNessuna valutazione finora

- Mba ZC416 Course HandoutDocumento12 pagineMba ZC416 Course HandoutareanNessuna valutazione finora

- School of Law KIIT, Deemed To Be University, Bhubaneswar-751024Documento7 pagineSchool of Law KIIT, Deemed To Be University, Bhubaneswar-751024soumyaNessuna valutazione finora

- Mba ZC416 Course HandoutDocumento12 pagineMba ZC416 Course HandoutSajid RehmanNessuna valutazione finora

- Principles of Eco Course ModuleDocumento18 paginePrinciples of Eco Course ModuleVansh AgarwalNessuna valutazione finora

- Lesson Plan Financial Derivatives MbaiiiDocumento5 pagineLesson Plan Financial Derivatives MbaiiiSheg AonNessuna valutazione finora

- University of . College of .. School/Department of . Syllabus For Economics (Common Course)Documento7 pagineUniversity of . College of .. School/Department of . Syllabus For Economics (Common Course)Malasa EjaraNessuna valutazione finora

- Securities LawDocumento5 pagineSecurities LawAnkitaNessuna valutazione finora

- Course Outline Microeconomics-IDocumento3 pagineCourse Outline Microeconomics-Idhruv mahashayNessuna valutazione finora

- Stock Market Analysis & TradingDocumento4 pagineStock Market Analysis & TradingAshish SinghNessuna valutazione finora

- Study of Financial Derivatives (Futures & Options) : A Project Report On Functional ManagementDocumento45 pagineStudy of Financial Derivatives (Futures & Options) : A Project Report On Functional ManagementmaheshNessuna valutazione finora

- 2015-16 S. Y. B. Com PDFDocumento54 pagine2015-16 S. Y. B. Com PDFsuvarna chaudhariNessuna valutazione finora

- Financial Markets Course OutlineDocumento2 pagineFinancial Markets Course OutlineDawit NegashNessuna valutazione finora

- ME COURSE PACK 2019 - Managerial EconomicsDocumento13 pagineME COURSE PACK 2019 - Managerial EconomicsABHINANDAN GHOSH 1927401Nessuna valutazione finora

- T.Y.B.a. Economics SyllabusDocumento9 pagineT.Y.B.a. Economics SyllabusTori Chakma DangkoNessuna valutazione finora

- LLM (Syllabus) 2018 (1 Yr Program)Documento25 pagineLLM (Syllabus) 2018 (1 Yr Program)Faizan BhatNessuna valutazione finora

- MBA 132: Managerial Economics Course PlanDocumento9 pagineMBA 132: Managerial Economics Course PlanVimal SharmaNessuna valutazione finora

- Session Plan - Fmi MMS RevisedDocumento5 pagineSession Plan - Fmi MMS RevisedRasesh ShahNessuna valutazione finora

- CHRIST UNIVERSITY DEPARTMENT OF MANAGEMENT STUDIES COURSE PLAN III BBM – ODD SEMESTER PAPER 333 – FINANCIAL MANAGEMENTDocumento3 pagineCHRIST UNIVERSITY DEPARTMENT OF MANAGEMENT STUDIES COURSE PLAN III BBM – ODD SEMESTER PAPER 333 – FINANCIAL MANAGEMENTDeep RayNessuna valutazione finora

- LESSON PLAN BCom-313Documento3 pagineLESSON PLAN BCom-313Anjali. 1999Nessuna valutazione finora

- EC3065 Financial EngineeringDocumento2 pagineEC3065 Financial EngineeringAnonymous s6gDZo7lXNessuna valutazione finora

- Managerial Economics Course OutlineDocumento6 pagineManagerial Economics Course OutlineParvathaneni KarishmaNessuna valutazione finora

- ME Course OutlineDocumento3 pagineME Course OutlinegeorgeavadakkelNessuna valutazione finora

