Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Chapter 4 - Ethics in The Marketplace

Caricato da

Tina Mariano DyDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Chapter 4 - Ethics in The Marketplace

Caricato da

Tina Mariano DyCopyright:

Formati disponibili

CHAPTER 4. ETHICS IN THE MARKETPLACE (from Syllabus) A. Topics 1. Price fixing 2. Manipulation of supply 3. Tying arrangements 4.

Retail price maintenance agreements 5. Price discrimination 6. Bribery 7. Antitrust view B. Example for the above 7 related to Philippine Laws C. Case should cover implications to: profit, environment, work-life balance, and individual responsibility Below are the Learning Objectives and Chapter Outline found online: Learning Objectives & Overview | Course Syllabus | LH's Virtual Office

Business Ethics: Concepts & Cases: Chapter 4 Objectives and Overview

Ethics in the Marketplace

Learning Objectives

1. Understand the case for the morality of free markets as the best guarantors of capitalist distributive justice, economic utility, and liberty rights: appreciate the limitations of this justification. 2. Understand how the case for the morality of free markets depends on the assumption of perfect competition. 3. Know the defining features and essential presuppositions of perfectly competitive markets. 4. Understand how perfect competition is a useful idealization, and how the principle of diminishing marginal utility and of increasing marginal costs interact to determine the equilibrium price. 5. Understand the nature of monopoly markets and their negative impacts on perfect competition. 6. Understand the nature of oligopoly markets, their negative impacts on perfect competition, and the several different ways in which oligopolistic influence may be exercised.

7. Understand the do-nothing view, the anti-trust view and the regulative view as competing schools of thought about appropriate public policy with regard to oligopoly markets.

Overview

If free markets are moral it's because they allocate resources and distribute commodities in ways that are just, that maximize utility, and that respect the liberty of buyers and sellers. Since markets having these benefits depend crucially on their competitiveness, anticompetitive conditions and practices are morally dubious. Monopoly practices and markets and oligopoly practices and markets are two principle types of anticompetitive practices and conditions that free market economies spawn. Under monopoly conditions a market segment is controlled by a single seller. Under oligopoly conditions a market segment is controlled by just a few sellers. Though real markets are all imperfect, perfect competition serves as a useful idealization not only for economic purposes of explaining and predicting the behavior of actual markets but also for ethical purposes, i.e., for understanding and assessing the moral case for keeping markets as perfectly competitive as possible. Under this idealization a perfectly competitive market is defined in terms of seven conditions: 1. distribution: numerous buyers and sellers, none of whom has a substantial market share. 2. openness: buyers and sellers are free to enter or leave the market 3. full and perfect knowledge: each buyer & seller has full and perfect knowledge of each others' doings 4. equivalent goods: goods being sold are similar enough that buyers don't care whose they buy. 5. nonsubsidization: costs of producing or using goods are borne entirely by the buyers & sellers. 6. rational economic agency: all buyers and sellers act as egoistic utility maximizers o try to buy (or produce) as low as possible o sell as high as possible 7. nonregulation: no external parties such as governments regulate the price, quantity, or quality of goods. Freely competitive markets, in addition, presuppose 1. an underlying system of production: so there's goods to exchange

2. an enforcable private property system: so buyers and sellers have ownership rights to transfer 3. a system of contracts: to administer such transfers. Perfect competition gets its ethical import from that fact that it's the self-regulative abilities of free markets -- in response to supply and demand -- that provides the principle arguments for the moral superiority for free markets. Where supply exceeds demand, prices, profits, and production decrease; where demand exceeds supply, prices, profits, and production increase: thus under conditions of perfect competition production naturally tends toward the equillibrium point (where supply equals demand) and goods find their "natural price" (= ordinary costs of production + normal rates of profit). Normal profit is "the average profit that producers could make in other markes that carry similar risks" (p. 213). The principle of diminishing marginal utility affects demand and states that each additional item consumed is less valuable than each earlier item: the principle of increasing marginal costs affects supply and states that each additional item produced beyond a certain point costs more to produce than each earlier item. The principle moral benefits alleged for free markets are three: 1. serving demands of capitalist (contribution-based) justice 2. maximizing economic utility 3. safeguarding negative rights of economic liberty Even so, this would-be moral justification of them is limited by additional considerations of positive rights, of care and of character; and it is challenged by competing egalitarian, needs-based and socialist-contribution-based conceptions of distributive justice. Finally, to the extent that actual "free-market" policies fail to be perfectly competitive, their claim to actually having the alleged benefits (and with it their claim to morality) is diminished. Monopoly and oligopoly conditions are morally problematic due to their violation, especially, of the two "basic conditions" for the existence of perfect competetion, distribution, and openness. Monopoly markets, being -- "markets in which a single firm is the only seller . . . and which new sellers are barred from entering" (p. 221) are by definition notdistributed (rather, concentrated) and not open (rather, closed). Under monopoly conditions, the nonexistence of competition and the inability of competitors to enter (to increase supply and bid prices down) results in artificially high prices; prices above the equillibrium point or natural price. This equillibrium point, being the point at which investors make a fair return (equal to the going-rate across comparable markets), is the point at which capitalist justice is served. Consequently, under monopoly conditions such justice is ill-served: the seller charges more and the buyer is forced to pay more

