Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

SALES INCREASED BY $2,602,000.: Accruals Payable Accounts S Inventorie Receivable Accounts Cash

Caricato da

Christine Khay Gabriel BulawitDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

SALES INCREASED BY $2,602,000.: Accruals Payable Accounts S Inventorie Receivable Accounts Cash

Caricato da

Christine Khay Gabriel BulawitCopyright:

Formati disponibili

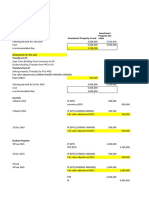

Questions:

a. What did the expansion have on sales, net operating profit after taxes (NOPAT) net operating

working capital (NOWC), total investor-supplied operating capital, net income?

Sales

Sales

01

-Sales

00

=$6,034,000 $3,432,000

=$2,602,000

SALES INCREASED BY $2,602,000.

Net Operating Profit After Taxes (NOPAT)

NOPAT

01

= EBIT (1 - TAX RATE)

= (-$130,948)(0.6)

= ($78,569)

NOPAT

00

= $190,428(0.6)

= $114,257

ANOPAT = ($78,569) - $114,257 = ($192,826)

NOPAT DECREASED BY $192,826.

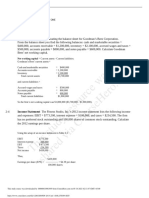

Net Operating Working Capital (NOWC)

NOWC

01

=

|

.

|

\

|

+

|

.

|

\

|

+ + ACCRUALS

PAYABLE

ACCOUNTS

S INVENTORIE

RECEIVABLE

ACCOUNTS

CASH

= ($7,282 + $632,160 + $1,287,360) - ($524,160 + $489,600)

= $913,042.

NOWC

00

= ($57,600 + $351,200 + $715,200) - ($145,600 + $136,000)

= $842,400.

ANOWC = $913,042 - $842,400 = $70,642.

NET OPERATING WORKING CAPITAL INCREASED BY $70,642.

Total Investor- Supplied Operating Capital

OC= NET OPERATING WORKING CAPITAL + NET PLANT AND EQUIPMENT

OC

01

= $913,042 + $939,790 = $1,852,832.

OC

00

= $842,400 + $344,800 = $1,187,200.

AOC = $1,852,832 - $1,187,200 = $665,632.

TOTAL INVESTOR-SUPPLIED OPERATING CAPITAL INCREASED SUBSTANTIALLY BY $665,632

FROM 2000 TO 2001.

Net Income

NI

01

NI

00

= ($160,176) - $87,960

= ($248,136).

THERE WAS A BIG DROP, -$248,136, IN NET INCOME DURING 2001.

b. What effect did the companys expansion have on its net cash flow, operating cash flows and

free cash flow?

Net Cash Flow

NCF = NI + DEP AND AMORT

NCF

01

= ($160,176) + $116,960 = ($43,216).

NCF

00

= $87,960 + $18,900 = $106,860.

NCF IS NEGATIVE IN 2001, BUT IT WAS POSITIVE IN 2000.

Operating Cash Flow

OCF = EBIT(1 - T) + DEP AND AMORT

OFC

01

= (-$130,948)(0.6) + $116,960

= $38,391.

OCF

00

= ($190,428)(0.6) + $18,900 = $133,157.

OCF IS POSITIVE IN 2001, BUT IT DECREASED BY OVER 70 PERCENT FROM ITS 2000 LEVEL.

Free Cash Flows

FCF

01

= NOPAT - NET INVESTMENT IN OPERATING CAPITAL

= (-$78,569) - ($1,852,832 - $1,187,200)

= (-$78,569) - $665,632

= ($744,201).

FREE CASH FLOW WAS -$744,201 IN 2001.

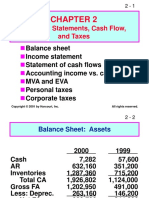

c. Jamison also has asked you to estimate DLeons EVA. She estimates that the after-tax cost of

capital was 10 percent in 2000 and 13 percent in 2001.

EVA= EBIT(1 - T) - AFTER-TAX COST OF OPERATING CAPITAL

EVA

01

= (-$130,948)(0.6) - ($1,852,832)(0.13)

= ($319,437)

EVA

00

= EBIT(1 - T) - AFTER-TAX COST OF OPERATING CAPITAL

= ($190,428)(0.6) - ($1,187,200)(0.10)

= ($4,463)

IN 2000, EVA WAS SLIGHTLY NEGATIVE; HOWEVER IN 2001 EVA WAS SIGNIFICANTLY

NEGATIVE.

d. Looking at DLeons stock price today, would you conclude that the expansion increased or

decreased MVA?