- G.P.Macroeconomics - IInd Semester - 2023-24 (1)Documento6 pagineG.P.Macroeconomics - IInd Semester - 2023-24 (1)Vasudha Dattakumar GuravNessuna valutazione finora

- Introduction To Economics Course OutlineDocumento3 pagineIntroduction To Economics Course OutlineSebehadin KedirNessuna valutazione finora

- S.Y.B.a. Economics Syllabus 2014-15Documento11 pagineS.Y.B.a. Economics Syllabus 2014-15mailsk123Nessuna valutazione finora

- Final Course Plan BBA233 - 2022-23Documento17 pagineFinal Course Plan BBA233 - 2022-23harshit119Nessuna valutazione finora

- Economics IDocumento5 pagineEconomics IASHISH SINGHNessuna valutazione finora

- Ty Bba 2015 PDFDocumento60 pagineTy Bba 2015 PDFBharat RasveNessuna valutazione finora

- Mba ZC416Documento12 pagineMba ZC416AbiNessuna valutazione finora

- Syllabus A212 2022 Group ADocumento6 pagineSyllabus A212 2022 Group AFatinNessuna valutazione finora

- 2421 Stock Markets OperationsDocumento4 pagine2421 Stock Markets OperationsHarsh KhannaNessuna valutazione finora

- Course Plan 2022Documento15 pagineCourse Plan 2022bharath.bkNessuna valutazione finora

- Academic Dairy: II Semester II Semester II Semester II SemesterDocumento11 pagineAcademic Dairy: II Semester II Semester II Semester II SemesterIndra SekharNessuna valutazione finora

- Economic Analysis For Business DecisionsDocumento6 pagineEconomic Analysis For Business DecisionsG NagarajanNessuna valutazione finora

- Mba - 4 TH Semester SyallabusDocumento11 pagineMba - 4 TH Semester SyallabusRONYMON MANUELNessuna valutazione finora

- School of Economics, Finance & Banking Uum College of Business Semester A161Documento10 pagineSchool of Economics, Finance & Banking Uum College of Business Semester A161Ng Sim YeeNessuna valutazione finora

- Synopsis SwetaGoelDocumento36 pagineSynopsis SwetaGoelLokesh JainNessuna valutazione finora

- Syllabus ECO111 Spring 2022Documento13 pagineSyllabus ECO111 Spring 2022LongDoanNessuna valutazione finora

- It Skills: After Studying This Course, The Probationary Officers Will Be Able ToDocumento13 pagineIt Skills: After Studying This Course, The Probationary Officers Will Be Able TokanwaljiaNessuna valutazione finora

- Sem 4Documento15 pagineSem 4GorishsharmaNessuna valutazione finora

- Course Outline FD (1.5)Documento5 pagineCourse Outline FD (1.5)KaranNessuna valutazione finora

- BBM 333 - fm1Documento4 pagineBBM 333 - fm1Aachal SinghNessuna valutazione finora

- Introduction To Economics CCDocumento3 pagineIntroduction To Economics CCtheirontemple03Nessuna valutazione finora

- 2022 - ME - COURSE PACK (2022) - ReviewDocumento19 pagine2022 - ME - COURSE PACK (2022) - ReviewNatasha DassNessuna valutazione finora

- ECO515 EconomicsDocumento15 pagineECO515 EconomicsSandip KumarNessuna valutazione finora

- Summer Project at Jainam.Documento143 pagineSummer Project at Jainam.Soyeb JindaniNessuna valutazione finora

- Advanced Financial Instruments and Markets Course Guide BookDocumento6 pagineAdvanced Financial Instruments and Markets Course Guide Bookfinancecottage100% (1)

- Fixed Income and Derivative AnalysisDocumento5 pagineFixed Income and Derivative AnalysisDaood AbdullahNessuna valutazione finora

- FDRMDocumento2 pagineFDRMsantu15038847420Nessuna valutazione finora

- Interpretation of Statutes and Principles of LegislationDocumento4 pagineInterpretation of Statutes and Principles of Legislationsahilwaghmare333Nessuna valutazione finora