than the goods are worth (i.e., their natural price). Furthermore, monopolies foster distributive inefficiency, since demand is less well served; and monopoly conditions remove competitive pressures ordinarily making for increased productive efficiency. Discretionary preferences of consumers also suffer under monopoly conditions: consumers are forced to cut back more on other items than they would have had to (under "normal conditions") to afford the monopolized goods. Finally, monopoly conditions do no so well safeguard economic liberty as open competition does: sellers are not free to enter the market; and buyers buy overpriced products under duress in the absence of alternative vendors. True monopolies are rare but oligopoly conditions -- where a few firms control most of the market -- are common and have similar anticompetitive dynamics and effects. Horizontal mergers -- between former competitors -- are the chief cause of oligopolistic conditions. Oligopoly markets, not unlike monopolies, are not well distributed, but largely concentrated: the fewer firms control the market the more "highly concentrated" the market is said to be. And they are not open, but relatively closed due to various factors, including anticompetitive strategems on the part of the oligopoly firms. The anticompetitive effects of oligopolies are aggravated by the ease with which the few firms controlling the market can join forces and create virtual monopoly conditions by their collusion. The anticompetitive effects of such collusion are similar to those of actual monopolies, with the same detrimental effects: capitalist justice is ill-served; utility in the form of productive and distributive efficiency is undermined; and rights of economic liberty are infringed. Explicit agreements, tacit agreements, and even bribery are anticompetitive practices frequently used to maintain oligopolistic control of markets. Oligopolies pose a special public policy challenge since the long-term trend in our economy is towards diminishing competition. There are three principle schools of thought regarding what to do in light of this fact. The Do-Nothing view maintains this trend is no problem, claiming competition between industries with substitutable products takes the place of competition with industries; that the countervailing forces of other large orgainization (especially governments and labor unions) blunts the effects of economic concentration; that markets can be economically efficient with as few as three competitors (as the "Chicago School" claims); and that economies of scale more than offset any ill-effects due to diminished competition. The Anti-trust View advocates breaking up larger firms into smaller units each controlling not more than 3-5% of the market in order to restore competition with all its beneficial effects. The Regulation View advocates the middle course of allowing concentration to preserve economies of scale while using regulation to prevent collusion and ensure that oligopoly firms maintain competitive relations among themselves.

Business Ethics: Concepts & Cases (6th edition) : Chapter 4

Ethics in the Marketplace

Introduction

If free markets are moral it's because they allocate resources & distribute commodities 1. in ways that are just 2. that maximize economic utility 3. that respect the liberty of both buyers and sellers These three benefits depend crucially on competition .Consequently, anticompetitive practices are morally dubious Two kinds of anticompetitive conditions and practices o monopoly conditions: a market segment controlled by one seller o oligopoly conditions: a market segment controlled by a few sellers

4.1 Perfect Competition

Under perfect competition, "no buyer or seller has the power to significantly affect the prices at which goods are exchanged." Seven features of perfectly competitive markets: 1. distributed: numerous buyers & sellers, none of whom has a substantial market share 2. open: buyers and sellers are free to enter or leave the market 3. full and perfect knowledge: each buyer & seller has full and perfect knowledge of each others' doings 4. equivalent goods: goods being sold are similar enough that buyers don't care whose they buy. 5. unsubsidized: costs of producing or using goods is borne entirely by the buyers & sellers 6. rational economic agency: all buyers and sellers act as egoistic utility maximizers try to buy (or produce) as low as possible sell as high as possible 7. unregulated: no external parties such as governments regulate the price, quantity, or quality of goods Breakdown of the seven features o 1-2 -- openness and distribution -- the "basic conditions" o 3-6 are "idealizing conditions" o 7 -- nonregulation -- a measure of how free the market all real economies are mixed, mixing free market elements command elements regulative admixtures justified by appeal to social utility distributive justice rights -- especially positive or welfare rights Essential presuppositions o an enforceable private property system so buyers and sellers have ownership rights to exchange o a system of contracts to facilitate & control transfers of ownership o an underlying system of production so there's goods to be exchanged Self-regulation: the basis for the alleged moral benefits of competitive markets o supply > demand sellers bid prices down: assumes distribution among sellers falling profits lead to decreased production: assumes openness profits in one market sector falling below those in others

causes sellers to move into the other, more profitable, sector demand > supply buyers bid prices up: assumes distribution among buyers rising profits lead to increased production: assumes openness profits in one market sector rising above those in others causes sellers to move out of the others and into the more profitable sector

Equilibrium in Perfectly Competitive Markets

Principle of Diminishing Marginal Utility o affecting demand o states that each additional item consumed is less useful or satisfying than each of the earlier items consequently is less valuable than each of the earlier items o consequence: "the price consumers are willing to pay for goods diminishes as the quantity of goods they buy increases" Principle of Increasing Marginal Costs o affecting supply o states that each additional item produced after a certain point costs more to produce than earlier items point determined by countervailing economies of scale & scarcity or plenitude of resources costs breakdown = ordinary costs + normal profits "ordinary" costs of production & distribution costs of labor materials marketing distribution etc. "normal" profit: "the average profit the producers could make in other markets that carry similar risks" (p. 213) Equilibrium price: the price at which supply = demand, i.e., o the amount buyers will pay for a quantity of goods o the production costs (including normal profits) of that quantity for the sellers Discussion: Perfect Competition as useful idealization o only a few markets -- mainly agricultural commodities markets -- come close to the ideal o perfect competition and explanatory construct or idealization

enables economists to make predictions as with other useful idealizations use of equations governing "frictionless planes" to estimate behavior of real inclined planes use of equations governing "free fall in a vacuum" to estimate the behavior of bodies falling in the atmosphere etc. ethically illuminating provides us with a clear understanding of the advantages of competition and understanding of why it may be desirable to keep markets as competitive as possible