MVA= (Shares outstanding) (Stock price) - Total common equity.

MVA

01

= [100,000sh ($2.25)] -$460,000

= ($235,000)

MVA

00

= [100,000sh ($8.50)] - $460,000

= $390,000

DURING THE LAST YEAR, STOCK PRICE HAS DECREASED BY OVER 73 PERCENT,

THUS ONE WOULD CONCLUDE THAT THE EXPANSION HAS DECREASED MVA.

e. DLeons purchase materials on 30-day terms, meaning that it is supposed to pay for purchases

within 30 days of receipt. Judging from its 2001 balance sheet, do you think DLeon pays supplier

on time? Explain. If not, what problems might this lead to?

DLEON PROBABLY DOES NOT PAY ITS SUPPLIERS ON TIME JUDGING FROM THE FACT

THAT ITS ACCOUNTS PAYABLES BALANCE INCREASED BY 260 PERCENT FROM THE PAST YEAR,

WHILE SALES INCREASED BY ONLY 76 PERCENT. COMPANY RECORDS WOULD SHOW IF THEY

PAID SUPPLIERS ON TIME. BY NOT PAYING SUPPLIERS ON TIME, DLEON IS STRAINING ITS

RELATIONSHIP WITH THEM. IF DLEON CONTINUES TO BE LATE, EVENTUALLY SUPPLIERS WILL

CUT THE COMPANY OFF AND PUT IT INTO BANKRUPTCY.

f. DLeon spends money for labor, materials, and fixed assets (depreciation) to make products, and

still more money to sell those products. Then, it makes sales that results in receivables, which

eventually result in cash inflows. Does it appear that DLeons sales price exceed its costs per

unit sold? How does it affect the cash balance?

IT DOES NOT APPEAR THE DLEONS SALES PRICE EXCEEDS ITS COSTS PER UNIT SOLD

AS INDICATED IN THE INCOME STATEMENT. THE COMPANY IS SPENDING MORE CASH THAN IT

IS TAKING IN AND, AS A RESULT, THE CASH ACCOUNT BALANCE HAS DECREASED.

Potrebbero piacerti anche

- Afif Juwandira-1162003016-Jawaban UTS Semester GenapDocumento10 pagineAfif Juwandira-1162003016-Jawaban UTS Semester GenapYusuf AssegafNessuna valutazione finora

- ch02 Financial Statement, Cash Flows and TaxesDocumento30 paginech02 Financial Statement, Cash Flows and TaxesAffan AhmedNessuna valutazione finora

- NOPAT NOPAT2011 - NOPAT20010 (Note ' MeansDocumento5 pagineNOPAT NOPAT2011 - NOPAT20010 (Note ' MeansBryan LluismaNessuna valutazione finora

- Chapter 2 Financial Statements Cash Flow and TaxesDocumento7 pagineChapter 2 Financial Statements Cash Flow and TaxesM. HasanNessuna valutazione finora

- Exercise 3. Cash Flows Statements and WorkingDocumento8 pagineExercise 3. Cash Flows Statements and WorkingQuang Dũng NguyễnNessuna valutazione finora

- Chapter No. 2B SlidesDocumento17 pagineChapter No. 2B SlidesAiqa AliNessuna valutazione finora

- Solutions To End-Of-Chapter ProblemsDocumento22 pagineSolutions To End-Of-Chapter ProblemsKalyani GogoiNessuna valutazione finora

- Solutions Ch2Documento3 pagineSolutions Ch2darkroyan426Nessuna valutazione finora

- Solutions Chapter 2Documento8 pagineSolutions Chapter 2Vân Anh Đỗ LêNessuna valutazione finora

- Corporate Finance Final ExamDocumento30 pagineCorporate Finance Final ExamJobarteh FofanaNessuna valutazione finora

- Chapter No. 2 Financial Statements, Taxes and Cash Flow Solutions To Questions and ProblemsDocumento9 pagineChapter No. 2 Financial Statements, Taxes and Cash Flow Solutions To Questions and ProblemsNuman Rox0% (1)

- Solutions To End-Of-Chapter ProblemsDocumento14 pagineSolutions To End-Of-Chapter ProblemsTushar MalhotraNessuna valutazione finora

