Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

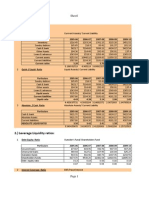

Cost of Good Sold: Total A/B

Caricato da

96624008210 valutazioniIl 0% ha trovato utile questo documento (0 voti)

7 visualizzazioni6 pagineSales to Net worth (shareholder's equity) A. Sales to Net Fixed Assets capital Work-in-progress Current Assets Total A / B 1070. 15827. 6592. 1.1896 0.0477352 4. Average Stock TO SALES A. Average Stock to Sales B. Average Stock to sales.

Descrizione originale:

Titolo originale

Ratio 2012

Copyright

© Attribution Non-Commercial (BY-NC)

Formati disponibili

XLSX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoSales to Net worth (shareholder's equity) A. Sales to Net Fixed Assets capital Work-in-progress Current Assets Total A / B 1070. 15827. 6592. 1.1896 0.0477352 4. Average Stock TO SALES A. Average Stock to Sales B. Average Stock to sales.

Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato XLSX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

7 visualizzazioni6 pagineCost of Good Sold: Total A/B

Caricato da

9662400821Sales to Net worth (shareholder's equity) A. Sales to Net Fixed Assets capital Work-in-progress Current Assets Total A / B 1070. 15827. 6592. 1.1896 0.0477352 4. Average Stock TO SALES A. Average Stock to Sales B. Average Stock to sales.

Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato XLSX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 6

1.

COST OF GOOD SOLD

A. Opening Stock Gross Profit Less: Closing Stock B. Sales Total A/B 12404.32 243887.76 19965.14 246634.7 0.9582064

A. Net Sales

Less:Gross Profit B. Sales Total A/B

2. RAW MATERIAL CONSUMPTION TO SALES

A. Raw Material Consumption B. Sales Total A/B 57527.08 246634.7 0.2332481

3. ADMINISTRATIVE EXP. TO SALES

A. Administrative Exp. B. Sales Total A/B 266.85 246634.7 0.001082

4. SELLING EXP.TO SALES

A. Selling Exp. B. Sales Total A/B 106.45 246634.7 0.0004316

5. ADMINISTRATIVE EXP. AND SELLING EXP. TO SALES

A. Administrative Exp. B. Selling Exp. C. Sales 266.85 106.45 246634.7

Total A+B/C

266.85043

6. GROSS PROFIT TO SALES

A. Gross Profit B. Sales Total A/B 10307.79 246634.7 0.0417938

7. NET PROFIT TO SALES

A. Net Profits B. Sales Total A/B 1070.29 246634.7 0.0043396

BALANCE SHEET 1. Sale to capital Employed

A. B. Sales 246634.7 2832.15 3634.67 1070.29 1466.92 831.8 10476.68 435.23 3540.69 146.75 10.216137 Share Capital Reserve and Other hands Net Profit Grants NCDC BMC Project Interest Free Loan Long Term Loan Redeemable Debentures Fixed Deposits (40% Long Term) Less: Expense not written off Total A/B

2. Sales to Net worth (Shareholder's equity)

A. Sales B. Share Capital Reserve fund and other funds 246634.7 2832.15 3634.67

Grants Net Profit Less: Extent not written off Total A/B

1466.92 1070.29 146.75 27.845422

3. Net Profit to Investment (Net Fixed Assets)

A. Net Profit B. Net fixed Assets Capital Work-in-Progress Current Assets Total A/B 1070.29 15827.85 6592.37 1.1896 0.0477352

4. Average Stock to Sales

A. Average Stock B. Sales Total A/B 16184.73 246634.7 0.0656223

5. Collection From Debtors Period

A. Dues from societies Trde Debtors Days Net credit Sales 624.91 9418.65 365 246634.7 14.863681

B. C.

Total A*B/C

6. Payment to Creditors Period

A. Due to societies Outstanding Against Purchases B. Days C. Net Credit Purchase Milk Purchase 21527.24 3657.315 365

159452.14

Oil Purchase Raw Material Purchase Total A*B/C

0 60016.98 41.884537

7. Average Working Capital to Sales

(I) Current Ratio A. Current Assets Stock Advances and Debtors Cash & Bank Balances B. Current Liabilities Deposits Due to Societies Outstanding Against Expenses Outstanding Against Purchases Sundry Creditors Bank Overdraft Total A/B (II) Cash + Debtors to Current Liabilities

A. Cash B. Trade Debtors Sundry Debtors Current Liabilities 4205.59 9418.65 642.2

25723.86 18886.4 4205.59

346.48 23851.96 881.19 5546.69 1865.66 8541.57 1.189657

C.