Ethics and Perfectly Competitive Markets (PCMs)

Capitalist distributive justice is well served by perfectly competitive markets o contributive justice: to each according to their contribution counting capital or ownership of the means of production as a contribution counting the value of workers contribution as = the price their services command on the job market accords with the practice of counting "normal" profit as a cost of production Economic utility or efficiency is best served o demand is served: sellers sell and producers produce what consumers want o efficiency is forced on producers & distributors by competition o consumers individual preferences are served each gets what they in particular most want from among the goods available Negative rights are well respected, especially rights of economic liberty o to buy and sell whatever you choose o whenever you choose o to and from whomever you choose Limitations on Perfectly Competitive Markets' Claims to Moral Superiority o Justice under competing conceptions not so well served egalitarian justice violated by income & wealth disparities arising under PCMs distribution according to ability to pay vs. need is contrary to needs-based conceptions

counting the value of labor as the price it commands on the job market contrary to Marxian contribution-based justice value of labor = fair-market value of product minus the ordinary costs of production "normal" profit not counted as a cost of production Justice and benefits alleged accrue only to market participants or those with money to buy it's only their demand that are served it's only their individual preferences that are served Positive rights of the poor may be violated: e.g., rights to food & shelter education health-care Conditions for perfect competition may conflict with care rational egoistic utility maximization neglects caring -- it's selfish efficiency demands of competition may conflict with caring if I'm too caring pay my help substantially more than my competitors if I spend substantially more on pollution controls than my competitors if I spend spend substantially more on safe working conditions than my competitors then I may lose out in the competition my production costs will be higher my competitors will undersell me putting me out of business Certain bad character traits may be encouraged and certain good traits discouraged by competitive markets discouraged good traits kindness caring generosity negative traits encourages greed & self-seeking materialism Imperfections of real markets insofar as they fall short of perfect competitiveness they may fail to deliver even the promised benefits of serving capitalistic justice maximizing utility securing negative rights of economic liberty

4.2 Monopoly Competition

In monopoly conditions the first two of the seven conditions defining perfect competition are violated o not distributed but concentrated instead of "numerous sellers, none of whom has a substantial share of the market" one seller has a 100% share of the market o not open but closed instead of other sellers being able to "freely and immediately enter" other sellers are prevented from entering due to various factors patent laws high capitalization costs anticompetitive machinations of the monopoly holder etc. o Monopoly markets Definition: "markets . . . in which a single firm is the only seller in the market and which new sellers are barred from entering." (p. 221) Principal Market-Distorting Effect inability of other competitors to enter the market thereby increasing supplies thereby bidding prices down results in artificially high prices above the "natural price" or equilibrium point natural price = cost of production + going-rate-ofprofit (CP + GRP)

Monopoly Competition: Justice, Utility, and Rights

Monopoly Markets & Capitalist Justice o Capitalist justice says: "to each according to their contribution of labor or investment. o Equilibrium point is where Capitalist justice is served. o Under monopoly conditions prices kept above equilibrium so the seller charges more than the goods are worth (i.e., their natural price) so the prices the buyer is forced to pay are unjust (i.e. > CP +GRP) Monopoly Markets & Economic Utility

1. Monopolies foster distributive inefficiency: demand is not served monopolies create (virtual?) shortages (indicated by high profits) other firms unable to enter the market to make up these shortages excess profits absorbed by the seller are resources not needed to supply the amounts of goods the consumers are getting: if others were free to enter the market the same goods would be supplied for less. 2. Monopolies remove competitive pressures making for productive efficiency 3. Discretionary preferences of consumers not as well-served: consumers forced cut back more than they would have had to (under "normal" conditions) to buy the monopolized goods Monopoly Markets and Negative Rights of Economic Freedom o Sellers not free to enter. o Buyers buy under duress: monopoly sellers can dictate terms to buyers goods they may not want: "You have to buy the Service Agreement with that." Example: Microsoft marketing of Explorer quantities they may not desire: "sorry it only comes by the dozen." o GM's reply to Bill Gates (humor)

4.3 Oligopolistic Competition

True monopolies are rare: but a second type of "imperfectly competitive market" is common. Oligopoly conditions: a few firms control most of the market o relatively common ("business as usual") o have similar dynamics and anticompetitive effects In oligopoly conditions the first two of the seven conditions defining perfect competition are violated o not distributed but concentrated instead of "numerous sellers, none of whom has a substantial share of the market" a few sellers have a near 100% share of the market o not open but closed instead of others sellers being able to "freely and immediately enter" other sellers are prevented from entering due to high start-up costs anticompetitive machinations of the oligopoly firms

long-term contracts with buyers etc.