- Manajemen Keuangan: Chapter 6: Making Capital Investment DecisionDocumento9 pagineManajemen Keuangan: Chapter 6: Making Capital Investment Decision21. Syafira Indi KhoirunisaNessuna valutazione finora

- Concepts Review and Critical Thinking Questions 4Documento6 pagineConcepts Review and Critical Thinking Questions 4fnrbhcNessuna valutazione finora

- Solutions Unit 2,8,9,10,11,16,19Documento58 pagineSolutions Unit 2,8,9,10,11,16,19Thảo TrangNessuna valutazione finora

- Solutions Manual Corporate Fiance Ross W-75%Documento10 pagineSolutions Manual Corporate Fiance Ross W-75%Desrifta FaheraNessuna valutazione finora

- CF-A#1 - Waris - 01-322221-024Documento8 pagineCF-A#1 - Waris - 01-322221-024Waris 3478-FBAS/BSCS/F16Nessuna valutazione finora

- CH 2 SolutionDocumento7 pagineCH 2 SolutionJohnNessuna valutazione finora

- RWJJ Chapter 2: Solutions To Assigned Questions and ProblemsDocumento9 pagineRWJJ Chapter 2: Solutions To Assigned Questions and ProblemsvzzrNessuna valutazione finora

- Vyaderm Caseanalysis PDFDocumento6 pagineVyaderm Caseanalysis PDFSahil Azher RashidNessuna valutazione finora

- Financial Statements, Taxes, and Cash Flow: Solutions To Questions and ProblemsDocumento9 pagineFinancial Statements, Taxes, and Cash Flow: Solutions To Questions and ProblemsJulyMoon RMNessuna valutazione finora

- Financial Statements, Cash Flow, and TaxesDocumento30 pagineFinancial Statements, Cash Flow, and TaxesSumitMadnaniNessuna valutazione finora

- Taxes and CashFlow ExercisesDocumento7 pagineTaxes and CashFlow ExercisesNelson NofantaNessuna valutazione finora

- Fundamentals of Corporate Finance 7Th Edition Brealey Solutions Manual Full Chapter PDFDocumento38 pagineFundamentals of Corporate Finance 7Th Edition Brealey Solutions Manual Full Chapter PDFcolonizeverseaat100% (10)

- Intermediate Accounting: Assignment 4: Exercise 4-6: Multiple-Step and Extraordinary ItemsDocumento13 pagineIntermediate Accounting: Assignment 4: Exercise 4-6: Multiple-Step and Extraordinary ItemsMuhammad MalikNessuna valutazione finora

- Last Assignment (Najeeb)Documento7 pagineLast Assignment (Najeeb)Najeeb KhanNessuna valutazione finora

- M - 30 S 2020 o ($'000) ($'000) ADocumento10 pagineM - 30 S 2020 o ($'000) ($'000) AAmmar TahirNessuna valutazione finora

- Finance 2Documento7 pagineFinance 2Vũ Hải YếnNessuna valutazione finora

- FIN2704 Tutorial 1 Question 3 SolutionDocumento5 pagineFIN2704 Tutorial 1 Question 3 SolutionAndrew TungNessuna valutazione finora

- Solution Manual For Corporate Finance Canadian 7th Edition by Ross Westerfield Jaffe Robertsl ISBN 0071339574 9780071339575Documento36 pagineSolution Manual For Corporate Finance Canadian 7th Edition by Ross Westerfield Jaffe Robertsl ISBN 0071339574 9780071339575stephanievargasogimkdbxwn100% (20)

- Financial Statements, Cash Flow, and TaxesDocumento36 pagineFinancial Statements, Cash Flow, and TaxesHussainNessuna valutazione finora

- Chapter 03Documento29 pagineChapter 03andi.w.rahardjoNessuna valutazione finora

- Solutions To Chapter 9 Using Discounted Cash-Flow Analysis To Make Investment DecisionsDocumento16 pagineSolutions To Chapter 9 Using Discounted Cash-Flow Analysis To Make Investment Decisionsmuhammad ihtishamNessuna valutazione finora

- Cfin 5th Edition Besley Solutions ManualDocumento35 pagineCfin 5th Edition Besley Solutions Manualghebre.comatula.75ew100% (28)

- Dwnload Full Cfin 5th Edition Besley Solutions Manual PDFDocumento35 pagineDwnload Full Cfin 5th Edition Besley Solutions Manual PDFandrefloresxudd100% (11)