Deposits Due to Societies Outstanding Against Expenses Outstanding Against Purchases Sundry Creditors Bank Overdraft Total A+B/C

346.48 23851.96 881.19 5546.69 1865.66 8541.57 0.3476

(III) Acid Test

A. Current Assets Advances & debtors Cash & Bank Balances 18886.4 4205.59

B. Current Liabilites

37244.11

Total

A/B

0.6200172

246635 10307.8 246635 0.95821

Potrebbero piacerti anche

- DataDocumento11 pagineDataA30Yash YellewarNessuna valutazione finora

- Tugas Cash FlowDocumento7 pagineTugas Cash FlowalfaNessuna valutazione finora

- 8100 (Birla Corporation)Documento61 pagine8100 (Birla Corporation)Viz PrezNessuna valutazione finora

- Kansai Nerolac Balance SheetDocumento19 pagineKansai Nerolac Balance SheetAlex KuriakoseNessuna valutazione finora

- Sources of FundsDocumento31 pagineSources of FundsrahulroycgNessuna valutazione finora

- John M CaseDocumento6 pagineJohn M CaseSwapnil JainNessuna valutazione finora

- Ratio 1Documento35 pagineRatio 1niranjanusmsNessuna valutazione finora

- Apollo Hospitals Financial AnalysisDocumento19 pagineApollo Hospitals Financial AnalysisVishal GuptaNessuna valutazione finora

- Wooly Cox Limited: Common Size Balance Sheet Description/Year 15-MarDocumento12 pagineWooly Cox Limited: Common Size Balance Sheet Description/Year 15-Marmahiyuvi mahiyuviNessuna valutazione finora

- Fa ProjectDocumento16 pagineFa Projecttapas_kbNessuna valutazione finora

- Project FinanceDocumento12 pagineProject FinancePiyush HirparaNessuna valutazione finora

- RatiosDocumento5 pagineRatiosscrewyou098Nessuna valutazione finora

- Readymade Garment Manufacturing.Documento23 pagineReadymade Garment Manufacturing.Yasir Sheikh83% (6)

- Live Project Presentation On: An Analysis Study of Annual Report of The Company ONGC''Documento16 pagineLive Project Presentation On: An Analysis Study of Annual Report of The Company ONGC''Dipankar SâháNessuna valutazione finora

- Particulars 2018-19 2017-18 Liquidity AnalysisDocumento10 pagineParticulars 2018-19 2017-18 Liquidity AnalysisIvy MajiNessuna valutazione finora

- Ratio AnalysisDocumento6 pagineRatio Analysisamitca9Nessuna valutazione finora

- AssignmentDocumento4 pagineAssignmentshanushashaNessuna valutazione finora

- Balance Sheet: Income StatementDocumento15 pagineBalance Sheet: Income StatementAmmar Naqvi50% (2)

- Sources of Funds and Application of Funds AnalysisDocumento12 pagineSources of Funds and Application of Funds AnalysisVishal KumarNessuna valutazione finora

- Lecture Common Size and Comparative AnalysisDocumento28 pagineLecture Common Size and Comparative AnalysissumitsgagreelNessuna valutazione finora

- Comman Size Analysis of Income StatementDocumento11 pagineComman Size Analysis of Income Statement4 7Nessuna valutazione finora

- Assignment On Ratio Analysis On Beximco Pharmaceutical Ltd. Presented by Group: PlatinumDocumento19 pagineAssignment On Ratio Analysis On Beximco Pharmaceutical Ltd. Presented by Group: PlatinumProttoy HaqueNessuna valutazione finora

- Profit After Tax (Pat) & Sources of FundsDocumento9 pagineProfit After Tax (Pat) & Sources of FundsAbhishek SinghNessuna valutazione finora

- (Pso) Pakistan State OilDocumento4 pagine(Pso) Pakistan State OilSalman AtherNessuna valutazione finora

- APL Apollo Tubes Ltd Working Capital ManagementDocumento17 pagineAPL Apollo Tubes Ltd Working Capital ManagementDhirajsharma123Nessuna valutazione finora

- Financial Ratios v3Documento18 pagineFinancial Ratios v3Amichai GravesNessuna valutazione finora

- Funds FlowDocumento6 pagineFunds FlowhellodearsNessuna valutazione finora

- Assignment OF Banking and Working Capital ON Financial Accounts and Working Capital OF GailDocumento9 pagineAssignment OF Banking and Working Capital ON Financial Accounts and Working Capital OF GailSachin Kumar BassiNessuna valutazione finora

- Horizontal Vertical Ratio Analysis Problem Soln 16.04.2013Documento15 pagineHorizontal Vertical Ratio Analysis Problem Soln 16.04.2013Ojas MaheshwaryNessuna valutazione finora

- Name Suhail Abdul Rashid TankeDocumento9 pagineName Suhail Abdul Rashid TankeIram ParkarNessuna valutazione finora