Concentration o the fewer the firms controlling the market the more "highly concentrated" the market o the more firms controlling the market the less "highly concentrated" Horizontal mergers: the chief cause of oligopolistic conditions o horizontal merger = "unification of two or more companies that were formerly competing in the same line of business" e.g., Daimler, Disney-Times-Warner anticompetitive Dynamic: Creation of Virtual Monopoly Conditions via Collusion o with only a few firms in the market it is relatively easy for them to join forces and act as a unit "much like a single giant firm" by agreeing to set prices at the same (excessively high) level tacitly: a "gentlemen's agreement" explicitly: price fixing by agreeing to restrict output & control supply (OPEC) o with similar anti-competitive & consequently dubious ethical consequences violations of capitalist justice negative impacts on economic utility distributive inefficiencies productive inefficiencies diminished discretionary preference satisfaction o with similar negative (economic freedom) rights violations others are prevented from entering the market sellers dictate terms buyers have no recourse since the "competition" has agreed to dictate the same terms

Explicit Agreements

Price fixing: managers meet (secretly) & agree to set prices at a artificially high levels. Manipulation of Supply: firms agree to limit their production o result in artificially induced shortages o hence in artificially high prices Exclusive Dealing Arrangements: firms sell to retailers on condition

that retailers will not buy from certain other companies (contra openness) o or will not sell outside of a certain geographical area (contra distribution) Tying Arrangements: the seller agrees to sell to buyer only on condition that the buyer agrees to buy other products from the firm. Retail Price Maintenance Agreements: manufacturer sells to retailer only on the condition o that they agree to charge the same set retail price for the goods. o effects diminishes competition between retailers removes competitive pressure on the manufacturer to lower prices decrease production costs Price Discrimination: charging different prices to different buyers for identical goods. o Examples Continental Pie Co. underselling Utah Pie Co. in Salt Lake City Most famous case: Standard Oil cornering of the oil market at the end of the 19th century used regional price discrimination region by region to undersell the locally based oil companies & drive them out of business. The airlines? o Price differences are legitimate only when based on volume differences other differences related to true costs of manufacturing transporting packaging marketing servicing

o

Tacit Agreements

Explicit agreements to undertake many of the anti-competitive practices just named are illegal Most collusion between oligopolies, consequently is based on unspoken or "tacit" forms of cooperation Genesis of unspoken cooperation o firms each come to recognize that competition is not in their best interest o that cooperation would be in the best interests of all

so without any explicit agreement to cooperate they undertake to act as if there were such an agreement you might say there is such an agreement de facto or in practice Price-setting: when one major player raises prices, all the would-be competitors follow suit o each realizes all will benefit as long as they continue to act in this concerted fashion o "price leader" version the oligopolies recognize one (dominant) player as the industry's price leader and tacitly agree to follow suit in setting prices at whatever level this firm sets

o

Bribery

Bribes can be used to secure the sale of products o serve to shut out other sellers o hence, are anticompetitive Not all bribes are of this sort: e.g. "tips" customarily given to customs agents in some countries to "expedite the process" Ethical rules for bribery: potentially excusatory & mitigating questions o Is the offer of payment initiated by the payer? if so, this is a morally culpable act of bribery if not -- if the payee initiates the transaction by demanding payment (usually accompanied by an explicit or implicit threat: e.g., the processing won't be "expedited") it's more like extortion by the payee than bribery by the payer the payer is absolved of moral responsibility or their responsibility is at least diminished o Is the payment made to induce the payee to act in a manner contrary to the duties or responsibilities of their office if so: it's a morally culpable bribe: the payer is inducing the payee to act immorally if not -- as in the case of the customs official -- it may not be. o Are the nature and purpose of the payment considered ethically unobjectionable by the local culture if so (again as in the case of the customs agent) then it may be morally excusable if not done for anticompetitive purposes

if not done for the purpose of inducing the payee to do something immoral may be ethically permissible on utilitarian grounds: otherwise the process won't be "expedited" might, however, still be a legal violation of the Foreign Corrupt Practices Act of 1977 agreement with local practices won't be a mitigating or excusing factor if it is done for anticompetitive purposes or if it is done for the purpose of inducing the payee to do something immoral

Oligopolies and Public Policy

The problem o Competition within industries has declined & is declining. o What to do in light of this fact?

The Do-Nothing View

No Problem: Competition between industries with substitutable products takes the place of competition within o example: steel industry, though highly concentrated, faces competition from plastics, aluminum, etc. o question: what to do when Alcoa & U. S. Steel & 3M merge? "Countervailing power" of other large corporate groups blunts the effects of concentration o unions & government o large corporate buyers not so easy to dictate terms to Chicago School: markets are economically efficient with as few as three significant rivals Big is good o economies of scale reductions in unit costs of production using the same fixed resources o offsets drawbacks: excessive profits offset by incredible cost savings o necessary to meet foreign competition from subsidized industries o Velasquez is dubious: "research suggests that

in most industries expansion beyond a certain point will not lower costs but will instead increase them."

The Antitrust View

Reinstitution of competitive pressures o is necessary in order to rein in excessive oligopoly profits o requires breaking up large firms into smaller units (each controlling not more than 3-5% of the market) Expected results o higher levels of competition will emerge o along with a decrease in explicit and tacit collusion o bringing about the beneficial consequences lower prices for consumers greater innovation increased development of cost cutting technologies

The Regulation View

Oligopoly corporations should not be broken up o economies of scale would be lost if they were forced to decentralize mass production mass distribution etc. o these economies should be passed on to consumers in the form of cheaper products more plentiful products To pass savings due to economies of scale along to consumers requires proper regulation of large corporations o nationalization -- government take-over of operations the regulative extreme controversial sometimes necessary & beneficial, some argue never necessary or beneficial others argue leads to unresponsive bureaucracy removes competitive pressure from these firms or industries which negatively effects productivity efficiency innovation o proponent of regulation usually have in mind measures less extreme than regulation

to ensure that markets continue to be structured competitively: to ensure that firms maintain competitive market relations between themselves i.e., to prevent collusion may be voluntarily followed or legally enforced justified insofar as competition is necessary to best secure utilitarian benefits distributive justice rights to negative freedom