- Grine American University Business Finance I Fall 2022-2023 Quiz 1Documento2 pagineGrine American University Business Finance I Fall 2022-2023 Quiz 1Gözde UğurluNessuna valutazione finora

- AC517Documento11 pagineAC517Inaia ScottNessuna valutazione finora

- BT-Chap 2Documento11 pagineBT-Chap 2Diệu Quỳnh100% (1)

- Lec 3 After Mid TermDocumento11 pagineLec 3 After Mid TermsherygafaarNessuna valutazione finora

- CFS Company Has The Following Details For Two-Year Period, 2019 and 2018Documento7 pagineCFS Company Has The Following Details For Two-Year Period, 2019 and 2018MiconNessuna valutazione finora

- FIN220 Tutorial Chapter 2Documento37 pagineFIN220 Tutorial Chapter 2saifNessuna valutazione finora

- Solution Manual For Essentials of Corporate Finance 10th by RossDocumento38 pagineSolution Manual For Essentials of Corporate Finance 10th by Rossjohnniewalshhtlw100% (21)

- Financial Statements, Cash Flow, and TaxesDocumento43 pagineFinancial Statements, Cash Flow, and TaxesshimulNessuna valutazione finora

- Full Download Solutions Manual To Accompany Construction Accounting Financial Management 2nd Edition 9780135017111 PDF Full ChapterDocumento36 pagineFull Download Solutions Manual To Accompany Construction Accounting Financial Management 2nd Edition 9780135017111 PDF Full Chapterurocelespinningnuyu100% (20)

- Solutions Manual To Accompany Construction Accounting Financial Management 2nd Edition 9780135017111Documento36 pagineSolutions Manual To Accompany Construction Accounting Financial Management 2nd Edition 9780135017111epha.thialol.lqoc100% (50)

- Activity 3 CAMINGAWAN BSMA 2B PDFDocumento7 pagineActivity 3 CAMINGAWAN BSMA 2B PDFMiconNessuna valutazione finora

- Solutions To Selected End-Of-Chapter 6 Problem Solving QuestionsDocumento9 pagineSolutions To Selected End-Of-Chapter 6 Problem Solving QuestionsVân Anh Đỗ LêNessuna valutazione finora

- Fin 201 1stsolution SetDocumento6 pagineFin 201 1stsolution Set123xxNessuna valutazione finora

- Solution Manual For Fundamental Financial Accounting Concepts 7th Edition by EdmondsDocumento9 pagineSolution Manual For Fundamental Financial Accounting Concepts 7th Edition by EdmondsDiane Jones100% (26)

- CH02答案Documento7 pagineCH02答案zmm45x7sjtNessuna valutazione finora

- Financial Statements, Cash Flow, and TaxesDocumento44 pagineFinancial Statements, Cash Flow, and TaxesJuliani Tania RizkyNessuna valutazione finora

- MK Cap Budgeting CH 9 - 10 Ross PDFDocumento17 pagineMK Cap Budgeting CH 9 - 10 Ross PDFSajidah PutriNessuna valutazione finora

- Kunci Tugas 9aDocumento19 pagineKunci Tugas 9aKhoirun NisaaNessuna valutazione finora

- Tugas Financial ManagementDocumento5 pagineTugas Financial Managementesterelisabet7777Nessuna valutazione finora

- Chapter 1 Exercises 2Documento7 pagineChapter 1 Exercises 2thtram03Nessuna valutazione finora

- Financial Management 2 - BirminghamDocumento21 pagineFinancial Management 2 - BirminghamsimuragejayanNessuna valutazione finora

- Solutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment DecisionsDocumento12 pagineSolutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment Decisionshung TranNessuna valutazione finora

- CH 02Documento30 pagineCH 02AhsanNessuna valutazione finora

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineDa EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNessuna valutazione finora

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsDa EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNessuna valutazione finora

- Accounting-For Merchandising BusinessDocumento73 pagineAccounting-For Merchandising BusinessMhel Demabogte100% (3)

- Interview QuestionsDocumento2 pagineInterview QuestionsKishore KulkarniNessuna valutazione finora

- Jose C. Feliciano College FoundationDocumento5 pagineJose C. Feliciano College FoundationJa CalibosoNessuna valutazione finora

- Total Assets 335,000 80,000: Additional InformationDocumento8 pagineTotal Assets 335,000 80,000: Additional InformationHohohoNessuna valutazione finora