- Jawaban Case 1-8Documento14 pagineJawaban Case 1-8Haris SatriawanNessuna valutazione finora

- Balance Sheet: Share Capital and ReservesDocumento7 pagineBalance Sheet: Share Capital and ReservesTanzeel HassanNessuna valutazione finora

- ProjectDocumento10 pagineProjectHassaan AmeerNessuna valutazione finora

- Ratio AnalysisDocumento13 pagineRatio AnalysisGaurav PoddarNessuna valutazione finora

- Pert 2Documento4 paginePert 2Natya NindyagitayaNessuna valutazione finora

- 0 20211022172100altman Z Score AnalysisDocumento19 pagine0 20211022172100altman Z Score AnalysisVISHAL PATILNessuna valutazione finora

- 0 20211022172126analytical ModelsDocumento35 pagine0 20211022172126analytical ModelsVISHAL PATILNessuna valutazione finora

- Group 9 - ONGC - MA ProjectDocumento13 pagineGroup 9 - ONGC - MA ProjectShubham JainNessuna valutazione finora

- Company Profile Ratio Analysis 2019 I. Liquidity RatiosDocumento9 pagineCompany Profile Ratio Analysis 2019 I. Liquidity RatiosVishnu AryanNessuna valutazione finora

- Salvo Chemical Industry Limited IPO detailsDocumento8 pagineSalvo Chemical Industry Limited IPO detailsAlamgir HossainNessuna valutazione finora

- Capital Reserve/surplus Deposits Borrowing Deferred Tax Liab. Current Liab. Provisions TotalDocumento20 pagineCapital Reserve/surplus Deposits Borrowing Deferred Tax Liab. Current Liab. Provisions TotalPradipta BeheraNessuna valutazione finora

- RatioDocumento6 pagineRatioSing Kian GanNessuna valutazione finora

- Baldwin Case Analysis - Kanupriya ChaudharyDocumento4 pagineBaldwin Case Analysis - Kanupriya ChaudharyKanupriya ChaudharyNessuna valutazione finora

- BPCL History, Products, FinancialsDocumento15 pagineBPCL History, Products, FinancialsSristyNessuna valutazione finora

- Annual Financial Statements and Key MetricsDocumento8 pagineAnnual Financial Statements and Key MetricsGuru_McLarenNessuna valutazione finora

- BUS 635 Project On BD LampsDocumento24 pagineBUS 635 Project On BD LampsNazmus Sakib PlabonNessuna valutazione finora

- Document 8Documento2 pagineDocument 8ayeshaNessuna valutazione finora

- Analysis of Apollo TiresDocumento12 pagineAnalysis of Apollo TiresTathagat ChatterjeeNessuna valutazione finora

- British PetroleumDocumento7 pagineBritish PetroleumboniadityaNessuna valutazione finora

- Mahindra and Mahindra Profit & Loss AccountDocumento13 pagineMahindra and Mahindra Profit & Loss AccountwenemeneNessuna valutazione finora

- Balance Sheet (Crore)Documento10 pagineBalance Sheet (Crore)MOHAMMED ARBAZ ABBASNessuna valutazione finora

- ObjectiveTestQuestions ONE F3Documento34 pagineObjectiveTestQuestions ONE F3Waseem Ahmad QurashiNessuna valutazione finora

- CHAPTER 4 Kondisi Keuangan (Analisis Industri)Documento1 paginaCHAPTER 4 Kondisi Keuangan (Analisis Industri)NanangNessuna valutazione finora

- Financial Accounting 2022Documento5 pagineFinancial Accounting 2022Siddhant GNessuna valutazione finora

- Cnooc LimitedDocumento3 pagineCnooc LimitedMahdiNessuna valutazione finora

- Annual Balance Sheet and Profit Loss AnalysisDocumento6 pagineAnnual Balance Sheet and Profit Loss AnalysisSANDHALI JOSHI PGP 2021-23 BatchNessuna valutazione finora

- September 2016payroll 2Documento33 pagineSeptember 2016payroll 2Tesfaye BelayeNessuna valutazione finora

- 17 - Manoj Batra - Hero Honda MotorsDocumento13 pagine17 - Manoj Batra - Hero Honda Motorsrajat_singlaNessuna valutazione finora

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachDa EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachValutazione: 3 su 5 stelle3/5 (3)

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioDa EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNessuna valutazione finora

- CBSE Class 11 Accountancy Revision Notes Chapter-2 Theory Base of AccountingDocumento8 pagineCBSE Class 11 Accountancy Revision Notes Chapter-2 Theory Base of AccountingAyush PatelNessuna valutazione finora