Case for Discussions

Playing Monopoly: Microsoft (ABC News CD-ROM) Case History

1977: Bill Gates & Paul Allen begin writing programs for the Apple II PC, rename their company Microsoft, and move to Seattle "where, with 13 employees, it ended the year with revenues of 1.4 million." 1980: IBM belatedly decides to enter the PC market & finds itself in need of an operating system fast o CP/M (a multiplatform OS) turns down IBMs offer to license its OS for IBM o Approach Bill Gates who says he can provide them with an OS o "Gates went to a friend who he knew had written a ... 'knock-off of CP/M' and paid him $60,000 for the rights to this 'knock off': Gates did not tell his "friend" about the IBM offer o IBM's share of the market grew to 40% by 1987. "MS-DOS became the standard operating system for computers built to IBM standards," roughly 90% of all PCs o thousands of applications including Microsoft's own MS Word and Mulitplan developed for this OS 1984: Apple Computer develops operating system with graphical interface 1987: Microsoft releases its Windows OS also featuring graphical interface o Apple sued Microsoft for infringement: claiming that because Windows copied the "look and feel" of the their copyrighted MacIntosh OS o Apple lost the case and with it the competitive advantage it had briefly enjoyed" o Microsoft continues to control some 90 percent of the personal computer market Netscape

o o

Netscape Navigator after its release in December of 1994 Navigator quickly captured 70% of the internet browser market browsers do not only display text and graphics but can execute instructions (software programs) much like an OS, making them a potential competitors to Windows. Bill Gates' 1995 memo: "A new competitor "born" on the internet is Netscape. Their browser is dominant, with a 70% usage share. They are pursuing a multi-platform strategy where they move the key API [applications programming interface] into the client to commoditize the underlying operating system."

Java a programming language developed by Sun Microsystems in 1995 o can operate on any computer equipped with Java software regardless of the OS, again threatening to make Windows obsolete o "This scares the hell out of me," Bill Gates wrote in an internal e-mail. Navigator + Java! Oh no! o Netscape agreed with Sun to incorporate Java into Navigator o So Java programs didn't need Windows: they could run on any Navigator equipped computer o Furthermore, this made Navigator a "major distribution vehicle" for Java Microsoft kills Navigator o Microsoft's "offer you can't refuse" Offer: Microsoft would supply the browser for the Windows operating system and Netscape would provide browsers only for other operating systems. Since this would be to exchange 70% market share for a 10% market share, Netscape naturally refused Microsoft punished Netscape for this by refusing to share the codes for Windows 95 to impede Netscape from developing a new version of their browser to take advantage of the Windows 95 API o Microsoft's Internet Explorer competing browser released in 1995 failed to make the major inroads in Netscape's market share that Microsoft wanted Microsoft executive Christian Wildfeuer wrote in a 1997 memo that it would be "very hard to increase browser share on the merits of Internet Explorer 4 alone" and proposed that Microsoft "leverage our Operating System asset to make people use Internet Explorer instead of Netscape Navigator." o Implementation of the bundling strategy

o

Window 95: incorporated a copy of Internet Explorer that automatically installed with the OS Windows 98: fully integrated Internet Explorer with the OS so that IE couldn't really be removed: Windows 98 called on IE to perform crucial operations despite the fact that this slowed its operations made it more crash prone made it difficult and risky for PC owners to try to replace IE with Navigator as their default browsers undercut Netscape on pricing by giving away IE "for free," as Microsoft put it Microsoft further required computer manufacturers to agree not to promote Netscape's browser [by making it the default browser] and offered incentives to manufacturers not to install Navigator at all. Success! Navigator's market share plummeted and Explorer's soared. Microsoft "pollutes" Java o Microsoft negotiates a license to distribute Java with Windows from Sun Sun "not knowing that Microsoft was planning to change Java" (Velasquez) [Or were threats employed, as with Netscape. Perhaps MS made Sun "an offer they couldn't refuse".] o Microsoft distributes an altered version incorporating changes that prevent regular (Sun) Java programs from running on computers using MS-Java. o Since 90% of machines are now MS, applications programs began to be written for MS Java & not Sun. o The "strategic objective" to "kill cross-platform Java" by expanding the "polluted Java market" (as and internal MS document puts it), had been achieved: "Microsoft had turned Java into a part of Windows" (Velasquez) U.S. DOJ (under Janet Reno in 1998) accuses Microsoft of "a pattern of anticompetitive practices designed to thwart browser competition on the merits, to deprive customers of choice between alternative browsers, and to exclude Microsoft's Internet browser competitors" that was in violation of the Sherman Antitrust Act, the DOJ charged, on four counts. o Judge Jackson finds Microsoft guilty on three of the counts o Ordered MS to be broken up into two separate companies MS OS marketing & development MS applications program marketing & development

Furthermore ordered MS could not punish or threaten computer manufacturers for installing and promoting competitors' products MS had to allow computer manufacturers to remove any MS applications from the Windows OS [i.e., unbundle the aps.] that MS would not have to implement his orders until it had time to appeal Ruling on Appeal o Jackson's findings of fact were accepted o Jackson's breakup penalty was reversed: MS argued his bias against Microsoft affected the severity of the remedy he imposed o A new penalty would have to be devised. New Penalty: Negotiated in 2001 between MS and "the new Republicanappointed head of the DOJ" John Ashcroft o MS would share its API with rival applications software companies o MS would give computer makers and users the ability to hide icons for Windows applications o MS could not prevent competing programs from being installed on Windows computers o MS could not retaliate against computer makers that used competing software. o however, MS could continue to bundle applications into the OS Ongoing Pattern o MS tried to corner the server market to share APIs with competing server software programmers o MS bundled its Windows Media Player together with Windows 2000 o 2004 European Commission fined MS $613 million ordered MS to disclose the APIs to competing server software programmers ordered MS to offer a version of Windows without Windows Media Player o On appeal: MS doesn't have to offer that version until appeals are exhausted: that will take several years Linux -- a free open source OS -- is an emerging alternative to windows

o

Questions for Discussion 1. Identify the behaviors that you think are ethically questionable in the history of Microsoft. Evaluate the ethics of these behaviors.