- Intro To EconomicsDocumento9 pagineIntro To EconomicsMelat GetachewNessuna valutazione finora

- IV Semester SyllabusDocumento9 pagineIV Semester SyllabusShiva Kumar MahadevappaNessuna valutazione finora

- Managerial Economics Course OutlineDocumento12 pagineManagerial Economics Course OutlineChaqib SultanNessuna valutazione finora

- 4.83 M.A. Economics Sem III IV1Documento26 pagine4.83 M.A. Economics Sem III IV1Arisha KhanNessuna valutazione finora

- Chapter 1897Documento18 pagineChapter 1897Pritee SinghNessuna valutazione finora

- Syllabus (1)Documento4 pagineSyllabus (1)icygnus25Nessuna valutazione finora

- 1 2 3 4 5 6 Shares Recession Equity Stake Stock Market Forecast DebtDocumento12 pagine1 2 3 4 5 6 Shares Recession Equity Stake Stock Market Forecast DebtThanh Hang NguyenNessuna valutazione finora

- Uts Trading Blueprint PDFDocumento4 pagineUts Trading Blueprint PDFGodly Touch RecordsNessuna valutazione finora

- S F M - New Syllabus - Study MaterialDocumento455 pagineS F M - New Syllabus - Study MaterialTummu SureshNessuna valutazione finora

- What Is A Forward Contract?Documento3 pagineWhat Is A Forward Contract?Prateek SehgalNessuna valutazione finora

- 2013715173232IM - Pantloon - 15 July 2013 - FINALDocumento184 pagine2013715173232IM - Pantloon - 15 July 2013 - FINALdeeptiNessuna valutazione finora

- RHB Islamic Bank Berhad 2014Documento33 pagineRHB Islamic Bank Berhad 2014Ahmad Pazil Md IsaNessuna valutazione finora

- Onapal V CADocumento10 pagineOnapal V CAMp CasNessuna valutazione finora

- Zaloom - 2012 - Traders and Market MoralityDocumento23 pagineZaloom - 2012 - Traders and Market MoralityVladimir Caraballo AcuñaNessuna valutazione finora

- Share Trading in IndiaDocumento83 pagineShare Trading in IndiaAjay TyagiNessuna valutazione finora

- Meryll Lynch V CaDocumento7 pagineMeryll Lynch V CaGabe BedanaNessuna valutazione finora

- FINA3203 01 IntroductionDocumento27 pagineFINA3203 01 IntroductionBenLeeNessuna valutazione finora

- Credit Valuation AdjustmentDocumento14 pagineCredit Valuation Adjustmenttasneem chherawalaNessuna valutazione finora

- FRM 2013 Part 1 Practice ExamDocumento39 pagineFRM 2013 Part 1 Practice ExamVitor Salgado100% (1)

- Guest Lecture Session By-Bhabani Sankar Rout: Financial DerivativeDocumento8 pagineGuest Lecture Session By-Bhabani Sankar Rout: Financial DerivativeAP ABHILASHNessuna valutazione finora

- SFM Revision Handouts PraveenKhatodDocumento12 pagineSFM Revision Handouts PraveenKhatodpooja poleNessuna valutazione finora

- Brent PriceDocumento4 pagineBrent PriceSaureen BhattNessuna valutazione finora

- Derivatives Study on India's Growing MarketDocumento9 pagineDerivatives Study on India's Growing MarketManjunath NayakaNessuna valutazione finora

- Financial Markets - Week 4Documento23 pagineFinancial Markets - Week 4gonzgd90Nessuna valutazione finora

- Ventura ProjectDocumento75 pagineVentura ProjectbasavarajNessuna valutazione finora

- Bhopal Sharemrket Broker ListDocumento6 pagineBhopal Sharemrket Broker ListNishant ThakurNessuna valutazione finora