- 01Documento14 pagine01NarinderNessuna valutazione finora

- FAChapter 12Documento3 pagineFAChapter 12zZl3Ul2NNINGZzNessuna valutazione finora

- Daiwa - India GenericsDocumento77 pagineDaiwa - India Genericsadwaitk2013Nessuna valutazione finora

- (In Case of Hawassa Universtiy Awada Business and Economics: - Altaye Dagne TadeseDocumento42 pagine(In Case of Hawassa Universtiy Awada Business and Economics: - Altaye Dagne TadeseAmir sabirNessuna valutazione finora

- RATIOSDocumento25 pagineRATIOSdaisyNessuna valutazione finora

- Capital StructureDocumento8 pagineCapital StructurePRK21MS1099 GOPIKRISHNAN JNessuna valutazione finora

- HP Cotton Sept 2021 ResultsDocumento6 pagineHP Cotton Sept 2021 ResultsPuneet367Nessuna valutazione finora

- Man Sci CompreDocumento9 pagineMan Sci CompreJessa Mae CacNessuna valutazione finora

- Financing of Project: DR Anurag AgnihotriDocumento79 pagineFinancing of Project: DR Anurag AgnihotriAnvesha TyagiNessuna valutazione finora

- LK INDOFARMA 2018 - CompressedDocumento89 pagineLK INDOFARMA 2018 - CompressedDika DaniswaraNessuna valutazione finora

- Quiz 1 - Limited CompaniesDocumento2 pagineQuiz 1 - Limited CompaniesELIZABETH MARGARETHANessuna valutazione finora

- 1.1 Conceptual FrameworkDocumento9 pagine1.1 Conceptual FrameworkMhaye Arabit GaylicanNessuna valutazione finora

- Act 20-AP 01 Coe, AP & AeDocumento3 pagineAct 20-AP 01 Coe, AP & AeJomar VillenaNessuna valutazione finora

- 1087-Article Text-5572-1-10-20221123Documento6 pagine1087-Article Text-5572-1-10-20221123Dimas SultoniNessuna valutazione finora

- Intermediate Accounting IFRS Edition: Kieso, Weygandt, WarfieldDocumento51 pagineIntermediate Accounting IFRS Edition: Kieso, Weygandt, WarfieldĐức HuyNessuna valutazione finora

- Sol. Man. - Chapter 1 - The Accounting Process - Ia Part 1a - 2020 EditionDocumento12 pagineSol. Man. - Chapter 1 - The Accounting Process - Ia Part 1a - 2020 EditionCharlene Mae MalaluanNessuna valutazione finora

- Learning Outcome Statements: Effective: January 1, 2020 Revised: April 1, 2019Documento14 pagineLearning Outcome Statements: Effective: January 1, 2020 Revised: April 1, 2019Hasmitha GowdaNessuna valutazione finora

- Phân Tích Báo Cáo Tài Chính Công Ty Amvi BiotechDocumento19 paginePhân Tích Báo Cáo Tài Chính Công Ty Amvi BiotechNhan Thien Nhu100% (1)

- Lecture 6 1567834793996Documento52 pagineLecture 6 1567834793996Jay ShuklaNessuna valutazione finora

- Institute of Chartered Accountants of PakistanDocumento4 pagineInstitute of Chartered Accountants of PakistanAqib SheikhNessuna valutazione finora

- Target Costing and Cost Analysis For Pricing DecisionsDocumento52 pagineTarget Costing and Cost Analysis For Pricing Decisionsainsyasya 98Nessuna valutazione finora

- Definitions of Selected Financial Terms Ratios and Adjustments For Microfinance PDFDocumento35 pagineDefinitions of Selected Financial Terms Ratios and Adjustments For Microfinance PDFSaw PreciousNessuna valutazione finora

- P22Documento64 pagineP22Adnan MemonNessuna valutazione finora

- Valuation of GoodwillDocumento34 pagineValuation of GoodwillGamming Evolves100% (1)

- Solution 1.1: Solutions To Gripping IFRS: Graded Questions Financial Reporting FrameworkDocumento893 pagineSolution 1.1: Solutions To Gripping IFRS: Graded Questions Financial Reporting Frameworksarvesh guness100% (1)

- Snake LTD - Class WorkingsDocumento2 pagineSnake LTD - Class Workingsmusa morinNessuna valutazione finora