2. What characteristics of the market for operating systems do you think created the monopoly market for Microsoft? Evaluate this market in terms of utility, rights, and justice. 3. In your view, should the government have sued Microsoft for violation of the antitrust laws? Was Judge Jackson's order that Microsoft be broken into two companies fair to Microsoft? Was Judge Kollar-Kotelly's November 1, 2003 decision fair? Was the April 2004 decision of the European Commission fair to Microsoft? 4. Who, if anyone, is harmed by the sort of market that Microsoft's operating system has enjoyed? What kind of public policies, if any, should we have to deal with industries like the operating system industry? 5. What other issues do you believe this case raises or what else to you think it shows? Archer Daniels Midland and the Friendly Competitors Questions for Discussion 1. Evaluate Terry Wilson's assertion that the difference between the $1.20/lb. price of Lysine when ADM entered the market and the $.60/lb. the price fell to due to the oversupply that resulted from ADM's entry was money that the five companies were "giving away to their customers" (p.201). What, if anything, is wrong with the principle that "the competitor is our friend and the customer is our enemy"? 2. Your text cites a number of factors that cause companies to engage in pricefixing. Identify the factors that you think were present in the ADM case & explain. 3. Was Mark Whitacre to blame for what he did? For which of the things that he did? Do you feel that in the end he was treated fairly? Why or why not? 4. What other issues do you believe this case raises or what else to you think it shows?

http://www.wutsamada.com/alma/bizeth/velasq4.htm

Potrebbero piacerti anche

- Perfect Competition Under EbayDocumento31 paginePerfect Competition Under EbayAkshay Mall100% (4)

- Chapter 3 The Business System: Government, Markets, and International TradeDocumento23 pagineChapter 3 The Business System: Government, Markets, and International TradeLH50% (4)

- Chapter 1 Summary Business EthicsDocumento3 pagineChapter 1 Summary Business EthicskarimNessuna valutazione finora

- Wyckoff Strategies Techniques Free ChaptersDocumento8 pagineWyckoff Strategies Techniques Free ChaptersMicaela Seisas0% (1)

- Chapter 6 Trade ProtectionismDocumento26 pagineChapter 6 Trade Protectionismsalsa azzahraNessuna valutazione finora

- Problem Set 6 Solution PDFDocumento4 pagineProblem Set 6 Solution PDFTaib MuffakNessuna valutazione finora

- Chapter 2 Ethical Principle in BusinessDocumento23 pagineChapter 2 Ethical Principle in BusinessLH50% (4)

- Chapter 4 Ethics in The MarketplaceDocumento19 pagineChapter 4 Ethics in The MarketplaceLH100% (1)

- Personal Selling: Preparation and ProcessDocumento21 paginePersonal Selling: Preparation and Processsumit negi100% (1)

- Consumer Decision Process ExplainedDocumento2 pagineConsumer Decision Process ExplainedraviNessuna valutazione finora

- Chapter 6 Identifying Market Segments and Target Customers - WEEK 4Documento20 pagineChapter 6 Identifying Market Segments and Target Customers - WEEK 4abe onimushaNessuna valutazione finora

- Ethics in The MarketplaceDocumento19 pagineEthics in The Marketplacewsnarejo100% (1)

- Your quiz results are readyDocumento17 pagineYour quiz results are readyReemaKamalShriem100% (1)

- Five Forces Model Assignment-1Documento3 pagineFive Forces Model Assignment-1Saqib AliNessuna valutazione finora

- (MS04) As Business v2Documento17 pagine(MS04) As Business v2shalynngatere100% (2)

- The Ethics of Consumer Production and Marketing-1Documento25 pagineThe Ethics of Consumer Production and Marketing-1Khawar ayub100% (1)

- Market StructureDocumento6 pagineMarket StructureRachel Dollison100% (2)

- Itep Onlıne Grocery - Reading TestDocumento5 pagineItep Onlıne Grocery - Reading TestCihan ÖztürkNessuna valutazione finora

- Northwest Newsprint Case Report Karthick Raj S 1913050Documento15 pagineNorthwest Newsprint Case Report Karthick Raj S 1913050BharaniNessuna valutazione finora

- Chapter 6 The Ethics of Consumer Production and MarketingDocumento21 pagineChapter 6 The Ethics of Consumer Production and MarketingLH0% (1)

- Case StudiesDocumento14 pagineCase Studiesanon-96244100% (1)

- W3 Ethics in The Market PlaceDocumento30 pagineW3 Ethics in The Market PlaceMuhammad Nurhilmi0% (1)

- Chapter 1 Managers Profits and Markets PDFDocumento42 pagineChapter 1 Managers Profits and Markets PDFZarn ZaragozaNessuna valutazione finora

- HS Entrepreneurship Sample ExamDocumento27 pagineHS Entrepreneurship Sample ExamKate Queen Curay GumpalNessuna valutazione finora

- Velasquez PPT Chapter 01Documento28 pagineVelasquez PPT Chapter 01Haha123100% (1)