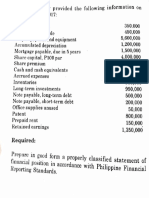

- AF210: Financial Accounting: School of Accounting and FinanceDocumento11 pagineAF210: Financial Accounting: School of Accounting and FinanceShikhaNessuna valutazione finora

- Aud Quiz 2Documento6 pagineAud Quiz 2MC allivNessuna valutazione finora

- Swot Analysis of Asset Classes: Asset Strength Weakness Oppotunity Threat EquitiesDocumento4 pagineSwot Analysis of Asset Classes: Asset Strength Weakness Oppotunity Threat EquitiesAnooja SajeevNessuna valutazione finora

- Investment Analysis and Portfolio Management (Mba 3RD Sem) (Akanksha)Documento30 pagineInvestment Analysis and Portfolio Management (Mba 3RD Sem) (Akanksha)priyank chourasiyaNessuna valutazione finora

- Acc 103 - Day 23 - SasDocumento3 pagineAcc 103 - Day 23 - Sasfecamacho53Nessuna valutazione finora

- Chapter 3Documento60 pagineChapter 3Girma NegashNessuna valutazione finora

- Infrastructure Report for Flamingo Hotel ProjectDocumento17 pagineInfrastructure Report for Flamingo Hotel ProjectFarah ArishaNessuna valutazione finora

- PT 1st Quarter (Fin Ratios)Documento7 paginePT 1st Quarter (Fin Ratios)Janin Gallana100% (4)

- Technical Analysis RADocumento27 pagineTechnical Analysis RAZawad47 AhaNessuna valutazione finora

- Cost and Management Accounting - by Zahirul Hoque-Handbook ofDocumento381 pagineCost and Management Accounting - by Zahirul Hoque-Handbook ofwaqif.khanNessuna valutazione finora

- Demerger and It'S Impact On Performance: A Case Study of Hero Honda LTDDocumento9 pagineDemerger and It'S Impact On Performance: A Case Study of Hero Honda LTDSumit KalelkarNessuna valutazione finora

- Standardized Financial Statements: Accounting Analysis GuideDocumento3 pagineStandardized Financial Statements: Accounting Analysis GuideJonathanChanNessuna valutazione finora

- Dwnload Full Essentials of Corporate Finance 9th Edition Ross Test Bank PDFDocumento35 pagineDwnload Full Essentials of Corporate Finance 9th Edition Ross Test Bank PDFoutlying.pedantry.85yc100% (11)

- Standard Chartered Bank: A Global Financial Services CompanyDocumento37 pagineStandard Chartered Bank: A Global Financial Services CompanyFiOna SalvatOreNessuna valutazione finora

- Altman Z-Score Altman Z-Score: Fauji Fertilizer Company 2019 National Foods Company 2019Documento4 pagineAltman Z-Score Altman Z-Score: Fauji Fertilizer Company 2019 National Foods Company 2019tech& GamingNessuna valutazione finora

- Making Capital Investment DecisionsDocumento48 pagineMaking Capital Investment DecisionsJerico ClarosNessuna valutazione finora

- Investment Detective CaseDocumento3 pagineInvestment Detective CaseWidyawan Widarto 闘志50% (2)

- HANDOUT - Bonds PayableDocumento4 pagineHANDOUT - Bonds PayableMarian Augelio PolancoNessuna valutazione finora

- Chap 004Documento9 pagineChap 004dbjnNessuna valutazione finora

- P4-3 WPDocumento4 pagineP4-3 WPAna LailaNessuna valutazione finora

- CV Morten JosefsenDocumento3 pagineCV Morten JosefsenMorten Josefsen100% (1)

- MC FinalDocumento14 pagineMC Finalahmed arfanNessuna valutazione finora

- Accounts Revision QuestionsDocumento293 pagineAccounts Revision QuestionsRishab Gupta100% (1)

- CH 23 Statementofcashflowssolutionsinteraccounting16thedition-171116132124Documento71 pagineCH 23 Statementofcashflowssolutionsinteraccounting16thedition-171116132124Lina SakhiNessuna valutazione finora

- Assignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedDocumento10 pagineAssignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedJason MablesNessuna valutazione finora

- A Study On The Financial Performance of Hindustan Unilever LimitedDocumento60 pagineA Study On The Financial Performance of Hindustan Unilever LimitedSanjay PrakashNessuna valutazione finora

- Fac2601 PDFDocumento7 pagineFac2601 PDFoscar.matenguNessuna valutazione finora

- Lecture 5 - Financial Statement AnalysisDocumento36 pagineLecture 5 - Financial Statement AnalysisIsyraf Hatim Mohd TamizamNessuna valutazione finora

- Corporations CH 12 Lecture 1Documento18 pagineCorporations CH 12 Lecture 1Faisal SiddiquiNessuna valutazione finora