- Principles of Management Series Test 1 Question PaperDocumento1 paginaPrinciples of Management Series Test 1 Question PaperKailas Sree Chandran0% (1)

- Chapter1 - Statistics For Managerial DecisionsDocumento26 pagineChapter1 - Statistics For Managerial DecisionsRanjan Raj UrsNessuna valutazione finora

- HRM Question Bank (BBA)Documento5 pagineHRM Question Bank (BBA)DipankarNessuna valutazione finora

- FT MBA Macroeconomics and National Competitiveness Examination Question PaperDocumento2 pagineFT MBA Macroeconomics and National Competitiveness Examination Question PaperCovid19 Clinical TrialsNessuna valutazione finora

- Review - CHAPTER 1 The Revolution Is Just BeginningDocumento4 pagineReview - CHAPTER 1 The Revolution Is Just BeginningNguyện ÝNessuna valutazione finora

- BUSINESS LAW and EthicsDocumento2 pagineBUSINESS LAW and EthicsSowjanya TalapakaNessuna valutazione finora

- Product Market StakeholdersDocumento3 pagineProduct Market Stakeholdersqaqapataqa100% (1)

- Ge MatrixDocumento9 pagineGe MatrixAshiq NobitaNessuna valutazione finora

- CHAPTER 3 - Marketing PPT MGMTDocumento41 pagineCHAPTER 3 - Marketing PPT MGMTrtNessuna valutazione finora

- Revenue MaximizationDocumento2 pagineRevenue Maximizationsambalikadzilla6052Nessuna valutazione finora

- Industrial Management ModelDocumento2 pagineIndustrial Management Modelrajendrakumar100% (1)

- Chapter 15 Designing and Managing Integrated Marketing ChannelsDocumento26 pagineChapter 15 Designing and Managing Integrated Marketing ChannelsrioNessuna valutazione finora

- Unit 1 Microeconomics Sample Questions Multiple ChoiceDocumento11 pagineUnit 1 Microeconomics Sample Questions Multiple ChoicebryanNessuna valutazione finora

- BBA 603 Entrepreneurship GuideDocumento20 pagineBBA 603 Entrepreneurship Guideaditya mishraNessuna valutazione finora

- Principles of finance chapter 1 key business organizationsDocumento12 paginePrinciples of finance chapter 1 key business organizationshtrucphuongNessuna valutazione finora

- Chapter 8 Ethics and The EmployeeDocumento29 pagineChapter 8 Ethics and The EmployeeEngel QuimsonNessuna valutazione finora

- Google vs Microsoft Case Study on Clash of Tech TitansDocumento2 pagineGoogle vs Microsoft Case Study on Clash of Tech TitansShahid AliNessuna valutazione finora

- Strategy Formulation & Analytical Framework for MicrosoftDocumento12 pagineStrategy Formulation & Analytical Framework for MicrosoftahsanNessuna valutazione finora

- David SM Chapter 2 PPT by Fred R David Stategic Management Concepts and Cases 13th EditionDocumento38 pagineDavid SM Chapter 2 PPT by Fred R David Stategic Management Concepts and Cases 13th EditionSyed Haris Ali0% (2)

- Chapter 3 Analyzing The Marketing EnvironmentDocumento30 pagineChapter 3 Analyzing The Marketing EnvironmentZubaer Riad100% (1)

- Demand NumericalsDocumento2 pagineDemand Numericalsmahesh kumar0% (1)

- Strategic Marketing Ch7Documento20 pagineStrategic Marketing Ch7Tariq JaleesNessuna valutazione finora

- CF Final (1) On PTR Restaurant Mini CaseDocumento23 pagineCF Final (1) On PTR Restaurant Mini Caseshiv029Nessuna valutazione finora

- Social Ethical Issues of AdvertisingDocumento23 pagineSocial Ethical Issues of AdvertisingAlex Lee50% (2)

- Business Ethics TYBMS 1Documento17 pagineBusiness Ethics TYBMS 1joshchaitanya_50% (2)

- Question Paper Investment Banking and Financial Services-I (261) : April 2006Documento192 pagineQuestion Paper Investment Banking and Financial Services-I (261) : April 2006neeraj_adorable4409100% (3)

- Excise Clearance For ExportsDocumento10 pagineExcise Clearance For ExportsRadhakrishna UppalapatiNessuna valutazione finora

- What Is ServicescapeDocumento3 pagineWhat Is ServicescapePawan Coomar100% (1)

- Chapter 4 - Winning Markets Through Market-Oriented Strategic Planning Multiple Choice QuestionsDocumento18 pagineChapter 4 - Winning Markets Through Market-Oriented Strategic Planning Multiple Choice QuestionsMutya Neri Cruz0% (1)

- Marketing Case StudyDocumento2 pagineMarketing Case StudyJulius DennisNessuna valutazione finora

- Cage ModelDocumento25 pagineCage ModelLaura GómezNessuna valutazione finora

- Ethics in Competitive MarketsDocumento11 pagineEthics in Competitive Marketsdini6483Nessuna valutazione finora

- BAGB2033 Lesson 4Documento8 pagineBAGB2033 Lesson 4aqilahNessuna valutazione finora

- Notes On MonopolyDocumento56 pagineNotes On MonopolySuraj MoreNessuna valutazione finora

- Ethics in The MarketplaceDocumento19 pagineEthics in The MarketplaceTameem YousafNessuna valutazione finora

- Ethics in MarketplaceDocumento32 pagineEthics in MarketplaceAkanksha AroraNessuna valutazione finora

- Assignment Marketing CompetitionDocumento4 pagineAssignment Marketing Competitionzouz3000Nessuna valutazione finora

- Ethics in The Marketplace: Course Syllabus LH's Virtual OfficeDocumento12 pagineEthics in The Marketplace: Course Syllabus LH's Virtual OfficeMomina AyazNessuna valutazione finora

- Differentiating Between Market StructuresDocumento12 pagineDifferentiating Between Market Structuresbarneca1234Nessuna valutazione finora

- Competitive Market ModelDocumento5 pagineCompetitive Market Modelshandil7Nessuna valutazione finora

- Ringkasan Materi - Business Ethics CH 4Documento4 pagineRingkasan Materi - Business Ethics CH 4Abigail EnricaNessuna valutazione finora

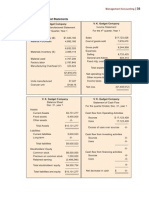

- MFG Income StatementDocumento1 paginaMFG Income StatementTina Mariano DyNessuna valutazione finora

- Bayes' Theorem Exercises From The Book of AndersonDocumento1 paginaBayes' Theorem Exercises From The Book of AndersonTina Mariano DyNessuna valutazione finora

- Counting Rules in StatisticsDocumento1 paginaCounting Rules in StatisticsTina Mariano DyNessuna valutazione finora

- Business Process ReengineeringDocumento23 pagineBusiness Process ReengineeringTina Mariano DyNessuna valutazione finora

- Patterns of OrganizationDocumento5 paginePatterns of OrganizationTina Mariano DyNessuna valutazione finora

- Patterns of OrganizationDocumento5 paginePatterns of OrganizationTina Mariano DyNessuna valutazione finora

- GSB Mba DlsuDocumento1 paginaGSB Mba DlsuMidi GenticaNessuna valutazione finora

- A.O Cont.. - 01-04-2023 Theory and Lit Corrections NowDocumento32 pagineA.O Cont.. - 01-04-2023 Theory and Lit Corrections NowƏfąþą RobertNessuna valutazione finora

- Food Waste in CanadaDocumento41 pagineFood Waste in CanadaCityNewsTorontoNessuna valutazione finora

- Final Manuscript Black Pearl Coffee JellyDocumento82 pagineFinal Manuscript Black Pearl Coffee JellyDexter C. DapitanNessuna valutazione finora

- Power Generation/Variable Load: Review: Lesson 6Documento3 paginePower Generation/Variable Load: Review: Lesson 6Rasel IslamNessuna valutazione finora

- Inventory Management With Online Payment and Preorder DiscountsDocumento23 pagineInventory Management With Online Payment and Preorder Discounts35074Md Arafat KhanNessuna valutazione finora

- AcknowledgementDocumento27 pagineAcknowledgementSaileshRavindranNessuna valutazione finora

- Chapter 5Documento55 pagineChapter 5Tesfu AknawNessuna valutazione finora

- Intro To Service Management - #2Documento10 pagineIntro To Service Management - #2Endrei Clyne MerculloNessuna valutazione finora

- CH 05 Elasticity and Its ApplicationDocumento5 pagineCH 05 Elasticity and Its ApplicationAnkitNessuna valutazione finora

- MIT World Peace University Mechanical System Design Pricing FactorsDocumento17 pagineMIT World Peace University Mechanical System Design Pricing FactorsChinmay LearningNessuna valutazione finora

- Pepsi Vs Coca ColaDocumento24 paginePepsi Vs Coca ColaWaseem WaqarNessuna valutazione finora

- 0455 s03 Ms 1+2+3+4+6Documento17 pagine0455 s03 Ms 1+2+3+4+6Muhammad Salim Ullah KhanNessuna valutazione finora

- FinalDocumento20 pagineFinalMaryamNessuna valutazione finora

- Types of Monetary StandardsDocumento7 pagineTypes of Monetary StandardsMadel UreraNessuna valutazione finora

- MGEA02H3 LEC01/LEC02/LEC03: Note - This Is Version ADocumento21 pagineMGEA02H3 LEC01/LEC02/LEC03: Note - This Is Version AYINGWEN LINessuna valutazione finora

- 1588109526arogunmati Oluwadamilola Alexander 18ENG05011 Agricultural Business Plan4Documento14 pagine1588109526arogunmati Oluwadamilola Alexander 18ENG05011 Agricultural Business Plan4Ezennaka MaduabuchiNessuna valutazione finora

- Lecture 2Documento5 pagineLecture 2Ariel ThngNessuna valutazione finora

- Practice Test 2 - Midterm - M4B PDFDocumento2 paginePractice Test 2 - Midterm - M4B PDFNguyễn Quốc HưngNessuna valutazione finora

- MU Past PapersDocumento14 pagineMU Past PapersDesi TVNessuna valutazione finora

- Market Equilibrium Govt Intervention PDFDocumento16 pagineMarket Equilibrium Govt Intervention PDFkkNessuna valutazione finora

- Perfect Competition in 5 ChaptersDocumento6 paginePerfect Competition in 5 ChaptersAbrha636Nessuna valutazione finora

- INVENTORY MODELS in supply chainDocumento31 pagineINVENTORY MODELS in supply chainRuthika AkkarajuNessuna valutazione finora

- The Use of Knowledge in The Modern WorldDocumento3 pagineThe Use of Knowledge in The Modern WorldJAMNessuna valutazione finora

- Derivation of LM CurveDocumento17 pagineDerivation of LM CurvehomayunNessuna valutazione finora